401(k) Catch-Up Contribution FAQs: Your Top Questions Answered (2025 Rules)

Got questions about 401(k) catch-up contributions? You’re not alone. With updated 2025 limits and new Roth rules on the horizon, this article answers the most common questions about who qualifies, how much you can contribute, and what strategic moves to consider in your 50s and early 60s.

As retirement gets closer, many individuals start to wonder how they can supercharge their savings and make up for lost time. For those age 50 and older, catch-up contributions offer a powerful opportunity to contribute more to retirement accounts beyond the standard annual limits. Below, I’ve addressed some of the most common questions I get from clients about catch-up contributions, especially with the updated 2025 rules in play.

Can I make catch-up contributions if I’m working part-time in retirement?

Yes, as long as you have earned income from a job, and you have met the plan’s eligibility requirements. So, even if you’ve scaled back your hours or semi-retired, you may still be eligible to make additional contributions.

For example, if you're age 65 and working part-time and eligible for your company’s 401(k) plan, you can contribute up to $23,500, plus an extra $7,500 in catch-up contributions for a total of $31,000 in 2025, assuming you have at least $31,000 in W2 compensation.

If you have less than $31,000 in W2 comp, you will be capped by the lesser of the annual contribution limit or 100% of your W2 compensation.

Are Roth catch-up contributions allowed?

Yes. If your employer plan offers a Roth option, you can choose to make your catch-up contributions as Roth dollars. This means you contribute after-tax money now and take qualified distributions tax-free in retirement.

This option is popular for individuals who are in the same tax bracket now as they plan to be in retirement. The Roth source also avoids required minimum distributions (RMDs) starting at age 73 or 75.

How do catch-up contributions impact required minimum distributions (RMDs)?

Catch-up contributions themselves don’t change the timing or calculation of RMDs. However, where you put the catch-up dollars can affect your future RMDs. If you contribute catch-up dollars to a Roth 401(k) and then roll over the balance to a Roth IRA prior to the RMD start age, RMDs are not required.

Adding more to the pre-tax employee deferral source within the plan may increase your future RMD requirement since pre-tax retirement accounts are subject to the annual RMD requirement once you reach age 73 (for those born 1951–1959) or 75 (for those born 1960 or later).

Should I prioritize catch-up contributions or pay down my mortgage?

This depends on your interest rate, your retirement timeline, tax bracket, and your overall financial goals. Generally, if your mortgage interest rate is below 4% and you’re behind on retirement savings, catch-up contributions may be a better use of your idle cash, especially if your investments are growing tax-deferred (pre-tax) or tax-free (roth).

However, if you’re already on track for retirement and the psychological benefit of being debt-free is important to you, putting extra cash toward your mortgage can make sense. It’s all about balancing the right financial decision with your personal preferences.

What happens if I forget to update my payroll deferrals after turning 50?

Unfortunately, you won’t automatically get the benefit since your employer’s payroll system won’t adjust your contributions just because you had a birthday. You need to take action and manually increase your deferrals to take advantage of the higher limits.

For example, if you turn 50 this year and forget to bump your 401(k) deferrals, you may miss out on contributing an additional $7,500. Worse yet, once the calendar year closes, you can't go back and make up for it.

Are there additional tax benefits associated with making catch-up contributions?

It’s common that the years leading up to retirement are often the highest income years for an individual. The additional pre-tax contributions associated with the catch-up contribution allow employees to take more of their income off the table during the peak income years and shift it into the retirement years, when ideally they are in a lower tax bracket.

What is the new age 60 – 63 catch-up contribution?

Starting in 2025, there is a new enhanced catch-up contribution available to employees covered by 401(k) and 403(b) plans who are aged 60 to 63. Instead of being limited to just the regular $7,500 catch-up contribution, in 2025, employees age 60 – 63 will be allowed to make a catch-up contribution equal to $11,250.

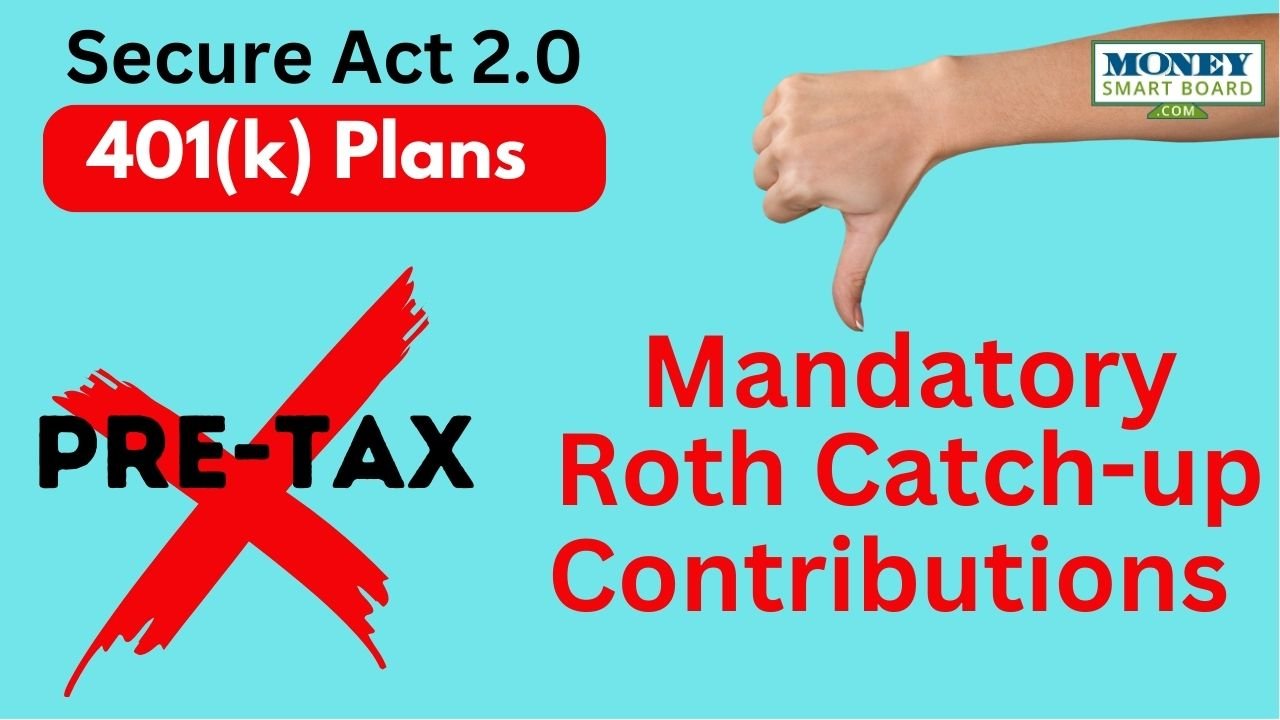

What is the Mandatory Roth catch-up for high income earners?

Starting in 2026, and for the following years, if an employee makes more than $145,000 in W2 compensation (indexed for inflation) with the same employer in the previous year, that employee will no longer be allowed to make pre-tax catch-up contributions. If they make a catch-up contribution, it will be required to be a Roth catch-up contribution.

Final Thoughts…

Whether you’re still decades from retirement or just a few years away, catch-up contributions are a crucial part of retirement planning for those age 50 and older. With the 2025 limits now in place and Roth rules continuing to evolve, understanding how these contributions fit into your broader plan can help you save smarter — and avoid costly mistakes.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What are catch-up contributions and who qualifies for them?

Catch-up contributions allow individuals age 50 and older to contribute additional funds to retirement accounts beyond the standard annual limits. For 2025, employees can contribute up to $23,500 to a 401(k) plus an extra $7,500 in catch-up contributions, for a total of $31,000 — provided they have sufficient earned income.

Can part-time workers make catch-up contributions?

Yes. As long as you have earned income and meet your employer plan’s eligibility requirements, you can make catch-up contributions even if you’re working part-time. The total contribution amount cannot exceed 100% of your W-2 compensation.

Are Roth catch-up contributions available?

If your employer plan offers a Roth option, you can make your catch-up contributions as Roth dollars. Roth contributions are made after tax, grow tax-free, and qualified withdrawals are also tax-free, offering flexibility for future tax planning.

How do catch-up contributions affect required minimum distributions (RMDs)?

Catch-up contributions do not change when RMDs begin, but the type of account matters. Pre-tax catch-up dollars increase your future RMDs, while Roth 401(k) contributions can be rolled into a Roth IRA before RMD age to avoid mandatory withdrawals altogether.

Should I prioritize catch-up contributions or pay down my mortgage?

It depends on your financial situation. If your mortgage rate is low (under 4%) and you’re behind on retirement savings, maximizing catch-up contributions may be beneficial. However, paying down your mortgage may make sense if you’re already on track for retirement and value being debt-free or if you have a higher interest rate on your mortgage.

What happens if I forget to increase my deferrals after turning 50?

Your employer’s payroll system won’t automatically adjust contributions, so you must update them manually. Missing the adjustment means forfeiting that year’s extra contribution opportunity — once the year ends, you can’t retroactively make up the difference.

What is the new enhanced age 60–63 catch-up contribution for 2025?

Starting in 2025, employees aged 60 to 63 can make a larger catch-up contribution of up to $11,250 to 401(k) and 403(b) plans, providing an additional savings boost in the final years before retirement.

What is the new rule for high-income earners and Roth catch-ups?

Beginning in 2026, employees earning more than $145,000 (indexed for inflation) in W-2 income with the same employer will be required to make catch-up contributions as Roth contributions — pre-tax catch-ups will no longer be allowed for this group.

401(k) Catch-Up Contributions Explained: Maximize Your Retirement Savings in 2025

Turning 50? It’s time to boost your retirement savings.

This article breaks down the updated 2025 401(k) catch-up contribution limits, new rules for ages 60–63, and whether pre-tax or Roth contributions make the most sense for your situation.

For individuals aged 50 or older, catch-up contributions allow for additional retirement savings during what are often their highest earning years. With updated limits and new provisions taking effect in 2025, this strategy can be especially valuable for those looking to strengthen their financial position ahead of retirement and maximize tax efficiency in what are typically their highest income years leading up to retirement.

Below, I break down the 2025 catch-up contribution limits, rules, and strategic considerations to help you make informed decisions.

What Are Catch-Up Contributions?

Catch-up contributions allow individuals aged 50 or older to contribute above the standard annual limits to retirement accounts. You’re eligible to make catch-up contributions starting in the calendar year you turn 50.

2025 Contribution Limits

Here are the updated 2025 401(k) contribution limits for each plan type:

401(k), 403(b), 457(b):

Standard limit: $23,500

Age 50 – 59 & Age 64+ catch-up: $7,500

Age 60 – 63 catch-up: $11,250

New 401(k) Age 60–63 Catch-Up Limits

Beginning in 2025, a new tier of higher catch-up limits will apply to individuals between ages 60 and 63. Under the SECURE 2.0 Act, these individuals can contribute an additional amount equal to 50% of the regular catch-up contribution for that plan year. For 2025, this equates to an extra $3,750, bringing the total possible contribution to $34,750 for 401(k), 403(b), and 457(b) plans. This enhanced catch-up contribution is optional for employers, so it's important to confirm with your plan sponsor whether this provision is available in your plan.

To learn more, read our article: New Age 60 – 63 401(k) Enhanced Catch-up Contribution Starting in 2025

Pre-Tax vs. Roth Catch-Up Contributions

Employer-sponsored retirement plans often allow participants to choose whether their catch-up contributions are made on a pre-tax or Roth (after-tax) basis. The best approach depends on income levels, expected tax rates in retirement, and broader financial planning goals.

Pre-tax contributions reduce your taxable income today but are taxed when withdrawn in retirement.

Roth contributions provide no current tax deduction but grow and distribute tax-free in retirement.

When Pre-Tax May Make Sense:

You're in a high tax bracket today (e.g., 24%+)

You expect to be a lower tax bracket during the retirement years

Example:

Tom is age 60, married, and earns $400,000 annually, placing him in the 32% federal tax bracket. In the next 5 years, Tom expects to retire and be in a lower federal tax bracket. By making pre-tax catch-up contributions now, it will allow him to reduce his current taxable income, while potentially taking distributions in a lower tax bracket later.

When Roth May Make Sense:

You expect your current tax rate to be roughly the same in retirement

You already have substantial pre-tax retirement account balances

You expect tax rates to rising in the future

Example:

Susan is age 52, single filer, earns $125,000 per year, and is in the 22% tax bracket. She expects her income to remain steady over time. By choosing Roth catch-up contributions, she pays tax now at a relatively low rate and avoids taxation on future withdrawals.

Mandatory Roth Catch-Up Contributions for High Earners (Effective 2026)

Starting in 2026, individuals earning $145,000 or more (adjusted for inflation) in wages from the same employer in the previous year will be required to make catch-up contributions to their workplace plan on a Roth basis. This rule applies only to employer-sponsored plans (like 401(k)s) and does not impact Simple IRA plans. For 2025, these Roth rules have been delayed, giving high-income earners time to prepare.

To learn about the rules and exceptions for high earners, read our article: Mandatory 401(k) Roth Catch-up Details Confirmed by IRS January 2025

The Big Picture: Why This Strategy Matters Near Retirement

For individuals within five to ten years of retirement, catch-up contributions provide an opportunity to meaningfully increase retirement savings without relying on higher investment returns or making dramatic lifestyle changes. The added contributions also support strategic tax planning by allowing savers to choose between pre-tax and Roth treatment based on their broader income picture.

Catch-up contributions can help:

Maximize tax-advantaged savings when your income is typically at its highest

Take advantage of compound growth on a larger balance

Strategically shift assets into Roth accounts for future tax-free income

Consider the numbers:

A 60-year-old contributing the full $34,750 annual catch-up amount for three consecutive years could accumulate over $111,000 in additional retirement savings, assuming a 7% annual return. If contributed to a Roth 401(k), those funds would grow and be distributed tax-free, offering valuable flexibility in retirement.

Even if retirement is only a few years away, catch-up contributions can play a significant role in improving retirement readiness and reducing future tax burdens.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What are catch-up contributions and who qualifies for them?

Catch-up contributions allow individuals aged 50 or older to contribute more to retirement accounts than the standard annual limit. Eligibility begins in the calendar year you turn 50, regardless of your income level or how close you are to retirement.

What are the 2025 catch-up contribution limits?

In 2025, employees can contribute up to $23,500 to a 401(k), 403(b), or 457(b) plan. Those aged 50–59 and 64 or older can contribute an additional $7,500, while individuals aged 60–63 can make an enhanced catch-up contribution of $11,250, for a total of $34,750 if allowed by their employer’s plan.

How does the new age 60–63 catch-up rule work?

Starting in 2025, individuals between ages 60 and 63 can make a higher catch-up contribution equal to 150% of the standard catch-up limit. This provision under the SECURE 2.0 Act lets older workers maximize savings during their final working years, but availability depends on whether an employer adopts the rule.

Should I make my catch-up contributions pre-tax or Roth?

The best option depends on your tax situation. Pre-tax contributions reduce taxable income now and are ideal if you expect to be in a lower tax bracket in retirement. Roth contributions are made after-tax but grow tax-free and are advantageous if you expect future tax rates to rise or your income to remain steady.

What is the mandatory Roth catch-up rule for high-income earners?

Beginning in 2026, employees earning $145,000 or more (adjusted for inflation) from the same employer in the previous year must make catch-up contributions on a Roth basis. This means contributions will be made after tax, and future withdrawals will be tax-free.

Why are catch-up contributions especially important near retirement?

Catch-up contributions help individuals nearing retirement boost savings during peak earning years without depending solely on market growth. They also provide tax planning flexibility by letting savers choose between pre-tax and Roth options based on their expected future income and tax rates.

Federal Disaster Area Penalty-Free IRA & 401(k) Distribution and Loan Options

Individuals who experience a hurricane, flood, wildfire, earthquake, or other type of natural disaster may be eligible to request a Qualified Disaster Recovery Distribution or loan from their 401(k) or IRA to assist financially with the recovery process. The passing of the Secure Act 2.0 opened up new distribution and loan options for individuals whose primary residence is in an area that has been officially declared a “Federal Disaster” area.

Individuals who experience a hurricane, flood, wildfire, earthquake, or other type of natural disaster may be eligible to request a Qualified Disaster Recovery Distribution or loan from their 401(k) or IRA to assist financially with the recovery process. The passing of the Secure Act 2.0 opened up new distribution and loan options for individuals whose primary residence is in an area that has been officially declared a “Federal Disaster” area.

Qualified Disaster Recovery Distributions (QDRD)

In December 2022, the passing of the Secure Act 2.0 made permanent, a distribution option within both 401(K) plans and IRAs, that allows individuals to distribute up to $22,000 from either a 401(k) or IRA, and that distribution is exempt from the 10% early withdrawal penalty. Typically, when an individual is under the age of 59½ and takes a distribution from a 401(K) or IRA, the distribution is subject to both taxes and a 10% early withdrawal penalty.

For an individual, it’s an aggregate of $22,000 between both their 401(k) and IRA accounts, meaning, they can’t distribute $22,000 from their IRA and then another $22,000 from their 401(k), and avoid the 10% penalty on the full $44,000.

If you are married, if each spouse has an IRA and/or 401(k) plan, each spouse would be eligible to process a qualified disaster recovery distribution for the full $22,000 and avoid the 10% penalty on the combined $44,000.

Taxation of Federal Disaster Distributions

Even though these distributions are exempt from the 10% early withdrawal penalty, they are still subject to federal and state income taxes, but the taxpayer has two options:

The taxpayer can elect to include the full amount of the distribution as taxable income in the year that the QDRD takes place; OR

The taxpayer can elect to spread the taxable amount evenly over a 3-year period that begins the year that distribution occurred.

Here is an example of the tax options. Tim is age 40, he lives in Florida, and his area experiences a hurricane. Shortly after the hurricane, the area where Tim’s house is located was officially declared a Federal Disaster Area by FEMA. To help pay for the damage to his primary residence, Tim processes a $12,000 qualified disaster recovery distribution from his Traditional IRA. Tim would not have to pay the 10% early withdrawal penalty due to the QDRD exception, but he would be required to pay federal income tax on the full $12,000. He has the option to either report the full $12,000 on his tax return in the year the distribution took place, or he could elect to spread the $12,000 tax liability over the next 3 years, reporting $4,000 in additional taxable income each year beginning the year that the QDRD took place.

Repayment Option

If an individual completes a disaster recovery distribution from their 401(k) or IRA, they have the option to repay the money to the account within 3 years of the date of the distribution. This allows them to recoup the taxes paid on the distribution by filing an amended tax return(s) for the year or years that the tax liability was reported from the QDRD.

180 Day & Financial Loss Requirement

To make an individual eligible to request a QDRD, not only does their primary residence have to be located within a Federal Disaster area, but they also need to request the QDRD within 180 days of the disaster, and they must have sustained an economic loss on account of the disaster.

QDRD Are Optional Provisions Within 401(k) Plans

If you have a 401(k) plan, a Qualified Disaster Recovery Distribution is an OPTIONAL provision that must be adopted by the plan sponsor of a 401(k) to provide their employees with this distribution option. In other words, your employer is not required to allow these disaster recovery distributions, they have to adopt them. If you live in an area that is declared a federal disaster area and your 401(k) plan does not allow this type of distribution option, you can contact your employer and request that it be added to the plan. Many companies may not be aware that this is a voluntary distribution option that can be added to their plan.

If you have an IRA, as long as you meet the criteria for a QDRD, you are eligible to request this type of distribution.

If you have a 401(k) plan with a former employer and their plan does not allow QDRD, you may be able to rollover the balance in the 401(k) to an IRA, and then request the QDRD from the IRA.

What Changed?

Prior to the passing of Secure Act 2.0, Congress had to authorize these Qualified Disaster Recovery Distributions for each disaster. Section 331 of the Secure Act 2.0 made these QDRDs permanent.

However, one drawback is in the past, these qualified disaster recovery distributions were historically allowed up to $100,000, but the new tax law lowered the maximum QDRD amount to only $22,000.

$100,000 401(k) Loan for Disaster Relief

In addition to the qualified disaster recovery distributions, Secure Act 2.0, also allows plan participants in 401(K) plans to request loans up to the LESSER of $100,000 or 100% of their vested balance in the plan.

Typically, when plan participants request loans from a 401(K) plan, the maximum amount is the LESSER of $50,000 or 50% of their vested balance in the plan. Secure Act 2.0, doubled that amount. The eligibility requirements to receive a disaster recovery 401(k) loan are the same as the eligibility requirements for a Qualified Disaster Recovery Distribution.

In addition to the higher loan limit, plan participants eligible for a 401(K) qualified disaster recovery loan, are also allowed to delay the start date of their loan payments for up to 1 year from the loan processing date. Normally when a 401(K) loan is requested, loan payments begin immediately.

These loans are still subject to the 5-year duration limit, but with the optional 12-month delay in the loan payment start date, the maximum duration of these qualified disaster loans is technically 6 years.

401(K) Loans Are an Optional Provision

Similar to Qualified Disaster Recovery Distributions, 401(k) loans are an optional provision that must be adopted by the plan sponsor of a 401(k) plan. Some plans allow plan participants to take loans while others do not, so the ability to take these disaster recovery loans will vary from plan to plan.

Loans Are Only Available In Qualified Retirement Plans

The $100,000 loan option is only available for Qualified Retirement Plans such as 401(k) and 403(b) plans. IRAs do not provide a loan option. The $22,000 Qualified Disaster Recovery Distribution is the only option for IRAs unless Congress specifically authorizes a higher maximum distribution amount for a specific Federal Disaster, which is within their power to do.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is a Qualified Disaster Recovery Distribution (QDRD)?

A Qualified Disaster Recovery Distribution allows individuals impacted by a federally declared disaster to withdraw up to $22,000 from a 401(k) or IRA without paying the 10% early withdrawal penalty. This provision was made permanent under the Secure Act 2.0 to provide faster financial relief after natural disasters.

Are Qualified Disaster Recovery Distributions still subject to income taxes?

Yes. Although QDRDs are exempt from the 10% early withdrawal penalty, the amount withdrawn is still taxable. Individuals can choose to report the full amount as income in the year of withdrawal or spread the tax burden evenly over three years.

Can a Qualified Disaster Recovery Distribution be repaid?

Yes. Individuals who take a QDRD may repay the distributed amount to their retirement account within three years. Doing so allows them to recover the taxes paid by filing amended tax returns for the years in which the income was reported.

Who qualifies for a QDRD under Secure Act 2.0?

To qualify, an individual’s primary residence must be located in a federally declared disaster area, and they must have suffered an economic loss related to the disaster. The distribution must also be requested within 180 days of the disaster declaration.

Do all 401(k) plans allow Qualified Disaster Recovery Distributions?

No. QDRDs are optional provisions that must be adopted by the employer’s 401(k) plan sponsor. Employees can ask their employers to add this feature if it is not already available. IRA holders, however, are automatically eligible if they meet the qualification criteria.

What are the new 401(k) loan limits for disaster recovery under Secure Act 2.0?

Eligible participants in federally declared disaster areas may borrow up to the lesser of $100,000 or 100% of their vested 401(k) balance. This doubles the normal loan limit, and participants may also delay loan repayments for up to one year.

Can IRA owners take loans under disaster relief provisions?

No. The disaster relief loan option applies only to qualified retirement plans like 401(k) or 403(b) plans. IRA owners are limited to the $22,000 Qualified Disaster Recovery Distribution option unless Congress authorizes higher limits for a specific disaster.

Starting in 2024, 401(k) Plan Will Be Required to Cover Part-time Employees

In the past, companies have been allowed to limit access to their 401(k) plan to just full-time employees but that is about to change starting in 2024. With the passing of the Secure Act, beginning in 2024, companies that sponsor 401(K) plans will be required to allow part-time employees to participate in their qualified retirement plans.

In the past, companies have been allowed to limit access to their 401(k) plan to just full-time employees but that is about to change starting in 2024. With the passing of the Secure Act, beginning in 2024, companies that sponsor 401(K) plans will be required to allow part-time employees to participate in their qualified retirement plans.

It’s very important for companies to make note of this now because many companies will need to start going through their employee census data to identify the part-time employees that will become eligible for the 401(K) plan on January 1, 2024. Failure to properly notify these part-time employees of their eligibility to participate in the plan could result in plan compliance failures, DOL penalties, and it could require the company to make a mandatory employer contribution to those employees for the missed deferral opportunity.

Full-time Employee Restriction

Prior to the passing of the Secure Act 1.0 in December 2019, 401(K) plans were allowed to limit participation in plans to employees that had completed 1 year of service which is commonly defined as 12 months of employment AND 1,000 hours worked within that 12-month period. The 1 year wait with the 1,000 hours requirement allowed companies to keep part-time employees who work less than 1,000 hours from participating in the company’s 401(k) plan.

Secure Act 1.0

When Congress passed Secure Act 1.0 in December 2019, it included a new provision that requires 401(K) plans to cover part-time employees who have completed three consecutive years of service and worked 500 or more hours during each of those years to participate in the plan starting in 2024. For purposes of the 3 consecutive years and 500 hours requirement, companies are only required to track employee service back to January 1, 2021, any services prior to that date, can be disregarded for purposes of this new part-time employee coverage requirement.

Example: John works for Company ABC which sponsors a 401(k) plan. The plan restricts eligibility to 1 year and 1,000 hours. John has been working part-time for Company ABC since March 2020 and he worked the following hours in 2021, 2022, and 2023:

2021 Hours Worked: 560

2022 Hours Worked: 791

2023 Hours Worked: 625

Since John had never worked more than 1,000 hours in a 12-month period, he was never eligible to participate in the ABC 401(k) plan. However, under the new Secure Act 1.0 rules, ABC would be required to allow John to participate in the plan starting January 1, 2024, because he works for three consecutive years with more than 500 hours.

Excluded Employees

The new part-time employee coverage requirement does not apply to employees covered by a collective bargaining agreement or nonresident aliens. 401(K) plans are still allowed to exclude those employees regardless of hours worked.

Employee Deferrals Only

For the part-time employees that meet the 3 consecutive years and 500+ hours of service each year, while the new rules require them to be offered the opportunity to participate in the 401(k) plan, it only requires plans to make them eligible to participate in the employee deferral portion of the plan. It does not require them to be eligible for EMPLOYER contributions. For part-time employees who become eligible to participate under these new rules, they are allowed to put their own money into the plan, but the company is not required to provide them with an employer matching, employer non-elective, profit sharing, or safe harbor contributions until that employee has met the plan’s full eligibility requirements.

In the example we looked at previously with John, John would be allowed to voluntarily make employee contributions from his paycheck but if the company sponsors an employer matching contribution that requires employees to work 1 year and 1,000 hours to be eligible, John would not be eligible to receive the employer matching contribution even though he is eligible to make employee contributions to the plan.

Secure Act 2.0

Up until now, we have covered the new part-time employee coverage requirements under Secure Act 1.0. However, in December 2022, Congress passed Secure Act 2.0, which changed the part-time employee coverage requirements beginning January 1, 2025. The main change that Secure Act 2.0 made is it reduced the 3 Consecutive Years down to 2 Consecutive Years starting in 2025. Both still require 500 or more hours each year but now a part-time employee will only need to complete 2 consecutive years of 500 or more hours instead of 3 beginning in 2025.

Also in 2025, under Secure Act 2.0, for purposes of assessing the 2 consecutive years with 500 or more hours, companies only have to look at service dating back to January 1, 2023, employment before that date is excluded from this part-time employee coverage exception.

2024 & 2025 Summary

Starting in 2024, employers will need to look back as far as January 1, 2021, and identify part-time employees who worked at least 3 consecutive years with 500 or more hours worked in each of those three years.

Starting in 2025, employers will need to look at both definitions of part-time employees. The Secure Act 1.0, three consecutive years of 500 hours or more going back to January 1, 2021, and separately, the Secure Act 2.0, 2 consecutive years of 500 hours or more going back to January 1, 2023. An employee could technically become eligible under either definition.

Penalties For Not Notifying Part-time Employees of Eligibility

Companies should take this new part-time employee eligibility rule very seriously. Failure to properly notify part-time employees of their eligibility to make employee deferrals to the 401(K) plan could result in a plan compliance failure and the assessment of Department of Labor penalties. The DOL conducts random audits of 401(K) plans and one of the primary pieces of information that they typically request during an audit is for the employer to provide a full employee census file and be able to prove that they properly notified each eligible employee of their ability to participate in the company’s 401(K) plan.

In addition to fines for not properly notifying these new part-time employees of their ability to participate in the plan, the DOL could require the company to make a “QNEC” (Qualified Non-Elective Contribution) on behalf of those part-time employees which is a pure EMPLOYER contribution. Even though these part-time employees might not be eligible for other employer contributions in the plan, this QNEC funded by the employer is to make up for the missed employee deferral opportunity. The DOL is basically saying that since the company did not properly notify the employee of their ability to make contributions out of their paycheck, now the company has to fund those contributions on their behalf. They could assign the QNEC amount equal to the average percentage of compensation amount deferred by the rest of the employees covered by the plan which could be a very costly mistake for an employer.

Why The Rule Change?

There are two primary drivers that led to the adoption of this new 401(k) part-time employee coverage requirement. First, acknowledging a change in the U.S. labor force, where instead of employees working one full-time job, more employees are working multiple part-time jobs. By working multiple part-time jobs with different employers, while that employee may work more than 1000 hours a year, they may never become eligible to participate in any of their employer’s 401(K) plans because they were not considered full-time with any single employer.

This brings us to the second driver of this new rule, which is increasing access for more employees to an employer-based retirement-saving solution. Given the increase in life expectancy, there is a retirement savings shortfall issue within the U.S., and giving employees easier access to employer-based solutions may encourage more employees to save more for retirement.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What changes are coming for part-time employee eligibility in 401(k) plans?

Beginning January 1, 2024, employers that sponsor 401(k) plans must allow certain part-time employees to contribute to the plan. This change, introduced under the Secure Act, expands retirement plan access to workers who previously did not meet the full-time employment requirements.

Who qualifies as a part-time employee eligible to join a 401(k) in 2024?

Under Secure Act 1.0, part-time employees who have completed at least three consecutive years of service and worked at least 500 hours in each of those years must be allowed to participate in their employer’s 401(k) plan beginning in 2024. Employers are required to track service hours starting from January 1, 2021.

Will part-time employees receive employer contributions?

Not necessarily. The new rule only guarantees eligibility for employee salary deferrals. Employers are not required to provide matching or other employer contributions to part-time workers until they meet the plan’s standard eligibility requirements, such as one year of service and 1,000 hours worked.

How will eligibility requirements change again in 2025 under Secure Act 2.0?

Starting January 1, 2025, Secure Act 2.0 reduces the eligibility threshold from three consecutive years to two consecutive years of at least 500 hours worked per year. Employers will only need to track service back to January 1, 2023, for this new rule.

Are there any employees excluded from this new rule?

Yes. Employees covered by collective bargaining agreements and nonresident aliens are excluded from the part-time eligibility requirements. These groups may continue to be excluded from participation regardless of hours worked.

What are the penalties for not notifying eligible part-time employees?

Employers who fail to notify newly eligible part-time employees may face Department of Labor penalties and compliance corrections. The DOL could also require the company to make a Qualified Non-Elective Contribution (QNEC) to affected employees to compensate for missed deferral opportunities.

Why did Congress expand 401(k) access to part-time employees?

The rule change reflects the evolving U.S. labor market, where many workers hold multiple part-time jobs instead of one full-time position. Expanding eligibility helps address retirement savings gaps and increases access to employer-based retirement plans for more workers.

3 New Startup 401(k) Tax Credits

When Congress passed the Secure Act 2.0 in December 2022, they introduced new tax credits and enhanced old tax credits for startup 401(k) plans for plan years 2023 and beyond. There are now 3 different tax credits that are available, all in the same year, for startup 401(k) plans that now only help companies to subsidize the cost of sponsoring a retirement plan but also to offset employer contributions made to the employee to enhance a company’s overall benefits package.

When Congress passed the Secure Act 2.0 in December 2022, they introduced new tax credits and enhanced old tax credits for startup 401(k) plans. There are now 3 different tax credits that are available for startup 401(k) plans that were put into place to help companies to subsidize the cost of sponsoring a retirement plan and also to subsidize employer contributions made to the employees to enhance the company’s overall benefits package. Here are the 3 startup 401(k) credits that are now available to employers:

Startup Tax Credit (Plan Cost Credit)

Employer Contribution Tax Credit

Automatic Enrollment Tax Credit

Startup Tax Credit

To incentivize companies to adopt an employer-sponsored retirement plan for their employees, Secure Act 2.0 enhanced the startup tax credits available to employers starting in 2023. This tax credit was put into place to help businesses offset the cost of establishing and maintaining a retirement plan for their employees for the first 3 years of the plan’s existence. Under the new Secure 2.0 credit, certain businesses will be eligible to receive a tax credit for up to 100% of the annual plan costs.

A company must meet the following requirement to be eligible to capture this startup tax credit:

The company may have no more than 100 employees who received compensation of $5,000 or more in the PRECEDING year; and

The company did not offer a retirement plan covering substantially the same employees during the PREVIOUS 3 YEARS.

The plan covers at least one non-HCE (non-Highly Compensated Employee or NHCE)

To identify if you have a NHCE, you have to look at LAST YEAR’s compensation and both this year’s and last year’s ownership percentage. For the 2023 plan year, a NHCE is any employee that:

Does NOT own more than 5% of the company; and

Had less than $135,000 in compensation in 2022. For the compensation test, you look back at the previous year’s compensation to determine who is a HCE or NHCE in the current plan year. For 2023, you look at 2022 compensation. The IRS typically increases the compensation threshold each year for inflation.

A note here about “attribution rules”. The IRS is aware that small business owners have the ability to maneuver around ownership and compensation thresholds, so there are special attribution rules that are put into place to limit the “creativity” of small business owners. For example, ownership is shared or “attributed” between spouses, which means if you own 100% of the business, your spouse that works for the business, even though they are not an owner and only earn $30,000 in W2, they are considered a HCE because they are attributed your 100% ownership in the business.

Besides just attribution rules, employer-sponsored retirement plans also has control group rules, affiliated service group rules, and other fun rules that further limit creativity. Especially for individuals that are owners of multiple businesses, these special 401(k) rules can create obstacles when attempting to qualify for these tax credits. Bottom line, before blindly putting a retirement plan in place to qualify for these tax credits, make sure you talk to a professional within the 401(k) industry that understands all of these rules.

401(k) Startup Tax Credit Amount

Let’s assume your business qualifies for the 401(k) startup tax credit, what is the amount of the tax credit? Here are the details:

For companies with 50 employees or less: The credit covers 100% of the company’s plan costs up to an annual limit of the GREATER of $500 or $250 multiplied by the number of plan-eligible NHCE, up to a maximum credit of $5,000.

For companies with 51 to 100 employees: The credit covers 50% of the company’s plan costs up to an annual limit of the GREATER of $500 or $250 multiplied by the number of plan-eligible NHCE, up to a maximum credit of $5,000.

This is a federal tax credit that is available to eligible employers for the first 3 years that the new plan is in existence. If you have enough NHCE’s, you could technically qualify for $5,000 each year for the first 3 years that the retirement plan is in place.

A note on the definition of “plan-eligible NHCEs”. These are NHCEs that are also eligible to participate in your plan in the current plan year. NHCEs that are not eligible to participate because they have yet to meet the eligibility requirement, do not count toward the max credit calculation.

What Type of Plan Costs Qualify For The Credit?

Qualified costs include costs paid by the employer to:

Setup the Plan

Administer the Plan (TPA Fees)

Recordkeeping Fees

Investment Advisory Fees

Employee Education Fees

To be eligible for the credit, the costs must be paid by the employer directly to the service provider. Fees charged against the plan assets or included in the mutual fund expense ratios do not qualify for the credit. Since historically many startup plans use 401(k) platforms that utilize higher expense ratio mutual funds to help subsidize some of the out-of-pocket cost to the employer, these higher tax credits may change the platform approach for start-up plans because the employer and the employee may both be better off by utilizing a platform with low expense ratio mutual funds, and the employer pays the TPA, recordkeeping, and investment advisor fees directly in order to qualify for the credit.

Note: It’s not uncommon for the owners of the company to have larger balances in the plan compared to the employees, so they also benefit by not having the plan fee paid out of plan assets.

Startup Tax Credit Example

A company has 20 employees, 2 HCEs and 18 NHCEs, and all 20 employees are currently eligible to participate in the new 401(k) plan that the company just started in 2023. During 2023, the company paid $3,000 in total plan fees directly to the TPA firm, investment advisor, and recordkeeper of the plan. Here is the credit calculation:

18 Eligible NHCEs x $250 = $4,500

Total 401(k) Startup Credit for 2023 = $3,000

Even though this company would have been eligible for a $4,500 tax credit, the credit cannot exceed the total fees paid by the employer to the 401(k) service providers, and the total plan fees in this example were $3,000.

No Carry Forward

If the company incurs plan costs over and above the credit amount, the new tax law does not allow plan costs that exceed the maximum credit to be carried forward into future tax years.

Solo(k) Plans Are Not Eligible for Startup Tax Credit

Due to the owner-only nature of a Solo(K) plan, there would not be any NHCEs in a Solo(K) plan, so they would not be eligible for the startup tax credit.

401(k) Employer Contribution Tax Credit

This is a new tax credit starting in 2023 that will provide companies with a tax credit for all or a portion of the employer contribution that is made to the 401(k) plan for employees earning no more than $100,000 in compensation.

The eligible requirement for this employer contribution credit is similar to that of the startup tax credit with one difference:

The company may have no more than 100 employees who received compensation of $5,000 or more in the PRECEDING year; and

The company did not offer a retirement plan covering substantially the same employees during the PREVIOUS 5 YEARS.

The plan makes an employer contribution for at least one employee whose annual compensation is not above $100,000.

Employer Contribution Tax Credit Calculation

The maximum credit is assessed on a per-employee basis and for each employee is the LESSER of:

Actual employer contribution amount; or

$1,000 for each employee making $100,000 or less in FICA wages

$1,000 Per Employee Limit

The $1,000 limit is applied to each INDIVIDUAL employee’s employer contribution. It is NOT a blindfolded calculation of $1,000 multiped by each of your employees under $100,000 in comp regardless of the amount of their actual employer contribution.

For example, Company RTE has two employees making under $100,000 per year, Sue and Rick. Sue receives an employer contribution of $3,000 and Rick received an employer contribution of $400. The max employer contribution credit would be $1,400, $400 for Rick’s employer contribution, and $1,000 for Sue’s contribution since she would be subject to the $1,000 per employee cap.

S-Corp Owners

As mentioned above, the credit only applies to employees with less than $100,000 in annual compensation but what about S-corp owners? The only compensation that is taken into account for S-corp owners for purposes of retirement plan contributions is their W2 income. So what happens when an S-corp owner has W2 income of $80K but takes a $500,000 dividend from the S-corp? Good news for S-corp owners, the $100,000 comp threshold only looks at the plan compensation which for S-corp owners is just their W2 income, so an employer contribution for an S-corp would be eligible for this credit as long as their W2 is below $100,000 but they would still be subject to the $1,000 per employee cap.

5-Year Decreasing Scale

Unlike the startup tax credit that stays the same for the first 3 years of the plan’s existence, the Employer Contribution Tax Credit decreases after year 2 but lasts for 5 years instead of just 3 years. Similar to the startup tax credit, there is a deviation in the calculation depending on whether the company has more or less than 50 employees.

For companies that have 50 or fewer employees, the employer contribution tax credit phase-down schedule is as follows:

Year 1: 100%

Year 2: 100%

Year 3: 75%

Year 4: 50%

Year 5: 25%

50 or Less Employee Example

Company XYZ starts a new 401(k) plan for their employees in 2023 and offers a safe harbor employer matching contribution. The company has 20 eligible employees, 18 of the 20 are making less than $100,000 for the year in compensation, all 18 employees contribute to the plan and each employee is eligible for a $1,250 employer matching contribution.

Since the tax credit is capped at $1,000 per employee, that credit would be calculated as follows:

$1,000 x 18 Employees = $18,000

The total employer contribution for these 18 employees would be $1,250 x 18 = $22,250 but the company would be eligible to receive a tax credit in year 1 for $18,000 of the $22,250 that was contributed to the plan on behalf of these 18 employees in Year 1.

Note: If an employee only receives a $600 employer match, the tax credit for that employee is only $600. The $1,000 per employee cap only applies to employees that receive an employer contribution in excess of $1,000.

51 to 100 Employees

For companies with 51 – 100 employees, the employer contribution credit calculation is slightly more complex. Same 5 years phase-down schedule as the 1 – 50 employee companies but the amount of the credit is reduced by 2% for EACH employee over 50 employees. To determine the amount of the discount you multiply 2% by the number of employees that the company has over 50, and then subtract that amount from the full credit percentage that is available for that plan year.

For example, a new startup 401K has 80 employees, and they are in Year 1 of the 5-year discount schedule, the tax credit would be calculated as follows:

100% - (2% x 30 EEs) = 40%

So instead of receiving a 100% tax credit for the eligible employer contributions for the employees making under $100,000 in compensation, this company would only receive a 40% tax credit for those employer contributions.

Calculation Crossroads

There is a second step in this employer contribution tax credit calculation for companies with 51 – 100 that has the 401(K) industry at a crossroads and will most likely require guidance from the IRS on how to properly calculate the tax credit for these companies when applying the $1,000 per employee cap.

I’m seeing very reputable TPA firms (third-party administrators) run the second half of this calculation differently based on their interpretation of WHEN to apply the $1,000 per employee cap and it creates different results in the amount of tax credit awarded.

Calculation 1: Some firms are applying the $1,000 per employee cap to the employer contributions BEFORE the discounted tax credit percentage is applied.

Calculation 2: Other firms apply the $1,000 per employee cap AFTER the discounted tax credit is applied to each employee’s employer contribution for purposes of assessing the $1,000 cap per employee.

I’ll show you why this matters in a simple example just using 2 employees:

Sue and Peter both make under $100,000 in compensation and work for Company ABC which has 80 employees. Company ABC just implemented a 401(K) plan this year with an employer matching contribution, both Sue and Peter contribute to the plan, Sue is entitled to a $1,300 matching contribution and Peter is entitled to a $900 matching contribution.

Since the company has over 80 employees, the company is only entitled to a 40% credit for the eligible employer contribution:

100% - (2% x 30 EEs) = 40%

Calculation 1: If Company ABC applies the $1,000 per employee limit BEFORE applying the 40% credit, Sue’s contribution would be capped at $1,000 and Peter’s contribution would be $900, resulting in a total employer contribution of $1,900. To determine the credit amount:

$1,900 x 40% = $760

Calculation 2: If Company ABC applies the $1,000 per employee limit AFTER applying the 40% credit:

Sue: $1,300 x 40% = $520

Peter: $900 x 40% = $360

Total Credit = $880

Calculation 2 naturally produces a high tax credit because the credit amount is being applied against Sue’s total employer contribution of $1,300 which is then bringing her contribution in the calculation below the $1,000 per employee limit.

Which calculation is right? At this point, I have no idea. We will have to wait and see if we get guidance from the IRS.

Capturing Both Tax Credits In The Same Year

Companies are allowed to claim both the 401(K) Startup Tax Credit and the Employer Contribution Tax Credit in the same plan year. For example, you could have a company that establishes a new 401(k) plan in 2023, that qualifies for a $4,000 credit to cover plan costs and another $40,000 credit for employer contributions to total $44,000 in tax credits for the year.

Automatic Enrollment Tax Credit

The IRS and DOL are also incentivizing startup and existing 401(K) plans to adopt automatic enrollment in their plan design by offering an additional $500 credit per year for the first 3 years that this feature is included in the plan. This credit is only available to employers that have no more than 100 employees with at least $5,000 in compensation in the preceding year. The automatic enrollment feature must also meet the eligible automatic contribution arrangement (EACA) requirements to qualify.

For 401(k) plans that started after December 29, 2022, Secure Act 2.0 REQUIRES those plans to adopt an automatic enrollment by 2025. While a new plan could technically opt out of auto-enrollment in 2023 and 2024, since it’s now going to be required starting in 2025, it might be easier just to include that feature in your new plan and capture the tax credit for the next three years.

Note: Automatic enrollment will not be required in 2025 for plans that were in existence prior to December 30, 2022.

Simple IRA & SEP IRA Tax Credits

Both the Startup Tax Credit and Employer Contribution Tax Credits can also be claimed by companies that sponsor Simple IRAs and SEP IRAs.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What new 401(k) tax credits were created under the Secure Act 2.0?

Secure Act 2.0 introduced and expanded three key tax credits for employers starting retirement plans:

Startup Tax Credit – Covers plan setup and administration costs.

Employer Contribution Tax Credit – Offsets employer matching or nonelective contributions.

Automatic Enrollment Tax Credit – Rewards employers that add automatic enrollment features.

Who qualifies for the 401(k) Startup Tax Credit?

Employers with 100 or fewer employees earning $5,000+ in the previous year qualify if:

The business hasn’t offered a retirement plan in the past 3 years, and

The new plan covers at least one non-highly compensated employee (NHCE).

How much is the 401(k) Startup Tax Credit worth?

For the first 3 years of a new plan:

Employers with ≤50 employees: 100% of eligible costs up to $5,000 per year.

Employers with 51–100 employees: 50% of eligible costs up to $5,000 per year.

Eligible costs include plan setup, recordkeeping, administration, employee education, and investment advisory fees.

Do Solo 401(k) plans qualify for the Startup Tax Credit?

No. Solo 401(k) plans are not eligible because they have no non-highly compensated employees (NHCEs), which is a requirement for the credit.

What is the Employer Contribution Tax Credit?

This new 5-year credit offsets employer contributions made to employees earning under $100,000 per year.

The credit equals the lesser of the employer contribution or $1,000 per employee.

For employers with ≤50 employees, the credit starts at 100% for the first 2 years and then phases down to 25% by year 5.

Employers with 51–100 employees receive a reduced credit (decreasing by 2% for each employee over 50).

Can S-Corp owners qualify for the Employer Contribution Tax Credit?

Yes. The $100,000 compensation limit only considers W-2 wages, not distributions. So, if an S-Corp owner has less than $100,000 in W-2 income, their employer contribution can qualify for the tax credit.

Can companies claim both the Startup and Employer Contribution credits?

Yes. Eligible employers can claim both credits in the same year. For example, a company could receive a $4,000 startup cost credit and a $40,000 employer contribution credit in a single tax year.

What is the Automatic Enrollment Tax Credit?

Employers with ≤100 employees who implement an eligible automatic contribution arrangement (EACA) can claim a $500 annual credit for 3 years. This applies to both new and existing plans that add automatic enrollment.

When is automatic enrollment required for new 401(k) plans?

Starting in 2025, all new 401(k) and 403(b) plans established after December 29, 2022, must include automatic enrollment. Older plans are exempt from this requirement.

Do Simple IRAs and SEP IRAs qualify for these credits?

Yes. Both the Startup Tax Credit and Employer Contribution Tax Credit also apply to businesses offering Simple IRAs or SEP IRAs instead of 401(k) plans.

529 to Roth IRA Transfers: A New Backdoor Roth Contribution Strategy Is Born

With the passing of the Secure Act 2.0, starting in 2024, owners of 529 accounts will now have the ability to transfer up to $35,000 from their 529 college savings account directly to a Roth IRA for the beneficiary of the account. While on the surface, this would just seem like a fantastic new option for parents that have money leftover in 529 accounts for their children, it is potentially much more than that. In creating this new rule, the IRS may have inadvertently opened up a new way for high-income earners to move up to $35,000 into a Roth IRA, creating a new “backdoor Roth IRA contribution” strategy for high-income earners and their family members.

With the passing of the Secure Act 2.0, starting in 2024, owners of 529 accounts will now have the ability to transfer up to $35,000 from their 529 college savings account directly to a Roth IRA for the beneficiary of the account. While on the surface, this would just seem like a fantastic new option for parents that have money leftover in 529 accounts for their children, it is potentially much more than that. In creating this new rule, the IRS may have inadvertently opened up a new way for high-income earners to move up to $35,000 into a Roth IRA, creating a new “backdoor Roth IRA contribution” strategy for high-income earners and their family members.

Money Remaining In the 529 Account for Your Children

I will start by explaining this new 529 to Roth IRA transfer provision using the scenario that it was probably intended for; a parent that owns a 529 account for their children, the kids are done with college, and there is still a balance remaining in the 529 account.

The ability to shift money from a 529 account directly to a Roth IRA for your child is a fantastic new distribution option for balances that may be leftover in these accounts after your child or grandchild has completed college. Prior to the passage of the Secure Act 2.0, there were only two options for balances remaining in 529 accounts:

Change the beneficiary on the account to someone else

Process a non-qualified distribution from the account

Both options created potential challenges for the owners of 529 accounts. For the “change the beneficiary option”, what if you only have one child, or what if the remaining balance is in the youngest child’s account? There may not be anyone else to change the beneficiary to.

The second option, processing a “non-qualified distribution” from the 529 account, if there were investment earnings in the account, those investment earnings are subject to taxes and a 10% penalty because they were not used to pay a qualified education expense.

The “Roth Transfer Option” not only gives account owners a third attractive option, but it’s so attractive that planners may begin advising clients to purposefully overfund these 529 accounts with the intention of processing these Roth transfers after the child has completed college.

Requirements for 529 to Roth IRA Transfers

Before I get into explaining the advanced tax and wealth accumulation strategies associated with this new 529 distribution option, like any new tax law, there is a list of rules that you have to follow to be eligible to process these 529 to Roth IRA transfers.

The 15 Year Rule

The first requirement is the 529 account must have been in existence for at least 15 years to be eligible to execute a Roth transfer from the account. The clock starts when you deposit the first dollar into that 529 account. The planning tip here is to fund the 529 as soon as you can after the child is born, if you do, the 529 account will be eligible for Roth IRA transfers by their 15th or 16th birthday.

There is an unanswered question surrounding rollovers between state plans and this 15-year rule. Right now, you are allowed to rollover let’s say a Virginia 529 account into a New York 529 account. The question becomes, since the New York 529 account is a new account, would that end up re-setting the 15-year inception clock?

Contributions Within The Last 5 Years Are Not Eligible

When you go to process a Roth transfer from a 529 account, contributions made to the 529 account within the previous 5 years are not eligible for Roth transfers.

The Beneficiary of the 529 Account and the Owners of the Roth IRA Must Be The Same Person

A third requirement is the beneficiary listed on the 529 account and the owner of the Roth IRA account must be the same person. If your daughter is the beneficiary of the 529 account, she would also need to be the owner of the Roth IRA that is receiving the transfer directly from the 529 account. There is a big question surrounding this requirement that we still need clarification on from the IRS. The question is this: Is the account owner allowed to change the beneficiary on the 529 account without having to re-satisfy a new 15-year account inception requirement?

If they allow beneficiary changes without a new 15-year inception period, with 529 accounts, the account owner can change the beneficiary on these accounts to whomever they want……..including themselves. This would allow a parent to change the beneficiary to themselves on the 529 account and then transfer the balance to their own Roth IRA, which may not be the intent of the new law. We will have to wait for guidance on this.

No Roth IRA Income Limitations

As many people are aware, if you make too much, you are not allowed to contribute to a Roth IRA. For 2023, the ability to make Roth IRA contributions begins to phase out at the following income levels:

Single Filer: $138,000

Married Filer: $218,000

These transfers directly from 529 accounts to the beneficiary’s Roth IRA do not carry the income limitation, so regardless of the income level of the 529 account owner or the beneficiary, there a no maximum income limit that would preclude these 529 to Roth IRA transfers from taking place.

The IRA Owner Must Have Earned Income

With exception of the Roth IRA income phaseout rules, the rest of the Roth RIA rules still apply when determining whether or not a 529 to Roth IRA transfer is allowed in a given tax year. First, the beneficiary of the 529 (also the owner of the Roth IRA) needs to have earned income in the year that the transfer takes place to be eligible to process a transfer from the 529 to their Roth IRA.

Annual 529 to Roth IRA Transfer Limits

The amount that can be transferred from the 529 to the Roth IRA is also limited each year by the regular Roth IRA annual contribution limits. For 2023, an individual under the age of 50, is allowed to make a Roth IRA contribution of up to $6,500. That is the most that can be moved from the 529 account to Roth IRA in a single tax year. But in addition to this hard dollar limit, you have to also take into account any other Roth IRA contributions that were made to the IRA owner’s account and the IRA owners earned income for that tax year.

The annual contribution limit to a Roth IRA for 2023 is actually the LESSER of:

$6,500; or

100% of the earned income of the account owner

Assuming the IRA contribution limits stay the same in 2024, if a child only has $3,000 in income, the maximum amount that could be transferred from the 529 to the Roth IRA in 2024 is $3,000.

If the child made a contribution of their own to the Roth IRA, that would also count against the amount that is available for the 529 to Roth IRA transfer. For example, the child makes $10,000 in earned income, making them eligible for the full $6,500 Roth IRA contribution, but if the child contributes $2,000 to their Roth IRA throughout the year, the maximum 529 to Roth IRA transfer would be $4,500 ($6,500 - $2,000 = $4,500)

The IRA limits could be the same or potentially higher in 2024 when this 529 to Roth IRA transfer option goes into effect.

$35,000 Limiting Maximum Per Beneficiary

The maximum lifetime amount that can be transferred from a 529 to a Roth IRA is $35,000 for each beneficiary. Given the annual contribution limits that we just covered, you would not be allowed to just transfer $35,000 from the 529 to the Roth IRA all in one shot. The $35,000 lifetime limit would be reached after making multiple years of transfers from the 529 to the Roth IRA over a number of tax years.

Advanced 529 Planning Strategies Using Roth Transfers

Now I’m going to cover some of the advanced tax and wealth accumulation strategies that may be able to be executed under this 529 Roth Transfer provision. Disclosure, writing this in February 2023, we are still waiting on guidance from the IRS on what they may or may not have intended with this new 529 to Roth transfer option that becomes available starting in 2024, so their guidance could either reinforce that these strategies can be used or limit the use of these advanced strategies. Time will tell.

Super Funding A Roth IRA For Your Child

While 529 accounts have traditionally been used to save exclusively for future college expenses for your children or grandchild, they just become much more than that. Parents and grandparents can now fund these accounts when a child is young with the pure intention of NOT using the funds for college but rather creating a supercharged Roth IRA as soon as that child begins earning income in their teenage years and into their 20s.

This is best illustrated in an example. You have a granddaughter that is born in 2023, you open a 529 account for her and fund it with $15,000. By the time your granddaughter has reached age 18, let’s assume through wise investment decisions, the account has tripled to $45,000. Between ages 18 and 21, she works a summer job making $8,000 in earned income each year and then gets a job after graduating college making $80,000 per year. Assuming she made no contributions to a Roth IRA over the years, you would be able to make transfers between her 529 account and her Roth IRA up to the annual contribution limit until the total transfers reached the $35,000 lifetime maximum.

If that $35,000 lifetime maximum is reached when she turns age 24, assuming she also makes wise investment decisions and earns 8% per year on her Roth IRA until she reaches age 60, at age 60 she would have $620,000 in that Roth IRA account that could be withdrawal ALL TAX-FREE.

Now multiply that $620,000 across EACH of your children or grandchildren, and it becomes a truly fantastic way to build tax-free wealth for the next generation.

529 Backdoor Roth Contribution Strategy

A fun fact, there are no age limits on either the owner or beneficiary of a 529 account. At the age of 40, I could open a 529 account, be the owner and the beneficiary of the account, fund the account with $15,000, wait the 15 years, and then when I turn age 55, begin processing transfers directly from the 529 to my Roth IRA up to the maximum annual IRA limit each year until I reach my $35,000 lifetime limit.

I really don’t care that the money has to sit in the 529 for 15 years because 529 accumulate tax deferred anyways, and by the time I hit age 59.5, making me eligible for tax-free withdrawal of the earnings, I will have already moved most of the balance over to my Roth IRA. Oh and remember, even if you make too much to contribute directly to a Roth IRA, the income limits do not apply to these 529 to Roth IRA direct transfers.

The IRS may have inadvertently created a new “Backdoor Roth IRA Contribution” strategy for high-income earners.

Now there may be some limitations that can come into play with the age of the individual executing this strategy, it’s really less about their age, and more about whether or not they will have earned income 15 years from now when the 529 to Roth IRA transfer window opens. If you are 65, fund a 529, and then at age 80 want to begin these 529 to Roth IRA transfers, if you have no earned income, you can process these 529 to Roth IRA transfers because you are limited by the regular IRA annual contribution limits that require you to have earned income to process the transfers.

Advantage Over Traditional Backdoor Roth Conversions

For individuals that have a solid understanding of how the traditional “Backdoor Roth IRA Contribution” strategy works, the new 529 to Roth IRA transfer strategy potentially contains additional advantages over and above the traditional backdoor Roth strategy. These movements from the 529 to Roth IRA are not considered “conversions”, they are considered direct transfers. Why is that important? Under the traditional Backdoor Roth Contribution strategy the taxpayer is making a non-deductible contribution to a traditional IRA and then processes a conversion to a Roth IRA.

One of the IRS rules during this conversion process is the “aggregation rule”. When a Roth conversion is processed, the taxpayer has to aggregate all of their pre-tax IRA balance together in determining how much of the conversion is taxable, so if the taxpayer has other pre-tax IRAs, it came sometimes derail the backdoor Roth contribution strategy. If they instead use the 529 to Roth IRA direct transfer processes, since as of right now it is not technically a “conversion”, the aggregate rule is avoided.

The second big advantage is with the 529 to Roth IRA transfer strategy, the Roth IRA is potentially being funded with “untaxed earnings” as opposed to after-tax dollar. Again, in the traditional Backdoor Roth Strategy, the taxpayer is using after-tax money to make a nondeductible contribution to a Traditional IRA and then converting those dollars to a Roth IRA. If instead the taxpayer funds a 529 with $15,000 in after-tax dollars, but during the 15-year holding, The account grows the $35,000, they are then able to begin direct transfers from the 529 to the Roth IRA when $20,000 of that account balance represents earnings that were never taxed. Pretty cool!!

State Tax Deduction Clawbacks?

There are some states, like New York, that offer tax deductions for contributions to 529 accounts up to annual limits. When the federal government changes the rules for 529 accounts, the states do not always follow suit. For example, when the federal government changed the tax laws allowing account owners to distribute up to $10,000 per year for K – 12 qualified expenses from 529 accounts, some states, like New York, did not follow suit, and did not recognize the new “qualified expenses”. Thus, if someone in New York distributed $10,000 from a 529 for K – 12 expenses, while they would not have to pay federal tax on the distribution, New York viewed it as a “non-qualified distribution”, not only making the earnings subject to state taxes but also requiring a clawback of any state tax deduction that was taken on the contribution amounts.

The question becomes will the states recognize these 529 to Roth IRA transfers as “qualified distributions,” or will they be subject to taxes and deduction clawbacks at the state level? Time will tell.

Waiting for Guidance From The IRS

This new 529 to Roth IRA transfer option that starts in 2024 has the potential to be a tremendous tax-free wealth accumulation strategy for not just children but for individuals of all ages. However, as I mentioned multiple times in the article, we have to wait for formal guidance from the IRS to determine which of these advanced wealth accumulation strategies will be allowed from tax years 2024 and beyond.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the new 529 to Roth IRA transfer rule under the Secure Act 2.0?

Starting in 2024, owners of 529 college savings accounts can transfer up to $35,000 over their lifetime from a 529 directly to a Roth IRA for the account’s beneficiary. This gives families a new tax-free way to repurpose unused education savings.

What are the main requirements for a 529 to Roth IRA transfer?

The 529 account must be at least 15 years old, and contributions made within the last 5 years cannot be transferred. The 529 beneficiary and the Roth IRA owner must be the same person, and the beneficiary must have earned income in the year of transfer.

How much can be transferred each year?

Transfers are subject to the annual Roth IRA contribution limit—currently $6,500 per year (or less if earned income is lower). It may take several years to reach the $35,000 lifetime transfer cap.

Do income limits apply to 529 to Roth IRA transfers?

No. These transfers are not subject to Roth IRA income phaseouts, meaning high-income earners can use this rule even if they’re normally ineligible to contribute directly to a Roth IRA.

Can parents use this rule as a backdoor Roth IRA strategy?

Potentially. If future IRS guidance allows changing a 529 beneficiary to oneself without restarting the 15-year clock, high-income earners could fund their own Roth IRAs using this method—creating a new type of “backdoor Roth” strategy.

Are there potential state tax implications?

Yes. Some states may not treat 529-to-Roth transfers as qualified distributions, which could trigger state taxes or clawbacks of prior state tax deductions.

When will the IRS provide more guidance on this rule?

The IRS is expected to issue clarifications before the rule takes effect in 2024. Guidance will determine whether advanced strategies—like beneficiary changes or state conformity—are allowed.

Mandatory Roth Catch-up Contributions for High Wage Earners - Secure Act 2.0

Starting in 2026, individuals that make over $145,000 in wages will no longer be able to make pre-tax catch-up contributions to their employer-sponsored retirement plan. Instead, they will be forced to make catch-up contributions in Roth dollars which means that they will no longer receive a tax deduction for those contributions.

Starting in 2026, individuals that make over $150,000 in wages will no longer be able to make pre-tax catch-up contributions to their employer-sponsored retirement plan. Instead, they will be forced to make catch-up contributions in Roth dollars which means that they will no longer receive a tax deduction for those contributions.

This, unfortunately, was not the only change that the IRS made to the catch-up contribution rules with the passing of the Secure Act 2.0 on December 23, 2022. Other changes will take effect in 2025 to further complicate what historically has been a very simple and straightforward component of saving for retirement.

Even though this change will not take effect until 2026, your wage for 2025 may determine whether or not you will qualify to make pre-tax catch-up contributions in the 2026 tax year. In addition, high wage earners may implement tax strategies in 2025, knowing that they are going to lose this sizable tax deduction in the 2026 tax year.

Effective Date Delayed Until 2026

Originally when the Secure Act 2.0 was passed, the Mandatory 401(K) Roth Catch-up was scheduled to become effective in 2024. However, in August 2023, the IRS released a formal notice delaying the effective date until 2026. This was most likely a result of 401(k) service providers reaching out to the IRS requesting for the delay so the IRS has more time to provide much needed additional guidance on this new rule as well as time for the 401(k) service providers to update their systems to comply with the new rules.

Before Secure Act 2.0

Before the Secure Act 2.0 was passed, the concept of making catch-up contributions to your employer-sponsored retirement account was very easy. If you were age 50 or older at any time during that tax year, you were able to contribute the maximum employee deferral amount for the year PLUS an additional catch-up contribution. For 2025, the annual contribution limits for the various types of employer-sponsored retirement plans that have employee deferrals are as follows:

401(k) / 403(b)

EE Deferral Limit: $23,500

Regular Age 50 Catch-up Limit: $7,500

Enhanced Age 60 – 63 Catch-up Limit: $11,250

Simple IRA

EE Deferral Limit: $16,500 or $17,600 (depending on size of employer)

Regular Age 50 Catch-up Limit: $3,500

Enhanced Age 60 – 63 Catch-up Limit: $5,250