Do I Make Too Much To Qualify For Financial Aid?

If you have children that are college-bound at some point you will begin the painful process of calculating how much college will cost for both you and them. However, you might be less worried about the financial aspects of your child going to college after viewing some of the Bloomsburg student apartments for rent on the market at the moment.

If you have children that are college-bound at some point you will begin the painful process of calculating how much college will cost for both you and them. However, you might be less worried about the financial aspects of your child going to college after viewing some of the Bloomsburg student apartments for rent on the market at the moment. Anyway, I have heard the statement, "well they will just have to take loans" but what parents don't realize is loans are a form of financial aid. Loans are not a given. Whether your children plan to attend a public college or private college, both have formulas to determine how much a family is expected to pay out of pocket before you even reach any "financial aid" which includes loans.

College Costs Are Increasing By 6.5% Per Year

The rise in the cost of college has outpaced the inflation rate of most other household costs over the past three decades.

To put this in perspective, if you have a 3 year old child and the cost of tuition / room & board for a state school is currently $25,000 by the time that child turns 17, the cost for one year of tuition / room & board will be $60,372. Multiply that by 4 years for a bachelor's degree: $241,488. Ouch!!! Which leads you to the next question, how much of that $60,372 per year will I have to pay out of pocket?

FAFSA vs CSS Profile Form

Public schools and private school have a different calculation for how much “aid” you qualify for. Public or state schools go by the FAFSA standards. Private schools use the “CSS Profile” form. The FAFSA form is fairly straight forward and is applied universally for state colleges. However, private schools are not required to follow the FAFSA financial aid guidelines which is why they have the separate CSS Profile form. By comparison the CSS profile form requests more financial information.

For example, for couples that are divorced, the FAFSA form only takes into consideration the income and assets of the parent that the child lives with for more than six months out of the year. This excludes the income and assets of the parent that the child does not live with for the majority of the year which could have a positive impact on the financial aid calculation. However, the CSS profile form, for children with divorced parents, requests and takes into consideration the income and assets of both parents regardless of their marital status.

Expected Family Contribution

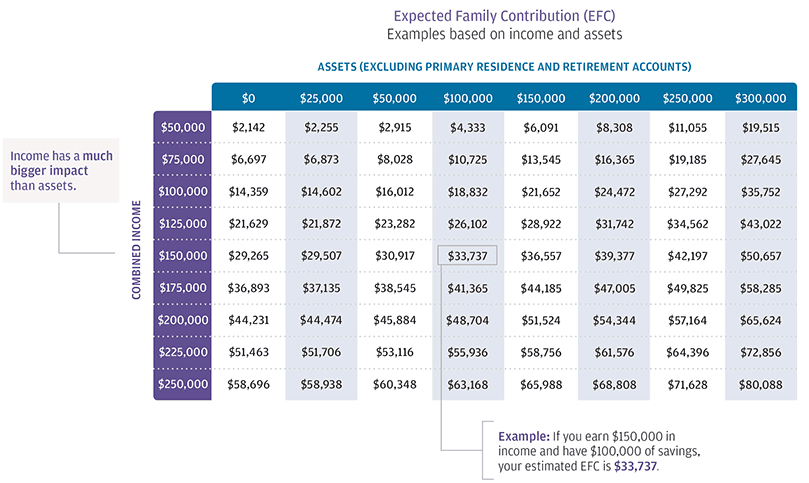

Both the FAFSA and CSS Profile form result in an "Expected Family Contribution" (EFC). That is the amount the family is expected to pay out of pocket for their child's college expense before the financial aid package begins. Below is a EFC award chart based on the following criteria:

FAFSA Criteria

2 Parent Household

1 Child Attending College

1 Child At Home

State of Residence: NY

Oldest Parent: 49 year old

As you can see in the chart, income has the largest impact on the amount of financial aid. If a married couple has $150,000 in AGI but has no assets, their EFC is already $29,265. For example, if tuition / room and board is $25,000 for SUNY Albany that means they would receive no financial aid.

Student Loans Are A Form Of Financial Aid

Most parents don't realize the federal student loans are considered "financial aid". While "grant" money is truly "free money" from the government to pay for college, federal loans make up about 32% of the financial aid packages for the 2016 – 2017 school year. See the chart below:

Start Planning Now

The cost of college is increasing and the amount of financial aid is declining. According to The College Board, between 2010 – 2016, federal financial aid declined by 25% while tuition and fees increased by 13% at four-year public colleges and 12% at private colleges. This unfortunate trend now requires parents to start running estimated EFC calculation when their children are still in elementary school so there is a plan for paying for the college costs not covered by financial aid.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Tax Reform: Your Company May Voluntarily Terminate Your Retirement Plan

Make no mistake, your company retirement plan is at risk if the proposed tax reform is passed. But wait…..didn’t Trump tweet on October 23, 2017 that “there will be NO change to your 401(k)”? He did tweet that, however, while the tax reform might not directly alter the contribution limits to employer sponsored retirement plans, the new tax rates

Make no mistake, your company retirement plan is at risk if the proposed tax reform is passed. But wait…..didn’t Trump tweet on October 23, 2017 that “there will be NO change to your 401(k)”? He did tweet that, however, while the tax reform might not directly alter the contribution limits to employer sponsored retirement plans, the new tax rates will produce a “disincentive” for companies to sponsor and make employer contributions to their plans.

What Are Pre-Tax Contributions Worth?

Remember, the main incentive of making contributions to employer sponsored retirement plans is moving income that would have been taxed now at a higher tax rate into the retirement years, when for most individuals, their income will be lower and that income will be taxed at a lower rate. If you have a business owner or executive that is paying 45% in taxes on the upper end of the income, there is a large incentive for that business owner to sponsor a retirement plan. They can take that income off of the table now and then realize that income in retirement at a lower rate.

This situation also benefits the employees of these companies. Due to non-discrimination rules, if the owner or executives are receiving contributions from the company to their retirement accounts, the company is required to make employer contributions to the rest of the employees to pass testing. This is why safe harbor plans have become so popular in the 401(k) market.

But what happens if the tax reform is passed and the business owners tax rate drops from 45% to 25%? You would have to make the case that when the business owner retires 5+ years from now that their tax rate will be below 25%. That is a very difficult case to make.

An Incentive NOT To Contribute To Retirement Plans

This creates an incentive for business owners NOT to contribution to employer sponsored retirement plans. Just doing the simple math, it would make sense for the business owner to stop contributing to their company sponsored retirement plan, pay tax on the income at a lower rate, and then accumulate those assets in a taxable account. When they withdraw the money from that taxable account in retirement, they will realize most of that income as long term capital gains which are more favorable than ordinary income tax rates.

If the owner is not contributing to the plan, here are the questions they are going to ask themselves:

Why am I paying to sponsor this plan for the company if I’m not using it?

Why make an employer contribution to the plan if I don’t have to?

This does not just impact 401(k) plans. This impacts all employer sponsored retirement plans: Simple IRA’s, SEP IRA’s, Solo(k) Plans, Pension Plans, 457 Plans, etc.

Where Does That Leave Employees?

For these reasons, as soon as tax reform is passed, in a very short time period, you will most likely see companies terminate their retirement plans or at a minimum, lower or stop the employer contributions to the plan. That leaves the employees in a boat, in the middle of the ocean, without a paddle. Without a 401(k) plan, how are employees expected to save enough to retire? They would be forced to use IRA’s which have much lower contribution limits and IRA’s don’t have employer contributions.

Employees all over the United States will become the unintended victim of tax reform. While the tax reform may not specifically place limitations on 401(k) plans, I’m sure they are aware that just by lowering the corporate tax rate from 35% to 20% and allowing all pass through business income to be taxes at a flat 25% tax rate, the pre-tax contributions to retirement plans will automatically go down dramatically by creating an environment that deters high income earners from deferring income into retirement plans. This is a complete bomb in the making for the middle class.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

5 Options For Money Left Over In College 529 Plans

If your child graduates from college and you are fortunate enough to still have a balance in their 529 college savings account, what are your options for the remaining balance? There are basically 5 options for the money left over in college 529 plans.

If your child graduates from college and you are fortunate enough to still have a balance in their 529 college savings account, what are your options for the remaining balance? There are basically 5 options for the money left over in college 529 plans.

Advanced degree for child

If after the completion of an undergraduate degree, your child plans to continue on to earn a master's degree, law school, or medical school, you can use the remaining balance toward their advanced degree.

Transfer the balance to another child

If you have another child that is currently in college or a younger child that will be attending college at some point, you can change the beneficiary on that account to one of your other children. There is no limit on the number of 529 accounts that can be assigned to a single beneficiary.

Take the cash

When you make withdrawals from 529 accounts for reasons that are not classified as a "qualified education expenses", the earnings portion of the distribution is subject to income taxation and a 10% penalty. Again, only the earnings are subject to taxation and the penalty, your cost basis in the account is not. For example, if my child finishes college and there is $5,000 remaining in their 529 account, I can call the 529 provider and ask them what my cost basis is in the account. If they tell me my cost basis is $4,000 that means that the income taxation and 10% penalty will only apply to $1,000. The rest of the account is withdrawn tax and penalty free.

Reserve the account for a future grandchild

Once your child graduates from college, you can change the beneficiary on the account to yourself. By doing so the account will continue to grow and once your first grandchild is born, you can change the beneficiary on that account over to the grandchild.

Reserve the account for yourself or spouse

If you think it's possible that at some point in the future you or your wife may go back to school for a different degree or advanced degree, you assign yourself as the beneficiary of the account and then use the account balance to pay for that future degree.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Equifax Data Breach: How To Protect Yourself

Equifax, a credit agency, had a data breach that resulted in an estimated 143 million people having their personal information compromised. Surprisingly enough, the greatest risk is right not now but rather a few months down the road. After your data is stolen, your information is sold on the black market, and then the bad guys figure out how they

Equifax, a credit agency, had a data breach that resulted in an estimated 143 million people having their personal information compromised. Surprisingly enough, the greatest risk is right not now but rather a few months down the road. After your data is stolen, your information is sold on the black market, and then the bad guys figure out how they are going to use your personal information to maximize their financial gain. So there is delay between the time that your information is stolen and when the fraudulent activity using your data begins.

In this article we are going to discuss the top ways to protect your credit from fraudulent activity. Here are the main steps

Monitor your financial activity closely

Run a free credit report

Consider "Freezing" your credit

Step 1: Monitor Your Financial Activity Closely

Make sure you keep a close eye on each transaction running through your checking account and credit card. This is often the first place that signs of fraudulent activity surfaces. If for some reason you cannot identify a charge to your card or bank account, make sure you contact your financial institution immediately.

Use Credit Cards, Not Debit Cards

Along these lines we strongly recommend that you use a credit card instead of a debit card and just payoff the balance of the credit card each month. If your debit card information is compromised and the "bad guys" charge $1,000 to the card, the $1,000 is actually pulled out of your checking account. You now have to report the fraudulent activity and get your money back. Instead, if your credit card is compromised and they make the $1,000 fraudulent transaction, you notify the credit card company but you are not out the $1,000. They just remove the charge from the bill and the credit card tracks down the bad guys. You should only be using your debit card for ATM withdrawals.

Step 2: Run A Free Credit Report

You should get in the habit of running a credit report on yourself once a year. These credit reports list all of your current creditors: car loans, mortgage, credit cards, store charge accounts, credit lines, etc. If you see a creditor on the list that you cannot identify that is a big red flag. If your data is compromised, the bad guys may use your data to apply for a credit card without your knowledge. The only way that you would find out that the fraudulent account existed is by running a credit report on yourself. Running your credit report once a year does not hurt your credit score. It's only if you are running your credit report more frequently that it could impact your credit score. Frequent credit runs can give the impression that you are eagerly searching for more credit and it can lower your credit score.

You can run a free credit report at www.annualcreditreport.com or you can request one from your bank or credit union.

Step 3: Consider Freezing Your Credit

One of the best ways to protect yourself is to freeze your credit with the 3 credit bureaus. There 3 credit bureaus are:

Equifax

Experian

TransUnion

A credit freeze means if someone tries to access your credit to establish a credit card, car loan, whatever it is, the request for the credit report will reject. When you set up the credit freeze each of the bureaus will you with a login or a pin number that allows you to "unfreeze" your credit for a selected period of time. If you have implemented a credit freeze and you apply for a car loan, you would follow the steps below:

Ask the dealership which credit bureau they run their reports through

Login to your account at that credit bureau

Unfreeze your credit report for a selected period of time

Notify the dealership of the limited time window to request the credit report

The window will automatically close and your credit will "re-freeze"

The credit freeze is simple to implement and it can be implemented by visiting the website of each credit bureau. You can also implement the freeze by calling the credit bureau but the on hold wait time is so long that we recommend to our clients implement the freeze via the web.Below is great video that walks you though what the online freezing process looks like:

Don't Use Public Wifi

One last tip to protect your information, do not use public wifi networks. It's tempting if you are at a coffee shop, hotel, or airport to access their free wifi network but it's the wrong move. There are individuals that have special programs that hack into the wireless network and see everything that you are looking at on your laptop or mobile device. If you are going to use a wireless network, make sure it is secure.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Can I Negotiate A Car Lease Buyout?

The short answer is "yes", but the approach that you take will most likely determine whether or not you are successful at purchasing your vehicle for a lower price than the amount listed in the lease agreement. When you lease a car, the lease agreement typically includes an amount that you can purchase the car for at the end of the lease. That amount is

The short answer is "yes", but the approach that you take will most likely determine whether or not you are successful at purchasing your vehicle for a lower price than the amount listed in the lease agreement. When you lease a car, the lease agreement typically includes an amount that you can purchase the car for at the end of the lease. That amount is essentially a guess by the bank that is providing the financing for the lease as to what the future value of your vehicle will be at the end of the lease.

Lease Buyout Calculation

Step number one in the negotiation process is to determine what your vehicle is worth. Did the bank guess right or wrong? If the purchase amount in your lease agreement is $25,000 but you find that the vehicle, based on current market conditions, is only worth $18,000, you probably have room to negotiate the purchase price of your vehicle but you have to do your homework. Compare your vehicle's purchase price to the retail value of local auto dealers. If you can show the bank that there is a local auto dealer trying to sell the exact make and model of your leased car with similar mileage, the bank will be more likely to accept a lower purchase price realizing that they guessed wrong.

Deal Directly With The Bank

You may have noticed that I continue to reference the "bank" in the negotiation process and not the "dealer". This is intentional. Some leasing banks allow dealers to increase the cost of the lease buyout to make a profit. Dealers can also charge document fees, which are taxable in most states. It may also be advantageous to line up your own financing for the lease purchase amount before entering into the negotiation process. If the dealer arranges the financing for you, it can sometimes increase your interest rate to make more money on the purchase. By dealing directly with the leasing bank you can cut out these additional costs.

You Make The Offering Price

Start by making an offer to the leasing bank based on your market research. Also make sure you contact the leasing bank well in advance of the lease "turn-in date". The bank may not be able to provide you with an immediate response to your offer so give yourself plenty of time for the negotiation process to work.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog. I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Can I Use My 401K or IRA To Buy A House?

The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to help toward the down payment on my house?". The short answer is in most cases, "Yes". The next important questions is "Is it a good idea to take a withdrawal from my retirement account for the down

The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to help toward the down payment on my house?". The short answer is in most cases, "Yes". The next important questions is "Is it a good idea to take a withdrawal from my retirement account for the down payment given all of the taxes and penalties that I would have to pay?" This article aims to answer both of those questions and provide you with withdrawal strategies to help you avoid big tax consequences and early withdrawal penalties.

401(k) Withdrawal Options Are Not The Same As IRA's

First you have to acknowledge that different types of retirement accounts have different withdrawal options available. The withdrawal options for a down payment on a house from a 401(k) plan are not the same a the withdrawal options from a Traditional IRA. There is also a difference between Traditional IRA's and Roth IRA's.

401(k) Withdrawal Options

There may be loan or withdrawal options available through your employer sponsored retirement plan. I specifically say "may" because each company's retirement plan is different. You may have all or none of the options available to you that will be presented in this article. It all depends on how your company's 401(k) plan is designed. You can obtain information on your withdrawal options from the plan's Summary Plan Description also referred to as the "SPD".

Taking a 401(k) loan.............

The first option is a 401(k) loan. Some plans allow you to borrow 50% of your vested balance in the plan up to a maximum of $50,000 in a 12 month period. Taking a loan from your 401(k) does not trigger a taxable event and you are not hit with the 10% early withdrawal penalty for being under the age of 59.5. 401(k) loans, like other loans, change interest but you are paying that interest to your own account so it is essentially an interest free loan. Typically 401(k) loans have a maximum duration of 5 years but if the loan is being used toward the purchase of a primary residence, the duration of the loan amortization schedule can be extended beyond 5 years if the plan's loan specifications allow this feature.

Note of caution, when you take a 401(k) loan, loan payments begin immediately after the loan check is received. As a result, your take home pay will be reduced by the amount of the loan payments. Make sure you are able to afford both the 401(k) loan payment and the new mortgage payment before considering this option.

The other withdrawal option within a 401(k) plan, if the plan allows, is a hardship distribution. As financial planners, we strongly recommend against hardship distributions for purposes of accumulating the cash needed for a down payment on your new house. Even though a hardship distribution gives you access to your 401(k) balance while you are still working, you will get hit with taxes and penalties on the amount withdrawn from the plan. Unlike IRA's which waive the 10% early withdrawal penalty for first time homebuyers, this exception is not available in 401(k) plans. When you total up the tax bill and the 10% early withdrawal penalty, the cost of this withdrawal option far outweighs the benefits.

If You Have A Roth IRA.......Read This.....

Roth IRA's can be one of the most advantageous retirement accounts to access for the down payment on a new house. With Roth IRA's, you make after tax contributions to the account, and as long as the account has been in existence for 5 years and you are over the age of 59� all of the earnings are withdrawn from the account 100% tax free. If you withdraw the investment earnings out of the Roth IRA before meeting this criteria, the earnings are taxed as ordinary income and a 10% early withdrawal penalty is assessed on the earnings portion of the account.

What very few people know is if you are under the age of 59� you have the option to withdraw just your after-tax contributions and leave the earnings in your Roth IRA. By doing so, you are able to access cash without taxation or penalty and the earnings portion of your Roth IRA will continue to grow and can be distributed tax free in retirement.

The $10,000 Exclusion From Traditional IRA's.......

Typically if you withdraw money out of your Traditional IRA prior to age 59� you have to pay ordinary income tax and a 10% early withdrawal penalty on the distribution. There are a few exceptions and one of them is the "first time homebuyer" exception. If you are purchasing your first house, you are allowed to withdrawal up to $10,000 from your Traditional IRA and avoid the 10% early withdrawal penalty. You will still have to pay ordinary income tax on the withdrawal but you will avoid the early withdrawal penalty. The $10,000 limit is an individual limit so if you and your spouse both have a traditional IRA, you could potentially withdrawal up to $20,000 penalty free.

Helping your child to buy a house..........

Here is a little known fact. You do not have to be the homebuyer. You can qualify for the early withdrawal exemption if you are helping your spouse, child, grandchild, or parent to buy their first house.

Be careful of the timing rules..........

There is a very important timing rule associated with this exception. The closing must take place within 120 day of the date that the withdrawal is taken from the IRA. If the closing happens after that 120 day window, the full 10% early withdrawal penalty will be assessed. There is also a special rollover rule for the first time homebuyer exemption which provides you with additional time to undo the withdrawal if need be. Typically with IRA's you are only allowed 60 days to put the money back into the IRA to avoid taxation and penalty on the IRA withdrawal. This is called a "60 Day Rollover". However, if you can prove that the money was distributed from the IRA with the intent to be used for a first time home purchase but a delay or cancellation of the closing brought you beyond the 60 day rollover window, the IRS provides first time homebuyers with a 120 window to complete the rollover to avoid tax and penalties on the withdrawal.

Don't Forget About The 60 Day Rollover Option

Another IRA withdrawal strategy that is used as a “bridge solution” is a “60 Day Rollover”. The 60 Day Rollover option is available to anyone with an IRA that has not completed a 60 day rollover within the past 12 months. If you are under the age of 59.5 and take a withdrawal from your IRA but you put the money back into the IRA within 60 days, it’s like the withdrawal never happened. We call it a “bridge solution” because you have to have the cash to put the money back into your IRA within 60 days to avoid the taxes and penalty. We frequently see this solution used when a client is simultaneously buying and selling a house. It’s often the intent that the seller plans to use the proceeds from the sale of their current house for the down payment on their new house. Unfortunately due to the complexity of the closing process, sometimes the closing on the new house will happen prior to the closing on the current house. This puts the homeowner in a cash strapped position because they don’t have the cash to close on the new house.

As long as the closing date on the house that you are selling happens within the 60 day window, you would be able to take a withdrawal from your IRA, use the cash from the IRA withdrawal for the closing on their new house, and then return the money to your IRA within the 60 day period from the house you sold. Unlike the “first time homebuyer” exemption which carries a $10,000 limit, the 60 day rollover does not have a dollar limit.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Tax Deductions For College Savings

Did you know that if you are resident of New York State there are tax deductions waiting for you in the form of a college savings account? As a resident of NYS you are allowed to take a NYS tax deduction for contributions to a NYS 529 Plan up to $5,000 for a single filer or $10,000 for married filing joint. These limits are hard dollar thresholds so it

Did you know that if you are resident of New York State there are tax deductions waiting for you in the form of a college savings account? As a resident of NYS you are allowed to take a NYS tax deduction for contributions to a NYS 529 Plan up to $5,000 for a single filer or $10,000 for married filing joint. These limits are hard dollar thresholds so it does not matter how many kids or grandchildren you have.

529 Accounts

529 accounts are one of the most tax efficient ways to save for college. You receive a state income tax deduction for contributions and all of the earnings are withdrawn tax free if used for a qualified education expense. These accounts can only be used for a college degree but they can be used toward an associate’s degree, bachelor’s degree, masters, or doctorate. You can name whoever you want as a beneficiary including yourself. More commonly, we see parents set these accounts up for their children or grandparents for the grandchildren.

Can they go to college in any state?

If you setup a NYS 529 account, the beneficiary can go to college anywhere in the United States. It’s not limited to just colleges in New York. As the owner of the account you can change the beneficiary on the account whenever you choose or close the account at your discretion.

What if they don't go to college?

The question we usually get is “what if they don’t go to college?” If you have a 529 account for a beneficiary that does not end up going to college you have a few choices. You can change the beneficiary listed on the account to another child or even yourself. You can also decide to just liquidate the account and receive a check. If the account is closed and the balance is not used for a qualified college expense then you as the owner receive your contributions back tax and penalty free. However, you will pay ordinary income tax and a 10% penalty on just the earnings portion of the account.

What if my child receives a scholarship?

There is a special withdrawal exception for scholarship awards. They do not want to penalize you because the beneficiary did well in high school or is a star athlete so they allow you to make a withdrawal from the 529 account equal to the amount of the scholarship. You receive your contributions tax free, you pay ordinary income tax on the earnings, but you avoid the 10% penalty for not using the account toward a qualified college expense.

Don't make this mistake.............

We often see individuals making the mistake of setting up a 529 account in another state because “their advisor told them to do so”. You are completely missing out on a good size NYS tax deduction because you only get credit for NYS 529 contributions. A little-known fact is that you can rollover a 529 with another state into a NYS 529 account and that rollover amount will count toward your $5,000 / $10,000 deduction limit for the year. If a client has $30,000 in a 529 account outside of NYS we typically advise them to roll it over in $10,000 pieces over a three year period to maximize the $10,000 per year NYS tax deduction.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Who Pays The Tax On A Cash Gift?

This question comes up a lot when a parent makes a cash gift to a child or when a grandparent gifts to a grandchild. When you make a cash gift to someone else, who pays the tax on that gift? The short answer is “typically no one does”. Each individual has a federal “lifetime gift tax exclusion” of $5,400,000 which means that I would have to give

This question comes up a lot when a parent makes a cash gift to a child or when a grandparent gifts to a grandchild. When you make a cash gift to someone else, who pays the tax on that gift? The short answer is “typically no one does”. Each individual has a federal “lifetime gift tax exclusion” of $13,990,000 which means that I would have to give away $13.99 million dollars before I would owe “gift tax” on a gift. For married couples, they each have a $13.99 million dollar exclusion so they would have to gift away $27.98M before they would owe any gift tax. When a gift is made, the person making the gift does not pay tax and the person receiving the gift does not pay tax below those lifetime thresholds.

“But I thought you could only gift $19,000 per year per person?” The $19,000 per year amount is the IRS “gift exclusion amount” not the “limit”. You can gift $19,000 per year to any number of people and it will not count toward your $13.99M lifetime exclusion amount. A married couple can gift $38,000 per year to any one person and it will not count toward their $27.98 million lifetime exclusion. If you do not plan on making gifts above your lifetime threshold amount you do not have to worry about anyone paying taxes on your cash gifts.

Let’s look at an example. I’m married and I decide to gift $20,000 to each of my three children. When I make that gift of $60,000 ($20K x 3) I do not owe tax on that gift and my kids do not owe tax on the gift. Also, that $60,000 does not count toward my lifetime exclusion amount because it’s under the $38,000 annual exclusion for a married couple to each child.

In the next example, I’m single and I gift $1,000,000 my neighbor. I do not owe tax on that gift and my neighbor does not owe any tax on the gift because it is below my $13.99M threshold. However, since I made a gift to one person in excess of my $19,000 annual exclusion, I do have to file a gift tax return when I file my taxes that year acknowledging that I made a gift $981,000 in excess of my annual exclusion. This is how the IRS tracks the gift amounts that count against my $13.99M lifetime exclusion.

Important note: This article speaks to the federal tax liability on gifts. If you live in a state that has state income tax, your state’s gift tax exclusion limits may vary from the federal limits.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.