The Top 2 Strategies For Paying Off Student Loan Debt

With total student loan debt in the United States approaching $1.4 Trillion dollars, I seem to be having this conversation more and more with clients. There has been a lot of speculation between president obama and student loans, but student loan debt is still piling up. The amount of student loan debt is piling up and it's putting the next generation of

With total student loan debt in the United States approaching $1.4 Trillion dollars, I seem to be having this conversation more and more with clients. There has been a lot of speculation between president obama and student loans, but student loan debt is still piling up. The amount of student loan debt is piling up and it's putting the next generation of our work force at a big disadvantage. While you yourself may not have student loan debt, at some point you may have to counsel a child, grandchild, friend, neighbor, or a co-worker that just can't seem to get ahead because of the financial restrains of their student loan payments. After all, for a child born today, it's projected that the cost for a 4 year degree including room and board will be $215,000 for a State College and $487,000 for a private college. Half a million dollars for a 4 year degree!!

The most common reaction to this is: "There is no way that this can happen. Something will have to change." The reality is, as financial planners, we were saying that exact same thing 10 years ago but we don't say that anymore. Despite the general disbelief that this will happen, the cost of college has continued to rise at a rate of 6% per year over the past 10 years. It's good old supply and demand. If there is a limited supply of colleges and the demand for a college degree keeps going up, the price will continue to go up. As many of us know, a college degree is not necessarily an advantage anymore, it's the baseline. You need it just to get the job interview and that will be even more true for types of jobs that will be available in future years.

No Professional Help

Making matters worse, most individuals that have large student loan debt don't have access to high quality financial planners because they do not have any investible assets since everything is going toward paying down their student loan debt. I wrote this article to give our readers a look into how we as Certified Financial Planners® help our clients to dig out of student loan debt. Unfortunately a lot of the advice that you will find by searching online is either incomplete or wrong. The solution for digging out of student loan debt is not a one size fits all solution and there are trap doors along the way.

Loan Inventory

The first step in the process is to the collect and organize all of the information pertaining to your student loan debt. Create a spreadsheet that lists the following information:

Name of Lender

Type of Loan (Federal or Private)

Name of Loan Servicer

Total Outstanding Loan Balance

Interest Rate

Fixed or Variable Interest Rate

Minimum Monthly Payment

Current Monthly Payment

Estimated Payoff Date

Now, below this information I want you to list January 1 of the current year and the next 10 years. It will look like this:

Total Balance

January 1, 2018

January 1, 2019

January 1, 2020

Each year you will record your total student loan debt below your itemized student loan information. Why? In most cases you are not going to be able to payoff your student loans overnight. It’s going to be a multi-year process. But having this running total will allow you to track your progress. You can even add another column to the right of the “Total Balance” column labelled “Goal”. If your goal is to payoff your student loan debt in five years, set some preliminary balance goals for yourself. When you receive a raise or a bonus at work, a tax refund, or a cash gift from a family member, this will encourage you to apply some or all of those cash windfalls toward your student loan balance to stay on track.

Order of Payoff

The most common advice you will find when researching this topic is “make minimum payments on all of the student loans with the exception of your student loan with the highest interest rate and apply the largest payment you can against that loan”. Mathematically this is the right strategy but we do not necessary recommend this strategy for all of our clients. Here’s why……..

There are two situations that we typically run into with clients:

Situation 1: “I’m drowning in student loan debt and need a lifeline”

Situation 2: “I’m starting to make more money at my job. Should I use some of that extra income to pay down my student loan debt or should I be applying it toward my retirement plan or saving for a house?”

Situation 1: I'm Drowning

As financial planners we are unfortunately running into Situation 1 more frequently. You have young professionals that are graduating from college with a 4 year degree, making $50,000 per year in their first job, but they have $150,000 of student loan debt. So they basically have a mortgage that starts 6 months after they graduate but that mortgage payment comes without a house. For the first few years of their career they are feeling good about their new job, they receive some raises and bonuses here and there, but they still feel like they are struggling every month to meet their expenses. The realization starts to set in the “I’m never going to get ahead because these student loan payments are killing me. I have to do something.”

If you or someone you know is in this category remember these words: “Cash is king”. You will hear this in the business world and it’s true for personal finances as well. As mentioned earlier, from a pure math standpoint, they fastest way to get out of debt is to target the debt with the highest interest rate and go from there. While mathematically that may work, we have found that it is not the best strategy for individuals in this category. If you are in the middle of the ocean, treading water, with the closest island a mile away, why are we having a debate about how fast you can swim to that island? You will never make it. Instead you just need someone to throw you a life preserver.

Life Preserver Strategy

If you are just barely meeting your monthly expense or find yourself falling short each month, you have to stop the bleeding. In these situations, you should be 100% focus on improving your current cash flow not whether you are going to be able to payoff your student loans in 8 years instead of 10 years. In the spreadsheet that you created, organize all of your student loan debt from the largest outstanding loan balance to the smallest. Ignore the interest rate column for the time being. Next, begin making the minimum payments on all of your student loans except for the one with the SMALLEST BALANCE. We need to improve your cash flow which means reducing the number of monthly payments that you have each month. Once the month to month cash flow is no longer an issue then you can graduate to Situation 2 and revisit the debt payoff strategy.

This strategy also builds confidence. If you have a $50,000 loan with a 7% interest rate and two other student loans for $5,000 with an interest rate of 4% while applying more money toward the largest loan balance will save you the most interest long term, it’s going to feel like your climbing Mt. Everest. “Why put an extra $200 toward that $50,000 loan? I’m going to be paying it until I’m 50.” There is no sense of accomplishment. We find that individuals that choose this path will frequently abandon the journey. Instead, if you focus your efforts on the loans with the smaller balances and you are able to pay them off in a year, it feels good. Getting that taste of real progress is powerful. This strategy comes from the book written by Dave Ramsey called the Total Money Makeover. If you have not read the book, read it. If you have a child or grandchild graduating from college, if you were going to give them a check for graduation, buy the book for them and put the check in the book. Tell them that “this check will help you to get a start in your new career but this book is worth the amount of the check multiplied by a thousand”.

Situation 2: Paying Off Your Student Loans Faster

If you are in Situation 2, you are no longer treading water in the middle of the ocean and you made it to the island. The name of this island is “Risk Free Rate Of Return”. Let me explain.

Individuals in this scenario have a good handle on their monthly expenses and they are finding that they now have extra discretionary income. So what’s the best use of that extra income? When you are younger there are probably a number items on your wish list, some of which you may debate looking into title loans near me to obtain. Here are the top four that we see:

Retirement savings

Saving for a house

Paying off student loan debt

Buying a new car

Don't Leave Free Money On The Table

Before applying all of your extra income toward your student loan payments, we ask our clients “what is the employer contribution formula for your employer’s retirement plan?” If it’s a match formula, meaning you have to put money in the plan to get the employer contribution, we will typically recommend that our clients contribute the amount needed to receive the full employer match. Otherwise you are leaving free money on the table.

The amount of that employer contribution represents a risk free rate of return. Meaning, unlike the investing in the stock market, you do not have to take any risk to receive that return on your money. If your company guarantees a 100% match on the first 5% of pay contribution out of your paycheck into the plan, your money is guaranteed to double up to 5% of your pay. Where else are you going to get a 100% risk free rate of return on your money?

Start With The Highest Interest Rate

Now that you have extra income each month you can begin to pick and choose how you apply it. You should list all of you student loans from the highest interest rate to the lowest. If it’s close between two interest rates but one is a fixed interest rate and the other is a variable interest rate, it’s typically better to pay down the variable interest rate loan first if interest rates are expected to move higher. Apply the minimum payment amount to all of your student loan payments and apply as much as you can toward the loan with the HIGHEST INTEREST RATE. Once the loan with the highest interest rate is paid off, you will move on to the next one.

Again, by applying more money toward your student loans, those additional payments represent a risk free rate of return equal to the interest rate that is being charges on each loan. For example, if the highest interest rate on one of your student loans is 7%, every additional dollar that you are apply toward paying off that loan you are receiving a 7% rate of return on because you are not paying that amount to the lender.

Here is a rebuttal question that we sometimes get: “But wouldn’t it be better to put it in the stock market and earn a higher rate of return?” However, that’s not an apple to apples comparison. The 7% rate of return that you are receiving by paying down that student loan balance is guaranteed because it represents interest that would have been paid to the lender that you are now keeping. By contrast, even though the stock market may average an 8% annualized rate of return over a 10 year period, you have to take risk to obtain that 8% rate of return. A 7% risk free rate of return is the equivalent of being able to buy a CD at a bank with a 7% interest rate guaranteed by the FDIC which does not exist right now.

But Can't I Deduct The Interest On My Student Loans?

It depends on how much you make. In 2018, if you are single, the deduction for student loan interest begins to phaseout at $70,000 of AGI and you completely lose the deduction once your AGI is above $85,000. If you are married filing a joint tax return, the deduction begins to phaseout at $140,000 of AGI and it’s completely gone once your AGI hits $170,000.

Also the deduction is limited to $2,500.

However, even if you can deduct the interest on your student loan, the tax benefit is probably not as big as you think. Let me explain via an example. Take the following fact set:

Tax Filing Status: Single

Adjusted Gross Income (AGI): $50,000

Outstanding Student Loan Balance: $60,000

Interest Rate: 7% ($4,200 Per Year)

First, you are limited to deducting $2,500 of the $4,200 in student loan interest that you paid to the lender. At $50,000 of AGI your top federal tax bracket in 2018 is 22%. So that $2,500 equals $550 in actual tax savings ($2,500 x 22% = $550). If you want to get technical, taking the tax deduction into account, your after tax interest rate on your student loan debt is really 6.08% instead of 7%. Can you get a CD from a bank right now with a 6% interest rate? No. From both a debt reduction standpoint and a rate of return standpoint, it probably makes sense to pay down that loan more aggressively.

Striking A Balance

When you are younger, you typically have a lot of financial goals such as saving for retirement, paying off debt, saving for the down payment on your first house, starting a family, college savings for you kids, etc. While I'm sure you would like to take all of your extra income and really start aggressively reducing your student loans you have to determine what the right balance is between all of your financial goals. If you receive a $5,000 bonus from work, you may allocate $3,000 of that toward your student loan debt and deposit $2,000 in your savings account for the eventual down payment on your first house. We also recommend speaking a loan authority company to see what can be done to help you reach your goal. One example being to create that "goal" column in your student loan spreadsheet will help you to keep that balance and eventually lead to the payoff of all of your student loans.

Forgiveness Scheme

Although they are not very common and only a few people can qualify for one of these schemes, they will provide great help. A student loan forgiveness scheme can help a student pay off their loan over an extended period of time, a shorter period of time, reduce the amount they owe, or entirely pay off the loan for them. However, like I have already mentioned, this is based upon whether they qualify or not.I hope this has been of some assistance and i have provided you with some helpful advice on how to prepare for and manage your student loan.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Marriage Penalty: Past and Present

Whether you're currently married or not, the new tax legislation may impact how the "Marriage Penalty" affects you. Never heard of such a thing? Let's take a look at a simple example and show how it may be different under the new tax regulation.

The Marriage Penalty: Past and Present

Whether you're currently married or not, the new tax legislation may impact how the "Marriage Penalty" affects you. Never heard of such a thing? Let's take a look at a simple example and show how it may be different under the new tax regulation.

The Past (kind of)

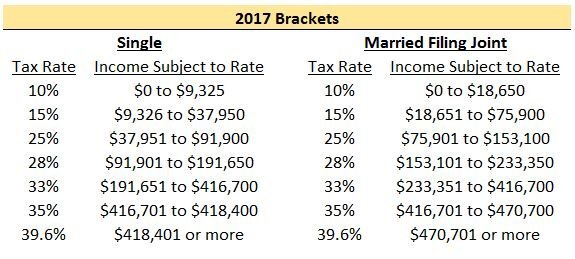

I say "kind of" because most people still have to file their 2017 tax return. Here is the 2017 tax table for Single Filers and Married Filing Joint Filers:

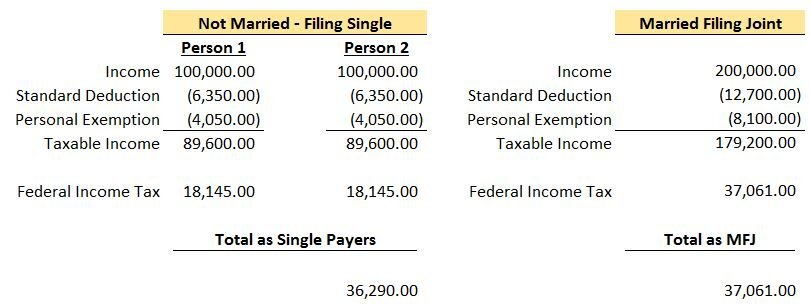

A reasonable person would think that the income subject to tax would simply double if you went from filing Single to Married Filing Joint. As you can see, this isn't the case once you are in the 25%+ tax bracket and it can mean big dollars! Let's take a look at a simple example where each person makes the same amount of money. We will also assume they will be taking the standard deduction in 2017.

Note: To calculate the “Federal Income Tax” amount above, you can use the IRS tables here 2017 1040 Tax Table Instructions. All of your income is not taxed at your top rate. For example, if your top income falls in the 25% tax bracket, as a single payer you will only pay 25% on income from $37,951 to $91,900. Everything below that range will be taxed at either 10% or 15%.

As you can see, because of the change in filing status, this couple owed a total of $771 more to the federal government. This is the “Marriage Penalty”. Typically as incomes rise, the dollar amount of the penalty becomes larger. For this couple, their top tax bracket went from 25% each when filing single to 28% filing joint.

The Present

Here is the 2018 tax table in the new tax legislation for Single Filers and Married Filing Joint Filers:

Upon review, you can see that the top income brackets are not doubled for Married Filing Joint. At 37%, a single person filing would reach the top rate at $500,001 while married filing joint would reach at $600,001. That being said, the “Marriage Penalty” appears to kick in at higher income levels compared to the past and therefore should impact less people. The income bracket for Married Filing Joint is doubled up until $400,000 of combined income compared to just $75,901 under the 2017 brackets.

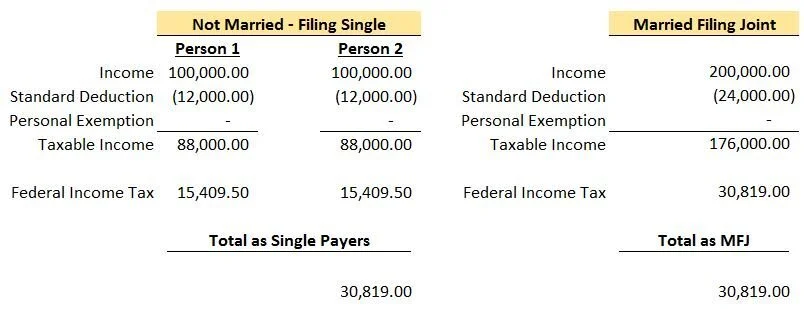

Let’s take a look at the same couple in the example above.

Due to the income brackets doubling from single to married filing joint for this couple, the “Marriage Penalty” they would have incurred in 2017 appears to go away. In this example, they would also pay less in federal taxes in both situations. This article is more focused on the impact on the “Marriage Penalty” but having a lower tax bill is always a plus.

Standard vs. Itemized Deductions

The tax brackets aren’t the only penalty. Another common tax increase people see when going from single to married filing joint are the deductions they lose. If I’m single and own a home, it is likely I will itemized because the sum of my property taxes, mortgage interest, and state income taxes exceed the standard deduction amount. Assume the couple in the example above is still not married but Person 1 owns a home and rather than taking the standard deduction, Person 1 itemizes for an amount of $15,000. For 2017, their total deductions will be $21,350 ($15,000 Person 1 plus $6,350 Person 2) and for 2018, their total deductions will be $27,000 ($15,000 Person 1 plus $12,000 Person 2).

Now they get married and have to choose whether to itemize or take the standard deduction.

2017: Assuming they live together in the same house, in 2017 they would still itemize because they have deductions of $15,000 for Person 1 and some additional items that Person 2 would bring to the table (i.e. their state income taxes). Say their total itemized deductions are $18,000 when married filing joint. They would still itemize because $18,000 is more than the Married Filing Joint standard deduction of $12,700. But now compare the $18,000 to the $21,350 they got filing single. They lose out on $3,350 of deductions. Usually, less deductions equals more taxes.

2018: Assuming they live together in the same house, in 2018 they would no longer itemize. Assuming their total itemized deductions are still $18,000, that is less than the $24,000 standard deduction they can take when married filing joint. $24,000 standard deduction in 2018 is still less than the $27,000 they got filing separately by $3,000. Again, less deductions usually means more taxes. The “Marriage Penalty” lives on!

A lot of people will still lose out on deductions in 2018 but the “Marriage Penalty” will hit less people because of the increase in the standard deduction. If Person 1 has itemized deductions of $10,000 in 2017, they would itemize if they filed single and possibly take the standard deduction of $12,700 filing joint. In 2018 however, Person 1 would take the standard deduction both as a single tax payer ($12,000) and married filing joint ($24,000) which takes away the “Marriage Penalty” related to the deduction.

The Why?

Why do tax brackets work this way? Like most taxes, I assume the idea was to generate more income for the government. Some may also argue that typical couples don't make the same salaries which seems like an archaic point of view.Was it all fixed with the new tax legislation? It doesn't appear so but it does look like less people will be struck by Cupid's Marriage Penalty.

About Rob.........

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

More Taxpayers Will Qualify For The Child Tax Credit

There is great news for parents in the middle to upper income tax brackets in 2018. The new tax law dramatically increased the income phaseout threshold for claiming the child tax credit. In 2017, parents were eligible for a $1,000 tax credit for each child under the age of 17 as long as their adjusted gross income (“AGI”) was below $75,000 for single

There is great news for parents in the middle to upper income tax brackets in 2018. The new tax law dramatically increased the income phaseout threshold for claiming the child tax credit. In 2017, parents were eligible for a $1,000 tax credit for each child under the age of 17 as long as their adjusted gross income (“AGI”) was below $75,000 for single filers and $110,000 for married couples filing a joint return. If your AGI was above those amounts, the $1,000 credit was reduced by $50 for every $1,000 of income above those thresholds. In other words, the child tax credit completely phased out for a single filer with an AGI greater than $95,000 and for a married couple with an AGI greater than $130,000.

Note: If you are not sure what the amount of your AGI is, it’s the bottom line on the first page of your tax return (Form 1040).

New Phaseout Thresholds In 2018+

Starting in 2018, the new phaseout thresholds for the Child Tax Credit begin at the following AGI levels:

Single Filer: $200,000

Married Filing Joint: $400,000

If your AGI falls below these thresholds, you are eligible for the full Child Tax Credit. For taxpayers with an AGI amount that exceeds these thresholds, the phaseout calculation is the same as 2017. The credit is reduced by $50 for every $1,000 in income over the AGI threshold.

Wait......It Gets Better

Not only will more families qualify for the child tax credit in 2018 but the amount of the credit was doubled. The new tax law increased the credit from $1,000 to $2,000 for each child under the age of 17.

In 2017, a married couple, with three children, with an AGI of $200,000, would have received nothing for the child tax credit. In 2018, that same family will receive a $6,000 tax credit. That’s huge!! Remember, “tax credits” are more valuable than “tax deductions”. Tax credits reduce your tax liability dollar for dollar whereas tax deductions just reduce the amount of your income subject to taxation.

Tax Reform Giveth & Taketh Away

While the change to the tax credit is good news for most families with children, the elimination of personal exemptions starting in 2018 is not.

In 2017, taxpayers were able to take a tax deduction equal to $4,050 for each dependent (including themselves) in addition to the standard deduction. For example, a married couple with 3 children and $200,000 in income, would have been eligible received the following tax deductions:

Standard Deduction: $12,700

Husband: $4,050

Wife: $4,050

Child 1: $4,050

Child 2: $4,050

Child 3: $4,050

Total Deductions $32,950

Child Tax Credit: $0

This may lead you to the following question: “Does the $6,000 child tax credit that this family is now eligible to receive in 2018 make up for the loss of $20,250 ($4,050 x 5) in personal exemptions?”

By itself? No. But you have to also take into consideration that the standard deduction is doubling in 2018. For that same family, in 2018, they will have the following deductions and tax credits:

Standard Deduction: $24,000

Personal Exemptions: $0

Total Deductions: $24,000

Child Tax Credit: $6,000

Even though $24,000 plus $6,000 is not greater than $32,950, remember that credits are worth more than tax deductions. In 2017, a married couple, with $200,000 in income, put the top portion of their income subject to the 28% tax bracket. Thus, $32,950 in tax deductions equaled a $9,226 reduction in their tax bill ($32,950 x 28%).

In 2018, due to the changes in the tax brackets, instead of their top tax bracket being 28%, it’s now 24%. The $24,000 standard deduction reduces their tax bill by $5,760 ($24,000 x 24%) but now they also have a $6,000 tax credit with reduces their remaining tax bill dollar for dollar, resulting in a total tax savings of $11,760. Taxes saved over last year: $2,534. Not a bad deal.

For many families, the new tax brackets combined with the doubling of the standard deduction and the doubling of the child tax credit with higher phaseout thresholds, should offset the loss of the personal exemptions in 2018.

This information is for educational purposes only. Please consult your accountant for personal tax advice.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Will Your Paycheck Increase In 2018?

U.S taxpayers have a big reason to celebrate this week. By the end of February, you should see your paycheck increase. The government released the new payroll withholding tables this week which will lower the amount of taxes withheld from your paycheck and increase your take home pay. Naturally the next question is "How much will my paycheck go

U.S taxpayers have a big reason to celebrate this week. By the end of February, you should see your paycheck increase. The government released the new payroll withholding tables this week which will lower the amount of taxes withheld from your paycheck and increase your take home pay. Naturally the next question is "How much will my paycheck go up?" Out of curiously, I spent my Saturday morning comparing the 2017 tax tables to the new 2018 tax tables to answer that question. Yes, this is what nerds do on their weekends.

The Calculation

Like most financial calculations, it's long and boring. I will provide you with the cliff notes version. The government provides your company with tax withholding tables that they enter into the payroll system. It tells your employer how much to withhold in fed taxes from each pay check. The three main variables in the calculation are:

Payroll frequency (weekly, bi-weekly, etc)

The number of withholding allowances that you claim

The amount of your pay

Single Filers or Head of Household

If you are a single or head of household tax filer, I ran the following calculations based on a bi-weekly payroll schedule and an employee claiming one withholding allowance. The table below illustrates how much your annual take home pay may increase under the new tax withholding tables at various salary levels.

Based on this analysis, it looks like a single filer’s paycheck will increase between 2% – 3% as soon as the new withholding tables are entered into the payroll system. If you want to know how much your bi-weekly pay will increase, just take the annual numbers listed above and divide them by 26 pay periods. If the payroll frequency at your company is something other than bi-weekly or you claim more than one withholding allowance, your percentage increase in take home pay will deviate from the table listed above.

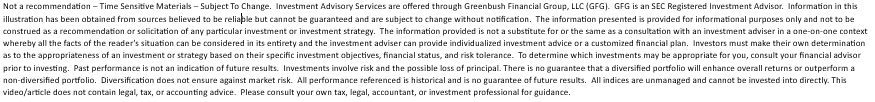

Married Couples Filing Joint

For employees that are married and file a joint tax return, below is the calculations based on a bi-weekly payroll schedule and two withholding allowances. The table below illustrates how much your annual take home pay may increase under the new tax withholding tables at various salary levels.

Even though I added an additional withholding allowance in the calculation for the married employee, I was surprised that the “range” of the percentage increase in the take home pay for a married employee was noticeably wider than a single tax filer. As you will see in the table above, the increase in take home pay for an employee in this category range from 1.5% – 3.1%.

Another interesting observation, in the single filer table, the percentage increase in take home pay actually diminished as the employee’s annual compensation increased. In contrast, for the married employee, the percentage increase in annual take home pay gradually increased as the employee’s annual salary increased. Conclusion…..get married in 2018? Nothing says love like new withholding tables.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Will The Value Of Your House Drop Under The New Tax Law?

It's not a secret to anyone at this point that the new tax bill is going to inflict some pain on the U.S. housing market in 2018. The questions that most homeowners and real estate investors are asking is: "How much are home prices likely to decrease within the next year due to the tax changes?" The new $10,000 limitation on SALT deductions, the lower

It's not a secret to anyone at this point that the new tax bill is going to inflict some pain on the U.S. housing market in 2018. The questions that most homeowners and real estate investors are asking is: "How much are home prices likely to decrease within the next year due to the tax changes?" The new $10,000 limitation on SALT deductions, the lower deduction cap mortgages interest, and the higher standard deduction are all lining up to take a bite out of real estate prices. The size of the bite will largely depend on where you live and the value of your house.

3 Bites That Will Hurt

The Trump tax reform made three significant changes to the tax laws that will impact housing prices:

Capped state and local tax ("SALT") deductions at $10,000 (includes property taxes)

Lowered the deduction cap on the first $750,000 of a mortgage

Doubled the standard deduction

The New Standard Deduction

There is a reason why I'm starting this analysis with the doubling of the standard deduction in 2018. For many households in the U.S., the doubling of the standard deduction will make the cap on the SALT deductions irrelevant. Let me explain. Below is a comparison of the standard deduction limits in 2017 versus 2018:

In 2018, a married couple filing a joint tax return would need over $24,000 in itemized deductions to justify not taking the standard deduction and calling it a day. For a married couple, both W-2 employees, $7,000 in property taxes, $9,000 in state income taxes, if those are their only itemized deductions, then it will most likely makes sense for them to take the $24,000 standard deduction. So the $10,000 cap on property taxes and state income taxes becomes irrelevant because it’s an itemized deduction. This will be a big change for many U.S. households. In 2017, that same family may have itemized because their property and state taxes exceeded the $12,700 standard deduction threshold.

For taxpayers age 65 and older, the new tax law kept the additional standard deduction amounts: $1,250 for single filers and $2,500 for married filing joint which are over and above the normal limits.

$10,000 Cap On State & Local Taxes

Starting in 2018, taxpayers are limited to a $10,000 deduction for a combination of their property taxes, school taxes, and state & local income tax. For states that have both high property taxes and high income taxes like New York, New Jersey, and California, homeowners will most likely be looking at a larger decrease in the value of their homes versus states like Florida that have lower property taxes and no state income taxes. The houses with the higher dollar value may experience a larger drop in price.

If you live in a $200,000 house, the property / school taxes are $5,000, and you decided to sell your house, the family looking to buy your house may already be planning on taking the $24,000 standard deduction at that income level, so the new tax cap would not really decrease the “value” of the house to the potential buyer.

On the flip side, if you own a $600,000 house, your property/school taxes are $18,000, and you are looking to sell your house, the new $10,000 cap will most likely have a negative impact on the value of your house. As you might assume, the individuals and families with the higher incomes that could afford to purchase a $600,000 house will naturally be the homeowners that will continue to itemize their deduction in 2018. So owning that $600K house in 2018 comes at an additional annual cost to the buyer because they lose $8,000 in property tax deductions. For individuals and families in the top federal tax bracket (37%), the cost to live in that house just went up by $3,120 per year. I have personally already had two clients call me that just purchased a house in 2017 with property taxes above the $10,000 cap and they said “I might not have purchased this big of a house if I knew I was not going to be able to deduct all of the property taxes”.

$750,000 Deduction Cap On Mortgages

Prior to 2018, taxpayers could only deduct interest on the first $1,000,000 of a mortgage. For all new mortgages, beginning in 2018, the cap was reduced from $1,000,000 to $750,000. The new tax law grandfathered the $1M cap for mortgages that were already in existence prior to December 31, 2017. Obviously this change will only impact very high income earning individuals and families living in houses valued at $1M+ but it still may have a negative impact on the prices of those big houses. I say "may" because if you can afford a $3M condo in Manhattan, you may not care that you lost a $7,500 tax deduction.

It Depends Where You Live

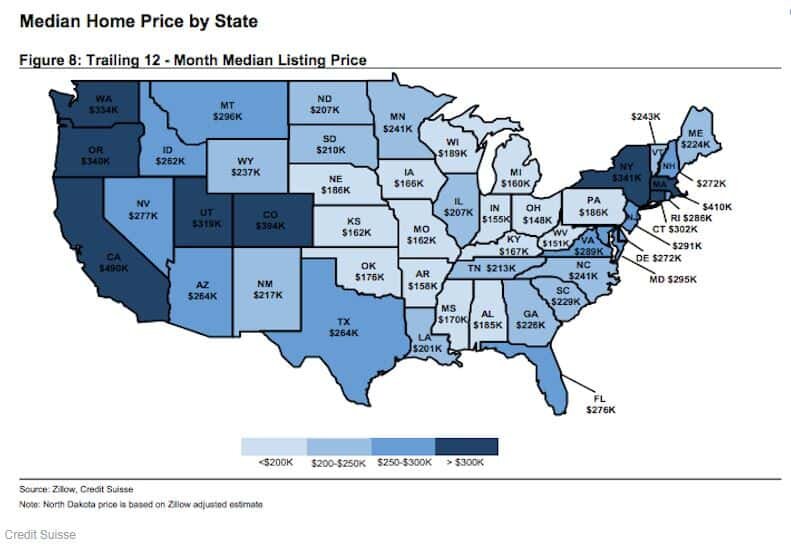

Given these changes to tax law, it seems likely that the states with higher property taxes and higher home values will be the most vulnerable to price adjustments. Below is a map, from Zillow and Credit Suisse, showing the median home price by state:

Let's also locate the states that have a high concentration of mortgages over $500,000. As mentioned above, this may put price pressure on homeowners trying to sell houses above the new $750,000 mortgage interest deduction threshold:

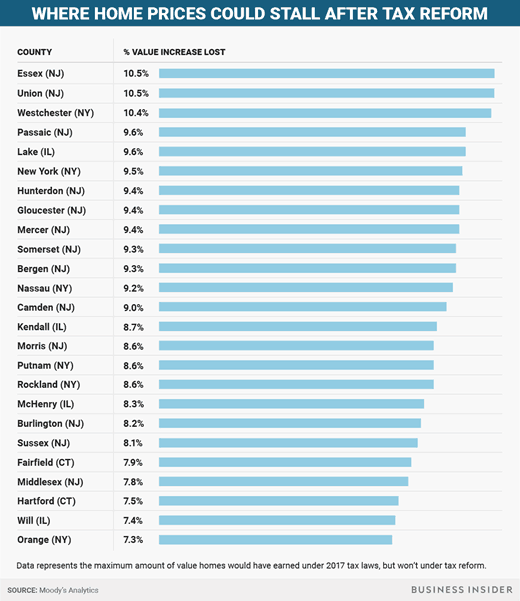

And the "Non-Winners" are New York, California, and New Jersey. Moody's published a list of the 25 counties that are expect to lose the largest percentage of value. Note, that only six of those counties are located outside of New York or New Jersey:

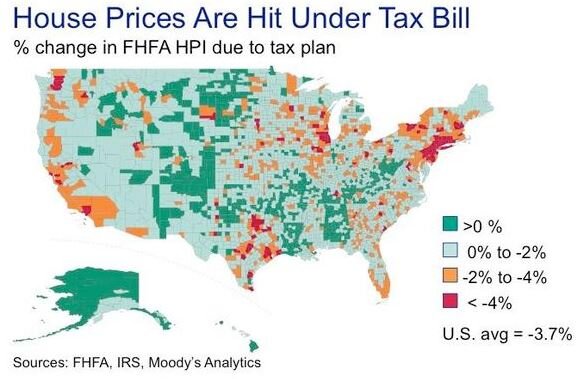

To bring it all together, Moody's and FHFA published the illustration below showing the percentage change in the Federal Housing Finance Agency – House Price Index as a result of the new tax bill:

It's safe to assume that geographically, the negative impact that the new tax rules will have on the U.S. house market will occur in concentrated pockets as opposed to a widespread reduction in housing prices across the country.

Do Not Move To Alaska Just Yet!!

Before you show the chart above to your family at dinner tonight with a “Go Alaska” hat on, I urge you to read on. (Disclosure, I have nothing against Alaska. I was born in Fairbanks, Alaska) If you live in one of the “red spots” on the heat map above or in one of the counties in the list of “where home prices could stall after tax reform”, the charts above do not necessarily mean that at the end of 2018 your house is going to be worth 5% less than it was at the beginning of 2018. Moody’s has done the comparison of the tax bill passing versus no tax bill. If prior to the tax bill being passed it was estimated in 2018 that homes in your area were going to increase in value by 5% and the heat map above shows a 4% drop as a result of tax reform, then that means instead the value of your home growing by 5% it may only grow by 1%.

As with any forecast, it’s anyone’s guess at this point how the math will actually work itself out but in general I think it will be more positive than the consensus expects.

House Values Under $250,000 – Status Quo

Given the changes to the tax law, if you live in a house that is valued under $250,000, regardless of where you live, the downward pressure on the price of your house as a result of tax reform should be minimal. Why? Most buyers in this range will most likely be electing the standard deduction anyways so the new $10,000 cap on SALT deductions should have little to no impact. This should even be true for states that have high property taxes because the homeowners would need over $24,000 in itemized deductions before the $10,000 cap would potentially hurt them tax wise.

The Sandwich: House Values $250,000 - $750,000

The homeowners at the highest risk of a reduction in the value of their house are located in what I call “The Sandwich”. They have a house that is valued somewhere between $250,000 – $750,000 and they live in a high property tax state. While Congress touts that the doubling of the standard deduction is a “fix all” for all of the tax deductions that have been taken away, it’s unfortunately not. There are a number of individuals and families that are in the income range customarily associated with buying a $250K – $750K house that may actually pay more in taxes under the new rules.

Taxpayers in this group are also moving from their “starter house” in their first “big house”. Unlike the super wealthy that may care less about paying an extra $5,000 in taxes per year, for an upper middle class family that has kids, that is saving for college, and contributing to 401(k) plans, the loss of that tax benefit may mean they can’t take a family vacation if they buy that bigger house. Less buyers in the market for houses in this “Sandwich” range translates to lower prices.

How much lower? Probably nothing dramatic in the short term because the U.S. economy is doing so well. When the economy is growing, people feel secure in their jobs, wages are going up, workers are getting bonuses, and that provides them with the additional income needed to make that larger mortgage payment and pay a little more in taxes.

My concern would be for someone that is planning to purchase a house and then sell within the next 5 years. If the economy goes into a recession, people start losing their jobs, and the U.S. consumer starts look for more ways to stretch their dollars, the homeowners that stretched themselves to buy the bigger house based on the big bonus that they received when the economy was humming are at a big risk of losing their house. In addition, there may be fewer buyers in the market because families may not want to waste money on property taxes that they can’t deduct.

The Millionaire Club: House Values $750,000+

It would seem that houses in the $750,000+ range have the most lose to for two reasons. First, homeowners in this category pay the highest property taxes and they are typically not electing the standard deduction at this income level. Second, home buyers at this price point would also be negatively impacted by the lower $750,000 cap on the mortgage interest deduction.

But I doubt this will be the case. Why? There is only so much lake front property. If you make over $5M per year and you fall in love with a lake house in upstate New York that has a $1.5M price tag, while you could try to find a similar lake house in a more tax friendly state, if you make $5M per year, what’s another $15,000 in expenses for buy your first choice.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Will Home Equity Loan Interest Be Deductible In 2019+?

The answer............it depends. It depends on what you used or are going to use the home equity loan for. Up until the end of 2017, borrowers could deduct interest on home equity loans or homes equity lines of credit up to $100,000. Unfortunately, many homeowners will lose this deduction under the new tax law that takes effect January 1, 2018.

The answer............it depends. It depends on what you used or are going to use the home equity loan for. Up until the end of 2017, borrowers could deduct interest on home equity loans or homes equity lines of credit up to $100,000. Unfortunately, many homeowners will lose this deduction under the new tax law that takes effect January 1, 2018.

Old Rules

Taxpayers used to be able to take a home equity loan or tap into a home equity line of credit, spend the money on whatever they wanted (pool, college tuition, boat, debt consolidation) and the interest on the loan was tax deductible. For borrowers in higher tax brackets this was a huge advantage. For a taxpayer in the 39% fed tax bracket, if the interest rate on the home equity loan was 3%, their after tax interest rate was really 1.83%. This provided taxpayers with easy access to cheap money.

The Rules Are Changing In 2018

To help pay for the new tax cuts, Congress had to find ways to bridge the funding gap. In other words, in order for some new tax toys to be given, other tax toys needed to be taken away. One of those toys that landed in the donation box was the ability to deduct the interest on home equity loans and home equity lines of credit. But all may not be lost. The tax law splits "qualified residence interest" into two categories:

Acquisition Indebtedness

Home Equity Indebtedness

Whether or not your home equity loan or HELOC is considered acquisition indebtedness or home equity indebtedness may ultimately determine whether or not the interest on that loan will continue to be deductible in 2018 and future years under the new tax rules. I say "may" because we need additional guidance form the IRS as to how the language in the tax bill will be applied in the real world. As of right now you have some tax professionals stating that all interest from homes equity sources will be disallowed beginning in 2018 and other tax professionals taking the position that home equity loans from acquisition indebtedness will continue to be eligible for the tax deduction in 2018. For the purpose of this article, we will assume that the IRS will continue to allow the deduction of interest on home equity loans and HELOCs associated with acquisition indebtedness.

Acquisition Indebtedness

Acquisition indebtedness is defined as “indebtedness that is secured by the residence and that is incurred in acquiring, constructing, or substantially improving any qualified residence of the taxpayer”. It seems likely, under this definition, if you took out a home equity loan to build an addition on your house, that would be classified as a “substantial improvement” and you would be able to continue to deduct the interest on that home equity loan in 2018. Where we need help from the IRS is further clarification on the definition of “substantial improvement”. Is it any project associated with the house that arguably increases the value of the property?

More good news, this ability to deduct interest on home equity loans and HELOCs for debt that qualifies as “acquisition indebtedness” is not just for loans that were already issued prior to December 31, 2017 but also for new loans.

Home Equity Indebtedness

Home equity indebtedness is debt incurred and secured by the residence that is used for items that do not qualify as "acquisition indebtedness". Basically everything else. So beginning in 2018, interest on home equity loans and HELOC's classified as "home equity indebtedness" will not be tax deductible.

No Grandfathering

Unfortunately for taxpayers that already have home equity loans and HELOCs outstanding, the Trump tax reform did not grandfather the deduction of interest for existing loans. For example, if you took a home equity loan in 2016 for $20,000 and there is still a $10,000 balance on the loan, you will be able to deduct the interest that you paid in 2017 but beginning in 2018, the deduction will be lost if it does not qualify as "acquisition indebtedness".

Partial Deduction

An important follow-up question that I have received from clients is: “what if I took a home equity loan for $50,000, I used $30,000 to renovate my kitchen, but I used $20,000 as a tuition payment for my daughter? Do I lose the deduction on the full outstanding balance of the loan because it was not used 100% for substantial improvements to the house? Great question. Again, we need more clarification on this topic from the IRS but it would seem that you would be allowed to take a deduction of the interest for the portion of the loan that qualifies as “acquisition indebtedness” but you would not be able to deduct the interest attributed to the “non-acquisition or home equity indebtedness”.

Time out……how do you even go about calculating that if it’s all one loan? Even if I can calculate it, how is the IRS going to know what portion of the interest is attributed to the kitchen project and which portion is attributed to the tuition payment? More great questions and we don’t have answers to them right now. These are the types of issues that arise when you rush major tax reform through Congress and then you make it effective immediately. There is a laundry list of unanswered questions and we just have to wait for clarification on from the IRS.

Itemized Deduction

An important note about the deduction of interest on a home equity loan or HELOC, it's an itemized deduction. You have to itemize in order to capture the tax benefit. Since the new tax rules eliminated or limited many of the itemized deductions available to taxpayers and increased the standard deduction to $12,000 for single filers and $24,000 for married filing joint, many taxpayers who previously itemized will elect the standard deduction for the first time in 2018. In other word, regardless of whether or not the IRS allows the deduction for home equity loan interest assigned to acquisition indebtedness, very few taxpayers will reap the benefits of that tax deduction because your itemized deductions would need to exceed the standard deduction thresholds before you would elect to itemize.

Will This Crush The Home Equity Loan Market?

My friends in the banking industry have already started to ask me, “what impact do you think the new tax rules will have on the home equity loan market as a whole?” It obviously doesn’t help but at the same time I don’t think it will deter most homeowners from accessing home equity indebtedness. Why? Even without the deduction, home equity will likely remain one of the cheapest ways to borrow money. Typically the interest rate on home equity loans and HELOCs are lower because the loan is secured by the value of your house. Personal loans, which typically have no collateral, are a larger risk to the lender, so they charge a higher interest rate for those loans.

Also, for most families in the United States, the primary residence is their largest asset. A middle class family may not have access to a $50,000 unsecured personal loan but if they have been paying down their mortgage for the past 15 years, they may have $100,000 in equity in their house. With the cost of college going up and financial aid going down, for many families, accessing home equity via a loan or a line of credit may be the only viable option to help bridge the college funding gap.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do I Make Too Much To Qualify For Financial Aid?

If you have children that are college-bound at some point you will begin the painful process of calculating how much college will cost for both you and them. However, you might be less worried about the financial aspects of your child going to college after viewing some of the Bloomsburg student apartments for rent on the market at the moment.

If you have children that are college-bound at some point you will begin the painful process of calculating how much college will cost for both you and them. However, you might be less worried about the financial aspects of your child going to college after viewing some of the Bloomsburg student apartments for rent on the market at the moment. Anyway, I have heard the statement, "well they will just have to take loans" but what parents don't realize is loans are a form of financial aid. Loans are not a given. Whether your children plan to attend a public college or private college, both have formulas to determine how much a family is expected to pay out of pocket before you even reach any "financial aid" which includes loans.

College Costs Are Increasing By 6.5% Per Year

The rise in the cost of college has outpaced the inflation rate of most other household costs over the past three decades.

To put this in perspective, if you have a 3 year old child and the cost of tuition / room & board for a state school is currently $25,000 by the time that child turns 17, the cost for one year of tuition / room & board will be $60,372. Multiply that by 4 years for a bachelor's degree: $241,488. Ouch!!! Which leads you to the next question, how much of that $60,372 per year will I have to pay out of pocket?

FAFSA vs CSS Profile Form

Public schools and private school have a different calculation for how much “aid” you qualify for. Public or state schools go by the FAFSA standards. Private schools use the “CSS Profile” form. The FAFSA form is fairly straight forward and is applied universally for state colleges. However, private schools are not required to follow the FAFSA financial aid guidelines which is why they have the separate CSS Profile form. By comparison the CSS profile form requests more financial information.

For example, for couples that are divorced, the FAFSA form only takes into consideration the income and assets of the parent that the child lives with for more than six months out of the year. This excludes the income and assets of the parent that the child does not live with for the majority of the year which could have a positive impact on the financial aid calculation. However, the CSS profile form, for children with divorced parents, requests and takes into consideration the income and assets of both parents regardless of their marital status.

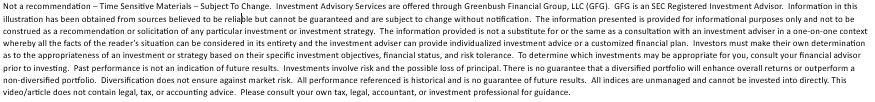

Expected Family Contribution

Both the FAFSA and CSS Profile form result in an "Expected Family Contribution" (EFC). That is the amount the family is expected to pay out of pocket for their child's college expense before the financial aid package begins. Below is a EFC award chart based on the following criteria:

FAFSA Criteria

2 Parent Household

1 Child Attending College

1 Child At Home

State of Residence: NY

Oldest Parent: 49 year old

As you can see in the chart, income has the largest impact on the amount of financial aid. If a married couple has $150,000 in AGI but has no assets, their EFC is already $29,265. For example, if tuition / room and board is $25,000 for SUNY Albany that means they would receive no financial aid.

Student Loans Are A Form Of Financial Aid

Most parents don't realize the federal student loans are considered "financial aid". While "grant" money is truly "free money" from the government to pay for college, federal loans make up about 32% of the financial aid packages for the 2016 – 2017 school year. See the chart below:

Start Planning Now

The cost of college is increasing and the amount of financial aid is declining. According to The College Board, between 2010 – 2016, federal financial aid declined by 25% while tuition and fees increased by 13% at four-year public colleges and 12% at private colleges. This unfortunate trend now requires parents to start running estimated EFC calculation when their children are still in elementary school so there is a plan for paying for the college costs not covered by financial aid.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Tax Reform: Your Company May Voluntarily Terminate Your Retirement Plan

Make no mistake, your company retirement plan is at risk if the proposed tax reform is passed. But wait…..didn’t Trump tweet on October 23, 2017 that “there will be NO change to your 401(k)”? He did tweet that, however, while the tax reform might not directly alter the contribution limits to employer sponsored retirement plans, the new tax rates

Make no mistake, your company retirement plan is at risk if the proposed tax reform is passed. But wait…..didn’t Trump tweet on October 23, 2017 that “there will be NO change to your 401(k)”? He did tweet that, however, while the tax reform might not directly alter the contribution limits to employer sponsored retirement plans, the new tax rates will produce a “disincentive” for companies to sponsor and make employer contributions to their plans.

What Are Pre-Tax Contributions Worth?

Remember, the main incentive of making contributions to employer sponsored retirement plans is moving income that would have been taxed now at a higher tax rate into the retirement years, when for most individuals, their income will be lower and that income will be taxed at a lower rate. If you have a business owner or executive that is paying 45% in taxes on the upper end of the income, there is a large incentive for that business owner to sponsor a retirement plan. They can take that income off of the table now and then realize that income in retirement at a lower rate.

This situation also benefits the employees of these companies. Due to non-discrimination rules, if the owner or executives are receiving contributions from the company to their retirement accounts, the company is required to make employer contributions to the rest of the employees to pass testing. This is why safe harbor plans have become so popular in the 401(k) market.

But what happens if the tax reform is passed and the business owners tax rate drops from 45% to 25%? You would have to make the case that when the business owner retires 5+ years from now that their tax rate will be below 25%. That is a very difficult case to make.

An Incentive NOT To Contribute To Retirement Plans

This creates an incentive for business owners NOT to contribution to employer sponsored retirement plans. Just doing the simple math, it would make sense for the business owner to stop contributing to their company sponsored retirement plan, pay tax on the income at a lower rate, and then accumulate those assets in a taxable account. When they withdraw the money from that taxable account in retirement, they will realize most of that income as long term capital gains which are more favorable than ordinary income tax rates.

If the owner is not contributing to the plan, here are the questions they are going to ask themselves:

Why am I paying to sponsor this plan for the company if I’m not using it?

Why make an employer contribution to the plan if I don’t have to?

This does not just impact 401(k) plans. This impacts all employer sponsored retirement plans: Simple IRA’s, SEP IRA’s, Solo(k) Plans, Pension Plans, 457 Plans, etc.

Where Does That Leave Employees?

For these reasons, as soon as tax reform is passed, in a very short time period, you will most likely see companies terminate their retirement plans or at a minimum, lower or stop the employer contributions to the plan. That leaves the employees in a boat, in the middle of the ocean, without a paddle. Without a 401(k) plan, how are employees expected to save enough to retire? They would be forced to use IRA’s which have much lower contribution limits and IRA’s don’t have employer contributions.

Employees all over the United States will become the unintended victim of tax reform. While the tax reform may not specifically place limitations on 401(k) plans, I’m sure they are aware that just by lowering the corporate tax rate from 35% to 20% and allowing all pass through business income to be taxes at a flat 25% tax rate, the pre-tax contributions to retirement plans will automatically go down dramatically by creating an environment that deters high income earners from deferring income into retirement plans. This is a complete bomb in the making for the middle class.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

5 Options For Money Left Over In College 529 Plans

If your child graduates from college and you are fortunate enough to still have a balance in their 529 college savings account, what are your options for the remaining balance? There are basically 5 options for the money left over in college 529 plans.

If your child graduates from college and you are fortunate enough to still have a balance in their 529 college savings account, what are your options for the remaining balance? There are basically 5 options for the money left over in college 529 plans.

Advanced degree for child

If after the completion of an undergraduate degree, your child plans to continue on to earn a master's degree, law school, or medical school, you can use the remaining balance toward their advanced degree.

Transfer the balance to another child

If you have another child that is currently in college or a younger child that will be attending college at some point, you can change the beneficiary on that account to one of your other children. There is no limit on the number of 529 accounts that can be assigned to a single beneficiary.

Take the cash

When you make withdrawals from 529 accounts for reasons that are not classified as a "qualified education expenses", the earnings portion of the distribution is subject to income taxation and a 10% penalty. Again, only the earnings are subject to taxation and the penalty, your cost basis in the account is not. For example, if my child finishes college and there is $5,000 remaining in their 529 account, I can call the 529 provider and ask them what my cost basis is in the account. If they tell me my cost basis is $4,000 that means that the income taxation and 10% penalty will only apply to $1,000. The rest of the account is withdrawn tax and penalty free.

Reserve the account for a future grandchild

Once your child graduates from college, you can change the beneficiary on the account to yourself. By doing so the account will continue to grow and once your first grandchild is born, you can change the beneficiary on that account over to the grandchild.

Reserve the account for yourself or spouse

If you think it's possible that at some point in the future you or your wife may go back to school for a different degree or advanced degree, you assign yourself as the beneficiary of the account and then use the account balance to pay for that future degree.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Equifax Data Breach: How To Protect Yourself

Equifax, a credit agency, had a data breach that resulted in an estimated 143 million people having their personal information compromised. Surprisingly enough, the greatest risk is right not now but rather a few months down the road. After your data is stolen, your information is sold on the black market, and then the bad guys figure out how they

Equifax, a credit agency, had a data breach that resulted in an estimated 143 million people having their personal information compromised. Surprisingly enough, the greatest risk is right not now but rather a few months down the road. After your data is stolen, your information is sold on the black market, and then the bad guys figure out how they are going to use your personal information to maximize their financial gain. So there is delay between the time that your information is stolen and when the fraudulent activity using your data begins.

In this article we are going to discuss the top ways to protect your credit from fraudulent activity. Here are the main steps

Monitor your financial activity closely

Run a free credit report

Consider "Freezing" your credit

Step 1: Monitor Your Financial Activity Closely

Make sure you keep a close eye on each transaction running through your checking account and credit card. This is often the first place that signs of fraudulent activity surfaces. If for some reason you cannot identify a charge to your card or bank account, make sure you contact your financial institution immediately.

Use Credit Cards, Not Debit Cards

Along these lines we strongly recommend that you use a credit card instead of a debit card and just payoff the balance of the credit card each month. If your debit card information is compromised and the "bad guys" charge $1,000 to the card, the $1,000 is actually pulled out of your checking account. You now have to report the fraudulent activity and get your money back. Instead, if your credit card is compromised and they make the $1,000 fraudulent transaction, you notify the credit card company but you are not out the $1,000. They just remove the charge from the bill and the credit card tracks down the bad guys. You should only be using your debit card for ATM withdrawals.

Step 2: Run A Free Credit Report

You should get in the habit of running a credit report on yourself once a year. These credit reports list all of your current creditors: car loans, mortgage, credit cards, store charge accounts, credit lines, etc. If you see a creditor on the list that you cannot identify that is a big red flag. If your data is compromised, the bad guys may use your data to apply for a credit card without your knowledge. The only way that you would find out that the fraudulent account existed is by running a credit report on yourself. Running your credit report once a year does not hurt your credit score. It's only if you are running your credit report more frequently that it could impact your credit score. Frequent credit runs can give the impression that you are eagerly searching for more credit and it can lower your credit score.

You can run a free credit report at www.annualcreditreport.com or you can request one from your bank or credit union.

Step 3: Consider Freezing Your Credit

One of the best ways to protect yourself is to freeze your credit with the 3 credit bureaus. There 3 credit bureaus are:

Equifax

Experian

TransUnion

A credit freeze means if someone tries to access your credit to establish a credit card, car loan, whatever it is, the request for the credit report will reject. When you set up the credit freeze each of the bureaus will you with a login or a pin number that allows you to "unfreeze" your credit for a selected period of time. If you have implemented a credit freeze and you apply for a car loan, you would follow the steps below:

Ask the dealership which credit bureau they run their reports through

Login to your account at that credit bureau

Unfreeze your credit report for a selected period of time

Notify the dealership of the limited time window to request the credit report

The window will automatically close and your credit will "re-freeze"

The credit freeze is simple to implement and it can be implemented by visiting the website of each credit bureau. You can also implement the freeze by calling the credit bureau but the on hold wait time is so long that we recommend to our clients implement the freeze via the web.Below is great video that walks you though what the online freezing process looks like:

Don't Use Public Wifi

One last tip to protect your information, do not use public wifi networks. It's tempting if you are at a coffee shop, hotel, or airport to access their free wifi network but it's the wrong move. There are individuals that have special programs that hack into the wireless network and see everything that you are looking at on your laptop or mobile device. If you are going to use a wireless network, make sure it is secure.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.