How Much Emergency Fund Should You Have And How To Get There

If you watched the nightly news during the latest government shutdown you would have seen stories about how people struggle when they aren’t getting a paycheck. Most Americans are not immune to having a set back at a job and it is a scary feeling to not know when the next paycheck will come. The emergency fund is what will help you bridge the

How Much Emergency Fund Should You Have And How To Get There

If you watched the nightly news during the latest government shutdown you would have seen stories about how people struggle when they aren’t getting a paycheck. Most Americans are not immune to having a set back at a job and it is a scary feeling to not know when the next paycheck will come. The emergency fund is what will help you bridge the gap in these hard times. This article should help determine how much emergency fund you should have and strategies on how you can get there.

We make a point of this in every financial plan we put together because of its importance. A lot of people will say their job is secure so they don’t need to worry about having an emergency fund. This may be true, nevertheless the emergency fund is not only for the most extreme circumstances but any unexpected expense. Anyone can have an unforeseen cost of $1,000 to $5,000 and most people would have to pay for this expense on a credit card that will accrue interest and take time to payoff.

Another common thought is, “I have disability insurance, so I don’t need an emergency fund”. Most disability insurance will not start until a 90-day elimination period has been met. This means you will be out of a check for that period but still have all the expenses you normally would.

Current Savings In The United States

“Smartasset” came out with a study in November 2018 that stated; of those Americans with savings accounts, the average savings account balance was $33,766.49. This seems like an amount that would be enough for most people to have in a “rainy day fund”. But that is the average. Super Savers with very large balances will skew this calculation so we use the median which more accurately reflects the state of most Americans. The median balance is only approximately $5,200 per “Smartasset”.

With a median balance of only $5,200, it doesn’t take much misfortune for that to be spent down to $0. At $5,200, it is safe to assume that most Americans are living paycheck to paycheck.

If your income only meets your normal expenses, you need to ask yourself the question “where am I coming up with the money for an unexpected cost?”. For a lot of people, it is a credit card, another type of loan, or dipping into their retirement assets. By taking care of the immediate need, you shift the burden to another part of your financial wellbeing.

Emergency Fund Calculator

There is no exact dollar amount but a consensus in the planning industry is between 4-6 months of living expenses. This is usually enough to cover expenses while you are searching for the next paycheck or to have other assistance kick in.

It is important for everyone to put together a budget. How do you know what 4-6 months of living expenses is if you don’t know what you spend? Putting together a budget takes time but you need to know where your money is going in order to make the adjustments necessary to save. If you are in a position that you don’t see your savings account increasing, or at least remaining the same, you are likely just meeting expenses with your current income.

Resource: EXPENSE PLANNER to help you focus on your spending.

I Know My Number, How Do I get There?

Determining the amount is the easy part, now it is getting there. The less likely option would be going to your boss asking, “I need to replenish my emergency fund, can you increase my pay?”. Winning the lottery would also be nice but not something you can count on.Changing spending habits is an extremely difficult thing to do. Especially if you don’t know what you’re spending money on. Once you have an accurate budget, you should take a hard look at it and make cuts to some of the discretionary items on the list. It will likely take a combination of savings strategies that will get you to an appropriate emergency fund level. Below is a list of some ideas;

Skip a vacation one year

Put any potential tax refund in savings

Put a bonus check into savings

Increase the amount of your paycheck that goes to savings when you get a raise

Side work

Don’t upgrade a phone every time your due

Downgrade a vehicle or use the vehicle longer once paid off

Reward Yourself

There is no doubt some pain will be felt if you are trying to save more and it also takes time. Set a goal and stick to it but work in some rewards to yourself. If you are making good progress after say 3 months, splurge on something to keep your sanity but won’t impact the main objective.

Where To Keep Your Emergency Fund?

This account is meant to be liquid and accessible. So locking it up in some sort of long term investment that may have penalties for early withdrawal would not be ideal. We typically suggest using an institution you are familiar with and putting it in a savings account that can earn some interest.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Can I Open A Roth IRA For My Child?

Parents always want their children to succeed financially so they do everything they can to set them up for a good future. One of the options for parents is to set up a Roth IRA and we have a lot of parents that ask us if they are allowed to establish one on behalf of their son or daughter. You can, as long as they have earned income. This can be a

Parents will often ask us: “What type of account can I setup for my kids that will help them to get a head start financially in life?" One of the most powerful wealth building tools that you can setup for your children is a Roth IRA because all of accumulation between now and when they withdrawal it in retirement will be all tax free. If your child has $10,000 in their Roth IRA today, assuming they never make another deposit to the account, and it earns 8% per year, 40 years from now the account balance would be $217,000.

Contribution Limits

The maximum contribution that an individual under the age of 50 can make to a Roth IRA in 2025 is the LESSER of:

$7,000

100% of earned income

For most children between the age of 15 and 21, their Roth IRA contributions tend to be capped by the amount of their earned income. The most common sources of earned income for young adults within this age range are:

• Part-time employment

• Summer jobs

• Paid internships

• Wages from parent-owned company

If they add up all of their W-2's at the end of the year and they total $3,000, the maximum contribution that you can make to their Roth IRA for that tax year is $3,000.

Roth IRA's for Minors

If your child is under the age of 18, you can still establish a Roth IRA for them. However, it will be considered a "custodial IRA". Since minors cannot enter into contracts, you as the parent serve as the custodian to their account. You will need to sign all of the forms to setup the account and select the investment allocation for the IRA. It's important to understand that even though you are listed as a custodian on the account, all contributions made to the account belong 100% to the child. Once the child turns age 18, they have full control over the account.

Age 18+

If the child is age 18 or older, they will be required to sign the forms to setup the Roth IRA and it's usually a good opportunity to introduce them to the investing world. We encourage our clients to bring their children to the meeting to establish the account so they can learn about investing, stocks, bonds, the benefits of compounded interest, and the stock market in general. It's a great learning experience.

Contribution Deadline & Tax Filing

The deadline to make a Roth IRA contribution is April 15th following the end of the calendar year. We often get the question: "Does my child need to file a tax return to make a Roth IRA contribution?" The answer is "no". If their taxable income is below the threshold that would otherwise require them to file a tax return, they are not required to file a tax return just because a Roth IRA was funded in their name.

Distribution Options

While many of parents establish Roth IRA’s for their children to give them a head start on saving for retirement, these accounts can be used to support other financial goals as well. Roth contributions are made with after-tax dollars. The main benefit of having a Roth IRA is if withdrawals are made after the account has been established for 5 years and the IRA owner has obtained age 59½, there is no tax paid on the investment earnings distributed from the account.

If you distribute the investment earnings from a Roth IRA before reaching age 59½, the account owner has to pay income tax and a 10% early withdrawal penalty on the amount distributed. However, income taxes and penalties only apply to the “earnings” portion of the account. The contributions, since they were made with after-tax dollars, can be withdrawn from the Roth IRA at any time without having to pay income taxes or penalties.

Example: I deposit $7,000 to my daughter’s Roth IRA and four years from now the account balance is $9,000. My daughter wants to buy a house but is having trouble coming up with the money for the down payment. She can withdraw $7,000 out of her Roth IRA without having to pay taxes or penalties since that amount represents the after-tax contributions that were made to the account. The $2,000 that represents the earnings portion of the account can remain in the account and continue to accumulate tax-free. Not only did I provide my daughter with a head start on her retirement savings but I was also able to help her with the purchase of her first house.

We have seen clients use this flexible withdrawal strategy to help their children pay for their wedding, pay for college, pay off student loans, and to purchase their first house.

Not Limited To Just Your Children

This wealth accumulate strategy is not limited to just your children. We have had grandparents fund Roth IRA's for their grandchildren and aunts fund Roth IRA's for their nephews. They do not have to be listed as a dependent on your tax return to establish a custodial IRA. If you are funding a Roth IRA for a minor or a college student that is not your child, you may have to obtain the total amount of wages on their W-2 form from their parents or the student because the contribution could be capped based on what they made for the year.

Business Owners

Sometimes we see business owners put their kids on payroll for the sole purpose of providing them with enough income to make the $7,000 contribution to their Roth IRA. Also, the child is usually in a lower tax bracket than their parents, so the wages earned by the child are typically taxed at a lower tax rate. A special note with this strategy: you have to be able to justify the wages being paid to your kids if the IRS or DOL comes knocking at your door.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Moving Expenses Are No Longer Deductible

If you were planning on moving this year to take a new position with a new company or even a new position within your current employer, the moving process just got a little more expensive. Not only is it expensive, but it can put you under an intense amount of stress as there will be lots of things that you need to have in place before packing up and

If you were planning on moving this year to take a new position with a new company or even a new position within your current employer, the moving process just got a little more expensive. Not only is it expensive, but it can put you under an intense amount of stress as there will be lots of things that you need to have in place before packing up and moving. Even things like how you are going to transport your car over to your new home, can take up a lot of your time, and on top of that, you have to think about how much it's going to cost. Prior to the tax law changes that took effect January 1, 2018, companies would often offer new employees a "relocation package" or "moving expense reimbursements" to help subsidize the cost of making the move. From a tax standpoint, it was great benefit because those reimbursements were not taxable to the employee. Unfortunately that tax benefit has disappeared in 2018 as a result of tax reform.

Taxable To The Employee

Starting in 2018, moving expense reimbursements paid to employee will now represent taxable income. Due to the change in the tax treatment, employees may need to negotiate a higher expense reimbursement rate knowing that any amount paid to them from the company will represent taxable income.

For example, let’s say you plan to move from New York to California and you estimate that your moving expense will be around $5,000. In 2017, your new employer would have had to pay you $5,000 to fully reimburse you for the moving expense. In 2018, assuming you are in the 35% tax bracket, that same employer would need to provide you with $6,750 to fully reimburse you for your moving expenses because you are going to have to pay income tax on the reimbursement amount.

Increased Expense To The Employer

For companies that attract new talent from all over the United States, this will be an added expense for them in 2018. Many companies limit full moving expense reimbursement to executives. Coincidentally, employees at the executive level are usually that highest paid. Higher pay equals higher tax brackets. If you total up the company's moving expense reimbursements paid to key employees in 2017 and then add another 40% to that number to compensate your employees for the tax hit, it could be a good size number.

Eliminated From Miscellaneous Deductions

As an employee, if your employer did not reimburse you for your moving expenses and you had to move at least 50 miles to obtain that position, prior to 2018, you were allowed to deduct those expenses when you filed your taxes and you were not required to itemize to capture the deduction. However, this expense will no longer be deductible even for employees that are not reimbursed by their employer for the move starting in 2018.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Warning To All Employees: Review The Tax Withholding In Your Paycheck Otherwise A Big Tax Bill May Be Waiting For You

As a result of tax reform, the IRS released the new income tax withholding tables in January and your employer probably entered those new withholding amounts into the payroll system in February. It was estimated that about 90% of taxpayers would see an increase in their take home pay once the new withholding tables were implemented.

As a result of tax reform, the IRS released the new income tax withholding tables in January and your employer probably entered those new withholding amounts into the payroll system in February. It was estimated that about 90% of taxpayers would see an increase in their take home pay once the new withholding tables were implemented. While lower tax rates and more money in your paycheck sounds like a good thing, it may come back to bite you when you file your taxes.

The Tax Withholding Guessing Game

Knowing the correct amount to withhold for federal and state income taxes from your paycheck is a bit of a guessing game. Withhold too little throughout the year and when you file your taxes you have a tax bill waiting for you equal to the amount of the shortfall. Withhold too much and you will receive a big tax refund but that also means you gave the government an interest free loan for the year.

There are two items that tell your employer how much to withhold for federal income tax from your paycheck:

Income Tax Withholding Tables

Form W-4

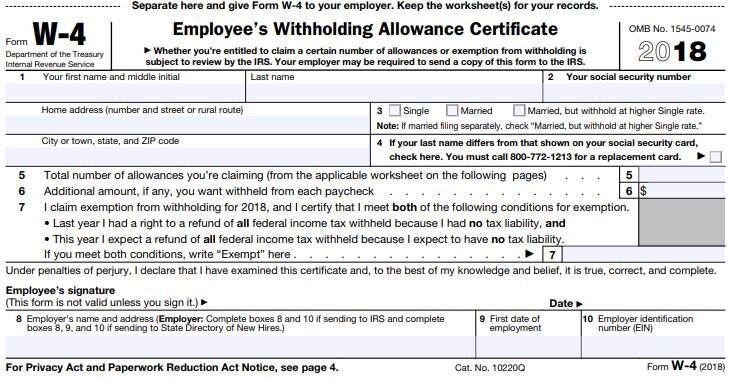

The IRS provides your employer with the Income Tax Withholding Tables. On the other hand, you as the employee, complete the Form W-4 which tells your employer how much to withhold for taxes based on the “number of allowances” that you claim on the form.

What Is A W-4 Form?

The W-4 form is one of the many forms that HR had you complete when you were first hired by the company. Here is what it looks like:

Section 3 of this form tells your employer which withholding table to use:

Single

Married

Married, but withhold at higher Single Rate

Section 5 tells your employer how many "allowances" you are claiming. Allowance is just another word for "dependents". The more allowances your claim, the lower the tax withholding in your paycheck because it assumes that you will have less "taxable income" because in the past you received a deduction for each dependent. This is where the main problem lies. Due to the changes in the tax laws, the tax deduction for personal exemptions was eliminated. This may adversely affect some taxpayers the were claiming a high number of allowances on their W-4 form because even though the number of their dependents did not change, their taxable income may be higher in 2018 because the deduction for personal exemptions no longer exists.

Even though everyone should review their Form W-4 form this year, employees that claimed allowances on their W-4 form are at the highest risk of either under withholding or over withholding taxes from their paychecks in 2018 due to the changes in the tax laws.

How Much Should I Withhold From My Paycheck For Taxes?

So how do you go about calculating that right amount to withhold from your paycheck for taxes to avoid an unfortunate tax surprise when you file your taxes for 2018? There are two methods:

Ask your accountant

Use the online IRS Withholding Calculator

The easiest and most accurate method is to ask your personal accountant when you meet with them to complete your 2017 tax return. Bring them your most recent pay stub and a blank Form W-4. Based on the changes in the tax laws, they can assist you in the proper completion of your W-4 Form based on your estimated tax liability for the year.If you complete your own taxes, I would highly recommend visiting the updated IRS Withholding Calculator. The IRS calculator will ask you a series of questions, such as:

How many dependents you plan to claim in 2018

Are you over the age of 65

The number of children that qualify for the dependent care credit

The number of children that will qualify for the new child tax credit

Estimated gross wages

How much fed income tax has already been withheld year to date

Payroll frequency

At the end of the process it will provide you with your personal results based on the data that you entered. It will provide you with guidance as to how to complete your Form W-4 including the number of allowances to claim and if applicable, the additional amount that you should instruct your employer to withhold from your paycheck for federal income taxes. Additional withholding requests are listed in Section 6 of the Form W-4.

Avoid Disaster

Having this conversation with your accountant and/or using the new IRS Withholding Calculator will help you to avoid a big tax disaster in 2018. Unfortunately, many employees may not learn about this until it's too late. Employees that are used to getting a tax refund may find out in the spring of next year that they owe thousands of dollars to the IRS because the combination of the new tax tables and the changes in the tax law that caused them to inadvertently under withhold federal income taxes throughout the year.

Action Item!!

Take action now. The longer you wait to run this calculation or to have this conversation with your accountant, the larger the adjustment may be to your paycheck. It's easier to make these adjustments now when you have nine months left in the year as opposed to waiting until November.I would strongly recommend that you share this article with your spouse, children in the work force, and co-workers to help them avoid this little known problem. The media will probably not catch wind of this issue until employees start filing their tax returns for 2018 and they find out that there is a tax bill waiting for them.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Top 2 Strategies For Paying Off Student Loan Debt

With total student loan debt in the United States approaching $1.4 Trillion dollars, I seem to be having this conversation more and more with clients. There has been a lot of speculation between president obama and student loans, but student loan debt is still piling up. The amount of student loan debt is piling up and it's putting the next generation of

With total student loan debt in the United States approaching $1.4 Trillion dollars, I seem to be having this conversation more and more with clients. While you yourself may not have student loan debt, at some point you may have to counsel a child, grandchild, friend, neighbor, or a co-worker that just can't seem to get ahead because of the financial restraints of their student loan payments. After all, for a child born today, it's projected that the cost for a 4 year degree including room and board will be $258,491 for a State College and $607,848 for a private college. That’s over a half a million dollars for a 4-year degree!!

The most common reaction to this is: "There is no way that this can happen. Something will have to change." As financial planners, we were saying that exact same thing 10 years ago but we don't say that anymore. Despite the general disbelief that this will happen, the cost of college has continued to rise at a rate of 6% per year over the past 15 years. It's good old supply and demand. If there is a limited supply of colleges and the demand for a college degree keeps going up, the price will continue to go up. As many of us know, a college degree is not necessarily an advantage anymore, it's the baseline. You need it just to get the job interview and that will be even more true for types of jobs that will be available in future years.

No Professional Help

Making matters worse, most individuals that have large student loan debt don't have access to high quality financial planners because they do not have any investible assets since everything is going toward paying down their student loan debt. I wrote this article to give our readers a look into how we as Certified Financial Planners® help our clients to dig out of student loan debt. Unfortunately, a lot of the advice that you will find by searching online is either incomplete or wrong. The solution for digging out of student loan debt is not a one size fits all solution and there are trap doors along the way.

Loan Inventory

The first step in the process is to collect and organize all of the information pertaining to your student loan debt. Create a spreadsheet that lists the following information:

Name of Lender

Type of Loan (Federal or Private)

Name of Loan Servicer

Total Outstanding Loan Balance

Interest Rate

Fixed or Variable Interest Rate

Minimum Monthly Payment

Current Monthly Payment

Estimated Payoff Date

Now, below this information I want you to list January 1 of the current year and the next 10 years. It will look like this:

Total Balance

January 1, 2025

January 1, 2026

January 1, 2027

Each year you will record your total student loan debt below your itemized student loan information. Why? In most cases you are not going to be able to payoff your student loans overnight. It’s going to be a multi-year process. But having this running total will allow you to track your progress. You can even add another column to the right of the “Total Balance” column labelled “Goal”. If your goal is to payoff your student loan debt in five years, set some preliminary balance goals for yourself. When you receive a raise or a bonus at work, a tax refund, or a cash gift from a family member, this will encourage you to apply some or all of those cash windfalls toward your student loan balance to stay on track.

Order of Payoff

The most common advice you will find when researching this topic is “make minimum payments on all of the student loans with the exception of your student loan with the highest interest rate and apply the largest payment you can against that loan”. Mathematically this is the right strategy but we do not necessary recommend this strategy for all of our clients. Here’s why……..

There are two situations that we typically run into with clients:

Situation 1: “I’m drowning in student loan debt and need a lifeline”

Situation 2: “I’m starting to make more money at my job. Should I use some of that extra income to pay down my student loan debt or should I be applying it toward my retirement plan or saving for a house?”

Situation 1: I'm Drowning

As financial planners we are unfortunately running into Situation 1 more frequently. You have young professionals that are graduating from college with a 4 year degree, making $50,000 per year in their first job, but they have $150,000 of student loan debt. So they basically have a mortgage that starts 6 months after they graduate but that mortgage payment comes without a house. For the first few years of their career they are feeling good about their new job, they receive some raises and bonuses here and there, but they still feel like they are struggling every month to meet their expenses. The realization starts to set in the “I’m never going to get ahead because these student loan payments are killing me. I have to do something.”

If you or someone you know is in this category remember these words: “Cash is king”. You will hear this in the business world and it’s true for personal finances as well. As mentioned earlier, from a pure math standpoint, the fastest way to get out of debt is to target the debt with the highest interest rate and go from there. While mathematically that may work, we have found that it is not the best strategy for individuals in this category. If you are in the middle of the ocean, treading water, with the closest island a mile away, why are we having a debate about how fast you can swim to that island? You will never make it. Instead you just need someone to throw you a life preserver.

Life Preserver Strategy

If you are just barely meeting your monthly expense or find yourself falling short each month, you have to stop the bleeding. In these situations, you should be 100% focused on improving your current cash flow not whether you are going to be able to payoff your student loans in 8 years instead of 10 years. In the spreadsheet that you created, organize all of your student loan debt from the largest outstanding loan balance to the smallest. Ignore the interest rate column for the time being. Next, begin making the minimum payments on all of your student loans except for the one with the SMALLEST BALANCE. We need to improve your cash flow which means reducing the number of monthly payments that you have each month. Once the month to month cash flow is no longer an issue then you can graduate to Situation 2 and revisit the debt payoff strategy.

This strategy also builds confidence. If you have a $50,000 loan with a 7% interest rate and two other student loans for $5,000 with an interest rate of 4% while applying more money toward the largest loan balance will save you the most interest long term, it’s going to feel like your climbing Mt. Everest. “Why put an extra $200 toward that $50,000 loan? I’m going to be paying it until I’m 50.” There is no sense of accomplishment. We find that individuals that choose this path will frequently abandon the journey. Instead, if you focus your efforts on the loans with the smaller balances and you are able to pay them off in a year, it feels good. Getting that taste of real progress is powerful. This strategy comes from the book written by Dave Ramsey called the Total Money Makeover. If you have not read the book, read it. If you have a child or grandchild graduating from college, if you were going to give them a check for graduation, buy the book for them and put the check in the book. Tell them that “this check will help you to get a start in your new career but this book is worth the amount of the check multiplied by a thousand”.

Situation 2: Paying Off Your Student Loans Faster

If you are in Situation 2, you are no longer treading water for a cash flow standpoint but now have the luxury paying off the higher interest rate student loans first and you may be able to commit more than just the minimum payment toward your student loans to pay them off faster. But in this stage, it’s also important to balance your other financial goal with paying off your student loan debt, such as:

Retirement savings

Saving for a house

Paying off student loan debt

Buying a new car

Don't Leave Free Money On The Table

Before applying all of your extra income toward your student loan payments, we ask our clients “what is the employer contribution formula for your employer’s retirement plan?” If it’s a match formula, meaning you have to put money in the plan to get the employer contribution, we will typically recommend that our clients contribute the amount needed to receive the full employer match. Otherwise you are leaving free money on the table.

The amount of that employer contribution represents a risk free rate of return. Meaning, unlike the investing in the stock market, you do not have to take any risk to receive that return on your money. If your company guarantees a 100% match on the first 5% of pay contribution out of your paycheck into the plan, your money is guaranteed to double up to 5% of your pay. Where else are you going to get a 100% risk free rate of return on your money?

Start With The Highest Interest Rate

Now that you have extra income each month you can begin to pick and choose how you apply it. You should list all of you student loans from the highest interest rate to the lowest. If it’s close between two interest rates but one is a fixed interest rate and the other is a variable interest rate, it’s typically better to pay down the variable interest rate loan first if interest rates are expected to move higher. Apply the minimum payment amount to all of your student loan payments and apply as much as you can toward the loan with the HIGHEST INTEREST RATE. Once the loan with the highest interest rate is paid off, you will move on to the next one.

Again, by applying more money toward your student loans, those additional payments represent a risk free rate of return equal to the interest rate that is being charges on each loan. For example, if the highest interest rate on one of your student loans is 7%, every additional dollar that you are apply toward paying off that loan you are receiving a 7% rate of return on because you are not paying that amount to the lender.

Here is a rebuttal question that we sometimes get: “But wouldn’t it be better to put it in the stock market and earn a higher rate of return?” However, that’s not an apples to apples comparison. The 7% rate of return that you are receiving by paying down that student loan balance is guaranteed because it represents interest that would have been paid to the lender that you are now keeping. By contrast, even though the stock market may average an 8% annualized rate of return over a 10 year period, you have to take risk to obtain that 8% rate of return. A 7% risk free rate of return is the equivalent of being able to buy a CD at a bank with a 7% interest rate guaranteed by the FDIC which does not exist right now.

But Can't I Deduct The Interest On My Student Loans?

It depends on how much you make. In 2025, if you are single, the deduction for student loan interest begins to phaseout at $85,000 of AGI and you completely lose the deduction once your AGI is above $100,000. If you are married filing a joint tax return, the deduction begins to phaseout at $170,000 of AGI and it’s completely gone once your AGI hits $200,000.

Also the deduction is limited to $2,500.

However, even if you can deduct the interest on your student loan, the tax benefit is probably not as big as you think. Let me explain via an example. Take the following fact set:

Tax Filing Status: Single

Adjusted Gross Income (AGI): $50,000

Outstanding Student Loan Balance: $60,000

Interest Rate: 7% ($4,200 Per Year)

First, you are limited to deducting $2,500 of the $4,200 in student loan interest that you paid to the lender. At $50,000 of AGI your top federal tax bracket in 2025 is 22%. So that $2,500 equals $550 in actual tax savings ($2,500 x 22% = $550). If you want to get technical, taking the tax deduction into account, your after tax interest rate on your student loan debt is really 6.08% instead of 7%. Can you get a CD from a bank right now with a 6% interest rate? No. From both a debt reduction standpoint and a rate of return standpoint, it probably makes sense to pay down that loan more aggressively.

Striking A Balance

When you are younger, you typically have a lot of financial goals such as saving for retirement, paying off debt, saving for the down payment on your first house, starting a family, college savings for you kids, etc. While I'm sure you would like to take all of your extra income and really start aggressively reducing your student loans you have to determine what the right balance is between all of your financial goals. If you receive a $5,000 bonus from work, you may allocate $3,000 of that toward your student loan debt and deposit $2,000 in your savings account for the eventual down payment on your first house. One example being to create that "goal" column in your student loan spreadsheet will help you to keep that balance and eventually lead to the payoff of all of your student loans.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Marriage Penalty: Past and Present

Whether you're currently married or not, the new tax legislation may impact how the "Marriage Penalty" affects you. Never heard of such a thing? Let's take a look at a simple example and show how it may be different under the new tax regulation.

The Marriage Penalty: Past and Present

Whether you're currently married or not, the new tax legislation may impact how the "Marriage Penalty" affects you. Never heard of such a thing? Let's take a look at a simple example and show how it may be different under the new tax regulation.

The Past (kind of)

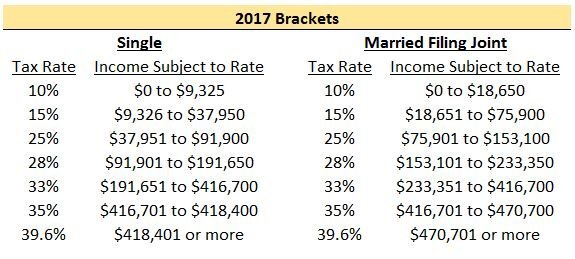

I say "kind of" because most people still have to file their 2017 tax return. Here is the 2017 tax table for Single Filers and Married Filing Joint Filers:

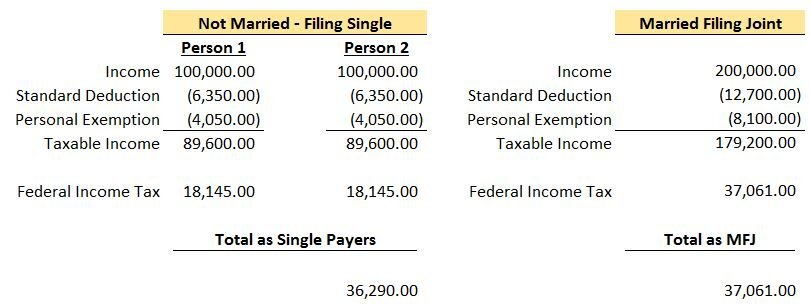

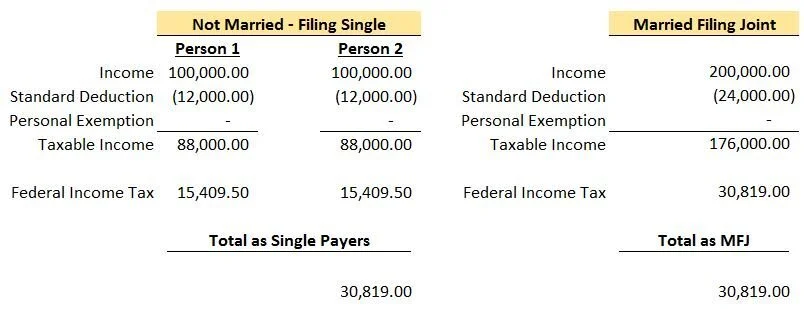

A reasonable person would think that the income subject to tax would simply double if you went from filing Single to Married Filing Joint. As you can see, this isn't the case once you are in the 25%+ tax bracket and it can mean big dollars! Let's take a look at a simple example where each person makes the same amount of money. We will also assume they will be taking the standard deduction in 2017.

Note: To calculate the “Federal Income Tax” amount above, you can use the IRS tables here 2017 1040 Tax Table Instructions. All of your income is not taxed at your top rate. For example, if your top income falls in the 25% tax bracket, as a single payer you will only pay 25% on income from $37,951 to $91,900. Everything below that range will be taxed at either 10% or 15%.

As you can see, because of the change in filing status, this couple owed a total of $771 more to the federal government. This is the “Marriage Penalty”. Typically as incomes rise, the dollar amount of the penalty becomes larger. For this couple, their top tax bracket went from 25% each when filing single to 28% filing joint.

The Present

Here is the 2018 tax table in the new tax legislation for Single Filers and Married Filing Joint Filers:

Upon review, you can see that the top income brackets are not doubled for Married Filing Joint. At 37%, a single person filing would reach the top rate at $500,001 while married filing joint would reach at $600,001. That being said, the “Marriage Penalty” appears to kick in at higher income levels compared to the past and therefore should impact less people. The income bracket for Married Filing Joint is doubled up until $400,000 of combined income compared to just $75,901 under the 2017 brackets.

Let’s take a look at the same couple in the example above.

Due to the income brackets doubling from single to married filing joint for this couple, the “Marriage Penalty” they would have incurred in 2017 appears to go away. In this example, they would also pay less in federal taxes in both situations. This article is more focused on the impact on the “Marriage Penalty” but having a lower tax bill is always a plus.

Standard vs. Itemized Deductions

The tax brackets aren’t the only penalty. Another common tax increase people see when going from single to married filing joint are the deductions they lose. If I’m single and own a home, it is likely I will itemized because the sum of my property taxes, mortgage interest, and state income taxes exceed the standard deduction amount. Assume the couple in the example above is still not married but Person 1 owns a home and rather than taking the standard deduction, Person 1 itemizes for an amount of $15,000. For 2017, their total deductions will be $21,350 ($15,000 Person 1 plus $6,350 Person 2) and for 2018, their total deductions will be $27,000 ($15,000 Person 1 plus $12,000 Person 2).

Now they get married and have to choose whether to itemize or take the standard deduction.

2017: Assuming they live together in the same house, in 2017 they would still itemize because they have deductions of $15,000 for Person 1 and some additional items that Person 2 would bring to the table (i.e. their state income taxes). Say their total itemized deductions are $18,000 when married filing joint. They would still itemize because $18,000 is more than the Married Filing Joint standard deduction of $12,700. But now compare the $18,000 to the $21,350 they got filing single. They lose out on $3,350 of deductions. Usually, less deductions equals more taxes.

2018: Assuming they live together in the same house, in 2018 they would no longer itemize. Assuming their total itemized deductions are still $18,000, that is less than the $24,000 standard deduction they can take when married filing joint. $24,000 standard deduction in 2018 is still less than the $27,000 they got filing separately by $3,000. Again, less deductions usually means more taxes. The “Marriage Penalty” lives on!

A lot of people will still lose out on deductions in 2018 but the “Marriage Penalty” will hit less people because of the increase in the standard deduction. If Person 1 has itemized deductions of $10,000 in 2017, they would itemize if they filed single and possibly take the standard deduction of $12,700 filing joint. In 2018 however, Person 1 would take the standard deduction both as a single tax payer ($12,000) and married filing joint ($24,000) which takes away the “Marriage Penalty” related to the deduction.

The Why?

Why do tax brackets work this way? Like most taxes, I assume the idea was to generate more income for the government. Some may also argue that typical couples don't make the same salaries which seems like an archaic point of view.Was it all fixed with the new tax legislation? It doesn't appear so but it does look like less people will be struck by Cupid's Marriage Penalty.

About Rob.........

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

More Taxpayers Will Qualify For The Child Tax Credit

There is great news for parents in the middle to upper income tax brackets in 2018. The new tax law dramatically increased the income phaseout threshold for claiming the child tax credit. In 2017, parents were eligible for a $1,000 tax credit for each child under the age of 17 as long as their adjusted gross income (“AGI”) was below $75,000 for single

There is great news for parents in the middle to upper income tax brackets. The new tax law dramatically increased the income phase-out threshold for claiming the child tax credit. In 2017, parents were eligible for a $1,000 tax credit for each child under the age of 17 as long as their adjusted gross income (“AGI”) was below $75,000 for single filers and $110,000 for married couples filing a joint return. If your AGI was above those amounts, the $1,000 credit was reduced by $50 for every $1,000 of income above those thresholds. In other words, the child tax credit completely phased out for a single filer with an AGI greater than $95,000 and for a married couple with an AGI greater than $130,000.

Note: If you are not sure what the amount of your AGI is, it’s the bottom line on the first page of your tax return (Form 1040).

New Phaseout Thresholds Beginning In 2018

Starting in 2018 and for years going forward, the new phaseout thresholds for the Child Tax Credit begin at the following AGI levels:

Single Filer: $200,000

Married Filing Joint: $400,000

If your AGI falls below these thresholds, you are eligible for the full Child Tax Credit. For taxpayers with an AGI amount that exceeds these thresholds, the phaseout calculation is the same as 2017. The credit is reduced by $50 for every $1,000 in income over the AGI threshold.

Wait......It Gets Better

Not only will more families now qualify for the child tax credit but the amount of the credit was doubled. The new tax law increased the credit from $1,000 to $2,000 for each child under the age of 17.

In 2025, a married couple, with three children, with an AGI of $200,000, would have received nothing for the child tax credit. Now, that same family will receive a $6,000 tax credit. That’s huge!! Remember, “tax credits” are more valuable than “tax deductions”. Tax credits reduce your tax liability dollar for dollar whereas tax deductions just reduce the amount of your income subject to taxation.

This information is for educational purposes only. Please consult your accountant for personal tax advice.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Will Your Paycheck Increase In 2018?

U.S taxpayers have a big reason to celebrate this week. By the end of February, you should see your paycheck increase. The government released the new payroll withholding tables this week which will lower the amount of taxes withheld from your paycheck and increase your take home pay. Naturally the next question is "How much will my paycheck go

U.S taxpayers have a big reason to celebrate this week. By the end of February, you should see your paycheck increase. The government released the new payroll withholding tables this week which will lower the amount of taxes withheld from your paycheck and increase your take home pay. Naturally the next question is "How much will my paycheck go up?" Out of curiously, I spent my Saturday morning comparing the 2017 tax tables to the new 2018 tax tables to answer that question. Yes, this is what nerds do on their weekends.

The Calculation

Like most financial calculations, it's long and boring. I will provide you with the cliff notes version. The government provides your company with tax withholding tables that they enter into the payroll system. It tells your employer how much to withhold in fed taxes from each pay check. The three main variables in the calculation are:

Payroll frequency (weekly, bi-weekly, etc)

The number of withholding allowances that you claim

The amount of your pay

Single Filers or Head of Household

If you are a single or head of household tax filer, I ran the following calculations based on a bi-weekly payroll schedule and an employee claiming one withholding allowance. The table below illustrates how much your annual take home pay may increase under the new tax withholding tables at various salary levels.

Based on this analysis, it looks like a single filer’s paycheck will increase between 2% – 3% as soon as the new withholding tables are entered into the payroll system. If you want to know how much your bi-weekly pay will increase, just take the annual numbers listed above and divide them by 26 pay periods. If the payroll frequency at your company is something other than bi-weekly or you claim more than one withholding allowance, your percentage increase in take home pay will deviate from the table listed above.

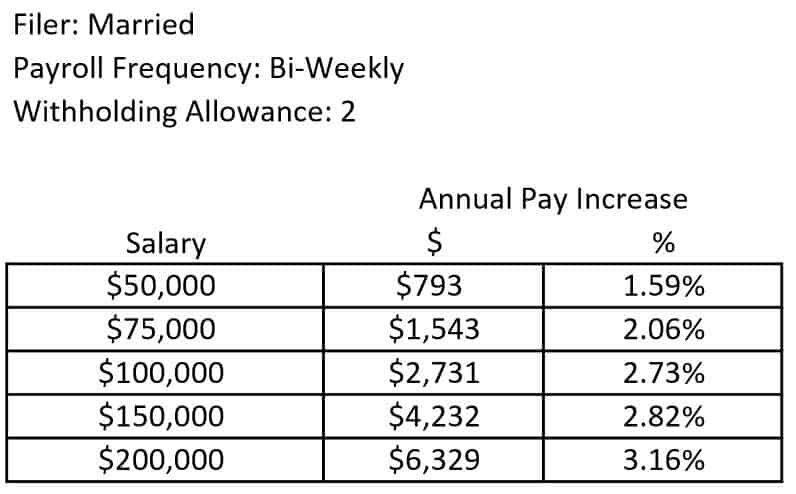

Married Couples Filing Joint

For employees that are married and file a joint tax return, below is the calculations based on a bi-weekly payroll schedule and two withholding allowances. The table below illustrates how much your annual take home pay may increase under the new tax withholding tables at various salary levels.

Even though I added an additional withholding allowance in the calculation for the married employee, I was surprised that the “range” of the percentage increase in the take home pay for a married employee was noticeably wider than a single tax filer. As you will see in the table above, the increase in take home pay for an employee in this category range from 1.5% – 3.1%.

Another interesting observation, in the single filer table, the percentage increase in take home pay actually diminished as the employee’s annual compensation increased. In contrast, for the married employee, the percentage increase in annual take home pay gradually increased as the employee’s annual salary increased. Conclusion…..get married in 2018? Nothing says love like new withholding tables.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.