401(k) Catch-Up Contribution FAQs: Your Top Questions Answered (2025 Rules)

Got questions about 401(k) catch-up contributions? You’re not alone. With updated 2025 limits and new Roth rules on the horizon, this article answers the most common questions about who qualifies, how much you can contribute, and what strategic moves to consider in your 50s and early 60s.

As retirement gets closer, many individuals start to wonder how they can supercharge their savings and make up for lost time. For those age 50 and older, catch-up contributions offer a powerful opportunity to contribute more to retirement accounts beyond the standard annual limits. Below, I’ve addressed some of the most common questions I get from clients about catch-up contributions, especially with the updated 2025 rules in play.

Can I make catch-up contributions if I’m working part-time in retirement?

Yes, as long as you have earned income from a job, and you have met the plan’s eligibility requirements. So, even if you’ve scaled back your hours or semi-retired, you may still be eligible to make additional contributions.

For example, if you're age 65 and working part-time and eligible for your company’s 401(k) plan, you can contribute up to $23,500, plus an extra $7,500 in catch-up contributions for a total of $31,000 in 2025, assuming you have at least $31,000 in W2 compensation.

If you have less than $31,000 in W2 comp, you will be capped by the lesser of the annual contribution limit or 100% of your W2 compensation.

Are Roth catch-up contributions allowed?

Yes. If your employer plan offers a Roth option, you can choose to make your catch-up contributions as Roth dollars. This means you contribute after-tax money now and take qualified distributions tax-free in retirement.

This option is popular for individuals who are in the same tax bracket now as they plan to be in retirement. The Roth source also avoids required minimum distributions (RMDs) starting at age 73 or 75.

How do catch-up contributions impact required minimum distributions (RMDs)?

Catch-up contributions themselves don’t change the timing or calculation of RMDs. However, where you put the catch-up dollars can affect your future RMDs. If you contribute catch-up dollars to a Roth 401(k) and then roll over the balance to a Roth IRA prior to the RMD start age, RMDs are not required.

Adding more to the pre-tax employee deferral source within the plan may increase your future RMD requirement since pre-tax retirement accounts are subject to the annual RMD requirement once you reach age 73 (for those born 1951–1959) or 75 (for those born 1960 or later).

Should I prioritize catch-up contributions or pay down my mortgage?

This depends on your interest rate, your retirement timeline, tax bracket, and your overall financial goals. Generally, if your mortgage interest rate is below 4% and you’re behind on retirement savings, catch-up contributions may be a better use of your idle cash, especially if your investments are growing tax-deferred (pre-tax) or tax-free (roth).

However, if you’re already on track for retirement and the psychological benefit of being debt-free is important to you, putting extra cash toward your mortgage can make sense. It’s all about balancing the right financial decision with your personal preferences.

What happens if I forget to update my payroll deferrals after turning 50?

Unfortunately, you won’t automatically get the benefit since your employer’s payroll system won’t adjust your contributions just because you had a birthday. You need to take action and manually increase your deferrals to take advantage of the higher limits.

For example, if you turn 50 this year and forget to bump your 401(k) deferrals, you may miss out on contributing an additional $7,500. Worse yet, once the calendar year closes, you can't go back and make up for it.

Are there additional tax benefits associated with making catch-up contributions?

It’s common that the years leading up to retirement are often the highest income years for an individual. The additional pre-tax contributions associated with the catch-up contribution allow employees to take more of their income off the table during the peak income years and shift it into the retirement years, when ideally they are in a lower tax bracket.

What is the new age 60 – 63 catch-up contribution?

Starting in 2025, there is a new enhanced catch-up contribution available to employees covered by 401(k) and 403(b) plans who are aged 60 to 63. Instead of being limited to just the regular $7,500 catch-up contribution, in 2025, employees age 60 – 63 will be allowed to make a catch-up contribution equal to $11,250.

What is the Mandatory Roth catch-up for high income earners?

Starting in 2026, and for the following years, if an employee makes more than $145,000 in W2 compensation (indexed for inflation) with the same employer in the previous year, that employee will no longer be allowed to make pre-tax catch-up contributions. If they make a catch-up contribution, it will be required to be a Roth catch-up contribution.

Final Thoughts…

Whether you’re still decades from retirement or just a few years away, catch-up contributions are a crucial part of retirement planning for those age 50 and older. With the 2025 limits now in place and Roth rules continuing to evolve, understanding how these contributions fit into your broader plan can help you save smarter — and avoid costly mistakes.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What are catch-up contributions and who qualifies for them?

Catch-up contributions allow individuals age 50 and older to contribute additional funds to retirement accounts beyond the standard annual limits. For 2025, employees can contribute up to $23,500 to a 401(k) plus an extra $7,500 in catch-up contributions, for a total of $31,000 — provided they have sufficient earned income.

Can part-time workers make catch-up contributions?

Yes. As long as you have earned income and meet your employer plan’s eligibility requirements, you can make catch-up contributions even if you’re working part-time. The total contribution amount cannot exceed 100% of your W-2 compensation.

Are Roth catch-up contributions available?

If your employer plan offers a Roth option, you can make your catch-up contributions as Roth dollars. Roth contributions are made after tax, grow tax-free, and qualified withdrawals are also tax-free, offering flexibility for future tax planning.

How do catch-up contributions affect required minimum distributions (RMDs)?

Catch-up contributions do not change when RMDs begin, but the type of account matters. Pre-tax catch-up dollars increase your future RMDs, while Roth 401(k) contributions can be rolled into a Roth IRA before RMD age to avoid mandatory withdrawals altogether.

Should I prioritize catch-up contributions or pay down my mortgage?

It depends on your financial situation. If your mortgage rate is low (under 4%) and you’re behind on retirement savings, maximizing catch-up contributions may be beneficial. However, paying down your mortgage may make sense if you’re already on track for retirement and value being debt-free or if you have a higher interest rate on your mortgage.

What happens if I forget to increase my deferrals after turning 50?

Your employer’s payroll system won’t automatically adjust contributions, so you must update them manually. Missing the adjustment means forfeiting that year’s extra contribution opportunity — once the year ends, you can’t retroactively make up the difference.

What is the new enhanced age 60–63 catch-up contribution for 2025?

Starting in 2025, employees aged 60 to 63 can make a larger catch-up contribution of up to $11,250 to 401(k) and 403(b) plans, providing an additional savings boost in the final years before retirement.

What is the new rule for high-income earners and Roth catch-ups?

Beginning in 2026, employees earning more than $145,000 (indexed for inflation) in W-2 income with the same employer will be required to make catch-up contributions as Roth contributions — pre-tax catch-ups will no longer be allowed for this group.

401(k) Catch-Up Contributions Explained: Maximize Your Retirement Savings in 2025

Turning 50? It’s time to boost your retirement savings.

This article breaks down the updated 2025 401(k) catch-up contribution limits, new rules for ages 60–63, and whether pre-tax or Roth contributions make the most sense for your situation.

For individuals aged 50 or older, catch-up contributions allow for additional retirement savings during what are often their highest earning years. With updated limits and new provisions taking effect in 2025, this strategy can be especially valuable for those looking to strengthen their financial position ahead of retirement and maximize tax efficiency in what are typically their highest income years leading up to retirement.

Below, I break down the 2025 catch-up contribution limits, rules, and strategic considerations to help you make informed decisions.

What Are Catch-Up Contributions?

Catch-up contributions allow individuals aged 50 or older to contribute above the standard annual limits to retirement accounts. You’re eligible to make catch-up contributions starting in the calendar year you turn 50.

2025 Contribution Limits

Here are the updated 2025 401(k) contribution limits for each plan type:

401(k), 403(b), 457(b):

Standard limit: $23,500

Age 50 – 59 & Age 64+ catch-up: $7,500

Age 60 – 63 catch-up: $11,250

New 401(k) Age 60–63 Catch-Up Limits

Beginning in 2025, a new tier of higher catch-up limits will apply to individuals between ages 60 and 63. Under the SECURE 2.0 Act, these individuals can contribute an additional amount equal to 50% of the regular catch-up contribution for that plan year. For 2025, this equates to an extra $3,750, bringing the total possible contribution to $34,750 for 401(k), 403(b), and 457(b) plans. This enhanced catch-up contribution is optional for employers, so it's important to confirm with your plan sponsor whether this provision is available in your plan.

To learn more, read our article: New Age 60 – 63 401(k) Enhanced Catch-up Contribution Starting in 2025

Pre-Tax vs. Roth Catch-Up Contributions

Employer-sponsored retirement plans often allow participants to choose whether their catch-up contributions are made on a pre-tax or Roth (after-tax) basis. The best approach depends on income levels, expected tax rates in retirement, and broader financial planning goals.

Pre-tax contributions reduce your taxable income today but are taxed when withdrawn in retirement.

Roth contributions provide no current tax deduction but grow and distribute tax-free in retirement.

When Pre-Tax May Make Sense:

You're in a high tax bracket today (e.g., 24%+)

You expect to be a lower tax bracket during the retirement years

Example:

Tom is age 60, married, and earns $400,000 annually, placing him in the 32% federal tax bracket. In the next 5 years, Tom expects to retire and be in a lower federal tax bracket. By making pre-tax catch-up contributions now, it will allow him to reduce his current taxable income, while potentially taking distributions in a lower tax bracket later.

When Roth May Make Sense:

You expect your current tax rate to be roughly the same in retirement

You already have substantial pre-tax retirement account balances

You expect tax rates to rising in the future

Example:

Susan is age 52, single filer, earns $125,000 per year, and is in the 22% tax bracket. She expects her income to remain steady over time. By choosing Roth catch-up contributions, she pays tax now at a relatively low rate and avoids taxation on future withdrawals.

Mandatory Roth Catch-Up Contributions for High Earners (Effective 2026)

Starting in 2026, individuals earning $145,000 or more (adjusted for inflation) in wages from the same employer in the previous year will be required to make catch-up contributions to their workplace plan on a Roth basis. This rule applies only to employer-sponsored plans (like 401(k)s) and does not impact Simple IRA plans. For 2025, these Roth rules have been delayed, giving high-income earners time to prepare.

To learn about the rules and exceptions for high earners, read our article: Mandatory 401(k) Roth Catch-up Details Confirmed by IRS January 2025

The Big Picture: Why This Strategy Matters Near Retirement

For individuals within five to ten years of retirement, catch-up contributions provide an opportunity to meaningfully increase retirement savings without relying on higher investment returns or making dramatic lifestyle changes. The added contributions also support strategic tax planning by allowing savers to choose between pre-tax and Roth treatment based on their broader income picture.

Catch-up contributions can help:

Maximize tax-advantaged savings when your income is typically at its highest

Take advantage of compound growth on a larger balance

Strategically shift assets into Roth accounts for future tax-free income

Consider the numbers:

A 60-year-old contributing the full $34,750 annual catch-up amount for three consecutive years could accumulate over $111,000 in additional retirement savings, assuming a 7% annual return. If contributed to a Roth 401(k), those funds would grow and be distributed tax-free, offering valuable flexibility in retirement.

Even if retirement is only a few years away, catch-up contributions can play a significant role in improving retirement readiness and reducing future tax burdens.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What are catch-up contributions and who qualifies for them?

Catch-up contributions allow individuals aged 50 or older to contribute more to retirement accounts than the standard annual limit. Eligibility begins in the calendar year you turn 50, regardless of your income level or how close you are to retirement.

What are the 2025 catch-up contribution limits?

In 2025, employees can contribute up to $23,500 to a 401(k), 403(b), or 457(b) plan. Those aged 50–59 and 64 or older can contribute an additional $7,500, while individuals aged 60–63 can make an enhanced catch-up contribution of $11,250, for a total of $34,750 if allowed by their employer’s plan.

How does the new age 60–63 catch-up rule work?

Starting in 2025, individuals between ages 60 and 63 can make a higher catch-up contribution equal to 150% of the standard catch-up limit. This provision under the SECURE 2.0 Act lets older workers maximize savings during their final working years, but availability depends on whether an employer adopts the rule.

Should I make my catch-up contributions pre-tax or Roth?

The best option depends on your tax situation. Pre-tax contributions reduce taxable income now and are ideal if you expect to be in a lower tax bracket in retirement. Roth contributions are made after-tax but grow tax-free and are advantageous if you expect future tax rates to rise or your income to remain steady.

What is the mandatory Roth catch-up rule for high-income earners?

Beginning in 2026, employees earning $145,000 or more (adjusted for inflation) from the same employer in the previous year must make catch-up contributions on a Roth basis. This means contributions will be made after tax, and future withdrawals will be tax-free.

Why are catch-up contributions especially important near retirement?

Catch-up contributions help individuals nearing retirement boost savings during peak earning years without depending solely on market growth. They also provide tax planning flexibility by letting savers choose between pre-tax and Roth options based on their expected future income and tax rates.

How Transfer on Death (TOD) Accounts Help You Avoid Probate

Confused about transfer-on-death (TOD) accounts? This article answers the most common questions about Transfer on Death designations, how they work, and how they can help you avoid probate.

As an investment firm, we typically encourage clients to add TOD beneficiaries to their individual brokerage accounts to avoid the probate process, should the owner of the account unexpectedly pass away. TOD stands for “Transfer on Death”. When someone passes away, their assets pass to their beneficiaries in one of three ways:

Probate

Contract

Trust

Passing Asset by Contract

When you set up an IRA, 401(K), annuity, or life insurance policy, at some point during the account opening process, the custodian or life insurance company will ask you to list beneficiaries on your account. This is a standard procedure for these types of accounts because when the account owner passes away, they look at the beneficiary form completed by the account owner, and the assets pass “by contract” to the beneficiaries listed on the account. Since these accounts pass by contract, they automatically avoid the headaches of the probate process.

Probate

Non-retirement accounts like brokerage accounts, savings accounts, and checking accounts are often set up in an individual's name without beneficiaries listed on the account. If someone that passes away has one of these accounts, the decedent’s last will and testament determines who will receive the balance in those accounts - but those accounts are required to go through a legal process called “probate”. The probate process is required to transfer the decedent’s assets into their “estate”, and then ultimately distribute the assets of the estate to the estate beneficiaries.

Since the probate process involves the public court system, it can often take months before the assets of the estate are distributed to the beneficiaries of the estate. Depending on the size and complexity of the estate, there could also be expenses associated with the probate process, including but not limited to court filing fees, attorney fees, accountant fees, executor fees, appraiser fees, or valuation experts.

For this reason, many estate plans aim to avoid probate whenever possible.

Transfer On Death Designation

A very easy solution to avoid the probate process for brokerage accounts, checking accounts, and savings accounts, is to add a TOD designation to the account. The process of turning an individual account into a Transfer on Death account is also very easy because it usually only involves completing a Transfer-on-Death form, which lists the name and percentages of the beneficiaries assigned to the account. Once an individual account has been changed into a TOD account, if the account owner were to pass away, that account no longer goes through the probate process; it now passes to the beneficiaries by contract, similar to an IRA.

Frequently Asked Questions About TOD Accounts

After we explain the TOD strategy to clients, there are often several commonly asked questions that follow, so I’ll list them in a question-and-answer format:

Q: Can you change the beneficiaries listed on a TOD account at any time?

A: Yes, the beneficiaries assigned to a TOD account can be changed at any time by completing an updated TOD designation form

Q: If I list TOD beneficiaries on all of my non-retirement accounts, do I still need a will?

A: We strongly recommend that everyone execute a will for assets that are difficult to list TOD beneficiaries, such as a car, jewelry, household items, and for any other assets that don’t pass by contract or by trust.

Q: Can I list TOD beneficiaries on my house?

A: It depends on what state you live in. Currently, 31 states allow TOD deeds for real estate. New York became the newest state added to the list in 2024.

Q: Can my TOD beneficiaries be the same as my will?

A: Yes, you can make the TOD beneficiaries the same as your will. However, since TOD accounts pass by contract and not by your will, you can make beneficiary designations other than what is listed in your will.

Q: Can I list different beneficiaries on each TOD account (brokerage, checking, savings)?

A: Yes

Q: Can I list a trust as the beneficiary of my TOD account?

A: Yes

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What does TOD mean and how does it work?

TOD stands for “Transfer on Death.” It allows you to name beneficiaries on certain financial accounts—such as brokerage, checking, or savings accounts—so that the assets transfer directly to those beneficiaries when you pass away, bypassing the probate process entirely.

How is a TOD account different from probate or a trust?

Assets that pass through probate are distributed under a will and may take months to settle, while assets in a trust or TOD account pass directly to beneficiaries without court involvement. A TOD designation provides a simple, low-cost way to avoid probate for individual accounts.

Can I change the beneficiaries on my TOD account?

Yes. You can update or change your TOD beneficiaries at any time by completing a new Transfer-on-Death designation form with your financial institution. The most recent form on file will determine who receives the assets upon your passing.

Do I still need a will if I have TOD accounts?

Yes. A will is still necessary for assets that cannot have TOD beneficiaries, such as vehicles, personal items, or real estate in states that don’t allow TOD deeds. A will ensures these remaining assets are distributed according to your wishes.

Can I add TOD beneficiaries to my house or real estate?

In many states, yes. As of 2024, 31 states—including New York—allow Transfer-on-Death deeds for real estate. Rules vary by state, so it’s important to confirm eligibility and filing requirements where you live.

Can I name different beneficiaries on each TOD account?

Yes. You can assign unique beneficiaries and percentage allocations for each TOD account, giving you flexibility in how your assets are distributed.

Can I name a trust as the beneficiary of my TOD account?

Yes. You can designate a trust as your TOD beneficiary, which can be beneficial if your estate plan includes specific instructions for how and when assets should be distributed to heirs.

How to Avoid the New York State Estate Tax Cliff

When someone passes away in New York, in 2025, there is a $7.16 million estate tax exclusion amount, which is significantly lower than the $13.9M exemption amount available at the federal level. However, in addition to the lower estate tax exemption amount, there are also two estate tax traps specific to New York that residents need to be aware of when completing their estate plan. Those two tax traps are:

1) The $7.5 million Cliff Rule

2) No Portability between spouses

With proper estate planning, these tax traps can potentially be avoided, allowing residents of New York to side-step a significant state tax liability when passing assets onto their heirs.

When someone passes away in New York in 2025, there is a $7.16 million estate tax exclusion amount, which is significantly lower than the $13.9M exemption amount available at the federal level. However, in addition to the lower estate tax exemption amount, there are also two estate tax traps specific to New York that residents need to be aware of when completing their estate plan. Those two tax traps are:

The $7.5 million Cliff Rule

No Portability between spouses

With proper estate planning, these tax traps can potentially be avoided, allowing residents of New York to side-step a significant state tax liability when passing assets onto their heirs.

New York Estate Tax Cliff Rule

When it comes to estate planning, it’s important to understand that estate tax rules at the federal and state levels can vary. Some states adhere to the federal rules, but New York is not one of those states. New York has a very punitive “cliff rule” where once an estate reaches a specific dollar amount, the New York estate tax exemption is eliminated, and the ENTIRE value of the estate is subject to New York state tax.

As mentioned above, the New York estate tax exemption for 2025 is $7,160,000. So, for anyone who lives in New York and passes away with an estate that is valued below that amount, they do not have to pay estate tax at the state or federal level.

For individuals that pass away with an estate valued between $7,160,000 and $7,518,000, they pay estate tax to New York only on the amount that exceeds the $7,160,000 threshold.

But the “cliff” happens at $7,518,000. Once an estate in New York exceeds $7,518,000, the ENTIRE estate is subject to New York Estate Tax, which ranges from 3.06% to 16% depending on the size of the estate.

Non-Portability Between Spouses in New York

Married couples that live in New York must be aware of how the portability rules vary between the federal and state levels. “Portability” is something that happens at the passing of the first spouse, and it refers to how much of the unused estate tax exemption can be transferred or “ported” over to the surviving spouse. The $13.9M federal estate tax exemption is “per person” and “full portable”. Why is this important? It’s common for married couples to own most assets “jointly with rights of survivorship”, so when the first spouse passes away, the surviving spouse assumes full ownership of the asset. However, since the spouse who passed away did not have any assets solely in their name, there is nothing to include in their estate, so the $13.9M federal estate tax exemption at the passing of the first spouse goes unused.

At the federal level that’s not an issue because the federal estate tax exemption for a married couple is portable, which means if the first spouse that passes away does not use their full estate tax exemption, any unused exemption amount is transferred to the surviving spouse. Assuming that the spouse who passes away first does not use any of their estate tax exemption, when the second spouse passes, they would have a $27.8 million federal estate tax exemption ($13.9M x 2).

However, New York does not allow portability, so any unused estate tax exemption at the passing of the first spouse is completely lost. The fact that New York does not allow portability requires more proactive estate tax planning prior to the passing of the first spouse.

Here is a quick example showing how this works: Larry & Kathy are married and have an estate valued at $10M in which most of their assets are titled jointly with rights of survivorship. Since everything is titled jointly, if Larry were to pass away in 2025, the $10M in assets would transfer over to Kathy with no estate taxes due at either the Federal or State level. The problem arises when Kathy passes away 2 years later. Assuming Kathy passes away with the same $10M in her name, there is still no federal estate taxes due because she more than covered by the $27.8M exemption at the federal level, however, because New York’s estate tax exemption is not portable, and her assets are well over the $7.5M cliff, the full $10M would be taxed by the New York level, resulting in close to a $1M tax liability. A tax liability that could have been completely avoided with proper estate planning.

If instead of Larry and Kathy holding all of their assets jointly, they had segregated their assets to $5M owned by Larry and $5M owned by Kathy, when Larry passed away, he would have been able to use his $7.1M New York State estate tax exemption to protect the full $5M. Then, when Kathy passed with her $5M two years later, she would have been able to use her full $7.1M New York State tax exemption, resulting in $0 in taxes paid to New York State — avoiding nearly $1M in unnecessary tax liability.

Setting Up Separate Trusts

A common solution that our clients will use to address both the $7.5M cliff and the non-portability issue in New York is that each spouse will set up their own revocable trust, and then split the non-retirement account assets in a way to maximize the $7.1M New York State exemption amount at the passing of the first spouse.

I will sometimes hear married couples say “Well, we don’t have to worry about this because our total estate is only $6 million.” That would be true today, but if that married couple is only 70 years old, and they are both in good health, what if their assets double in size before the first spouse passes? Now they have a problem.

Special Legal Disclosure: This article is for educational purposes only, and it does not contain any legal advice. For legal advice, please contact an attorney.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQ):

What is the New York estate tax exemption for 2025?

In 2025, New York’s estate tax exclusion amount is $7.16 million per person, which is significantly lower than the federal estate tax exemption of $13.9 million. Estates valued below $7.16 million are not subject to New York or federal estate tax, but larger estates may face substantial state tax liability.

What is the New York “estate tax cliff rule”?

The “cliff rule” means that if an estate exceeds 105% of the exemption amount—$7.518 million in 2025—the entire estate becomes subject to New York estate tax, not just the amount above the threshold. Once an estate crosses the cliff, tax rates ranging from 3.06% to 16% can apply to the entire estate value.

How does New York’s estate tax differ from federal estate tax rules?

Unlike federal law, which allows full portability between spouses and a much higher exemption amount, New York has no portability and a lower threshold. This means any unused exemption at the first spouse’s death is lost unless proactive estate planning is done.

What does “non-portability” between spouses mean in New York?

Non-portability means a surviving spouse cannot use the unused estate tax exemption of their deceased spouse. Without planning, the first spouse’s exemption is forfeited, potentially exposing the surviving spouse’s estate to higher New York taxes later.

How can married couples avoid the New York estate tax cliff and non-portability issue?

Couples can establish separate revocable trusts and divide ownership of assets so that each spouse has enough in their name to fully use their individual New York estate tax exemption. This strategy allows both exemptions to be utilized and avoids unnecessary state taxes at the second spouse’s death.

Why does asset titling matter for estate tax planning in New York?

Jointly held assets automatically transfer to the surviving spouse and bypass the first spouse’s estate, preventing use of that spouse’s exemption. Properly titling assets between spouses or placing them in individual trusts ensures both exemptions can be applied.

When should New York residents start estate tax planning?

It’s wise to plan early—especially for couples whose combined assets approach or exceed $5–6 million. Asset growth, real estate appreciation, and investment performance can easily push estates over the $7.5 million threshold in the future, triggering significant tax liability without planning.

Multi-Generational Roth Conversion Planning

With the new 10-Year Rule in effect, passing along a Traditional IRA could create a major tax burden for your beneficiaries. One strategy gaining traction among high-net-worth families and retirees is the “Next Gen Roth Conversion Strategy.” By paying tax now at lower rates, you may be able to pass on a fully tax-free Roth IRA—one that continues growing tax-free for years after the original account owner has passed away.

With the new 10-Year Rule in place for non-spouse beneficiaries of retirement accounts, one of the new tax strategies for passing tax-free wealth to the next generation is something called the “Next Gen Roth Conversion Strategy”. This tax strategy works extremely well when the beneficiaries of the retirement account are expected to be in the same or higher tax bracket than the current owner of the retirement account.

Here's how the strategy works. The current owner of the retirement account begins to initiate large Roth conversions over the course of a number of years to purposefully have those pre-tax retirement dollars taxed in a low to medium tax bracket. This way, when it comes time to pass assets to their beneficiaries, the beneficiaries inherit Roth IRA assets instead of pre-tax Traditional IRA and 401(k) assets that could be taxed at a much higher rate due to the requirement to fully liquidate and pay tax on those assets within a 10-year period.

In addition to lowering the total income tax paid on those pre-tax retirement assets, this strategy can also create multi-generational tax-free wealth, reduce the size of an estate to save on estate taxes, and reduce future RMDs for the current account owner.

10-Year Rule for Non-Spouse Beneficiaries

This tax strategy surfaced when the new 10-Year Rule went into place with the passing of the Secure Act. Non-spouse beneficiaries who inherit pre-tax retirement accounts are now required to fully deplete and pay tax on those account balances within a 10-year period following the passing of the original account owner. In many cases when children inherit pre-tax retirement accounts from their parents, they are still working, which means that they already have income on the table.

For example, if Josh, a non-spouse beneficiary, inherits a $600,000 Traditional IRA from his father when he is age 50, he would be required to pay tax on the full $600,000 within 10 years of his father passing. But what if Josh is married and he and his wife still work and are making $360,000 per year? If Josh and his wife do not plan to retire within the next 10 years, the $600,000 that is required to be distributed from that inherited IRA while they are still working could be subject to very high tax rates since the taxable distribution stacks on top of the $360,000 that they are already making. A large portion of those IRA distributions could be subject to the 32% federal tax bracket.

If Josh’s father had started making $100,000 Roth conversions each year while both he and Josh’s mother were still alive, they could have taken advantage of the 22% Federal Tax Bracket I in 2025 (which ranges from $96,951 to $206,000 in taxable income). If they had very little other income in retirement, they could have processed large Roth conversions, paid just 22% in federal taxes on the converted amount, and eventually passed a Roth IRA on to Josh. Utilizing this strategy, the full $600,000 pre-tax IRA would have been subject to the parent’s federal tax rate of 22% as opposed to Josh’s tax rate of 32%, saving approximately $60,000 in taxes paid to the IRS.

Tax Free Accumulations For 10 More Years

But it gets better. By Josh’s parents processing Roth conversions while they were still alive, not only is there multigenerational tax savings, but when John inherits a Roth IRA instead of a Traditional IRA from his parents, all of the accumulation within that Roth IRA since the parents completed the conversion, PLUS 10 years after Josh inherits the Roth IRA, are completely tax-free.

Multi-generational Tax-Free Wealth

If you are a non-spouse beneficiary, whether you inherited a pre-tax retirement account or a Roth IRA, you are subject to the 10-year distribution rule (unless you qualify for one of the exceptions). With a pre-tax IRA or 401(k), not only is the beneficiary required to deplete and pay tax on the account within 10 years, but they may also be required to process RMDs (required minimum distributions) from their inherited IRA each year, depending on the age of the decedent when they passed away.

With an Inherited Roth IRA, the account must be depleted in 10 years, but there is no annual RMD requirement, because RMDs do not apply to Roth IRAs subject to the 10-year rule. So, essentially, someone could inherit a $500,000 Roth IRA, take no money out for 9 years, and then at the end of the 10th year, distribute the full balance TAX-FREE. If the owner of the inherited Roth IRA invests the account wisely and obtains an 8% annualized rate of return, at the end of year 10 the account would be worth $1,079,462, which would be withdrawn completely tax-free.

Reduce The Size of an Estate

For individuals who are expected to have an estate large enough to trigger estate tax at the federal and/or state level, this “Next Gen Roth Conversion” strategy can also help to reduce the size of the estate subject to estate tax. When a Roth conversion is processed, it’s a taxable event, and any tax paid by the account owner essentially shrinks the size of the estate subject to taxation.

If someone has a $15 million estate, and included in that estate is a $5 million balance in a Traditional IRA and that person does nothing, it creates two problems. First, the balance in the Traditional IRA will continue to grow, increasing the estate tax liability that will be due when the individual passes assets to the next generation. Second, if there are only two beneficiaries of the estate, each beneficiary will have to move $2.5 million into their own inherited IRA and fully deplete and pay tax on that $2.5M PLUS earnings within a 10-year period. Not great.

If, instead, that individual begins processing Roth conversions of $500,000 per year, and over a course of 10 years can fully convert the Traditional IRA to a Roth IRA (ignoring earnings), two good things can happen. First, if that individual pays an effective tax rate of 30% on the conversions, it will decrease the size of the estate by $1.5 million ($5M x 30%), potentially lowering the estate tax liability when assets are passed to the beneficiaries of the estate. Second, even though the beneficiaries of the estate would inherit a $3.5M Roth IRA instead of a $5M Traditional IRA, no RMDs would be required each year, the beneficiaries could invest the Inherited Roth IRA which could potentially double the value of the Inherited Roth IRA during that 10-year period, and withdraw the full balance at the end of year 10, completely tax free, resulting in big multi-generational tax free wealth.

The Power of Tax-Free Compounding

Not only does the beneficiary of the Roth IRA benefit from tax-free growth for the 10 years following the account owner's death, but they also receive the benefit of tax-free growth and withdrawal within the Roth IRA, as long as the account owner is still alive. For example, if someone begins these Roth conversions at age 70 and they live until age 90, that’s 20 years of compounding, PLUS another 10 years after they pass away, so 30 years in total.

A quick example showing the power of this tax-free compounding effect: someone processes a $200,000 Roth conversion at age 70, lives until age 90, and achieves an 8% per year rate of return. When they pass away at age 90, the balance in their Roth IRA would be $932,191. The non-spouse beneficiary then inherits the Roth IRA and invests the account, also achieving an 8% annual rate of return. In year 10, the Inherited Roth IRA would have a balance of $2,012,531. So, the original owner of the Traditional IRA paid tax on $200,000 when the Roth conversion took place, but it created a potential $2M tax-free asset for the beneficiaries of that Roth IRA.

Reduce Future RMDs of Roth IRA Account Owner

Outside of creating the multi-generational tax-free wealth, by processing Roth conversions in retirement, it’s shifting money from pre-tax retirement accounts subject to annual RMDs into a Roth IRA that does not require RMDs. First, this lowers the amount of future taxable RMDs to the Roth IRA account owner because assets are being shifted from their Traditional IRA to Roth IRA, and second, since RMDs are not required from Roth IRAs, the assets in that IRA are allowed to continue to compound investment returns without disruption.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the “Next Gen Roth Conversion Strategy”?

The Next Gen Roth Conversion Strategy involves gradually converting pre-tax retirement assets, such as Traditional IRAs or 401(k)s, into Roth IRAs while the account owner is in a lower tax bracket. This allows heirs to inherit Roth assets that grow and distribute tax-free rather than being forced to pay higher taxes under the 10-Year Rule for inherited pre-tax accounts.

How does the 10-Year Rule affect inherited retirement accounts?

Under the SECURE Act, non-spouse beneficiaries must fully deplete inherited pre-tax retirement accounts within 10 years of the original owner’s death. This often forces distributions during high-income years, which can push beneficiaries into higher tax brackets and increase total taxes owed.

Why is this strategy beneficial for high-earning heirs?

When heirs are in the same or higher tax bracket as the original account owner, converting to a Roth during the parent’s lifetime allows the taxes to be paid at a lower rate. The heirs then inherit a Roth IRA that continues to grow tax-free and can be withdrawn without triggering additional income tax.

How does the strategy create multi-generational tax-free wealth?

After the account owner passes, heirs can keep the inherited Roth IRA invested for up to 10 years without required minimum distributions (RMDs). All investment growth during that time is tax-free, and the full balance can be withdrawn at the end of year 10 with no taxes owed.

Can Roth conversions also reduce estate taxes?

Yes. The taxes paid during the conversion process reduce the overall size of the estate, which may lower exposure to federal or state estate taxes. Converting pre-tax assets to Roth IRAs can therefore benefit both the heirs and the estate itself.

How does this strategy help minimize future RMDs?

By converting pre-tax accounts to Roth IRAs, retirees reduce the balance of assets subject to required minimum distributions. Since Roth IRAs do not require RMDs during the owner’s lifetime, more assets can continue compounding tax-free for longer.

What makes the Next Gen Roth Conversion Strategy so powerful?

It combines proactive tax planning, estate reduction, and multi-generational wealth transfer. Taxes are paid strategically at lower rates, future RMDs are minimized, and beneficiaries receive assets that can grow for up to a decade after inheritance—completely tax-free.

IRS Gifting Rules: Tuition vs. Student Loan Payments

Helping a family member pay for education? Make sure you're on the right side of the IRS.

Whether you're covering K–12 tuition, writing checks for college, or assisting with student loans after graduation, the tax treatment of those payments isn’t always intuitive. The IRS draws a clear line between direct tuition payments and student loan contributions—and crossing that line could mean triggering gift tax rules you didn’t anticipate.

As the cost of college and private school continues to rise, it's increasingly common for extended family members—not just parents—to want to assist with the cost of tuition or student loan payments after graduation. However, many of those family members are surprised to learn that there are different gift tax and tax reporting rules that are dependent upon whether a direct tuition payment is made versus just helping with student loan payments post-graduation.

Tuition Payment Gift Exclusion

Because there are different gift tax rules that apply when making a tuition payment on behalf of someone else versus making a student loan payment for someone else, we will start with the tuition payment scenario first. Oddly enough in the eyes of the IRS, when someone makes a tuition payment for another person, the IRS does not view it as a “gift”. However, if that same person instead decides to help a family member pay off their student loans, the IRS views that action as a “gift”. So, when we have grandparents who want to help their grandchildren pay for college, we often advise them to provide their support as tuition payments directly to the college as opposed to allowing their grandchild to take the student loans and then assisting them in repaying the student loans after they have graduated.

As long as the tuition payment is made directly to the college from the family member, it does not constitute a gift, and gifting limits do not apply. However, if the money is not remitted directly to the college, then the gifting rules do apply. Sometimes, family members make the mistake of giving money directly to the student or the parents of the student to make the tuition payments; if that happens, they have now made a gift and must follow the gift tax and reporting rules.

What about tuition for a K-12 private school? The tuition gift exclusion also applies to tuition payments for preschool and K-12 private schools.

Another important note, the gift exception only applies to tuition. It is not extended to room and board. If a non-parent pays for the room and board on behalf of a student, it is considered a gift.

Student Loan Payment Gift Tax Rules

When someone makes a loan payment on behalf of someone else, the IRS considers that a gift. This is true whether the money is given to the individual and then they make the loan payment, or if payments are made directly to the loan servicer on behalf of the college student / graduate. As mentioned earlier, there are gift reporting rules and potential gift tax implications that the individual making the gift or loan payment needs to be aware of.

Annual Gift Exclusion

For 2025, the annual gift exclusion amount is $19,000, which, for purposes of this article, means any one person can make a student loan payment for someone else up to $19,000 per year without having to worry about filing a gift tax return or paying gift tax. The number of people to whom the annual gift exclusion amount is applied is infinite, meaning if a grandparent has 3 grandchildren, and they all have student loans, a single grandparent could make student loan payments up to $19,000 for EACH grandchild, and they are completely covered by the annual gift exclusion. No action needed.

If there are two grandparents, you can double the exclusion per grandchild to $38,000, since they each have a $19,000 annual gift exclusion.

For example, Jen graduated from college with $35,000 of student loan debt; her 2 grandparents would like to pay off the $35,000 on her behalf by sending a check directly to the servicer of the student loan. Since the amount is under the $38,000 joint filer gift exclusion amount, a gift tax return does not need to be filed, and no gift taxes are due.

If instead Jen had $50,000 in student loan debt, we might advise her grandparents to remit the max gift amount this year ($38,000) and then as soon as we flip into January of the next tax year, they can remit the remaining amount ($12,000) which is also under the annual exclusion limit since it resets each year.

Gifting Over the Annual Exclusion Amount

If a student loan payment is made on behalf of a family member that exceeds the annual gift exclusion amount, a gift tax return would need to be filed in the tax year the student loan payment was made. This, however, does not mean that gift tax is due.

The IRS provides a “lifetime gift tax exclusion” amount of $13.9 million per tax filer, meaning each person would have to gift over $13.9 million during their lifetime before any gift tax is due. For a married couple, double that to $27.8 million. Thus, only the ultra-wealthy typically have to worry about paying gift tax.

Be aware that state gifting limits can vary from the federal limits, so depending on what state you live in, you may or may not owe gift tax at the state level.

While gift tax may not be due on the student loan payment that is made, just remember that if the student loan payment exceeds the annual gift exclusion amount, a gift tax return still needs to be filed.

No Tax Impact For The Person Receiving The Gift

When a cash gift is made or a student loan payment is made on behalf of someone else, the person with the student loans in their name or the recipient of the gift does not incur a tax event. It’s a tax-free event for the recipient. If gift tax is triggered, it is paid by the person making the gift, not the person who benefited from the gift.

Estate Planning Strategy

There are a number of estate planning strategies that can be implemented, acknowledging these gift tax rules.

For individuals looking to shrink the size of their estate – either to avoid estate taxes or just to begin gifting to family members - tuition payments offer a unique advantage. Since direct tuition payments do not count as gifts, this opens up the ability to make tuition payments directly to a pre-school, K-12 private school, or college that are in excess of the $19,000 annual gift exclusion amount in an effort to shrink the size of the estate or avoid the headache of the gift tax filing process.

If you want to make a gift to your child, grandchild, or other family member, but you do not want to give them the cash directly, making a payment directly to the student loan service provider can ensure that the gift is used towards the outstanding student loan balance, but it is still subject to the gift tax and reporting requirements.

What if you have some family members who have student loans, but others do not, and you want to gift equally? Option 1: Give each family member a check for the annual gift exclusion amount and tell them they can do whatever they want with the cash, apply it toward a student loan, fund a Roth IRA, down payment on a house, etc. Option 2: You can send payments directly to the loan service provider for the family members who have student loans and make direct gifts to the family members without loans. All personal preference.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Are tuition payments considered gifts for tax purposes?

No. When tuition payments are made directly to an educational institution on behalf of a student, the IRS does not consider them gifts. This means they are not subject to annual gift limits or gift tax reporting, as long as the payment is sent directly to the school and not to the student or their parents.

Does the tuition payment gift exclusion apply to private school?

Yes. The exclusion applies to qualified tuition payments made directly to preschools, K–12 private schools, and colleges. However, it only covers tuition — payments for room, board, books, or other expenses are considered gifts and subject to normal gift tax rules.

What are the gift tax rules for helping pay off student loans?

Payments made toward someone else’s student loans are considered gifts by the IRS, even if paid directly to the loan servicer. The 2025 annual gift exclusion allows up to $19,000 per person, per recipient ($38,000 for a married couple) to be gifted without filing a gift tax return.

What happens if my gift or loan payment exceeds the annual exclusion amount?

If your total gifts to one person exceed $19,000 in 2025, you must file a gift tax return. However, most people will not owe gift tax because the lifetime gift and estate tax exemption is $13.9 million per person ($27.8 million per couple). Filing is required, but tax is rarely due.

Do recipients pay taxes on gifts or student loan payments made for them?

No. The person receiving the gift or having their loan paid on their behalf does not owe taxes. If a taxable gift is made, any gift tax owed is the responsibility of the giver, not the recipient.

Can tuition payments or gifts help with estate planning?

Yes. Direct tuition payments are an effective way to reduce the size of an estate without affecting your annual or lifetime gift exclusions. For families seeking to lower estate tax exposure, paying tuition directly for children or grandchildren can be a powerful estate planning tool.

Can I combine tuition payments and student loan gifts for one person?

Yes, but only the direct tuition payment is excluded from gift limits. Any additional help—such as paying student loans or covering living expenses—counts toward the annual $19,000 gift exclusion per recipient.

Company Stock In Your 401(k)? Don’t Forget To Elect NUA

If you’re retiring or leaving your job and have company stock in your 401(k), understanding NUA (Net Unrealized Appreciation) could save you thousands in taxes. Many miss this valuable opportunity by rolling everything into an IRA without considering the tax implications. Our latest article breaks down how NUA works, common tax mistakes, and when choosing NUA makes sense. Learn how factors like your age, retirement timeline, and stock performance play a role. Don’t overlook this strategy if your company stock has grown significantly in value—it could make a big difference in your retirement savings.

For employees with company stock as an investment holding within their 401(k) accounts, there is a special distribution rule available that provides significant tax benefits called “NUA”, which stands for Net Unrealized Appreciation. The NUA option becomes available to employees who have either retired or terminated their employment with a company and are in the process of rolling over their 401(k) balances to an IRA. The purpose of this article is to help employees understand:

How does the NUA 401(k) distribution option work?

What are the tax benefits of electing NUA?

The immediate tax event that is triggered with an NUA election

What situations should NUA be elected?

What situations should NUA be AVOIDED?

Special estate tax rules for NUA shares

The Common Rollover Mistake

For employees who have company stock in their 401(k) and do not receive proper guidance, they can easily miss the window to make the NUA election, which can cost them thousands of dollars in additional taxes in their retirement years. When employees leave a company, it’s common for the employee to open a Rollover IRA and process a direct rollover of their entire balance in their 401(k) to their IRA to avoid triggering an immediate tax event as they move their retirement savings away from their former employer.

Example: Tim retires from Company ABC and has a $500,000 balance in that 401(k) plan; $200,000 of the $500,000 is invested in ABC company stock. He sets up a traditional IRA, calls the 401(k) provider, and requests that they process a direct rollover of the full $500,000 balance from his 401K to his IRA. The 401(k) platform processes the rollover, and Tim deposits the $500,000 to his IRA with no taxes being triggered. Then, Tim begins taking distributions from his IRA to supplement his income in retirement. On the surface, everything seems perfectly fine with this scenario. However, Tim may have completely missed a huge tax-saving opportunity by failing to request NUA treatment of his company stock within his 401(k) account.

How Does NUA Work?

When an employee has company stock in their 401(k) account and they go to take a distribution/rollover from their 401(k) after they leave employment with the company, they may be able to elect NUA treatment of the portion of their 401(k) that is invested in company stock. But what does NUA treatment mean? When an employee processes a rollover from their pre-tax 401(k) balance to their Rollover IRA, and then takes distributions from their IRA in the future, they have to pay ordinary income tax on all distributions taken from the IRA account. However, prior to requesting a full rollover of their 401(k) balance to their IRA, an employee with company stock in their 401(k) account can make an NUA election, which allows the appreciation in the stock within the 401(k) account to be taxed at long-term capital gains rates in the future as opposed to ordinary income tax rates which may be higher.

But employees must be aware that by electing NUA, it triggers an immediate tax event for the employee.

Here is how NUA works as an example. Sue has a 401(k) account with Company XYZ. The total balance of Sue’s 401(k) is $800,000, but $400,000 of the $800,000 balance is invested in XYZ company stock that Sue has accumulated over the past 20 years with the company. The cost basis of Sue’s $400,000 in company stock within the 401(k) is $50,000, so over that 20-year period, the company stock has gained $350,000 in value.

When Sue retires, instead of rolling over the full $800,000 balance to her Rollover IRA, she makes an NUA election. The NUA election will send the $400,000 in company stock within her 401(k) account to an after-tax brokerage account in Sue’s name as opposed to a Rollover IRA account. When that happens, Sue has to pay ordinary income tax, not on the full $400,000 value of the stock, but on the $50,000 cost basis amount of the company stock. The $350,000 in “unrealized gain” in the company stock is now sitting in Sue’s brokerage account, and when she sells the stock, she receives long-term capital gain treatment of the $350,000 gain, as opposed to paying ordinary income tax on the $350,000 gain if it was rolled over to her IRA.

But what happens to the rest of Sue’s 401(k) balance that was not invested in company stock? The non-company stock portion of Sue’s 401(k) account can be rolled over to a Rollover IRA and it’s a 100% tax-free event. She just pays ordinary income tax on future distributions from the IRA account.

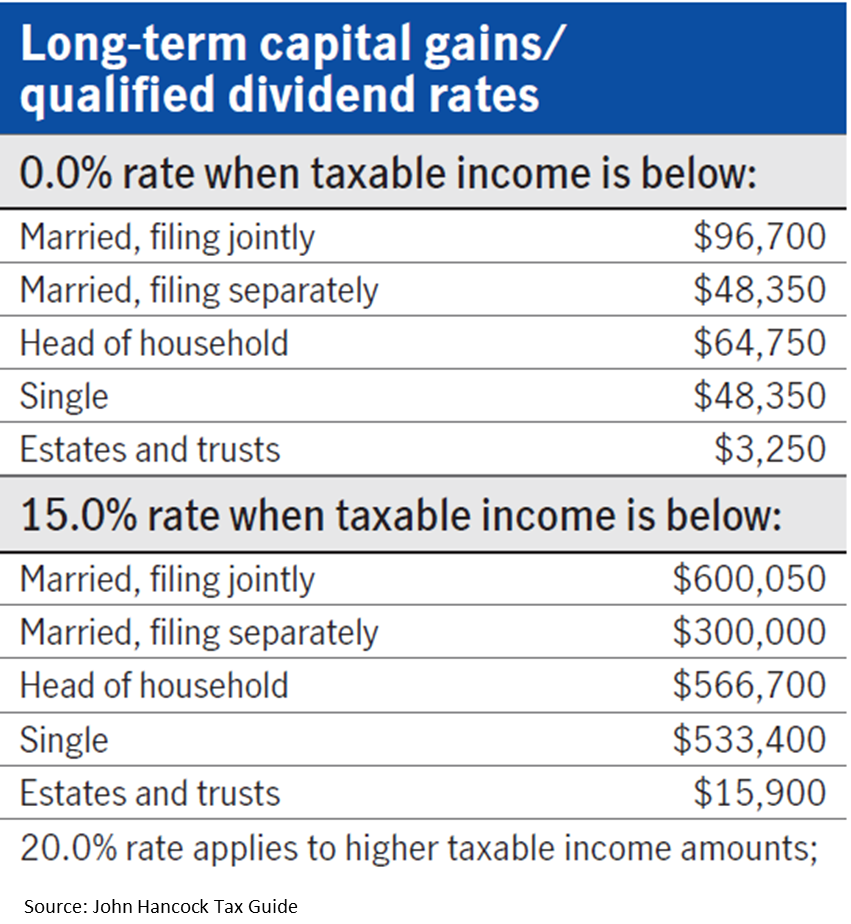

NUA – Long-Term Capital Gains Rates

Depending on Sue’s income level in retirement, her federal long-term capital gains rate may be 0%, 15%, or 20%, which may be lower than if she had realized the IRA distribution at ordinary income tax rates. Here is a quick chart that illustrates the 2025 long-term capital gains rates by filing status and income level:

NUA Triggers A Tax Event

Now let’s go back and review the tax event that was triggered when Sue requested the $400,000 transfer of her company stock from the 401(k) to her brokerage account. Again, when the NUA is processed, she only has to pay ordinary income tax on the cost basis amount of the stock, so in Sue’s case, in the year the NUA distribution takes place, she would have to report an additional $50,000 in taxable income. The tax liability generated could either be paid with her personal cash reserve or she could liquidate some of the company stock in her after-tax brokerage account to pay the taxes.

Timing of the NUA Distribution

There is a tax strategy associated with the timing of requesting the NUA distribution. If someone works for a company until September and then retires, they already have 9 months' worth of income in that tax year. In this case, it may be beneficial to process the rollover from the 401(k) with the NUA to the brokerage account the following tax year, when the individual’s W-2 income is completely off the table, so the taxable cost basis associated with the NUA election is potentially taxed at a lower rate since there is no W2 income the following year.

The Employee’s Age Matters for NUA

Because the cost basis of the company stock is treated like a cash distribution, if an employee takes an NUA distribution before age 55 and has already left the company, the cost basis would be subject to ordinary income tax and the 10% early withdrawal penalty.

NUA – Age 55 Exception To The 10% Early Withdrawal Penalty

Why age 55 and not 59½? Qualified retirement plans (401(k), 403(b), 457(b) plans) have a special exception to the under age 59½ 10% early withdrawal penalty. If you terminate employment with the company AFTER reaching age 55 and you take a cash distribution or NUA directly from the 401(k) plan, the employee is no longer subject to the 10% early withdrawal penalty. But an employee who terminates employment at age 54 and requests the NUA distribution at age 55 would still get hit with the 10% penalty because they did not separate from service AFTER reaching age 55.

The cost basis associated with the NUA distribution is treated the same as a regular cash distribution from a 401(k) plan.

When Electing NUA Makes Sense

There are certain situations where making the NUA election makes sense, and there are situations where it should be avoided. We will start off by reviewing the common situations where electing NUA makes sense in lieu of rolling over the entire balance to an IRA.

Large Unrealized Gain In The Company Stock

In order for the NUA election to make sense, there typically has to be a large unrealized gain built up in the company stock within the 401(k) plan. Said another way, the company stock has to have performed well within the 401(k) account. If the value of the company stock in an employee's 401(k) account is $200,000 and the cost basis is $170,000, if that employee elects an NUA and then transfers the $200,000 in stock to their brokerage account, it’s going to trigger a $170,000 immediate tax event and only $30,000 would receive long-term capital gains treatment. In this case, it’s probably not worth the tax hit.

In the example with Sue, she only had to pay ordinary income tax on $50,000 of the $400,000 in company stock, so the NUA would make more sense in her situation because she is shifting $350,000 to long-term capital gains treatment.

Ordinary Income Tax vs Long Term Capital Gains Rates

For NUA to make sense, it’s a race between what tax rate someone would pay if the money were distributed from a Rollover IRA and distributed at ordinary income tax rates versus the long-term capital gains tax rate if NUA is elected. Under current tax law, the federal tax rate jumps from 12% to 22% at $96,950 for a joint tax filer. On the surface it would seem that someone with under $96,950 in income might be better off rolling over the balance to an IRA and paying ordinary income tax rates at 12% instead of the long-term capital gains rate of 15%. However, if you look at the long-term capital gains tax rates in the table earlier in the article, if in 2025 a joint filer has income below $96,700, the long-term capital gains rate is 0%, and a 0% tax rate always wins.

Time Horizon Matters

An employee's time horizon to retirement also factors into the NUA decision. If an employee leaves a company at age 40, not only would they have to pay taxes and the 10% penalty on the cost basis of the NUA distribution, but by moving the company stock to a taxable brokerage account, they are losing the tax deferred accumulation benefit associated with the Rollover IRA for the next 19+ years. Since the brokerage account is a taxable account, the owner of the account has to pay taxes every year on dividends, interest, and realized gains produced by the brokerage account. If the company stock is liquidated and the full 401(k) balance is rolled over to an IRA, all of the investment income avoids immediate taxation and continues to accumulate within the IRA account. For taxpayers in higher tax brackets, this may have its advantages.

There are a lot of factors in the NUA decision, but in general, the shorter the timeline to when distributions will begin from retirement savings, the more it favors NUA; the longer the time horizon to retirement, the less it favors NUA over the benefits of continued tax deferred accumulation in a Rollover IRA account.

Reduce Future RMDs

For individuals who have a majority of their assets in pre-tax retirement accounts, like 401(k) and IRA accounts, and are fortunate enough to not need to take large distributions from those accounts in retirement because they have other sources of income, eventually when those individuals reach RMD age (73 or 75), the IRS is going to force them to start taking large taxable distributions out of their pre-tax retirement accounts.

For an individual in this situation, electing NUA can be an attractive option. Instead of their full 401(k) balance ending up in a Rollover IRA with a future RMD requirement, the company stock is sent to a brokerage account that does not require RMDs.

Estate Planning – No Step-Up In Cost Basis for NUA

Here is a little-known estate planning fact about NUA elections. Normally, when you have unrealized gains in a brokerage account and the owner of the account passes away, the beneficiaries of the estate receive a step-up in cost basis, which eliminates the taxable gain if the beneficiaries were to sell the stock. For individuals that elect NUA from a 401(k) account, there is a special rule that states if shares are deposited into a brokerage account as a result of an NUA election, the remaining portion of the NUA will be considered “income with respect of the decedent”, meaning the beneficiaries of the estate will have to pay long-term capital gains when they eventually sell those shares.

I’m not sure how this is tracked because when you move shares into a brokerage account that has NUA, if the shares continue to appreciate in value, and shares are bought and sold throughout the decedent’s lifetime, how do you determine which portion of the remaining unrealized gain was from the NUA election and which portion represents unrealized gains post NUA? A wonderful question for your tax professional if you end up in this situation.

When To Avoid NUA

As part of the analysis above, I highlighted a number of situations where an NUA election might not make sense, but a quick hit list is:

Company stock has not performed well in 401(k) account – high cost basis

High tax rate assessed on the cost basis amount during the year of NUA election

Employee under age 55 or 59½, potentially triggering early withdrawal penalty

Long time horizon to retirement (loss of tax deferred accumulation)

Ordinary tax rate lower or similar to long-term capital gains rate

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is NUA and how does it work?

NUA, or Net Unrealized Appreciation, is a special tax rule that allows employees with company stock in their 401(k) to move that stock to a taxable brokerage account after leaving the company. The original cost basis of the stock is taxed as ordinary income, but the stock’s appreciation is later taxed at more favorable long-term capital gains rates instead of ordinary income tax rates.

When can employees use the NUA option?

NUA treatment is available only after separating from an employer due to retirement, termination, or death. It must be elected before rolling over company stock from the 401(k) to an IRA — otherwise, the opportunity is lost permanently.

What are the tax benefits of electing NUA?

The main advantage is that the appreciation in company stock is taxed at long-term capital gains rates (0%, 15%, or 20%) instead of higher ordinary income tax rates. This can lead to significant tax savings when the stock is eventually sold.

What tax event occurs when NUA is elected?

When NUA is processed, the employee must pay ordinary income tax on the stock’s cost basis in the year of distribution. The appreciation amount is not taxed until the stock is sold and is then treated as a long-term capital gain.

When does electing NUA make sense?

NUA is most beneficial when the company stock has a low cost basis and substantial unrealized gains. It can also be a good choice for retirees looking to reduce future required minimum distributions (RMDs) since the company stock moved to a brokerage account is no longer subject to RMDs.

When should NUA be avoided?

NUA may not make sense if the company stock has a high cost basis, the taxpayer is under age 55 (potentially triggering the 10% early withdrawal penalty), or if the individual’s ordinary income tax rate is similar to or lower than the long-term capital gains rate. It may also be less beneficial for those with many years until retirement who would lose the advantage of continued tax-deferred growth.

Does company stock transferred through NUA receive a step-up in basis at death?

No. Company stock distributed under NUA rules does not receive a full step-up in cost basis when the owner passes away. The portion of the gain representing the original NUA remains taxable to heirs as long-term capital gains when the shares are sold.

What’s the biggest mistake employees make with company stock in a 401(k)?

Many employees roll their 401(k) balances directly into an IRA without evaluating whether NUA treatment applies. Once the rollover is complete, the NUA opportunity is lost forever — potentially costing thousands in unnecessary future taxes.

The Hidden Tax Traps in Retirement Most People Miss

Many retirees are caught off guard by unexpected tax hits from required minimum distributions (RMDs), Social Security, and even Medicare premiums. In this article, we break down the most common retirement tax traps — and how smart planning can help you avoid them.

Most people think retirement is the end of tax planning. But nothing could be further from the truth. There are several tax traps that retirees encounter, which range from:

How RMDs create tax surprises

How Social Security is taxed

How Medicare Premiums (IRMAA) are affected by income

A lack of tax-specific distribution planning

We will be covering each of these tax traps in this article to assist retirees in avoiding these costly mistakes in the retirement years.

RMD Tax Surprises

Once you reach a specific age, the IRS requires individuals to begin taking mandatory distributions from their pre-tax retirement accounts, called RMDs (required minimum distributions). Distributions from pre-tax retirement accounts represent taxable income to the retiree, which requires advanced planning to ensure that that income is not realized at an unnecessarily high tax rate.

All too often, Retirees will make the mistake of putting off distributions from their pre-tax retirement accounts until RMDs are required to begin, which allows the pretax accounts to accumulate and become larger during retirement, which in turn requires larger distributions once the RMD start age is reached.

Here is a common example: Tim and Sue retire from New York State at age 55 and both have pensions that are more than enough to meet their current expenses. Both of them also have retirement accounts through NYS, totaling $500,000. Assuming Tim and Sue start taking their required minimum distributions (RMDs) at age 75, and since Tim and Sue do not need to take withdrawals from their retirement account to supplement their income, those retirement accounts could grow to over $1,000,000. This sounds like a good thing, but it creates a potential tax problem. By age 75, they’ll both be receiving their pensions and have turned on Social Security, which under current tax law is 85% taxable at the federal level. On top of that, they’ll need to take a required minimum distribution of $37,735 which stacks up on top of all their other income sources.

This additional income from age 75 and beyond could:

Be subject to higher tax rates

Trigger higher Medicare Premiums

Cause them to phase out of certain tax deductions or credits

In hindsight, it may have been more prudent for Tim & Sue to begin taking distributions from their retirement accounts each year beginning the year after they retired, to avoid many of these unforeseen tax consequences 20 years after they retired.

How Is Social Security Taxed?

I start this section by saying, based on current law, because the Trump administration has on its agenda to make social security tax-free at the Federal level. At the time of this article, social security is potentially subject to taxation at the federal level for individuals based on their income. A handful of states also tax social security benefits.

Here is a quick summary of the proportion of social security benefits subject to taxation at the Federal level in 2025:

0% Taxable: Combined income for single filers below $25,000 and joint filers below $32,000.

50% Taxable: Combined income for single filers between $25,000 - $34,000 and joint filers between $32,000 - $44,000

85% Taxable: Combined income for single filers above $34,000 and joint filers above $44,000.

One-time events that occur in retirement could dramatically impact the amount of a retiree's social security benefit, subject to taxation. For example, a retiree might sell a stock at a gain in a brokerage account, surrender an insurance policy, earn part-time income, or take a distribution from a pre-tax retirement account. Any one of these events could inadvertently trigger a larger tax liability associated with the amount of an individual’s social security that is subject to taxation at the Federal level.

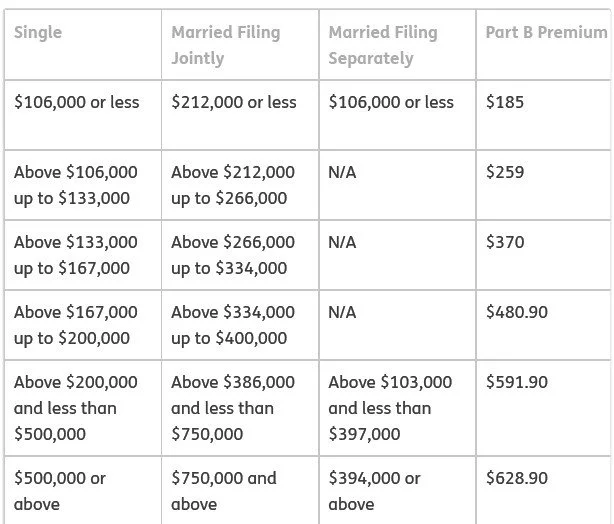

Medicare Premiums Are Income-Based

When you turn age 65, many retirees discover for the first time that there is a cost associated with enrolling in Medicare, primarily in the form of the Medicare Part B premiums that are deducted directly from a retiree's monthly social security benefit. The tax trap is that if a retiree shows too much income in a given year, it can cause their Medicare premium to increase for 2 years in the future.

Medicare looks back at your income from two years prior to determine the amount of your Medicare Part B premium in the current year. Here is the Medicare Part B premium table for 2025:

As you can see from the table, as income rises, so does the monthly premium charged by Medicare. There are no additional benefits, the retiree just has to pay more for their Medicare coverage.

This is where those higher RMDs can come back to haunt retirees once they reach the RMD start age. They might be ok between ages 65 – 75, but once they hit age 75 and must start taking RMDs from their pre-tax retirement accounts, those pre-tax RMD’s can sometimes push retirees over the Medicare based premium income threshold, and then they end up paying higher premiums to Medicare for the rest of their lives that could have been avoided.

Lack of Retirement Distribution Planning

All these tax traps surface due to a lack of proper distribution planning as an individual enters retirement. It’s incredibly important for retirees to look at their entire asset picture leading up to retirement, determine the income level that is needed to cover expenses in their retirement year, and then construct a long-term distribution plan that allows them to minimize their tax liability over the remainder of their life expectancy. This may include:

Processing sizable distributions from pre-tax accounts early in the retirement years

Processing Roth conversions

Delaying to file for social security

Developing a tax plan for surrendering permanent life insurance policies

Evaluating pension and annuity elections

A tax plan for realizing gains in taxable investment accounts

Forecasting RMDs at age 73 or 75

Developing a robust distribution plan leading up to retirement can potentially save retirees thousands of dollars in taxes over the long run and avoid many of the pitfalls and tax traps that we reviewed in the article today.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Why is tax planning still important in retirement?