What Happens If You Die Without a Will?

Dying without a will means state laws decide who inherits your assets, not you. It also creates longer, more expensive probate and leaves guardianship decisions for your children up to a judge. This article explores the risks of dying intestate and how a simple will can protect your family.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

No one likes to think about their own death, but estate planning is one of the most important financial steps you can take to protect your family and loved ones. One of the simplest — yet most critical — estate planning tools is a will.

Unfortunately, many people pass away without one. According to surveys, more than half of Americans don’t have a will in place. But what really happens if you die without a will?

State laws decide who gets your assets — not you.

The probate process becomes longer, more expensive, and more stressful for your family.

Guardians for minor children are chosen by a judge, not by you.

Children can inherit large sums at age 18 with no safeguards, which can sometimes hurt more than help.

Simple solutions exist — a basic will can often be set up for a minimal cost.

Let’s walk through what happens if you don’t have a will, why that can create complications, and what you can do to avoid these pitfalls.

State Laws Take Over

If you die without a will, you die “intestate.” This means your estate will be distributed according to your state’s intestacy laws. These laws vary by state, but most follow a general pattern:

If you’re married, your assets may be split between your spouse and children.

If you’re single with children, everything generally goes to your kids in equal shares.

If you have no spouse or children, assets may pass to your parents, siblings, nieces, nephews, or more distant relatives.

The problem? State law or a judge, who doesn’t know you or your family dynamics will decide how your estate is distributed. You lose the ability to decide who receives what, when they receive it, or under what conditions.

A Longer, More Expensive Probate Process

With a valid will, your executor follows your instructions and distributes assets relatively quickly. Without a will, the court must:

Appoint an executor (which may take time and spark disagreements).

Require appraisals of property, attorney involvement, and court oversight.

Follow state intestacy laws to distribute assets.

This makes the probate process longer, more complicated, and often more expensive. Beneficiaries can wait months — even years — before assets are fully distributed.

For families already grieving a loss, this added complexity can be emotionally draining.

The Stakes Are Higher With Minor Children

If you have children under 18, the consequences of dying without a will become even more serious.

Guardianship: A judge will appoint a guardian for your children, without knowing who you would have chosen.

Inheritance access: At age 18, children may receive their full inheritance outright.

That means a teenager could suddenly inherit hundreds of thousands of dollars from life insurance, retirement accounts, or the sale of your home. Without safeguards in place, that money may not be used wisely and could dramatically affect your child’s life path.

A properly drafted will (or even better, a trust) can set rules, such as delaying inheritance until your children reach a more mature age or providing funds gradually over time.

Probate Isn’t the Only Issue

Estate planning attorneys often recommend going one step further than a will to avoid probate altogether. Common strategies include:

Revocable living trust: Assets in a trust bypass probate and are distributed privately according to your instructions.

Transfer on Death (TOD) accounts: Bank and brokerage accounts with TOD designations pass directly to beneficiaries without probate.

Beneficiary designations: Retirement accounts and life insurance policies allow you to name beneficiaries directly, which supersedes a will.

These strategies not only streamline the distribution process but can also protect your family from unnecessary legal fees and court delays.

A Will Doesn’t Have to Be Expensive

One of the biggest misconceptions is that creating a will is time-consuming or costly. In reality, establishing a will can be very inexpensive:

Online services like LegalZoom.com or Rocket Lawyer can help you set up a simple will for a minimal fee.

While these are good starting points, we recommend working with an estate attorney if your situation is more complex — especially if you have children, significant assets, or unique wishes.

Think of a will as one of the most affordable forms of “insurance” you can buy. For a small upfront cost, you can save your family thousands of dollars, countless hours, and significant emotional stress later.

Final Thoughts

If you die without a will, the state — not you — decides how your assets are distributed and who cares for your children. The probate process becomes more costly, more time-consuming, and much more stressful for your loved ones.

The good news is that creating a will is relatively easy and inexpensive. Whether through a simple online service or a consultation with an estate attorney, taking this step ensures you stay in control and your family is protected.

At the end of the day, a will is about more than just money — it’s about peace of mind.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What happens if you die without a will?

If you die without a will, your estate is distributed according to your state’s intestacy laws. This means a court decides who receives your assets and when, which can lead to outcomes you may not have intended.

How does dying without a will affect the probate process?

Without a will, the probate process is usually longer, more expensive, and more complicated. The court must appoint an executor, oversee asset distribution, and may require appraisals or attorney involvement—all of which add time and cost.

What happens to minor children if a parent dies without a will?

If you have minor children and no will, a judge will decide who becomes their guardian. In addition, any inheritance they receive becomes theirs outright at age 18, without safeguards to ensure it’s managed responsibly.

Can you avoid probate without a will?

Yes. Using tools like revocable living trusts, Transfer on Death (TOD) accounts, and beneficiary designations can help assets pass directly to heirs without going through probate. These strategies can save time and reduce legal expenses.

Is creating a will expensive or time-consuming?

Creating a basic will is typically affordable and straightforward. Online services can help for a low cost, while more complex situations may benefit from an estate attorney’s guidance.

Why is having a will so important?

A will ensures your wishes are honored, your loved ones are protected, and your estate is distributed efficiently. It also provides peace of mind knowing your family won’t face unnecessary legal or financial burdens during an already difficult time.

If You Retire With $1 Million, How Long Will It Last?

Is $1 million enough to retire? The answer depends on withdrawal rates, inflation, investment returns, and taxes. This article walks through different scenarios to show how long $1 million can last and what retirees should consider in their planning.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

Retirement planning often circles around one big question: If I save $1 million, how long will it last once I stop working? The answer isn’t one-size-fits-all. It depends on a handful of key factors, including:

Your annual withdrawal rate

Inflation (the rising cost of goods and services over time)

Your assumed investment rate of return

Taxes (especially if most of your money is in pre-tax retirement accounts)

In this article, we’ll walk through each of these factors and then run the numbers on a few different scenarios. By the end, you’ll have a much clearer idea of how far $1 million can take you in retirement.

Step 1: Determining Your Withdrawal Rate

Your withdrawal rate is simply the amount of money you’ll need to take from your retirement accounts each year to cover living expenses. Everyone’s number looks different:

Some retirees might only need $60,000 per year after tax.

Others might need $90,000 per year after tax.

The key is to determine your annual expenses first. Then consider:

Other income sources (Social Security, pensions, part-time work, rental income, etc.)

Tax impact (if pulling from pre-tax accounts, you’ll need to withdraw more than your net spending need to cover taxes).

For example, if you need $70,000 in after-tax spending money, you might need to withdraw closer to $75,000–$90,000 per year from your 401(k) or IRA to account for taxes.

Step 2: Don’t Forget About Inflation

Inflation is the silent eroder of retirement plans. Even if you’re comfortable living on $70,000 today, that number won’t stay static. If we assume a 3% inflation rate, here’s how that changes over time:

At age 65: $70,000

At age 80: $109,000

At age 90: $147,000

Expenses like healthcare, insurance, and groceries tend to rise faster than other categories, so it’s critical to build inflation adjustments into your plan.

Step 3: The Assumed Rate of Return

Once you retire, you move from accumulation mode (saving and investing) to distribution mode (spending down your assets). This shift raises important questions about asset allocation.

During accumulation years, you weren’t withdrawing, so market dips didn’t permanently hurt your portfolio.

In retirement, selling investments during downturns locks in losses, making it harder for your account to recover.

That’s why most retirees take at least one or two “step-downs” in portfolio risk when they stop working.

For most clients, a reasonable retirement assumption is 4%–6% annual returns, depending on risk tolerance.

Step 4: The Impact of Taxes

Taxes can make a significant difference in how long your retirement savings last.

If most of your money is in pre-tax accounts (401k, traditional IRA), you’ll need to gross up withdrawals to cover taxes.

Example: If you need $80,000 after tax, and your tax bill is $10,000, you’ll really need to withdraw $90,000 from your retirement accounts.

Now, if you have Social Security income or other sources, that reduces how much you need to pull from your investments.

Example:

Annual after-tax expenses: $80,000

Grossed-up for taxes: $90,000

Social Security provides: $30,000

Net needed from retirement accounts: $60,000 (indexed annually for inflation)

Scenarios: How Long Does $1 Million Last?

Now let’s put the numbers into action. Below are four scenarios that show how long a $1 million retirement portfolio lasts under different withdrawal rates. Each assumes:

Retirement age: 65

Beginning balance: $1,000,000

Inflation: 3% annually

Investment return: 5% annually

Scenario 1: Withdrawal Rate $40,000 Per Year

Assumptions:

Annual withdrawal: $40,000 (indexed for 3% inflation)

Rate of return: 5%

Result: Portfolio lasts 36 years (until age 100).

Why not forever? Because inflation steadily raises the withdrawal amount. At age 80, withdrawals rise to $62,000/year. By age 90, they reach $83,000/year.

Math Note: For the duration math, while age 90 minus age 65 would be 35 years. We are also counting the first year age 65 all the way through age 90, which is technically 36 years. (Same for all scenarios below)

Scenario 2: Withdrawal Rate $50,000 Per Year

Assumptions:

Annual withdrawal: $50,000 (indexed for 3% inflation)

Rate of return: 5%

Result: Portfolio lasts 26 years (until age 90).

By age 80, withdrawals grow to $77,000/year. By age 90, they reach $104,000/year.

Scenario 3: Withdrawal Rate $60,000 Per Year

Assumptions:

Annual withdrawal: $60,000 (indexed for 3% inflation)

Rate of return: 5%

Result: Portfolio lasts 21 years (until age 85).

Scenario 4: Withdrawal Rate $80,000 Per Year

Assumptions:

Annual withdrawal: $80,000 (indexed for 3% inflation)

Rate of return: 5%

Result: Portfolio lasts 15 years (until age 79).

Even if you bump the return to 6%, it only extends one more year to age 80. Higher withdrawals create a significant risk of outliving your money.

Final Thoughts

If you retire with $1 million, the answer to “How long will it last?” depends heavily on your withdrawal rate, inflation, taxes, and investment returns. A $40,000 withdrawal rate can potentially last through age 100, while a more aggressive $80,000 withdrawal rate may deplete funds before age 80.

The bottom line: Everyone’s situation is unique. Your lifestyle, income sources, tax situation, and risk tolerance will shape your plan. This is why working with a financial advisor is so important — to stress-test your retirement under different scenarios and give you peace of mind that your money will last as long as you do.

For more information on our fee based financial planning services to run your custom retirement projections, please visit our website.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What is a safe withdrawal rate in retirement?

A commonly used guideline is the 4% rule, meaning you withdraw 4% of your starting balance each year, adjusted for inflation. However, personal factors—such as market performance, expenses, and longevity—should guide your specific rate.

How does inflation affect retirement spending?

Inflation steadily increases the cost of living, which raises how much you need to withdraw each year. At a 3% inflation rate, an annual $70,000 expense today could grow to over $100,000 within 15 years, reducing how long savings can last.

Why do investment returns matter so much in retirement?

Once you start taking withdrawals, poor market performance can have a lasting impact because you’re selling investments during downturns.

How do taxes impact retirement withdrawals?

Withdrawals from pre-tax accounts like traditional IRAs and 401(k)s are taxable, so you may need to take out more than your net spending needs. For instance, needing $80,000 after tax could require withdrawing around $90,000 or more before tax.

What can help make retirement savings last longer?

Strategies like moderating withdrawal rates, maintaining some stock exposure for growth, and factoring in Social Security or pension income can extend portfolio longevity. Regularly reviewing your plan helps ensure it stays aligned with your goals and spending needs.

The Risk of Outliving Your Retirement Savings

Living longer is a blessing, but it also means your savings must stretch further. Rising costs, inflation, and healthcare expenses can quietly erode your nest egg. This article explains how to stress-test your retirement plan to ensure your money lasts as long as you do.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

When you imagine retirement, perhaps you see time with family, travel, golf, and more time for your hobbies. What many don’t realize is how two forces—longer lifespans and rising costs—can quietly erode your nest egg while you're still enjoying those moments. Living longer is a blessing, but it means your savings must stretch further. And inflation, especially for healthcare and long-term care, can quietly chip away at your financial comfort over the years. Let’s explore how these factors shape your retirement picture—and what you can do about it.

What you’ll learn in this article:

How life expectancy is evolving, and how it’s increasing the need for more retirement savings

The impact of inflation on a retiree's expenses over the long term

How inflation on specific items like healthcare and long-term care are running at much higher rates than the general rate of inflation

How retirees can test their retirement projections to ensure that they are properly accounting for inflation and life expectancy

How pensions can be both a blessing and a curse

1. Living Longer: A Good But Bad Thing

The Social Security life tables estimate that a 65-year-old male in 2025 is expected to live another 21.6 years (reaching about age 86.6), while a 65-year-old female can expect about 24.1 more years, extending to around 89.1 (ssa.gov).

That has consequences:

If a retiree spends $60,000 per year, a male might need 21.6 × $60,000 = $1,296,000 in total

A female might need 24.1 × $60,000 = $1,446,000

These totals—before considering inflation—highlight how long-term retirement can quickly become a multi-million-dollar endeavor.

2. Inflation: The Silent Retirement Thief

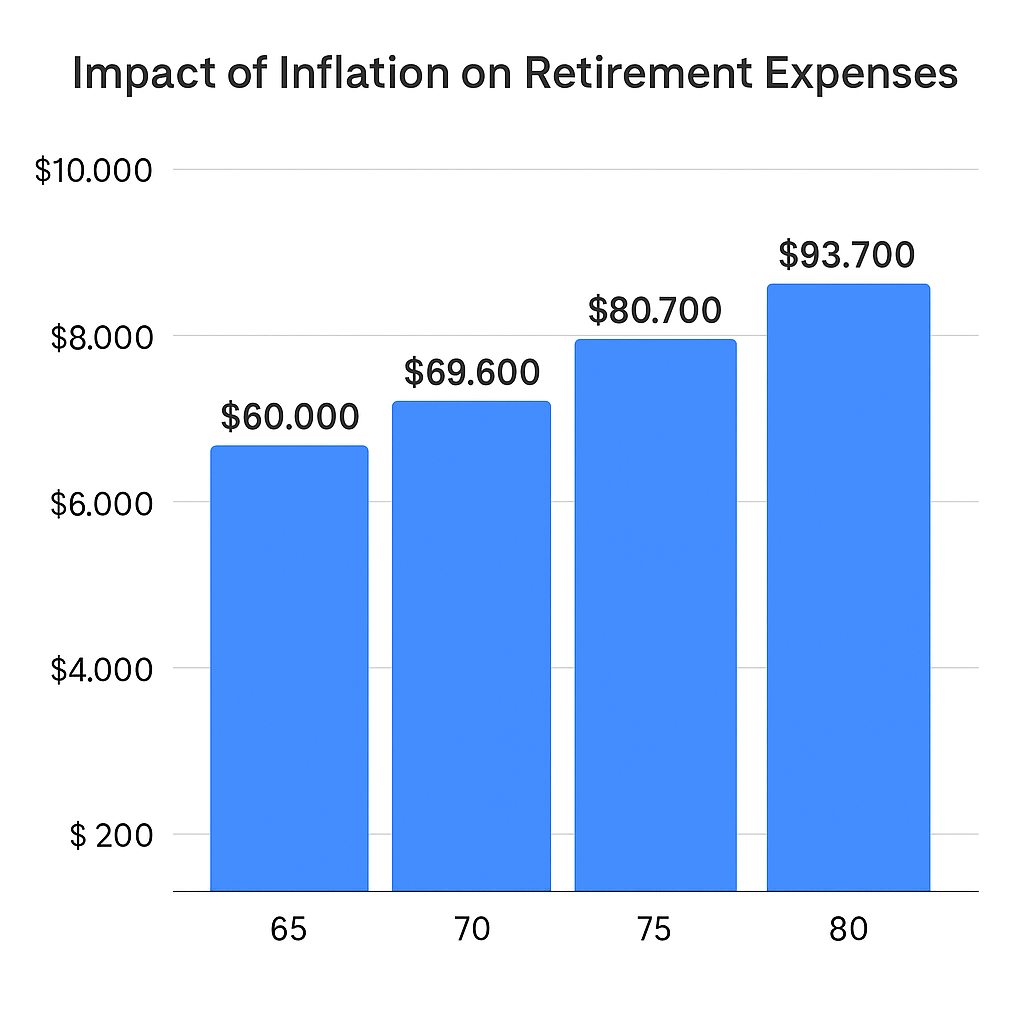

Inflation steadily erodes the real value of money. Over the past 20 years, average annual inflation has held near 3%. Let’s model how inflation reshapes $60,000 in annual after-tax expenses for a 65 year-old retiree over time with a 3% annual increase:

At age 80 (15 years after retirement):

$60,000 × (1.03)^15 ≈ $93,068 per yearAt age 90 (25 years after retirement):

$60,000 × (1.03)^25 ≈ $127,278 per year

In just the first 15 years, this retiree’s annual expenses increased by $33,068 per year, a 55% increase.

3. The Hidden Risk of Relying Too Much on Pensions

One of the most common places retirees feel this pinch is with pensions. Most pensions provide a fixed monthly amount that does not rise meaningfully with inflation. That can create a false sense of security in the early years of retirement.

Example:

A married couple has after-tax expenses of 70,000 per year.

They receive $50,000 from pensions and $30,000 from Social Security.

At retirement, their $80,000 of income in enough to meet their $70,000 in after-tax annual expenses.

Here’s the problem:

The $50,000 pension payment will not increase.

Their expenses, however, will rise with inflation. After 15 years at 3% inflation, those same expenses could total about $109,000 per year.

By then, their combined pension and Social Security will fall well short, forcing them to dip heavily into savings—or cut back their lifestyle.

This illustrates why failing to account for inflation often means retirees “feel fine” at first, only to face an unexpected shortfall 10–15 years later.

4. Healthcare & Long-term Care Expenses

While the general rise in expenses by 3% per year would seem challenging enough, there are two categories of expenses that have been rising by much more than 3% per year for the past decade: healthcare and long-term care. Since healthcare often becomes a large expense for individuals 65 year of age and older, it’s created additional pressure on the retirement funding gap.

Prescription drugs shot up nearly 40% over the past decade, outpacing overall inflation (~32.5%) (nypost.com).

Overall healthcare spending jumped 7.5% from 2022 to 2023, reaching $4.9 trillion—well above historical averages (healthsystemtracker.org).

In-home long-term care is also hefty—median rates for a home health aide have skyrocketed, with 24-hour care nearing $290,000 annually in some cases (wsj.com).

5. The Solution: Projections That Embrace Uncertainty

When retirement may stretch 20+ years, and inflation isn’t uniform across expense categories, guessing leads to risk. A projection-driven strategy helps you:

Model life expectancy: living until age 85 – 95 (depending on family longevity)

Incorporate general inflation (3%) on your expenses within your retirement projections

Determine if you have enough assets to retire comfortably

Whether your plan shows a wide cushion or flags a potential shortfall, you’ll make confident decisions—about savings, investments, expense reduction, or part-time work—instead of crossing your fingers.

6. Working with a Fee-Based Financial Planner Can Help

Here’s the bottom line: Living longer is wonderful, but it demands more planning in the retirement years as inflation, taxes, life expectancy, and long-term care risks continue to create larger funding gaps for retirees.

A fee-based financial planner can help you run personalized retirement projections, taking these variables into account—so you retire with confidence. And if the real world turns out kinder than your model, that's a bonus. If you would like to learn more about our fee-based retirement planning services, please feel free to visit our website at: Greenbush Financial Group – Financial Planning.

Learn more about our financial planning services here.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

How does longer life expectancy affect retirement planning?

People are living well into their 80s and 90s, meaning retirement savings must cover 20–30 years or more. The longer you live, the more years your portfolio must fund, increasing the importance of conservative withdrawal rates and sustainable planning.

Why is inflation such a big risk for retirees?

Inflation steadily raises the cost of living, reducing the purchasing power of fixed income sources like pensions. Even at a modest 3% inflation rate, living expenses can rise more than 50% over 15 years, requiring larger withdrawals from savings.

How does inflation impact pensions and fixed income sources?

Most pensions don’t increase with inflation, so their purchasing power declines over time. A pension that comfortably covers expenses at retirement may fall short within 10–15 years as costs rise, forcing retirees to draw more from savings.

Why are healthcare and long-term care costs such a concern in retirement?

Healthcare and long-term care expenses have been increasing faster than general inflation. Costs for prescriptions, medical services, and in-home care can grow at 5–7% annually, putting additional strain on retirement savings.

How can retirees plan for inflation and longevity risk?

Running detailed retirement projections that factor in inflation, longer life expectancy, and varying rates of return helps reveal whether savings are sufficient. This approach allows retirees to make informed decisions about spending, investing, and lifestyle adjustments.

When should retirees work with a financial planner?

Consulting a fee-based financial planner early in the retirement planning process can help test different inflation and longevity scenarios. A planner can build customized projections and ensure your plan remains flexible as costs and life circumstances evolve.

How Much Money Will You Need to Retire Comfortably?

Retirement planning isn’t just about hitting a number. From withdrawal rates and inflation to taxes and investment returns, several factors determine if your savings will truly last. This article explores how to test your retirement projections and build a plan for financial security.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

As a Certified Financial Planner who runs retirement projections on a daily basis, one of the most common questions I get is: “How much money do I need to retire?”

The answer may surprise you—because there’s no universal number. The amount you’ll need depends largely on one thing: your expenses.

In this article, we’ll walk through:

Why expenses are the biggest driver of how much you need to retire

How inflation impacts retirement spending

Why the type of account you own matters

The importance of factoring in all your income sources

A quick 60-second way to test your own retirement readiness

Expenses: The Biggest Driver

When you ask, “Can I retire comfortably?”, the first question to answer is: How much do you spend each year?

For example:

If your expenses are $40,000 per year, then $500,000 in retirement savings could potentially be enough—especially if you’re supplementing withdrawals with Social Security or a pension.

But if your expenses are $90,000 per year, that same $500,000 likely won’t stretch nearly as far.

Your retirement lifestyle drives your retirement savings need. Someone with modest expenses may not need millions to retire, while someone with higher spending will require significantly more.

Don’t Forget About Inflation

It’s not just today’s expenses you need to plan for—it’s tomorrow’s too. Inflation quietly eats away at your purchasing power, making your cost of living higher every single year.

Here’s an example:

At age 65, your expenses are $60,000 per year.

If expenses rise at 3% annually, by age 80 they’ll be roughly $93,700 per year.

That’s a 50% increase in just 15 years—and you’ll need your retirement assets to keep up.

This is one of the hardest factors for individuals to quantify without financial planning software. Inflation not only increases expenses, but it changes your withdrawal rate from investments, which can impact how long your money lasts.

The Type of Account Matters

Not all retirement accounts are created equal. The type of retirement/investment accounts you own has a big impact on whether you can retire comfortably.

Pre-tax accounts (401k, traditional IRA): Every dollar withdrawn is taxed as ordinary income. A $1,000,000 account might really be worth closer to $700,000 after taxes.

Roth accounts: Withdrawals are tax-free, making these extremely valuable in retirement.

After-tax brokerage accounts: Withdrawals often receive more favorable capital gains treatment, so the tax drag can be lighter compared to pre-tax accounts.

Cash: Offers liquidity but typically earns little return, making it best for short-term expenses.

In short: Roth and after-tax brokerage accounts often provide more after-tax value compared to pre-tax accounts.

Factor in All Your Income Sources

Getting a general idea of your retirement income picture is key. This means adding up:

Social Security benefits

Pensions

Investment income (dividends, interest, etc.)

Part-time income in retirement

Withdrawals from retirement accounts

Once you total these income sources, you’ll need to apply the tax impact. Only then can you compare your after-tax income against your after-tax expenses (adjusted for inflation each year) to see if there’s a gap.

This is exactly how financial planners build retirement projections to determine sustainability.

Find Out If You Can Retire in 60 Seconds

Curious if you’re on track? We’ve built a 60-second retirement check-up that can help you quickly see if you have enough to retire.

Bottom line: There’s no magic retirement number. The amount you need depends on your expenses, inflation, account types, and income sources. By running the numbers—and stress-testing them with a financial planner—you can gain the confidence to know whether you’re truly ready to retire comfortably.

Partner with a Fee-Based Financial Planner to Build Your Retirement Plan

While rules of thumb and calculators can provide a helpful starting point, everyone’s retirement picture looks different. Your income needs, lifestyle goals, and unique financial situation will ultimately determine how much you need to retire comfortably.

Working with a fee-based financial planner can help take the guesswork out of retirement planning. A planner will create a customized strategy that factors in your retirement expenses, investments, Social Security, healthcare, and tax planning—so you know exactly where you stand and what adjustments to make.

If you’d like to explore your own numbers and build a retirement roadmap, we’d love to help. Learn more about our financial planning services here.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

How much money do I need to retire?

There’s no single number that fits everyone—the right amount depends primarily on your annual expenses, lifestyle, and income sources. A retiree spending $40,000 per year will need far less savings than someone spending $90,000.

Why are expenses the most important factor in retirement planning?

Your spending habits determine how much income your portfolio must generate. Knowing your annual expenses helps estimate your withdrawal needs, which directly drives how large your retirement savings must be.

How does inflation affect retirement spending?

Inflation gradually increases the cost of living, reducing the purchasing power of your money. At a 3% inflation rate, $60,000 in annual expenses today could rise to about $94,000 in 15 years, meaning your savings must grow to keep pace.

How does the type of retirement account impact how much you need to save?

Withdrawals from pre-tax accounts like 401(k)s and traditional IRAs are taxable, so you may need to save more to cover taxes. Roth IRAs and brokerage accounts often provide more after-tax value, since withdrawals may be tax-free or taxed at lower rates.

What income sources should I include when estimating retirement readiness?

Include all sources such as Social Security, pensions, dividends, part-time income, and withdrawals from savings. Comparing your total after-tax income against your inflation-adjusted expenses helps reveal whether you’re financially ready to retire.

How can I quickly estimate if I’m on track for retirement?

A simple way is to compare your projected annual expenses (adjusted for inflation) with your expected retirement income. Working with a fee-based financial planner can oftern provide a more comprehensive approach to answering the question “Do I have enough to retire?”

A Financial Checklist for Surviving Spouses

Losing a spouse is overwhelming, and financial matters can add to the stress. Greenbush Financial Group provides a gentle, step-by-step checklist to help surviving spouses address immediate needs, manage estate matters, and plan for the future with confidence.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

Losing a spouse is one of life’s most difficult experiences. During this time of grief, handling financial matters can feel overwhelming. It’s important to remember that you don’t need to do everything at once. In fact, we often advise clients not to make any major financial decisions for 6 to 12 months after the loss of a loved one, if it can be avoided.

This guide is designed to provide a gentle checklist of financial steps to consider, along with reassurance that you don’t need to navigate this alone.

Step 1: Take Care of Immediate Needs

In the first weeks, focus only on what must be handled right away:

Ensure bills and accounts are being paid—utilities, mortgage, and insurance premiums—so nothing important lapses. If additional cash is needed to cover these expenses or funeral costs, you may want to contact your investment advisor to request a distribution from your brokerage or retirement account.

Gather key documents such as the death certificate, Social Security card, and marriage certificate. You will need several certified copies of the death certificate.

Notify Social Security to stop benefits if your spouse was receiving them, and inquire about survivor benefits.

Contact your spouse’s employer (if applicable) to ask about any final pay, life insurance, or retirement benefits.

Inventory assets and debts: Create a list of accounts, loans, credit cards, and other financial items.

At this stage, just focus on stabilization. Bigger decisions can wait.

Step 2: Meet With Your Estate Attorney

An estate attorney can be one of the most important resources for a surviving spouse. They will help guide you through the legal aspects of settling your spouse’s estate and make sure everything is handled properly. Some of the areas they may assist with include:

Reviewing your spouse’s will or trust to ensure assets are distributed according to their wishes.

Probate guidance if the estate needs to go through the court process.

Updating property titles and deeds (such as the home, vehicles, or other jointly owned assets).

Retitling accounts that were in your spouse’s name alone.

Confirming beneficiary designations on retirement accounts, life insurance, and other policies.

Handling debts and obligations—making sure outstanding bills or loans are addressed properly.

Advising on estate tax issues and helping file any required estate or inheritance tax returns.

Updating your own estate plan to reflect changes in beneficiaries, powers of attorney, and trusts.

Meeting with an estate attorney early ensures that the legal and financial transition is handled with care, giving you peace of mind during a difficult time.

Step 3: Understand Insurance and Benefits

Life insurance: If your spouse had life insurance, begin the claims process. Take your time deciding how to use any proceeds.

Employer benefits: You may be eligible for continued health coverage, pension payments, or survivor retirement benefits.

Government benefits: Social Security survivor benefits may be available, depending on age and circumstances.

Step 4: Review Bank and Investment Accounts

After the first three steps, begin to look at household finances more closely.

Confirm joint accounts: In many cases, joint bank accounts automatically transfer to the surviving spouse.

Update beneficiary designations: Retirement accounts, life insurance, and transfer-on-death accounts should be reviewed.

Check for automatic payments: Make sure you know which accounts are connected to bills or subscriptions.

Begin retitling accounts per the direction of your estate attorney or investment advisor.

This helps establish a clear picture of where things stand.

Step 5: Avoid Major Financial Decisions for 6–12 Months

Grief can cloud judgment. If possible, hold off on large changes such as:

Selling the family home

Making major investment decisions

Gifting or lending large sums of money

Instead, focus on maintaining stability and keeping everything in order until you feel emotionally and financially ready.

Step 6: Seek Guidance from Financial Professionals

You don’t need to carry this burden alone. Financial professionals can provide both guidance and peace of mind:

Accountants can help navigate tax considerations, including filing final returns for your spouse.

Financial planners can help you prioritize needs and create a roadmap for the months and years ahead.

Investment advisors can review your portfolio and suggest adjustments to fit your new circumstances.

Having trusted professionals at your side means you don’t have to make every decision yourself. They can help simplify the process and give you confidence that nothing is being overlooked.

Step 7: Begin Planning for the Future—When You’re Ready

When you feel ready, start thinking about the long-term picture:

Update your own will, trust, and estate plan.

Revisit beneficiaries on accounts and insurance policies.

Adjust your budget and income sources for your new household situation.

Consider whether your investment and retirement plans need rebalancing.

Take these steps one at a time, at a pace that feels manageable.

Final Thoughts

The loss of a spouse is deeply personal, and the financial responsibilities that follow can feel heavy. Remember: you do not need to have all the answers right away, and you don’t need to do this alone.

By leaning on a checklist like this—and enlisting the support of accountants, planners, and advisors—you can move forward step by step. Over time, clarity will return, and you’ll feel more confident about the financial decisions that lie ahead.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What financial steps should I take immediately after losing a spouse?

Focus first on essential needs—keeping bills current, gathering key documents, and notifying Social Security and your spouse’s employer. Avoid making major financial changes right away; the priority is maintaining stability during the initial weeks.

Why is meeting with an estate attorney so important after a spouse’s death?

An estate attorney helps ensure your spouse’s will, trusts, and beneficiary designations are properly executed. They can guide you through probate, retitle assets, settle debts, and help update your own estate plan to reflect your new situation.

What types of benefits should a surviving spouse review?

Survivors should check for life insurance proceeds, employer benefits such as pensions or continued health coverage, and Social Security survivor benefits. Each of these may provide valuable financial support during the transition.

When should I start making major financial decisions after a loss?

It’s best to wait six to twelve months before making large financial moves, such as selling property or changing investments. This allows time for emotions to settle and for you to make decisions with clarity.

How can financial professionals help after the loss of a spouse?

Accountants can manage tax filings and estate issues, while financial planners and investment advisors can help organize accounts, adjust your financial plan, and guide long-term decisions with care and objectivity.

What long-term financial updates should I make as a surviving spouse?

When ready, update your own will, trust, and beneficiary designations. Review your budget, income sources, and investment strategy to ensure they align with your new circumstances and future goals.

Advantages of Using A Bond Ladder Instead of ETFs or Mutual Funds

Bond ladders can provide investors with predictable income, interest rate protection, and more control compared to bond ETFs or mutual funds. Greenbush Financial Group breaks down how they work, the different ladder strategies, and why some investors prefer this approach.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

When it comes to investing, one of the biggest challenges is dealing with interest rate uncertainty. Rates go up, rates go down, and bond prices fluctuate with those changes. For investors who want predictable income and a way to smooth out the risks of rising and falling interest rates, a bond ladder can be a powerful strategy.

In this article, we’ll walk through:

What a bond ladder is and how it works

How a bond ladder helps hedge against interest rate fluctuations

The different types of bond ladders (equal-weighted, barbell, middle-loaded)

Why some investors prefer an individual bond ladder over bond mutual funds or ETFs

What Is a Bond Ladder?

A bond ladder is a portfolio of individual bonds with staggered maturity dates. For example, you might buy bonds maturing in 1 year, 2 years, 3 years, 4 years, and 5 years. When the 1-year bond matures, you reinvest the proceeds into a new 5-year bond, keeping the “ladder” in place.

This structure offers two key benefits:

Hedging Interest Rate Risk: Since a portion of your ladder matures every year (or at regular intervals), you always have an opportunity to reinvest at the prevailing interest rate—whether rates go up or down.

Consistent Income and Liquidity: The maturing bonds provide cash flow that can be reinvested or used for spending needs.

In short, a bond ladder helps smooth out the effects of interest rate fluctuations while still generating steady income.

Types of Bond Ladders and How They Work

There isn’t just one way to build a bond ladder. The structure you choose depends on your investment goals, risk tolerance, and views on interest rates. Here are three common approaches:

1. Equal-Weighted Bond Ladder

How it works: Bonds are spread evenly across maturity dates (e.g., equal amounts in 1, 2, 3, 4, and 5-year maturities).

Why use it: This is the most straightforward approach. It balances risk and return by spreading exposure across time horizons, making it a good fit for investors who want predictability.

2. Barbell Strategy

How it works: Bonds are concentrated at the short and long ends of the maturity spectrum, with little or nothing in the middle. For example, you might own 1-year and 10-year bonds, but nothing in between.

Why use it: Short-term bonds provide liquidity and flexibility, while long-term bonds lock in higher yields. This strategy can be appealing when you expect interest rates to change significantly in the future.

3. Middle-Loaded Ladder

How it works: Bonds are concentrated in intermediate maturities (e.g., 3–7 years).

Why use it: Provides a balance between short-term reinvestment risk and long-term interest rate exposure. This can be attractive if you think the current yield curve makes mid-range maturities the “sweet spot” for returns.

Bond ladders can also vary by duration. Some investors create 5-year ladders, 10-year ladders, or 20-year ladders.

Why Build a Bond Ladder Instead of Using a Mutual Fund or ETF?

You might wonder: why not just buy a bond fund and let the professionals handle it? There are several reasons why individual investors prefer building their own bond ladders:

Predictable Cash Flow: With a ladder, you know exactly when each bond will mature and what it will pay. Bond funds and ETFs fluctuate daily, and there are no set maturity dates.

Control Over Holdings: You decide the maturity schedule, the credit quality, and the exact bonds in your ladder. In a fund, you’re subject to the manager’s decisions.

Reduced Interest Rate Risk: In a bond ladder, if you hold bonds to maturity, you get your principal back regardless of market fluctuations. Bond funds never truly “mature,” so you’re always exposed to price swings.

Potentially Lower Costs: By buying individual bonds and holding them, you avoid ongoing expense ratios charged by mutual funds and ETFs.

In short, a bond ladder offers clarity, predictability, and control that pooled investment vehicles can’t always match.

Why You Need Significant Capital for a Bond Ladder

While bond ladders offer many advantages, they aren’t practical for every investor. Building a well-diversified ladder requires a substantial amount of money for a few reasons:

Minimum Purchase Amounts: Many individual bonds trade in $1,000 or $5,000 increments. To build a ladder with multiple rungs across different maturities, you need enough capital to meet those minimums. When investing in short-term U.S. treasuries, sometimes the purchase minimum is $250,000.

Diversification Needs: A proper ladder spreads risk across multiple issuers and maturities. Doing this with small amounts of money is difficult, leaving you concentrated in just a few bonds.

Transaction Costs: Buying and selling individual bonds often involves markups or commissions, which can eat into returns if the investment amount is too small.

Income Needs: If you’re using the ladder to generate income, small investments may not produce meaningful cash flow compared to what’s achievable with funds or ETFs.

For these reasons, investors with smaller portfolios often turn to bond mutual funds or ETFs. These vehicles pool money from many investors, allowing even modest contributions to achieve diversification, professional management, and steady income without the large upfront commitment required by a ladder

Final Thoughts

A bond ladder can be an excellent strategy for investors looking to hedge interest rate risk, generate predictable income, and maintain flexibility. Whether you choose an equal-weighted ladder for balance, a barbell strategy for flexibility and yield, or a middle-loaded approach to target the sweet spot of the curve, the right structure depends on your unique goals.

And while bond mutual funds and ETFs may be convenient, an individual bond ladder provides unmatched control, transparency, and reliability.

If you’re considering adding a bond ladder to your portfolio, the key is aligning it with your financial objectives, income needs, and risk tolerance. Done correctly, it’s a time-tested way to bring stability and consistency to your investment plan.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What is a bond ladder and how does it work?

A bond ladder is a portfolio of individual bonds with staggered maturity dates, such as 1-, 2-, 3-, 4-, and 5-year terms. As each bond matures, the proceeds are reinvested into a new long-term bond, creating a cycle that provides steady income and helps manage interest rate risk.

How does a bond ladder help protect against interest rate changes?

Because bonds mature at regular intervals, you continually reinvest at current market rates. This means when interest rates rise, maturing bonds can be rolled into higher-yielding ones; when rates fall, the longer-term bonds in the ladder continue to earn higher fixed rates.

What are the different types of bond ladders?

Common structures include equal-weighted ladders (evenly spread maturities), barbell strategies (short- and long-term maturities), and middle-loaded ladders (focused on intermediate terms). Each structure balances risk, return, and flexibility differently.

Why might investors choose a bond ladder over a bond mutual fund or ETF?

An individual bond ladder offers predictable maturity dates, control over holdings, and stable cash flow if bonds are held to maturity. In contrast, bond funds and ETFs fluctuate in value and have no set maturity, which can expose investors to ongoing price volatility.

Who is a bond ladder best suited for?

Bond ladders typically work best for investors with larger portfolios who want predictable income and can meet minimum bond purchase requirements. Smaller investors may prefer bond funds or ETFs for diversification and lower entry costs. We advise consulting with your personal investment advisor.

What are the key advantages of using a bond ladder in a portfolio?

A bond ladder provides consistent income, reduces interest rate risk, and enhances liquidity through regular maturities. It also allows investors to match cash flow needs with future expenses while maintaining control over credit quality and investment duration.

5 Must-Read Financial Books to Build Wealth and Success at Any Stage of Life

Looking to build wealth and sharpen your money skills? Greenbush Financial Group highlights 5 must-read financial books that cover debt, investing, business strategy, and long-term success. Perfect for every stage of life.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

Knowledge is power—especially when it comes to money. The earlier you learn the fundamentals of personal finance and business, the faster you can avoid mistakes and build wealth compared to your peers. But whether you’re just starting out in your career, navigating mid-life financial challenges, or planning for retirement, the right financial knowledge can create opportunities and help you achieve greater freedom.

As the Managing Partner of Greenbush Financial Group, I often recommend books as a way to jump-start that education. The right book can provide not only financial strategies but also the mindset shifts needed to succeed both personally and professionally. Below are five must-read books that cover everything from managing debt to investing to starting a business:

The Total Money Makeover by Dave Ramsey

How to Win Friends and Influence People by Dale Carnegie

Rich Dad Poor Dad by Robert Kiyosaki

Blue Ocean Strategy by W. Chan Kim and Renée Mauborgne

One Up on Wall Street by Peter Lynch

1. The Total Money Makeover by Dave Ramsey

For individuals who find themselves weighed down by student loans, credit card balances, or car payments, this book is the perfect starting point. Ramsey lays out a proven system—his famous “baby steps”—to help readers eliminate debt, build an emergency fund, and begin saving for the future. His approach is straightforward, no-nonsense, and centered on living a debt-free lifestyle.

Key Lessons:

Start with a written budget and tell every dollar where to go.

Attack debt with the “debt snowball” method—paying off the smallest balances first.

Build an emergency fund to protect against unexpected expenses.

Avoid credit cards and debt as a lifestyle—cash is freedom.

Live below your means to create margin for saving and investing.

2. How to Win Friends and Influence People by Dale Carnegie

Originally published in 1936, this timeless classic focuses on building strong relationships—a skill just as valuable in business as it is in everyday life. Carnegie teaches that success often depends more on how you treat people than on technical expertise. For anyone looking to grow their career, improve leadership skills, or strengthen communication, this book remains one of the best guides available.

Key Lessons:

Don’t criticize, condemn, or complain—lead with kindness.

Give honest and sincere appreciation—people thrive on recognition.

Become genuinely interested in others, and remember their names.

Avoid arguments—approach conversations with warmth and curiosity.

Let others feel ownership of ideas—collaboration builds stronger outcomes.

3. Rich Dad Poor Dad by Robert Kiyosaki

This book reshapes the way many people think about money. Through the contrast of his “rich dad” and “poor dad,” Kiyosaki explains why building assets and investing are essential, while relying solely on a paycheck can limit financial growth. The book highlights the benefits of owning a business or investing in income-producing assets versus being stuck in the cycle of working for money.

Key Lessons:

Assets put money in your pocket, liabilities take it out—know the difference.

Don’t work only for money—learn how money works and put it to work for you.

Entrepreneurship and investing create wealth faster than wages.

Financial education is more important than formal education.

Take calculated risks instead of seeking complete security.

4. Blue Ocean Strategy by W. Chan Kim and Renée Mauborgne

For those who aspire to start their own business, this book is essential. The authors explain how companies can break away from crowded, competitive “red oceans” and instead create innovative products or services in uncontested “blue oceans.” This strategy allows entrepreneurs to differentiate themselves, grow faster, and avoid the race-to-the-bottom competition.

Key Lessons:

Don’t compete in crowded markets—create new market space.

Focus on differentiation and value innovation, not price wars.

Eliminate what doesn’t add value, and elevate what customers truly care about.

Small, creative ideas can disrupt entire industries.

Long-term success comes from standing apart, not blending in.

5. One Up on Wall Street by Peter Lynch

Originally published in 1989, this classic investment book remains one of the most practical guides for everyday investors. Lynch, one of the most successful mutual fund managers of all time, explains how average people can use their everyday knowledge—like the products they buy and the companies they interact with—to make smart investment decisions. While the markets have evolved since the book’s release, the core principles remain timeless.

Key Lessons:

Invest in what you know—your everyday life can reveal great companies.

Do your own research before following Wall Street trends.

Long-term investing beats short-term speculation.

A simple, understandable company is often a better investment than a complex one.

Patience and discipline are critical—ignore market noise.

Final Thoughts

Each of these books delivers valuable lessons that can change the way you approach money, career, and business. From getting out of debt, to building stronger relationships, to launching innovative companies, these resources provide a roadmap to success.

No matter your stage of life or career, pick the book that speaks most to your current situation and commit to applying what you learn. Over time, the habits and strategies you gain will compound, setting you apart and positioning you for long-term wealth.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

Why is financial education so important?

Financial knowledge helps individuals make informed decisions about saving, investing, and managing debt. The earlier you learn core principles, the more effectively you can avoid mistakes, build wealth, and create financial independence over time.

What are the best books to start learning about personal finance?

Books like The Total Money Makeover by Dave Ramsey, Rich Dad Poor Dad by Robert Kiyosaki, and One Up on Wall Street by Peter Lynch offer practical guidance on budgeting, investing, and building long-term wealth. Each provides actionable strategies for different stages of life.

How can The Total Money Makeover help with debt management?

Dave Ramsey’s book focuses on eliminating debt through a structured “baby steps” plan. It teaches readers to live on a budget, build an emergency fund, and use the “debt snowball” method to gain momentum toward financial freedom.

What’s the main takeaway from Rich Dad Poor Dad?

The book emphasizes that wealth comes from owning assets and understanding how money works, not just earning a paycheck. It encourages entrepreneurship, investing, and financial education as the keys to long-term success.

Why is How to Win Friends and Influence People valuable for financial success?

Success in business and personal finance often depends on relationships and communication. Dale Carnegie’s classic teaches principles of empathy, influence, and connection that are vital for leadership, networking, and negotiation.

Who should read Blue Ocean Strategy?

Aspiring entrepreneurs and business leaders can benefit from this book’s insights on creating new markets instead of competing in saturated ones. It provides a framework for innovation, differentiation, and long-term growth.

What investing lessons does One Up on Wall Street teach?

Peter Lynch shows that everyday investors can identify great opportunities by observing products and companies they already know. His approach focuses on patience, research, and long-term investing rather than short-term speculation.

Understanding Per Stirpes Beneficiary Designations

“Per stirpes” is a common estate planning term that determines how assets pass to descendants if a beneficiary dies before you. Greenbush Financial Group explains how per stirpes works, compares it to non–per stirpes designations, and outlines why updating your beneficiary forms is critical for ensuring your wishes are honored.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

When you fill out a beneficiary form for a retirement account, life insurance policy, or investment account, you may come across the term “per stirpes.” It’s a Latin phrase, but don’t let that intimidate you. Choosing per stirpes for your beneficiaries simply determines what happens if one of your named beneficiaries passes away before you do.

In this article, we’ll cover:

What per stirpes means and how it works

A simple comparison of per stirpes vs. non–per stirpes designations

Why keeping beneficiaries up to date is so important

Special considerations when children or minors are involved

What Does Per Stirpes Mean?

Per stirpes means “by branch” or “by the bloodline.” With this designation, if one of your named beneficiaries passes away before you, their share of the inheritance automatically passes down to their descendants.

If you don’t select per stirpes, your beneficiary designation is considered non–per stirpes, which means that if a beneficiary predeceases you, their share is generally redistributed among the remaining named beneficiaries.

Example: 50/50 Beneficiaries

Let’s walk through a clear example.

Case 1: Non–Per Stirpes (default in many plans)

You name your two children, Anna and Ben, as 50/50 beneficiaries.

Anna passes away before you.

Result: Ben inherits 100% of the account. Anna’s children (your grandchildren) do not receive anything unless you’ve updated the beneficiary form to include them.

Case 2: Per Stirpes

You name your two children, Anna and Ben, as 50/50 beneficiaries per stirpes.

Anna passes away before you, leaving two children of her own.

Result: Ben still receives his 50% share. Anna’s 50% share is split evenly between her two children (25% each).

This is why per stirpes is often called a “fail-safe” designation—it ensures the inheritance follows the family line if a beneficiary dies before you.

Why Keeping Beneficiaries Updated Matters

While per stirpes can act as a backup plan, the best approach is to keep your beneficiary designations current.

If a beneficiary passes away, you can always file a new form naming updated beneficiaries.

If you update promptly, the per stirpes designation never even comes into play.

Regular reviews—especially after major life events like births, deaths, or divorces—can help ensure your assets go exactly where you intend.

Special Considerations for Minors

Per stirpes can create complications if the next in line are minor children. For example, if Anna’s 50% share passes to her 10-year-old child, that minor generally cannot inherit assets outright. Instead, the guardian of the child may have to serve as a custodian to the account until the child reaches the age of majority. However, when the child reaches the age of majority, they gain full control over their inheritance, which may or may not be beneficial.

This raises an important planning question:

Do you want minor children to inherit directly?

Or would it make more sense to create a trust and name the trust as the beneficiary?

Working with an estate planning attorney can help clarify the best approach for your family.

Key Takeaways

Per stirpes means a beneficiary’s share passes down to their descendants if they predecease the account owner.

Non–per stirpes means a predeceased beneficiary’s share is typically divided among the remaining beneficiaries.

Keeping beneficiary forms up to date reduces the need to rely on per stirpes.

If potential per stirpes beneficiaries are minors, additional planning (like a trust) may be necessary.

Beneficiary designations are powerful estate planning tools. A quick review of your forms can make all the difference in ensuring your assets are passed down according to your wishes—without leaving things to chance.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What does “per stirpes” mean on a beneficiary form?

“Per stirpes” is a Latin term meaning “by branch” or “by bloodline.” It ensures that if a named beneficiary passes away before you, their share automatically goes to their descendants, such as their children or grandchildren.

How does per stirpes differ from non–per stirpes?

With a per stirpes designation, a deceased beneficiary’s share passes down to their heirs. In contrast, a non–per stirpes designation redistributes that share among the remaining living beneficiaries, bypassing the deceased beneficiary’s family line.

Why should I keep my beneficiary designations up to date?

Life events such as marriages, births, deaths, or divorces can change your intentions for who should inherit your assets. Regularly updating your forms ensures your accounts are distributed according to your current wishes rather than relying on default rules or outdated designations.

What happens if a per stirpes beneficiary is a minor?

Minors typically cannot inherit assets outright, so a custodian or guardian may need to manage the funds until the child reaches adulthood. Some families use trusts to control when and how minors receive their inheritance.

When should I consider naming a trust instead of individuals as beneficiaries?

If you want more control over how and when heirs—especially minors—receive their inheritance, naming a trust as the beneficiary can help. A trust allows you to set specific rules for distributions and avoid complications with guardianship or early access to funds.

Is per stirpes the best option for everyone?

Not necessarily. While per stirpes ensures assets follow the family line, some people prefer equal redistribution among surviving beneficiaries. The best choice depends on your family structure, estate goals, and how you want your assets to be passed down.