Retiring Before 65? How to Bridge the Health Insurance Gap Until Medicare

Retiring before age 65 creates a major challenge: how to pay for health insurance until Medicare begins. Greenbush Financial Group outlines options including ACA exchange subsidies, COBRA, spouse employer plans, and HSAs—plus key planning steps to manage income, reduce costs, and avoid gaps in coverage.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

One of the biggest challenges for individuals planning to retire before age 65 is how to pay for health insurance until Medicare kicks in. Unlike employer coverage, which often subsidizes a large portion of the premium, individual coverage can be expensive—and health care costs are a major factor in determining if early retirement is financially feasible.

In this article, we’ll explore:

Health insurance through the Affordable Care Act (ACA) exchange and how subsidies work

COBRA coverage as a temporary option and how rules vary by state

Coverage through a spouse’s employer and how to coordinate benefits when one spouse retires

Using a Health Savings Account (HSA) to fund health care expenses before Medicare

Why income planning is critical when considering exchange subsidies

How “Navigators” can help retirees select the right plan

The importance of planning ahead before you retire

Exchange Policies: Income-Based Subsidies

The ACA exchange (also known as the marketplace) provides health insurance options that may be more affordable than people realize—thanks to premium tax credits and cost-sharing subsidies.

Here’s the key: Subsidies are based on income, not assets.

This means someone could have $1 million in investment / retirement accounts but report relatively low taxable income and still qualify for significant subsidies. For example, if you live primarily off savings or manage withdrawals from retirement accounts strategically, you may qualify for much lower premiums.

Planning Tip: Since subsidies are income-driven, managing taxable income (through Roth conversions, tax-efficient withdrawals, or capital gains planning) is a crucial part of retirement planning before age 65.

COBRA Coverage

Another option to bridge the gap is COBRA coverage from your former employer. COBRA allows you to continue your existing employer plan, typically for 18 months, but in some cases longer depending on state laws.

The downside? Cost. Under COBRA, you generally pay the full premium plus a 2% administrative fee, which can be much higher than what you were used to as an active employee.

Coverage Through a Spouse’s Employer

If your spouse is still working, you may be able to join their employer-sponsored health plan. This option is often less expensive than COBRA or the exchange, and employers usually subsidize a portion of the premium for dependents.

When one spouse retires, it’s important to notify the employer and coordinate the change in coverage. Many plans allow special enrollment when a spouse loses employer-sponsored insurance, so timing the switch correctly is key.

Using a Health Savings Account (HSA)

If you’ve been contributing to an HSA during your working years, this account can be a valuable bridge for health care costs before Medicare.

HSAs allow you to withdraw funds tax-free for qualified medical expenses, including insurance premiums for COBRA or Medicare.

Unlike Flexible Spending Accounts (FSAs), unused HSA funds carry over year to year, making them an effective tool for pre-retirement savings.

By banking HSA contributions in your working years, you give yourself more flexibility to cover early-retirement health care costs.

The Financial Planning Perspective

Health care is often the largest expense for retirees before Medicare eligibility. When building your retirement income plan, ask:

How much will insurance cost under COBRA, a spouse’s plan, or the exchange?

How much taxable income do you plan to show in early retirement, and will it affect exchange subsidies?

Do you have HSA funds available to offset these costs?

How long will you need coverage before Medicare (just a few years or more than a decade)?

The answers to these questions directly impact whether early retirement is financially realistic.

Exchange Navigators: Help at No Cost

Not everyone feels comfortable navigating the ACA exchange on their own. Fortunately, each state has navigators—trained professionals who help individuals understand their health coverage options and available subsidies.

These navigators are state-funded, so their services come at no additional cost to you. If you’re considering exchange coverage, speaking with a navigator can help ensure you’re getting the right plan and maximizing subsidies.

Planning Ahead Is Critical

One of the biggest mistakes we see is individuals retiring without a plan for health insurance. Waiting too long to assess the various options can lead to gaps in insurance, higher premiums, or missed opportunities for subsidies.

Planning ahead allows you to:

Time your retirement date with coverage options

Estimate premiums under different income scenarios

Decide between COBRA, a spouse’s plan, or the exchange

Maximize tax strategies to reduce costs

Key Takeaways

Retiring before 65 requires a clear plan for health insurance until Medicare.

The ACA exchange offers income-based subsidies, making taxable income planning essential.

COBRA coverage can provide continuity but is usually expensive

If your spouse is still working, joining their plan may be the most cost-effective bridge.

HSAs are a powerful tool to fund health insurance and medical costs pre-Medicare.

Use navigators for guidance on exchange policies and subsidies.

Start planning health coverage well before your retirement date to avoid costly surprises.

Health care is one of the biggest financial considerations for early retirees. By planning ahead, you can bridge the gap to Medicare while keeping costs manageable—and retire with peace of mind.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What are the main health insurance options for early retirees before Medicare?

Common options include coverage through the Affordable Care Act (ACA) exchange, COBRA from a former employer, or joining a spouse’s employer-sponsored plan. Each option varies in cost, duration, and flexibility, depending on your income and household situation.

How do ACA exchange subsidies work for retirees?

Premium subsidies under the ACA are based on taxable income, not total assets. Retirees who manage withdrawals from retirement accounts strategically can often qualify for significant premium reductions, even with substantial savings.

Is COBRA a good option for early retirees?

COBRA allows you to stay on your former employer’s plan for up to 18 months (depending on state law), maintaining the same coverage. However, you must pay the full premium plus a small administrative fee, which can make it one of the more expensive options.

Can I use my spouse’s health insurance if I retire early?

Yes. If your spouse continues to work, you may be eligible to join their employer-sponsored plan. This is often more affordable than COBRA or an ACA plan, especially since many employers subsidize dependent coverage.

How can a Health Savings Account (HSA) help cover pre-Medicare costs?

Funds in an HSA can be withdrawn tax-free for qualified medical expenses, including COBRA and Medicare premiums. Building up HSA savings before retirement can provide a valuable source of tax-efficient funds to cover healthcare costs.

Why is income planning so important for ACA subsidies?

Since exchange subsidies are income-based, managing distributions from taxable retirement accounts, or capital gains planning, can dramatically lower your health insurance premiums in early retirement.

What are ACA “navigators,” and how can they help?

Navigators are trained, state-funded professionals who help individuals compare ACA plans and determine eligibility for subsidies. Their services are free and can simplify selecting the most cost-effective coverage for your situation.

Putting Your Child on Payroll: Tax Benefits and Planning Considerations for Business Owners

Hiring your child in your business can reduce family taxes and create powerful retirement savings opportunities. Greenbush Financial Group explains how payroll wages allow Roth IRA contributions, open the door to retirement plan participation, and provide long-term wealth benefits—while highlighting the rules and compliance concerns you need to know.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

For business owners, employing your child in the family business can be both financially and personally rewarding. Not only does it teach children about responsibility and work ethic, but it can also open up meaningful tax and retirement planning opportunities. However, this strategy comes with important rules and limitations that need to be carefully understood before implementation.

In this article, we’ll cover:

Why parents consider putting their children on payroll

The tax benefits of shifting income

How retirement plan contributions can supercharge long-term wealth for kids

Using W-2 wages to fund Roth IRAs

Key limitations and compliance concerns to keep in mind

Shifting Income: The Tax Advantage

One of the primary motivations for hiring your child is income shifting—moving taxable income from a higher-bracket parent to a lower-bracket child.

For example, instead of paying yourself additional compensation taxed at 37%, you could pay your child for legitimate work at their much lower (or even 0%) tax bracket. The wages are deductible for the business, and the child may owe little to no federal income tax, depending on their total earnings.

This strategy can effectively lower the family’s overall tax bill while compensating your child fairly for real work.

Retirement Plan Contributions for Your Child

If your child is legitimately on payroll, they may also become eligible for participation in the company’s retirement plan. With the right plan design, this could allow:

401(k) deferrals (including Roth contributions) up to $23,500 per year in 2025

Employer contributions in addition to employee deferrals, depending on plan rules.

Imagine the power of decades of tax-free Roth 401(k) growth starting in your child’s teenage years. Even modest contributions today could compound into significant wealth by retirement.

Funding a Roth IRA

Even if your child doesn’t earn enough to max out a 401(k) or work enough hour to become eligible for the company’s 401(k) plan, any earned income reported on a W-2 makes them eligible to contribute to a Roth IRA.

The 2025 contribution limit is $7,000 for individuals under age 50.

Contributions must not exceed the child’s earned income for the year.

This is one of the most effective long-term wealth accumulation strategies available for young workers, given the decades of tax-free growth that a Roth IRA can provide.

Practical Limitations and Compliance Concerns

While the benefits are clear, there are serious rules and restrictions that business owners must respect:

Reasonable work and pay: The job duties and pay must be appropriate for the child’s age and abilities. A 6-year-old making $30,000 a year for “marketing or consulting” is not likely to pass IRS scrutiny.

Labor laws: States impose restrictions on how much and what type of work minors can do. These vary by state, and compliance is essential.

Payroll compliance: Children on payroll must be treated like any other employee—filed on W-2s, subject to FICA taxes (unless an exception applies), and paid at reasonable market rates.

Retirement plan eligibility: Not all plans allow immediate participation. Some require minimum service or age thresholds. Plan design must be reviewed before assuming your child can make contributions.

Audit risk: Employing family members can attract IRS attention. Documentation of actual work performed (e.g., timesheets, job descriptions, projects completed) is important.

Other Considerations

While putting children on payroll can save taxes and accelerate wealth-building, it’s not a one-size-fits-all strategy. Business owners must weigh:

The cost of payroll taxes on the child’s wages

Retirement plan contribution obligations for other employees if the child becomes eligible

Administrative requirements and state-specific child labor rules

The optics of compensation relative to duties performed

Key Takeaways

Hiring your child can shift income into a lower tax bracket and reduce the family’s overall tax bill.

Payroll wages open the door to retirement savings strategies like Roth 401(k) contributions (if the plan allows) and Roth IRAs (up to $7,000 per year).

Plan design, labor laws, and IRS scrutiny mean you must be cautious, document carefully, and ensure the arrangement is reasonable.

This strategy can be powerful for both tax savings today and long-term wealth accumulation for your child—but it must be implemented correctly.

Before putting your child on payroll, consult with both your tax advisor and your retirement plan administrator. Done right, this can be a smart family wealth-building strategy. Done wrong, it can create compliance headaches.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

Why would a business owner put their child on payroll?

Hiring your child allows you to shift income from a higher tax bracket to a lower one, reducing the family’s overall tax liability. It also helps children learn valuable work and financial skills while legitimately earning income.

How does hiring a child create tax benefits?

Wages paid to a child for real work are deductible business expenses, lowering the company’s taxable income. Meanwhile, the child may owe little to no federal income tax if their earnings stay below standard deduction thresholds.

Can my child contribute to a retirement plan if they work for my business?

Yes. If they meet eligibility requirements, children can make 401(k) contributions—including Roth deferrals—through your company’s retirement plan. Even small contributions in their early years can compound significantly over time.

Can my child open a Roth IRA with earned income?

Absolutely. As long as your child earns income reported on a W-2, they can contribute up to $7,000 per year (2025 limit) to a Roth IRA, not exceeding their total earned income. Roth IRAs are especially powerful for young workers due to decades of tax-free growth.

What are the key IRS and labor law rules when employing your child?

The work must be age-appropriate, pay must be reasonable for the duties performed, and proper payroll procedures must be followed. Employers must also comply with state child labor laws and maintain documentation of actual work performed.

Are there any risks or downsides to hiring your child?

Yes. Improper pay, lack of documentation, or failure to follow labor laws can trigger IRS scrutiny. Additionally, adding your child to the company’s payroll may create additional administrative costs or affect retirement plan participation rules.

What should business owners do before putting their child on payroll?

Consult with your tax advisor and retirement plan administrator to ensure the arrangement complies with IRS and labor regulations. Proper planning helps you maximize tax benefits while avoiding compliance issues.

Do Social Security and Pension Payments Automatically Stop After Someone Passes Away?

When a loved one passes away, Social Security and pension payments don’t always stop automatically. Greenbush Financial Group explains how benefits are handled, what survivor benefits may continue, and why notifying the right agencies quickly can prevent overpayments and financial stress.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

When a loved one passes away, the last thing most families want to think about is financial paperwork. But knowing how Social Security and pensions handle payments after death is important to avoid complications—and sometimes even having to pay money back.

In this article, we’ll walk through:

How Social Security gets notified of a death

How pension plans handle benefit changes or survivor benefits

What happens if extra payments are made after someone dies

Steps families can take to make the process smoother

Does Social Security Automatically Get Notified?

Social Security does not always know right away when someone has passed away. Notification usually happens through a few channels:

Funeral homes: Most funeral directors automatically report the death to Social Security if you provide the Social Security number.

Vital records offices: State offices that issue death certificates send reports to Social Security.

Family members: Survivors can call Social Security directly at 1-800-772-1213 to report the death.

It’s generally a good idea for a family member to call Social Security directly, even if the funeral home is handling notification. This avoids delays and prevents overpayments.

What About Pension Payments?

Unlike Social Security, pension payments come from an employer-sponsored retirement plan, and each plan has its own rules.

When a pensioner passes away:

The plan administrator must be notified (usually with a copy of the death certificate).

If the pension had a survivor benefit option, payments may continue to the surviving spouse, but potentially at a reduced amount (for example, 50% or 75% of the original benefit).

If no survivor benefit was elected, payments stop entirely.

Employers and pension administrators typically don’t receive automatic death notifications. It is up to the family or executor to contact the plan.

What Happens if Extra Payments Are Made?

If Social Security or a pension plan issues payments after the recipient’s death, those payments are considered overpayments and must be returned.

Social Security: Payments are typically due back if they were made for the month after the person passed. For example, if someone dies in June, the July payment (received in July for June’s benefit) must be returned. The bank may be required to send it back automatically.

Pensions: If payments continue after the date of death, the plan administrator will usually request repayment once notified.

If funds have already been withdrawn from the account, the surviving family may be responsible for repayment.

Key Takeaways

Social Security is usually notified by funeral homes or state records, but families should still call directly to avoid delays.

Pension plans typically do not get automatic notifications—survivors must contact the plan administrator with a death certificate.

Survivor benefits depend on the pension election made at retirement.

Any overpayments from Social Security or pensions must be returned.

While it’s an uncomfortable topic, taking quick action to notify Social Security and pension administrators can prevent financial stress later. It’s one of those small but important steps in the estate settlement process.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions:

Does Social Security automatically know when someone dies?

Not always. Funeral homes typically report deaths to Social Security if given the person’s Social Security number, and state vital records offices also send reports. However, families should still call Social Security directly at 1-800-772-1213 to confirm notification and prevent overpayments.

What happens to Social Security payments after death?

Social Security benefits stop the month a person dies. Any payment made for the month after death must be returned. For example, if someone passes in June, the benefit received in July must be sent back.

How are pension payments handled when a retiree passes away?

Pension plans must be notified of the death, usually with a copy of the death certificate. If a survivor benefit was chosen, payments may continue to the spouse—often at a reduced amount (such as 50% or 75%). If no survivor option was selected, pension payments stop entirely.

Who is responsible for reporting a death to the pension plan?

The family, executor, or surviving spouse must contact the pension plan administrator directly. Employers and pension providers do not receive automatic death notifications.

What if Social Security or the pension keeps paying after death?

Any payments made after the date of death are considered overpayments and must be returned. The bank may automatically send back Social Security payments, while pension plans typically contact the family to recover funds.

Special Rules for S-Corps with Employer-Sponsored Retirement Plans

Missing a Required Minimum Distribution can feel overwhelming, but the rules have changed under SECURE Act 2.0. In this article, we explain how to correct a missed RMD, reduce IRS penalties, and file the right tax forms to stay compliant.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

S-Corporations can be an excellent structure for small business owners, especially from a tax perspective. But when it comes to retirement plans—such as 401(k)s and profit-sharing plans—S-Corps play by a slightly different set of rules compared to other business entities. Understanding these differences is critical for maximizing retirement savings and avoiding unpleasant surprises.

In this article, we’ll cover:

How compensation is defined for S-Corp owners in a retirement plan

Why relying too heavily on distributions can limit retirement savings

The impact of employer contributions for S-Corp owners with staff

Timing considerations for employee deferrals in S-Corps versus pass-through entities

A practical example that shows how these rules work in real life

W-2 Wages Drive Retirement Contributions for S-Corp Owners

Here’s the key difference:

Partnerships and sole proprietorships – Contributions are based on total pass-through earnings from the business.

S-Corporations – Contributions are based only on W-2 wages paid to the owner.

This matters because many S-Corp owners try to minimize their W-2 salary and take more of their income in shareholder distributions. Distributions avoid payroll taxes, which can be a big tax advantage. But retirement plans only look at W-2 wages when calculating contribution limits.

Example: High Income, Low W-2

Suppose an S-Corp owner earns $500,000 total income, but only pays themselves $100,000 in W-2 wages.

Maximum employer contribution = 25% of W-2 wages = $25,000

Add employee salary deferral = up to $23,500 (2025 limit, or $31,000 if age 50+)

Total = roughly $48,500 (or $56,000 with catch-up)

That’s far below the 2025 annual addition limit of $70,000 ($77,500 with catch-up). By keeping W-2 wages artificially low, the owner unintentionally caps their retirement contributions.

The Ripple Effect on Employees

If the owner sets their employer contribution at 25% of W-2 compensation, that percentage generally applies to eligible employees as well.

In our example, if the owner receives a 25% contribution on $100,000 ($25,000), employees may also need to receive a large employer contribution for the plan to pass testing.

For a company with multiple employees, this can become a very expensive retirement plan design.

Timing of Deferrals: Another S-Corp Quirk

Another important difference involves the timing of employee salary deferrals:

S-Corp owners are on payroll, so any employee deferrals must be processed through payroll no later than the final paycheck in December. If you wait until after year-end, it’s too late to make employee deferrals for that tax year.

Partnership or sole proprietor owners may have more flexibility, since contributions can often be made up to the tax filing deadline (with extensions) and still count toward the prior year.

Translation: If you’re an S-Corp owner, don’t wait until tax season to think about retirement contributions. Deferrals need to be in place before December 31st.

Key Takeaways for S-Corp Owners

Only W-2 wages count toward retirement contributions, not shareholder distributions.

Keeping W-2 wages too low may limit your ability to maximize contributions.

Large employer contributions for the owner can trigger equally large contributions for employees.

Employee salary deferrals must run through payroll and be completed by the last December paycheck.

Careful planning throughout the year—not just at tax time—is essential.

If you’re an S-Corp owner considering a retirement plan, make sure your payroll and compensation strategy aligns with your retirement savings goals. The right plan design can help you strike a balance between tax efficiency today and meaningful retirement wealth in the future.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

How do retirement plan contributions work for S-Corporation owners?

For S-Corp owners, retirement contributions are based only on W-2 wages—not total business income or shareholder distributions. This makes salary decisions especially important for maximizing 401(k) or profit-sharing plan contributions.

Why can keeping W-2 wages low hurt retirement savings for S-Corp owners?

While taking more income as shareholder distributions can reduce payroll taxes, it also limits how much you can contribute to a retirement plan. Employer contributions are capped at 25% of W-2 wages, so a lower salary means smaller allowable contributions.

How do employer contributions for owners affect employees in an S-Corp retirement plan?

If an owner contributes a high percentage of their W-2 income (such as 25%), nondiscrimination testing may require giving the same percentage to eligible employees. This can significantly increase plan costs for businesses with multiple staff members.

When must S-Corp owners make 401(k) salary deferrals?

Employee deferrals must be processed through payroll no later than the final paycheck of the year. Unlike partnerships or sole proprietors, S-Corp owners cannot make deferrals after December 31 for the prior tax year.

Can S-Corp owners include distributions when calculating 401(k) contributions?

No. Only W-2 wages qualify for retirement plan contribution calculations. Distributions from the S-Corp are not considered “earned income” for 401(k) or profit-sharing purposes.

What steps should S-Corp owners take to maximize retirement contributions?

Plan ahead by setting a reasonable W-2 salary that supports both tax efficiency and contribution goals. Coordinate payroll timing, plan design, and employee testing requirements with your tax advisor and retirement plan administrator early in the year.

How to Correct Missed Required Minimum Distributions (RMDs)

Missing a Required Minimum Distribution can feel overwhelming, but the rules have changed under SECURE Act 2.0. In this article, we explain how to correct a missed RMD, reduce IRS penalties, and file the right tax forms to stay compliant.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

Missing a Required Minimum Distribution (RMD) can cause a lot of stress, especially when you hear the words IRS excise tax. Fortunately, the rules around missed RMDs were updated under the SECURE Act 2.0, which provides some relief compared to the old law. In this article, we’ll break down:

What happens if you miss an RMD and how to correct it

The updated excise tax penalties under SECURE Act 2.0

The “first year” April 1st rule and why you may need to take two RMDs in one year

The new IRS guidance for beneficiaries who inherit retirement accounts

What tax forms need to be filed if you miss an RMD

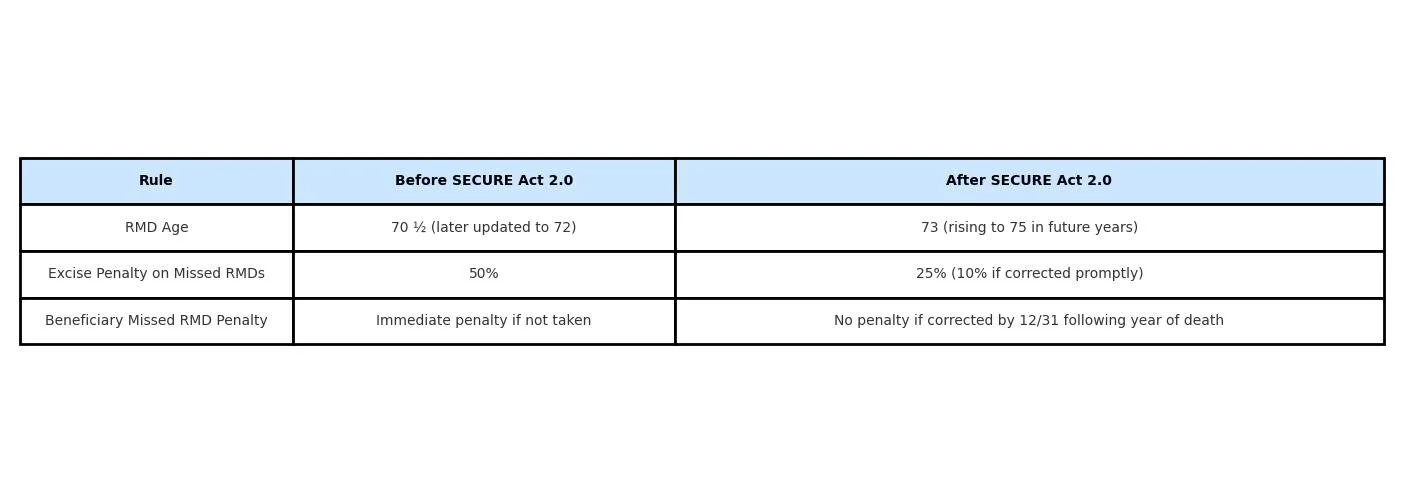

A quick before-and-after look at the old rules versus SECURE Act 2.0

What Happens if You Miss an RMD?

If you forget to take an RMD, the IRS assesses an excise tax penalty on the amount you should have withdrawn. Under the old law, that penalty was steep—50% of the missed RMD.

Under SECURE Act 2.0, the penalty was reduced to a much more manageable amount:

25% penalty on the missed distribution.

If corrected quickly (by taking the missed RMD and filing the proper paperwork), the penalty may be further reduced to 10%.

Example: If you missed a $10,000 RMD:

Old rule: You owed $5,000 in penalties.

New rule: You may owe only $1,000 (if corrected promptly).

The First-Year April 1st Rule

When you reach RMD age (currently age 73 under SECURE Act 2.0), your very first required distribution doesn’t have to be taken in that calendar year. Instead, you can delay it until April 1st of the following year.

But here’s the catch: if you delay your first RMD, you’ll still need to take two RMDs in that next year—the delayed one (by April 1st) plus the regular one (by December 31st).

Example:

Jane turns 73 in 2025.

She can delay her first RMD until April 1, 2026.

If she does, she must also take her 2026 RMD by December 31, 2026—meaning two taxable distributions in one year.

IRS Relief for Inherited Accounts (New Guidance)

For beneficiaries of inherited IRAs or retirement accounts, the IRS just issued new guidance under SECURE Act 2.0.

If a decedent had an RMD due in the year of their death and it wasn’t taken, the beneficiary must still withdraw it. However, the IRS has clarified that as long as the missed RMD is taken by December 31st of the year following the decedent’s death, no excise penalty will be assessed.

This is a significant update and provides more flexibility for beneficiaries who may be navigating a difficult time.

Before SECURE Act 2.0 vs. After

Filing Tax Forms for Missed RMDs

If you missed an RMD, you need to do two things:

Take the missed distribution as soon as possible.

File Form 5329 with your federal tax return to report the missed RMD and calculate the excise penalty.

If you qualify for the reduced 10% penalty, you’ll indicate this on Form 5329.

The actual RMD amount you withdraw will be reported on your Form 1099-R and included in your taxable income for the year you take it.

In some cases, the IRS has historically waived penalties if you can show “reasonable cause” for missing the RMD and that you’ve corrected the mistake. While SECURE Act 2.0 made the penalties less severe, requesting a waiver may still be an option worth considering with your tax professional.

Key Takeaways

SECURE Act 2.0 lowered the penalty for missed RMDs from 50% down to 25% (or 10% if fixed promptly).

The first-year April 1st rule gives you some flexibility but may cause two RMDs in one year.

Beneficiaries now have until December 31st of the year following the decedent’s death to take missed RMDs without penalty.

File Form 5329 to report missed RMDs and claim reduced penalties.

Missing an RMD isn’t ideal, but it’s not the end of the world—especially under the updated SECURE Act 2.0 rules. The most important step is to correct it quickly and make sure you file the proper paperwork with your tax return.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What happens if you miss a Required Minimum Distribution (RMD)?

If you miss an RMD, the IRS may assess an excise tax penalty on the amount that should have been withdrawn. Under SECURE Act 2.0, the penalty is now 25% of the missed amount, reduced to 10% if you correct the mistake promptly by taking the distribution and filing the appropriate tax form.

How did SECURE Act 2.0 change the penalties for missed RMDs?

Previously, missing an RMD triggered a 50% penalty on the shortfall. SECURE Act 2.0 lowered this to 25%, with a further reduction to 10% if the missed distribution is corrected in a timely manner. This change provides much-needed relief for retirees who make honest errors.

What is the April 1st rule for first-year RMDs?

When you first reach RMD age (currently 73), you can delay your initial withdrawal until April 1st of the following year. However, doing so means you must take two RMDs that year—the delayed one and the new year’s required amount—potentially increasing your taxable income.

What are the new IRS rules for inherited IRAs and missed RMDs?

If a deceased account owner had an RMD due in the year of death, the beneficiary must still take that distribution. Under new guidance, if the missed RMD is taken by December 31st of the year following the death, no excise penalty will apply.

What should you do if you missed an RMD?

Take the missed distribution as soon as possible and file IRS Form 5329 with your tax return to report the oversight and calculate any applicable penalty. Your financial or tax advisor can help determine if you qualify for the reduced 10% penalty or a possible waiver.

Can the IRS waive the RMD penalty entirely?

Yes. The IRS may waive the penalty if you can demonstrate reasonable cause for missing the RMD and show that you corrected the issue promptly. While SECURE Act 2.0 reduced the penalties, requesting a waiver may still be worthwhile in some cases.

Filing a Medicare Income Appeal Form: What You Need to Know

Paying higher Medicare premiums than you should? If your income has dropped, you may qualify to file Form SSA-44 and appeal your IRMAA surcharge. Our guide explains how Medicare’s income-based premiums work, which life events allow an appeal, and how to lower your Part B and Part D costs.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

As a Certified Financial Planner®, one question I consistently encounter from retirees is how Medicare premiums relate to income—and what to do if those premiums no longer reflect your current financial reality. If your income has dropped but you're still paying higher Medicare Part B and Part D premiums, you may qualify to file a Medicare income appeal. Here's how to navigate that process.

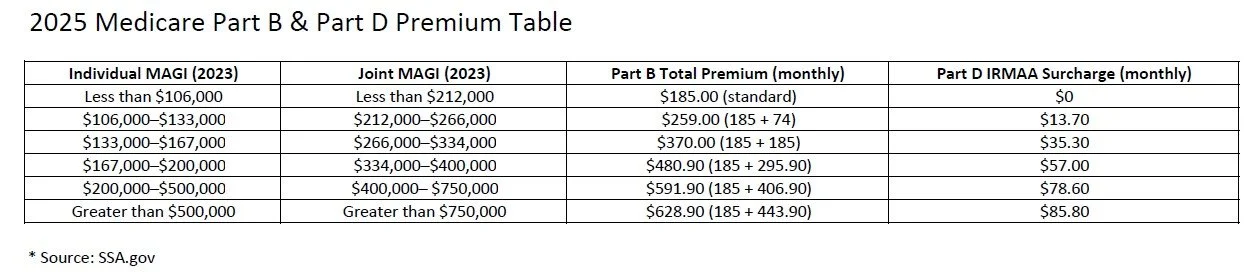

Medicare Premiums Are Income-Based (IRMAA)

Medicare Part B (covering medical services, outpatient care, durable medical equipment, and more) and Part D (prescription drug coverage) premiums are adjusted based on your Modified Adjusted Gross Income (MAGI) from two years prior. This is known as the Income‑Related Monthly Adjustment Amount (IRMAA).

For 2025, premiums are determined using your 2023 MAGI.

Here’s a summarized 2025 IRMAA table for Part B and Part D:

Appealing IRMAA Premiums

If your income has changed significantly due to a qualifying event (and yet Medicare is still charging higher premiums based on your 2023 income), you can appeal using Form SSA‑44, titled “Medicare Income‑Related Monthly Adjustment Amount – Life‑Changing Event.”

The Appeal Form You Must Submit

To initiate the process, you'll complete Form SSA‑44 and submit it to the Social Security Administration (SSA). On the form, you’ll:

Indicate your qualifying life-changing event.

Provide documentation to support your reduced income.

Request recalculation of your Medicare premiums based on your new financial situation.

Qualifying Life-Changing Events

Appeal eligibility hinges on experiencing specific life-changing events, such as:

Retirement (work stoppage or reduction)

Death of a spouse

Divorce or annulment

Loss of income-producing property (beyond your control)

Loss or reduction of pension income

Certain employer settlement payouts

Common Scenarios That Do Not Qualify

Not all income changes are appealable. Examples that typically do not qualify include:

One-time sale of investment / real estate resulting in a capital gain

Large distributions from IRAs

Severance payments

Inheritance distributions

Roth IRA conversions

These changes don’t typically meet SSA’s definition of life-changing events.

The Two-Year Look-Back Period

Remember: Medicare bases IRMAA on your MAGI from two years ago.

2025 premiums rely on your 2023 income

2026 premiums will use your 2024 income, and so forth

How Reimbursement Works After an Approved Appeal

Once your appeal is approved:

SSA will recalculate your premiums based on your current income.

Any excess premiums you've already paid will be reimbursed—typically via direct deposit (if your Social Security benefit is direct-deposited) or a mailed check.

Future premiums will reflect the lower, recalculated amount automatically—so you pay less going forward.

Final Thoughts

This is a proactive process that requires the income appeal form to be submitted; without it, retirees could end up paying thousands of dollars in higher Medicare premiums that could otherwise have been avoided.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What is IRMAA, and how does it affect Medicare premiums?

IRMAA stands for Income-Related Monthly Adjustment Amount. It’s an additional charge added to Medicare Part B and Part D premiums for higher-income individuals. The Social Security Administration bases IRMAA on your Modified Adjusted Gross Income (MAGI) from two years prior.

How does income determine Medicare premiums?

Medicare uses your MAGI reported on your tax return from two years ago to set your current premiums. For example, your 2025 premiums are based on your 2023 income. As income rises, IRMAA surcharges are added in tiers to standard Medicare costs.

Can you appeal your Medicare premiums if your income has dropped?

Yes. If your income has fallen due to a life-changing event—such as retirement, marriage, divorce, or the loss of a spouse—you can request a reduction in your IRMAA charges by filing an appeal with the Social Security Administration.

How do you file a Medicare income appeal?

You can submit Form SSA-44, “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event,” along with documentation supporting your income reduction. The SSA reviews your request and may adjust your premiums based on your current financial situation.

What qualifies as a life-changing event for an IRMAA appeal?

Common qualifying events include retirement, loss of employment or income, marriage, divorce, or the death of a spouse. The event must have significantly reduced your income compared to the amount used to calculate your current premiums.

How long does it take for an IRMAA adjustment to take effect?

If your appeal is approved, the adjustment typically applies to future premiums within one to two billing cycles. You may also receive a refund if you’ve already overpaid based on outdated income information.

Why is it important to review your Medicare premiums each year?

Since IRMAA is based on prior-year tax data, your premiums may not always reflect your current income level. Reviewing your Medicare costs annually ensures you’re not overpaying and helps identify whether you qualify for an appeal.

Should You Withhold Taxes from Your Social Security Benefit?

Social Security benefits can be taxable at the federal level—and in some states. Should you withhold taxes directly from your benefit or make quarterly estimated payments? This guide explains your options, deadlines, and strategies to avoid IRS penalties.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

For many retirees, Social Security is a cornerstone of their retirement income. But what sometimes comes as a surprise is that Social Security benefits can be subject to federal income tax—and in a few cases, state income tax as well. This raises an important planning question: should you withhold taxes directly from your Social Security benefit, or handle them another way?

Let’s walk through the key considerations.

Social Security Withholding Options

The Social Security Administration (SSA) allows you to elect to have federal income taxes withheld directly from your monthly benefit. Unlike wages, where you can set a specific withholding percentage, Social Security offers fixed percentage options:

7%

10%

12%

22%

These percentages are applied to your total monthly benefit, and the withheld amount is sent directly to the IRS. This system is called voluntary withholding, and it can be a convenient way to avoid unexpected tax bills at the end of the year.

How Social Security Is Taxed at the Federal Level

Whether or not your Social Security benefit is taxable depends on your provisional income, which includes:

Your adjusted gross income (AGI), plus

Any tax-exempt interest, plus

50% of your Social Security benefits

Depending on your filing status and income level:

Single filers: If provisional income is between $25,000 and $34,000, up to 50% of your Social Security is taxable. Above $34,000, up to 85% of benefits may be taxable.

Married filing jointly: If provisional income is between $32,000 and $44,000, up to 50% of benefits are taxable. Above $44,000, up to 85% of benefits may be taxable.

It’s important to note that no one pays tax on more than 85% of their Social Security benefit.

State Taxation of Social Security

Most states do not tax Social Security benefits. However, as of now, 12 states do tax Social Security in some form:

Colorado

Connecticut

Kansas

Minnesota

Montana

Nebraska

New Mexico

Rhode Island

Utah

Vermont

West Virginia

Wisconsin

Each state has its own rules, income thresholds, and exemptions, so the actual impact can vary significantly.

What If You Don’t Withhold? Estimated Tax Payments

If you choose not to have taxes withheld from your Social Security benefits, you may need to make quarterly estimated tax payments to the IRS. These payments cover your expected federal tax liability and prevent penalties.

The deadlines for estimated tax payments are:

April 15 – for income earned January 1 through March 31

June 15 – for income earned April 1 through May 31

September 15 – for income earned June 1 through August 31

January 15 (of the following year) – for income earned September 1 through December 31

How to Elect Withholding from Your Social Security Benefit

You can elect to have taxes withheld from your Social Security in two ways:

Online – Log into your my Social Security account and update your withholding preferences electronically.

Paper Form – Complete IRS Form W-4V (Voluntary Withholding Request) and mail it to your local Social Security office.

Once processed, your elected withholding percentage will be applied to each monthly benefit.

IRS Penalties for Not Withholding or Paying Estimated Taxes

If you fail to withhold taxes or make sufficient estimated tax payments, the IRS may assess underpayment penalties. These penalties are essentially interest charges, calculated on the unpaid balance for each quarter you were short.

The penalty is based on:

The amount underpaid, and

The length of time the payment was late

The interest rate is tied to the federal short-term interest rate plus 3% and is adjusted quarterly.

For retirees living on fixed income, these penalties can feel like an unnecessary burden. Electing withholding or staying current with estimated payments can help avoid these surprises.

Final Thoughts

For many retirees, setting up withholding directly from Social Security benefits is the easiest way to stay on top of taxes. It provides peace of mind, ensures compliance, and avoids the hassle of quarterly estimated payments.

However, every situation is unique. The decision should factor in your other sources of income, state tax laws, and overall tax bracket.

Working with a financial planner or tax professional can help determine whether withholding, estimated payments, or a combination of both makes the most sense for you.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

Are Social Security benefits taxable?

Depending on your total income, up to 85% of your Social Security benefits may be subject to federal income tax. The amount taxed is based on your provisional income—which includes your adjusted gross income, tax-exempt interest, and half of your Social Security benefits.

How can I have taxes withheld from my Social Security benefits?

You can elect voluntary withholding through the Social Security Administration. Fixed percentages of 7%, 10%, 12%, or 22% can be withheld from each monthly payment and sent directly to the IRS to cover your federal tax liability.

How do I request tax withholding from my Social Security payments?

You can make the election online through your my Social Security account or by filing IRS Form W-4V (Voluntary Withholding Request) with your local Social Security office. Once processed, the withholding percentage applies automatically to future payments.

Which states tax Social Security benefits?

Most states do not tax Social Security, but a handful—including Colorado, Kansas, Minnesota, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont, West Virginia, Wisconsin, and Connecticut—do in some form. Rules and exemptions vary by state.

What happens if I don’t withhold taxes from my Social Security income?

If you choose not to withhold, you may need to make quarterly estimated tax payments to the IRS. Missing these payments or paying too little can result in underpayment penalties and interest charges.

When are quarterly estimated tax payments due?

Estimated payments are typically due on April 15, June 15, September 15, and January 15 of the following year. These payments cover taxes owed on income not subject to withholding, including Social Security, pensions, and investment income.

How can retirees avoid IRS underpayment penalties?

Setting up withholding directly from Social Security benefits is often the easiest option. Alternatively, retirees can work with a tax professional to estimate their annual tax liability and adjust quarterly payments accordingly to avoid penalties.

Understanding Self-Employment Tax: A Guide for the Newly Self-Employed

Self-employment taxes can catch new business owners off guard. Our step-by-step guide explains the 15.3% tax rate, quarterly deadlines, and strategies to avoid costly mistakes.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

Becoming self-employed can be one of the most rewarding career moves you’ll ever make. It comes with flexibility, independence, and the ability to control your own destiny. But it also comes with new responsibilities—particularly when it comes to taxes. One of the first financial hurdles new business owners encounter is understanding self-employment tax and how to keep up with their tax obligations throughout the year.

For business owners learning these rules for the first time, here is the step-by-step breakdown of what you need to know.

What Is Self-Employment Tax?

When you work as an employee and receive a W-2, your employer withholds Social Security and Medicare taxes from your paycheck. What many don’t realize is that your employer is paying half of those taxes on your behalf.

When you’re self-employed, however, you are both the employer and the employee. That means you’re responsible for the full 15.3% self-employment tax (12.4% for Social Security and 2.9% for Medicare) on your net earnings. If your income is above certain thresholds, an additional 0.9% Medicare surtax may apply.

This tax is in addition to federal and state income taxes, which makes planning ahead critical.

Estimated Tax Payments and Deadlines

Unlike W-2 employees, there’s no paycheck system automatically sending taxes to the government for you. The IRS expects you to make quarterly estimated tax payments. These payments cover both your income tax liability and your self-employment tax.

The deadlines for estimated tax payments are:

April 15 – for income earned January 1 through March 31

June 15 – for income earned April 1 through May 31

September 15 – for income earned June 1 through August 31

January 15 (of the following year) – for income earned September 1 through December 31

If the due date falls on a weekend or holiday, the deadline shifts to the next business day.

How Are Estimated Taxes Calculated?

The IRS gives you two main methods for calculating estimated taxes, sometimes called the “safe harbor” rules:

Prior-Year Method (110% Rule)

If your adjusted gross income was more than $150,000 in the previous year (or $75,000 if single), you can avoid penalties by paying 110% of your prior year’s total tax liability in equal quarterly installments.

If your income was below those thresholds, the requirement is 100% of your prior year’s tax liability.

Current-Year Method

Alternatively, you can calculate your actual expected tax liability for the current year and make payments to cover 90% of that amount.

What Happens If You Don’t Pay Estimated Taxes?

Failing to make estimated tax payments can lead to IRS penalties. These are generally underpayment penalties, calculated based on the amount you should have paid each quarter compared to what you actually paid.

In addition to penalties, you’ll still owe the unpaid taxes at year-end. This often creates a cash flow crisis for new self-employed individuals who didn’t set money aside during the year.

The IRS does offer some relief if:

You owe less than $1,000 in tax after subtracting withholding and credits, or

You paid at least 90% of your current-year tax liability (or 100%/110% of your prior year’s tax liability, depending on income).

Still, the safest strategy is to set aside a portion of each payment you receive for taxes and make your estimated payments on time.

How IRS Penalties Are Calculated?

The IRS calculates underpayment penalties using two key components:

Amount of Underpayment – The penalty is based on how much you should have paid each quarter versus how much you actually paid.

Time Period of Underpayment – The penalty is essentially interest charged on the shortfall, starting from the due date of the missed payment until the date you make it.

The interest rate used is tied to the federal short-term interest rate plus 3%. This rate changes quarterly, so the penalty amount can vary depending on when the shortfall occurred.

For example:

If you owed $4,000 in estimated payments for a quarter but only paid $2,000, the IRS considers the $2,000 shortfall late.

Interest is charged daily on the unpaid portion until you make up the difference or file your return.

While penalties may seem small at first, they add up quickly—especially if you consistently underpay throughout the year.

Why Taxes Become More Complex When You’re Self-Employed

For most W-2 employees, tax filing is relatively straightforward—gather a W-2 or two, maybe add a few deductions, and you’re done. For the self-employed, the process quickly becomes more involved:

Tracking business expenses for deductions (supplies, mileage, home office, etc.).

Paying both sides of Social Security and Medicare taxes.

Dealing with quarterly estimated payments.

Understanding rules around depreciation, retirement plan contributions, and health insurance deductions.

Because of these added layers, we strongly recommend engaging an experienced accounting firm or tax professional, especially in your first few years. This not only ensures compliance but also frees up your time to focus on building your business instead of spending evenings trying to interpret the tax code.

Final Thoughts

Transitioning from employee to self-employed entrepreneur comes with an exciting new level of independence—but it also requires discipline. Understanding self-employment tax, staying on top of quarterly estimated payments, and planning ahead for income tax can help you avoid costly surprises at year-end.

Working with a qualified tax professional or financial planner can help you estimate payments accurately, maximize deductions, and keep your business finances running smoothly.

Remember: as a self-employed individual, you are your own payroll department. Treating taxes like a regular business expense is the best way to stay ahead and protect your financial success.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What is self-employment tax, and who has to pay it?

Self-employment tax covers both the employee and employer portions of Social Security and Medicare taxes, totaling 15.3%. Anyone earning $400 or more in net self-employment income must generally pay this tax, in addition to regular income taxes.

How often do self-employed individuals have to pay taxes?

The IRS requires quarterly estimated tax payments to cover both income and self-employment taxes. Payments are typically due April 15, June 15, September 15, and January 15 of the following year.

How can I calculate my estimated tax payments?

You can use the “safe harbor” rules: pay 100% of your prior year’s tax liability (110% if your income was over $150,000) or 90% of your current year’s expected tax liability. These methods help avoid IRS underpayment penalties.

What happens if I don’t make estimated tax payments?

Missing payments or underpaying can result in IRS penalties and interest, calculated based on how much you underpaid and for how long. Even if penalties apply, you’ll still owe the unpaid taxes at year-end.

How are IRS penalties for underpayment calculated?

Penalties function like interest, accruing daily on any shortfall from the payment due date until it’s paid. The rate is the federal short-term interest rate plus 3%, adjusted quarterly.

Why is tax planning more complex for self-employed individuals?

Self-employed taxpayers must track deductible expenses, manage quarterly payments, pay both sides of payroll taxes, and navigate complex deductions like home office or retirement contributions. Professional guidance can simplify compliance and help maximize deductions.

What’s the best way to stay on top of taxes when self-employed?

Set aside a portion of every payment you receive for taxes, make quarterly estimated payments on time, and work with a tax professional to stay compliant. Treating taxes as a regular business expense helps prevent surprises at year-end.