Child Tax Credit Increased Under the Big Beautiful Tax Bill

The Big Beautiful Tax Bill that just passed includes several targeted tax updates that will impact households beginning in the 2025 tax year. One of the more widely applicable changes is a modest increase to the Child Tax Credit (CTC)—a benefit claimed by millions of families each year.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

The Big Beautiful Tax Bill that just passed includes several targeted tax updates that will impact households beginning in the 2025 tax year. One of the more widely applicable changes is a modest increase to the Child Tax Credit (CTC)—a benefit claimed by millions of families each year.

While the increase is not dramatic, it’s important to understand who qualifies, how the credit works under the updated rules, and how income and immigration status can affect your eligibility. In this article, we break down the new $2,200 Child Tax Credit and what it means for your next few tax seasons.

What’s Changing with the Child Tax Credit?

Starting with the 2025 tax year, the Child Tax Credit increases from $2,000 per child to $2,200 per child under age 17. The credit is partially refundable and continues to be subject to income-based phaseouts.

Here’s a snapshot of the updated rules:

SSN Requirement Still Applies — Mixed-Status Families Blocked

One of the more controversial aspects of the bill is the continued requirement that both the parent (taxpayer) and each qualifying child must have a valid Social Security number (SSN) to claim the credit.

This rule effectively excludes mixed-status families—where a child may be a U.S. citizen but one or both parents file taxes using an ITIN (Individual Taxpayer Identification Number). If any family member lacks a valid SSN, the household becomes ineligible to claim the credit for that child.

If a child has an ITIN instead of a SSN—even if they’re a dependent on your return—the $2,200 credit is not available.

How the Refundable Portion Works

The refundable part of the Child Tax Credit—currently capped at $1,700 per child—is designed to benefit lower-income families who may not owe enough in federal taxes to use the full $2,200 credit.

In 2025, the refundable portion remains capped at $1,700 per child, but it is now indexed for inflation—meaning it could increase slightly each year going forward. To claim the refundable portion, families must have earned income above a set threshold (currently $2,500), which will also adjust with inflation.

This means that even if your tax liability is zero, you may still receive part of the credit as a refund, depending on your income and number of qualifying children.

Income Phase-Outs: No Change from Previous Law

The Big Beautiful Tax Bill does not change the phase-out thresholds for high-income earners. The Child Tax Credit still begins to phase out at the following Modified Adjusted Gross Income (MAGI) levels:

For every $1,000 your income exceeds the threshold, the credit is reduced by $50.

Example: A married couple with two children and a MAGI of $420,000 would see their credit reduced by $1,000 total ($50 × 20 = $1,000), leaving them with a remaining $3,400 in credit ($2,200 × 2 − $1,000).

Additional Child Tax Credit for Non-Filers

For individuals or families that don’t owe any federal tax or own less than the maximum credit amount, they may be able to get a partial refund of the credit by claiming the Additional Child Tax Credit (ACTC) but it’s requires a “phase-in calculation”. To determine the credit amount available for each child, the IRS multiplies your earned income amount over $2,500 by 15%. You can claim that amount for each eligible child.

For example, if a parents income is $10,000, the formula is:

$10,000 - $2,500 = $7,500

$7,500 x 15% = $1,125 Credit Per Child

If this calculated amount is less than the full $1,700 refundable amount, you would receive this lower amount per child. But in either case, the refundable amount per child is never greater than $1,700.

Planning Tips for Maximizing the Child Tax Credit

If your family qualifies, here are a few ways to maximize your tax benefit:

1. Ensure All Dependents Have Valid SSNs

If your child is a newborn, make sure to apply for their Social Security number as early as possible. No SSN = no credit.

2. Be Aware of Income Thresholds

If you're nearing the phase-out thresholds, consider strategies to reduce your taxable income, such as:

Maxing out 401(k) or traditional IRA contributions

Contributing to a Health Savings Account (HSA)

Deferring end-of-year bonuses if possible

3. Track Refundability Rules

Even if your income is modest, you can still benefit from the refundable portion. Ensure you have earned income and are filing correctly to take advantage.

Effective Date: 2025 Tax Year

All the changes to the Child Tax Credit go into effect for the 2025 tax year and are scheduled to remain in place through 2028, unless Congress acts to extend or modify the provisions before then.

Final Thoughts

While the increase from $2,000 to $2,200 may not be groundbreaking, it still represents additional tax relief for millions of families.

As always, the key to getting the most out of the Child Tax Credit is making sure your documentation is in order, understanding the income thresholds, and coordinating your year-end tax planning to align with these updated rules.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the new Child Tax Credit amount under the Big Beautiful Tax Bill?

Starting with the 2025 tax year, the Child Tax Credit increases from $2,000 to $2,200 per qualifying child under age 17. The credit remains partially refundable, allowing eligible families to receive up to $1,700 per child even if they owe little or no federal income tax.

When do the new Child Tax Credit rules take effect?

The updated Child Tax Credit applies to the 2025 through 2028 tax years. Unless Congress takes further action, the provisions are set to expire after 2028.

Who qualifies for the $2,200 Child Tax Credit?

To qualify, both the taxpayer and the child must have valid Social Security numbers (SSNs), and the child must be under age 17 at the end of the tax year. The credit begins to phase out at higher income levels.

What are the income limits for the Child Tax Credit?

The phase-out thresholds remain unchanged:

$400,000 for married couples filing jointly

$200,000 for single filers and heads of household

The credit is reduced by $50 for every $1,000 of income above these thresholds.

Can families with ITINs claim the Child Tax Credit?

No. Under the new law, both the parent and each qualifying child must have a valid SSN. Families filing with ITINs (Individual Taxpayer Identification Numbers) are not eligible for the $2,200 credit. This rule also excludes mixed-status families where one or both parents lack SSNs.

How does the refundable portion of the Child Tax Credit work?

The refundable portion, known as the Additional Child Tax Credit (ACTC), allows families with earned income over $2,500 to receive a refund even if they owe no tax. The refundable amount equals 15% of earned income over $2,500, up to $1,700 per child (indexed for inflation).

Example:

If you earn $10,000 in 2025, the refundable credit is:

($10,000 − $2,500) × 15% = $1,125 per child

How can I maximize the Child Tax Credit?

Make sure each qualifying child has an SSN before filing.

Manage your income to stay below the phase-out thresholds—contributing to retirement accounts or HSAs can help.

If eligible, claim the refundable portion by reporting earned income above $2,500.

Why are mixed-status families excluded from the Child Tax Credit?

Congress maintained the SSN requirement from prior law to limit eligibility to taxpayers and children who both have valid Social Security numbers. Families where a child or parent files with an ITIN are not eligible for the credit.

Will the Child Tax Credit increase again after 2028?

As written, the $2,200 credit and related rules are temporary. The credit is scheduled to revert to prior levels in 2029, unless new legislation extends or modifies it.

New Auto Loan Interest Deduction Under the Big Beautiful Tax Bill: What You Need to Know

The recently passed Big Beautiful Tax Bill introduced a series of attention-grabbing tax changes but one provision could directly benefit millions of Americans is the creation of a new tax deduction for auto loan interest.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

The recently passed Big Beautiful Tax Bill introduced a series of attention-grabbing tax changes but one provision could directly benefit millions of Americans is the creation of a new tax deduction for auto loan interest.

For the first time in decades, personal auto loan interest is partially deductible—but it’s not as simple as deducting any old car payment. This provision comes with strict qualifications for both the vehicle and the borrower, and the clock is already ticking, as it’s only available from 2025 through 2028.

In this article, we’ll walk through the key features of the deduction, qualification criteria, and how to plan for this new benefit.

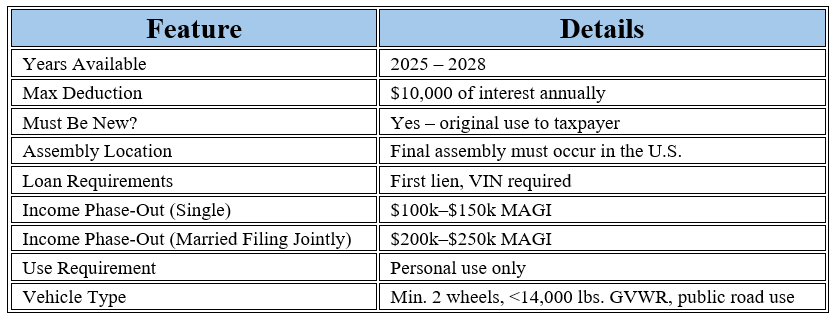

Qualified Passenger Vehicle Loan Interest Deduction

Starting January 1, 2025, taxpayers can deduct interest on certain qualified auto loans—but only if the vehicle and loan meet specific federal criteria.

Here’s what qualifies:

Up to $10,000 per year of interest on a qualifying auto loan can be deducted from your federal income.

Vehicle must be assembled in the United States; final assembly must occur within the U.S.

Only new vehicles—used vehicles do not qualify.

The loan must be secured by a first lien on the vehicle (i.e., the lender has the primary claim if you default).

The vehicle must be for personal use only; commercial use or fleet vehicles are excluded.

A valid Vehicle Identification Number (VIN) must be reported on your tax return.

This is an above-the-line deduction, meaning you don’t need to itemize to claim it—an important feature for the many taxpayers who now take the standard deduction.

What Passenger Vehicles Qualify?

Not all vehicles are eligible for the deduction. The IRS has laid out clear requirements for what constitutes a qualified passenger vehicle under this provision.

Eligible vehicles include:

Cars, minivans, SUVs, pickup trucks, vans, and motorcycles

Must have a gross vehicle weight rating (GVWR) under 14,000 pounds

Must be treated as a “motor vehicle” under Title II of the Clean Air Act

Final assembly must occur in the United States

Commercial or fleet sales do not qualify—the deduction is strictly for personal-use vehicles

If you're purchasing a vehicle in 2025 or beyond, be sure to check the window sticker or manufacturer's certification to ensure your vehicle meets the final assembly and GVWR requirements.

Income Phase-Outs for High Earners

As with many provisions in the Big Beautiful Tax Bill, the new auto loan interest deduction phases out for higher-income earners based on modified adjusted gross income (MAGI).

Here’s how the phase-out works:

Example:

A single taxpayer with $110,000 in MAGI is $10,000 over the phase-out threshold.

$10,000 ÷ $1,000 = 10 increments

10 × $200 = $2,000 deduction reduction

Since the max deduction is $10,000, that taxpayer would only be able to deduct $8,000 in auto loan interest.

The deduction completely phases out once your MAGI exceeds the threshold by $50,000, meaning:

Single filers earning $150,000 or more

Married couples filing jointly earning $250,000 or more

will not be eligible for this deduction.

Why It Matters

With auto loan rates hovering between 6–9% in today’s environment, the ability to deduct interest—especially up to $10,000 per year—can provide meaningful tax relief for car buyers. For example, if you finance a $50,000 vehicle at 7% interest, you could pay $3,000–$4,000 in interest annually. Deducting that amount directly reduces your taxable income and could save hundreds or even thousands in federal taxes depending on your tax bracket.

Planning Considerations

With interest rates still elevated and vehicle prices remaining high, this new deduction could result in meaningful savings—but only if your loan and income qualify.

Buy New and Verify Final Assembly Location

Used vehicles don’t qualify. You must be the first owner, and the vehicle must be assembled in the U.S.

Structure the Loan Properly

Make sure your loan is a secured first lien—most auto loans are, but personal loans and some alternative financing options might not qualify.

Mind Your Income

If you’re near the income phaseout thresholds, consider strategies to reduce your MAGI—like maxing out traditional retirement accounts or HSA contributions—to stay within range.

Track Interest Separately

Keep detailed records of interest paid. Many lenders provide this info via a year-end statement or IRS Form 1098.

Key Dates and Summary Table

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the new auto loan interest deduction under the Big Beautiful Tax Bill?

Beginning January 1, 2025, taxpayers can deduct up to $10,000 per year in interest paid on qualifying personal auto loans. The deduction is available for new, U.S.-assembled vehicles financed with a first-lien loan and remains in effect through 2028.

Do I need to itemize deductions to claim this benefit?

No. The deduction is classified as an above-the-line deduction, meaning you can claim it even if you take the standard deduction.

Which vehicles qualify for the deduction?

Eligible vehicles must be newly purchased (not used), assembled in the United States, and have a gross vehicle weight rating under 14,000 pounds. Cars, SUVs, pickup trucks, vans, and motorcycles may qualify, provided they are for personal—not commercial—use.

Are used or leased vehicles eligible?

No. Used vehicles, leased vehicles, and vehicles financed through unsecured personal loans do not qualify for the deduction.

What are the income limits for the auto loan interest deduction?

The deduction begins to phase out at modified adjusted gross income (MAGI) of $100,000 for single filers and $200,000 for married couples filing jointly. It is reduced by $200 for every $1,000 of income above these thresholds and fully phases out at $150,000 (single) and $250,000 (joint).

Why does the vehicle’s assembly location matter?

Only vehicles with final assembly in the United States qualify for the deduction. Buyers should confirm the assembly location using the manufacturer’s certification label or the vehicle’s window sticker.

How much can this deduction save the average car buyer?

The potential savings depend on your tax bracket and total interest paid. For example, if you pay $4,000 in interest at a 24% tax rate, the deduction could reduce your federal taxes by roughly $960.

When does the new deduction expire?

The provision is temporary and applies to tax years 2025 through 2028. Unless renewed by Congress, it will expire after December 31, 2028.

What documentation should I keep for my taxes?

Keep your loan agreement showing it is a first-lien secured loan, your lender’s year-end statement or Form 1098 showing total interest paid, and documentation verifying the vehicle’s final assembly location and VIN.

Estate Tax Exemption Raised to $15 Million Under the Big Beautiful Tax Bill: What It Means for Your Estate Plan

The newly enacted “Big Beautiful Tax Bill” includes a wide range of updates to the tax code, but one of the most impactful—and underreported—changes is the significant increase in the federal estate tax exemption. Under the new law, the federal estate tax exemption rises to $15 million per person, or $30 million for married couples with proper planning.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

The newly enacted “Big Beautiful Tax Bill” includes a wide range of updates to the tax code, but one of the most impactful—and underreported—changes is the significant increase in the federal estate tax exemption. Under the new law, the federal estate tax exemption rises to $15 million per person, or $30 million for married couples with proper planning.

This change opens new estate planning opportunities for high-net-worth individuals and families—but it's not as simple as just celebrating the larger exemption. There are still important state-level considerations and planning decisions that need attention.

Let’s walk through what’s changed, what hasn’t, and what you should be doing now to stay ahead.

A Quick Recap: What Is the Estate Tax Exemption?

The estate tax exemption is the amount of an individual's estate that can be passed on to heirs free of federal estate tax. Any amount over the exemption is typically taxed at a flat 40% federal rate.

Before this bill, the federal exemption had been set to sunset at the end of 2025—reverting from its inflation-adjusted ~$13.6 million in 2024 down to about $6 million. But the Big Beautiful Tax Bill not only prevented that sunset, it increased the exemption even further to:

$15 million per individual

$30 million per married couple (with proper portability election)

These new levels apply beginning in 2026 and are indexed for inflation going forward.

State Estate Taxes Still Matter

While the federal estate tax exemption is now very generous, it’s critical to remember that many states impose their own estate or inheritance taxes, often with much lower exemption thresholds.

Here are a few examples:

In states like Massachusetts and Oregon, even moderate estates can trigger a significant tax liability. Also, some states (like New York) have cliff provisions where exceeding the exemption by even a small amount can result in estate tax being applied to the entire estate—not just the portion over the threshold.

Bottom line: Even if you’re under the federal exemption, you may still face state-level estate taxes depending on where you live or own property.

What This Means for Your Estate Planning

The increase to a $15 million federal exemption doesn’t mean you should put your estate plan on the shelf. In fact, now may be the perfect time to refine and optimize your estate strategy.

Here’s what to consider:

1. Leverage Gifting Strategies While the Window Is Open

The $15 million exemption opens the door to making significant tax-free gifts. Techniques like spousal lifetime access trusts (SLATs), grantor retained annuity trusts (GRATs), and intentionally defective grantor trusts (IDGTs) may still be appropriate depending on your goals.

2. Don’t Overlook State-Level Planning

Work with your estate planning attorney to structure your estate to reduce or eliminate state estate tax exposure. This might include retitling assets, setting up trusts, or evaluating residency if you're near retirement.

3. Make Sure Your Documents Are Aligned

Many older estate plans were drafted with lower exemption amounts in mind. If your documents still refer to formulas like “credit shelter amount” or “maximum federal exemption,” you could unintentionally disinherit a spouse or fail to make full use of today’s exemption.

4. Portability Still Matters

Married couples should continue to file a federal estate tax return upon the death of the first spouse to elect portability and lock in both exemptions—especially now that we're talking about $30 million per couple.

The Takeaway

The Big Beautiful Tax Bill gives ultra-high-net-worth families a powerful estate tax planning opportunity. But for many, the state estate tax will continue to be a more pressing issue than the federal threshold.

Whether you’re just above the state threshold or pushing into eight-figure net worth territory, the key is proactive, coordinated planning. A well-structured estate plan not only protects wealth from unnecessary taxation but ensures that it’s distributed in alignment with your legacy goals.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the new federal estate tax exemption under the Big Beautiful Tax Bill?

Beginning in 2026, the federal estate tax exemption increases to $15 million per person and $30 million for married couples who elect portability. These amounts will be indexed annually for inflation.

When does the new exemption take effect?

The higher exemption takes effect on January 1, 2026. Until then, the 2024–2025 inflation-adjusted exemption (approximately $13.6 million per person) remains in place.

Wasn’t the federal exemption supposed to decrease in 2026?

Yes. Under prior law, the exemption was scheduled to “sunset” at the end of 2025, reverting to roughly $6 million per person. The Big Beautiful Tax Bill not only prevented that reduction but raised the exemption further to $15 million.

What is the current federal estate tax rate?

Amounts exceeding the exemption are subject to a flat 40% federal estate tax.

Does this change eliminate state-level estate taxes?

No. Many states still impose their own estate or inheritance taxes with much lower exemption limits—often between $1 million and $5 million. States such as Massachusetts, Oregon, and New York have their own rules that can create substantial tax exposure even if you’re below the federal threshold.

How does portability work for married couples?

Portability allows a surviving spouse to use any unused portion of their deceased spouse’s exemption. To take advantage, the estate of the first spouse must file a federal estate tax return (Form 706), even if no federal estate tax is due.

Can I make gifts using the higher exemption before 2026?

The $15 million exemption doesn’t apply until 2026, but you can continue to make gifts under the current (2024–2025) exemption without penalty. If you plan to make large gifts, consider doing so before the law changes to preserve flexibility and confirm how the IRS applies the new thresholds.

How can I reduce or avoid state estate taxes?

Strategies may include establishing or updating trusts, retitling assets, changing residency to a state without estate tax, or leveraging lifetime gifting to reduce your taxable estate. Work with an estate planning attorney familiar with your state’s laws.

Do I need to update my estate planning documents?

Possibly. Older wills and trusts often reference outdated exemption formulas or definitions. Review your plan to ensure it reflects current law and your intentions, especially if it uses terms like “credit shelter trust” or “maximum exemption amount.”

Why is estate planning still important even with a $15 million exemption?

Beyond taxes, estate planning governs how your wealth transfers, protects beneficiaries, and ensures your legacy goals are met. It also addresses incapacity, guardianship, and charitable intentions—issues unaffected by the exemption increase.

Do You Pay More or Less Taxes When You Get Married?

In this article, we break down when couples may face a marriage penalty—and when they might receive a marriage bonus. You'll see side-by-side income examples, learn how the 2026 sunset of the Tax Cuts and Jobs Act could impact your future tax bill, and understand how marriage affects things like IRA eligibility, Social Security taxes, and student loan repayment plans.

Marriage brings about numerous life changes—some personal, some financial. One common question couples ask is whether tying the knot means paying more in taxes. The answer? It depends.

Let’s walk through the key considerations that determine whether you face a marriage bonus or a marriage penalty, how upcoming tax law changes could impact your filing status, and what smart tax planning looks like for married couples.

1. Marriage Bonus vs. Marriage Penalty

The IRS offers special tax brackets and deductions for married couples filing jointly—but whether this works in your favor depends on your income levels.

Marriage Bonus

Occurs when one spouse earns significantly more than the other (or one spouse doesn’t earn at all). Filing jointly often results in a lower combined tax bill compared to filing separately.

Marriage Penalty

Occurs when both spouses earn similar, high incomes. Their combined income may push them into a higher tax bracket faster than if they filed as two single individuals.

The Marriage Bonus and Penalty Have Been Diminished

Since the passing of the Tax Cuts and Jobs Act in 2017, the gap between the married penalty and the marriage bonus has greatly decreased. Said another way, in many cases, when comparing the federal income tax paid by two single filers to what they would pay if they got married and started filing as married filing jointly, the amounts are now fairly similar.

Example:

Couple A: Two people earning $50,000 each, no dependents in 2025

As single filers, they would each pay $4,016 in Federal income tax, resulting in a total of $8,032 between the two of them.

If they were married filing jointly, earning a combined $100,000, their federal tax liability would be $8,032, which is the same exact amount.

Couple B: One person earning $200,000 and the second person earning $50,000

As single filers, they would pay $37,538 and $4,016 in federal income tax, respectively, for a total of $41,554 in taxes paid.

If they were married filing jointly, earning a combined $250,000, their federal tax liability would be $39,076, putting them in the “married bonus” category because they paid $2,478 less as joint filers.

2. 2025/2026 Tax Law Changes

The Tax Cuts and Jobs Act (TCJA) of 2017 temporarily expanded the marriage bonus by adjusting tax brackets so that married filing jointly brackets were nearly double those for single filers. But that could change.

What’s happening in 2026?

Unless Congress acts, the TCJA provisions will sunset at the end of 2025. This means:

Tax brackets may revert to pre-2018 levels

The standard deduction will shrink

The marriage penalty may reappear or worsen for dual earners

A tax bill is moving through Congress to extend or modify these provisions, but the tax bill has yet to pass Congress and reach its final form.

3. Impacts on Other Financial Areas

Marriage affects more than just your tax bracket. Here are other areas where your combined income can matter:

IRAs & Roth IRAs:

Couples with high combined income may be phased out of Roth IRA eligibility or be ineligible for deductible Traditional IRA contributions.Child Tax Credit & Earned Income Tax Credit (EITC):

Phaseouts are based on combined income, which can reduce or eliminate your eligibility even if you previously qualified.Student Loan Repayment:

Income-driven repayment (IDR) plans like REPAYE or SAVE base your payments on combined household income, increasing monthly obligations after marriage.

4. Filing Separately — When Does It Make Sense?

Most married couples file jointly, but there are a few niche cases where filing separately may be beneficial:

One spouse has high medical expenses relative to their income

You’re repaying student loans on an income-driven plan that uses individual income

For a married couple with children, if there is a big deviation in income between the two spouses, the lower-income-earning spouse may qualify for more child-related tax credits and deductions.

One spouse has significant tax liabilities or legal concerns and you want to limit shared responsibility

However, filing separately often disqualifies you from certain credits and deductions, so it’s important to weigh the trade-offs.

5. Tax Planning Tips for Married Couples

Timing Matters:

If you marry on December 31, you’re considered married for the whole tax year. That means your filing status changes for that year, no matter the wedding date.Update Your Withholding:

Adjust your W-4 to avoid under- or over-withholding. The IRS has a helpful Tax Withholding Estimator to guide you.Run a Mock Return:

Use tax software or consult a planner to compare filing jointly vs. separately before submitting your return.

Final Thoughts

Marriage doesn’t automatically mean you’ll pay more in taxes—but it does change the equation. For some, marriage brings a welcome tax break. For others, particularly high earners, it may result in higher taxes and lost deductions.

Strategic tax planning—especially in light of the pending changes to the tax laws—can help minimize surprises and maximize your benefits as a married couple.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Does getting married mean you’ll pay more in taxes?

Not always—it depends on your income levels and how they combine. If one spouse earns significantly more than the other, you may receive a marriage bonus. If both spouses earn similar, high incomes, you may face a marriage penalty because your combined income could push you into a higher tax bracket.

What is the difference between a marriage bonus and a marriage penalty?

A marriage bonus occurs when filing jointly reduces your combined tax liability compared to filing separately as single taxpayers. A penalty occurs when your combined income causes you to pay more tax as a couple than you would have individually.

Did the 2017 Tax Cuts and Jobs Act (TCJA) change the marriage penalty?

Yes. The TCJA largely reduced or eliminated the marriage penalty by aligning joint filer tax brackets to be nearly double those for single filers. However, these provisions are temporary and are set to expire at the end of 2025 unless Congress renews them.

Can marriage affect IRA and Roth IRA contributions?

Yes. Married couples’ combined income is used to determine eligibility for Roth IRA contributions and deductible Traditional IRA contributions. High-income couples may phase out of eligibility due to their joint modified adjusted gross income (MAGI).

How does marriage impact the Child Tax Credit or Earned Income Tax Credit (EITC)?

Both credits are subject to income phaseouts based on combined household income. After marriage, your eligibility could decrease or disappear even if you qualified for these credits individually before.

Will marriage change my student loan repayment plan?

Yes, potentially. Income-driven repayment (IDR) plans such as SAVE or REPAYE often use combined household income to calculate monthly payments, which can increase the payment amount after marriage.

When does it make sense for married couples to file separately?

Filing separately may help when one spouse has high medical expenses relative to income, is repaying student loans under an income-driven plan, or has significant tax liabilities or legal issues. However, filing separately often disqualifies you from valuable deductions and credits, so it’s usually best to compare both scenarios first.

Does timing matter if you get married late in the year?

Yes. The IRS considers you married for the entire year if you are married on December 31. That means your filing status changes for that tax year, even if you married on the last day of December.

What should newly married couples do to adjust their taxes?

Update your W-4 form to reflect your new filing status and income levels, review your estimated tax payments, and consider running a mock return to compare joint versus separate filing options. This helps avoid over- or under-withholding and surprises at tax time.

What’s the best way to minimize taxes as a married couple?

Strategic planning is key. Maximize tax-advantaged savings (like 401(k)s or HSAs), manage income timing, and coordinate deductions. A tax professional can help you determine whether to file jointly or separately and how to prepare for upcoming tax law changes in 2026.

Does Changing Your State of Domicile Allow You To Avoid Paying Capital Gains Tax?

As individuals approach retirement, they often ask the tax question, “If I were to move to a state that has no state income tax in retirement, would it allow me to avoid having to pay capital gains tax on the sale of my investments or a rental property?” The answer depends on a few variables.

As individuals approach retirement, they will often ask the tax question, “If I were to move to a state that has no state income tax in retirement, would it allow me to avoid having to pay capital gains tax on the sale of my investments or a rental property?”. The answer depends on the following variables:

What type of asset did you sell?

When did you sell it?

What are the requirements to change domicile to another state?

Selling A Rental Property

We will start off by looking at the Rental Property sale scenario. If someone owns an investment property in New York and they plan to move to Florida the following year, would it be better to wait to sell the property until after they have officially changed their domicile to Florida to potentially avoid having to pay state income tax on the gain to New York? Or would they have to pay tax to New York either way?

Unfortunately, it is the latter of the two. If you own real estate in a state that has income tax and your property has gone up in value, you’ll have to pay tax on the gain to that state when you sell it—regardless of where you live. When someone pays tax to a state other than their state of domicile, they normally receive a credit for the tax paid to offset any tax owed to their state of domicile and avoid double taxation. But that raises the obvious question: What if the state of domicile has no income tax? What happens to the credit? Answer: it’s lost. In the example of someone domiciled in Florida—a state with no income tax—who sells a property in New York, which does have a state income tax, they would owe tax to New York on the gain. However, because Florida has no income tax, there would be nothing to offset, and the credit for taxes paid to New York is effectively lost.

Selling A Primary Residence

While selling a primary residence follows the real estate rules that we just covered, the one main difference is that there is a large gain exclusion when someone sells their primary residence, that does not apply to investment properties. The gain exclusion amounts are as follows:

Single Filer: $250,000

Married Filing Joint: $500,000

Based on these exclusion amounts, someone filing a joint tax return would have to realize a gain greater than $500,000 before they would owe any tax to the federal or state government when they sell their primary residence. Remember, it’s the gain, not the sales price. If someone purchased a house for $300,000 and sells it for $700,000, there is a $400,000 gain in the property. If they file a joint tax return, the full $400,000 is sheltered from taxation by the primary residence exclusion.

Once the gain exceeds $250,000 for a single filer or $500,000 for a joint filer, then the owner of the house would have to pay tax to the state the house is located in, regardless of their state of domicile at the time of the sale.

Selling Stocks or Investments

If someone has a large unrealized gain in their taxable brokerage account and they are considering moving to a state that has no income tax, they will ask, “If I wait to sell my stock until after I have officially changed my state of domicile, will I avoid having to pay state income tax on the realized gain?” The answer here is “Yes”. This is one of the advantages that investment holdings like stocks, bonds, ETFs, and mutual funds have over real estate investments.

For example, Jen lives in New York and purchased shares of Nvidia a few years back for $10,000, which are now worth $200,000. If she sold the shares now, she would have to pay a flat 15% long-term capital gain at the federal level, and approximately 6% ($11,400) to New York State. However, if Jen plans to move to Florida and waits to sell the Nvidia stock until after she has officially domiciled in Florida, she would still have to pay the 15% long-term capital gains tax to the Feds, but she would completely avoid having to pay tax on the gain to New York State, saving her $11,400 in taxes.

The Timing of The Sale of Stock is Key

When someone changes their state of domicile mid-year, which is most, a line in the sand is drawn from a tax standpoint. For example, if Jen moved from New York to Florida on May 15th, all investment activity between January 1st – May 14th would be taxed in New York, and all investment activity May 15th – December 31st would be taxed (essentially not taxed) in Florida. It’s for this reason that individuals who have taxable investment accounts and are planning to move to a more tax-favorable state within the next few years may be influenced as to when they decide to sell certain investments at a gain within their taxable investment portfolio.

IRA Distribution Taxation

Traditional IRA distributions are taxed at ordinary income tax rates, but the same timing principle applies; any distribution processed prior to the change in domicile would be taxed in their current state, and distributions processed after the change of domicile are taxed or, in some cases, not taxed, in their new state. If Roth conversions in retirement are part of your tax strategy, this is also one of the reasons why individuals will wait until they have become domiciled in the new state before actually processing Roth conversions.

What Are The Requirements To Change Your State of Domicile

The rules for changing your state of domicile are more complex than most people think. It’s not just “I have to be in that state for more than 6 months out of the year.” That may be one of the requirements, but there are many others. So many that we had to write a whole separate article on this topic, which can be found here:

Article: How To Change Your Residency To Another State for Tax Purposes

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Can moving to a state with no income tax help me avoid paying capital gains tax?

It depends on your income picture and the type of assets that you own. If you live in a state now that has income tax but you pay very little state income tax, moving to a state that has no income tax will have a minimal impact. However, if you specific sources of income, such as investment income or taxable income from Roth conversions, moving from a state that has income tax to a state with no income tax can have a meaningful impact.

Do I still owe state tax on the sale of a rental property after moving?

Yes. If you sell a rental property located in a state that imposes income tax, you must pay tax to that state on the gain, regardless of where you live at the time of sale. You receive a credit on the state tax paid to apply against any state tax due in your current state, but if there is no state income tax in your current state of domicile, the credit goes unused.

How is the sale of a primary residence taxed when moving to another state?

You can exclude up to $250,000 in gains if single or $500,000 if married filing jointly when selling your primary residence, provided you meet ownership and use requirements. Any gain above these thresholds is taxable to the state where the property is located, even if you’ve moved to a no-tax state.

Can I avoid state taxes on stock sales by moving before I sell?

Yes. If you wait to sell appreciated investments such as stocks, ETFs, or mutual funds until after establishing domicile in a no-income-tax state, you can avoid state tax on the capital gains. The timing of your move and the sale determines which state has taxing authority.

How does the timing of domicile change affect investment taxation?

When you change residency mid-year, income earned before the move is taxed by your former state, while income earned after is taxed under the new state’s rules. For example, investment gains realized before moving from New York to Florida would be taxed in New York, but gains realized afterward would not be.

Are IRA withdrawals and Roth conversions affected by state residency changes?

Yes. Distributions from traditional IRAs or Roth conversions made before changing residency are taxed in your former state, while those made afterward follow the tax rules of your new domicile. This timing can be strategically used to reduce state income taxes in retirement.

What are the main requirements to change your state of domicile for tax purposes?

Changing domicile involves more than just spending six months in another state. You must establish clear intent and presence — such as changing your driver’s license, voter registration, mailing address, and location of key assets — to prove your new primary residence for tax purposes.

Tax Filing Requirements For Minor Children with Investment Income

When parents gift money to their kids, instead of having the money sit in a savings account, often parents will set up UTMA accounts at an investment firm to generate investment returns in the account that can be used by the child at a future date. Depending on the amount of the investment income, the child may be required to file a tax return.

When parents gift money to their kids, instead of having the money sit in a savings account, often parents will set up a UTMA Account at an investment firm to generate investment returns that can be used by the child at a future date. But if the child is a minor, which is often the case, we have to educate our clients on the following topics:

How UTMA accounts work for minor children

Since the child will have investment income, do they need to file a tax return?

The special standard deduction for dependents

How kiddie tax works (taxed investment income at the parent’s tax rate)

Completed gifts for estate planning

How UTMA Accounts Work

When a parent sets up an investment account for their child, if the child is a minor, they typically set up the accounts as UTMA accounts, which stands for Uniform Transfer to Minors Act. UTMA accounts are established in the social security number of the child, and the parent is typically listed on the account as the “custodian”. As the custodian, the parent has full control over the account until the child reaches the “age of majority”. Once the child reaches the age of majority, the UTMA designation is removed, the account is re-registered into the name of the adult child, and the child now has full control over the account.

Age of Majority Varies State by State for UTMA

While the age of majority varies state by state, the age of majority for UTMA purposes and the age of majority for all other reasons often varies. For most states, the “age of majority” is 18 but the “UTMA age of majority” is 21. That is true for our state: New York. If a parent establishes an UTMA account in New York, the parent has control over the account until the child reaches age 21, then the control of the account must be turned over to their child.

$19,000 Gifting Exclusion Amount

When a parent deposits money to a UTMA account, in the eyes of the IRS, the parent has completed a gift. Even though the parent has control of the minor child’s UTMA account, from that point forward, the assets in the account belong to the child. Parents with larger estates will sometimes include gifting to the kids each year in their estate planning strategy. Each parent can make a gift of $19,000 (2025 Limit) each year ($38K combined) into the child’s UTMA account, and that gift will not count against the parent’s lifetime Federal and State lifetime estate tax exclusion amount.

A parent can contribute more than $19,000 per year to the child’s UTMA account, but a gift tax return may need to be filed in that year. For more information on this topic, see our video:

Video: When You Make Cash Gifts To Your Children, Who Pays The Tax?

When Does The Minor Child Need To File A Tax Return?

For minor children that have investment income from a UTMA account, if they are claimed as a dependent on their parent’s tax return, they will need to file a tax return if their investment income is above $1,350, which is the standard deduction amount for dependents with unearned income in 2025.

For dependent children with investment income over the $1,350 threshold, the investment is taxed at different rates. Here is a quick breakdown of how it works:

$0 - $1,350: Covered by standard deduction. No tax due

1,350 - $2,700: Taxed at the CHILD’s marginal tax rate

$2,700+: Taxed at the PARENT’s marginal tax rate (“Kiddie tax”)

How Does Kiddie Tax Work?

Kiddie tax is a way for the IRS to prevent parents in high-income tax brackets from gifting assets to their kids in an effort to shift the investment income into their child’s lower tax bracket. For children that have unearned income above $2,700, that income is now taxed as if it was earned by the parent, not the child. This applies to dependent children under the age of 18 at the end of the tax year or full-time students younger than 24.

IRS Form 8615 needs to be filed with the child’s tax return, which calculates tax liability on the unearned income above $2,700 based on the parent's tax rate. A tax note here: in these cases, the parent’s tax return has to be completed before the child can file their tax return since the parent’s taxable income is included in the Kiddie tax calculation. In other words, if the parents put their tax return on extension, the child’s tax return will also need to be put on extension.

Unearned vs Earned Income

This article has focused on the unearned income of a child; if the child also has earned income from employment, there are different tax filing rules. The earned income portion of the child’s income can potentially be sheltered by the $15,000 (2025) standard deduction awarded to individual tax filers.

This topic is fully covered in our article: At What Age Does A Child Have To File A Tax Return?

Investment Strategy for Minor Child’s UTMA

Knowing the potential tax implications associated with the UTMA account for your child, there is usually a desire to avoid the Kiddie tax as much as possible. This can often drive the investment strategy within the UTMA account to focus on investment holdings that do not produce a lot of dividends or interest income. It’s also common to try to avoid short-term capital gains within a child’s UTMA account since a large short-term capital gain could be taxed as ordinary income at the parent’s tax rate.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is a UTMA account?

A UTMA, or Uniform Transfers to Minors Act account, allows parents or guardians to invest money for a minor child. The account is opened under the child’s Social Security number, with the parent listed as custodian. The custodian controls the account until the child reaches the age of majority, at which point the child assumes full ownership.

When does a child gain control of their UTMA account?

The age of majority for UTMA accounts varies by state. In most states it is 21, even though the legal age of adulthood may be 18. For example, in New York, the custodian retains control until the child turns 21.

How are contributions to a UTMA account treated for tax purposes?

Contributions to a UTMA account are considered completed gifts. For 2025, the annual gift tax exclusion is $19,000 per parent ($38,000 per couple). Contributions above this amount require the filing of a gift tax return, though gift tax is rarely due unless lifetime gifting exceeds federal estate tax limits.

Does a child with a UTMA account need to file a tax return?

If the child is a dependent and has more than $1,350 in unearned income (dividends, interest, or capital gains) in 2025, they must file a tax return. The first $1,350 is covered by the dependent standard deduction.

How is investment income in a UTMA account taxed?

The first $1,350 of unearned income is tax-free.

The next $1,350 is taxed at the child’s tax rate.

Unearned income above $2,700 is taxed at the parent’s tax rate under the Kiddie Tax rules.

What is the Kiddie Tax?

The Kiddie Tax prevents parents in high tax brackets from shifting income to their children’s lower tax bracket. For dependent children under age 18 (or full-time students under age 24), investment income above $2,700 is taxed at the parent’s marginal rate. IRS Form 8615 must be filed with the child’s tax return to calculate this amount.

What’s the difference between earned and unearned income for a child?

Earned income comes from work (such as a job) and is subject to regular income tax and payroll taxes. Unearned income includes interest, dividends, and capital gains from investments. Earned income may be sheltered by the $15,000 standard deduction in 2025, while unearned income follows the dependent thresholds described above.

How can parents minimize taxes in a child’s UTMA account?

To limit Kiddie Tax exposure, parents often invest UTMA funds in assets that produce little or no taxable income, such as growth-oriented stocks or tax-efficient mutual funds. They may also try to avoid frequent trading to prevent short-term capital gains, which are taxed at higher rates.

Why Do Wealthy Families Set Up Foundations and How Do They Work?

When a business owner sells their business and is looking for a large tax deduction and has charitable intent, a common solution is setting up a private foundation to capture a large tax deduction. In this video, we will cover how foundations work, what is the minimum funding amount, the tax benefits, how the foundation is funded, and more…….

When a business owner sells their business or a corporate executive receives a windfall in W2 compensation, some of these individuals will set up and fund a private foundation to capture a significant tax deduction, and potentially pre-fund their charitable giving for the rest of their lives and beyond. In this video, David Wojeski of the Wojeski Company CPA firm and Michael Ruger of Greenbush Financial Group will be covering the following topics regarding setting up a private foundation:

What is a private foundation

Why do wealthy individuals set up private foundations

What are the tax benefits associated with contributing to a private foundation

Minimum funding amount to start a private foundation

Private foundation vs. Donor Advised Fund vs. Direct Charitable Contributions

Putting family members on the payroll of the foundation

What is the process of setting up a foundation, tax filings, and daily operations

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is a private foundation?

A private foundation is a nonprofit organization typically funded by a single individual, family, or business. It’s designed to support charitable activities, either by making grants to other nonprofits or by conducting its own charitable programs. The foundation is controlled by its founders or appointed board members rather than by the public.

Why do wealthy individuals set up private foundations?

High-net-worth individuals often establish private foundations to create a lasting legacy of charitable giving, maintain control over how funds are distributed, and involve family members in philanthropy. It also allows donors to give strategically over time rather than making one-time gifts to multiple organizations.

What are the tax benefits of contributing to a private foundation?

Contributions to a private foundation are tax-deductible. Assets contributed to the foundation grow tax-free, and donors can make grants to charities in future years while capturing the tax deduction in the year of the initial contribution.

What is the minimum funding amount to start a private foundation?

While there is no legal minimum, some experts recommend starting with at least $1 million to $2 million in assets. This level of funding helps offset administrative, tax filing, and compliance costs associated with running the foundation.

How does a private foundation compare to a Donor Advised Fund or direct charitable giving?

A Donor Advised Fund (DAF) is easier and less expensive to set up and maintain than a private foundation. However, a private foundation offers more control over investment management, grant-making, and governance. Direct charitable contributions are simpler still but provide no long-term control or legacy-building opportunities.

Can family members receive compensation from a private foundation?

Yes. Family members can serve on the foundation’s board or be paid for legitimate services such as administration, accounting, or grant oversight. However, compensation must be reasonable and documented to comply with IRS rules for private foundations.

What is involved in setting up and maintaining a private foundation?

Setting up a foundation involves establishing a nonprofit corporation or trust, applying for IRS tax-exempt status under Section 501(c)(3), and creating bylaws or a governing document. Ongoing operations include annual IRS Form 990-PF filings, distributing at least 5% of assets annually to charitable causes, maintaining proper records, and adhering to self-dealing and investment regulations.

The Huge NYS Tax Credit Available For Donations To The SUNY Impact Foundation

There is a little-known, very lucrative New York State Tax Credit that came into existence within the past few years for individuals who wish to make charitable donations to their SUNY college of choice through the SUNY Impact Foundation. The tax credit is so large that individuals who make a $10,000 donation to the SUNY Impact Foundation can receive a dollar-for-dollar tax credit of $8,500 whether they take the standard deduction or itemize on their tax return. This results in a windfall of cash to pre-selected athletic programs and academic programs by the donor at their SUNY college of choice, with very little true out-of-pocket cost to the donors themselves once the tax credit is factored in.

There is a little-known, very lucrative New York State Tax Credit that came into existence within the past few years for individuals who wish to make charitable donations to their SUNY college of choice through the SUNY Impact Foundation. The tax credit is so large, that individuals who make a $10,000 donation to the SUNY Impact Foundation can receive a dollar-for-dollar tax credit of $8,500 whether they take the standard deduction or itemize on their tax return. This results in a windfall of cash to pre-selected athletic programs and academic programs by the donor at their SUNY college of choice, with very little true out-of-pocket cost to the donors themselves once the tax credit is factored in.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the SUNY Impact Foundation Tax Credit?

The SUNY Impact Foundation Tax Credit is a generous New York State tax incentive that allows individuals to receive a large state tax credit for making a charitable donation to the SUNY Impact Foundation. This program was introduced in recent years to encourage private giving to support SUNY campuses and their programs.

Do you have to itemize deductions to receive the SUNY Impact Foundation tax credit?

No. Donors can claim the full New York State tax credit whether they itemize deductions or take the standard deduction on their tax return. This makes it a valuable opportunity for both high-income and middle-income taxpayers.

Where does the donation go?

All contributions are made through the SUNY Impact Foundation, a statewide nonprofit that supports State University of New York campuses. Donors can designate their gift to specific SUNY colleges or to particular athletic or academic programs at those institutions.

How does the SUNY Impact Foundation benefit SUNY schools?

The foundation channels private donations directly to SUNY institutions, providing extra funding for scholarships, research, athletics, and academic innovation. The tax credit encourages more private giving to supplement public funding for SUNY programs.

Is there a limit on how much you can donate?

The program is capped annually by the state, and only a limited number of donors can participate each year. Interested individuals should contact the SUNY Impact Foundation or their financial advisor early to confirm availability and eligibility.