When Should High-Income Earners Max Out Their Roth 401(k) Instead of Pre-tax 401(k)?

While pre-tax contributions are typically the 401(k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferrals contribution all in Roth dollars and forgo the immediate tax deduction.

While pre-tax contributions are typically the 401(k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferral contributions all in Roth dollars and forgo the immediate tax deduction.

No Income Limits for Roth 401(k)

It’s common for high income earners to think they are not eligible to make Roth deferrals to their 401(k) because their income is too high. However, unlike Roth IRAs that have income limitations for making contributions, Roth 401(k) contributions have no income limitation.

401(k) Deferral Aggregation Limits

In 2025, the employee deferral limits are $23,500 for individuals under the age of 50, $31,000 for individuals aged 50-59 and 64 and older and $34,750 for individuals age 60-63. If your 401(k) plan allows Roth deferrals, the annual limit is the aggregate between both pre-tax and Roth deferrals, meaning you are not allowed to contribute $23,500 pre-tax and then turn around and contribute $23,500 Roth in the same year. It’s a combined limit between the pre-tax and Roth employee deferral sources in the plan.

Scenario 1: Business Owner Has Abnormally Low-Income Year

Business owners from time to time will have a tough year for their business. They may have been making $300,000 or more per year for the past year but then something unexpected happens or they make a big investment in their business that dramatically reduces their income from the business for the year. We counsel these clients to “never waste a bad year for the business”.

Normally, a business owner making over $300,000 per year would be trying to max out their pre-tax deferral to their 401(K) plans in an effort to reduce their tax liability. But, if they are only showing $80,000 this year, placing a married filing joint tax filer in the 12% federal tax bracket, I’ll ask, “When are you ever going to be in a tax bracket below 12%?”. If the answer is “probably never”, then it an opportunity to change the tax plan, max out their Roth deferrals to the 401(k) plan, and realize that income at their abnormally lower rate. Plus, as the Roth source grows, after age 59 ½ they will be able to withdrawal the Roth source ALL tax free including the earnings.

Scenario 2: Change In Employment Status

Whenever there is a change in employment status such as:

Retirement

High income spouse loses a job

Reduction from full-time to part-time employment

Leaving a high paying W2 job to start a business which shows very little income

All these events may present an abnormally low tax year, similar to the business owner that experienced a bad year for the business, that could justify the switch from pre-tax deferrals to Roth deferrals.

The Value of Roth Compounding

I’ll pause for a second to remind readers of the big value of Roth. With pre-tax deferrals, you realize a tax benefit now by avoiding paying federal or state income taxes on those employee deferrals made to your 401(k) plan. However, you must pay tax on those contributions AND the earnings when you take distributions from that account in retirement. The tax liability is not eliminated, just deferred.

Scenario 3: Too Much In Pre-Tax Retirement Accounts Already

When high income earners have been diligently saving in their 401(k) plan for 30 plus years, sometimes they amass huge pre-tax balances in their retirement plans. While that sounds like a good thing, sometimes it can come back to haunt high-income earnings in retirement when they hit their RMD start date. RMD stands for required minimum distribution, and when you reach a specific age, the IRS forces you to begin taking distributions from your pre-tax retirement account whether you need to our not. The IRS wants their income tax on that deferred tax asset.

The RMD start age varies depending on your date of birth but right now the RMD start age ranges from age 73 to age 75. If for example, you have $3,000,000 in a Traditional IRA or pre-tax 401(k) and you turn age 73 in 2025, your RMD for 2025 would be $113,207. That is the amount that you would be forced to withdrawal out of your pre-tax retirement account and pay tax on. In addition to that income, you may also be showing income from social security, investment income, pension, or rental income depending on your financial picture at age 73.

If you are making pre-tax contributions to your retirement now, normally the goal is to take that income off that table now and push it into retirement when you will hopefully be in a lower tax bracket. However, if your pre-tax balances become too large, you may not be in a lower tax bracket in retirement, and if you’re not going to be in a lower tax bracket in retirement, why not switch your contributions to Roth, pay tax on the contributions now, and then you will receive all of the earning tax free since you will now have money in a Roth source.

Scenario 4: Multi-generational Wealth

It’s not uncommon for individuals to engage a financial planner as they approach retirement to map out their distribution plan and verify that they do in fact have enough to retire. Sometimes when we conduct these meetings, the clients find out that not only do they have enough to retire, but they will not need a large portion of their retirement plan assets to live off and will most likely pass it to their kids as inheritance.

Due to the change in the inheritance rules for non-spouse beneficiaries that inherit a pre-tax retirement account, the non-spouse beneficiary now is forced to deplete the entire account balance 10 years after the decedent has passed AND potentially take RMDs during the 10- year period. Not a favorable tax situation for a child or grandchild inheriting a large pre-tax retirement account.

If instead of continuing to amass a larger pre-tax balance in the 401(k) plan, say that high income earner forgoes the tax deduction and begins maxing out their 401K contributions at $31,000 per year to the Roth source. If they retire at age 65, and their life expectancy is age 90, that Roth contribution could experience 25 years of compounding investment returns and when their child or grandchild inherits the account, because it’s a Roth IRA, they are still subject to the 10 year rule, but they can continue to accumulate returns in that Roth IRA for another 10 years after the decedent passes away and then distribute the full account balance ALL TAX FREE. That is super powerful from a tax free accumulate standpoint.

Very few strategies can come close to replicating the value of this multigenerational wealth accumulation strategy.

One more note about this strategy, Roth sources are not subject to RMDs. Unlike pre-tax retirement plans which force the account owner to begin taking distributions at a specific age, Roth accounts do not have an RMD requirement, so the money can stay in the Roth source and continue to compound investment returns.

Scenario 5: Tax Diversification Strategy

The pre-tax vs Roth deferrals strategy is not an all or nothing decision. You are allowed to allocate any combination of pre-tax and Roth deferrals up to the annual contribution limits each year. For example, a high-income earner under the age of 50 could contribute $13,000 pre-tax and $10,500 Roth in 2025 to reach the $23,500 deferral limit.

Remember, the pre-tax strategy assumes that you will be in lower tax bracket in retirement than you are now, but some individuals have the point of view that with the total U.S. government breaking new debt records every year, at some point they are probably going to have to raise the tax rates to begin to pay back our massive government deficit. If someone is making $300,000 and paying a top Fed tax rate of 24%, even if they expect their income to drop in retirement to $180,000, who’s to say the tax rate on $180,000 income in 20 years won’t be above the current 24% rate if the US government needs to generate more tax return to pay back our national debt?

To hedge against this risk, some high-income earnings will elect to make some Roth deferrals now and pay tax at the current tax rate, and if tax rates go up in the future, anything in that Roth source (unless the government changes the rules) will be all tax free.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Can high-income earners make Roth 401(k) contributions?

Yes. Unlike Roth IRAs, Roth 401(k)s have no income limits for eligibility, meaning even high earners can make Roth contributions through their employer’s retirement plan if the plan allows them.

When might it make sense for a high-income earner to choose Roth 401(k) contributions?

Roth contributions can make sense during years of unusually low income or reduced tax brackets — such as a down business year or a job change — since the tax cost of contributing after-tax dollars is lower. These contributions can then grow tax-free for retirement.

How do Roth 401(k) and pre-tax 401(k) contributions differ in taxation?

Pre-tax 401(k) contributions lower taxable income now but are taxed upon withdrawal. Roth 401(k) contributions are made with after-tax dollars, but both contributions and earnings can be withdrawn tax-free in retirement if certain conditions are met.

What happens if you already have large pre-tax retirement balances?

Having too much in pre-tax accounts can lead to large required minimum distributions (RMDs) and higher taxable income in retirement. Switching future contributions to Roth can help balance tax exposure and reduce the impact of RMDs later.

Why might Roth 401(k)s be beneficial for multi-generational wealth planning?

Roth accounts are not subject to RMDs during the account owner’s lifetime and can be passed to heirs who can continue to grow the funds tax-free for up to 10 years. This makes Roth assets a powerful tool for tax-efficient inheritance planning.

Can you combine Roth and pre-tax 401(k) contributions?

Yes. Employees can split their deferrals between Roth and pre-tax sources in any ratio, as long as the combined total does not exceed annual IRS limits. This approach provides tax diversification and flexibility in managing future tax risk.

Why might tax diversification be valuable for retirement planning?

Future tax rates are uncertain, especially given rising government debt levels. Having both pre-tax and Roth sources allows retirees to draw income strategically depending on future tax environments.

Secure Act 2.0: Roth Simple IRA Contributions Beginning in 2023

With the passage of the Secure Act 2.0, for the first time ever, starting in 2023, taxpayers will be allowed to make ROTH contributions to Simple IRAs. Prior to 2023, only pre-tax contributions were allowed to be made to Simple IRA plans.

With the passage of the Secure Act 2.0, for the first time ever, starting in 2023, taxpayers were allowed to make ROTH contributions to Simple IRAs. Prior to 2023, only pre-tax contributions were allowed to be made to Simple IRA plans.

Roth Simple IRAs

So what happens when an employee walks in and asks to start making Roth contributions to their Simple IRA? While the Secure Act 2.0 allows it, the actual ability to make Roth contributions to Simple IRAs is taking more time for the following reasons:

The custodians that provide Simple IRA accounts to employees may need more time to create updated client agreements to include Roth language

Employers may need to decide if they want to allow Roth contributions to their plans and educate their employees on the new options

Employers will need to communicate to their payroll providers that there will be a new deduction source in payroll for these Roth contributions

Employees may need time to consult with their financial advisor, accountant, or plan representative to determine whether they should be making Roth or Pre-tax Contributions to their Simple IRA.

Mandatory or Optional?

Now that the law has passed, if a company sponsors a Simple IRA plan, are they required to offer the Roth contribution option to their employees? It’s not clear. If the Simple IRA Roth option follows the same path as its 401(k) counterpart, then it would be a voluntary election made by the employer to either allow or not allow Roth contributions to the plan.

For companies that sponsor Simple IRA plans, each year, the company is required to distribute Form 5304-Simple to the employees. This form provides employees with information on the following:

• Eligibility requirements

• Employer contributions

• Vesting

• Withdrawals and Rollovers

The IRS will most likely have to create an updated Form 5304-Simple for 2023, which includes the new Roth language. If the Roth election is voluntary, then the 5304-Simple form would most likely include a new section where the company that sponsors the plan would select “yes” or “no” to Roth employee deferrals. We will update this article once the answer is known.

Separate Simple IRA Roth Accounts?

Another big question that we have is whether or not employees that elect the Roth Simple IRA contributions will need to set up a separate account to receive them.

In the 401(k) world, plans have recordkeepers that track the various sources of contributions and the investment earnings associated with each source so the Pre-Tax and Roth contributions can be made to the same account. In the past, Simple IRAs have not required recordkeepers because the Simple IRA account consists of all pre-tax dollars.

Going forward, employees that elect to begin making Roth contributions to their Simple IRA, they may have to set up two separate accounts, one for their Roth balance and the other for their Pre-tax balance. Otherwise, the plans would need some form of recordkeeping services to keep track of the two separate sources of money within an employee’s Simple IRA account.

Simple IRA Contribution Limits

For 2025, the annual contribution limit for employee deferrals to a Simple IRA is the LESSER of:

• 100% of compensation; or

EE Deferral Limit: $16,500 or $17,600 (depending on size of employer)

Regular Age 50 Catch-up Limit: $3,500

Enhanced Age 60 – 63 Catch-up Limit: $5,250

These dollar limits are aggregate for all Pre-tax and Roth deferrals; in other words, you can’t contribute $16,500 in pre-tax deferrals and then an additional $16,500 in Roth deferrals. Similar to 401(k) plans, employees will most likely be able to contribute any combination of Pre-Tax and Roth deferrals up to the annual limit. For example, an employee under age 50 may be able to contribute $10,000 in pre-tax deferrals and $6,500 in Roth deferral to reach the $16,500 limit. *Do you want to add 60-63 rules? (YES – included it above but kept example simple)

Employer Roth Contribution Option

The Secure Act 2.0 also included a provision that allows companies to give their employees the option to receive their EMPLOYER contributions in either Pre-tax or Roth dollars. However, this Roth employer contribution option is only available in “qualified retirement plans” such as 401(k), 403(b), and 457(b) plans. Since a Simple IRA is not a qualified plan, this Roth employer contribution option is not available.

Employee Attraction and Retention

After reading all of this, your first thought might be, what a mess, why would a company voluntarily offer this if it’s such a headache? The answer: employee attraction and retention. Most companies have the same problem right now, finding and retaining high-quality employees. If you can offer a benefit to your employees that your competitors do not, it could mean the difference between a new employee accepting or rejecting your offer.

The Secure Act 2.0 introduced a long list of new features and changes to employer-sponsored retirement plans. These changes are being implemented in phases over the next few years, with some other big changes that started in 2024. The introduction of Roth to Simple IRA plans just happens to be the first of many. Companies that take the time to understand these new options and evaluate whether or not they would add value to their employee benefits package will have a competitive advantage when it comes to attracting and retaining employees.

Other Secure Act 2.0 Articles:

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Can employees now make Roth contributions to Simple IRAs?

Yes. Starting in 2023, the Secure Act 2.0 allows employees to make Roth contributions to Simple IRA plans for the first time. However, many custodians and employers are still updating systems, agreements, and payroll processes to support this new feature.

Are employers required to offer the Roth Simple IRA option?

Not necessarily. The IRS has not yet confirmed whether Roth contributions will be mandatory or optional for employers. If it mirrors 401(k) rules, the decision to allow Roth deferrals will likely be voluntary and indicated on Form 5304-Simple.

Do employees need a separate account for Roth contributions?

Possibly. Because Simple IRAs traditionally hold only pre-tax funds, employees may need to open a second account to receive Roth contributions unless their provider can track Roth and pre-tax sources within the same account.

What are the 2025 Simple IRA contribution limits?

For 2025, employees can defer the lesser of 100% of compensation or $16,500 ($17,600 for larger employers). The standard age 50 catch-up limit is $3,500, and employees aged 60–63 can make enhanced catch-up contributions up to $5,250. These limits apply in total to both pre-tax and Roth deferrals.

Can employer contributions be made as Roth dollars?

No. The Secure Act 2.0 Roth employer contribution option applies only to qualified plans such as 401(k), 403(b), and 457(b). Simple IRAs are not considered qualified plans, so employer contributions remain pre-tax.

Why would an employer offer Roth Simple IRA contributions?

Allowing Roth contributions can make a company’s benefits package more competitive, helping attract and retain high-quality employees. Offering tax-diversified savings options is increasingly viewed as a valuable employee benefit.

Roth Conversions In Retirement

Roth conversions in retirement are becoming a very popular tax strategy. It can help you to realize income at a lower tax rate, reduce your RMD’s, accumulate assets tax free, and pass Roth money onto your beneficiaries. However, there are pros and cons that you need to be aware of, because processing a Roth conversion involves showing more taxable income in a given year. Without proper tax planning, it could lead to unintended financial consequences such as:

· Social Security taxed at a higher rate

· Higher Medicare premiums

· Assets lost to a long term care event

· Higher taxes on long term capital gains

· Losing tax deductions and credits

· Higher property taxes

· Unexpected big tax liability

In this video, Michael Ruger will walk you through some of the strategies that he uses with his clients when implementing Roth Conversions. This can be a very effective wealth building strategy when used correctly.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Beware of the 5 Year Rule for Your Roth Assets

Being able to save money in a Roth account, whether in a company retirement plan or an IRA, has great benefits. You invest money and when you use it during retirement you don't pay taxes on your distributions. But is that always the case? The answer is no. There is an IRS rule that you must take note of known as the "5 Year Rule". There are a number

Beware of the 5 Year Rule for Your Roth Assets

Being able to save money in a Roth account, whether in a company retirement plan or an IRA, has great benefits. You invest money and when you use it during retirement you don't pay taxes on your distributions. But is that always the case? The answer is no. There is an IRS rule that you must take note of known as the "5 Year Rule". There are a number of scenarios where this rule could impact you and rather than getting too much into the weeds, this post is meant to serve as a public service announcement so you are aware it exists.

Advantages of a Roth

As previously mentioned, the benefit of Roth assets is that the account grows tax deferred and if the distributions are "qualified" you don't have to pay taxes. This is compared to a Traditional IRA/401(k) where the full distribution is taxed at ordinary income tax rates and regular investment accounts where you pay taxes on dividends/interest each year and capital gains taxes when you sell holdings. A quick example of Roth vs. Traditional below:

Roth Traditional

Original Investment $ 10,000.00 $ 10,000.00

Earnings $ 10,000.00 $ 10,000.00

Total Account Balance $ 20,000.00 $ 20,000.00

Taxes (Assume 25%) $ - $ 5,000.00

Account Value at Distribution $ 20,000.00 $ 15,000.00

This all seems great, and it is, but there are benefits of both Roth and Traditional (Pre-Tax) accounts so don’t think you have to start moving everything to Roth now. This article gives more detail on the two different types of accounts and may help you decide which is best for you Traditional vs. Roth IRA’s: Differences, Pros, and Cons.

Qualified Disbursements

Note the “occurs at least five years after the year of the employee’s first designated Roth contribution”. This is the “5 Year Rule”. The other qualifications are the same for Traditional IRA’s, but the “5 Year Rule” is special for Roth money. Not always good to be special.

It seems pretty straight forward and in most cases it is. Open a Roth IRA, let it grow at least 5 years, and as long as I’m 59.5 my distributions are qualified. Someone who has Roth money in a 401(k) or other employer sponsored plan may think it is just as easy. That isn’t always the case. Typically, an employee retires, and they roll their retirement savings into a Traditional or a Roth IRA. Say I worked at the company for 10 years, and I now retire and want to use all the savings I’ve created for myself throughout the years. I can start taking qualified distributions from my Roth IRA because I started contributing 10 years ago, correct? Wrong! The time you we’re contributing to the Roth 401(k) is not transferred to the new Roth IRA. If you took distributions directly from the 401(k) and we’re at least 59.5 they would be qualified. In most cases however, people don’t start using their 401(k) money until retirement and most plans only allow for lump sum distributions once you are no longer with the company.

So what do you do?

Open a Roth IRA outside of the plan with a small balance well before you plan to use the money. If I fund a Roth IRA with $100, 10 years from now I retire and roll my Roth 401(k) into that Roth IRA, I have satisfied the 5 year rule because I opened that Roth IRA account 10 years ago. The clock starts on the date the Roth IRA was opened, not the date the assets are transferred in.

About Rob.........

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Can I Use My 401K or IRA To Buy A House?

The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to help toward the down payment on my house?". The short answer is in most cases, "Yes". The next important questions is "Is it a good idea to take a withdrawal from my retirement account for the down

The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to help toward the down payment on my house?". The short answer is in most cases, "Yes". The next important questions is "Is it a good idea to take a withdrawal from my retirement account for the down payment given all of the taxes and penalties that I would have to pay?" This article aims to answer both of those questions and provide you with withdrawal strategies to help you avoid big tax consequences and early withdrawal penalties.

401(k) Withdrawal Options Are Not The Same As IRA's

First you have to acknowledge that different types of retirement accounts have different withdrawal options available. The withdrawal options for a down payment on a house from a 401(k) plan are not the same a the withdrawal options from a Traditional IRA. There is also a difference between Traditional IRA's and Roth IRA's.

401(k) Withdrawal Options

There may be loan or withdrawal options available through your employer sponsored retirement plan. I specifically say "may" because each company's retirement plan is different. You may have all or none of the options available to you that will be presented in this article. It all depends on how your company's 401(k) plan is designed. You can obtain information on your withdrawal options from the plan's Summary Plan Description also referred to as the "SPD".

Taking a 401(k) loan.............

The first option is a 401(k) loan. Some plans allow you to borrow 50% of your vested balance in the plan up to a maximum of $50,000 in a 12 month period. Taking a loan from your 401(k) does not trigger a taxable event and you are not hit with the 10% early withdrawal penalty for being under the age of 59.5. 401(k) loans, like other loans, change interest but you are paying that interest to your own account so it is essentially an interest free loan. Typically 401(k) loans have a maximum duration of 5 years but if the loan is being used toward the purchase of a primary residence, the duration of the loan amortization schedule can be extended beyond 5 years if the plan's loan specifications allow this feature.

Note of caution, when you take a 401(k) loan, loan payments begin immediately after the loan check is received. As a result, your take home pay will be reduced by the amount of the loan payments. Make sure you are able to afford both the 401(k) loan payment and the new mortgage payment before considering this option.

The other withdrawal option within a 401(k) plan, if the plan allows, is a hardship distribution. As financial planners, we strongly recommend against hardship distributions for purposes of accumulating the cash needed for a down payment on your new house. Even though a hardship distribution gives you access to your 401(k) balance while you are still working, you will get hit with taxes and penalties on the amount withdrawn from the plan. Unlike IRA's which waive the 10% early withdrawal penalty for first time homebuyers, this exception is not available in 401(k) plans. When you total up the tax bill and the 10% early withdrawal penalty, the cost of this withdrawal option far outweighs the benefits.

If You Have A Roth IRA.......Read This.....

Roth IRA's can be one of the most advantageous retirement accounts to access for the down payment on a new house. With Roth IRA's, you make after tax contributions to the account, and as long as the account has been in existence for 5 years and you are over the age of 59� all of the earnings are withdrawn from the account 100% tax free. If you withdraw the investment earnings out of the Roth IRA before meeting this criteria, the earnings are taxed as ordinary income and a 10% early withdrawal penalty is assessed on the earnings portion of the account.

What very few people know is if you are under the age of 59� you have the option to withdraw just your after-tax contributions and leave the earnings in your Roth IRA. By doing so, you are able to access cash without taxation or penalty and the earnings portion of your Roth IRA will continue to grow and can be distributed tax free in retirement.

The $10,000 Exclusion From Traditional IRA's.......

Typically if you withdraw money out of your Traditional IRA prior to age 59� you have to pay ordinary income tax and a 10% early withdrawal penalty on the distribution. There are a few exceptions and one of them is the "first time homebuyer" exception. If you are purchasing your first house, you are allowed to withdrawal up to $10,000 from your Traditional IRA and avoid the 10% early withdrawal penalty. You will still have to pay ordinary income tax on the withdrawal but you will avoid the early withdrawal penalty. The $10,000 limit is an individual limit so if you and your spouse both have a traditional IRA, you could potentially withdrawal up to $20,000 penalty free.

Helping your child to buy a house..........

Here is a little known fact. You do not have to be the homebuyer. You can qualify for the early withdrawal exemption if you are helping your spouse, child, grandchild, or parent to buy their first house.

Be careful of the timing rules..........

There is a very important timing rule associated with this exception. The closing must take place within 120 day of the date that the withdrawal is taken from the IRA. If the closing happens after that 120 day window, the full 10% early withdrawal penalty will be assessed. There is also a special rollover rule for the first time homebuyer exemption which provides you with additional time to undo the withdrawal if need be. Typically with IRA's you are only allowed 60 days to put the money back into the IRA to avoid taxation and penalty on the IRA withdrawal. This is called a "60 Day Rollover". However, if you can prove that the money was distributed from the IRA with the intent to be used for a first time home purchase but a delay or cancellation of the closing brought you beyond the 60 day rollover window, the IRS provides first time homebuyers with a 120 window to complete the rollover to avoid tax and penalties on the withdrawal.

Don't Forget About The 60 Day Rollover Option

Another IRA withdrawal strategy that is used as a “bridge solution” is a “60 Day Rollover”. The 60 Day Rollover option is available to anyone with an IRA that has not completed a 60 day rollover within the past 12 months. If you are under the age of 59.5 and take a withdrawal from your IRA but you put the money back into the IRA within 60 days, it’s like the withdrawal never happened. We call it a “bridge solution” because you have to have the cash to put the money back into your IRA within 60 days to avoid the taxes and penalty. We frequently see this solution used when a client is simultaneously buying and selling a house. It’s often the intent that the seller plans to use the proceeds from the sale of their current house for the down payment on their new house. Unfortunately due to the complexity of the closing process, sometimes the closing on the new house will happen prior to the closing on the current house. This puts the homeowner in a cash strapped position because they don’t have the cash to close on the new house.

As long as the closing date on the house that you are selling happens within the 60 day window, you would be able to take a withdrawal from your IRA, use the cash from the IRA withdrawal for the closing on their new house, and then return the money to your IRA within the 60 day period from the house you sold. Unlike the “first time homebuyer” exemption which carries a $10,000 limit, the 60 day rollover does not have a dollar limit.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Tax Secret: Spousal IRAs

Spousal IRA’s are one of the top tax tricks used by financial planners to help married couples reduce their tax bill. Here is how it works:

Spousal IRA’s are one of the top tax tricks used by financial planners to help married couples reduce their tax bill. Here is how it works:

In most cases you need “earned income” to be eligible to make a contribution to an Individual Retirement Account (“IRA”). The contribution limits for 2025 is the lesser of 100% of your AGI or $7,000 for individuals under the age of 50. If you are age 50 or older, you are eligible for the $1,000 catch-up making your limit $8,000.

There is an exception for “Spousal IRAs,” and there are two cases where this strategy works very well.

Case 1: One spouse works and the other spouse does not. The employed spouse is currently maxing out their contributions to their employer-sponsored retirement plan, and they are looking for other ways to reduce their income tax liability.

If the AGI (adjusted gross income) for that couple is below $236,000 in 2025, the employed spouse can make a contribution to a Spousal Traditional IRA up to the $7,000/$8,000 limit even though their spouse had no “earned income”. It should also be noted that a contribution can be made to either a Traditional IRA or Roth IRA but the contributions to the Roth IRA do not reduce the tax liability because they are made with after tax dollars.

Case 2: One spouse is over the age of 70 ½ and still working (part-time or full-time) while the other spouse is retired. IRA rules state that once you are age 70½ or older, you can no longer make contributions to a traditional IRA. However, if you are age 70½ or older BUT your spouse is under the age of 70½, you still can make a pre-tax contribution to a traditional IRA for your spouse.

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Strategies to Save for Retirement with No Company Retirement Plan

The question, “How much do I need to retire?” has become a concern across generations rather than something that only those approaching retirement focus on. We wrote the article, How Much Money Do I Need To Save To Retire?, to help individuals answer this question. This article is meant to help create a strategy to reach that number. More

The question, “How much do I need to retire?” has become a concern across generations rather than something that only those approaching retirement focus on. But what if you, or in the case of married couples, your spouse, are not covered by an employer-sponsored retirement plan? In this article we are going to cover retirement savings strategies for individuals that may not be covered by an employer-sponsored retirement plan.

Married Filing Jointly - One Spouse Covered by Employer Sponsored Plan and is Not Maxing Out

A common strategy we use for clients when a covered spouse is not maxing out their deferrals is to increase the deferrals in the retirement plan and supplement income with the non-covered spouse’s salary. The limits for 401(k) deferrals in 2025 is $23,500 for individuals under 50, $31,000 for individuals 50-59 and 64+ and $34,750 for individuals 60-63. For example, if I am covered and only contribute $8,000 per year to my account and my spouse is not covered but has additional money to save for retirement, I could increase my deferrals up to the plan limits using the amount of additional money we have to save. This strategy is helpful as it allows for easier tracking of retirement accounts and the money is automatically deducted from payroll. Also, if you are contributing pre-tax dollars, this will decrease your tax liability.

Note: Payroll deferrals must be withheld from payroll by 12/31. If you owe money when you file your taxes in April, you would not be able to go back and increase your deferrals in your company plan for that tax year.

Married Filing Jointly - One Spouse Covered by Employer Sponsored Plan and is Maxing Out

If the covered spouse is maxing out at the high limits already, you may be able to save additional pre-tax dollars depending on your Adjusted Gross Income (AGI).

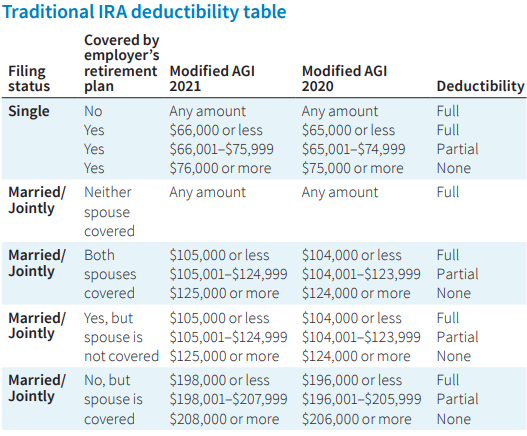

Below is the Traditional IRA Deductibility Table for 2025. This table shows how much individuals or married couples can earn and still deduct IRA contributions from their taxable income.

As shown in the chart, if you are married filing jointly and one spouse is covered, the couple can fully deduct IRA contributions to an account in the covered spouses name if AGI is less than $126,000 and can fully deduct IRA contributions to an account in the non-covered spouses name if AGI is less than $236,000. The Traditional IRA limits for 2025 are $7,000 if under 50 and $8,000 if 50+. These lower limits and income thresholds make contributing to company sponsor plans more attractive in most cases.

Single or Married Filing Jointly and Neither Spouse is Covered

If you (and your spouse if married filing joint) are not covered by an employer sponsored plan, you do not have an income threshold for contributing pre-tax dollars to a Traditional IRA. The only limitations you have relate to the amount you can contribute. These contribution limits for both Traditional and Roth IRA’s are $7,000 if under 50 and $8,000 if 50+. If married filing joint, each spouse can contribute up to these limits.

Unlike employer sponsored plans, your contributions to IRA’s can be made after 12/31 of that tax year as long as the contributions are in before you file your tax return.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

Traditional vs. Roth IRA’s: Differences, Pros, and Cons

Individual Retirement Accounts (IRA’s) are one of the most popular retirement vehicles available for savers and the purpose of this article is to give a general idea of how IRA’s work, explain the differences between Traditional and Roth IRA’s, and provide some pros and cons of each. In January 2015, The Investment Company Institute put out a research

Individual Retirement Accounts (IRA’s) are one of the most popular retirement vehicles available for savers and the purpose of this article is to give a general idea of how IRA’s work, explain the differences between Traditional and Roth IRA’s, and provide some pros and cons of each. In January 2015, The Investment Company Institute put out a research report with some interesting statistics regarding IRA’s which can be found at the following link, ICI Research Perspective. The article states, “In mid-2014, 41.5 million, or 33.7 percent of U.S. households owned at least one type of IRA”. At first I was slightly shocked and asked myself the following question: “If IRA’s are the most important investment vehicle and source of income for most retirees, how do only one third of U.S. households own one?” Then when I took a step back and considered how money gets deposited into these retirement vehicles this figure begins making more sense.

Yes, a lot of American’s will contribute to IRA’s throughout their lifetime whether it is to save for retirement throughout one’s lifetime or each year when the CPA gives you the tax bill and you ask “What can I do to pay less?” When thinking about IRA’s in this way, one third of American’s owning IRA’s is a scary figure and leads one to believe more than half the country is not saving for retirement. This is not necessarily the case. 401(k) plans and other employer sponsored defined contribution plans have become very popular over the last 20 years and rather than individuals opening their own personal IRA’s, they are saving for retirement through their employer sponsored plan.

Employees with access to these employer plans save throughout their working years and then, when they retire, the money in the company retirement account will be rolled into IRA’s. If the money is rolled directly from the company sponsored plan into an IRA, there is likely no tax or penalty as it is going from one retirement account to another. People roll the balance into IRA’s for a number of reasons. These reasons include the point that there is likely more flexibility with IRA’s regarding distributions compared to the company plan, more investment options available, and the retiree would like the money to be managed by an advisor. The IRA’s allow people to draw on their savings to pay for expenses throughout retirement in a way to supplement income that they are no longer receiving through a paycheck.

The process may seem simple but there are important strategies and decisions involved with IRA’s. One of those items is deciding whether a Traditional, Roth or both types of IRA’s are best for you. In this article we will breakdown Traditional and Roth IRA’s which should illustrate why deciding the appropriate vehicle to use can be a very important piece of retirement planning.

Why are they used?

Both Traditional and Roth IRA’s have multiple uses but the most common for each is retirement savings. People will save throughout their lifetime with the goal of having enough money to last in retirement. These savings are what people are referring to when they ask questions like “What is my number?” Savers will contribute to retirement accounts with the intent to earn money through investing. Tax benefits and potential growth is why people will use retirement accounts over regular savings accounts. Retirees have to cover expenses in retirement which are likely greater than the social security checks they receive. Money is pulled from retirement accounts to cover the expenses above what is covered by social security. People are living longer than they have in the past which means the answer to “What is my number?” is becoming larger since the money must last over a greater period.

How much can I contribute?

For both Traditional and Roth IRA’s, the limit in 2021 for individuals under 50 is the lesser of $6,000 or 100% of MAGI and those 50 or older is the lesser of $7,000 or 100% of MAGI. More limit information can be found on the IRS website Retirement Topics - IRA Contribution Limits

What are the important differences between Traditional and Roth?

Taxation

Traditional (Pre-Tax) IRA: Typically people are more familiar with Traditional IRA’s as they’ve been around longer and allow individuals to take income off the table and lower their tax bill while saving. Each year a person contributes to a Pre-Tax IRA, they deduct the contribution amount from the income they received in that tax year. The IRS allows this because they want to encourage people to save for retirement. Not only are people decreasing their tax bill in the year they make the contribution, the earnings of Pre-Tax IRA’s are not taxed until the money is withdrawn from the account. This allows the account to earn more as money is not being taken out for taxes during the accumulation phase. For example, if I have $100 in my account and the account earns 10% this year, I will have $10 of earnings. Since that money is not taxed, my account value will be $110. That $110 will increase more in the following year if the account grows another 10% compared to if taxes were taken out of the gain. When the money is used during retirement, the individual will be taxed on the amount distributed at ordinary income tax rates because the money was never taxed before. A person’s tax rate during retirement is likely to be lower than while they are working because total income for the year will most likely be less. If the account owner takes a distribution prior to 59 ½ (normal retirement age), there will be penalties assessed.

Roth (After-Tax) IRA: The Roth IRA was established by the Taxpayer Relief Act of 1997. Unlike the Traditional IRA, contributions to a Roth IRA are made with money that has already been subject to income tax. The money gets placed in these accounts with the intent of earning interest and then when the money is taken during retirement, there is no taxes due as long as the account has met certain requirements (i.e. has been established for at least 5 years). These accounts are very beneficial to people who are younger or will not need the money for a significant number of years because no tax is paid on all the earnings that the account generates. For example, if I contribute $100 to a Roth IRA and the account becomes $200 in 15 years, I will never pay taxes on the $100 gain the account generated. If the account owner takes a distribution prior to 59 ½ (normal retirement age), there will be penalties assessed on the earnings taken.

Eligibility

Traditional IRA: Due to the benefits the IRS allows with Traditional IRA’s, there are restrictions on who can contribute and receive the tax benefit for these accounts. Below is a chart that shows who is eligible to deduct contributions to a Traditional IRA:

There are also Required Minimum Distributions (RMD’s) associated with Pre-Tax dollars in IRA’s and therefore people cannot contribute to these accounts after the age of 70 ½. Once the account owner turns 70 ½, the IRS forces the individual to start taking distributions each year because the money has never been taxed and the government needs to start receiving revenue from the account. If RMD’s are not taken timely, there will be penalties assessed.

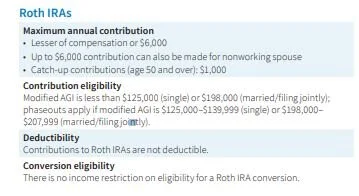

Roth IRA: As long as an individual has earned income, there are only income limitations on who can contribute to Roth IRA’s. The limitations for 2021 are as follows:

There are a number of strategies to get money into Roth IRA’s as a financial planning strategy. This method is explained in our article Backdoor Roth IRA Contribution Strategy.

Investment Strategies

Investment strategies are different for everyone as individuals have different risk tolerances, time horizons, and purposes for these accounts.

That being said, Roth IRA’s are often times invested more aggressively because they are likely the last investment someone touches during retirement or passes on to heirs. A longer time horizon allows one to be more aggressive if the circumstances permit. Accounts that are more aggressive will likely generate higher returns over longer periods. Remember, Roth accounts are meant to generate income that will never be taxed, so in most cases that account should be working for the saver as long as possible. If money is passed onto heirs, the Roth accounts are incredibly valuable as the individual who inherits the account can continue earning interest tax free.

Choosing the correct IRA is an important decision and is often times more complex than people think. Even if you are 30 years from retiring, it is important to consider the benefits of each and consult with a professional for advice.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.