The Risk of Outliving Your Retirement Savings

Living longer is a blessing, but it also means your savings must stretch further. Rising costs, inflation, and healthcare expenses can quietly erode your nest egg. This article explains how to stress-test your retirement plan to ensure your money lasts as long as you do.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

When you imagine retirement, perhaps you see time with family, travel, golf, and more time for your hobbies. What many don’t realize is how two forces—longer lifespans and rising costs—can quietly erode your nest egg while you're still enjoying those moments. Living longer is a blessing, but it means your savings must stretch further. And inflation, especially for healthcare and long-term care, can quietly chip away at your financial comfort over the years. Let’s explore how these factors shape your retirement picture—and what you can do about it.

What you’ll learn in this article:

How life expectancy is evolving, and how it’s increasing the need for more retirement savings

The impact of inflation on a retiree's expenses over the long term

How inflation on specific items like healthcare and long-term care are running at much higher rates than the general rate of inflation

How retirees can test their retirement projections to ensure that they are properly accounting for inflation and life expectancy

How pensions can be both a blessing and a curse

1. Living Longer: A Good But Bad Thing

The Social Security life tables estimate that a 65-year-old male in 2025 is expected to live another 21.6 years (reaching about age 86.6), while a 65-year-old female can expect about 24.1 more years, extending to around 89.1 (ssa.gov).

That has consequences:

If a retiree spends $60,000 per year, a male might need 21.6 × $60,000 = $1,296,000 in total

A female might need 24.1 × $60,000 = $1,446,000

These totals—before considering inflation—highlight how long-term retirement can quickly become a multi-million-dollar endeavor.

2. Inflation: The Silent Retirement Thief

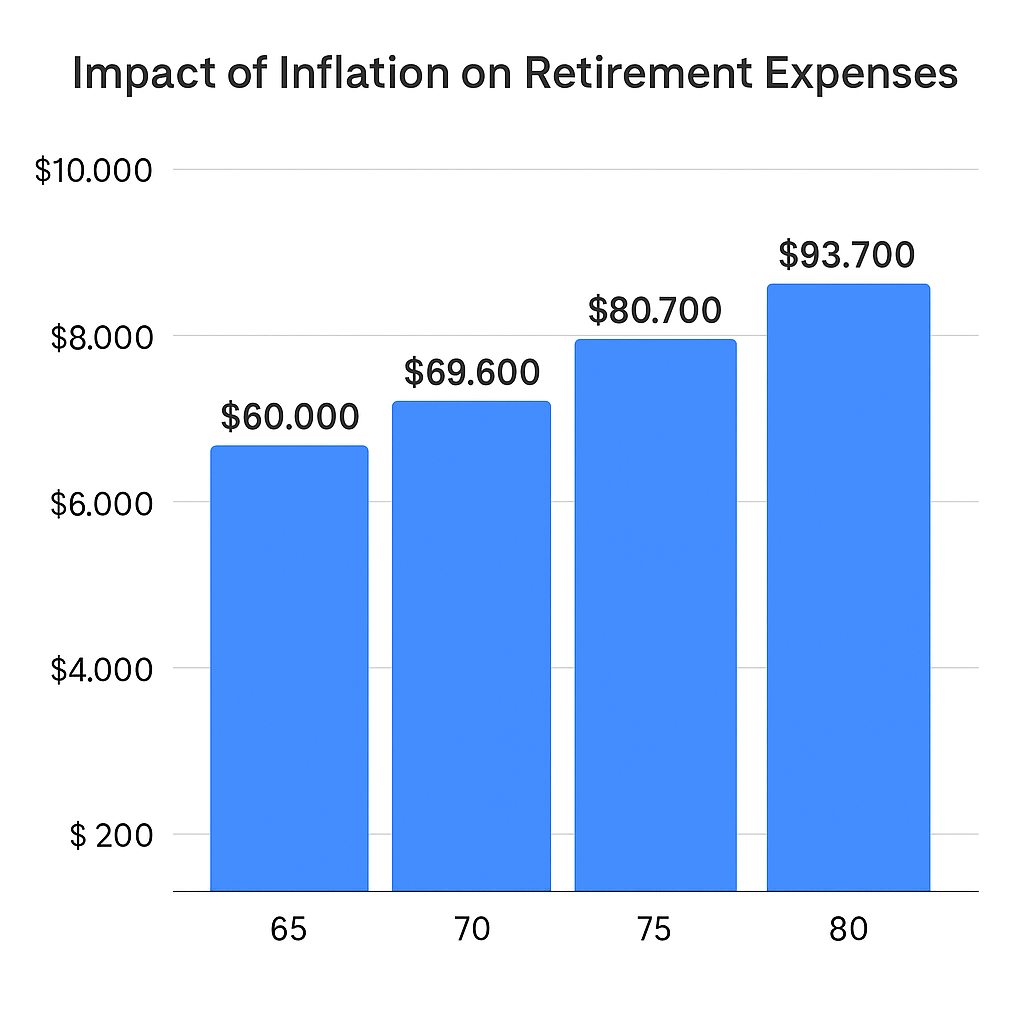

Inflation steadily erodes the real value of money. Over the past 20 years, average annual inflation has held near 3%. Let’s model how inflation reshapes $60,000 in annual after-tax expenses for a 65 year-old retiree over time with a 3% annual increase:

At age 80 (15 years after retirement):

$60,000 × (1.03)^15 ≈ $93,068 per yearAt age 90 (25 years after retirement):

$60,000 × (1.03)^25 ≈ $127,278 per year

In just the first 15 years, this retiree’s annual expenses increased by $33,068 per year, a 55% increase.

3. The Hidden Risk of Relying Too Much on Pensions

One of the most common places retirees feel this pinch is with pensions. Most pensions provide a fixed monthly amount that does not rise meaningfully with inflation. That can create a false sense of security in the early years of retirement.

Example:

A married couple has after-tax expenses of 70,000 per year.

They receive $50,000 from pensions and $30,000 from Social Security.

At retirement, their $80,000 of income in enough to meet their $70,000 in after-tax annual expenses.

Here’s the problem:

The $50,000 pension payment will not increase.

Their expenses, however, will rise with inflation. After 15 years at 3% inflation, those same expenses could total about $109,000 per year.

By then, their combined pension and Social Security will fall well short, forcing them to dip heavily into savings—or cut back their lifestyle.

This illustrates why failing to account for inflation often means retirees “feel fine” at first, only to face an unexpected shortfall 10–15 years later.

4. Healthcare & Long-term Care Expenses

While the general rise in expenses by 3% per year would seem challenging enough, there are two categories of expenses that have been rising by much more than 3% per year for the past decade: healthcare and long-term care. Since healthcare often becomes a large expense for individuals 65 year of age and older, it’s created additional pressure on the retirement funding gap.

Prescription drugs shot up nearly 40% over the past decade, outpacing overall inflation (~32.5%) (nypost.com).

Overall healthcare spending jumped 7.5% from 2022 to 2023, reaching $4.9 trillion—well above historical averages (healthsystemtracker.org).

In-home long-term care is also hefty—median rates for a home health aide have skyrocketed, with 24-hour care nearing $290,000 annually in some cases (wsj.com).

5. The Solution: Projections That Embrace Uncertainty

When retirement may stretch 20+ years, and inflation isn’t uniform across expense categories, guessing leads to risk. A projection-driven strategy helps you:

Model life expectancy: living until age 85 – 95 (depending on family longevity)

Incorporate general inflation (3%) on your expenses within your retirement projections

Determine if you have enough assets to retire comfortably

Whether your plan shows a wide cushion or flags a potential shortfall, you’ll make confident decisions—about savings, investments, expense reduction, or part-time work—instead of crossing your fingers.

6. Working with a Fee-Based Financial Planner Can Help

Here’s the bottom line: Living longer is wonderful, but it demands more planning in the retirement years as inflation, taxes, life expectancy, and long-term care risks continue to create larger funding gaps for retirees.

A fee-based financial planner can help you run personalized retirement projections, taking these variables into account—so you retire with confidence. And if the real world turns out kinder than your model, that's a bonus. If you would like to learn more about our fee-based retirement planning services, please feel free to visit our website at: Greenbush Financial Group – Financial Planning.

Learn more about our financial planning services here.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

How does longer life expectancy affect retirement planning?

People are living well into their 80s and 90s, meaning retirement savings must cover 20–30 years or more. The longer you live, the more years your portfolio must fund, increasing the importance of conservative withdrawal rates and sustainable planning.

Why is inflation such a big risk for retirees?

Inflation steadily raises the cost of living, reducing the purchasing power of fixed income sources like pensions. Even at a modest 3% inflation rate, living expenses can rise more than 50% over 15 years, requiring larger withdrawals from savings.

How does inflation impact pensions and fixed income sources?

Most pensions don’t increase with inflation, so their purchasing power declines over time. A pension that comfortably covers expenses at retirement may fall short within 10–15 years as costs rise, forcing retirees to draw more from savings.

Why are healthcare and long-term care costs such a concern in retirement?

Healthcare and long-term care expenses have been increasing faster than general inflation. Costs for prescriptions, medical services, and in-home care can grow at 5–7% annually, putting additional strain on retirement savings.

How can retirees plan for inflation and longevity risk?

Running detailed retirement projections that factor in inflation, longer life expectancy, and varying rates of return helps reveal whether savings are sufficient. This approach allows retirees to make informed decisions about spending, investing, and lifestyle adjustments.

When should retirees work with a financial planner?

Consulting a fee-based financial planner early in the retirement planning process can help test different inflation and longevity scenarios. A planner can build customized projections and ensure your plan remains flexible as costs and life circumstances evolve.

How Much Money Will You Need to Retire Comfortably?

Retirement planning isn’t just about hitting a number. From withdrawal rates and inflation to taxes and investment returns, several factors determine if your savings will truly last. This article explores how to test your retirement projections and build a plan for financial security.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

As a Certified Financial Planner who runs retirement projections on a daily basis, one of the most common questions I get is: “How much money do I need to retire?”

The answer may surprise you—because there’s no universal number. The amount you’ll need depends largely on one thing: your expenses.

In this article, we’ll walk through:

Why expenses are the biggest driver of how much you need to retire

How inflation impacts retirement spending

Why the type of account you own matters

The importance of factoring in all your income sources

A quick 60-second way to test your own retirement readiness

Expenses: The Biggest Driver

When you ask, “Can I retire comfortably?”, the first question to answer is: How much do you spend each year?

For example:

If your expenses are $40,000 per year, then $500,000 in retirement savings could potentially be enough—especially if you’re supplementing withdrawals with Social Security or a pension.

But if your expenses are $90,000 per year, that same $500,000 likely won’t stretch nearly as far.

Your retirement lifestyle drives your retirement savings need. Someone with modest expenses may not need millions to retire, while someone with higher spending will require significantly more.

Don’t Forget About Inflation

It’s not just today’s expenses you need to plan for—it’s tomorrow’s too. Inflation quietly eats away at your purchasing power, making your cost of living higher every single year.

Here’s an example:

At age 65, your expenses are $60,000 per year.

If expenses rise at 3% annually, by age 80 they’ll be roughly $93,700 per year.

That’s a 50% increase in just 15 years—and you’ll need your retirement assets to keep up.

This is one of the hardest factors for individuals to quantify without financial planning software. Inflation not only increases expenses, but it changes your withdrawal rate from investments, which can impact how long your money lasts.

The Type of Account Matters

Not all retirement accounts are created equal. The type of retirement/investment accounts you own has a big impact on whether you can retire comfortably.

Pre-tax accounts (401k, traditional IRA): Every dollar withdrawn is taxed as ordinary income. A $1,000,000 account might really be worth closer to $700,000 after taxes.

Roth accounts: Withdrawals are tax-free, making these extremely valuable in retirement.

After-tax brokerage accounts: Withdrawals often receive more favorable capital gains treatment, so the tax drag can be lighter compared to pre-tax accounts.

Cash: Offers liquidity but typically earns little return, making it best for short-term expenses.

In short: Roth and after-tax brokerage accounts often provide more after-tax value compared to pre-tax accounts.

Factor in All Your Income Sources

Getting a general idea of your retirement income picture is key. This means adding up:

Social Security benefits

Pensions

Investment income (dividends, interest, etc.)

Part-time income in retirement

Withdrawals from retirement accounts

Once you total these income sources, you’ll need to apply the tax impact. Only then can you compare your after-tax income against your after-tax expenses (adjusted for inflation each year) to see if there’s a gap.

This is exactly how financial planners build retirement projections to determine sustainability.

Find Out If You Can Retire in 60 Seconds

Curious if you’re on track? We’ve built a 60-second retirement check-up that can help you quickly see if you have enough to retire.

Bottom line: There’s no magic retirement number. The amount you need depends on your expenses, inflation, account types, and income sources. By running the numbers—and stress-testing them with a financial planner—you can gain the confidence to know whether you’re truly ready to retire comfortably.

Partner with a Fee-Based Financial Planner to Build Your Retirement Plan

While rules of thumb and calculators can provide a helpful starting point, everyone’s retirement picture looks different. Your income needs, lifestyle goals, and unique financial situation will ultimately determine how much you need to retire comfortably.

Working with a fee-based financial planner can help take the guesswork out of retirement planning. A planner will create a customized strategy that factors in your retirement expenses, investments, Social Security, healthcare, and tax planning—so you know exactly where you stand and what adjustments to make.

If you’d like to explore your own numbers and build a retirement roadmap, we’d love to help. Learn more about our financial planning services here.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

How much money do I need to retire?

There’s no single number that fits everyone—the right amount depends primarily on your annual expenses, lifestyle, and income sources. A retiree spending $40,000 per year will need far less savings than someone spending $90,000.

Why are expenses the most important factor in retirement planning?

Your spending habits determine how much income your portfolio must generate. Knowing your annual expenses helps estimate your withdrawal needs, which directly drives how large your retirement savings must be.

How does inflation affect retirement spending?

Inflation gradually increases the cost of living, reducing the purchasing power of your money. At a 3% inflation rate, $60,000 in annual expenses today could rise to about $94,000 in 15 years, meaning your savings must grow to keep pace.

How does the type of retirement account impact how much you need to save?

Withdrawals from pre-tax accounts like 401(k)s and traditional IRAs are taxable, so you may need to save more to cover taxes. Roth IRAs and brokerage accounts often provide more after-tax value, since withdrawals may be tax-free or taxed at lower rates.

What income sources should I include when estimating retirement readiness?

Include all sources such as Social Security, pensions, dividends, part-time income, and withdrawals from savings. Comparing your total after-tax income against your inflation-adjusted expenses helps reveal whether you’re financially ready to retire.

How can I quickly estimate if I’m on track for retirement?

A simple way is to compare your projected annual expenses (adjusted for inflation) with your expected retirement income. Working with a fee-based financial planner can oftern provide a more comprehensive approach to answering the question “Do I have enough to retire?”

Don’t Gift Your House To Your Children

A common financial mistake that I see people make when attempting to protect their house from a long-term care event is gifting their house to their children. While you may be successful at protecting the house from a Medicaid spend-down situation, you will also inadvertently be handing your children a huge tax liability after you pass away. A tax liability, that with proper planning, could be avoided entirely.

A common financial mistake that I see people make when attempting to protect their house from a long-term care event is gifting their house to their children. While you may be successful at protecting the house from a Medicaid spend-down situation, you will also inadvertently be handing your children a huge tax liability after you pass away. A tax liability, that with proper planning, could be avoided entirely.

Asset Protection Strategy

As individuals enter their retirement years, they become rightfully more concerned about a long-term care event happening at some point in the future. The most recent statistic that I saw stated that “someone turning age 65 today has almost a 70% chance of needing some type of long-term care services at some point in the future” (Source: longtermcare.gov).

Long-term care is expensive, and most states require you to spend down your countable assets until you reach a level where Medicaid starts to pick up the tab. Different states have different rules about the spend-down process. However, there are ways to protect your assets from this Medicaid spend-down process.

In New York, the primary residence is not subject to the spend-down process but Medicaid can place a lien against your estate, so after you pass, they force your beneficiaries to sell the house, so Medicaid can recoup the money that they paid for your long-term care expenses. Since most people would prefer to avoid this situation and have their house passed to their children, they we'll sometimes gift the house to their kids while they're still alive to get it out of their name.

5 Year Look Back Rule

Gifting your house to your kids may be an effective way to protect the primary residence from a Medicaid lien, but this has to be done well before the long-term care event. In New York, Medicaid has a 5-year look back, which means anything that was gifted away 5 years before applying for Medicaid is back on the table for the spend down and Medicaid estate lien. However, if you gift your house to your kids more than 5 years before applying for Medicaid, the house is completely protected.

Tax Gifting Rules

So what’s the problem with this strategy? Answer, taxes. When you gift someone a house, they inherit your cost basis in the property. If you purchased your house 30 years ago for $100,000, you gift it to your children, and then they sell the house after you pass for $500,000; they will have to pay tax on the $400,000 gain in the value of the house. It would be taxed at a long-term capital gains rate, but for someone living in New York, tax liability might be 15% federal plus 7% state tax, resulting in a total tax rate of 22%. Some quick math:

$400,000 gain x 22% Tax Rate = $88,000 Tax Liability

Medicaid Trust Solution

Good news: there is a way to altogether avoid this tax liability to your beneficiaries AND protect your house from a long-term care event by setting up a Grantor Irrevocable Trust (Medicaid Trust) to own your house. With this solution, you establish an Irrevocable Trust to own your house, you gift your house to your trust just like you would gift it to your kids, but when you pass away, your house receives a “step-up in cost basis” prior to it passing to your children. A step-up in cost basis means the cost basis of that asset steps up the asset’s value on the day you pass away.

From the earlier example, you bought your house 30 years ago for $100,000, and you gift it to your Irrevocable Trust; when you pass away, the house is worth $500,000. Since a Grantor Irrevocable Trust owned your house, it passes through your estate, receives a step-up to $500,000, and your children can sell the house the next day and have ZERO tax liability.

The Cost of Setting Up A Medicaid Trust

So why doesn’t every one set up a Medicaid Trust to own their house? Sometimes people are scared away by the cost of setting up the trust. Setting up the trust could cost between $2,000 - $10,000 depending on the trust and estate attorney that you engage to set up your trust. Even though there is a cost to setting up the trust, I always compare that to the cost of not setting up your trust and leaving your beneficiaries with that huge tax liability. In the example we looked at earlier, paying the $3,000 to set up the trust would have saved the kids from having to pay $88,000 in taxes when they sold the house after you passed.

Preserves $500,000 Primary Residence Exclusion

By gifting your house to a grantor irrevocable trust instead of your children, you also preserve the long-term capital gain exclusion allowance if you decide to sell your house at some point in the future. When you sell your primary residence, you are allowed to exclude the following gain from taxation depending on your filing status:

Single Filer: $250,000

Joint Filer: $500,000

If you gift your house to your children and then five years from now, you decide to sell your house for whatever reason while you are still alive, it would trigger a tax event for your kids because they technically own your house, and it’s not their primary residence. By having your house owned by your Grantor Irrevocable Trust, if you were to sell your house, you would be eligible for the primary residence gain exclusion, and the trust could either buy your next house or you could deposit the proceeds to a trust account so the assets never leave the trust and remain protected for the 5-year lookback rule.

How Do Medicaid Trusts Work?

This article was meant to highlight the pitfall of gifting your house to your kids; however, if you would like to learn more about the Medicaid Trust solution and the Medicaid spend down process, please feel free to watch our videos on these topics below:

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Why is gifting your house to your children a mistake for Medicaid planning?

While gifting your home can protect it from Medicaid’s spend-down rules, it also transfers your cost basis to your children. When they sell the property after your death, they may owe significant capital gains taxes on the home’s appreciation—liability that could have been avoided with proper planning.

What is Medicaid’s five-year look-back rule?

Medicaid reviews all asset transfers made within five years prior to applying for benefits. If you gifted your home or other assets during that time, Medicaid may count those transfers against you, delaying eligibility or subjecting the home to a lien for care costs.

How does a Medicaid Trust protect your home and reduce taxes?

A Grantor Irrevocable Trust (commonly called a Medicaid Trust) allows you to transfer ownership of your home while retaining the right to live in it. When you pass away, the home passes through your estate and receives a step-up in cost basis, eliminating capital gains taxes for your heirs while protecting the home from Medicaid recovery.

What is a step-up in cost basis?

A step-up in cost basis resets the home’s taxable value to its fair market value on the date of your death. For example, if you bought your home for $100,000 and it’s worth $500,000 when you die, your heirs’ cost basis becomes $500,000—allowing them to sell it with little or no tax owed.

Can you still use the home sale exclusion with a Medicaid Trust?

Yes. Because a Grantor Irrevocable Trust maintains your tax identity, you retain the $250,000 (single) or $500,000 (married) exclusion on the sale of your primary residence. This benefit is lost if you transfer ownership directly to your children.

What does it cost to set up a Medicaid Trust?

Setting up a Medicaid Trust typically costs between $2,000 and $10,000, depending on the attorney and complexity of your estate. While this is an upfront expense, it often saves families tens of thousands of dollars in future tax liability and asset protection.

Can the trust sell or hold proceeds from the home?

Yes. If the home is sold, the proceeds can remain in the trust or be used to purchase another home, keeping the funds protected under the five-year Medicaid look-back rule. The key is ensuring the sale proceeds never leave the trust’s ownership.

Secure Act 2.0: RMD Start Age Pushed Back to 73 Starting in 2023

On December 23, 2022, Congress passed the Secure Act 2.0, which moved the required minimum distribution (RMD) age from the current age of 72 out to age 73 starting in 2023. They also went one step further and included in the new law bill an automatic increase in the RMD beginning in 2033, extending the RMD start age to 75.

On December 23, 2022, Congress passed the Secure Act 2.0, which moved the required minimum distribution (RMD) age from the current age of 72 out to age 73 starting in 2023. They also went one step further and included in the new law bill an automatic increase in the RMD beginning in 2033, extending the RMD start age to 75.

This is the second time within the past 3 years that Congress has changed the start date for required minimum distributions from IRAs and employer-sponsored retirement plans. Here is the history and the future timeline of the RMD start dates:

1986 – 2019: Age 70½

2020 – 2022: Age 72

2023 – 2032: Age 73

2033+: Age 75

You can also determine your RMD start age based on your birth year:

1950 or Earlier: RMD starts at age 72

1951 – 1959: RMD starts at age 73

1960 or later: RMD starts at age 75

What Is An RMD?

An RMD is a required minimum distribution. Once you hit a certain age, the IRS requires you to start taking a distribution each year from your various retirement accounts (IRA, 401(K), 403(b), Simple IRA, etc.) because they want you to begin paying tax on a portion of your tax-deferred assets whether you need them or not.

What If You Turned Age 72 In 2022?

If you turned age 72 anytime in 2022, the new Secure Act 2.0 does not change the fact that you would have been required to take an RMD for 2022. This is true even if you decided to delay your first RMD until April 1, 2023, for the 2022 tax year.

If you are turning 72 in 2023, under the old rules, you would have been required to take an RMD for 2023; under the new rules, you will not have to take your first RMD until 2024, when you turn age 73.

Planning Opportunities

By pushing the RMD start date from age 72 out to 73, and eventually to 75 in 2033, it creates more tax planning opportunities for individuals that do need to take distributions out of their IRAs to supplement this income. Since these distributions from your retirement account represent taxable income, by delaying that mandatory income could allow individuals the opportunity to process larger Roth conversions during the retirement years, which can be an excellent tax and wealth-building strategy.

Delaying your RMD can also provide you with the following benefits:

Reduce the amount of your Medicare premiums

Reduce the percentage of your social security benefit that is taxed

Make you eligible for tax credits or deductions that you would have phased out of

Potentially allow you to realize a 0% tax rate on long-term capital gains

Continue to keep your pre-tax retirement dollars invested and growing

Additional Secure Act 2.0 Articles

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the new RMD age under the Secure Act 2.0?

Starting in 2023, the required minimum distribution (RMD) age increased from 72 to 73. Beginning in 2033, the RMD age will rise again to 75.

How does the new RMD timeline compare to previous rules?

Before 2020, RMDs began at age 70½. The Secure Act of 2019 moved it to age 72, and Secure Act 2.0 now increases it to age 73 in 2023 and age 75 starting in 2033.

How do you determine your RMD start age based on birth year?

If you were born in 1950 or earlier, your RMD started at 72. Those born between 1951 and 1959 begin at 73, and anyone born in 1960 or later will start at 75.

What if I turned 72 in 2022?

If you reached age 72 in 2022, you are still required to take your first RMD for that tax year, even if you delayed it until April 1, 2023. The new rule applies only to individuals turning 72 in 2023 or later.

What are the benefits of delaying RMDs?

Delaying RMDs can create valuable tax planning opportunities, including the ability to complete larger Roth conversions, reduce taxable income, lower Medicare premiums, and minimize taxes on Social Security benefits.

Can delaying RMDs impact long-term investment growth?

Yes. By postponing mandatory withdrawals, your tax-deferred savings can remain invested and continue to grow, potentially increasing your retirement assets over time.

Turn on Social Security at 62 and Your Minor Children Can Collect The Dependent Benefit

Not many people realize that if you are age 62 or older and have children under the age of 18, your children are eligible to receive social security payments based on your earnings history, and it’s big money. However, social security does not advertise this little know benefit, so you have to know how to apply, the rules, and tax implications.

Not many people realize that if you are age 62 or older and have children under the age of 18, your children are eligible to receive social security payments based on your earnings history, and it’s big money. However, social security does not advertise this little know benefit, so you have to know how to apply, the rules, and tax implications. In this article, I will walk you through the following:

The age limit for your children to be eligible to receive SS benefits

The amount of the payments to your kids

The family maximum benefit calculation

How the benefits are taxed to your children

How to apply for the social security dependent benefits

Pitfall: You may have to give the money back to social security…..

Eligibility Requirements for Dependent Benefits

Three requirements make your children eligible to receive social security payments based on your earnings history:

You have to be age 62 or older

You must have turned on your social security benefit payments

Your child must be unmarried and meet one of the following eligibility requirements:

Under the age of 18

Between the ages of 18 and 19 and a full-time student K – 12

Age 18 or older with a disability that began before age 22

How Much Does Your Child Receive?

If you are 62 or older, you have turned on your social security benefits, and your child meets the criteria above, your child would be eligible to receive 50% of your Full Retirement Age (FRA) Social Security Benefit EVERY YEAR, until they reach age 18. This can sometimes change a parent’s decision to turn on their social security benefit at age 62 instead of waiting until their Full Retirement Age of 67 (for individuals born in 1960 or later). But it gets better because the 50% of your FRA social security benefit is for EACH child.

For example, Jim is retired, age 62, and he has one child under age 18, Josh, who is age 12. If he turns on his social security benefit at age 62, he would receive $1,200 per month, but if he waits until his FRA of 67, he would receive $1,700 per month. Even though Jim would receive a lower social security benefit at age 62, if he turns on his benefit at age 62, Jim and his child Josh would receive the following monthly payments from social security:

Jim: $1,200 ($14,400 per year)

Josh: $850 ($10,200 per year)

Even though Jim receives a reduced SS benefit by turning on his benefit at age 62, the 50% dependent child benefit is still calculated based on Jim’s Full Retirement Age benefit of $1,700. Josh will be eligible to continue to receive monthly payments from social security until the month of his 18th birthday. That’s a lot of money that could go towards college savings, buying a car, or a down payment on their first house.

The Family Maximum Benefit Limit

If you have 10 children, I have bad news; social security imposes a “family maximum benefit limit” for all dependents eligible to collect on your earnings history. The family benefits are limited to 150% to 188% of the parent’s full retirement age benefit.

I’ll explain this via an example. Let’s assume everything is the same as in the previous example with Jim, but now Jim has four children, all under 18. Let’s also assume that Jim’s Family maximum benefit is 150% of his FRA benefit, which would equal a maximum family benefit of $2,550 per month ($1,700 x 150%). We now have the following:

Jim: $1,200

Child 1: $850

Child 2: $850

Child 3: $850

Child 4: $850

If you total up the monthly social security benefits paid to Jim and his children, it equals $4,600, which is $2,050 over the $2,550 family maximum benefit limit.

Always Use Your FRA Benefit In The Family Max Calculation

Here is another important rule to note when calculating the family maximum benefit, regardless of when your file for your social security benefits, age 62, 64, 67, or 70, you always use your Full Retirement Age benefit when calculating the Family Maximum Benefit amount. In the example above, Jim filed for social security benefits early at age 62. Instead of using Jim’s age $1,200 social security benefit to calculate the remaining amount available for his children, Jim has to use his FRA benefit of $1,700 in the formula before determining how much his children are eligible to receive.

Social security would reduce the children’s benefits by an equal amount until their total benefit is reduced to the family maximum limit.

These are the steps:

Jim Max Family Benefit = $1,700 (FRA) x 150% = $2,550

$2,550 (Family Max) - $1,700 (Jim FRA) = $850

Divide $850 by Jim’s 4 eligible children = $212.50 for each child

This results in the following social security benefits paid to Jim and his 4 children:

Jim: $1,200

Child 1: $212.50

Child 2: $212.50

Child 3: $212.50

Child 4: $212.50

A note about ex-spouses, if someone was married for more than 10 years, then got divorced, the ex-spouse may still be entitled to the 50% spousal benefit, but that does not factor into the family maximum calculation, nor is it reduced for any family maximum benefit overages.

Social Security Taxation

Social security payments received by your children are considered taxable income, but that does not necessarily mean that they will owe any tax on the amounts received. Let me explain, your child’s income has to be above a specific threshold before they owe any federal taxes on the social security benefits they receive.

You have to add up all of their regular taxable income and tax-exempt income and then add 50% of the social security benefits that they received. If your child has no other income besides the social security benefits, it’s just 50% of the social security benefits that were paid to them. If that total is below $25,000, they do not have to pay any federal tax on their social security benefit. If it’s above that amount, then a portion of the social security benefits received will be taxable at the federal level.

States have different rules when it comes to taking social security benefits. Most states do not tax social security benefits, but there are about 13 states that assess state taxes on social security benefits in one form or another, but our state New York, is thankfully not one of them.

You Can Still Claim Your Child As A Dependent On Your Tax Return

More good news, even though your child is showing income via the social security payment, you can still claim them as a dependent on your tax return as long as they continue to meet the dependent criteria.

How To Apply For Social Security Dependent Benefits

You cannot apply for your child’s dependent benefits online; you have to apply by calling the Social Security Administration at 800-772-1213 or scheduling an appointment at your local Social Security office.

Be Care of This Pitfall

There is one pitfall to the social security payment received by your child or children, it’s not a pitfall about the money received, but the issue revolves around the titling of the account that the social security benefits are deposited into when they are received on behalf of the child.

The premise behind social security providing these benefits to the minor children of retirees is that if someone retires at age 62 and still has minor children as dependents, they may need additional income to support the household expenses. Whether that is true or not does not prevent you from taking advantage of these dependent payments to your children, but it does raise the issue of the “conserved benefits” letter that many people receive once the child turns age 18.

You may receive a letter from social security once your child is 18 instructing you to return any of the social security dependent payments received on your child’s behalf and saved. So wait, if you save this money for our child to pay for college, you have to hand it back to social security, but if you spend it, you get to keep it? On the surface, the answer is “yes,” but it all depends on who is listed as the account owner that the social security payments are deposited into on behalf of your child.

If the parent is listed as an owner or joint owner of the account, you are expected to return the saved or “conserved” payment to the Social Security Administration. However, if the account that the social security payments are deposited into is owned 100% by your child, you do not have to return the saved money to social security.

Then I will get the question, “Well, what type of account can you set up for a 12-year-old that they own 100%?” Some banks will allow you to set up savings accounts in the name of a child at age 14, UTMA accounts can be set up at any age, and they are considered accounts owned 100% by the child even though a parent is listed as a custodian.

Watch out for the 529 account pitfall. For parents that want to use these Social Security payments to help subsidize college savings, they will sometimes set up a 529 account and deposit the payments into that account to take advantage of the tax benefits. Even though these 529 accounts are set up with the child listed as the beneficiary, they are often considered assets of the parents because the parent has control over the distributions from the account. However, you can set up 529 accounts as UTMA 529, which avoids this issue since the child is now technically the owner and has complete control over the assets at the age of majority.

FAFSA Considerations

Be aware that if your child is college bound and you expect to qualify for need-based financial aid, assets owned by the child count against the FAFSA calculation. The way the calculation works is that about 20% of any assets owned by the child count against the need-based financial aid that is awarded. There is no way around this issue, but it’s not the end of the world because that means 80% of the balance does not count against the FAFSA calculation and it was free money from Social Security that can be used to pay for college.

Social Security Filing Strategy

If you are age 62 or older and have minor children, it may very well make sense to file for Social Security early, even though it may permanently reduce your Social Security benefit once you factor in the Social Security payments that will be made to your children as dependents. But, you have to make sure you understand how Social Security is taxed, the Security earned income penalty, the impact of Social Security survivor benefits for your spouse, and many other factors before making this decision.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Who is eligible for Social Security dependent benefits?

If you are age 62 or older, have turned on your own Social Security retirement benefits, and have unmarried children under 18 (or under 19 and still in high school), your children may qualify for dependent benefits. Children with disabilities that began before age 22 are also eligible.

How much can a child receive in Social Security benefits?

A qualifying child can receive up to 50% of your full retirement age (FRA) benefit amount each year until they turn 18. This is based on your FRA benefit—not the reduced amount if you start collecting early.

What is the family maximum benefit?

Social Security limits the total amount that can be paid to one family to between 150% and 188% of the worker’s FRA benefit. If total family benefits exceed this limit, each child’s payment is reduced proportionally.

Are children’s Social Security benefits taxable?

Yes, but most children won’t owe taxes. If your child’s total income, including 50% of their Social Security benefits, is under $25,000, no federal tax is due. Most states do not tax Social Security benefits, though about 13 states have their own rules.

Can I still claim my child as a dependent on my tax return?

Yes. Even though your child receives Social Security benefits, you can still claim them as a dependent if they meet the IRS dependency criteria.

How do I apply for my child’s benefits?

You cannot apply online. Call the Social Security Administration at 800-772-1213 or schedule an appointment at your local SSA office to apply for dependent benefits.

What happens to the money if it’s saved instead of spent?

If the Social Security payments are deposited into an account owned jointly with the parent, the SSA may require repayment of “conserved” funds once the child turns 18. However, if the payments are deposited into an account owned solely by the child (like a UTMA account), the funds generally do not have to be returned.

How do these benefits affect college financial aid (FAFSA)?

Assets owned by the child—such as those in a UTMA account—count more heavily against financial aid eligibility. About 20% of the child’s assets are included in the FAFSA calculation, but 80% are still excluded.

Should I file for Social Security early to access dependent benefits?

It can make financial sense to claim benefits at 62 if your children qualify for dependent payments, but you should carefully weigh the long-term trade-offs, including reduced personal benefits, taxes, and survivor benefits for your spouse.

Self-Employment Income In Retirement? Use a Solo(k) Plan To Build Wealth

It’s becoming more common for retirees to take on small self-employment gigs in retirement to generate some additional income and to stay mentally active and engaged. But, it should not be overlooked that this is a tremendous wealth-building opportunity if you know the right strategies. There are many, but in this article, we will focus on the “Solo(k) strategy

It’s becoming more common for retirees to take on small self-employment gigs in retirement to generate some additional income and to stay mentally active and engaged. But, it should not be overlooked that this is a tremendous wealth-building opportunity if you know the right strategies. There are many, but in this article, we will focus on the “Solo(k) strategy.”

What Is A Solo(K)

A Solo(k) plan is an employer-sponsored retirement plan that is only allowed to be sponsored by owner-only entities. It works just like a 401(k) plan through a company but without the high costs or administrative hassles. The owner of the business is allowed to make both employee deferrals and employer contributions to the plan.

Solo(k) Deferral Limits

For 2025, a business owner is allowed to contribute employee deferrals up to a maximum of the LESSER of:

100% of compensation; or

$31,000 (Assuming the business owner is age 50+) or

$34,750 (For individuals age 60-63)

Pre-tax vs. Roth Deferrals

Like a regular 401(K) plan, the business owner can contribute those employee deferrals as all pre-tax, all Roth, or some combination of the two. Herein lies the ample wealth-building opportunity. Roth assets can be an effective wealth accumulation tool. Like Roth IRA contributions, Roth Solo(k) Employee Deferrals accumulate tax deferred, and you pay NO TAX on the earnings when you withdraw them as long as the account owner is over 59½ and the Roth account has been in place for more than five years.

Also, unlike Roth IRA contributions, there are no income limitations for making Roth Solo(k) Employee Deferrals and the contribution limits are higher. If a business owner has at least $31,000 in compensation (net profit) from the business, they could contribute the entire $31,000 all Roth to the Solo(K) plan. A Roth IRA would have limited them to the max contribution of $8,000 and they would have been excluded from making that contribution if their income was above the 2025 threshold.

A quick note, you don’t necessarily need $31,000 in net income for this strategy to work; even if you have $18,000 in net income, you can make an $18,000 Roth contribution to your Solo(K) plan for that year. The gem to this strategy is that you are beginning to build this war chest of Roth dollars, which has the following tax advantages down the road……

Tax-Free Accumulation and Withdrawal: If you can contribute $100,000 to your Roth Solo(k) employee deferral source by the time you are 70, if you achieve a 6% rate of return at 80, you have $189,000 in that account, and the $89,000 in earnings are all tax-free upon withdrawal.

No RMDs: You can roll over your Roth Solo(K) deferrals into a Roth IRA, and the beautiful thing about Roth IRAs are no required minimum distributions (RMD) at age 73 or 75. Pre-tax retirement accounts like Traditional IRAs and 401(k) accounts require you to begin taking RMDs at age 73 or 75 based on your date of birth, which are forced taxable events; by having more money in a Roth IRA, those assets continue to build.

Tax-Free To Beneficiaries: When you pass assets on to your beneficiaries, the most beneficial assets to inherit are often a Roth IRA or Roth Solo(k) account. When they changed the rules for non-spouse beneficiaries, they must deplete IRAs and retirement accounts within ten years. With pre-tax retirement accounts, this becomes problematic because they have to realize taxable income on those potentially more significant distributions. With Roth assets, not only is there no tax on the distributions, but the beneficiary can allow that Roth account to grow for another ten years after you pass and withdraw all the earnings tax and penalty-free.

Why Not Make Pre-Tax Deferrals?

It's common for these self-employed retirees to have never made a Roth contribution to retirement accounts, mainly because, during their working years, they were in high tax brackets, which warranted pre-tax contributions to lower their liability. But now that they are retired and potentially showing less income, they may already be in a lower tax bracket, so making pre-tax contributions, only to pay tax on both the contributions and the earnings later, may be less advantageous. For the reasons I mentioned above, it may be worth foregoing the tax deduction associated with pre-tax contributions and selecting the long-term benefits associated with the Roth contributions within the Solo(k) Plan.

Now there are situations where one spouse retires and has a small amount of self-employment income while the other spouse is still employed. In those situations, if they file a joint tax return, their overall income limit may still be high, which could warrant making pre-tax contributions to the Solo(k) plan instead of Roth contributions. The beauty of these Solo(k) plans is that it’s entirely up to the business owner what source they want to contribute to from year to year. For example, this year, they could contribute 100% pre-tax, and then the following year, they could contribute 100% Roth.

Solo(k) versus SEP IRA

Because this question comes up frequently, let's do a quick walkthrough of the difference between a Solo(k) and a SEP IRA. A SEP IRA is also a popular type of retirement plan for self-employed individuals; however, SEP IRAs do not allow Roth contributions, and SEP IRAs limit contributions to 20% of the business owner’s net earned income. Solo(K) plans have a Roth contribution source, and the contributions are broken into two components, an employee deferral and an employer profit sharing.

As we looked at earlier, the employee deferral portion can be 100% of compensation up to the Solo(K) deferral limit of the year, but in addition to that amount, the business owner can also contribute 20% of their net earned income in the form of a profit sharing contribution.

When comparing the two, in most cases, the Solo(K) plan allows business owners to make larger contributions in a given year and opens up the Roth source.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is a Solo(k) plan?

A Solo(k) is a 401(k)-style retirement plan designed for self-employed individuals or business owners with no employees other than a spouse. It allows both employee and employer contributions, offering high contribution limits and flexible tax options.

How much can you contribute to a Solo(k) in 2025?

For 2025, you can contribute the lesser of 100% of your compensation or up to:

$31,000 if age 50 or older

$34,750 if age 60–63

These limits include employee deferrals and do not count potential employer profit-sharing contributions.

Can Solo(k) contributions be Roth or pre-tax?

Yes. You can choose to make contributions as pre-tax, Roth, or a combination of both. Roth contributions are made with after-tax dollars but grow tax-free, and qualified withdrawals are also tax-free.

Why might Roth Solo(k) contributions be advantageous for retirees?

Roth Solo(k) assets grow tax-free, have no required minimum distributions (RMDs) once rolled into a Roth IRA, and can be passed to beneficiaries without income tax. For retirees in lower tax brackets, contributing to Roth accounts may provide long-term tax benefits over pre-tax deferrals.

Can you make Roth contributions to a SEP IRA?

No. SEP IRAs only allow pre-tax contributions and do not offer a Roth option. This makes the Solo(k) plan a more flexible choice for self-employed individuals looking to build tax-free retirement income.

How does a Solo(k) compare to a SEP IRA?

A Solo(k) allows both employee deferrals (up to 100% of income) and employer profit-sharing contributions, plus the option for Roth contributions. A SEP IRA limits contributions to 20% of net earned income and only allows pre-tax contributions, typically resulting in lower total contribution potential.

Is a Solo(k) a good option for retirees with part-time income?

Yes. For retirees earning even modest self-employment income, a Solo(k) can be a powerful tool to continue saving for retirement—especially with Roth contributions that provide future tax-free income and estate planning advantages.

Grandparent Owned 529 Accounts Just Got Better

A 529 account owned by a grandparent is often considered one of the most effective ways to save for college for a grandchild. But in 2023, the rules are changing………

A 529 account owned by a grandparent is often considered one of the most effective ways to save for college for a student. Mainly because 529 accounts owned by the grandparents are invisible to the college financial aid calculation (FAFSA) when determining the financial aid package that will be awarded to a student. But there is a little-known pitfall about distributions from grandparent owned 529 accounts but thankfully the rules have changed. In this article, we will review:

Advantages of grandparent owned 529 accounts

The FAFSA pitfall of distributions from grandparent owned 529 accounts

The FAFSA two-year lookback period

The change to the 529 rules

Tax deductions for contributions to 529 accounts

What if your grandchild does not go to college?

Paying K – 12 expenses with a 529 account

Pitfall of Grandparent Owned 529 Accounts

Historically, there has been a major issue when grandparents begin distributing money out of these 529 accounts to pay college expenses for their grandchildren which can hurt their financial aid eligibility. While these accounts are invisible to the FAFSA calculation as an asset, in the year that the distribution takes place from a grandparent owned 529 account, those distributions did count as “income of the student” in the year that the distribution takes place. Income of the student counts heavily against the need-based financial aid award. Currently, any income of the student above the $9,410 threshold counts 50% against the financial aid award.

For example, if a grandparent distributes $30,000 from the 529 account to pay college expenses for the grandchild, in that determination year, assuming the child has no other income, that distribution could reduce the financial aid award two years later by $11,480.

FAFSA Two-Year Lookback

FAFSA has a two-year lookback for purposes of determining income in the EFC calculation (expected family contribution), so the family doesn’t realize the misstep until two years later. For example, if the distribution takes place in the fall of the student’s freshman year, the financial aid package would not be reduced until the fall of their junior year.

Since we are aware of this income two-year lookback rule, the workaround has been to advise grandparents not to distribute money from the 529 accounts until the spring of their sophomore year. If the child graduates in four years by the time they are submitting the FAFSA application for their senior year, that determination year that 529 distribution took place is no longer in play.

Quick Note: All of this only matters if the student qualifies for need-based financial aid. If the student, through their parent’s FAFSA application, does not qualify for any need-based financial aid, then the impact of these distributions from the grandparent owned 529 accounts is irrelevant because they were not receiving any financial aid anyways.

New Rules Starting in 2023

But the rules have changed starting in 2023 to make these grandparent owned 529 accounts even more advantageous. Under the new rules, distribution from grandparent owned 529 account will no longer count as income of the student. These 529 accounts owned by the grandparents are now completely invisible to the FAFSA calculation for both assets and income, which makes them even more valuable.

Tax Deduction For 529 Contributions

There can also be tax benefits for grandparents contributing to 529 accounts for their grandkids. Certain states allow state income tax deductions for contributions up to a certain thresholds. In New York State, there is a $5,000 state tax deduction for single filers and a $10,000 deduction for joint filers each tax year. The amounts vary from state to state and some states have no deduction, so you have to do your homework.

What If The Grandchild Does Not Go To College?

What happens if you fund this 529 account for your grandchild but then they decide not to go to college? There are a few options here. The grandparent can change the beneficiary of the account to another grandchild or family member. The second option, you can just take a distribution of the account balance. If the balance is distributed but it’s not used for college expenses, the contribution amounts are returned tax and penalty-free but the earnings portion of the account is subject to ordinary income taxes and a 10% penalty since it wasn’t used for qualified college expenses.

K - 12 Qualified Expenses

The federal government made changes to the tax rules in 2017 which also allow up to $10,000 per year to be distributed from 529 accounts for K - 12 expenses. If you have grandchildren that are attending a private k -12 school, this is another way for grandparents to potentially capture a tax deduction, and help pay those expenses.

However, and this is very important, while the federal government recognizes the K – 12 $10,000 per year as a qualified distribution, the states which sponsor these 529 plans may not adhere to those same rules. In fact, in New York State, not only does New York not recognize K – 12 expenses as “qualified expenses” for purposes of distributions from a 529 account, but these nonqualified withdrawals also require a recapture of any New York State tax benefits that have accrued on the contributions. Double ouch!! These rules vary state by state so you have to do your homework before paying K – 12 expenses out of a 529 account.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Why are grandparent-owned 529 accounts beneficial for college savings?

Grandparent-owned 529 accounts are not counted as assets in the FAFSA financial aid calculation, which can help maximize a student’s eligibility for need-based aid. Starting in 2023, distributions from these accounts are also excluded from the student’s income calculation, making them completely invisible to FAFSA.

What was the previous FAFSA pitfall with grandparent 529 distributions?

Before 2023, when grandparents made distributions from a 529 account to pay for college expenses, those withdrawals were considered “income of the student.” Since student income counts heavily against financial aid, these distributions could significantly reduce need-based aid two years later.

What changed with the FAFSA rules in 2023?

Under the new FAFSA rules, distributions from grandparent-owned 529 accounts are no longer treated as income to the student. This change eliminates the previous penalty and makes these accounts one of the most favorable tools for college funding.

Can grandparents receive tax benefits for 529 contributions?

Yes. Many states, including New York, offer state income tax deductions for contributions. In New York, the deduction is up to $5,000 for single filers or $10,000 for joint filers. Rules and deduction limits vary by state, so it’s important to review your state’s specific guidelines.

What happens if the grandchild doesn’t attend college?

If the grandchild doesn’t use the 529 funds for education, the account owner can change the beneficiary to another family member or withdraw the funds. Contributions can be withdrawn tax- and penalty-free, but earnings are subject to income tax and a 10% penalty if not used for qualified education expenses.

Can 529 funds be used for K–12 tuition?

Federally, up to $10,000 per year can be used for K–12 tuition expenses. However, not all states recognize K–12 expenses as qualified distributions. For example, New York does not and requires recapture of prior state tax deductions if K–12 withdrawals are made.

Are grandparent 529 distributions still reported on the FAFSA?

No. Beginning in 2023, both the value of grandparent-owned 529 accounts and any distributions from them are excluded from FAFSA’s financial aid calculation, eliminating the previous two-year lookback issue.

Potential investors of 529 plans may get more favorable tax benefits from 529 plans sponsored by their own state. Consult your tax professional for how 529 tax treatments and account fees would apply to your particular situation. To determine which college saving option is right for you, please consult your tax and accounting advisors. Neither APFS nor its affiliates or financial professionals provide tax, legal or accounting advice. Please carefully consider investment objectives, risks, charges, and expenses before investing. For this and other information about municipal fund securities, please obtain an offering statement and read it carefully before you invest. Investments in 529 college savings plans are neither FDIC insured nor guaranteed and may lose value.

Self-employed Individuals Are Allowed To Take A Tax Deduction For Their Medicare Premiums

If you are age 65 or older and self-employed, I have great news, you may be able to take a tax deduction for your Medicare Part A, B, C, and D premiums as well as the premiums that you pay for your Medicare Advantage or Medicare Supplemental coverage.

Self-employed Individuals Are Allowed To Take A Tax Deduction For Their Medicare Premiums

If you are age 65 or older and self-employed, I have great news, you may be able to take a tax deduction for your Medicare Part A, B, C, and D premiums as well as the premiums that you pay for your Medicare Advantage or Medicare Supplemental coverage. This is a huge tax benefit for business owners age 65 and older because most individuals without businesses are not able to deduct their Medicare premiums, so they have to be paid with after-tax dollars.

Individuals Without Businesses

If you do not own a business, you are age 65 or older, and on Medicare, you are only allowed to deduct “medical expenses” that exceed 7.5% of your adjusted gross income (AGI) for that tax year. Medical expenses can include Medicare premiums, deductibles, copays, coinsurance, and other noncovered services that you have to pay out of pocket. For example, if your AGI is $80,000, your total medical expenses would have to be over $6,000 ($80,000 x 7.5%) for the year before you would be eligible to start taking a tax deduction for those expenses.

But it gets worse, medical expenses are an itemized deduction which means you must forgo the standard deduction to claim a tax deduction for those expenses. For 2022, the standard deduction is $12,950 for single filers and $25,900 for married filing joint. Let’s look at another example, you are a married filer, $70,000 in AGI, and your Medicare premiums plus other medical expenses total $12,000 for the year since the 7.5% threshold is $5,250 ($70,000 x 7.5%), you would be eligible to deduct the additional $6,750 ($12,000 - $5,250) in medical expenses if you itemize. However, you would need another $13,600 in tax deductions just to get you up to the standard deduction limit of $25,900 before it would even make sense to itemize.

Self-Employed Medicare Tax Deduction

Self-employed individuals do not have that 7.5% of AGI threshold, they are able to deduct the Medicare premiums against the income generated by the business. A special note in that sentence, “against the income generated by the business”, in other words, the business has to generate a profit in order to take a deduction for the Medicare premiums, so you can’t just create a business, that has no income, for the sole purpose of taking a tax deduction for your Medicare premiums. Also, the IRS does not allow you to use the Medicare expenses to generate a loss.

For business owners, it gets even better, not only can the business owner deduct the Medicare premiums for themselves but they can also deduct the Medicare premiums for their spouse. The standard Medicare Part B premium for 2022 is $170.10 per month for EACH spouse, now let’s assume that they both also have a Medigap policy that costs $200 per month EACH, here’s how the annual deduction would work:

Business Owner Medicare Part B: $2,040 ($170 x 12 months)

Business Owner Medigap Policy: $2,400

Spouse Medicare Part B: $2,040

Spouse Medigap Policy: $2,400

Total Premiums: $8,880

If the business produces $10,000 in net profit for the year, they would be able to deduct the $8,880 against the business income, which allows the business owner to pay the Medicare premiums with pre-tax dollars. No 7.5% AGI threshold to hurdle. The full amount is deductible from dollar one and the business owner could still elect the standard deduction on their personal tax return.

The Tax Deduction Is Limited Only To Medicare Premiums

When we compare the “medical expense” deduction for individual taxpayers that carries the 7.5% AGI threshold and the deduction that business owners can take for Medicare premiums, it’s important to understand that for business owners the deduction only applies to Medicare premiums NOT their total “medical expenses” for the year which include co-pays, coinsurance, and other out of pocket costs. If a business owner has large medical expenses outside of the Medicare premiums that they deducted against the business income, they would still be eligible to itemize on their personal tax return, but the 7.5% AGI threshold for those deductions comes back into play.

What Type of Self-Employed Entities Qualify?

To be eligible to deduct the Medicare premiums as an expense against your business income your business could be set up as a sole proprietor, independent contractor, partnership, LLC, or an S-corp shareholder with at least 2% of the common stock.

The Medicare Premium Deduction Lowers Your AGI

The tax deduction for Medicare Premiums for self-employed individuals is considered an “above the line” deduction, which lowers their AGI, an added benefit that could make that taxpayer eligible for other tax credits and deductions that are income based. If your company is an S-corp, the S-corp can either pay your Medicare Premiums on your behalf as a business expense or the S-corp can reimburse you for the premiums that you paid, report those amounts on your W2, and you can then deduct it on Schedule 1 of your 1040.

Employer-Subsidized Health Plan Limitation

One limitation to be aware of, is if either the business owner or their spouse is eligible to enroll in an employer-subsidized health plan through their employer, you are no longer allowed to deduct the Medicare Premiums against your business income. For example, if you and your spouse are both age 66, and you are self-employed, but your spouse has a W2 job that offers health benefits to cover both them and their spouse, you would not be eligible to deduct the Medicare Premiums against your business income. This is true even if you voluntarily decline the coverage. If you or your spouse is eligible to participate, you cannot take a deduction for their Medicare premiums.

I receive the question, “What if they are only employed for part of the year with health coverage available?” For the month that they were eligible for employer-subsidized health plan, a deduction would not be able to be taken during those months for the Medicare premiums.

On the flip side, if the health plan through their employer is considered “credible coverage” by Medicare, you may not have to worry about Medicare premiums anyways.

Multiple Businesses

If you have multiple businesses, you will have to select a single business to be the “sponsor” of your health plan for the purpose of deducting your Medicare premiums. It’s usually wise to select the business that produces a consistent net profit because net profits are required to deduct all or a portion of the Medicare premium expense.

Forms for Tax Reporting

You will have to keep accurate records to claim this deduction. If you collect Social Security, the Medicare premiums are deducted directly from the social security benefit, but they issue you a SSA-1099 Form at the end of the year which summarized the Medicare Premiums that you paid for Part A and Part B.

If you have a Medigap Policy (Supplemental) with a Part D plan or a Medicare Advantage Plan, you normally make premium payments directly to the insurance company that you have selected to sponsor your plan. You will have to keep records of those premium payments.

No Deduction For Self-Employment Taxes

As a self-employed individual, the Medicare premiums are eligible for a federal, state, and local tax deduction but they do not impact your self-employment taxes which are the taxes that you pay to fund Medicare and Social Security.

Amending Your Tax Returns

If you have been self-employed for a few years, paying Medicare premiums, and are just finding out now about this tax deduction, the IRS allows you to amend your tax returns up to three years from the filing date. But again, the business had to produce a profit during those tax years to be eligible to take the deduction for those Medicare premiums.

DISCLOSURE: This information is for educational purposes only. For tax advice, please consult a tax professional.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Can self-employed individuals deduct their Medicare premiums?

Yes. Self-employed individuals age 65 and older can deduct Medicare Part A, B, C, and D premiums, as well as premiums for Medicare Advantage and Medigap policies, against their business income. This deduction allows them to pay Medicare premiums with pre-tax dollars rather than after-tax dollars.

How is the Medicare premium deduction different for individuals who are not self-employed?

Individuals who are not self-employed may only deduct medical expenses, including Medicare premiums, that exceed 7.5% of their adjusted gross income (AGI). These deductions must also be itemized, meaning taxpayers must forgo the standard deduction to claim them.

What requirements must be met to take the self-employed Medicare deduction?

The business must generate a net profit for the year, and the deduction cannot create or increase a business loss. The deduction is only available for the taxpayer and their spouse if neither is eligible for an employer-subsidized health plan.

Which types of business entities qualify for the Medicare premium deduction?

Eligible entities include sole proprietorships, independent contractors, partnerships, LLCs taxed as partnerships, and S corporation shareholders owning at least 2% of company stock. C corporations are not eligible for this specific deduction.

Does the Medicare premium deduction reduce adjusted gross income (AGI)?

Yes. The deduction is considered “above the line,” meaning it lowers AGI directly. This can help taxpayers qualify for other income-based credits or deductions.

What happens if a business owner or spouse has access to employer health coverage?

If either spouse is eligible for an employer-subsidized health plan, the Medicare premiums cannot be deducted against business income for those months. This rule applies even if the employer coverage is declined.

Can self-employed individuals amend past tax returns to claim this deduction?

Yes. The IRS allows taxpayers to amend returns for up to three years from the original filing date to claim missed Medicare premium deductions, provided the business generated a profit during those tax years.