How Do Executive Non-Qualified Deferred Compensation Plans Work?

If you're a high-income executive, you’ve likely hit the contribution ceiling on your 401(k) or other qualified plans. So what’s next?

Enter the non-qualified deferred compensation (NQDC) plan—a tax deferral strategy designed for executives who want to save more for retirement beyond traditional limits.

For highly compensated employees, saving for retirement isn’t always as simple as maxing out a 401(k). When income exceeds traditional plan limits, non-qualified deferred compensation (NQDC) plans—often offered to executives—can provide a powerful way to defer taxes and accumulate wealth beyond standard retirement vehicles.

But how do these plans actually work? And what should executives know before deferring compensation?

Let’s break it down.

What Is a Non-Qualified Deferred Compensation Plan?

An NQDC plan is an employer-sponsored agreement that allows certain employees—typically executives or other key personnel—to defer a portion of their income to a future date, such as retirement or separation from service.

Unlike qualified plans (such as a 401(k)), these plans do not fall under ERISA coverage and do not have contribution limits set by the IRS. This makes them attractive for those whose income exceeds the maximum deferral limits in traditional plans.

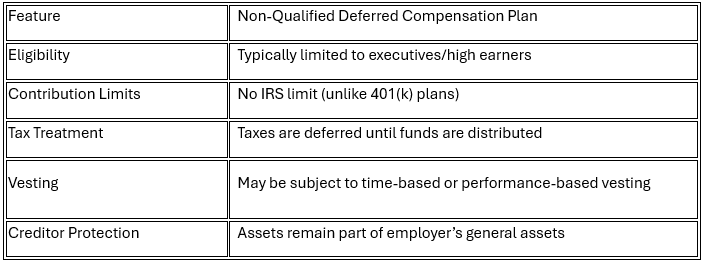

Key Features

How Deferrals Work

An executive elects—in advance of the year earned—to defer a portion of salary, bonus, or other compensation. This election is typically irrevocable for that year and must comply with IRC Section 409A.

For example:

Jane, a CFO earning $600,000, defers $100,000 of her 2025 compensation into her company’s NQDC plan. She’ll pay no income tax on that $100,000 in 2025—it'll be taxed when she receives the funds in retirement or at a future distribution date.

Distribution Options

The executive can usually choose from a menu of payout options, such as:

Lump sum at retirement

Installments over 5–10 years

Specific distribution events (e.g., separation from service, death, disability)

Important: Once the distribution schedule is set, changing it often requires a five-year delay and must follow 409A regulations to avoid penalties.

Tax Considerations

Deferred income is not taxed until it’s actually received.

Funds may grow tax-deferred in an investment vehicle selected by the participant or the employer.

Unlike a 401(k), contributions are not protected from creditors—they remain employer assets until distributed.

Distributions are taxed as ordinary income, not capital gains.

What Are the Risks?

NQDC plans can be valuable, but they come with risks not present in qualified plans:

Employer Solvency: Since funds remain part of the employer’s general assets, they could be lost in bankruptcy.

Limited Access: You cannot take early withdrawals without triggering taxes and penalties under 409A.

Inflexibility: Election and distribution decisions are difficult to change once made.

Unfunded plan: NQDC plans are not required to be “funded” by the employer like a 401(k) plan so it may just be a future promise of the employer to pay those amounts out to the employee when the benefit vests. This adds additional risk for the executive.

When Does an NQDC Plan Make Sense?

An NQDC plan can be a smart tool for:

High W2 earners who max out traditional retirement plans and want to save more

Executives with predictable income and long-term tenure at the company

Those expecting to be in a lower tax bracket in retirement

Executives who are employed by a financially strong company

However, it may not be suitable for someone with:

Uncertainty around staying with the employer long-term

Concerns about the company’s financial health

A need for liquidity or access to funds before retirement

Final Thought

Non-qualified deferred compensation plans can be a powerful tax deferral and wealth-building tool for high-income executives, but they require careful planning. Because these plans carry unique risks and limited flexibility, it’s important to review your full financial picture, long-term goals, and employer stability before making a deferral election.

If you're considering participating in your company’s NQDC plan, talk to a financial planner who understands executive compensation and tax strategy. The right guidance can help you avoid missteps and make the most of what these plans have to offer.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is a Non-Qualified Deferred Compensation (NQDC) plan?

A Non-Qualified Deferred Compensation (NQDC) plan is an employer-sponsored arrangement that allows select employees—typically executives or highly compensated individuals—to defer a portion of their income to a future date, such as retirement or separation from service. These plans are not subject to the same IRS limits as 401(k)s, allowing for greater savings potential.

How does an NQDC plan work?

Participants elect in advance to defer a portion of their salary, bonuses, or other compensation before it is earned. The deferred income grows tax-deferred until distributed, usually at retirement or another specified event. Because the funds technically remain part of the employer’s assets, they are not taxed until paid out to the employee.

When do I have to make my deferral election?

Under IRS Section 409A, deferral elections must be made before the start of the year in which the income is earned. These elections are generally irrevocable for that year and must follow strict timing and compliance rules to avoid penalties.

How are NQDC distributions paid?

Participants usually choose a distribution schedule when enrolling in the plan. Common options include a lump sum at retirement or installment payments over 5–10 years. Once the schedule is selected, it’s difficult to change without a five-year delay and compliance with Section 409A regulations.

How is deferred compensation taxed?

Deferred income and its growth are not taxed until distributed. When payouts occur, the amounts are taxed as ordinary income—not capital gains. However, if the plan violates 409A rules, deferred amounts could become immediately taxable with additional penalties.

Are NQDC plans protected from creditors?

No. Unlike 401(k)s, NQDC plan assets remain part of the employer’s general assets until distributed. This means that if the company faces bankruptcy or insolvency, participants may lose their deferred compensation.

What are the main risks of participating in an NQDC plan?

The key risks include employer insolvency, lack of liquidity, and limited flexibility. Because plans are often unfunded and cannot be accessed early without tax penalties, participants rely on their employer’s financial strength and long-term stability.

Who should consider using an NQDC plan?

These plans are best suited for high earners who have already maxed out qualified retirement plans, expect to stay with their employer long-term, and anticipate being in a lower tax bracket in retirement. They may also be attractive for executives at financially stable companies.

Who might want to avoid an NQDC plan?

NQDC plans may not be appropriate for individuals who expect to leave their employer soon, need short-term access to funds, or are concerned about the company’s financial health. Those uncertain about their future tax situation should also evaluate carefully before deferring large amounts.

What’s the difference between an NQDC plan and a 401(k)?

A 401(k) is a qualified, ERISA-protected plan with contribution limits and creditor protection. An NQDC plan is non-qualified, has no IRS contribution limits, offers greater flexibility in savings amounts, but lacks creditor protection and carries employer solvency risk.

Can I change my payout schedule after enrolling?

Generally no—changes to distribution timing or method require at least a five-year deferral from the original payout date and must follow strict Section 409A rules to avoid penalties.

Should I consult a financial planner before enrolling in an NQDC plan?

Yes. Because NQDC plans involve complex tax, investment, and timing decisions, working with a financial planner or tax advisor experienced in executive compensation can help you optimize your deferral strategy and manage potential risks.

Do You Pay More or Less Taxes When You Get Married?

In this article, we break down when couples may face a marriage penalty—and when they might receive a marriage bonus. You'll see side-by-side income examples, learn how the 2026 sunset of the Tax Cuts and Jobs Act could impact your future tax bill, and understand how marriage affects things like IRA eligibility, Social Security taxes, and student loan repayment plans.

Marriage brings about numerous life changes—some personal, some financial. One common question couples ask is whether tying the knot means paying more in taxes. The answer? It depends.

Let’s walk through the key considerations that determine whether you face a marriage bonus or a marriage penalty, how upcoming tax law changes could impact your filing status, and what smart tax planning looks like for married couples.

1. Marriage Bonus vs. Marriage Penalty

The IRS offers special tax brackets and deductions for married couples filing jointly—but whether this works in your favor depends on your income levels.

Marriage Bonus

Occurs when one spouse earns significantly more than the other (or one spouse doesn’t earn at all). Filing jointly often results in a lower combined tax bill compared to filing separately.

Marriage Penalty

Occurs when both spouses earn similar, high incomes. Their combined income may push them into a higher tax bracket faster than if they filed as two single individuals.

The Marriage Bonus and Penalty Have Been Diminished

Since the passing of the Tax Cuts and Jobs Act in 2017, the gap between the married penalty and the marriage bonus has greatly decreased. Said another way, in many cases, when comparing the federal income tax paid by two single filers to what they would pay if they got married and started filing as married filing jointly, the amounts are now fairly similar.

Example:

Couple A: Two people earning $50,000 each, no dependents in 2025

As single filers, they would each pay $4,016 in Federal income tax, resulting in a total of $8,032 between the two of them.

If they were married filing jointly, earning a combined $100,000, their federal tax liability would be $8,032, which is the same exact amount.

Couple B: One person earning $200,000 and the second person earning $50,000

As single filers, they would pay $37,538 and $4,016 in federal income tax, respectively, for a total of $41,554 in taxes paid.

If they were married filing jointly, earning a combined $250,000, their federal tax liability would be $39,076, putting them in the “married bonus” category because they paid $2,478 less as joint filers.

2. 2025/2026 Tax Law Changes

The Tax Cuts and Jobs Act (TCJA) of 2017 temporarily expanded the marriage bonus by adjusting tax brackets so that married filing jointly brackets were nearly double those for single filers. But that could change.

What’s happening in 2026?

Unless Congress acts, the TCJA provisions will sunset at the end of 2025. This means:

Tax brackets may revert to pre-2018 levels

The standard deduction will shrink

The marriage penalty may reappear or worsen for dual earners

A tax bill is moving through Congress to extend or modify these provisions, but the tax bill has yet to pass Congress and reach its final form.

3. Impacts on Other Financial Areas

Marriage affects more than just your tax bracket. Here are other areas where your combined income can matter:

IRAs & Roth IRAs:

Couples with high combined income may be phased out of Roth IRA eligibility or be ineligible for deductible Traditional IRA contributions.Child Tax Credit & Earned Income Tax Credit (EITC):

Phaseouts are based on combined income, which can reduce or eliminate your eligibility even if you previously qualified.Student Loan Repayment:

Income-driven repayment (IDR) plans like REPAYE or SAVE base your payments on combined household income, increasing monthly obligations after marriage.

4. Filing Separately — When Does It Make Sense?

Most married couples file jointly, but there are a few niche cases where filing separately may be beneficial:

One spouse has high medical expenses relative to their income

You’re repaying student loans on an income-driven plan that uses individual income

For a married couple with children, if there is a big deviation in income between the two spouses, the lower-income-earning spouse may qualify for more child-related tax credits and deductions.

One spouse has significant tax liabilities or legal concerns and you want to limit shared responsibility

However, filing separately often disqualifies you from certain credits and deductions, so it’s important to weigh the trade-offs.

5. Tax Planning Tips for Married Couples

Timing Matters:

If you marry on December 31, you’re considered married for the whole tax year. That means your filing status changes for that year, no matter the wedding date.Update Your Withholding:

Adjust your W-4 to avoid under- or over-withholding. The IRS has a helpful Tax Withholding Estimator to guide you.Run a Mock Return:

Use tax software or consult a planner to compare filing jointly vs. separately before submitting your return.

Final Thoughts

Marriage doesn’t automatically mean you’ll pay more in taxes—but it does change the equation. For some, marriage brings a welcome tax break. For others, particularly high earners, it may result in higher taxes and lost deductions.

Strategic tax planning—especially in light of the pending changes to the tax laws—can help minimize surprises and maximize your benefits as a married couple.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Does getting married mean you’ll pay more in taxes?

Not always—it depends on your income levels and how they combine. If one spouse earns significantly more than the other, you may receive a marriage bonus. If both spouses earn similar, high incomes, you may face a marriage penalty because your combined income could push you into a higher tax bracket.

What is the difference between a marriage bonus and a marriage penalty?

A marriage bonus occurs when filing jointly reduces your combined tax liability compared to filing separately as single taxpayers. A penalty occurs when your combined income causes you to pay more tax as a couple than you would have individually.

Did the 2017 Tax Cuts and Jobs Act (TCJA) change the marriage penalty?

Yes. The TCJA largely reduced or eliminated the marriage penalty by aligning joint filer tax brackets to be nearly double those for single filers. However, these provisions are temporary and are set to expire at the end of 2025 unless Congress renews them.

Can marriage affect IRA and Roth IRA contributions?

Yes. Married couples’ combined income is used to determine eligibility for Roth IRA contributions and deductible Traditional IRA contributions. High-income couples may phase out of eligibility due to their joint modified adjusted gross income (MAGI).

How does marriage impact the Child Tax Credit or Earned Income Tax Credit (EITC)?

Both credits are subject to income phaseouts based on combined household income. After marriage, your eligibility could decrease or disappear even if you qualified for these credits individually before.

Will marriage change my student loan repayment plan?

Yes, potentially. Income-driven repayment (IDR) plans such as SAVE or REPAYE often use combined household income to calculate monthly payments, which can increase the payment amount after marriage.

When does it make sense for married couples to file separately?

Filing separately may help when one spouse has high medical expenses relative to income, is repaying student loans under an income-driven plan, or has significant tax liabilities or legal issues. However, filing separately often disqualifies you from valuable deductions and credits, so it’s usually best to compare both scenarios first.

Does timing matter if you get married late in the year?

Yes. The IRS considers you married for the entire year if you are married on December 31. That means your filing status changes for that tax year, even if you married on the last day of December.

What should newly married couples do to adjust their taxes?

Update your W-4 form to reflect your new filing status and income levels, review your estimated tax payments, and consider running a mock return to compare joint versus separate filing options. This helps avoid over- or under-withholding and surprises at tax time.

What’s the best way to minimize taxes as a married couple?

Strategic planning is key. Maximize tax-advantaged savings (like 401(k)s or HSAs), manage income timing, and coordinate deductions. A tax professional can help you determine whether to file jointly or separately and how to prepare for upcoming tax law changes in 2026.

Exceptions to the 10% Early Withdrawal Penalty for IRA Distributions

Taking money from your IRA before age 59½? Normally, that means a 10% penalty on top of income tax—but there are exceptions.

In this article, we break down the most common situations where the IRS waives the early withdrawal penalty on IRA distributions. From first-time home purchases and higher education to medical expenses and unemployment, we walk through what qualifies and what to watch out for.

When distributions are processed from an IRA account prior to age 59½, the IRS generally assesses a 10% early withdrawal penalty in addition to the ordinary income taxes owed on the amount of the distribution.

However, as with most aspects of the tax code, there are exceptions.

Whether you’re facing a financial emergency or considering strategic planning options, it’s essential to understand the legitimate circumstances under which the IRS waives the early withdrawal penalty. In this article, we’ll walk through the most common exceptions to the 10% penalty and provide some guidance on how to navigate them.

The Basics: Tax vs. Penalty

First, a quick clarification:

When you take a distribution from a traditional IRA, you generally owe ordinary income tax on the amount withdrawn. That’s true whether you’re 40 or 70. The 10% early withdrawal penalty is in addition to that tax and is designed to discourage people from prematurely accessing their retirement funds.

However, the IRS carves out several exceptions for situations it deems reasonable or necessary. These exceptions waive the penalty, not the income tax (unless otherwise noted).

Key Exceptions to the 10% Early Withdrawal Penalty

Here are the most common exceptions that apply to IRA distributions:

1. First-Time Home Purchase

One of the more well-known exceptions to the 10% early withdrawal penalty is for a first-time home purchase. The IRS allows you to take up to $10,000 from your traditional IRA—penalty-free—to put toward buying, building, or rebuilding your first home. If you’re married, both spouses can each take $10,000 from their respective IRAs for a combined total of $20,000.

Now, the term “first-time homebuyer” is a bit misleading. You don’t have to be a literal first-time buyer—you just have to not have owned a primary residence in the last two years. That opens the door for people re-entering the housing market after renting, relocating, or going through a divorce.

2. Qualified Higher Education Expenses

Tuition, fees, books, supplies, and required equipment for you, your spouse, children, or grandchildren all qualify. Room and board also qualify if the student is enrolled at least half-time.

Planning tip: If you're considering this, remember that using retirement funds for education can impact long-term growth. Exhaust other education savings options first.

3. Disability

If you become totally and permanently disabled, you can take distributions at any age without penalty. The burden of proof here is high—the IRS requires documentation from a physician.

4. Substantially Equal Periodic Payments (SEPP)

This is a strategy where you take consistent withdrawals based on your life expectancy. You must commit to this withdrawal strategy for at least 5 years or until you reach age 59½, whichever is longer.

Strategy note: SEPPs can be complex and restrictive. It’s a tool best used under close guidance from a financial advisor or CPA.

5. Unreimbursed Medical Expenses

If you have unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (AGI), you can withdraw IRA funds penalty-free to cover that portion.

6. Health Insurance Premiums While Unemployed

If you’ve lost your job and received unemployment compensation for at least 12 consecutive weeks, you can use IRA funds to pay for health insurance premiums for yourself, your spouse, and dependents without triggering the penalty.

7. Death

If the IRA owner dies, the beneficiaries can take distributions from the inherited IRA without facing the 10% penalty, regardless of their age.

8. IRS Levy

If the IRS issues a levy directly on your IRA, you won’t face the penalty. Voluntary payments to the IRS, however, don’t qualify.

9. Qualified Birth or Adoption

You can withdraw up to $5,000 per child within one year of the birth or adoption without penalty. This is a relatively new provision under the SECURE Act and gives new parents a bit more flexibility.

Important Caveats

Roth IRAs have their own set of rules. Since contributions to a Roth are made with after-tax dollars, you can withdraw your contributions (not earnings) at any time, for any reason, without tax or penalty.

These 10% early withdrawal exceptions apply to IRAs, not necessarily to 401(k)s, which have a slightly different set of rules (though some overlap).

Final Thoughts

While these exceptions can be life-savers in times of need, early IRA withdrawals should still be a last resort for most people. The long-term cost in lost compounding and retirement security can be substantial.

That said, life doesn’t always go according to plan. Knowing your options—and using them strategically—can help you make informed, tax-efficient decisions when circumstances require flexibility.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the 10% early withdrawal penalty on IRA distributions?

If you withdraw money from a traditional IRA before age 59½, the IRS typically charges a 10% penalty in addition to ordinary income taxes owed on the amount withdrawn.

Are there exceptions to the 10% penalty?

Yes. The IRS waives the early withdrawal penalty for specific circumstances such as:

First-time home purchase (up to $10,000)

Qualified higher education expenses

Total and permanent disability

Unreimbursed medical expenses exceeding 7.5% of AGI

Health insurance premiums while unemployed

Can I use IRA funds for a first-time home purchase without penalty?

Yes. You can withdraw up to $10,000 ($20,000 for couples) penalty-free to buy, build, or rebuild a first home. You qualify as a “first-time buyer” if you haven’t owned a primary residence in the past two years.

Are college costs or medical expenses penalty-free?

Yes. You can withdraw IRA funds penalty-free for qualified education costs for yourself, your spouse, children, or grandchildren. You can also avoid the penalty if you use funds to pay unreimbursed medical bills that exceed 7.5% of your AGI.

Do these exceptions eliminate income taxes too?

No. The 10% penalty may be waived, but standard income tax on traditional IRA withdrawals still applies unless it’s a Roth IRA contribution being withdrawn.

Social Security: A Complete Guide to Benefits

Social Security isn’t just a retirement check—it’s a complex system of benefits that could impact your entire family. In this article, we walk through the four major types of Social Security benefits.

While most Americans understand Social Security as a monthly retirement benefit, the system is far more expansive than that. It provides a foundation of income not only for retirees, but also for spouses, surviving family members, and even minor children.

For many, Social Security is one of the largest sources of guaranteed income in retirement. Yet, without a clear understanding of how the program works, individuals often leave money on the table or make filing decisions that reduce lifetime benefits. In this guide, we’ll walk through the primary types of Social Security benefits available and the planning opportunities they create for you and your family.

Retirement Benefits

Retirement benefits are the most common form of Social Security income and are based on your earnings record over your working years. You must earn 40 quarters of work credit (typically 10 years of work) to qualify.

Filing Age Matters

You can begin collecting benefits as early as age 62, but doing so permanently reduces your monthly benefit. On the other hand, delaying benefits past your Full Retirement Age (FRA) can increase your monthly payment by as much as 8% per year until age 70.

For example, if your Full Retirement Age is 67 and your monthly benefit at that age is $2,000, delaying until age 70 would increase your benefit to approximately $2,480 per month for life.

Planning Strategy:

If you have other sources of income, delaying Social Security can be a powerful way to hedge against longevity risk. Higher lifetime benefits can also increase survivor benefits for a spouse, which is especially important if one spouse is expected to live significantly longer than the other.

Spousal Benefits

Spousal benefits allow a lower-earning spouse (or a non-working spouse) to claim up to 50% of their spouse’s full retirement benefit.

Eligibility Criteria:

Must be at least 62 years old

The higher-earning spouse must have filed for their own benefit

Marriage must have lasted at least 1 year (or 10 years if divorced)

For example, if your spouse's full benefit is $2,000 per month, you could receive $1,000 per month as a spousal benefit—even if you never worked.

Planning Tip:

If your own benefit is less than half of your spouse’s, spousal benefits can provide a significant boost to household income. However, if you claim before your FRA, your spousal benefit will also be reduced.

Survivor Benefits

When a worker passes away, their spouse and dependent children may be eligible for survivor benefits based on the deceased’s earnings record. These benefits can be a critical form of income replacement.

Who Can Claim:

A surviving spouse as early as age 60 (or 50 if disabled)

Surviving divorced spouses (if the marriage lasted 10+ years)

Minor children under age 18 (or 19 if still in high school)

Disabled adult children whose disability began before age 22

Survivor benefits can be up to 100% of the deceased worker’s benefit amount. However, claiming early will reduce the amount received.

Strategy Example:

A widow claiming survivor benefits at age 60 may receive 71.5% of the deceased spouse’s benefit, while waiting until her FRA allows her to claim the full 100%.

If the surviving spouse is also eligible for their own retirement benefit, they can switch between benefits to maximize lifetime payouts. For example, they might take survivor benefits early and delay their own retirement benefit until age 70 to receive delayed credits.

Benefits for Minor Children

Children of retired, disabled, or deceased workers may also qualify for Social Security benefits.

Eligibility:

Must be under age 18 (or 19 if still in high school)

Must be unmarried

Or, must have a disability that began before age 22

Each eligible child may receive up to 50% of the parent’s benefit (or 75% if the parent is deceased), subject to a family maximum of 150% to 180% of the worker’s benefit amount.

Planning Opportunity:

Parents nearing retirement who still have minor children can increase household income by claiming their own benefit and triggering minor benefits for their children. In some cases, this can result in tens of thousands of dollars in additional family income.

Disability Benefits (SSDI)

Social Security Disability Insurance (SSDI) is available to workers who have a qualifying disability and a sufficient work history.

Key Points:

The disability must be expected to last at least 12 months or result in death

The number of required work credits depends on your age at the time of disability

Benefits are based on your average lifetime earnings, similar to retirement benefits

SSDI also includes dependent benefits for minor children and spouses in certain cases, making it another critical piece of the Social Security safety net.

Taxation of Benefits

Many people are surprised to learn that Social Security benefits can be taxable at the federal level, depending on your income. The social security provisional income formula determines what portion of your social security benefits will be taxed at the federal level which ranges from 0% to 85%.

Provisional Income Calculation:

The provisional income formula is as follows:

Provisional income = AGI + tax-exempt interest + 50% of Social Security benefits

If your provisional income exceeds the IRS thresholds below, up to 85% of your Social Security benefits may be subject to federal income tax:

Single filers: Benefits become taxable if income > $25,000

Married filing jointly: Threshold starts at $32,000

Planning Tip:

Roth IRA distributions and qualified withdrawals from a Health Savings Account (HSA) do not count toward provisional income, making them useful tools in managing your tax liability in retirement.

Earnings Limits Before FRA

If you claim benefits before Full Retirement Age and continue working, your benefits may be temporarily reduced.

2025 Earnings Limit:

$23,400/year before FRA

$1 for every $2 earned above this limit is withheld

In the year you reach FRA, a higher threshold applies

No limit applies after reaching FRA

The good news: Any withheld benefits are recalculated into your future payments once you reach FRA, so the money is not lost—it’s just delayed.

Final Thoughts

Social Security is more than just a retirement benefit—it’s an income safety net for families, widows, children, and disabled workers. Understanding how and when to claim each type of benefit can create significant long-term financial value.

Whether you are approaching retirement or already receiving benefits, strategic planning around Social Security can impact your taxes, cash flow, and even legacy planning for future generations.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What are the main types of Social Security benefits available?

Social Security provides several types of benefits, including retirement, spousal, survivor, disability (SSDI), and benefits for minor children. Each type is based on specific eligibility criteria tied to a worker’s earnings record and family situation.

How does the age at which I claim Social Security affect my benefit amount?

Claiming benefits before your Full Retirement Age (FRA) reduces your monthly payments permanently, while delaying benefits past FRA can increase them by up to 8% per year until age 70. The best claiming age depends on factors like life expectancy, income needs, and spousal considerations.

Can a spouse who never worked receive Social Security benefits?

Yes, a non-working or lower-earning spouse can receive up to 50% of their spouse’s full retirement benefit as a spousal benefit. To qualify, the higher-earning spouse must have filed for benefits, and the marriage must meet the required duration rules.

What are survivor benefits and who can claim them?

Survivor benefits provide income to the spouse, children, or other dependents of a deceased worker. A surviving spouse can claim benefits as early as age 60, while dependent children and certain disabled adults may also qualify based on the worker’s earnings record.

Are Social Security benefits taxable?

Depending on your income, up to 85% of your Social Security benefits may be subject to federal income tax. The taxable portion is determined using your “provisional income,” which includes your adjusted gross income, tax-exempt interest, and half of your Social Security benefits.

How does working before Full Retirement Age affect my benefits?

If you claim benefits before FRA and continue to work, part of your payments may be temporarily withheld if your earnings exceed annual limits. Once you reach FRA, the withheld amounts are recalculated into future payments, effectively restoring the value over time.

Can children receive Social Security benefits based on a parent’s record?

Yes, children of retired, disabled, or deceased workers may qualify for benefits if they are under 18 (or 19 if still in high school) or became disabled before age 22. These payments can provide up to 50–75% of the parent’s benefit amount, subject to family maximum limits.

Still Working at 65? Here’s What to Do About Medicare and Social Security

Turning 65 is a major milestone — but if you're still working, it can also bring confusion around Medicare and Social Security. Do you need to enroll in Medicare? Will claiming Social Security now trigger an earnings penalty? The answers depend on your specific situation.

Turning 65 is a milestone that often raises questions about Medicare and Social Security. But if you’re still working — and especially if you have employer-sponsored health insurance — your decisions may not follow the traditional retirement playbook.

This guide outlines what you need to know about how continued employment affects Medicare enrollment and Social Security strategy.

Medicare: Do You Need to Enroll at 65?

You become eligible for Medicare at age 65, but whether you need to enroll right away depends on your health insurance situation.

If You Have Employer Coverage Through a Company with 20 or More Employees

You can delay Medicare Part B (medical insurance) and Part D (prescription drug coverage) without penalty.

Many people still choose to enroll in Part A (hospital insurance), which is typically premium-free, while keeping their employer plan as primary coverage.

However, if you're still contributing to a Health Savings Account (HSA), be careful — enrolling in Medicare Part A makes you ineligible to continue making HSA contributions.

Once you leave your job or lose coverage, you’ll qualify for a Special Enrollment Period and have eight months to sign up for Medicare Part B without facing late penalties.

If Your Employer Has Fewer Than 20 Employees

You generally need to enroll in Medicare Parts A and B at age 65. Medicare becomes your primary payer, and your employer plan pays secondary.

Failing to enroll can result in a gap in coverage and a permanent late enrollment penalty on your Medicare premiums.

We strongly recommend reaching out to the HR contact at your employer well in advance of your 65th birthday to fully understand what actions you need to take with regard your Medicare enrollment for both you and your spouse if they are covered by your plan as well.

Don’t Overlook Part D Requirements

If you delay enrolling in Medicare Part D, you must have “creditable” prescription drug coverage through your employer — meaning coverage that is expected to pay, on average, as much as Medicare’s standard prescription drug plan.

Be sure to confirm with your employer that your current plan meets Medicare’s creditable coverage standard to avoid future penalties.

How Social Security Fits Into the Picture

While you can claim Social Security as early as age 62, most people don’t reach their full retirement age (FRA) until age 67. While you are eligible to begin collecting your social security benefit while you are still working and prior to recaching age 67, it may make sense to delay receiving your social security benefits to avoid the earned income penalty.

If you claim before your full retirement age and your earnings exceed the annual limit ($23,400 in 2025), an earned income penalty is assessed against your benefit. For every $2 earned over the limit, $1 in benefits is withheld. These withheld benefits are not lost — your benefit is recalculated at FRA to account for months when payments were withheld.

Example:

If you earn $30,000 in 2025 before reaching FRA, you are $6,600 over the earnings limit. This would result in $3,300 of your Social Security benefits being withheld that year.

After you reach FRA, there is no reduction in benefits, no matter how much you earn.

Also by delay the receipt of your social security benefits, your benefit increase by about 6% per year between the ages of 62 and 67, and then increase by 8% per year between ages 67 and 70.

Key Action Steps at 65 If You're Still Working

Review your employer health plan: Determine whether it’s considered creditable coverage and how it coordinates with Medicare.

Decide on Medicare Part A: Enrolling may make sense, but if you're still contributing to an HSA, delay enrollment to remain eligible.

Verify Part D creditable coverage: Confirm with your employer that your prescription plan meets Medicare’s standards.

Review your Social Security strategy: Consider whether it makes sense to delay benefits to avoid earnings penalties and increase your monthly payout.

Final Thoughts

Working past age 65 can offer financial flexibility and allow you to delay drawing on Social Security, but it also comes with specific rules around Medicare and benefit eligibility. Taking the time to coordinate your health coverage, HSA contributions, and income planning now can help you avoid unnecessary penalties and make more informed decisions later.

Once you are within 5 year to retirement, it can be beneficial to work with a Certified Financial Planner to create a formal retirement plan which include reviewing what your expenses will be in retirement, social security filing strategy, Medicare coverage, distribution planning, and tax strategies leading up to your retirement date.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Do I need to sign up for Medicare when I turn 65 if I’m still working?

If your employer has 20 or more employees and provides group health coverage, you can delay Medicare Part B and Part D without penalty. However, if your employer has fewer than 20 employees, you generally need to enroll in Medicare Parts A and B at 65, as Medicare becomes your primary insurance.

Can I keep contributing to my Health Savings Account (HSA) after enrolling in Medicare?

No. Once you enroll in any part of Medicare, including Part A, you can no longer make HSA contributions. To continue contributing, you must delay all parts of Medicare enrollment until after you stop HSA-eligible coverage.

What happens if I delay Medicare Part B & D while keeping employer coverage?

You can delay Part B & D of Medicare if your employer’s health plan is considered “creditable coverage,” meaning it’s as good as or better than Medicare’s standard plan. If your coverage isn’t creditable, you may face a permanent late enrollment penalty when you eventually sign up for Medicare Part B & D.

How does working past 65 affect Social Security benefits?

You can begin Social Security as early as age 62, but if you earn more than the annual limit before reaching full retirement age (FRA), your benefits may be temporarily reduced. After FRA, your earnings no longer affect your Social Security payments, and delayed benefits increase your monthly amount by up to 8% per year until age 70.

Should I enroll in Medicare Part A at 65 even if I’m still covered by my employer?

Many people enroll in premium-free Part A at 65 while keeping their employer plan as primary coverage. However, if you’re still contributing to an HSA, you should delay Part A enrollment to avoid losing HSA contribution eligibility.

What steps should I take as I approach age 65 while still working?

Confirm whether your employer plan is creditable coverage, decide whether to enroll in Medicare Part A, and review how your plan coordinates with Medicare. Also, evaluate your Social Security filing strategy to balance income needs, taxes, and future benefit growth.

Understanding the Order of Withdrawals In Retirement

The order in which you withdraw money in retirement can make a huge difference in how long your savings last—and how much tax you pay. In this article, we break down a smart withdrawal strategy to help retirees and pre-retirees keep more of their hard-earned money.

When entering retirement, one of the most important financial questions you’ll face is: What’s the smartest order to pull funds from my various retirement accounts? Getting this order wrong can lead to unnecessary taxes, reduced portfolio longevity, and even higher Medicare premiums.

While there’s no universal rule that fits everyone, there are strategic guidelines that can help most retirees withdraw more efficiently and keep more of what they’ve saved.

1. Use Tax-Deferred Accounts (Traditional IRA / 401(k))

For clients who have both after-tax brokerage accounts or cash reserves as well as pre-tax retirement accounts, they are often surprised to find out that there are large tax advantages to taking distributions from pre-tax retirement accounts in the early years of retirement. Since all Traditional IRA and 401(k) distributions are taxed, retirees unknowingly will fully deplete their after-tax sources before turning to their pre-tax retirement accounts.

I’ll explain why this is a mistake.

When most individuals retire, their paychecks stop, and they may, tax-wise, find themselves in low to medium tax brackets. Knowing they are in low to medium tax brackets, by not taking distributions from pre-tax retirement accounts, a retiree could be wasting those low-bracket years.

For example, Scott and Kelly just retired. Prior to retirement their combine income was $300,000. Scott and Kelly have a cash reserve of $100,000, an after tax brokerage account with $250,000, and Traditional IRA’s totaling $800,000. Since their only fixed income source in retirement is their social security benefits totaling $60,000, if they need an additional $20,000 per year to meet their annual expenses, it may make sense for them to withdrawal that money from their Traditional IRAs as opposed to their cash reserve or brokerage account.

Reason 1: For a married couple filing a joint tax return, the 12% Federal tax bracket caps out at $96,000, that is relatively low tax rate. If they need $20,000 after tax to meet their expenses, they could gross up their IRA distribution to cover the 12% Fed Tax and withdrawal $22,727 from their IRA’s and still be in the 12% Fed bracket.

Reason 2: If they don't take withdrawals from their pretax retirement accounts, those account balances will keep growing, and at age 75, Scott and Kelly will be required to take RMD’s from their pre-tax retirement account, and those RMDs could be very large pushing them into the 22% Fed tax bracket.

Reason 3: For states like New York that have state income tax, depending on the state you live in, they may provide an annual state tax exemption for a certain amount of distributions from pre-tax retirement accounts each year. In New York, the state does not tax the first $20,000 EACH YEAR withdrawn from pre-tax retirement accounts. By not taking distributions in their early years and retirement, a retiree may be wasting that annual $20,000 New York state exemption, making a larger portion of their IRA distribution subject to state tax in the future.

For client who have both pre-tax retirement accounts and after-tax brokerage accounts, it can sometimes be a blend of the two, depending on how much money they need to meet their expenses. It could be that the first $20,000 comes from their Traditional IRA to keep them in the low tax bracket, but the remainder comes from their brokerage account. It varies on a case-by-case basis.

2. After-Tax Brokerage Accounts and Cash Reserve (Brokerage)

For individuals who retire after age 59 ½, the distribution strategy usually involves a blend of pre-tax retirement account distributions and distributions from after-tax brokerage accounts. When selling holdings in a brokerage account to raise cash for distributions, retirees have to be selective as to which holdings they sell. Selling holdings that have appreciated significantly in value could trigger large capital gains, adding to their taxable income in the retirement years. But there are typically holdings that may either have minimal gains that could be sold with very little tax impact or holding that have long-term capital gains treatment taxed at a flat 15% federal rate. Since every dollar is taxed coming out of a pre-tax retirement account, having after-tax cash or a brokerage account can sometimes allow a retiree to pick their tax bracket from year to year.

There is often an exception for individuals that retire prior to age 59½ or in some cases prior to age 65. In these cases, taking withdrawals from after-tax sources may be the primary objective. For individual under the age of 59 1/2 , if distributions are taken from a Traditional IRA prior to age 59 1/2, the individual faced taxation and a 10% early withdrawal penalty.

Note: There are some exceptions for 401(k) distributions after age 55 but prior to age 59 1/2.

For individuals who retire prior to age 65 and do not have access to retiree health benefits, they frequently have to obtain their insurance coverage through the state exchange, which has income subsidies available. Meaning the less income an individual shows, the less they have to pay out of pocket for their health insurance coverage. Taking taxable distributions from pre-tax retirement accounts could potentially raise their income, forcing them to pay more for their health insurance coverage. If instead they take distributions from after-tax sources, they could potentially receive very good health insurance coverage for little to no cost.

3. Save Roth IRA Funds for Last

Roth IRAs grow tax-free and offer tax-free withdrawals in retirement. Because they don’t have RMDs and don’t increase your taxable income, Roth IRAs are ideal for later in retirement, or even as a legacy asset to pass on to heirs. To learn more about creating generational wealth with Roth Conversions, watch this video.

Keeping your Roth untouched early in retirement also gives you flexibility in higher-income years. Need to take a larger withdrawal to fund a home project or major expense? Roth distributions won’t impact your tax bracket or Medicare premiums.

4. Special Considerations

Health Savings Accounts (HSAs):

If you have a balance in an HSA, use it for qualified medical expenses tax-free. These can be especially valuable in later years as healthcare costs increase.

Social Security Timing:

Delaying Social Security can reduce taxable income in early retirement, opening the door for Roth conversions and other tax strategies.

Sequence of Return Risk:

Withdrawing from the wrong accounts during a market downturn can permanently damage your portfolio. Diversifying your income sources can reduce that risk.

5. Avoid These Common Withdrawal Mistakes

Triggering higher Medicare premiums (IRMAA): Large withdrawals can push your income over thresholds that increase Medicare Part B and D premiums.

Missing Roth Conversion Opportunities: Processing Roth conversions to take advantage of low tax brackets and reduce future RMDs.

Tapping after-tax accounts too early: Maintaining a balance in a brokerage account can provide more tax flexibility in future years, and when it comes to estate planning these asset receive a step-up in cost basis before passing to your beneficiaries.

Final Thoughts

The order you withdraw your funds in retirement can significantly affect your taxes, benefits, and long-term financial security. A smart strategy blends tax awareness, income needs, and market conditions.

Every retiree’s situation is unique and working with a financial planner who understands the coordination of retirement income can help you keep more of your wealth and make it last longer.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the best order to withdraw funds from retirement accounts?

The “best” withdrawal strategy truly varies from person to person. A common mistake retirees make is fully retiring and withdrawing money first from after-tax sources, then, once depleted, from pre-tax sources. Depending on the types of investment accounts someone has and their income needs, a blended approach can often be ideal.

Why might it make sense to take IRA withdrawals early in retirement?

Early retirement years often come with lower taxable income, allowing retirees to withdraw from pre-tax accounts at favorable tax rates. Doing so can reduce the size of future RMDs and help avoid being pushed into higher tax brackets later in life.

How do after-tax brokerage accounts fit into a retirement income strategy?

After-tax brokerage accounts offer flexibility since withdrawals are not fully taxable—only gains are. They can help retirees manage their tax brackets from year to year, especially when balancing withdrawals from pre-tax and Roth accounts.

When should retirees use Roth IRA funds?

Roth IRAs are typically best reserved for later in retirement because withdrawals are tax-free and don’t affect Medicare premiums or tax brackets. They also have no required minimum distributions, making them valuable for legacy or estate planning.

How can withdrawal timing affect Medicare premiums?

Large distributions from pre-tax accounts can raise your income and trigger higher Medicare Part B and D premiums through the Income-Related Monthly Adjustment Amount (IRMAA). Spreading withdrawals over multiple years or using Roth funds strategically can help avoid these surcharges.

What are common mistakes to avoid when withdrawing retirement funds?

Common pitfalls include depleting after-tax accounts too early, missing Roth conversion opportunities, or taking large taxable withdrawals that increase Medicare costs. Coordinating withdrawals with tax brackets and healthcare needs can help prevent these costly errors.

How does delaying Social Security affect retirement withdrawal strategy?

Delaying Social Security reduces taxable income in early retirement, which can open opportunities for Roth conversions or strategic IRA withdrawals. Once benefits begin, managing income sources carefully helps minimize taxes and maximize long-term income.

Should You Put Your House in a Trust or Gift It?

Your home is one of the most valuable assets you'll pass on—but how you transfer it to the next generation can have major tax, legal, and financial consequences.

For many families, the home is one of the most valuable assets they’ll pass on to the next generation. But when it comes to estate planning, simply deciding who gets the house isn’t enough. How you transfer the home, either by placing it in a trust or gifting it during your lifetime, can have significant tax and legal implications.

In this article, we’ll break down the pros and cons of each option so you can make a more informed decision.

Option 1: Putting Your Home in a Trust

A revocable living trust is one of the most common tools used in estate planning to manage the transfer of assets after death—your home included.

Benefits of Using a Revocable Trust

Avoids Probate: When a home is placed in a trust, it can pass directly to your heirs without going through the probate process, which can be lengthy and public.

Maintains Control: With a revocable trust, you still own and control the property during your lifetime. You can sell it, live in it, or remove it from the trust at any time.

Clear Instructions: You can specify exactly how and when the property should transfer, including naming successor trustees to manage it if you become incapacitated.

Step-Up in Cost Basis: Heirs who receive a home through a trust at your death typically receive a step-up in basis, meaning capital gains taxes are calculated based on the home’s value at your date of death—not what you originally paid.

Potential Drawbacks

Setup Costs: Establishing a trust requires legal work and upfront costs.

Ongoing Maintenance: You’ll need to update the trust if your wishes change and ensure the title of the home is properly retitled into the trust.

Long-Term Care Risk: Unlike an Irrevocable Trust, a Revocable Trust is not protected from a Medicaid spenddown associated with a long-term care event.

To learn more about if you should put your house in a trust, watch our video here.

Option 2: Gifting the Home During Your Lifetime

Some individuals consider transferring ownership of their home to their children or heirs while they’re still alive. This might feel like a generous or efficient move—but it can come with unintended consequences.

When Gifting May Be Appropriate

If you’re planning ahead for Medicaid eligibility and want to remove assets from your estate (with timing and rules carefully considered)

If the home has minimal appreciation and capital gains aren’t a major concern

Risks of Gifting the Home

Loss of Control: Once you gift the property, you no longer own it. You can’t sell it or use it as collateral without the new owner’s permission.

No Step-Up in Basis: The recipient inherits your original cost basis. If the home has appreciated significantly, they may face large capital gains taxes when they sell it.

Medicaid Look-Back Period: Gifting a home may disqualify you from Medicaid benefits if done within five years of applying, depending on your state’s rules.

Possible Gift Tax Reporting: While you may not owe gift tax, you must file a gift tax return if the gift exceeds the annual exclusion limit ($19,000 per person in 2025).

To learn more about gifting your house to your children, watch our video here.

Which Option Is Better?

In most cases, placing your home in a trust provides more flexibility, tax efficiency, and control over how the asset is handled both during your life and after your death. It’s especially helpful if you want to:

Avoid probate

Maintain access and control

Ensure a step-up in basis for your heirs

Provide clear transfer instructions

Gifting, on the other hand, might make sense in very specific planning scenarios—but it carries more risk and fewer tax advantages if not done carefully.

Final Thoughts

Your home is more than just a valuable asset. It’s also tied to your financial security and your family’s future. Whether you decide to put it in a trust or gift it, the key is aligning the decision with your broader estate, tax, and long-term care planning goals.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What are the benefits of putting your home in a trust?

Placing your home in a revocable living trust helps it transfer to heirs without probate, maintaining privacy and avoiding court delays. It also allows you to retain control of the property during your lifetime and ensures your heirs receive a step-up in cost basis, reducing potential capital gains taxes when they sell the home.

What are the drawbacks of using a revocable trust for your home?

Setting up a trust requires legal documentation and some upfront cost, and the trust must be maintained over time to reflect your wishes. Additionally, assets in a revocable trust are not protected from Medicaid spend-down rules in the event of long-term care needs.

What happens if I gift my home to my children while I’m alive?

When you gift your home during your lifetime, ownership transfers immediately, meaning you lose control over the property. The recipient inherits your original cost basis, which could lead to higher capital gains taxes if they sell the home in the future.

Are there tax implications when gifting a home?

Yes. While you may not owe gift tax immediately, you must file a gift tax return if the gift exceeds the annual exclusion amount ($19,000 per person in 2025). The recipient also does not receive a step-up in cost basis, which can increase future taxable gains.

How does gifting a home affect Medicaid eligibility?

Gifting a home within five years of applying for Medicaid can trigger penalties or delay eligibility. The transfer may be counted under Medicaid’s “look-back” period, so timing and state-specific rules are important to consider.

Is it better to gift my home or put it in a trust?

For most people, placing the home in a revocable trust offers more flexibility, control, and tax efficiency. Gifting may make sense only in specific situations, such as Medicaid planning, and should be done with professional guidance to avoid costly mistakes. When it comes to Medicaid planning, often setting up an Irrevocable Trust to own the primary residence can be an ideal solution to protect the house from the long-term care event, and the beneficiaries can still receive the step-up in cost basis when they inherit the house.

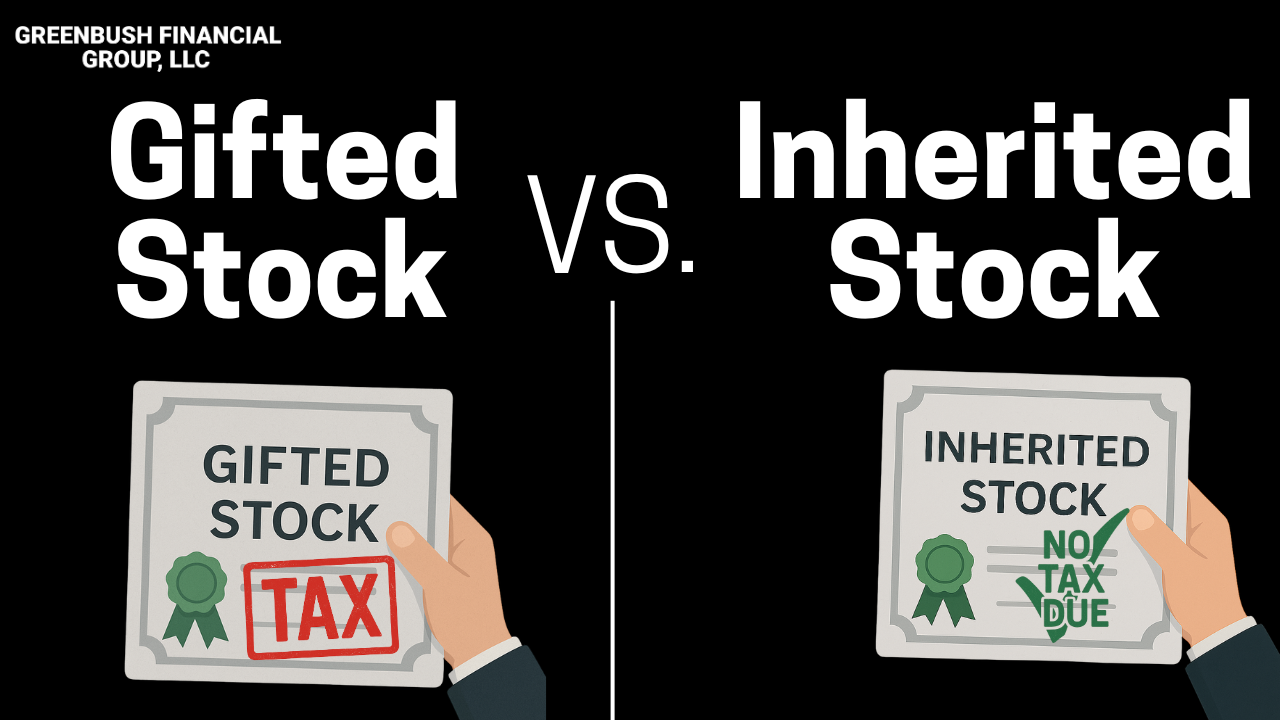

Don’t Gift That Stock Yet – Why Inheriting Might Be Better

Thinking about gifting your stocks to your kids or loved ones? You might want to hit pause. In this video, we break down why inheriting appreciated stock is often a far smarter move from a tax perspective.

When it comes to passing wealth to the next generation, many investors consider gifting appreciated stock during their lifetime. While the intention is generous, gifting stock prematurely can create unexpected tax consequences. In many cases, allowing your heirs to inherit the stock instead can lead to a significantly better outcome — especially from a tax perspective.

Here’s what you need to know before transferring shares.

The Key Difference: Gifting vs. Inheriting Stock

The tax treatment of appreciated stock hinges on the concept of cost basis — the original value of the stock when you acquired it.

Gifted stock: The recipient takes on your original cost basis. If they sell, they may owe capital gains tax on the full appreciation.

Inherited stock: The recipient receives a “step-up” in basis to the fair market value on the date of your death. If they sell shortly after, there may be little or no capital gain.

This example illustrates why timing matters when transferring highly appreciated assets.

When Gifting Might Still Make Sense

There are scenarios where gifting appreciated stock can be a smart move:

Low-Income Beneficiaries: If the person receiving the stock is in the 0% long-term capital gains tax bracket, they might sell the stock with no federal tax owed.

In 2025, this includes:

Single filers with taxable income under $47,025

Married couples filing jointly with taxable income under $94,050

Charitable Giving: Donating appreciated stock to a qualified charity allows you to avoid capital gains tax altogether and potentially deduct the fair market value of the donation.

Other Considerations

Timing of Sale: If your child or heir plans to sell the shares quickly, gifting may trigger a large capital gain — something they might not be prepared for.

Holding Period Requirements: Gifting doesn’t reset the holding period. If owner of the stock purchase the stock more than 12 months ago, if it’s gift to someone else and they sell it immediate, they receive long-term capital gain treatment since they get credit for the time the original owner held the securities.

State Taxes: Even if there's no federal capital gain, some states still impose capital gains taxes.

Final Checklist: Before You Gift Stock, Ask:

Has the stock appreciated significantly since I bought it?

Would the recipient likely sell the stock soon after receiving it?

Are they in a low-income tax bracket or facing large expenses?

Am I trying to reduce my estate or make a charitable contribution?

Final Thoughts

Gifting stock during your lifetime can be useful in the right situations — particularly for charitable intent or strategic gifting. But in many cases, letting your heirs inherit appreciated stock allows them to avoid a sizable capital gains tax bill.

Before gifting, consider your own goals, the recipient’s financial position, and the long-term tax impact. The best outcomes often come from a well-timed, well-informed plan.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the main difference between gifting and inheriting stock?

When you gift appreciated stock, the recipient assumes your original cost basis, meaning they may owe capital gains tax on all prior appreciation when they sell. In contrast, inherited stock receives a “step-up” in basis to its fair market value at the time of your death, often eliminating or greatly reducing capital gains tax if sold soon after.

When does gifting appreciated stock make sense?

Gifting may be advantageous if the recipient is in the 0% long-term capital gains tax bracket or if the stock is being donated to a qualified charity. In those cases, little to no capital gains tax may apply, and charitable donors may be able to deduct the stock’s fair market value.

How does the cost basis affect capital gains taxes on gifted stock?

The cost basis determines how much of the stock’s value is subject to capital gains tax. When stock is gifted, the recipient keeps the giver’s original basis, so highly appreciated shares can result in significant taxes when sold. Inherited shares, however, get a new basis equal to their current market value.

Are there tax benefits to donating appreciated stock to charity?

Yes. Donating appreciated stock directly to a qualified charity allows you to avoid paying capital gains tax on the appreciation and may provide a charitable deduction equal to the stock’s fair market value. This can be more tax-efficient than selling the stock and donating cash.

Do gifted stocks qualify for long-term capital gains treatment?

Yes, the recipient inherits the donor’s holding period. If the donor owned the stock for more than one year, the recipient can sell immediately and still qualify for long-term capital gains rates.

What should I consider before gifting appreciated stock?

Before gifting, assess how much the stock has appreciated, the recipient’s income level and potential tax bracket, and whether they plan to sell soon. In many cases, allowing heirs to inherit appreciated stock can result in better long-term tax outcomes due to the step-up in basis.