Only Minor Changes to HSA Accounts Following The Passing of the Big Beautiful Tax Bill

The Big Beautiful Tax Bill made waves with several high-profile tax changes, but surprisingly, very few changes were made to Health Savings Accounts (HSAs). Below we outline what made it into the final bill, what got removed, and what retirees—especially those on Medicare—need to know going forward.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

The Big Beautiful Tax Bill made waves with several high-profile tax changes, but surprisingly, very few changes were made to Health Savings Accounts (HSAs).

The original House version of the bill proposed several generous HSA reforms, but many of those provisions did not survive final negotiations in the Senate. What passed into law is far more limited in scope—but still important for HSA participants and high-deductible health plan (HDHP) users to understand.

Below we outline what made it into the final bill, what got removed, and what retirees—especially those on Medicare—need to know going forward.

What Changed for HSAs (Final Bill Provisions)

While many headline HSA changes were removed, a few modest but helpful updates did make it into the final version of the Big Beautiful Tax Bill. Starting in 2026, these changes will apply:

1. Modest Increase in Contribution Limits

HSA contribution limits will still increase, though not as dramatically as proposed in the original House bill. The finalized increases will be indexed annually, but will remain tethered to the HDHP inflation formula.

Projected (not confirmed) 2026 limits:

These are normal annual adjustments, not the doubling of limits that was originally proposed in the House version.

2. Expanded Eligible Expenses (Still Intact)

The final bill does include modest expansion of what HSA funds can be used for without penalty:

Fitness and wellness programs (with physician sign-off)

Some home health monitoring equipment

Nutritional counseling and weight loss programs (medically prescribed)

Telehealth and other remote care services before meeting the deductible (effective 2025)

While not a massive overhaul, this creates more flexibility for proactive health management and out-of-pocket wellness spending.

What Got Removed From the Final Bill

The Senate stripped out several big-ticket HSA reforms that many taxpayers were hoping for. These proposed changes did not make it into law:

No HSA Contributions for Medicare Enrollees

One of the biggest disappointments was the Senate’s removal of the provision that would have allowed retirees on Medicare Part A to continue contributing to HSAs.

As it stands under current law—and unchanged by the new bill—if you are enrolled in any part of Medicare, including just Part A (hospital insurance), you are prohibited from making HSA contributions, even if you're still working and covered by an employer’s HDHP.

For more information, read our article:

“The HSA 6-Month Rule: What Happens When You Enroll In Medicare at Age 65”

No Doubling of Contribution Limits

The House bill proposed doubling the annual HSA contribution limits but the Senate eliminated this enhancement during reconciliation. For now, standard annual inflation adjustments will continue to dictate contribution caps.

No Catch-Up Coordination for Married Couples

Another House provision that would have allowed spousal catch-up contributions into a single HSA was removed. Currently, each spouse must open their own HSA to make the age 55+ catch-up contribution. That rule remains unchanged.

Planning Implications for Retirees on Medicare

The final bill leaves the existing HSA-Medicare rule intact, which means:

If you’re age 65 or older and enrolled in Medicare, even just Part A, you cannot contribute to an HSA

You can still spend previously accumulated HSA funds tax-free on qualified medical expenses, including:

Medicare premiums (Parts B, D, and Medicare Advantage)

Long-term care insurance premiums (subject to limits)

Dental, vision, hearing, and copays

This reinforces the strategy of front-loading HSA contributions before Medicare enrollment, while you’re still eligible.

Final Thoughts

The final version of the Big Beautiful Tax Bill made far fewer changes to HSAs than originally proposed. While modest improvements to eligible expenses were included, the most exciting enhancements—especially for higher-income workers and retirees—were removed.

That said, HSAs remain one of the most tax-advantaged accounts available:

Tax-deductible contributions

Tax-free growth

Tax-free withdrawals for qualified expenses

For now, the existing HSA rules remain in place, and careful planning before Medicare enrollment is still essential for maximizing long-term tax benefits.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What HSA changes were included in the Big Beautiful Tax Bill?

The final bill made only modest updates to Health Savings Accounts (HSAs), including a small inflation-based increase in contribution limits beginning in 2026 and expanded eligibility for certain health-related expenses such as fitness programs, home health monitoring devices, and nutritional counseling.

Did the Big Beautiful Tax Bill double HSA contribution limits?

No. The Senate removed the House’s proposed doubling of annual HSA contribution limits. Instead, contribution limits will continue to rise modestly based on standard inflation adjustments tied to high-deductible health plan (HDHP) thresholds.

Can retirees on Medicare still contribute to an HSA?

No. The new law did not change the rule preventing Medicare enrollees—including those enrolled only in Part A—from contributing to an HSA. Once you enroll in Medicare, you can no longer make new contributions, though you can continue using existing funds for qualified medical expenses.

What expenses can HSAs now cover under the new law?

Beginning in 2026, HSAs can be used for a slightly broader range of qualified expenses, including physician-approved fitness and wellness programs, telehealth services before meeting the deductible, certain home monitoring devices, and medically prescribed nutritional counseling or weight loss programs.

What HSA reforms were removed from the final bill?

The following proposals from the House version were cut by the Senate:

Allowing Medicare enrollees to continue contributing to HSAs

Doubling annual HSA contribution limits

Allowing married couples to make both catch-up contributions into one HSA

What should retirees know about HSAs and Medicare under current law?

If you are 65 or older and enrolled in any part of Medicare, you cannot contribute new funds to an HSA. However, you may still withdraw from your HSA tax-free to pay for qualified medical expenses, including Medicare premiums, long-term care insurance (within IRS limits), and out-of-pocket healthcare costs.

Are HSAs still valuable after the Big Beautiful Tax Bill?

Yes. Even with limited reform, HSAs remain a “triple-tax-advantaged” account: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified expenses are tax-free. Pre-retirees should maximize contributions while eligible to take full advantage of these benefits.

EV Tax Credit Eliminated By The Big Beautiful Tax Bill: What You Need to Know Before the Clock Runs Out

The recently passed “Big Beautiful Tax Bill” includes sweeping changes to the tax code, but one provision that caught many by surprise is the elimination of the Electric Vehicle (EV) tax credit—a popular incentive for buyers of new, used, and commercial EVs.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

The recently passed “Big Beautiful Tax Bill” includes sweeping changes to the tax code, but one provision that caught many by surprise is the elimination of the Electric Vehicle (EV) tax credit—a popular incentive for buyers of new, used, and commercial EVs.

If you’ve been eyeing a new Tesla, Rivian, or Chevy Bolt and planning on that federal tax credit to sweeten the deal, the window is now closing faster than you might expect. Let’s break down what’s changing, when it changes, and what smart tax planning looks like from here.

What’s Changing: EV Credit Ends September 30, 2025

The new tax legislation repeals the federal EV tax credit for all categories of eligible vehicles—new, used, and commercial EVs—effective September 30, 2025.

Here are the key points:

Credits remain available through 9/30/2025 for qualifying vehicles that meet the current rules (including final assembly and battery sourcing requirements).

Starting October 1, 2025, no EV tax credits will be available—regardless of the manufacturer, price point, or battery configuration.

There is no phaseout, no new tiered system—it’s just gone.

This change has huge implications not just for consumers, but for dealers, automakers, and fleet operators who had integrated the credit into pricing, marketing, and adoption strategies.

Reminder: It’s a One-and-Done Tax Credit

One of the most misunderstood parts of the EV tax credit is how it actually works on your tax return. This isn’t a rebate or a refund check from the government—it’s a non-refundable tax credit, which means:

It can only be used once per taxpayer (for a qualifying new or used EV).

You only receive the portion of the credit that offsets your federal tax liability.

If your total tax due is less than the credit amount (e.g., $5,000 tax liability with a $7,500 credit), the excess is lost—you don’t get a refund or carryforward.

For this reason, tax planning is critical. You want to time the EV purchase in a year where you have enough tax liability to fully absorb the credit.

We break this concept down in greater detail in our dedicated article:

$7,500 EV Tax Credit: Use It or Lose It

What You Should Do Now

If you were planning to purchase an EV and benefit from the tax credit, here are a few action steps to consider:

1. Make Your Purchase Before the Deadline

To qualify, your EV purchase must be completed on or before September 30, 2025. If you’re ordering a vehicle with a long wait time, make sure delivery and documentation are completed by that deadline.

2. Coordinate With Your 2025 Tax Liability

Work with your tax advisor to project your 2025 tax liability. If it's too low to fully use the credit, you may want to consider:

Accelerating income into 2025

Deferring deductions

Selling appreciated assets that create short-term capital gains

IRA distributions or a Roth conversion

Why Is It Being Eliminated?

Supporters of the repeal argue that the EV market has matured, manufacturers have regained pricing power, and incentives are no longer needed to drive adoption. Others see it as a budgetary trade-off in the Big Beautiful Tax Bill designed to extend tax relief elsewhere (like the higher SALT cap and increased estate tax exemption).

Regardless of your view, the elimination is now law—and proactive planning is the only way to ensure you don’t leave money on the table.

Final Thoughts

The repeal of the EV tax credit may not be front-page news, but for taxpayers and businesses considering electric vehicle purchases, it’s a deadline worth tracking. If an EV is on your radar for 2025, your timing and tax planning just became far more important.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

When does the federal EV tax credit end?

The Big Beautiful Tax Bill eliminates the federal electric vehicle (EV) tax credit for new, used, and commercial EVs effective September 30, 2025. Purchases completed before that date may still qualify under current IRS rules.

Does the repeal apply to all types of EVs?

Yes. Beginning October 1, 2025, no EVs—regardless of manufacturer, price, or battery type—will be eligible for a federal tax credit. This repeal applies across the board with no phaseout or grandfathering period.

How does the EV tax credit work before the repeal?

The EV credit is a non-refundable tax credit, not a rebate. It reduces your federal income tax liability dollar-for-dollar, but only up to the amount you owe. Any unused portion is lost—you cannot carry it forward or receive it as a refund.

Can I still claim the EV tax credit in 2025?

Yes, if your qualifying vehicle is purchased and placed in service on or before September 30, 2025. To ensure eligibility, buyers should verify that final assembly, delivery, and paperwork are completed by that date.

Who benefits most from claiming the EV tax credit before it ends?

Taxpayers with sufficient federal tax liability to fully absorb the credit—often those with moderate to high income—benefit the most. Buyers with little or no tax liability may not receive the full $7,500 value.

How can I make sure I get the full EV credit?

Coordinate your purchase with your 2025 tax planning. If your expected tax bill is lower than the credit, consider strategies such as accelerating income, realizing capital gains, or completing a Roth conversion to increase your 2025 taxable income.

Why is the EV tax credit being repealed?

Lawmakers argued that the EV market has matured and that incentives are no longer needed to sustain demand. Others viewed the repeal as a budgetary offset to fund other tax relief measures, including a higher SALT cap and estate tax exemption.

What should EV buyers do now?

If you’re planning to buy an EV, act early to ensure delivery before the September 30, 2025 cutoff. Work with your tax advisor to evaluate your eligibility and confirm that you can maximize the credit before it disappears.

Child Tax Credit Increased Under the Big Beautiful Tax Bill

The Big Beautiful Tax Bill that just passed includes several targeted tax updates that will impact households beginning in the 2025 tax year. One of the more widely applicable changes is a modest increase to the Child Tax Credit (CTC)—a benefit claimed by millions of families each year.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

The Big Beautiful Tax Bill that just passed includes several targeted tax updates that will impact households beginning in the 2025 tax year. One of the more widely applicable changes is a modest increase to the Child Tax Credit (CTC)—a benefit claimed by millions of families each year.

While the increase is not dramatic, it’s important to understand who qualifies, how the credit works under the updated rules, and how income and immigration status can affect your eligibility. In this article, we break down the new $2,200 Child Tax Credit and what it means for your next few tax seasons.

What’s Changing with the Child Tax Credit?

Starting with the 2025 tax year, the Child Tax Credit increases from $2,000 per child to $2,200 per child under age 17. The credit is partially refundable and continues to be subject to income-based phaseouts.

Here’s a snapshot of the updated rules:

SSN Requirement Still Applies — Mixed-Status Families Blocked

One of the more controversial aspects of the bill is the continued requirement that both the parent (taxpayer) and each qualifying child must have a valid Social Security number (SSN) to claim the credit.

This rule effectively excludes mixed-status families—where a child may be a U.S. citizen but one or both parents file taxes using an ITIN (Individual Taxpayer Identification Number). If any family member lacks a valid SSN, the household becomes ineligible to claim the credit for that child.

If a child has an ITIN instead of a SSN—even if they’re a dependent on your return—the $2,200 credit is not available.

How the Refundable Portion Works

The refundable part of the Child Tax Credit—currently capped at $1,700 per child—is designed to benefit lower-income families who may not owe enough in federal taxes to use the full $2,200 credit.

In 2025, the refundable portion remains capped at $1,700 per child, but it is now indexed for inflation—meaning it could increase slightly each year going forward. To claim the refundable portion, families must have earned income above a set threshold (currently $2,500), which will also adjust with inflation.

This means that even if your tax liability is zero, you may still receive part of the credit as a refund, depending on your income and number of qualifying children.

Income Phase-Outs: No Change from Previous Law

The Big Beautiful Tax Bill does not change the phase-out thresholds for high-income earners. The Child Tax Credit still begins to phase out at the following Modified Adjusted Gross Income (MAGI) levels:

For every $1,000 your income exceeds the threshold, the credit is reduced by $50.

Example: A married couple with two children and a MAGI of $420,000 would see their credit reduced by $1,000 total ($50 × 20 = $1,000), leaving them with a remaining $3,400 in credit ($2,200 × 2 − $1,000).

Additional Child Tax Credit for Non-Filers

For individuals or families that don’t owe any federal tax or own less than the maximum credit amount, they may be able to get a partial refund of the credit by claiming the Additional Child Tax Credit (ACTC) but it’s requires a “phase-in calculation”. To determine the credit amount available for each child, the IRS multiplies your earned income amount over $2,500 by 15%. You can claim that amount for each eligible child.

For example, if a parents income is $10,000, the formula is:

$10,000 - $2,500 = $7,500

$7,500 x 15% = $1,125 Credit Per Child

If this calculated amount is less than the full $1,700 refundable amount, you would receive this lower amount per child. But in either case, the refundable amount per child is never greater than $1,700.

Planning Tips for Maximizing the Child Tax Credit

If your family qualifies, here are a few ways to maximize your tax benefit:

1. Ensure All Dependents Have Valid SSNs

If your child is a newborn, make sure to apply for their Social Security number as early as possible. No SSN = no credit.

2. Be Aware of Income Thresholds

If you're nearing the phase-out thresholds, consider strategies to reduce your taxable income, such as:

Maxing out 401(k) or traditional IRA contributions

Contributing to a Health Savings Account (HSA)

Deferring end-of-year bonuses if possible

3. Track Refundability Rules

Even if your income is modest, you can still benefit from the refundable portion. Ensure you have earned income and are filing correctly to take advantage.

Effective Date: 2025 Tax Year

All the changes to the Child Tax Credit go into effect for the 2025 tax year and are scheduled to remain in place through 2028, unless Congress acts to extend or modify the provisions before then.

Final Thoughts

While the increase from $2,000 to $2,200 may not be groundbreaking, it still represents additional tax relief for millions of families.

As always, the key to getting the most out of the Child Tax Credit is making sure your documentation is in order, understanding the income thresholds, and coordinating your year-end tax planning to align with these updated rules.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the new Child Tax Credit amount under the Big Beautiful Tax Bill?

Starting with the 2025 tax year, the Child Tax Credit increases from $2,000 to $2,200 per qualifying child under age 17. The credit remains partially refundable, allowing eligible families to receive up to $1,700 per child even if they owe little or no federal income tax.

When do the new Child Tax Credit rules take effect?

The updated Child Tax Credit applies to the 2025 through 2028 tax years. Unless Congress takes further action, the provisions are set to expire after 2028.

Who qualifies for the $2,200 Child Tax Credit?

To qualify, both the taxpayer and the child must have valid Social Security numbers (SSNs), and the child must be under age 17 at the end of the tax year. The credit begins to phase out at higher income levels.

What are the income limits for the Child Tax Credit?

The phase-out thresholds remain unchanged:

$400,000 for married couples filing jointly

$200,000 for single filers and heads of household

The credit is reduced by $50 for every $1,000 of income above these thresholds.

Can families with ITINs claim the Child Tax Credit?

No. Under the new law, both the parent and each qualifying child must have a valid SSN. Families filing with ITINs (Individual Taxpayer Identification Numbers) are not eligible for the $2,200 credit. This rule also excludes mixed-status families where one or both parents lack SSNs.

How does the refundable portion of the Child Tax Credit work?

The refundable portion, known as the Additional Child Tax Credit (ACTC), allows families with earned income over $2,500 to receive a refund even if they owe no tax. The refundable amount equals 15% of earned income over $2,500, up to $1,700 per child (indexed for inflation).

Example:

If you earn $10,000 in 2025, the refundable credit is:

($10,000 − $2,500) × 15% = $1,125 per child

How can I maximize the Child Tax Credit?

Make sure each qualifying child has an SSN before filing.

Manage your income to stay below the phase-out thresholds—contributing to retirement accounts or HSAs can help.

If eligible, claim the refundable portion by reporting earned income above $2,500.

Why are mixed-status families excluded from the Child Tax Credit?

Congress maintained the SSN requirement from prior law to limit eligibility to taxpayers and children who both have valid Social Security numbers. Families where a child or parent files with an ITIN are not eligible for the credit.

Will the Child Tax Credit increase again after 2028?

As written, the $2,200 credit and related rules are temporary. The credit is scheduled to revert to prior levels in 2029, unless new legislation extends or modifies it.

New Auto Loan Interest Deduction Under the Big Beautiful Tax Bill: What You Need to Know

The recently passed Big Beautiful Tax Bill introduced a series of attention-grabbing tax changes but one provision could directly benefit millions of Americans is the creation of a new tax deduction for auto loan interest.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

The recently passed Big Beautiful Tax Bill introduced a series of attention-grabbing tax changes but one provision could directly benefit millions of Americans is the creation of a new tax deduction for auto loan interest.

For the first time in decades, personal auto loan interest is partially deductible—but it’s not as simple as deducting any old car payment. This provision comes with strict qualifications for both the vehicle and the borrower, and the clock is already ticking, as it’s only available from 2025 through 2028.

In this article, we’ll walk through the key features of the deduction, qualification criteria, and how to plan for this new benefit.

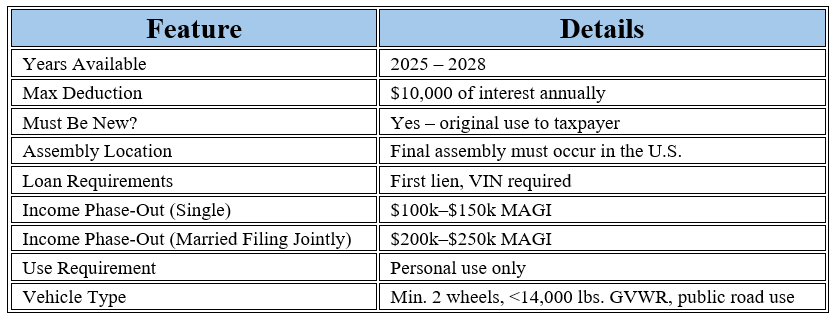

Qualified Passenger Vehicle Loan Interest Deduction

Starting January 1, 2025, taxpayers can deduct interest on certain qualified auto loans—but only if the vehicle and loan meet specific federal criteria.

Here’s what qualifies:

Up to $10,000 per year of interest on a qualifying auto loan can be deducted from your federal income.

Vehicle must be assembled in the United States; final assembly must occur within the U.S.

Only new vehicles—used vehicles do not qualify.

The loan must be secured by a first lien on the vehicle (i.e., the lender has the primary claim if you default).

The vehicle must be for personal use only; commercial use or fleet vehicles are excluded.

A valid Vehicle Identification Number (VIN) must be reported on your tax return.

This is an above-the-line deduction, meaning you don’t need to itemize to claim it—an important feature for the many taxpayers who now take the standard deduction.

What Passenger Vehicles Qualify?

Not all vehicles are eligible for the deduction. The IRS has laid out clear requirements for what constitutes a qualified passenger vehicle under this provision.

Eligible vehicles include:

Cars, minivans, SUVs, pickup trucks, vans, and motorcycles

Must have a gross vehicle weight rating (GVWR) under 14,000 pounds

Must be treated as a “motor vehicle” under Title II of the Clean Air Act

Final assembly must occur in the United States

Commercial or fleet sales do not qualify—the deduction is strictly for personal-use vehicles

If you're purchasing a vehicle in 2025 or beyond, be sure to check the window sticker or manufacturer's certification to ensure your vehicle meets the final assembly and GVWR requirements.

Income Phase-Outs for High Earners

As with many provisions in the Big Beautiful Tax Bill, the new auto loan interest deduction phases out for higher-income earners based on modified adjusted gross income (MAGI).

Here’s how the phase-out works:

Example:

A single taxpayer with $110,000 in MAGI is $10,000 over the phase-out threshold.

$10,000 ÷ $1,000 = 10 increments

10 × $200 = $2,000 deduction reduction

Since the max deduction is $10,000, that taxpayer would only be able to deduct $8,000 in auto loan interest.

The deduction completely phases out once your MAGI exceeds the threshold by $50,000, meaning:

Single filers earning $150,000 or more

Married couples filing jointly earning $250,000 or more

will not be eligible for this deduction.

Why It Matters

With auto loan rates hovering between 6–9% in today’s environment, the ability to deduct interest—especially up to $10,000 per year—can provide meaningful tax relief for car buyers. For example, if you finance a $50,000 vehicle at 7% interest, you could pay $3,000–$4,000 in interest annually. Deducting that amount directly reduces your taxable income and could save hundreds or even thousands in federal taxes depending on your tax bracket.

Planning Considerations

With interest rates still elevated and vehicle prices remaining high, this new deduction could result in meaningful savings—but only if your loan and income qualify.

Buy New and Verify Final Assembly Location

Used vehicles don’t qualify. You must be the first owner, and the vehicle must be assembled in the U.S.

Structure the Loan Properly

Make sure your loan is a secured first lien—most auto loans are, but personal loans and some alternative financing options might not qualify.

Mind Your Income

If you’re near the income phaseout thresholds, consider strategies to reduce your MAGI—like maxing out traditional retirement accounts or HSA contributions—to stay within range.

Track Interest Separately

Keep detailed records of interest paid. Many lenders provide this info via a year-end statement or IRS Form 1098.

Key Dates and Summary Table

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the new auto loan interest deduction under the Big Beautiful Tax Bill?

Beginning January 1, 2025, taxpayers can deduct up to $10,000 per year in interest paid on qualifying personal auto loans. The deduction is available for new, U.S.-assembled vehicles financed with a first-lien loan and remains in effect through 2028.

Do I need to itemize deductions to claim this benefit?

No. The deduction is classified as an above-the-line deduction, meaning you can claim it even if you take the standard deduction.

Which vehicles qualify for the deduction?

Eligible vehicles must be newly purchased (not used), assembled in the United States, and have a gross vehicle weight rating under 14,000 pounds. Cars, SUVs, pickup trucks, vans, and motorcycles may qualify, provided they are for personal—not commercial—use.

Are used or leased vehicles eligible?

No. Used vehicles, leased vehicles, and vehicles financed through unsecured personal loans do not qualify for the deduction.

What are the income limits for the auto loan interest deduction?

The deduction begins to phase out at modified adjusted gross income (MAGI) of $100,000 for single filers and $200,000 for married couples filing jointly. It is reduced by $200 for every $1,000 of income above these thresholds and fully phases out at $150,000 (single) and $250,000 (joint).

Why does the vehicle’s assembly location matter?

Only vehicles with final assembly in the United States qualify for the deduction. Buyers should confirm the assembly location using the manufacturer’s certification label or the vehicle’s window sticker.

How much can this deduction save the average car buyer?

The potential savings depend on your tax bracket and total interest paid. For example, if you pay $4,000 in interest at a 24% tax rate, the deduction could reduce your federal taxes by roughly $960.

When does the new deduction expire?

The provision is temporary and applies to tax years 2025 through 2028. Unless renewed by Congress, it will expire after December 31, 2028.

What documentation should I keep for my taxes?

Keep your loan agreement showing it is a first-lien secured loan, your lender’s year-end statement or Form 1098 showing total interest paid, and documentation verifying the vehicle’s final assembly location and VIN.

Estate Tax Exemption Raised to $15 Million Under the Big Beautiful Tax Bill: What It Means for Your Estate Plan

The newly enacted “Big Beautiful Tax Bill” includes a wide range of updates to the tax code, but one of the most impactful—and underreported—changes is the significant increase in the federal estate tax exemption. Under the new law, the federal estate tax exemption rises to $15 million per person, or $30 million for married couples with proper planning.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

The newly enacted “Big Beautiful Tax Bill” includes a wide range of updates to the tax code, but one of the most impactful—and underreported—changes is the significant increase in the federal estate tax exemption. Under the new law, the federal estate tax exemption rises to $15 million per person, or $30 million for married couples with proper planning.

This change opens new estate planning opportunities for high-net-worth individuals and families—but it's not as simple as just celebrating the larger exemption. There are still important state-level considerations and planning decisions that need attention.

Let’s walk through what’s changed, what hasn’t, and what you should be doing now to stay ahead.

A Quick Recap: What Is the Estate Tax Exemption?

The estate tax exemption is the amount of an individual's estate that can be passed on to heirs free of federal estate tax. Any amount over the exemption is typically taxed at a flat 40% federal rate.

Before this bill, the federal exemption had been set to sunset at the end of 2025—reverting from its inflation-adjusted ~$13.6 million in 2024 down to about $6 million. But the Big Beautiful Tax Bill not only prevented that sunset, it increased the exemption even further to:

$15 million per individual

$30 million per married couple (with proper portability election)

These new levels apply beginning in 2026 and are indexed for inflation going forward.

State Estate Taxes Still Matter

While the federal estate tax exemption is now very generous, it’s critical to remember that many states impose their own estate or inheritance taxes, often with much lower exemption thresholds.

Here are a few examples:

In states like Massachusetts and Oregon, even moderate estates can trigger a significant tax liability. Also, some states (like New York) have cliff provisions where exceeding the exemption by even a small amount can result in estate tax being applied to the entire estate—not just the portion over the threshold.

Bottom line: Even if you’re under the federal exemption, you may still face state-level estate taxes depending on where you live or own property.

What This Means for Your Estate Planning

The increase to a $15 million federal exemption doesn’t mean you should put your estate plan on the shelf. In fact, now may be the perfect time to refine and optimize your estate strategy.

Here’s what to consider:

1. Leverage Gifting Strategies While the Window Is Open

The $15 million exemption opens the door to making significant tax-free gifts. Techniques like spousal lifetime access trusts (SLATs), grantor retained annuity trusts (GRATs), and intentionally defective grantor trusts (IDGTs) may still be appropriate depending on your goals.

2. Don’t Overlook State-Level Planning

Work with your estate planning attorney to structure your estate to reduce or eliminate state estate tax exposure. This might include retitling assets, setting up trusts, or evaluating residency if you're near retirement.

3. Make Sure Your Documents Are Aligned

Many older estate plans were drafted with lower exemption amounts in mind. If your documents still refer to formulas like “credit shelter amount” or “maximum federal exemption,” you could unintentionally disinherit a spouse or fail to make full use of today’s exemption.

4. Portability Still Matters

Married couples should continue to file a federal estate tax return upon the death of the first spouse to elect portability and lock in both exemptions—especially now that we're talking about $30 million per couple.

The Takeaway

The Big Beautiful Tax Bill gives ultra-high-net-worth families a powerful estate tax planning opportunity. But for many, the state estate tax will continue to be a more pressing issue than the federal threshold.

Whether you’re just above the state threshold or pushing into eight-figure net worth territory, the key is proactive, coordinated planning. A well-structured estate plan not only protects wealth from unnecessary taxation but ensures that it’s distributed in alignment with your legacy goals.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the new federal estate tax exemption under the Big Beautiful Tax Bill?

Beginning in 2026, the federal estate tax exemption increases to $15 million per person and $30 million for married couples who elect portability. These amounts will be indexed annually for inflation.

When does the new exemption take effect?

The higher exemption takes effect on January 1, 2026. Until then, the 2024–2025 inflation-adjusted exemption (approximately $13.6 million per person) remains in place.

Wasn’t the federal exemption supposed to decrease in 2026?

Yes. Under prior law, the exemption was scheduled to “sunset” at the end of 2025, reverting to roughly $6 million per person. The Big Beautiful Tax Bill not only prevented that reduction but raised the exemption further to $15 million.

What is the current federal estate tax rate?

Amounts exceeding the exemption are subject to a flat 40% federal estate tax.

Does this change eliminate state-level estate taxes?

No. Many states still impose their own estate or inheritance taxes with much lower exemption limits—often between $1 million and $5 million. States such as Massachusetts, Oregon, and New York have their own rules that can create substantial tax exposure even if you’re below the federal threshold.

How does portability work for married couples?

Portability allows a surviving spouse to use any unused portion of their deceased spouse’s exemption. To take advantage, the estate of the first spouse must file a federal estate tax return (Form 706), even if no federal estate tax is due.

Can I make gifts using the higher exemption before 2026?

The $15 million exemption doesn’t apply until 2026, but you can continue to make gifts under the current (2024–2025) exemption without penalty. If you plan to make large gifts, consider doing so before the law changes to preserve flexibility and confirm how the IRS applies the new thresholds.

How can I reduce or avoid state estate taxes?

Strategies may include establishing or updating trusts, retitling assets, changing residency to a state without estate tax, or leveraging lifetime gifting to reduce your taxable estate. Work with an estate planning attorney familiar with your state’s laws.

Do I need to update my estate planning documents?

Possibly. Older wills and trusts often reference outdated exemption formulas or definitions. Review your plan to ensure it reflects current law and your intentions, especially if it uses terms like “credit shelter trust” or “maximum exemption amount.”

Why is estate planning still important even with a $15 million exemption?

Beyond taxes, estate planning governs how your wealth transfers, protects beneficiaries, and ensures your legacy goals are met. It also addresses incapacity, guardianship, and charitable intentions—issues unaffected by the exemption increase.

Trust Roles Easily Explained: Grantor, Trustee, and Beneficiary

Trust Roles Explained Easily: Whether you're setting up a trust or are currently an interested party in a an existing trust, understanding who does what is essential.

When it comes to estate planning, trusts can be powerful tools—but they’re only as effective as the people involved. Whether you’re creating a trust or have been named in one, you need to understand three key roles: grantor, trustee, and beneficiary.

Here’s how each role works, how they relate to one another, and what to watch out for.

The Three Key Roles in a Trust

1. Grantor (also called Settlor)

The grantor is the person who creates the trust and decides what goes into it and how it should be managed.

What the Grantor Does:

Creates and funds the trust

Sets the rules for how assets will be distributed

Names the trustee and beneficiaries

Can often serve as a trustee in a revocable trust

Example:

Sarah creates a revocable living trust and transfers her home and investment account into it. She sets terms for how her assets should pass to her children. Sarah is the grantor.

2. Trustee

The trustee is the person or institution responsible for managing the trust and following the rules set by the grantor.

Trustee Responsibilities:

Manage and safeguard trust assets

Follow the trust document’s instructions

Distribute funds to beneficiaries

Maintain records, file taxes, and act as a fiduciary

Example:

Sarah establishes an Irrevocable Trust and names her sister Emily as trustee. The trustee is awarded specific powers over the trust assets, such as establishing an investment account for the trust, selling real estate, making gifts to beneficiaries, hiring an accountant to prepare the tax return for the trust, and eventually distributing the assets accordingly. Emily is the trustee.

3. Beneficiary

The beneficiary is the person (or group) who receives the benefit of the trust, either now or in the future.

Beneficiaries Typically:

Receive income or assets according to the trust terms

Do not control how the trust is managed

Example:

Sarah’s children, Ava and Ben, are listed as beneficiaries. The trust states they’ll receive assets at age 30 but the trustee is allowed to distribute money from the trust to Ava and Ben to provide financial support for education, health, shelter, and living expenses. Ava and Ben are the beneficiaries.

Can One Person Fill Multiple Roles?

Yes. In many revocable trusts, the grantor can also be the trustee and beneficiary while alive. However, they must name a successor trustee to step in when needed.

In irrevocable trusts, the grantor typically gives up control and cannot serve as trustee or beneficiary.

For trusts that name someone beside the grantor as a trustee, it’s common that the trustee may also be a beneficiary of the trust.

Example:

Sarah establishes an Irrevocable Trust and names her daughter, Ava, as Trustee. Ava is also a beneficiary of the trust with her brother Ben.

Why These Roles Matter

Choosing the wrong person or failing to clearly define roles can lead to:

Disputes among family members

Over-providing or under-providing powers to the trustee

Mismanagement of assets

Delays in distribution or tax problems

Planning Tips

Review your trust documents and confirm who’s named in each role

Confirm all of the powers you have provided to the trustee

Name backup (successor) trustees in case your primary can’t serve

Pick a trustee who is reliable, impartial, and financially competent

Make sure your beneficiaries are clearly defined and up to date

Common Mistakes to Avoid

Naming a trustee who lacks the time or skills to manage finances

Forgetting to update your trust after a major life event (death, divorce, birth)

Assuming your trustee can make decisions outside the written terms (they can't)

Not reviewing your trust with your attorney after major tax law changes

Final Thought

Trusts only work when the right people are in the right roles—with a clear roadmap to follow. If you haven’t reviewed your trust recently, now is a great time.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is a grantor in a trust?

The grantor (also called the settlor) is the person who creates and funds the trust. They decide what assets go into it, set the distribution rules, and name the trustee and beneficiaries. In many revocable trusts, the grantor may also serve as the trustee during their lifetime.

What does a trustee do?

The trustee manages the trust’s assets according to the grantor’s instructions. Responsibilities include safeguarding property, making distributions to beneficiaries, maintaining records, filing taxes, and acting in the best interests of the beneficiaries. The trustee must follow the trust document exactly as written.

Who are the beneficiaries of a trust?

Beneficiaries are the individuals or organizations who receive the benefits of the trust, either through income distributions, asset transfers, or both. They do not control how the trust is managed unless specifically granted that authority.

Can one person serve as grantor, trustee, and beneficiary?

Yes, in many revocable living trusts, one person can fill all three roles. However, for irrevocable trusts, the grantor typically gives up control and cannot act as trustee or beneficiary. In some cases, a trustee may also be a beneficiary if allowed by the trust terms.

What happens if the trustee is also a beneficiary?

It’s common for a trustee to also be a beneficiary, especially in family trusts. However, this arrangement can create conflicts of interest, so the trust should clearly define limits on the trustee’s powers to ensure fair treatment of all beneficiaries.

Why is choosing the right trustee important?

The trustee controls how and when trust assets are managed and distributed. Selecting someone unreliable or inexperienced can lead to mismanagement, family disputes, or tax problems. A trustee should be financially responsible, impartial, and able to follow complex legal instructions.

Can a trust have more than one trustee?

Yes. Co-trustees can share responsibilities, which can help balance workload and oversight. However, having multiple trustees can also slow decision-making, so coordination and clear communication are essential.

What is a successor trustee?

A successor trustee is a backup who steps in if the primary trustee is unable or unwilling to serve. Naming one (or more) successor trustees ensures that the trust continues to operate smoothly without court involvement.

What are common mistakes people make when setting up a trust?

Frequent mistakes include naming an unqualified trustee, failing to update the trust after major life changes, misunderstanding the trustee’s authority, and neglecting to review the trust after tax law updates.

Why is it important to review your trust regularly?

Laws, family circumstances, and financial situations change over time. Reviewing your trust every few years—or after major events like marriage, divorce, or the birth of a child—ensures that your intentions remain clear and your plan stays effective.

Should Your Investment Strategy Change when You Retire

Should your investment strategy change when you retire? Most people don’t realize how much the answer impacts taxes, income, and long-term security. Retirement isn’t the end of your financial planning—it’s the start of a new phase. Your goals shift from growth to income, and your investment strategy should evolve with them.

Retirement marks a major shift in your financial life: you move from saving and accumulating wealth to spending it. But does that mean your investment strategy should change the moment you stop working?

The answer isn’t a simple yes or no—it depends on your goals, income needs, and risk tolerance. Let’s explore what changes may be necessary, what can stay the same, and how to align your investment approach with the realities of retirement.

1. Accumulation vs. Distribution: A New Financial Phase

During your working years, your investment strategy likely focused on growth—maximizing returns over the long term. For most, in retirement, the focus shifts to income and moderate growth. Your portfolio now needs to:

Support monthly withdrawals

Last for 20–30+ years

Withstand market volatility without derailing your lifestyle

This shift doesn't mean abandoning growth altogether, but it does mean adjusting how you balance risk and reward.

2. Reassess Your Asset Allocation

One of the first things to review in retirement is your asset allocation—how your investments are divided among stocks, bonds, and cash.

A typical pre-retirement portfolio may be 70–100% in equities. But in retirement, many advisors recommend dialing that back to reduce risk.

Example:

If you have a $1 million portfolio:

A 60/40 allocation would mean $600,000 in diversified stock funds and $400,000 in bonds or other fixed-income assets.

A 40/60 allocation might suit someone who is more risk-averse or heavily reliant on portfolio withdrawals.

Mistake Alert:

Some retirees swing too far into conservative territory. While that may feel safe, inflation can quietly erode your purchasing power—especially over a 25- to 30-year retirement.

3. Add an Income Strategy

Now that you’re drawing from your investments, it’s essential to have a plan for generating reliable income and decreasing the level of volatility with your portfolio. This may include:

Dividend-paying stocks or ETFs

Bond holdings or short-term fixed income

The goal is to create stable cash flow while giving your growth assets time to recover from market dips.

4. Be Strategic With Withdrawals

Your withdrawal strategy has a major impact on taxes and portfolio longevity. The order you pull from different account types matters.

Example:

Let’s say you need $80,000/year from your portfolio. You might:

Take $40,000 from a taxable account (capital gains taxed at lower rates)

Pull $20,000 from a Traditional IRA (fully taxable as income)

Social Security $20,000 (up to 85% taxable)

This balanced approach spreads the tax burden, avoids pushing you into a higher bracket, and gives your Roth assets (if you have them) more time to grow.

Common Misstep:

Many retirees default to depleting all of their after-tax assets first, but by not taking withdrawals from their tax-deferred accounts, like Traditional IRAs and 401(k) accounts, they potentially miss out on realizing those taxable distributions at very low tax rates. Having a withdrawal plan that coordinates your social security, Medicare premiums, after-tax accounts, pre-tax accounts, and Roth accounts is key.

5. Stay Diversified—Reduce Volatility In Portfolio

Diversification and reducing volatility are key considerations when entering retirement years. When you take withdrawals from your retirement accounts, the investment returns can vary significantly from those of the accumulation years. Why is that?

When you were working and contributing to your retirement accounts, and the economy hit a recession, since you were not withdrawing any money from your accounts when the market rebounded, you likely regained those losses fairly quickly. But in retirement, when you are taking distributions from the account as the market is moving lower, there is less money in the account when the market begins to rally. As such, your rate of return is more significantly impacted by market volatility when you enter distribution mode.

To reduce volatility in your portfolio, you may need to:

Increase your level of diversification across various asset classes

Keep a large cash reserve on hand to avoid selling stocks in a downturn

Be more proactive about adjusting your investment allocation in response to changing market conditions

6. Don’t Forget About Growth

Retirement could last 30 years or more. That means your portfolio needs to outpace inflation, especially with rising healthcare and long-term care costs.

Even if you’re taking distributions, keeping 30–60% in equities may help ensure your money grows enough to support you in later decades.

Final Thoughts: Don’t “Set It and Forget It”

Your investment strategy should evolve with you. Retirement isn’t a one-time financial event—it’s a new chapter that requires ongoing planning and regular reviews.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Should your investment strategy change when you retire?

While the focus shifts from accumulation to income and preservation, your investment approach should evolve based on your goals, risk tolerance, and income needs. Many retirees move toward a more balanced portfolio that supports sustainable withdrawals while still allowing for growth.

What’s the difference between the accumulation and distribution phases?

During the accumulation phase (your working years), the goal is to grow wealth through regular contributions and long-term compounding. In the distribution phase (retirement), you rely on your savings for income, so the emphasis shifts to generating steady cash flow and managing risk.

How should retirees adjust their asset allocation?

Many retirees move from aggressive stock-heavy portfolios to more balanced allocations—like 60/40 (stocks/bonds) or 40/60—depending on their comfort with risk. However, being too conservative can expose you to inflation risk, which can erode purchasing power over time.

How can you generate income from your investments in retirement?

Common income strategies include using dividend-paying stocks, bonds, or fixed-income funds to provide a steady cash flow. A well-structured income plan helps cover expenses while allowing growth-oriented investments to recover from market downturns.

What’s the best order to withdraw funds from retirement accounts?

Strategic withdrawals can help minimize taxes and extend portfolio longevity. The right order depends on your income, Social Security, and Medicare situation.

Why is diversification so important in retirement?

Diversification can reduce portfolio volatility—critical during retirement, when you’re withdrawing funds. Selling assets during a market downturn can permanently harm portfolio growth. Diversifying across asset classes and maintaining a cash buffer may help reduce the impact of market volatility.

Should retirees still invest in stocks?

In most cases, yes. Even in retirement, equities are important for long-term growth and inflation protection. With retirees living longer, it’s not uncommon for retirees to maintain investment accounts for 15+ years into retirement.

How often should retirees review their investment strategy?

At least once a year—or after major life or market changes. Retirement isn’t static, and your investment strategy should adjust to reflect evolving income needs, health costs, tax law updates, and market conditions.

What’s the most common mistake retirees make?

Becoming too conservative too soon. Avoiding market exposure entirely can limit growth and increase the risk of outliving your savings. A balanced approach that manages volatility while maintaining some growth potential is ideal in most situations.

The HSA 6-Month Rule: What Happens When You Enroll in Medicare at Age 65

If you’re approaching age 65 and contributing to a Health Savings Account (HSA), there’s a little-known Medicare rule that could quietly cost you.

Many people know that Health Savings Accounts (HSAs) offer triple tax benefits: tax-deductible contributions, tax-deferred growth, and tax-free withdrawals for qualified medical expenses. But what’s less commonly understood is the 6-month rule tied to Medicare Part A enrollment—and how it can affect your HSA eligibility.

If you’re turning 65 and planning to sign up for Medicare, this rule could impact when you must stop HSA contributions and potentially trigger a tax penalty if not handled properly.

Let’s walk through what the 6-month rule is, when it applies, and how to avoid costly mistakes.

What Is the HSA 6-Month Rule?

The 6-month rule refers to a Medicare regulation stating that when you apply for Medicare Part A after age 65, your coverage may retroactively begin up to six months prior to your application date—but no earlier than your 65th birthday.

Why does this matter for HSAs?

Because you cannot contribute to an HSA once you are enrolled in any part of Medicare. If your Medicare Part A enrollment is retroactive, and you weren’t aware, you could accidentally contribute to your HSA while you were technically ineligible—and face a tax penalty.

When Does the 6-Month Rule Apply?

This rule only comes into play if:

You are 65 or older, and

You delay enrolling in Medicare Part A, and

You later apply for Medicare Part A (for example, when retiring at 67 or 68)

At that point, the Social Security Administration may retroactively activate your Part A coverage up to 6 months prior to your application date.

Important: If you enroll in Medicare at age 65 or earlier, this rule does not apply. Your Part A coverage starts based on your enrollment date.

Timeline Example

Turns 65: July 2023

Continues working and delays Medicare

Applies for Medicare: October 2025 (at age 67)

Medicare Part A effective date: April 1, 2025

Last eligible month to contribute to an HSA: March 2025

Why You Must Stop HSA Contributions Before Medicare Coverage Starts

HSA rules state that:

You must stop making contributions to your HSA the month before your Medicare coverage begins.

Medicare coverage always begins on the first day of the month—so plan your final HSA contribution accordingly.

If you accidentally contribute while enrolled in Medicare—even retroactively—you may owe a 6% excise tax on those excess contributions.

How to Plan Around the 6-Month Rule

To avoid penalties and protect your tax savings:

1. Stop HSA Contributions at Least 6 Months Before Applying for Medicare

If you plan to delay Medicare past age 65, stop HSA contributions at least 6 months before you submit your Medicare application. This helps avoid retroactive coverage overlapping with HSA eligibility.

2. Calculate and Remove Excess Contributions Promptly

If you do contribute after your Medicare Part A effective date, you must remove the excess to avoid penalties.

How to calculate excess: Total the amount contributed after your Medicare coverage began. This includes both your own and any employer contributions during that ineligible period.

Penalty timeline: You must remove the excess contributions (plus any earnings) by your tax filing deadline—typically April 15 of the following year—to avoid the 6% excise tax.

If you miss that deadline, the 6% penalty applies for each year the excess amount remains in the account.

3. Use a Mid-Year Retirement Strategy

If retiring mid-year, prorate your annual HSA contribution based on the number of months you were eligible. Contributions made after Medicare enrollment—even by your employer—count toward your annual limit and must be removed if you were ineligible.

Final Thought:

The HSA 6-month rule is easy to overlook—but understanding how it works can help you avoid costly mistakes as you transition to Medicare. Whether you’re retiring soon or planning ahead, coordinating your HSA contributions with Medicare enrollment is an essential part of a tax-efficient retirement strategy.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the HSA 6-month rule?

The HSA 6-month rule refers to a Medicare regulation stating that when you apply for Medicare Part A after age 65, your coverage can be retroactive for up to six months—but no earlier than your 65th birthday. Since you cannot contribute to a Health Savings Account (HSA) while enrolled in any part of Medicare, this retroactive coverage can make you ineligible to contribute for that six-month period.

Why does the 6-month rule matter for HSA contributions?

Because Medicare Part A coverage may be applied retroactively, you could unknowingly contribute to your HSA during months when you were technically covered by Medicare. Those contributions would be considered “excess contributions” and subject to a 6% excise tax if not corrected.

When does the 6-month rule apply?

The rule applies only if you delay enrolling in Medicare Part A beyond age 65 and later apply. At that point, the Social Security Administration may backdate your Medicare Part A coverage up to six months. If you enroll at or before age 65, the rule does not apply.

How does retroactive Medicare coverage affect my HSA?

Once your Medicare Part A coverage begins—whether retroactively or not—you lose HSA eligibility from that start date. You must stop making contributions the month before your Medicare coverage begins to avoid excess contributions.

Can you give an example of the 6-month rule?

Yes. Suppose you turn 65 in July 2023 and continue working with an HSA-eligible plan. You apply for Medicare in October 2025 (at age 67). Your Medicare Part A effective date will be April 1, 2025—six months retroactive. Therefore, your last eligible HSA contribution month is March 2025.

When should I stop contributing to my HSA?

You should stop contributing at least six months before applying for Medicare Part A to ensure your contributions don’t overlap with retroactive coverage. This applies to both your own and any employer contributions.

What happens if I accidentally contribute while covered by Medicare?

Any contributions made after your Medicare Part A effective date are considered excess. You must withdraw those excess contributions (plus earnings) by your tax filing deadline—typically April 15 of the following year—to avoid a 6% penalty.

How do I calculate my excess contributions?

Add up all contributions (including employer contributions) made after your Medicare Part A effective date. That total must be withdrawn from your HSA. If not removed by your tax deadline, a 6% penalty applies each year the excess remains.

How should I handle HSA contributions if I retire mid-year?

If you retire partway through the year, prorate your HSA contribution limit based on the number of months you were eligible before Medicare enrollment. Contributions made after that date—even by your employer—count toward your annual limit and may need to be withdrawn.

What’s the best way to avoid penalties from the 6-month rule?

Plan ahead. Stop HSA contributions at least six months before applying for Medicare, coordinate with your HR or benefits department, and track contributions closely to prevent ineligible deposits.