2025 Retirement Planning: 7 Smart Purchases to Make Before You Stop Working

Retirement isn’t just about saving—it’s about spending wisely. From medical care and home repairs to travel and vehicles, this guide shows 7 smart purchases to consider before leaving the workforce, with tax and planning tips to help you retire stress-free.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

Most retirees spend decades saving and investing, only to face one of the hardest transitions at the finish line: shifting from saver to spender. At Greenbush Financial Group, we often hear clients say they wish they had spent more strategically before retiring—not less. By making key purchases while you still have earned income, you can reduce stress, avoid costly surprises, and give yourself permission to fully enjoy retirement.

This article covers seven smart spending decisions to consider before leaving the workforce, along with the tax and planning angles that can make them even more effective.

Medical and Dental Work Before Medicare

Healthcare costs can spike in retirement, and Medicare doesn’t cover everything—especially dental, vision, and hearing. It’s often wise to complete major procedures while you’re still working.

Max out your Health Savings Account (HSA) during your last high-income years. HSAs offer triple tax benefits—deductible contributions, tax-deferred growth, and tax-free withdrawals for qualified expenses.

If modifications such as no-threshold showers or grab bars are medically necessary, some may qualify as itemized deductions. Proper documentation is essential.

Map out coverage if you retire before age 65. Compare COBRA, ACA marketplace options, and potential premium tax credits.

Secure Your Next Home While Still Employed

Qualifying for a mortgage is often easier with W-2 income than retirement income. Buying or refinancing before you retire can lock in more favorable terms.

Downsizing? Remember the §121 home sale exclusion allows couples filing jointly to exclude up to $500,000 of capital gain on the sale of a primary residence ($250,000 if single).

Considering upgrades? Look into energy-efficiency credits under the Inflation Reduction Act. For example, the Energy Efficient Home Improvement Credit (25C) can provide annual tax credits for qualifying improvements.

Complete Major Home Repairs and Aging-in-Place Upgrades

Addressing big-ticket items before retirement reduces future cash flow stress. Common examples include:

Roof, HVAC system, windows, and insulation

Whole-home surge protection or backup power systems

No-threshold showers, wider doorways, higher-seat toilets

Tackling these projects upfront means fewer disruptions—and potentially fewer withdrawals during a market downturn.

Buy a Reliable, Paid-Off Vehicle

Transportation is a non-negotiable retirement expense. Purchasing a reliable, low-maintenance car before retiring allows you to enter retirement debt-free.

Evaluate new vs. certified pre-owned (CPO) for warranty protection.

For those considering EVs or hybrids, federal and state incentives can significantly reduce net cost.

Budget for a replacement cadence of 7–10 years to spread costs evenly across retirement.

Prepay for Bucket-List Travel

The early years of retirement are often called the “go-go years.” Booking major trips while you’re healthy—and locking in refundable deposits or travel insurance—helps ensure you actually take them.

Build a “first 1,000 days of retirement” calendar to schedule must-do experiences.

Consider paying now while your income supports larger expenses. This reduces pressure on retirement withdrawals later.

Use High-Income Years to Fund Future Spending

Your final working years often come with peak income. This creates opportunities to front-load retirement readiness:

Roth conversions up to the top of your target bracket before Medicare enrollment can reduce future taxable income.

Watch for IRMAA (income-related monthly adjustment amounts) at ages 63–65, which can increase Medicare premiums if income is too high.

Consider donor-advised fund (DAF) contributions to pre-fund charitable giving while reducing taxable income.

Don’t Forget Estate and Administrative Prep

Beyond purchases, pre-retirees benefit from a final sweep of administrative tasks:

Separate credit cards for spouses to maintain access to credit.

Pre-need funeral planning or irrevocable funeral trusts to relieve future burdens.

Refresh wills, POA, health care proxies, and beneficiary designations.

Audit recurring subscriptions, timeshares, and other lifestyle costs.

Key Takeaway

Retirement is about more than accumulating assets—it’s about spending them wisely. By completing health care, housing, car, and travel purchases while still earning, you free up your retirement income for flexibility and enjoyment. At Greenbush Financial Group, we help clients not only save smart but also spend smart.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What major expenses should I plan to cover before retiring?

Common pre-retirement purchases include completing medical or dental procedures, making home repairs or accessibility upgrades, and replacing your vehicle. Addressing these while you still have earned income helps reduce financial stress once you retire and may provide additional tax benefits.

Why should I complete medical and dental work before enrolling in Medicare?

Medicare generally doesn’t cover dental, vision, or hearing care. Completing major procedures before retirement—while you still have employer coverage—can save money and simplify your transition. It’s also smart to fully fund your Health Savings Account (HSA) in your final working years for future tax-free healthcare spending.

Is it better to buy or refinance a home before retiring?

Yes, qualifying for a mortgage is typically easier when you have active W-2 income. Buying, refinancing, or downsizing before retirement can secure better terms. Couples selling their primary residence may also exclude up to $500,000 in capital gains, and certain energy-efficient home upgrades may qualify for tax credits.

Why should I replace my car before retirement?

Buying a dependable, low-maintenance car before you retire allows you to enter retirement debt-free and avoid large future withdrawals.

How can I use my final high-income years to improve my retirement outlook?

Peak earning years are ideal for strategic financial moves like Roth conversions, funding a donor-advised fund (DAF), or prepaying for future travel. These steps can help lower future taxable income, manage Medicare premiums, and enhance your flexibility in retirement.

What estate and administrative steps should I complete before retiring?

Review and update your will, powers of attorney, and beneficiary designations. Consider establishing separate credit accounts for each spouse, planning funeral arrangements in advance, and canceling unnecessary subscriptions or timeshares to streamline post-retirement finances.

How do pre-retirement purchases support a more enjoyable retirement?

Spending strategically before you stop working lets you handle big expenses with current income, freeing future cash flow for experiences and lifestyle choices. At Greenbush Financial Group, we encourage clients to view retirement not just as saving wisely—but spending wisely, too.

How to Protect Yourself from Stock Market Crashes in Retirement

Market downturns feel different in retirement than during your working years. Learn strategies to protect your nest egg, avoid irreversible mistakes, and balance growth with safety to keep your retirement plan on track.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

The stock market has always gone through ups and downs, but when you’re retired, a downturn can feel much scarier than when you were working. Retirement alters the way you interact with your investments, and the strategies you use to protect yourself from market volatility must also adapt accordingly.

In this article, we’ll cover:

The difference between the accumulation years and distribution years

Why market downturns can be so damaging in retirement

The “irreversible mistake” retirees need to avoid

The risk of holding concentrated positions in retirement

Why being too conservative in retirement can also create problems

Accumulation vs. Distribution Years

One of the most important distinctions in retirement planning is understanding how your relationship with your portfolio changes once you leave the workforce.

Accumulation Years (Working Years):

During your career, you’re regularly contributing to retirement accounts. When the market drops, it can actually work in your favor because you’re buying shares “on sale.” Plus, you’re not taking withdrawals, so your full account balance is still in the market to participate in the rebound when it eventually happens.Distribution Years (Retirement Years):

Once retired, the dynamic shifts. Instead of contributing, you’re taking money out to fund your lifestyle. When a market downturn hits, withdrawals can force you to sell at the worst possible time—locking in losses. Unlike in your working years, your portfolio might not fully recover because the assets you sold are no longer invested when the market rebounds.

This difference makes retirees more vulnerable to something called sequence of returns risk, which is the risk of experiencing poor market returns early in retirement while simultaneously taking withdrawals.

The Irreversible Mistake

We call this the irreversible mistake—waiting too long to reduce your allocation to stocks and riskier asset classes post-retirement. Once those dollars are gone, there’s no “do-over button” to replace them, and trying to recoup the losses by staying overly aggressive can be too much of a gamble.

So, what’s the solution? It depends on:

The size of your retirement accounts

The percentage of income you need to withdraw each year

The purpose assigned to each investment account

For example, you might have a Roth IRA that you plan to leave untouched. Since you don’t need it for income, that account could stay invested more aggressively throughout retirement. On the other hand, accounts you draw from regularly may require a more balanced or conservative allocation to help weather downturns.

There’s no universal “right” equity allocation for retirees—it has to be determined account by account, based on your unique situation.

The Risk of Concentrated Positions

Another important consideration is whether you hold a concentrated position—a large percentage of your portfolio invested in a single stock or company.

During the accumulation years, an employee may accumulate significant shares of their employer’s stock, or investors may ride the success of a single company. Since you’re still working, contributing, and have decades before tapping retirement accounts, you may be able to absorb some of that added single stock risk.

During retirement, however, concentrated positions can pose an even bigger danger. At that point, it’s not just overall market volatility you’re exposed to, but also the unique risks of one company or business. If that single investment declines sharply—or worse, collapses—it could disproportionately impact your retirement security.

Diversifying concentrated positions before entering retirement may help reduce the risk of a single company determining the fate of your entire portfolio. Strategies such as gradually selling shares, using tax-efficient planning, or shifting portions of the concentrated holding into more diversified securities may all help manage that risk.

The Risk of Being Too Conservative

While it’s common (and often smart) to reduce risk in retirement, going too far in the opposite direction can create another set of problems.

People today are living longer—well into their 80s and 90s. That means a large portion of your retirement savings may remain invested for 15, 20, or even 30 years. If your portfolio is too conservative, you run two major risks:

Longevity Risk: You could outlive your savings because your money didn’t grow enough to keep pace with how long you live.

Inflation Risk: The cost of living rises every year. If your portfolio isn’t growing faster than inflation, your purchasing power declines over time.

For example, imagine someone retires and moves all their assets into bonds. While bonds may provide stability, they may not generate enough long-term growth to outpace inflation. Over decades, this could erode their ability to afford the same lifestyle.

Final Thoughts

Protecting yourself from stock market crashes in retirement isn’t about eliminating risk—it’s about managing it. That means:

Reducing volatility in the accounts you rely on for income

Avoiding the irreversible mistake of delaying the step down in risk post-retirement

Diversifying away from concentrated positions

Keeping enough growth in the portfolio to offset longevity and inflation risks

Every retiree’s situation is unique, and the best allocation depends on your income needs, time horizon, and goals. A thoughtful strategy that adapts as your life unfolds can help you weather market downturns while keeping your long-term financial plan on track.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What makes market downturns more dangerous for retirees than for younger investors?

Retirees face greater risk during downturns because they’re no longer adding to their investments and must withdraw funds to cover living expenses. Selling investments during a market decline can lock in losses and make it difficult for a portfolio to recover.

What is sequence of returns risk, and why does it matter in retirement?

Sequence of returns risk refers to the danger of experiencing poor investment returns early in retirement while taking withdrawals. Negative returns early on can deplete assets faster, leaving less money invested to benefit from future market recoveries.

What is the “irreversible mistake” retirees should avoid with their portfolios?

The irreversible mistake occurs when retirees wait too long to reduce their exposure to risky assets after leaving the workforce. A severe market downturn early in retirement can permanently damage a portfolio if withdrawals and losses happen simultaneously.

Why are concentrated stock positions especially risky in retirement?

Holding too much of a single stock can expose retirees to the financial health of one company rather than the broader market. If that company’s value falls sharply, it can disproportionately harm retirement security and long-term income stability.

Can being too conservative with investments in retirement cause problems?

Yes. While reducing risk is important, overly conservative portfolios may not generate enough growth to keep up with inflation or sustain income over a long retirement. This can increase the chance of outliving your savings.

How can retirees balance growth and safety in their portfolios?

A balanced strategy often includes maintaining conservative allocations in income-producing accounts while keeping some exposure to growth assets for long-term needs. Adjusting investment risk account by account can help align stability with the potential for continued growth.

New Ways to Plan for Long-Term Care Costs: Self-Insure & Medicaid Trusts

Planning for long-term care is harder than ever as insurance premiums rise and availability shrinks. In 2025, families are turning to two main strategies: self-insuring with dedicated assets or using Medicaid trusts for protection and eligibility. This article breaks down how each option works, their pros and cons, and which approach fits your financial situation. Proactive planning today can help you protect assets, reduce risks, and secure peace of mind for retirement.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

Planning for long-term care has always been one of the most challenging aspects of a retirement plan. For decades, the go-to solution was purchasing long-term care insurance. But as we move into 2025, this option is becoming less viable for many families due to skyrocketing premiums and shrinking availability associated with long-term care insurance. For example, in New York, there is now only one insurance company still offering new long-term care insurance policies. Carriers are exiting the market because the probability of policies paying out is high, and the dollar amounts associated with these claims can easily be in excess of $100,000 per year.

So where does that leave retirees and their families? Fortunately, there are two primary strategies that have emerged as alternatives:

Self-insuring by setting aside a dedicated pool of assets for potential care.

Using Irrevocable or Medicaid trusts to protect assets and plan for Medicaid eligibility.

In this article, we’ll break down each approach, their pros and cons, and what you should consider when deciding which path makes sense for you.

The Self-Insurance Strategy

Self-insuring means you create a separate “bucket” of assets earmarked specifically for long-term care needs. Instead of paying tens or even hundreds of thousands of dollars in premiums over the years for the long-term insurance coverage, those funds stay in your name. If a long-term care event never occurs, those assets simply pass on to your beneficiaries.

The benefits:

Flexibility—you decide how, when, and where care is provided.

Assets remain under your control and stay in your estate.

Avoid the risk of paying for insurance you never use.

The challenges:

You need significant extra assets, beyond what you already need to meet your retirement income goals.

Costs can be substantial—long-term care can run $120,000 to $200,000 per year, depending on location and type of care.

Self-insuring works best for those who have enough wealth to comfortably dedicate a portion of their portfolio to this potential risk without jeopardizing their retirement lifestyle.

The Trust Approach

For individuals or couples without the level of assets needed to fully self-insure, the next common strategy is using Irrevocable trusts (often called Medicaid trusts). These trusts are designed to protect non-retirement assets so that if you need long-term care in the future, you may qualify for Medicaid without having to spend down all your savings.

How it works:

Assets placed into an irrevocable trust are no longer counted as yours for Medicaid eligibility purposes.

If structured properly and far enough in advance, this can preserve assets for heirs while ensuring that Medicaid can help cover long-term care.

Important considerations:

There is typically a five-year look-back period in most states. If assets aren’t in the trust at least five years before applying for Medicaid, the strategy can fail.

Medicaid doesn’t cover everything. For example, around-the-clock home health care often isn’t fully covered, which limits flexibility.

The trust strategy is most effective for individuals who wish to protect their assets but recognize that care options may be limited to facilities and providers that accept Medicaid.

Which Approach is Right for You?

Ultimately, the choice between self-insuring and using a trust comes down to your financial position and your preferences for future care.

If you value flexibility and have the assets, self-insuring is often the preferred option.

If resources are more limited, a trust strategy can provide asset protection and access to Medicaid, even though it may reduce your care options.

The Key Takeaway: Plan Ahead

Whether you choose to self-insure, set up a trust, or use a combination of both, the most important factor is timing. These strategies require proactive planning—often years in advance. With costs continuing to rise and traditional long-term care insurance becoming less accessible, exploring these new approaches early can help protect both your assets and your peace of mind.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

Why is traditional long-term care insurance becoming less viable?

Long-term care insurance has become less practical due to rising premiums, stricter underwriting, and fewer insurers offering new policies. Many carriers have exited the market because claim payouts are large and frequent, making policies increasingly expensive for consumers.

What does it mean to self-insure for long-term care?

Self-insuring means setting aside a dedicated portion of your assets to cover potential long-term care expenses instead of paying insurance premiums. This approach offers flexibility and keeps assets under your control but requires sufficient wealth to handle potentially high annual costs.

Who is best suited for a self-insurance strategy?

Self-insuring typically works best for individuals or couples with substantial savings beyond what’s needed for retirement income. Those with enough assets can earmark funds for potential care without endangering their financial security or lifestyle.

What is a Medicaid or irrevocable trust, and how does it help with long-term care planning?

An irrevocable or Medicaid trust allows individuals to transfer assets out of their name, potentially helping them qualify for Medicaid coverage without depleting all their savings. If created properly and early enough, it can preserve wealth for heirs while enabling access to Medicaid-funded care.

What are the limitations of using a trust for long-term care planning?

Medicaid trusts must be established at least five years before applying for benefits to meet look-back rules. Additionally, Medicaid may not cover all types of care, such as full-time home assistance, which can limit personal choice and flexibility.

When should you start planning for long-term care needs?

It’s best to plan well in advance—ideally several years before care is needed. Early planning allows time to build assets for self-insuring or to structure a trust properly for Medicaid eligibility, reducing financial and emotional stress later.

“Sell in May and Go Away” is Dead

“Sell in May and Go Away” sounds clever, but the data tells a different story. Since 2020, investors who followed this rule would have missed out on strong summer gains. We break down why discipline and staying invested consistently beat market timing.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

One of the most well-known Wall Street adages is the “Sell in May and go away” strategy. The idea is simple: sell your stock holdings in May, avoid the typically slower summer months, and then re-enter the market in the fall when trading activity and returns supposedly pick back up. On the surface, this strategy sounds appealing—who wouldn’t want to avoid risk and still capture the best gains of the year?

But here’s the problem: if you had followed this strategy over the past six years, you would have missed out on some very strong returns. In fact, staying on the sidelines from June through August would have cost you real money.

In this article, we’ll cover:

A look at the actual S&P 500 returns from June–August over the past few years

Why investors would have been “right” only 1 out of 6 times

The real risk of following catchy headlines instead of hard data.

Why discipline through volatility has historically paid off.

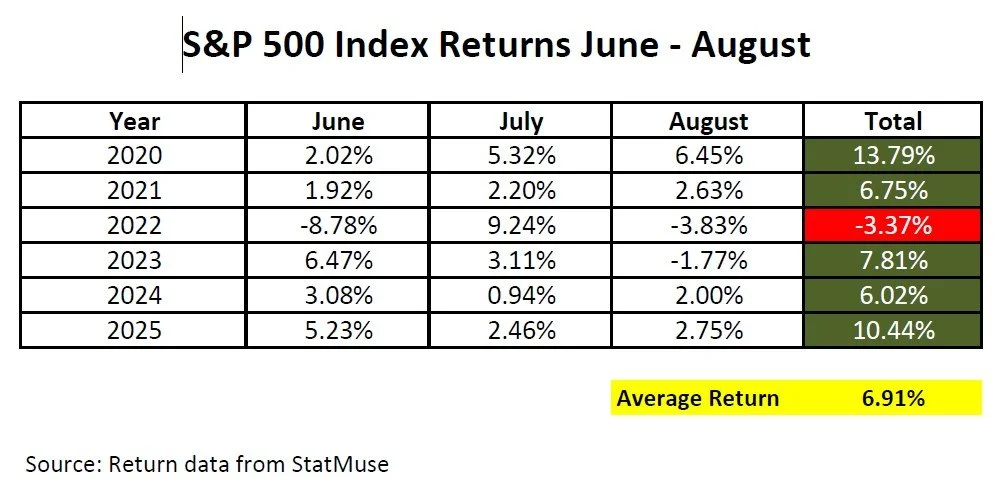

What the Data Really Says

Below is a breakdown of the S&P 500 Index returns from June through August for each year since 2020.

When we look at the data:

Five out of six years, the June – August months produced positive returns.

The average return over this period was 6.91%.

Investors would have only been correct in sitting out one year (2022), when the S&P fell by –3.37%.

Put simply, investors who followed the Sell In May and Go Away strategy for the past 6 years cost themselves about 7% PER YEAR in investment returns.

Why the Temptation is Strong

It’s easy to see how investors get drawn into these types of strategies. A headline or article points out that summer months are historically weaker, or that volatility spikes during this period. On paper, it can sound logical: avoid risk, re-enter later, and come out ahead.

But as the table shows, the reality doesn’t line up with the theory. By relying on the “Sell in May” strategy, investors risk leaving money on the table. That’s the danger of market timing—you need to be right not once, but twice (when to sell, and when to buy back in).

Volatility vs. Discipline

There’s no denying that the summer months often bring more volatility to the stock market. Thinner trading volumes and seasonal economic patterns can cause choppier price action. But investors who have had the discipline to ride through those bumps have been rewarded.

The past six years make this clear: while the S&P 500 had its ups and downs from June to August, the overall trend was solidly positive. That’s why sticking to a long-term investment plan often beats trying to time the market.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What does “Sell in May and go away” mean in investing?

“Sell in May and go away” is a market adage suggesting that investors should sell their stock holdings in May, avoid the summer months when returns are thought to be weaker, and reinvest in the fall. The strategy is based on historical seasonal trends but often oversimplifies how markets actually perform.

Has the “Sell in May” strategy worked in recent years?

Recent data shows that this strategy has largely underperformed. Over the past several years, the S&P 500 has delivered positive returns during the summer months more often than not, meaning investors who exited in May would have missed out on gains.

Why can following seasonal market sayings be risky?

Relying on old adages or headlines instead of data can lead to missed opportunities or poorly timed decisions. Markets are influenced by a range of factors—economic trends, interest rates, and company performance—not just the calendar.

What’s the downside of sitting out of the market during the summer?

Missing even a few strong market days can significantly reduce long-term investment returns. Staying invested allows you to participate in rebounds and compounding growth that can happen unexpectedly throughout the year.

Why is discipline so important for investors?

A disciplined, long-term investment approach helps smooth out volatility and avoid emotional decision-making. Sticking with a consistent strategy based on goals and time horizon has historically produced better outcomes than trying to time the market.

What’s a more effective alternative to timing seasonal trends?

Instead of trying to predict short-term market movements, investors can focus on maintaining a diversified portfolio aligned with their risk tolerance and financial objectives. This approach emphasizes consistency and adaptability rather than reacting to temporary patterns.

Behind Closed Doors: How the Fed Makes Interest Rate Decisions - Voting and Non Voting Members

On September 17, 2025, the Federal Reserve cut interest rates for the first time in years. Here’s how the FOMC voting process works, who gets a say, and why these decisions matter for the economy.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

On September 17, 2025, the Federal Reserve voted to lower its benchmark interest rate by 0.25%—the first rate cut in quite some time. The move brought the federal funds target range down to 4.00%–4.25% and sent a signal to markets that the Fed is beginning to ease monetary policy after a long pause.

This decision raises an important question: how exactly does the Fed decide whether to cut rates, raise them, or leave them the same?

In this post, we’ll break down:

How voting works within the Federal Reserve

The roles of Jerome Powell, the Board of Governors, and the regional Fed presidents

Why independence from politics is so critical to the Fed’s mission

Why rate cuts matter so much to the economy

Current changes happening inside the Fed leadership

Who Actually Votes on Interest Rates?

When the Fed meets to set interest rates, the decision is made by the Federal Open Market Committee (FOMC). The FOMC includes:

The seven members of the Federal Reserve Board of Governors in Washington, D.C.

The President of the New York Federal Reserve Bank, who always has a vote.

Four of the remaining 11 Reserve Bank presidents, who rotate into voting seats each year.

All 19 leaders—the seven governors plus the 12 Reserve Bank presidents—attend FOMC meetings and share their views on the economy. But only 12 get to cast a vote at each meeting.

This structure balances national perspectives from the Board of Governors with regional insights from across the country. For example, the president of the Dallas Fed might emphasize conditions in the oil industry, while the president of the Chicago Fed may highlight trends in agriculture and manufacturing.

The Role of Jerome Powell

Jerome Powell, as Chair of the Federal Reserve, gets most of the headlines. He leads meetings, frames the discussion, and communicates decisions to the public. But in terms of raw power, his vote carries the same weight as every other voting member. He doesn’t have veto authority and can’t unilaterally set policy.

What makes the Chair influential is his ability to guide consensus. Powell works with Fed staff to prepare proposals, sets the tone in deliberations, and—perhaps most importantly—speaks for the Fed in press conferences after decisions are made. His leadership matters, but ultimately he must secure a majority of votes to enact policy.

How the Voting Works at Each Meeting

At each of the Fed’s eight scheduled meetings per year, the process unfolds in a fairly structured way. The first day is devoted to reviewing economic data and forecasts. All members, both voting and non-voting, weigh in with their perspectives.

On the second day, a policy proposal is put on the table—whether to cut, hike, or hold interest rates steady. The voting members then cast their votes, and the majority carries the decision.

In the September 2025 meeting, most members supported a 0.25% rate cut. But not everyone agreed. Newly appointed Governor Stephen Miran dissented, preferring a larger half-point cut. The rest of the committee sided with the smaller step, showing how debates within the Fed can shape outcomes.

Why Rate Cuts Matter

Lowering interest rates is one of the most powerful tools the Fed has to influence the economy. A cut makes borrowing cheaper—whether it’s a family taking out a mortgage, a business financing new equipment, or a consumer using a credit card. This tends to spur spending and investment, which can help keep the economy growing and support job creation.

On the flip side, keeping rates too high for too long can slow growth and risk tipping the economy into recession. That’s why the September cut was seen as so significant: it marked a shift in strategy, signaling the Fed is now more concerned about supporting growth than restraining inflation.

The Fed’s Political Independence—Will It Last?

One of the most important principles of the Federal Reserve is that it is meant to operate independently of politics. Congress gave the Fed a dual mandate: to promote stable prices and maximum employment. To achieve that, Fed leaders serve long terms and can’t be removed simply because the president or Congress doesn’t like their decisions.

This independence is crucial. Without it, presidents might pressure the Fed to cut rates before elections to juice the economy, or raise rates to influence market sentiment—moves that could create long-term economic instability.

Recently, however, that independence of the Fed has been called into question. The Trump administration has openly criticized the Fed for not cutting rates sooner. A new Fed governor, Stephen Miran, joined the Board after also serving in the White House, raising questions about conflicts of interest. Also, the Trump administration is attempting to remove Governor Lisa Cook from the Board, blocked by federal courts so far, highlighting the political pressures the Fed faces today. Governor Cook’s removal would mean the President could select another member to take her place and that person, similar to Governor Miran, could greatly favor larger interest rate cuts per the President’s request.

Looking ahead, Jerome Powell’s term as Chair ends in May 2026. Whoever the president nominates to replace him—and whether the Senate confirms that nominee—will shape the direction of monetary policy for years to come. While Powell’s term as a Governor extends into 2028, his leadership role will change once a new Chair is selected.

Takeaway

The Fed’s decision to cut rates this September highlights not just the power of monetary policy, but also the complex process behind it. Rate decisions aren’t made by one person in Washington—they’re the result of debate, data analysis, and ultimately, a vote among 12 members of the FOMC.

Jerome Powell may be the face of the Fed, but he’s only one voice at the table. And while the Fed is designed to stand apart from partisan politics, the recent events within the current Fed members demonstrate just how difficult it can be to maintain that independence.

For investors, business owners, and households, understanding how these decisions are made is critical—because what happens in those FOMC meetings shapes the borrowing costs, job market, and investment opportunities that affect us all.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

Who decides when the Federal Reserve raises or lowers interest rates?

Interest rate decisions are made by the Federal Open Market Committee (FOMC), which includes the seven members of the Board of Governors, the president of the New York Fed, and four rotating regional Fed presidents. While all 19 leaders participate in discussions, only 12 vote on policy at each meeting.

What role does Jerome Powell play in the Fed’s decision-making process?

As Chair of the Federal Reserve, Jerome Powell leads meetings, shapes discussion topics, and communicates decisions publicly. However, his vote carries the same weight as every other voting member, and policy changes require a majority of the committee’s support.

How does the Federal Reserve vote on interest rate changes?

At each of the eight scheduled meetings per year, members review economic data and forecasts before voting on whether to raise, cut, or hold rates steady. The majority vote determines the outcome, and dissenting opinions are noted in official meeting records.

Why does the Fed lower interest rates?

The Fed cuts rates to make borrowing cheaper, which can stimulate consumer spending, business investment, and overall economic growth. Lower rates are often used when inflation is under control but the economy shows signs of slowing.

Why is the Federal Reserve’s independence from politics so important?

Independence allows the Fed to make decisions based on economic data rather than political pressure. Without it, policymakers could be influenced to manipulate interest rates for short-term political gains, potentially creating long-term economic instability.

What changes in Fed leadership could impact future monetary policy?

Jerome Powell’s term as Chair ends in May 2026, and whoever is appointed next will significantly influence the direction of monetary policy. Ongoing political tensions and leadership shifts could affect how aggressively the Fed adjusts rates in the coming years.

What’s a Target Date Fund and Should I Invest in It?

Target date funds adjust automatically as you approach retirement, offering a simple “set it and forget it” investment strategy. They can be a smart option for early savers, but investors with complex financial situations may need more customized solutions.

If you've logged into your 401(k) or IRA recently, there's a good chance you've seen investment options labeled something like “2050 Target Date Fund” or “2065 Retirement Fund.” But what exactly is a target date fund, and is it the right choice for your retirement savings?

This article breaks down how target date funds work, their pros and cons, and when they make sense within a broader financial plan.

What Is a Target Date Fund?

A target date fund is a type of investment fund that automatically adjusts its asset allocation based on your expected retirement year—your target date.

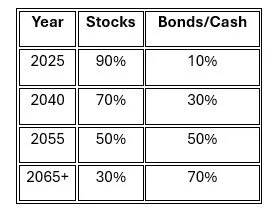

For example, a “2060 Target Date Fund” is designed for someone retiring around the year 2060. The fund starts out heavily invested in stocks to maximize growth. Over time, it gradually becomes more conservative, shifting toward bonds and cash equivalents as the retirement year approaches. This automatic reallocation is called the glide path.

Target date funds are often considered a “set-it-and-forget-it” option for retirement investors but understanding how they work may help determine whether they are a suitable option for your savings.

How the Glide Path Works

The glide path is the fund’s built-in schedule for reducing investment risk over time. Here's a simplified example of how the asset allocation might shift as retirement nears:

This gradual transition helps reduce the impact of market volatility as you get closer to drawing income from the portfolio. The example above may be a glide path associated with a “2065 Target Date Fund”.

Benefits of Target Date Funds

Simplicity: Target date funds are professionally managed, removing the need to select and monitor individual investments.

Diversification: These funds typically include a mix of U.S. and international stocks, bonds, and sometimes alternative investments, offering broad market exposure.

Automatic rebalancing: The fund rebalances its portfolio over time, keeping it aligned with its risk-reduction strategy without requiring action from the investor.

Good default option: Many 401(k) plans use target date funds as the default investment for participants who don’t actively choose their own allocation.

Potential Drawbacks to Consider

One-size-fits-all: These funds assume that all investors retiring in the same year have similar goals and risk tolerances, which isn’t always the case.

Higher fees: Some target date funds—especially those with actively managed components—can carry higher expense ratios compared to index-based options.

Misaligned risk profile: Some glide paths become too conservative too early, while others remain aggressive longer than ideal. The right fit depends on your personal retirement income plan.

Tax inefficiency in taxable accounts: Frequent rebalancing may create taxable events when held in non-retirement accounts. They are generally best suited for IRAs or 401(k)s.

When Target Date Funds Make Sense

Target date funds can be a solid choice if you:

Are early in your career and want a simple, broadly diversified investment

Don’t want to actively manage your retirement portfolio

Prefer to avoid emotional or reactive investment decisions

Are not yet working with a financial advisor

They are especially useful as a default option when you’re getting started or want to automate long-term investing with minimal oversight.

When to Consider Alternatives

You may want to explore other investment options if you:

Have substantial assets and want a more customized portfolio

Are implementing tax planning strategies like Roth conversions or asset location

Have other income sources in retirement that affect your risk tolerance

Want more control over your asset mix and withdrawal strategy

Have a lower risk tolerance than where the target date fund would allocate your investments

In these cases, building a personalized portfolio may better align with your goals and offer more flexibility.

Final Thoughts

Target date funds can offer convenience, professional management, and a clear path toward a retirement-ready portfolio. For many investors—especially those early in their careers—they can be a smart, efficient way to begin building long-term wealth.

However, as your financial picture grows more complex, it may be worth reevaluating whether a one-size-fits-all fund still fits your personal strategy. A custom portfolio tailored to your income needs, tax situation, and risk tolerance may offer more precise control over your retirement outcome.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Frequently Asked Questions (FAQs)

What is a target date fund?

A target date fund is a diversified investment designed to automatically adjust its mix of stocks, bonds, and other assets as you approach a specific retirement year. It aims to provide growth in the early years and gradually reduce risk as the target date gets closer.

How does a target date fund’s glide path work?

The glide path is the fund’s schedule for shifting from aggressive investments, like stocks, to more conservative holdings, such as bonds and cash equivalents. This gradual transition helps reduce volatility as you near retirement while still pursuing growth early on.

How do I choose the right target date fund?

Most investors select the fund closest to their expected retirement year. However, personal factors such as risk tolerance, savings rate, and income goals should also be considered when choosing a fund.

What are the main benefits of target date funds?

Target date funds offer automatic diversification and rebalancing, making them a convenient “set-it-and-forget-it” option. They can simplify retirement investing for those who prefer not to manage asset allocation themselves.

What are the potential drawbacks of target date funds?

One downside is that investors have little control over the fund’s specific holdings or risk adjustments. Glide paths also vary by provider, meaning some funds may remain more aggressive or conservative than expected.

Are target date funds a good choice for everyone?

They can be a strong fit for investors who want a hands-off approach, but those with complex financial goals or multiple investment accounts may benefit from a more customized strategy. Reviewing the fund’s allocation and costs before investing is essential.

Will Social Security Be There When You Retire?

Social Security is projected to face a funding shortfall in 2034, leading many Americans to wonder if it will still be there when they retire. While the system won’t go bankrupt, benefits could be reduced by about 20% unless Congress acts. Our analysis at Greenbush Financial Group explores what 2034 really means, why lawmakers are likely to intervene, and how to plan your retirement with Social Security uncertainty in mind.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

If you’ve looked at your Social Security statement recently, you may have noticed a troubling note: beginning in 2034, the system will no longer have enough funding to pay out full promised benefits. For many Americans, this raises a big question: Will Social Security even be there when I retire?

In this article, we’ll break down:

How Social Security is currently funded and why it faces challenges

What the 2034 date really means (hint: it’s not “bankruptcy”)

Why Congress is likely to act before major benefit cuts happen

Practical solutions that could shore up the system for future retirees

Why meaningful reform may not happen until the last minute

How Social Security Works Today

Social Security is funded primarily through FICA payroll taxes. Workers and employers each pay 6.2% of wages (12.4% total) into the system, which goes toward funding retirement benefits for current retirees.

Here’s the key point: the money doesn’t accumulate in a large “savings account” for future benefits. Instead, today’s payroll taxes go right back out the door to pay today’s beneficiaries. This setup worked well when there were many workers for each retiree, but demographic trends are changing the math.

Baby Boomers are retiring in large numbers.

People are living longer, so they collect benefits for more years.

Birth rates are low, meaning fewer workers are paying into the system.

This imbalance is the root of Social Security’s funding challenge.

What Happens in 2034?

Many people think 2034 is the year Social Security “goes bankrupt.” That’s not the full story.

According to the Social Security Trustees’ report, if Congress does nothing, the system’s trust funds will be depleted by 2034. At that point, incoming payroll taxes would still be enough to pay about 80% of promised benefits.

In practical terms, this would mean an immediate 20% cut in benefits for all recipients. While Social Security wouldn’t disappear, such a cut would have a huge impact on retirees who rely on it as their primary source of income.

Why We Believe Congress Will Act

It’s our opinion that Congress will not allow benefits to be cut so dramatically. Here’s why:

For a large portion of Americans over age 65, Social Security is the primary source of retirement income.

Cutting benefits by 20% would potentially impoverish millions of retirees.

Retirees also represent a powerful voting population, making it politically unlikely that lawmakers would let the system fail without intervention.

That doesn’t mean changes won’t come—but it does make drastic benefit cuts less likely.

Possible Solutions to Fix Social Security

The challenge is real, but there are several practical options available. The earlier these changes are made, the smaller the adjustments need to be. If lawmakers wait until 2034, the fixes may be more drastic. Some of the most common proposals include:

1. Increasing the Taxable Wage Base

Right now, Social Security taxes only apply to wages up to $176,100 (2025 limit). Someone earning $400,000 pays Social Security tax on less than half of their income.

Raising or eliminating the cap would bring more revenue into the system.

While no one likes higher taxes, it may be less painful than the economic impact of the sudden cut in Social Security Benefits starting in 2034

2. Extending the Full Retirement Age

Currently, full retirement age is 67. But Social Security hasn’t been properly indexed for life expectancy. Studies suggest that if it were, the full retirement age could be in the early 70s.

Extending retirement age would reduce how long people collect benefits.

This adjustment reflects the fact that Americans are living longer and the Social Security system was not originally designed to make payments to retirees for 15+ years

3. Limiting Early Filing Options

Right now, many people file early at 62, locking in a reduced benefit.

One proposal is to require younger workers (e.g., those 50 and under) to wait until full retirement age to claim.

This would preserve more assets in the trust over the long term.

Why Reform May Be Delayed

Unfortunately, even though the math is clear, we don’t expect Congress to make many changes before 2034. Why? Because fixing Social Security is a politically unfriendly topic.

To save the system, lawmakers must either raise taxes or cut benefits.

Neither of those options wins votes, which makes reform easy to push off.

This likely means the situation will get more tense as we approach 2034. If reforms aren’t passed in time, one possibility is a government bailout of the Social Security Trust, with additional money created to keep it solvent. While this could buy time, it doesn’t address the underlying funding imbalance—and could carry broader economic consequences.

How We Plan Around Social Security Uncertainty

For our clients, we don’t take a “wait and see” approach. Since we don’t know the exact fate of Social Security, for clients under a specific age, we build retirement plans that assume a reduction in benefits.

If Social Security benefits are reduced in the future, our clients’ plans are already designed to account for the cut, meaning their retirement income won’t be derailed.

If, on the other hand, Congress keeps Social Security fully intact, that’s fantastic—it simply means more income than we initially projected.

This conservative approach provides peace of mind and ensures that retirement strategies remain flexible no matter what happens in Washington.

The Bottom Line

Social Security faces real funding challenges, but it’s highly unlikely to disappear. Instead, it will probably undergo adjustments to ensure long-term solvency.

For retirees and pre-retirees, the key takeaway is this: don’t panic, but don’t ignore it either. Build your retirement plan with the assumption that Social Security may look different in the future. A fee-based financial planner can help you model different scenarios and build a strategy that works no matter how Congress acts.

If you’d like to explore how Social Security fits into your retirement plan, learn more about our financial planning services here.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

What Should I Do With My 401(k) From My Old Company?

When you leave a job, your old 401(k) doesn’t automatically follow you. You can leave it in the plan, roll it to your new employer’s 401(k), move it to an IRA, or cash it out. Each choice has different tax, investment, and planning implications.

Changing jobs often means leaving more than just your old desk behind. If you participated in your former employer’s 401(k) plan, you’re now faced with a decision: what should you do with that account?

It’s an important question—one that affects how you manage your retirement savings, your investment options, and potentially your tax situation. In this article, we’ll walk through the four main options for handling an old 401(k), along with the pros, cons, and planning considerations for each.

Option 1: Leave It Where It Is

Most employers allow former employees to leave their 401(k) accounts in the plan, provided the balance exceeds a minimum threshold (usually $7,000).

Pros

No immediate action required

Maintains investment options

Any growth in the account will continue to be tax-deferred

Cons

Potentially limited investment options compared to IRAs

Plan fees may be higher than alternatives

Harder to manage if you accumulate multiple old accounts

When It Makes Sense

If the old plan has strong investment options and low fees—or if you’re not ready to make a rollover decision—this can be a suitable temporary solution.

Option 2: Roll It Over to Your New Employer’s 401(k)

If your new employer offers a 401(k), you may be able to consolidate your old account into the new one.

Pros

Simplifies your retirement accounts

Keeps funds in a tax-advantaged account

May offer access to institutional fund pricing

Allows loans (if the new plan permits)

Cons

New plan may also have limited investment choices

Rollovers can take time and paperwork

Not all plans accept incoming rollovers

When It Makes Sense: If your new plan is well-managed and offers solid investment options and service, this can be a good way to consolidate and simplify your financial life.

Option 3: Roll It Over to an IRA

This is often the most flexible option for those who want greater control over their investments and potentially lower overall fees.

Pros

Broad range of investment choices

Can consolidate multiple old accounts into one

Often lower fees than 401(k) plans

More flexibility with withdrawal and Roth conversion strategies

Cons

Cannot take a loan from an IRA

Creditor protections may be weaker than in a 401(k), depending on your state

When It Makes Sense: If you’re comfortable managing your investments or working with a financial advisor, rolling into an IRA allows for more customization and control—especially when building a tax-efficient retirement income plan.

Option 4: Cash It Out

You always have the option to take the money and run—but doing so comes at a steep cost.

Pros

Provides immediate access to funds

Simple and final

Cons

Subject to income taxes

10% early withdrawal penalty if under age 59½

Permanently reduces your retirement savings

When It Makes Sense: Rarely. This is generally a last resort option, appropriate only in cases of financial emergency or if the balance is very small.

Additional Considerations

Check for Roth balances

Some plans allow Roth 401(k) contributions. If you have both pre-tax and Roth dollars, each portion must be rolled over correctly—to a Traditional IRA and Roth IRA respectively.

Watch for employer stock

If your 401(k) includes company stock, you may be eligible for Net Unrealized Appreciation (NUA) treatment, a tax strategy worth exploring with a professional.

Don’t miss the deadline

If you request a check and don’t complete a rollover within 60 days, it’s considered a distribution and taxed accordingly.

Final Thoughts

If you’ve left a job and have an old 401(k) sitting idle, now is the time to make a plan. Whether you leave it where it is, roll it over to your new plan or IRA, or—less ideally—cash it out, the decision should align with your long-term retirement goals, risk tolerance, and tax strategy.

In many cases, rolling the balance into an IRA offers the most flexibility, especially for those interested in managing taxes, investment choices, and future retirement withdrawals. If you're unsure which route is best, a financial advisor can help evaluate your options based on your full financial picture.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.