How is my Social Security Benefit Calculated?

The top two questions that we receive from individuals approaching retirement are:

What amount will I received from social security?

When should I turn on my social security benefits?

Are you eligible to receive benefits?

As you work and pay taxes, you earn Social Security “credits.” In 2015, you earn one credit for each $1,220 in earnings—up to a maximum of four credits a year. The amount of money needed to earn one credit usually goes up every year. Most people need 40 credits (10 years of work) to qualify for benefits.

When will I begin receiving my social security benefit?

You are entitled to your full social security benefit at your “Normal Retirement Age” (NRA). Your NRA varies based on your date of birth. Below is the chart that social security uses to determine your “normal retirement age” or “full retirement age”:

For example, if you were born in 1965, your NRA would be 67. At 67, you would be eligible for your full retirement benefit.

Delayed Retirement or Early Retirement

You can claim benefits as early as age 62, but your monthly check will be cut by 25% for the rest of your life. The way the math works out, for each year you take your social security benefit prior to your normal retirement age, you benefit is permanently reduce by 6% for each year you take it prior to your NRA.

On the opposite end of that scenario, if you delay claiming past your NRA, you will get a delayed credit of approximately 8% per year plus cost of living adjustments.

There are a number of variables that factor into this decision as to when to turn on your benefit. Some of the main factors are:

Your health

Do you plan to keep working?

What is your current tax bracket?

The amount of retirement savings that you have

Income difference between spouses

What amount will I receive from social security?

Social security uses a fairly complex formula for calculating social security retirement benefits but the short version is the formula uses your highest 35 years of income. If you have less than 35 years are income, zeros are entered into the average for the number of years you are short of 35 years of income. They also apply an inflation adjustment to your annual earnings in the calculation.

You can obtain your Social Security statement by creating an account at www.ssa.gov. Your statement contains lots of valuable information, such as:

Your estimated benefit amount at full retirement age

Eligibility for benefits

A detailed history of how much you've earned each year

Keep in mind that the figures in your statement are just estimates, and your eventual benefit amount could be quite different, especially if you're relatively young now.

Michael Ruger

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

New York State retiree health benefits include a powerful perk: reimbursement for Medicare Part B premiums after age 65. But many retirees don’t realize that IRMAA surcharges can also be reimbursed — and that process is manual. This guide explains how NYS Part B reimbursement works automatically through pension increases, how IRMAA (Income-Related Monthly Adjustment Amount) raises Medicare premiums for higher earners, what form you must file to get IRMAA money back, and how to claim up to four years of missed reimbursements.

If you inherited an IRA or other retirement account from a non-spouse after December 31, 2019, the SECURE Act’s 10-year rule may create a major tax event in 2030. Many beneficiaries don’t realize how much the account can grow during the 10-year window—potentially forcing large taxable withdrawals if they wait until the final year. In this article, we explain how the 10-year rule works, why 2030 is a high-risk tax year, and planning strategies that can reduce the tax hit long before the deadline arrives.

New York’s SECURE Choice program is changing how many employers must handle retirement benefits. If your business doesn’t currently offer a qualified retirement plan, you may be required to either register for SECURE Choice or implement an alternative plan option. In this article, we break down who must comply, key deadlines, and what employers should do now to avoid penalties and ensure employees have a retirement savings solution.

Trump Accounts are a new retirement savings vehicle created under the 2025 tax reform that allow parents, grandparents, and even employers to contribute up to $5,000 per year for a minor child — even if the child has no earned income. In this article, we explain how Trump Accounts work, contribution limits, tax rules, planning opportunities, and the key considerations to understand before opening one.

The IRS allows grandparents to give up to $19,000 per grandchild in 2025 without filing a gift tax return, and up to $13.99 million over their lifetime before any tax applies. Gifts are rarely taxable for recipients — but understanding Form 709, 529 plan rules, and tuition exemptions can help families transfer wealth efficiently and avoid IRS issues.

Even the most disciplined retirees can be caught off guard by hidden tax traps and penalties. Our analysis highlights five of the biggest “retirement gotchas” — including Social Security taxes, Medicare IRMAA surcharges, RMD penalties, the widow’s penalty, and state-level tax surprises. Learn how to anticipate these costs and plan smarter to preserve more of your retirement income.

The Social Security Administration announced a 2.8% cost-of-living adjustment (COLA) for 2026, slightly higher than 2025’s 2.5% increase but still below the long-term average. This modest rise may not keep pace with the real cost of living, as retirees continue to face rising prices for essentials like food, utilities, and healthcare. Learn how this affects your benefits, why COLA timing matters, and strategies to help offset inflation in retirement.

Many people fund their donor-advised funds with cash, but gifting appreciated securities can be a smarter move. By donating stocks, mutual funds, or ETFs instead of cash, you can avoid capital gains tax and still claim a charitable deduction for the asset’s full market value. Our analysis at Greenbush Financial Group explains how this strategy can create a double tax benefit and help you give more efficiently.

Healthcare often becomes one of the largest and most underestimated retirement expenses. From Medicare premiums to prescription drugs and long-term care, this article from Greenbush Financial Group explains why healthcare planning is critical—and how to prepare before and after age 65.

Retirement doesn’t always simplify your taxes. With multiple income sources—Social Security, pensions, IRAs, brokerage accounts—comes added complexity and opportunity. This guide from Greenbush Financial Group explains how to manage taxes strategically and preserve more of your retirement income.

Social Security is a cornerstone of retirement income—but when and how you claim can have a major impact on lifetime benefits. This article from Greenbush Financial Group explains 2025 thresholds, how benefits are calculated, and smart strategies for delaying, coordinating with taxes, and managing Medicare costs. Learn how to maximize your Social Security benefits and plan your income efficiently in retirement.

Social Security can be one of your most powerful retirement assets—if you claim it strategically. In this article from Greenbush Financial Group, we compare early versus delayed claiming paths, explore spousal and survivor benefits, and explain how tax and income planning can help you unlock more lifetime income.

Retirement isn’t just about saving—it’s about spending wisely. From medical care and home repairs to travel and vehicles, this guide shows 7 smart purchases to consider before leaving the workforce, with tax and planning tips to help you retire stress-free.

Market downturns feel different in retirement than during your working years. Learn strategies to protect your nest egg, avoid irreversible mistakes, and balance growth with safety to keep your retirement plan on track.

Planning for long-term care is harder than ever as insurance premiums rise and availability shrinks. In 2025, families are turning to two main strategies: self-insuring with dedicated assets or using Medicaid trusts for protection and eligibility. This article breaks down how each option works, their pros and cons, and which approach fits your financial situation. Proactive planning today can help you protect assets, reduce risks, and secure peace of mind for retirement.

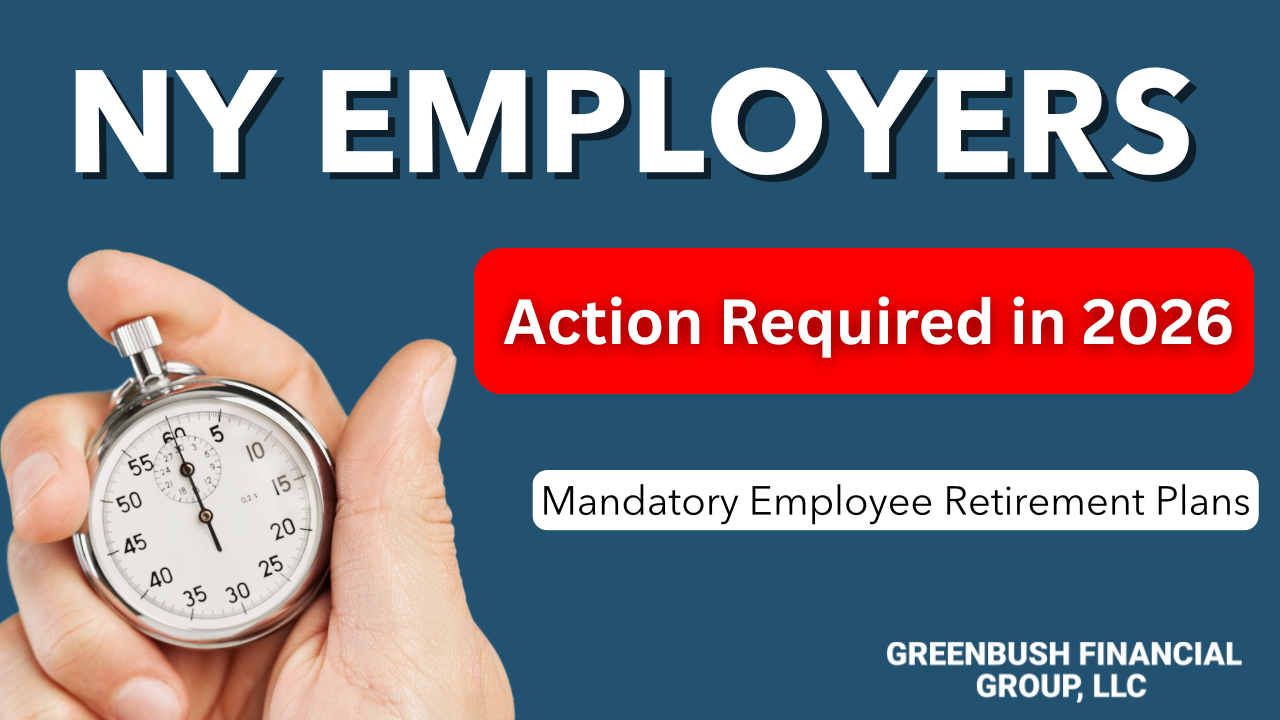

“Sell in May and Go Away” sounds clever, but the data tells a different story. Since 2020, investors who followed this rule would have missed out on strong summer gains. We break down why discipline and staying invested consistently beat market timing.

On September 17, 2025, the Federal Reserve cut interest rates for the first time in years. Here’s how the FOMC voting process works, who gets a say, and why these decisions matter for the economy.

Target date funds adjust automatically as you approach retirement, offering a simple “set it and forget it” investment strategy. They can be a smart option for early savers, but investors with complex financial situations may need more customized solutions.

Social Security is projected to face a funding shortfall in 2034, leading many Americans to wonder if it will still be there when they retire. While the system won’t go bankrupt, benefits could be reduced by about 20% unless Congress acts. Our analysis at Greenbush Financial Group explores what 2034 really means, why lawmakers are likely to intervene, and how to plan your retirement with Social Security uncertainty in mind.

When you leave a job, your old 401(k) doesn’t automatically follow you. You can leave it in the plan, roll it to your new employer’s 401(k), move it to an IRA, or cash it out. Each choice has different tax, investment, and planning implications.

Dying without a will means state laws decide who inherits your assets, not you. It also creates longer, more expensive probate and leaves guardianship decisions for your children up to a judge. This article explores the risks of dying intestate and how a simple will can protect your family.

Is $1 million enough to retire? The answer depends on withdrawal rates, inflation, investment returns, and taxes. This article walks through different scenarios to show how long $1 million can last and what retirees should consider in their planning.

Living longer is a blessing, but it also means your savings must stretch further. Rising costs, inflation, and healthcare expenses can quietly erode your nest egg. This article explains how to stress-test your retirement plan to ensure your money lasts as long as you do.

Retirement planning isn’t just about hitting a number. From withdrawal rates and inflation to taxes and investment returns, several factors determine if your savings will truly last. This article explores how to test your retirement projections and build a plan for financial security.

Losing a spouse is overwhelming, and financial matters can add to the stress. Greenbush Financial Group provides a gentle, step-by-step checklist to help surviving spouses address immediate needs, manage estate matters, and plan for the future with confidence.

Bond ladders can provide investors with predictable income, interest rate protection, and more control compared to bond ETFs or mutual funds. Greenbush Financial Group breaks down how they work, the different ladder strategies, and why some investors prefer this approach.

Looking to build wealth and sharpen your money skills? Greenbush Financial Group highlights 5 must-read financial books that cover debt, investing, business strategy, and long-term success. Perfect for every stage of life.

“Per stirpes” is a common estate planning term that determines how assets pass to descendants if a beneficiary dies before you. Greenbush Financial Group explains how per stirpes works, compares it to non–per stirpes designations, and outlines why updating your beneficiary forms is critical for ensuring your wishes are honored.

Retiring before age 65 creates a major challenge: how to pay for health insurance until Medicare begins. Greenbush Financial Group outlines options including ACA exchange subsidies, COBRA, spouse employer plans, and HSAs—plus key planning steps to manage income, reduce costs, and avoid gaps in coverage.

Hiring your child in your business can reduce family taxes and create powerful retirement savings opportunities. Greenbush Financial Group explains how payroll wages allow Roth IRA contributions, open the door to retirement plan participation, and provide long-term wealth benefits—while highlighting the rules and compliance concerns you need to know.