Social Security Filing Strategies

Making the right decision of when to turn on your social security benefit is critical. The wrong decision could cost you tens of thousands of dollars over the long run. Given all the variables surrounding this decision, what might be the right decision for one person may be the wrong decision for another. This article will cover some of the key factors to

Making the right decision of when to turn on your social security benefit is critical. The wrong decision could cost you tens of thousands of dollars over the long run. Given all the variables surrounding this decision, what might be the right decision for one person may be the wrong decision for another. This article will cover some of the key factors to consider:

Normal Retirement Age

First, you have to determine your "Normal Retirement Age" (NRA). This is listed on your social security statement in the "Your Estimated Benefits" section. If you were born between 1955 – 1960, your NRA is between age 66 – 67. If you were born 1960 or later, your NRA is age 67. You can obtain a copy of your statement via the social security website.

Before Normal Retirement Age

You have the option to turn on social security prior to your normal retirement age. The earliest you can turn on social security is age 62. However, they reduce your social security benefit by approximately 7% per year for each year prior to your normal retirement age. See the chart below which illustrates an individual with a normal retirement age of 67. If they turn on their social security benefit at age 62, they would only receive 70% of their full benefit. This reduction is a permanent reduction. It does not increase at a later date, outside of the small cost of living increases.

Taking Social Security Early

The big questions is: “If I start taking it age 62, at what age is the breakeven point?” Remember, if I turn on social security at 62 and my normal retirement age is 67, I have received 5 years of payments from social security. So at what age would I be kicking myself wishing that I had waited until normal retirement age to turn on my benefit. There are a few different ways to calculate this accounting for taxes, the rates of return on other retirement assets, inflations, etc. but in general it’s sometime between the ages of 78 and 82.

Since the breakeven point may be in your early 80’s, depending on your health, and the longevity in your family history, it may or may not make sense to turn on your benefit early. If we have a client that is in ok health but not great health and both of their parents passed way prior to age 85, then it may make sense to for them to turn on their social security benefit early. We also have clients that have pensions and turning on their social security benefit early makes the difference between retiring now or have to work for 5+ more years. As long as the long-term projections work out ok, we may recommend that they turn on their social security benefit early so they can retire sooner.

Are You Still Working?

This is a critical question for anyone that is considering turning on their social security benefits early. Why? If you turn on your social security benefit prior to reaching normal retirement age, there is an “earned income” penalty if you earn over the threshold set by the IRS for that year. See the table listed below:

In 2025, for every $2 that you earned over the $23,400 threshold, your social security was reduced by $1. For example, let’s say I’m entitled to $1,000 per month ($12,000 per year) from social security at age 62 and in 2025 I had $25,000 in W2 income. That is $1,600 over the $23,400 threshold for 2025 so they would reduce my annual benefit by $800. Not only did I reduce my social security benefit permanently by taking my social security benefit prior to normal retirement age but now my $12,000 in annual social security payments they are going to reduce that by another $800 due to the earned income penalty. Ouch!!!

Once you reach your normal retirement age, this earned income penalty no longer applies and you can make as much as you want and they will not reduce your social security benefit.

Because of this, the general rule of thumb is if you are still working and your income is above the IRS earned income threshold for the year, you should hold off on turning on your social security benefits until you either reach your normal retirement age or your income drops below the threshold.

Should I Delay May Benefit Past Normal Retirement Age

As was illustrated in first table, if you delay your social security benefit past your normal retirement age, your benefit will increase by approximately 8% per year until you reach age 70. At age 70, your social security benefit is capped and you should elect to turn on your benefits.

So when does it make sense to wait? The most common situation is the one where you plan to continue working past your normal retirement age. It’s becoming more common that people are working until age 70. Not because they necessarily have too but because they want something to keep them busy and to keep their mind fresh. If you have enough income from employment to cover you expenses, in many cases, it does make sense to wait. Based on the current formula, your social security benefit will increase by 8% per year for each year you delay your benefit past normal retirement age. It’s almost like having an investment that is guaranteed to go up by 8% per year which does not exist.

Also, for high-income earners, a majority of their social security benefit will be taxable income. Why would you want to add more income to the picture during your highest tax years? It may very well make sense to delay the benefit and allow the social security benefit to increase.

Death Benefit

The social security death benefit also comes into play as well when trying to determine which strategy is the right one for you. For a married couple, when their spouse passes away they do not continue to receive both benefits. Instead, when the first spouse passes away, the surviving spouse will receive the “higher of the two” social security benefits for the rest of their life. Here is an example:

Spouse 1 SS Benefit: $2,000

Spouse 2 SS Benefit: $1,000

If Spouse 1 passes away first, Spouse 2 would bump up to the $2,000 monthly benefit and their $1,000 monthly benefit would end. Now let’s switch that around, let’s say Spouse 2 passes away first, Spouse 1 will continue to receive their $2,000 per month and the $1,000 benefit will end.

If social security is a large percentage of the income picture for a married couple, losing one of the social security payments could be detrimental to the surviving spouse. Due to this situation, it may make sense to have the spouse with the higher benefit delay receiving social security past normal retirement to further increase their permanent monthly benefit which in turn increases the death benefit for the surviving spouse.

Spousal Benefit

The “spousal benefit” can be a powerful filing strategy. If you are married, you have the option of turning on your benefit based on your earnings history or you are entitled to half of your spouse’s benefit, whichever benefit is higher. This situation is common when one spouse has a much higher income than the other spouse.

Here is an important note. To be eligible for the spousal benefit, you personally must have earned 40 social security “credits”. You receive 1 credit for each calendar quarter that you earn a specific amount. In 2025, the figure was $1,810. You can earn up to 4 credits each calendar year.

Another important note, under the new rules, you cannot elect your spousal benefit until your spouse has started receiving social security payments.

Here is where the timing of the social security benefits come into play. You can turn on your spousal benefit as early as 62 but similar to the benefit based on your own earnings history it will be reduce by approximately 7% per year for each year you start the benefit prior to normal retirement age. At your normal retirement age, you are entitled to receive your full spousal benefit.

What happens if you delay your spousal benefit past normal retirement age? Here is where the benefit calculation deviates from the norm. Typically when you delay benefits, you receive that 8% annual increase in the benefits up until age 70. The spousal benefit is based exclusively on the benefit amount due to your spouse at their normal retirement age. Even if your spouse delays their social security benefit past their normal retirement age, it does not increase the 50% spousal benefit.

Here is the strategy. If it’s determined that the spousal benefit will be elected as part of a married couple’s filing strategy, since delaying the start date of the benefits past normal retirement age will only increase the social security benefit for the higher income earning spouse and not the spousal benefit, in many cases, it does not make sense to delay the start date of the benefits past normal retirement age.

Divorce

For divorced couples, if you were married for at least 10 years, you can still elect the spousal benefit even though you are no longer married. But you must wait until your ex-spouse begins receiving their benefits before you can elect the spousal benefit.

Also, if you were married for at least 10 years, you are also entitled to the death benefit as their ex-spouse. When your ex-spouse passes away, you can notify the social security office, elect the death benefit, and you will receive their full social security benefit amount for the rest of your life instead of just 50% of their benefit resulting from the “spousal benefit” calculation.

Whether or not your ex-spouse remarries has no impact on your ability to elect the spousal benefit or death benefit based on their earnings history.

Consult A Financial Planner

Given all of the variables in the mix and the importance of this decision, we strongly recommend that you consult with a Certified Financial Planner® before making your social security benefit elections. While the interaction with a fee-based CFP® may cost you a few hundred dollars, making the wrong decision regarding your social security benefits could cost you thousands of dollars over your lifetime. You can also download a Financial Planner Budget Worksheet to give you that extra help when sorting out your finances and monthly budgeting.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Turning 65 is a major milestone — but if you're still working, it can also bring confusion around Medicare and Social Security. Do you need to enroll in Medicare? Will claiming Social Security now trigger an earnings penalty? The answers depend on your specific situation.

The order in which you withdraw money in retirement can make a huge difference in how long your savings last—and how much tax you pay. In this article, we break down a smart withdrawal strategy to help retirees and pre-retirees keep more of their hard-earned money.

Thinking about gifting your stocks to your kids or loved ones? You might want to hit pause. In this video, we break down why inheriting appreciated stock is often a far smarter move from a tax perspective.

When it comes to retirement income, not all dollars are created equal. Some income sources are fully taxable, others partially — but a select few can be completely tax-free. And understanding the difference could mean thousands of dollars in savings each year.

Many retirees are caught off guard by unexpected tax hits from required minimum distributions (RMDs), Social Security, and even Medicare premiums. In this article, we break down the most common retirement tax traps — and how smart planning can help you avoid them.

Do you have enough to retire? Believe it or not, as financial planners, we can often answer that question in LESS THAN 60 SECONDS just by asking a handful of questions. In this video, I’m going to walk you through the 60-second calculation.

Squarespace Excerpt: As individuals approach retirement, they often begin reviewing their annual expenses, looking for ways to trim unnecessary expenses so their retirement savings last as long as possible now that their paychecks are about to stop for their working years. A common question that comes up during these client meetings is “Should I get rid of my life insurance policy now that I will be retiring?”

When clients are looking to purchase a new car one of the most common questions that we receive is “Should I Buy or Lease?” To get the answer, we interviewed a Certified Financial Planner and the owner of Rensselaer Honda to educate our audience on the pros and cons of buying vs leasing.

The most common questions that I receive when clients are about to purchase their next car is “should I buy it or lease it?” The answer depends on a number of factors including how long do you typically keep cars for, how many miles do you drive each year, the amount of the down payment, maintenance considerations, or do you have any teenagers in the family that will be driving soon?

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. In this article, I will address some of the variables at play when coming up with your number and provide detail as to why two answers you will find searching the internet are so common.

Claiming the $7,500 tax credit for buying an EV (electric vehicle) or hybrid vehicle may not be as easy as you think. First, it’s a “use it or lose it credit” meaning if you do not have a federal tax liability of at least $7,500 in the year that you buy your electric vehicle, you cannot claim the full $7,500 credit and it does not carryforward to future tax years.

Establishing an emergency fund is an important step in achieving financial stability and growth. Not only does it help protect you when big expenses arise or when a spouse loses a job but it also helps keep your other financial goals on track.

When you retire and turn on your pension, you typically have to make a decision as to how you would like to receive your benefits which includes making a decision about the survivor benefits. Do you select….

More and more retires are making the decision to keep their primary residence in retirement but also own a second residence, whether that be a lake house, ski lodge, or a condo down south. Maintaining two houses in retirement requires a lot of additional planning because you need to be able to answer the following questions:

I am getting the question much more frequently from clients - "When I retire, does it make sense from a tax standpoint to change my residency from New York to Florida?". When I explain how the taxes work

When a family member has a health event that requires them to enter a nursing home or need full-time home health care, it can be an extremely stressful financial event for their spouse, children, grandchildren, or caretaker

Due to the rapid rise in the unemployment rate as a result of the Coronavirus, Congress passed the CARES Act which includes a provision that provides mortgage relief to homeowners that have federally-backed mortgages.

With all the volatility going on in the market, it seems there is one certainty and that is the word “historical” will continue to be in the headlines. Over the past few months, we’ve seen the Dow Jones Average hit historical highs, the 10-year treasury hit historical lows, and historical daily point movements in the market.

The SECURE Act was signed into law on December 19, 2019 and with it comes some very important changes to the options that are available to non-spouse beneficiaries of IRA’s, 401(k), 403(b), and other types of retirement accounts

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents

The tax rules are different depending on the type of assets that you inherit. If you inherit a house, you may or may not have a tax liability when you go to sell it. This will largely depend on whose name was on the deed when the house was passed to you. There are also special exceptions that come into play if the house is owned by a trust, or if it was gifted

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance

Making the right decision of when to turn on your social security benefit is critical. The wrong decision could cost you tens of thousands of dollars over the long run. Given all the variables surrounding this decision, what might be the right decision for one person may be the wrong decision for another. This article will cover some of the key factors to

The short answer is "yes", but the approach that you take will most likely determine whether or not you are successful at purchasing your vehicle for a lower price than the amount listed in the lease agreement. When you lease a car, the lease agreement typically includes an amount that you can purchase the car for at the end of the lease. That amount is

The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to help toward the down payment on my house?". The short answer is in most cases, "Yes". The next important questions is "Is it a good idea to take a withdrawal from my retirement account for the down

Many of our clients own individual stocks that they either bought a long time ago or inherited from a family member. If they do not need to liquidate the stock in retirement to supplement their income, the question comes up “should I just gift the stock to my kids while I’m still alive or should I just let them inherit it after I pass away?” The right answer is

As kids enter their teenage years, as a parent, you begin to teach them more advanced life lessons that they will hopefully carry with them into adulthood. One of the life lessons that many parents teach their children early on is the value of saving money. By their teenage years many children have built up a small savings account from birthday gifts,

The number of conversations that we are having with our clients about planning for long term care is increasing exponentially. Whether it’s planning for their parents, planning for themselves, or planning for a relative, our clients are largely initiating these conversations as a result of their own personal experiences.

My wife and I just added our first child to the family so this is a topic that has been weighing on my mind over the last 40 weeks. I will share just one non-financial takeaway from the entire experience. The global population may be much lower if men had to go through what women do. That being said, this article is meant to be a guideline for some of the important financial items to consider with children. Worrying about your children will never end and being comfortable with the financial aspects of parenthood may allow you to worry a little less and be able to enjoy the time you have with the

This is one of the most common questions asked by our clients when they are looking for a new car. The answer depends on a number of factors:

How long do you typically keep your cars?

How many miles do you typically drive each year?

What do you want your down payment and monthly payment to be?

Social Security Loophole: Age 62+ With Kids In High School

There is a little known loophole in the social security system for parents that are age 62 or older with children still in high school or younger. Since couples are having children later in life this situation is becoming more common and it could equal big dollars for families that are aware of this social security filing strategy.

There is a little-known loophole in the social security system for parents that are age 62 or older with children still in high school or younger. Since couples are having children later in life this situation is becoming more common and it could equal big dollars for families that are aware of this social security filing strategy.

Here is how it works. If you are age 62 or older and you have children under the age of 18, they can collect a social security benefit based on your earnings history equal to half of the parent's social security benefit at normal retirement age. This amount could equal as much as $24,108 per year for one child for higher income earners. If you have multiple children the total annual amount paid to your family members could equal between 150% to 180% of your normal retirement benefit which could be in excess of $38,500 per year depending on your earnings history.

There are some key considerations. First, your children cannot collect on this “family benefit” until you have begun to collect your social security benefit. You can turn on your social security benefit as early as age 62 but they reduce the monthly amount that you receive if you turn on the benefit prior to your normal retirement age. However, it may make sense to do so depending on the amount of the family benefit paid and the duration of the benefit. If you wait until normal retirement age, you will receive a slightly higher social security benefit for yourself, but all of the social security dollars that could have been paid to your children is lost.

Second, if you are still working and your earned income exceeds certain thresholds this filing strategy may not be advantageous due to the earned income penalty. They reduce your social security benefit by $1 for every $2 earned over a given threshold ($23,400 in 2025). Not only is your social security benefit reduced but also the benefit to your dependents.

Due to these restrictions, this filing strategy yields the greatest benefit to parents that are either fully or partially retired, age 62 or older, with a child or children below the age of 18.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Even the most disciplined retirees can be caught off guard by hidden tax traps and penalties. Our analysis highlights five of the biggest “retirement gotchas” — including Social Security taxes, Medicare IRMAA surcharges, RMD penalties, the widow’s penalty, and state-level tax surprises. Learn how to anticipate these costs and plan smarter to preserve more of your retirement income.

The Social Security Administration announced a 2.8% cost-of-living adjustment (COLA) for 2026, slightly higher than 2025’s 2.5% increase but still below the long-term average. This modest rise may not keep pace with the real cost of living, as retirees continue to face rising prices for essentials like food, utilities, and healthcare. Learn how this affects your benefits, why COLA timing matters, and strategies to help offset inflation in retirement.

Healthcare often becomes one of the largest and most underestimated retirement expenses. From Medicare premiums to prescription drugs and long-term care, this article from Greenbush Financial Group explains why healthcare planning is critical—and how to prepare before and after age 65.

Retirement doesn’t always simplify your taxes. With multiple income sources—Social Security, pensions, IRAs, brokerage accounts—comes added complexity and opportunity. This guide from Greenbush Financial Group explains how to manage taxes strategically and preserve more of your retirement income.

Retirement isn’t just about saving—it’s about spending wisely. From medical care and home repairs to travel and vehicles, this guide shows 7 smart purchases to consider before leaving the workforce, with tax and planning tips to help you retire stress-free.

Market downturns feel different in retirement than during your working years. Learn strategies to protect your nest egg, avoid irreversible mistakes, and balance growth with safety to keep your retirement plan on track.

Planning for long-term care is harder than ever as insurance premiums rise and availability shrinks. In 2025, families are turning to two main strategies: self-insuring with dedicated assets or using Medicaid trusts for protection and eligibility. This article breaks down how each option works, their pros and cons, and which approach fits your financial situation. Proactive planning today can help you protect assets, reduce risks, and secure peace of mind for retirement.

Is $1 million enough to retire? The answer depends on withdrawal rates, inflation, investment returns, and taxes. This article walks through different scenarios to show how long $1 million can last and what retirees should consider in their planning.

Living longer is a blessing, but it also means your savings must stretch further. Rising costs, inflation, and healthcare expenses can quietly erode your nest egg. This article explains how to stress-test your retirement plan to ensure your money lasts as long as you do.

Retirement planning isn’t just about hitting a number. From withdrawal rates and inflation to taxes and investment returns, several factors determine if your savings will truly last. This article explores how to test your retirement projections and build a plan for financial security.

A common financial mistake that I see people make when attempting to protect their house from a long-term care event is gifting their house to their children. While you may be successful at protecting the house from a Medicaid spend-down situation, you will also inadvertently be handing your children a huge tax liability after you pass away. A tax liability, that with proper planning, could be avoided entirely.

On December 23, 2022, Congress passed the Secure Act 2.0, which moved the required minimum distribution (RMD) age from the current age of 72 out to age 73 starting in 2023. They also went one step further and included in the new law bill an automatic increase in the RMD beginning in 2033, extending the RMD start age to 75.

Not many people realize that if you are age 62 or older and have children under the age of 18, your children are eligible to receive social security payments based on your earnings history, and it’s big money. However, social security does not advertise this little know benefit, so you have to know how to apply, the rules, and tax implications.

It’s becoming more common for retirees to take on small self-employment gigs in retirement to generate some additional income and to stay mentally active and engaged. But, it should not be overlooked that this is a tremendous wealth-building opportunity if you know the right strategies. There are many, but in this article, we will focus on the “Solo(k) strategy

A 529 account owned by a grandparent is often considered one of the most effective ways to save for college for a grandchild. But in 2023, the rules are changing………

If you are age 65 or older and self-employed, I have great news, you may be able to take a tax deduction for your Medicare Part A, B, C, and D premiums as well as the premiums that you pay for your Medicare Advantage or Medicare Supplemental coverage.

When you retire and turn on your pension, you typically have to make a decision as to how you would like to receive your benefits which includes making a decision about the survivor benefits. Do you select….

More and more retires are making the decision to keep their primary residence in retirement but also own a second residence, whether that be a lake house, ski lodge, or a condo down south. Maintaining two houses in retirement requires a lot of additional planning because you need to be able to answer the following questions:

Many individuals that have long-term care insurance policies are beginning to receive letters in the mail notifying them that that their insurance premiums are going up by 50%, 70%, or more in some cases. This is after many of the same policyholders have experienced similar size premium increases just a few years ago. In this article I’m going to explain……

The order in which you take distributions from your retirement accounts absolutely matters in retirement. If you don’t have a formal withdraw strategy it could end up costing you in more ways than one. Click to read more on how this can effect you.

Medicare has important deadlines that you need to be aware of during your initial enrollment period. Missing those deadlines could mean gaps in coverage, penalties, and limited options when it comes to selecting a Medicare

Social Security payments can sometimes be a significant portion of a couple’s retirement income. If your spouse passes away unexpectedly, it can have a dramatic impact on your financial wellbeing in retirement. This is especially

As you approach age 65, there are a lot of very important decisions that you will have to make regarding your Medicare coverage. Since Medicare Parts A & B by itself have deductibles, coinsurance, and no maximum out of pocket

The SECURE Act was passed into law on December 19, 2019 and with it came some big changes to the required minimum distribution (“RMD”) requirements from IRA’s and retirement plans. Prior to December 31, 2019, individuals

As you approach age 65, there are very important decisions that you will have to make regarding your Medicare coverage. Whether you decide to retire prior to age 65, continue to work past age 65, or have retiree health benefits,

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents

If you live in an unfriendly tax state such as New York or California, it’s not uncommon for your retirement plans to include a move to a more tax friendly state once your working years are over. Many southern states offer nicer weather, no income taxes, and lower property taxes. According to data from the US Census Bureau, more residents

Inherited IRA’s can be tricky. There are a lot of rules surrounding;

Establishment and required minimum distribution (“RMD”) deadlines

Options available to spouse and non-spouse beneficiaries

Strategies for deferring required minimum distributions

Special 60 day rollover rules for inherited IRA’s

Given the downward spiral that GE has been in over the past year, we have received the same question over and over again from a number of GE employees and retirees: “If GE goes bankrupt, what happens to my pension?” While it's anyone’s guess what the future holds for GE, this is an important question that any employee with a pension should

How is my Social Security Benefit Calculated?

The top two questions that we receive from individuals approaching retirement are:

What amount will I received from social security?

When should I turn on my social security benefits?

The top two questions that we receive from individuals approaching retirement are:

What amount will I received from social security?

When should I turn on my social security benefits?

Are you eligible to receive benefits?

As you work and pay taxes, you earn Social Security “credits.” In 2015, you earn one credit for each $1,220 in earnings—up to a maximum of four credits a year. The amount of money needed to earn one credit usually goes up every year. Most people need 40 credits (10 years of work) to qualify for benefits.

When will I begin receiving my social security benefit?

You are entitled to your full social security benefit at your “Normal Retirement Age” (NRA). Your NRA varies based on your date of birth. Below is the chart that social security uses to determine your “normal retirement age” or “full retirement age”:

For example, if you were born in 1965, your NRA would be 67. At 67, you would be eligible for your full retirement benefit.

Delayed Retirement or Early Retirement

You can claim benefits as early as age 62, but your monthly check will be cut by 25% for the rest of your life. The way the math works out, for each year you take your social security benefit prior to your normal retirement age, you benefit is permanently reduce by 6% for each year you take it prior to your NRA.

On the opposite end of that scenario, if you delay claiming past your NRA, you will get a delayed credit of approximately 8% per year plus cost of living adjustments.

There are a number of variables that factor into this decision as to when to turn on your benefit. Some of the main factors are:

Your health

Do you plan to keep working?

What is your current tax bracket?

The amount of retirement savings that you have

Income difference between spouses

What amount will I receive from social security?

Social security uses a fairly complex formula for calculating social security retirement benefits but the short version is the formula uses your highest 35 years of income. If you have less than 35 years are income, zeros are entered into the average for the number of years you are short of 35 years of income. They also apply an inflation adjustment to your annual earnings in the calculation.

You can obtain your Social Security statement by creating an account at www.ssa.gov. Your statement contains lots of valuable information, such as:

Your estimated benefit amount at full retirement age

Eligibility for benefits

A detailed history of how much you've earned each year

Keep in mind that the figures in your statement are just estimates, and your eventual benefit amount could be quite different, especially if you're relatively young now.

Michael Ruger

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The IRS allows grandparents to give up to $19,000 per grandchild in 2025 without filing a gift tax return, and up to $13.99 million over their lifetime before any tax applies. Gifts are rarely taxable for recipients — but understanding Form 709, 529 plan rules, and tuition exemptions can help families transfer wealth efficiently and avoid IRS issues.

Even the most disciplined retirees can be caught off guard by hidden tax traps and penalties. Our analysis highlights five of the biggest “retirement gotchas” — including Social Security taxes, Medicare IRMAA surcharges, RMD penalties, the widow’s penalty, and state-level tax surprises. Learn how to anticipate these costs and plan smarter to preserve more of your retirement income.

The Social Security Administration announced a 2.8% cost-of-living adjustment (COLA) for 2026, slightly higher than 2025’s 2.5% increase but still below the long-term average. This modest rise may not keep pace with the real cost of living, as retirees continue to face rising prices for essentials like food, utilities, and healthcare. Learn how this affects your benefits, why COLA timing matters, and strategies to help offset inflation in retirement.

Many people fund their donor-advised funds with cash, but gifting appreciated securities can be a smarter move. By donating stocks, mutual funds, or ETFs instead of cash, you can avoid capital gains tax and still claim a charitable deduction for the asset’s full market value. Our analysis at Greenbush Financial Group explains how this strategy can create a double tax benefit and help you give more efficiently.

Healthcare often becomes one of the largest and most underestimated retirement expenses. From Medicare premiums to prescription drugs and long-term care, this article from Greenbush Financial Group explains why healthcare planning is critical—and how to prepare before and after age 65.

Retirement doesn’t always simplify your taxes. With multiple income sources—Social Security, pensions, IRAs, brokerage accounts—comes added complexity and opportunity. This guide from Greenbush Financial Group explains how to manage taxes strategically and preserve more of your retirement income.

Social Security is a cornerstone of retirement income—but when and how you claim can have a major impact on lifetime benefits. This article from Greenbush Financial Group explains 2025 thresholds, how benefits are calculated, and smart strategies for delaying, coordinating with taxes, and managing Medicare costs. Learn how to maximize your Social Security benefits and plan your income efficiently in retirement.

Social Security can be one of your most powerful retirement assets—if you claim it strategically. In this article from Greenbush Financial Group, we compare early versus delayed claiming paths, explore spousal and survivor benefits, and explain how tax and income planning can help you unlock more lifetime income.

Retirement isn’t just about saving—it’s about spending wisely. From medical care and home repairs to travel and vehicles, this guide shows 7 smart purchases to consider before leaving the workforce, with tax and planning tips to help you retire stress-free.

Market downturns feel different in retirement than during your working years. Learn strategies to protect your nest egg, avoid irreversible mistakes, and balance growth with safety to keep your retirement plan on track.

Planning for long-term care is harder than ever as insurance premiums rise and availability shrinks. In 2025, families are turning to two main strategies: self-insuring with dedicated assets or using Medicaid trusts for protection and eligibility. This article breaks down how each option works, their pros and cons, and which approach fits your financial situation. Proactive planning today can help you protect assets, reduce risks, and secure peace of mind for retirement.

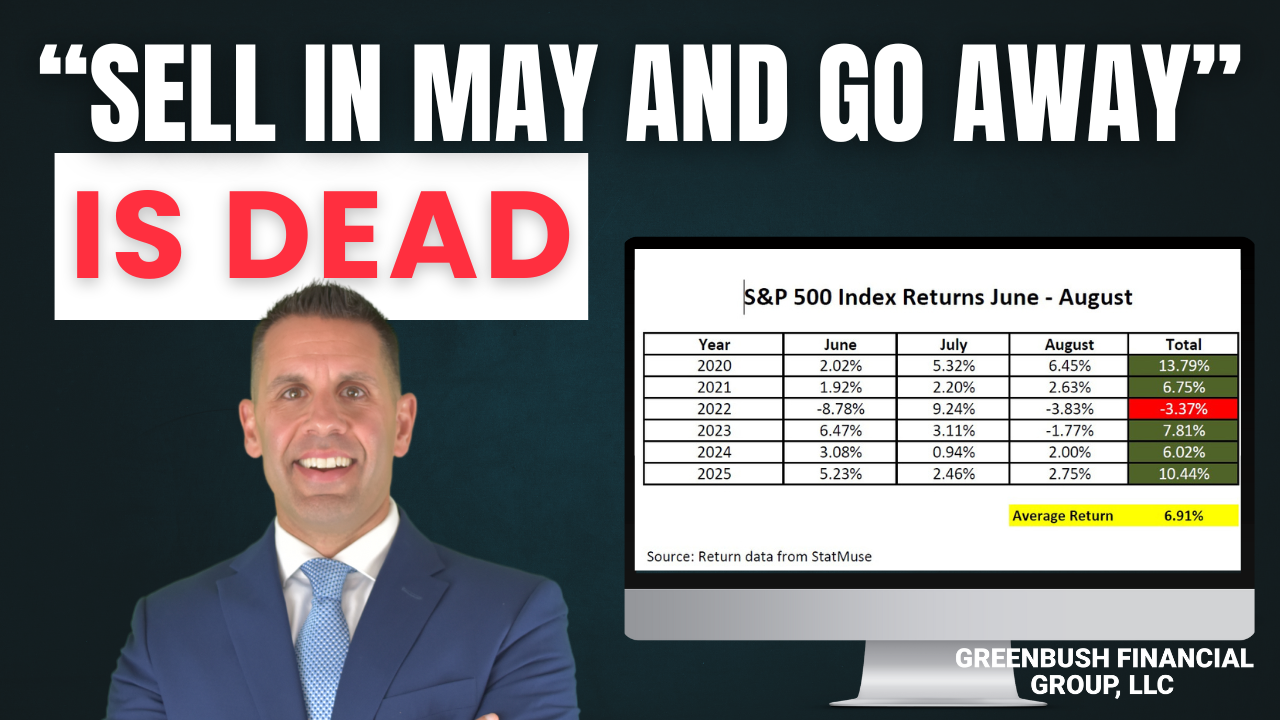

“Sell in May and Go Away” sounds clever, but the data tells a different story. Since 2020, investors who followed this rule would have missed out on strong summer gains. We break down why discipline and staying invested consistently beat market timing.

On September 17, 2025, the Federal Reserve cut interest rates for the first time in years. Here’s how the FOMC voting process works, who gets a say, and why these decisions matter for the economy.

Target date funds adjust automatically as you approach retirement, offering a simple “set it and forget it” investment strategy. They can be a smart option for early savers, but investors with complex financial situations may need more customized solutions.

Social Security is projected to face a funding shortfall in 2034, leading many Americans to wonder if it will still be there when they retire. While the system won’t go bankrupt, benefits could be reduced by about 20% unless Congress acts. Our analysis at Greenbush Financial Group explores what 2034 really means, why lawmakers are likely to intervene, and how to plan your retirement with Social Security uncertainty in mind.

When you leave a job, your old 401(k) doesn’t automatically follow you. You can leave it in the plan, roll it to your new employer’s 401(k), move it to an IRA, or cash it out. Each choice has different tax, investment, and planning implications.

Dying without a will means state laws decide who inherits your assets, not you. It also creates longer, more expensive probate and leaves guardianship decisions for your children up to a judge. This article explores the risks of dying intestate and how a simple will can protect your family.

Is $1 million enough to retire? The answer depends on withdrawal rates, inflation, investment returns, and taxes. This article walks through different scenarios to show how long $1 million can last and what retirees should consider in their planning.

Living longer is a blessing, but it also means your savings must stretch further. Rising costs, inflation, and healthcare expenses can quietly erode your nest egg. This article explains how to stress-test your retirement plan to ensure your money lasts as long as you do.

Retirement planning isn’t just about hitting a number. From withdrawal rates and inflation to taxes and investment returns, several factors determine if your savings will truly last. This article explores how to test your retirement projections and build a plan for financial security.

Losing a spouse is overwhelming, and financial matters can add to the stress. Greenbush Financial Group provides a gentle, step-by-step checklist to help surviving spouses address immediate needs, manage estate matters, and plan for the future with confidence.

Bond ladders can provide investors with predictable income, interest rate protection, and more control compared to bond ETFs or mutual funds. Greenbush Financial Group breaks down how they work, the different ladder strategies, and why some investors prefer this approach.

Looking to build wealth and sharpen your money skills? Greenbush Financial Group highlights 5 must-read financial books that cover debt, investing, business strategy, and long-term success. Perfect for every stage of life.

“Per stirpes” is a common estate planning term that determines how assets pass to descendants if a beneficiary dies before you. Greenbush Financial Group explains how per stirpes works, compares it to non–per stirpes designations, and outlines why updating your beneficiary forms is critical for ensuring your wishes are honored.

Retiring before age 65 creates a major challenge: how to pay for health insurance until Medicare begins. Greenbush Financial Group outlines options including ACA exchange subsidies, COBRA, spouse employer plans, and HSAs—plus key planning steps to manage income, reduce costs, and avoid gaps in coverage.

Hiring your child in your business can reduce family taxes and create powerful retirement savings opportunities. Greenbush Financial Group explains how payroll wages allow Roth IRA contributions, open the door to retirement plan participation, and provide long-term wealth benefits—while highlighting the rules and compliance concerns you need to know.

When a loved one passes away, Social Security and pension payments don’t always stop automatically. Greenbush Financial Group explains how benefits are handled, what survivor benefits may continue, and why notifying the right agencies quickly can prevent overpayments and financial stress.

Missing a Required Minimum Distribution can feel overwhelming, but the rules have changed under SECURE Act 2.0. In this article, we explain how to correct a missed RMD, reduce IRS penalties, and file the right tax forms to stay compliant.

Missing a Required Minimum Distribution can feel overwhelming, but the rules have changed under SECURE Act 2.0. In this article, we explain how to correct a missed RMD, reduce IRS penalties, and file the right tax forms to stay compliant.

Paying higher Medicare premiums than you should? If your income has dropped, you may qualify to file Form SSA-44 and appeal your IRMAA surcharge. Our guide explains how Medicare’s income-based premiums work, which life events allow an appeal, and how to lower your Part B and Part D costs.

Do I Have to Pay Taxes on my Social Security Benefit?

If your “combined income” exceeds specific annual limits, you may owe federal income taxes on up to 50% or 85% of your Social Security benefits. The limits for federal income tax purposes are listed in the chart below.

If your “combined income” exceeds specific annual limits, you may owe federal income taxes on up to 50% or 85% of your Social Security benefits. The limits for federal income tax purposes are listed in the chart below.

The federal income thresholds are not indexed for inflation, so they are the same every year. “Combined income” is defined as adjusted gross income plus any tax-exempt interest plus 50% of your Social Security Benefit. Some states tax Social Security Benefits, whereas others do not tax them. See the chart below:

Michael Ruger

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Even the most disciplined retirees can be caught off guard by hidden tax traps and penalties. Our analysis highlights five of the biggest “retirement gotchas” — including Social Security taxes, Medicare IRMAA surcharges, RMD penalties, the widow’s penalty, and state-level tax surprises. Learn how to anticipate these costs and plan smarter to preserve more of your retirement income.

The Social Security Administration announced a 2.8% cost-of-living adjustment (COLA) for 2026, slightly higher than 2025’s 2.5% increase but still below the long-term average. This modest rise may not keep pace with the real cost of living, as retirees continue to face rising prices for essentials like food, utilities, and healthcare. Learn how this affects your benefits, why COLA timing matters, and strategies to help offset inflation in retirement.

Healthcare often becomes one of the largest and most underestimated retirement expenses. From Medicare premiums to prescription drugs and long-term care, this article from Greenbush Financial Group explains why healthcare planning is critical—and how to prepare before and after age 65.

Retirement doesn’t always simplify your taxes. With multiple income sources—Social Security, pensions, IRAs, brokerage accounts—comes added complexity and opportunity. This guide from Greenbush Financial Group explains how to manage taxes strategically and preserve more of your retirement income.

Retirement isn’t just about saving—it’s about spending wisely. From medical care and home repairs to travel and vehicles, this guide shows 7 smart purchases to consider before leaving the workforce, with tax and planning tips to help you retire stress-free.

Market downturns feel different in retirement than during your working years. Learn strategies to protect your nest egg, avoid irreversible mistakes, and balance growth with safety to keep your retirement plan on track.

Planning for long-term care is harder than ever as insurance premiums rise and availability shrinks. In 2025, families are turning to two main strategies: self-insuring with dedicated assets or using Medicaid trusts for protection and eligibility. This article breaks down how each option works, their pros and cons, and which approach fits your financial situation. Proactive planning today can help you protect assets, reduce risks, and secure peace of mind for retirement.

Is $1 million enough to retire? The answer depends on withdrawal rates, inflation, investment returns, and taxes. This article walks through different scenarios to show how long $1 million can last and what retirees should consider in their planning.

Living longer is a blessing, but it also means your savings must stretch further. Rising costs, inflation, and healthcare expenses can quietly erode your nest egg. This article explains how to stress-test your retirement plan to ensure your money lasts as long as you do.

Retirement planning isn’t just about hitting a number. From withdrawal rates and inflation to taxes and investment returns, several factors determine if your savings will truly last. This article explores how to test your retirement projections and build a plan for financial security.

A common financial mistake that I see people make when attempting to protect their house from a long-term care event is gifting their house to their children. While you may be successful at protecting the house from a Medicaid spend-down situation, you will also inadvertently be handing your children a huge tax liability after you pass away. A tax liability, that with proper planning, could be avoided entirely.

On December 23, 2022, Congress passed the Secure Act 2.0, which moved the required minimum distribution (RMD) age from the current age of 72 out to age 73 starting in 2023. They also went one step further and included in the new law bill an automatic increase in the RMD beginning in 2033, extending the RMD start age to 75.

Not many people realize that if you are age 62 or older and have children under the age of 18, your children are eligible to receive social security payments based on your earnings history, and it’s big money. However, social security does not advertise this little know benefit, so you have to know how to apply, the rules, and tax implications.

It’s becoming more common for retirees to take on small self-employment gigs in retirement to generate some additional income and to stay mentally active and engaged. But, it should not be overlooked that this is a tremendous wealth-building opportunity if you know the right strategies. There are many, but in this article, we will focus on the “Solo(k) strategy

A 529 account owned by a grandparent is often considered one of the most effective ways to save for college for a grandchild. But in 2023, the rules are changing………

If you are age 65 or older and self-employed, I have great news, you may be able to take a tax deduction for your Medicare Part A, B, C, and D premiums as well as the premiums that you pay for your Medicare Advantage or Medicare Supplemental coverage.

When you retire and turn on your pension, you typically have to make a decision as to how you would like to receive your benefits which includes making a decision about the survivor benefits. Do you select….

More and more retires are making the decision to keep their primary residence in retirement but also own a second residence, whether that be a lake house, ski lodge, or a condo down south. Maintaining two houses in retirement requires a lot of additional planning because you need to be able to answer the following questions:

Many individuals that have long-term care insurance policies are beginning to receive letters in the mail notifying them that that their insurance premiums are going up by 50%, 70%, or more in some cases. This is after many of the same policyholders have experienced similar size premium increases just a few years ago. In this article I’m going to explain……

The order in which you take distributions from your retirement accounts absolutely matters in retirement. If you don’t have a formal withdraw strategy it could end up costing you in more ways than one. Click to read more on how this can effect you.

Medicare has important deadlines that you need to be aware of during your initial enrollment period. Missing those deadlines could mean gaps in coverage, penalties, and limited options when it comes to selecting a Medicare

Social Security payments can sometimes be a significant portion of a couple’s retirement income. If your spouse passes away unexpectedly, it can have a dramatic impact on your financial wellbeing in retirement. This is especially

As you approach age 65, there are a lot of very important decisions that you will have to make regarding your Medicare coverage. Since Medicare Parts A & B by itself have deductibles, coinsurance, and no maximum out of pocket

The SECURE Act was passed into law on December 19, 2019 and with it came some big changes to the required minimum distribution (“RMD”) requirements from IRA’s and retirement plans. Prior to December 31, 2019, individuals

As you approach age 65, there are very important decisions that you will have to make regarding your Medicare coverage. Whether you decide to retire prior to age 65, continue to work past age 65, or have retiree health benefits,

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents

If you live in an unfriendly tax state such as New York or California, it’s not uncommon for your retirement plans to include a move to a more tax friendly state once your working years are over. Many southern states offer nicer weather, no income taxes, and lower property taxes. According to data from the US Census Bureau, more residents

Inherited IRA’s can be tricky. There are a lot of rules surrounding;

Establishment and required minimum distribution (“RMD”) deadlines

Options available to spouse and non-spouse beneficiaries

Strategies for deferring required minimum distributions

Special 60 day rollover rules for inherited IRA’s

Given the downward spiral that GE has been in over the past year, we have received the same question over and over again from a number of GE employees and retirees: “If GE goes bankrupt, what happens to my pension?” While it's anyone’s guess what the future holds for GE, this is an important question that any employee with a pension should