How to Correct Missed Required Minimum Distributions (RMDs)

Missing a Required Minimum Distribution can feel overwhelming, but the rules have changed under SECURE Act 2.0. In this article, we explain how to correct a missed RMD, reduce IRS penalties, and file the right tax forms to stay compliant.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

Missing a Required Minimum Distribution (RMD) can cause a lot of stress, especially when you hear the words IRS excise tax. Fortunately, the rules around missed RMDs were updated under the SECURE Act 2.0, which provides some relief compared to the old law. In this article, we’ll break down:

What happens if you miss an RMD and how to correct it

The updated excise tax penalties under SECURE Act 2.0

The “first year” April 1st rule and why you may need to take two RMDs in one year

The new IRS guidance for beneficiaries who inherit retirement accounts

What tax forms need to be filed if you miss an RMD

A quick before-and-after look at the old rules versus SECURE Act 2.0

What Happens if You Miss an RMD?

If you forget to take an RMD, the IRS assesses an excise tax penalty on the amount you should have withdrawn. Under the old law, that penalty was steep—50% of the missed RMD.

Under SECURE Act 2.0, the penalty was reduced to a much more manageable amount:

25% penalty on the missed distribution.

If corrected quickly (by taking the missed RMD and filing the proper paperwork), the penalty may be further reduced to 10%.

Example: If you missed a $10,000 RMD:

Old rule: You owed $5,000 in penalties.

New rule: You may owe only $1,000 (if corrected promptly).

The First-Year April 1st Rule

When you reach RMD age (currently age 73 under SECURE Act 2.0), your very first required distribution doesn’t have to be taken in that calendar year. Instead, you can delay it until April 1st of the following year.

But here’s the catch: if you delay your first RMD, you’ll still need to take two RMDs in that next year—the delayed one (by April 1st) plus the regular one (by December 31st).

Example:

Jane turns 73 in 2025.

She can delay her first RMD until April 1, 2026.

If she does, she must also take her 2026 RMD by December 31, 2026—meaning two taxable distributions in one year.

IRS Relief for Inherited Accounts (New Guidance)

For beneficiaries of inherited IRAs or retirement accounts, the IRS just issued new guidance under SECURE Act 2.0.

If a decedent had an RMD due in the year of their death and it wasn’t taken, the beneficiary must still withdraw it. However, the IRS has clarified that as long as the missed RMD is taken by December 31st of the year following the decedent’s death, no excise penalty will be assessed.

This is a significant update and provides more flexibility for beneficiaries who may be navigating a difficult time.

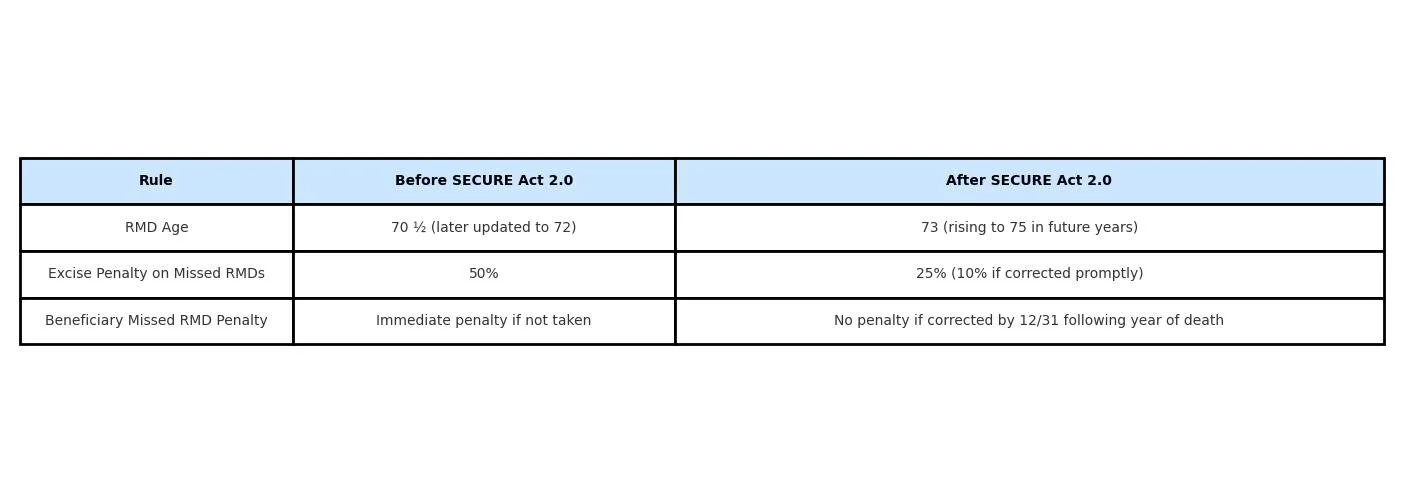

Before SECURE Act 2.0 vs. After

Filing Tax Forms for Missed RMDs

If you missed an RMD, you need to do two things:

Take the missed distribution as soon as possible.

File Form 5329 with your federal tax return to report the missed RMD and calculate the excise penalty.

If you qualify for the reduced 10% penalty, you’ll indicate this on Form 5329.

The actual RMD amount you withdraw will be reported on your Form 1099-R and included in your taxable income for the year you take it.

In some cases, the IRS has historically waived penalties if you can show “reasonable cause” for missing the RMD and that you’ve corrected the mistake. While SECURE Act 2.0 made the penalties less severe, requesting a waiver may still be an option worth considering with your tax professional.

Key Takeaways

SECURE Act 2.0 lowered the penalty for missed RMDs from 50% down to 25% (or 10% if fixed promptly).

The first-year April 1st rule gives you some flexibility but may cause two RMDs in one year.

Beneficiaries now have until December 31st of the year following the decedent’s death to take missed RMDs without penalty.

File Form 5329 to report missed RMDs and claim reduced penalties.

Missing an RMD isn’t ideal, but it’s not the end of the world—especially under the updated SECURE Act 2.0 rules. The most important step is to correct it quickly and make sure you file the proper paperwork with your tax return.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What happens if you miss a Required Minimum Distribution (RMD)?

If you miss an RMD, the IRS may assess an excise tax penalty on the amount that should have been withdrawn. Under SECURE Act 2.0, the penalty is now 25% of the missed amount, reduced to 10% if you correct the mistake promptly by taking the distribution and filing the appropriate tax form.

How did SECURE Act 2.0 change the penalties for missed RMDs?

Previously, missing an RMD triggered a 50% penalty on the shortfall. SECURE Act 2.0 lowered this to 25%, with a further reduction to 10% if the missed distribution is corrected in a timely manner. This change provides much-needed relief for retirees who make honest errors.

What is the April 1st rule for first-year RMDs?

When you first reach RMD age (currently 73), you can delay your initial withdrawal until April 1st of the following year. However, doing so means you must take two RMDs that year—the delayed one and the new year’s required amount—potentially increasing your taxable income.

What are the new IRS rules for inherited IRAs and missed RMDs?

If a deceased account owner had an RMD due in the year of death, the beneficiary must still take that distribution. Under new guidance, if the missed RMD is taken by December 31st of the year following the death, no excise penalty will apply.

What should you do if you missed an RMD?

Take the missed distribution as soon as possible and file IRS Form 5329 with your tax return to report the oversight and calculate any applicable penalty. Your financial or tax advisor can help determine if you qualify for the reduced 10% penalty or a possible waiver.

Can the IRS waive the RMD penalty entirely?

Yes. The IRS may waive the penalty if you can demonstrate reasonable cause for missing the RMD and show that you corrected the issue promptly. While SECURE Act 2.0 reduced the penalties, requesting a waiver may still be worthwhile in some cases.

Filing a Medicare Income Appeal Form: What You Need to Know

Paying higher Medicare premiums than you should? If your income has dropped, you may qualify to file Form SSA-44 and appeal your IRMAA surcharge. Our guide explains how Medicare’s income-based premiums work, which life events allow an appeal, and how to lower your Part B and Part D costs.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

As a Certified Financial Planner®, one question I consistently encounter from retirees is how Medicare premiums relate to income—and what to do if those premiums no longer reflect your current financial reality. If your income has dropped but you're still paying higher Medicare Part B and Part D premiums, you may qualify to file a Medicare income appeal. Here's how to navigate that process.

Medicare Premiums Are Income-Based (IRMAA)

Medicare Part B (covering medical services, outpatient care, durable medical equipment, and more) and Part D (prescription drug coverage) premiums are adjusted based on your Modified Adjusted Gross Income (MAGI) from two years prior. This is known as the Income‑Related Monthly Adjustment Amount (IRMAA).

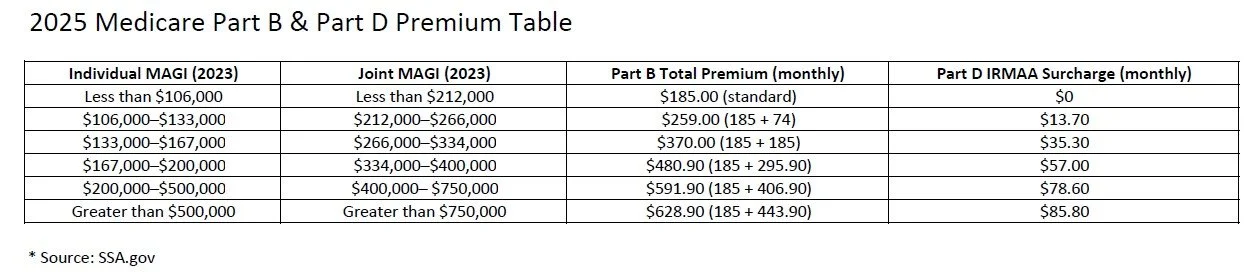

For 2025, premiums are determined using your 2023 MAGI.

Here’s a summarized 2025 IRMAA table for Part B and Part D:

Appealing IRMAA Premiums

If your income has changed significantly due to a qualifying event (and yet Medicare is still charging higher premiums based on your 2023 income), you can appeal using Form SSA‑44, titled “Medicare Income‑Related Monthly Adjustment Amount – Life‑Changing Event.”

The Appeal Form You Must Submit

To initiate the process, you'll complete Form SSA‑44 and submit it to the Social Security Administration (SSA). On the form, you’ll:

Indicate your qualifying life-changing event.

Provide documentation to support your reduced income.

Request recalculation of your Medicare premiums based on your new financial situation.

Qualifying Life-Changing Events

Appeal eligibility hinges on experiencing specific life-changing events, such as:

Retirement (work stoppage or reduction)

Death of a spouse

Divorce or annulment

Loss of income-producing property (beyond your control)

Loss or reduction of pension income

Certain employer settlement payouts

Common Scenarios That Do Not Qualify

Not all income changes are appealable. Examples that typically do not qualify include:

One-time sale of investment / real estate resulting in a capital gain

Large distributions from IRAs

Severance payments

Inheritance distributions

Roth IRA conversions

These changes don’t typically meet SSA’s definition of life-changing events.

The Two-Year Look-Back Period

Remember: Medicare bases IRMAA on your MAGI from two years ago.

2025 premiums rely on your 2023 income

2026 premiums will use your 2024 income, and so forth

How Reimbursement Works After an Approved Appeal

Once your appeal is approved:

SSA will recalculate your premiums based on your current income.

Any excess premiums you've already paid will be reimbursed—typically via direct deposit (if your Social Security benefit is direct-deposited) or a mailed check.

Future premiums will reflect the lower, recalculated amount automatically—so you pay less going forward.

Final Thoughts

This is a proactive process that requires the income appeal form to be submitted; without it, retirees could end up paying thousands of dollars in higher Medicare premiums that could otherwise have been avoided.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What is IRMAA, and how does it affect Medicare premiums?

IRMAA stands for Income-Related Monthly Adjustment Amount. It’s an additional charge added to Medicare Part B and Part D premiums for higher-income individuals. The Social Security Administration bases IRMAA on your Modified Adjusted Gross Income (MAGI) from two years prior.

How does income determine Medicare premiums?

Medicare uses your MAGI reported on your tax return from two years ago to set your current premiums. For example, your 2025 premiums are based on your 2023 income. As income rises, IRMAA surcharges are added in tiers to standard Medicare costs.

Can you appeal your Medicare premiums if your income has dropped?

Yes. If your income has fallen due to a life-changing event—such as retirement, marriage, divorce, or the loss of a spouse—you can request a reduction in your IRMAA charges by filing an appeal with the Social Security Administration.

How do you file a Medicare income appeal?

You can submit Form SSA-44, “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event,” along with documentation supporting your income reduction. The SSA reviews your request and may adjust your premiums based on your current financial situation.

What qualifies as a life-changing event for an IRMAA appeal?

Common qualifying events include retirement, loss of employment or income, marriage, divorce, or the death of a spouse. The event must have significantly reduced your income compared to the amount used to calculate your current premiums.

How long does it take for an IRMAA adjustment to take effect?

If your appeal is approved, the adjustment typically applies to future premiums within one to two billing cycles. You may also receive a refund if you’ve already overpaid based on outdated income information.

Why is it important to review your Medicare premiums each year?

Since IRMAA is based on prior-year tax data, your premiums may not always reflect your current income level. Reviewing your Medicare costs annually ensures you’re not overpaying and helps identify whether you qualify for an appeal.

Should You Withhold Taxes from Your Social Security Benefit?

Social Security benefits can be taxable at the federal level—and in some states. Should you withhold taxes directly from your benefit or make quarterly estimated payments? This guide explains your options, deadlines, and strategies to avoid IRS penalties.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

For many retirees, Social Security is a cornerstone of their retirement income. But what sometimes comes as a surprise is that Social Security benefits can be subject to federal income tax—and in a few cases, state income tax as well. This raises an important planning question: should you withhold taxes directly from your Social Security benefit, or handle them another way?

Let’s walk through the key considerations.

Social Security Withholding Options

The Social Security Administration (SSA) allows you to elect to have federal income taxes withheld directly from your monthly benefit. Unlike wages, where you can set a specific withholding percentage, Social Security offers fixed percentage options:

7%

10%

12%

22%

These percentages are applied to your total monthly benefit, and the withheld amount is sent directly to the IRS. This system is called voluntary withholding, and it can be a convenient way to avoid unexpected tax bills at the end of the year.

How Social Security Is Taxed at the Federal Level

Whether or not your Social Security benefit is taxable depends on your provisional income, which includes:

Your adjusted gross income (AGI), plus

Any tax-exempt interest, plus

50% of your Social Security benefits

Depending on your filing status and income level:

Single filers: If provisional income is between $25,000 and $34,000, up to 50% of your Social Security is taxable. Above $34,000, up to 85% of benefits may be taxable.

Married filing jointly: If provisional income is between $32,000 and $44,000, up to 50% of benefits are taxable. Above $44,000, up to 85% of benefits may be taxable.

It’s important to note that no one pays tax on more than 85% of their Social Security benefit.

State Taxation of Social Security

Most states do not tax Social Security benefits. However, as of now, 12 states do tax Social Security in some form:

Colorado

Connecticut

Kansas

Minnesota

Montana

Nebraska

New Mexico

Rhode Island

Utah

Vermont

West Virginia

Wisconsin

Each state has its own rules, income thresholds, and exemptions, so the actual impact can vary significantly.

What If You Don’t Withhold? Estimated Tax Payments

If you choose not to have taxes withheld from your Social Security benefits, you may need to make quarterly estimated tax payments to the IRS. These payments cover your expected federal tax liability and prevent penalties.

The deadlines for estimated tax payments are:

April 15 – for income earned January 1 through March 31

June 15 – for income earned April 1 through May 31

September 15 – for income earned June 1 through August 31

January 15 (of the following year) – for income earned September 1 through December 31

How to Elect Withholding from Your Social Security Benefit

You can elect to have taxes withheld from your Social Security in two ways:

Online – Log into your my Social Security account and update your withholding preferences electronically.

Paper Form – Complete IRS Form W-4V (Voluntary Withholding Request) and mail it to your local Social Security office.

Once processed, your elected withholding percentage will be applied to each monthly benefit.

IRS Penalties for Not Withholding or Paying Estimated Taxes

If you fail to withhold taxes or make sufficient estimated tax payments, the IRS may assess underpayment penalties. These penalties are essentially interest charges, calculated on the unpaid balance for each quarter you were short.

The penalty is based on:

The amount underpaid, and

The length of time the payment was late

The interest rate is tied to the federal short-term interest rate plus 3% and is adjusted quarterly.

For retirees living on fixed income, these penalties can feel like an unnecessary burden. Electing withholding or staying current with estimated payments can help avoid these surprises.

Final Thoughts

For many retirees, setting up withholding directly from Social Security benefits is the easiest way to stay on top of taxes. It provides peace of mind, ensures compliance, and avoids the hassle of quarterly estimated payments.

However, every situation is unique. The decision should factor in your other sources of income, state tax laws, and overall tax bracket.

Working with a financial planner or tax professional can help determine whether withholding, estimated payments, or a combination of both makes the most sense for you.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

Are Social Security benefits taxable?

Depending on your total income, up to 85% of your Social Security benefits may be subject to federal income tax. The amount taxed is based on your provisional income—which includes your adjusted gross income, tax-exempt interest, and half of your Social Security benefits.

How can I have taxes withheld from my Social Security benefits?

You can elect voluntary withholding through the Social Security Administration. Fixed percentages of 7%, 10%, 12%, or 22% can be withheld from each monthly payment and sent directly to the IRS to cover your federal tax liability.

How do I request tax withholding from my Social Security payments?

You can make the election online through your my Social Security account or by filing IRS Form W-4V (Voluntary Withholding Request) with your local Social Security office. Once processed, the withholding percentage applies automatically to future payments.

Which states tax Social Security benefits?

Most states do not tax Social Security, but a handful—including Colorado, Kansas, Minnesota, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont, West Virginia, Wisconsin, and Connecticut—do in some form. Rules and exemptions vary by state.

What happens if I don’t withhold taxes from my Social Security income?

If you choose not to withhold, you may need to make quarterly estimated tax payments to the IRS. Missing these payments or paying too little can result in underpayment penalties and interest charges.

When are quarterly estimated tax payments due?

Estimated payments are typically due on April 15, June 15, September 15, and January 15 of the following year. These payments cover taxes owed on income not subject to withholding, including Social Security, pensions, and investment income.

How can retirees avoid IRS underpayment penalties?

Setting up withholding directly from Social Security benefits is often the easiest option. Alternatively, retirees can work with a tax professional to estimate their annual tax liability and adjust quarterly payments accordingly to avoid penalties.

Understanding Self-Employment Tax: A Guide for the Newly Self-Employed

Self-employment taxes can catch new business owners off guard. Our step-by-step guide explains the 15.3% tax rate, quarterly deadlines, and strategies to avoid costly mistakes.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

Becoming self-employed can be one of the most rewarding career moves you’ll ever make. It comes with flexibility, independence, and the ability to control your own destiny. But it also comes with new responsibilities—particularly when it comes to taxes. One of the first financial hurdles new business owners encounter is understanding self-employment tax and how to keep up with their tax obligations throughout the year.

For business owners learning these rules for the first time, here is the step-by-step breakdown of what you need to know.

What Is Self-Employment Tax?

When you work as an employee and receive a W-2, your employer withholds Social Security and Medicare taxes from your paycheck. What many don’t realize is that your employer is paying half of those taxes on your behalf.

When you’re self-employed, however, you are both the employer and the employee. That means you’re responsible for the full 15.3% self-employment tax (12.4% for Social Security and 2.9% for Medicare) on your net earnings. If your income is above certain thresholds, an additional 0.9% Medicare surtax may apply.

This tax is in addition to federal and state income taxes, which makes planning ahead critical.

Estimated Tax Payments and Deadlines

Unlike W-2 employees, there’s no paycheck system automatically sending taxes to the government for you. The IRS expects you to make quarterly estimated tax payments. These payments cover both your income tax liability and your self-employment tax.

The deadlines for estimated tax payments are:

April 15 – for income earned January 1 through March 31

June 15 – for income earned April 1 through May 31

September 15 – for income earned June 1 through August 31

January 15 (of the following year) – for income earned September 1 through December 31

If the due date falls on a weekend or holiday, the deadline shifts to the next business day.

How Are Estimated Taxes Calculated?

The IRS gives you two main methods for calculating estimated taxes, sometimes called the “safe harbor” rules:

Prior-Year Method (110% Rule)

If your adjusted gross income was more than $150,000 in the previous year (or $75,000 if single), you can avoid penalties by paying 110% of your prior year’s total tax liability in equal quarterly installments.

If your income was below those thresholds, the requirement is 100% of your prior year’s tax liability.

Current-Year Method

Alternatively, you can calculate your actual expected tax liability for the current year and make payments to cover 90% of that amount.

What Happens If You Don’t Pay Estimated Taxes?

Failing to make estimated tax payments can lead to IRS penalties. These are generally underpayment penalties, calculated based on the amount you should have paid each quarter compared to what you actually paid.

In addition to penalties, you’ll still owe the unpaid taxes at year-end. This often creates a cash flow crisis for new self-employed individuals who didn’t set money aside during the year.

The IRS does offer some relief if:

You owe less than $1,000 in tax after subtracting withholding and credits, or

You paid at least 90% of your current-year tax liability (or 100%/110% of your prior year’s tax liability, depending on income).

Still, the safest strategy is to set aside a portion of each payment you receive for taxes and make your estimated payments on time.

How IRS Penalties Are Calculated?

The IRS calculates underpayment penalties using two key components:

Amount of Underpayment – The penalty is based on how much you should have paid each quarter versus how much you actually paid.

Time Period of Underpayment – The penalty is essentially interest charged on the shortfall, starting from the due date of the missed payment until the date you make it.

The interest rate used is tied to the federal short-term interest rate plus 3%. This rate changes quarterly, so the penalty amount can vary depending on when the shortfall occurred.

For example:

If you owed $4,000 in estimated payments for a quarter but only paid $2,000, the IRS considers the $2,000 shortfall late.

Interest is charged daily on the unpaid portion until you make up the difference or file your return.

While penalties may seem small at first, they add up quickly—especially if you consistently underpay throughout the year.

Why Taxes Become More Complex When You’re Self-Employed

For most W-2 employees, tax filing is relatively straightforward—gather a W-2 or two, maybe add a few deductions, and you’re done. For the self-employed, the process quickly becomes more involved:

Tracking business expenses for deductions (supplies, mileage, home office, etc.).

Paying both sides of Social Security and Medicare taxes.

Dealing with quarterly estimated payments.

Understanding rules around depreciation, retirement plan contributions, and health insurance deductions.

Because of these added layers, we strongly recommend engaging an experienced accounting firm or tax professional, especially in your first few years. This not only ensures compliance but also frees up your time to focus on building your business instead of spending evenings trying to interpret the tax code.

Final Thoughts

Transitioning from employee to self-employed entrepreneur comes with an exciting new level of independence—but it also requires discipline. Understanding self-employment tax, staying on top of quarterly estimated payments, and planning ahead for income tax can help you avoid costly surprises at year-end.

Working with a qualified tax professional or financial planner can help you estimate payments accurately, maximize deductions, and keep your business finances running smoothly.

Remember: as a self-employed individual, you are your own payroll department. Treating taxes like a regular business expense is the best way to stay ahead and protect your financial success.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What is self-employment tax, and who has to pay it?

Self-employment tax covers both the employee and employer portions of Social Security and Medicare taxes, totaling 15.3%. Anyone earning $400 or more in net self-employment income must generally pay this tax, in addition to regular income taxes.

How often do self-employed individuals have to pay taxes?

The IRS requires quarterly estimated tax payments to cover both income and self-employment taxes. Payments are typically due April 15, June 15, September 15, and January 15 of the following year.

How can I calculate my estimated tax payments?

You can use the “safe harbor” rules: pay 100% of your prior year’s tax liability (110% if your income was over $150,000) or 90% of your current year’s expected tax liability. These methods help avoid IRS underpayment penalties.

What happens if I don’t make estimated tax payments?

Missing payments or underpaying can result in IRS penalties and interest, calculated based on how much you underpaid and for how long. Even if penalties apply, you’ll still owe the unpaid taxes at year-end.

How are IRS penalties for underpayment calculated?

Penalties function like interest, accruing daily on any shortfall from the payment due date until it’s paid. The rate is the federal short-term interest rate plus 3%, adjusted quarterly.

Why is tax planning more complex for self-employed individuals?

Self-employed taxpayers must track deductible expenses, manage quarterly payments, pay both sides of payroll taxes, and navigate complex deductions like home office or retirement contributions. Professional guidance can simplify compliance and help maximize deductions.

What’s the best way to stay on top of taxes when self-employed?

Set aside a portion of every payment you receive for taxes, make quarterly estimated payments on time, and work with a tax professional to stay compliant. Treating taxes as a regular business expense helps prevent surprises at year-end.

How Much Life Insurance Should I Have?

Many people know they should have life insurance, but few know how much is enough. The right coverage amount depends on your income, debt, family size, and long-term goals. Whether you’re buying a policy for the first time or re-evaluating an old one, having the right number matters.

Many people know they should have life insurance, but few know how much is enough. The right coverage amount depends on your income, debt, family size, and long-term goals. Whether you’re buying a policy for the first time or re-evaluating an old one, having the right number matters.

This guide breaks down how to determine your ideal coverage—and why the wrong number can leave your family exposed.

Why Life Insurance Matters

Life insurance provides a financial safety net for your loved ones if you pass away unexpectedly. The payout can help:

Replace your income

Cover your mortgage and debts

Fund your children's education

Pay for funeral expenses

Maintain your family’s lifestyle

At its core, life insurance is about protecting the people who rely on you. It offers them financial time and stability during one of the hardest periods of their lives.

What Happens If You’re Underinsured?

A coverage gap could leave your spouse unable to afford the mortgage or force your children to delay college. Even a shortfall of $250,000 can mean long-term consequences like selling the family home, lifestyle changes for your family, dipping into retirement accounts, or accumulating debt.

Many people mistakenly believe their employer policy or small individual plan is “good enough.” In reality, it often isn’t.

How to Estimate Your Need?

Several variables play into estimating the need for life insurance, but it mostly comes back down to why life insurance matters and who you are trying to protect. When analyzing insurance coverage for financial planning clients, we focus on debt, income, future expenses, and retirement benefits (i.e. a future pension).

Let’s consider a typical family of four with the following assumptions.

Husband – Age 45 with Income of $75,000

Wife – Age 43 with Income of $150,000

2 Children – Age 3 and 7

Mortgage - $350,000

Husband Pension – $225,000 (Lump Sum Present Value of Future Payments)

As you can see in the examples, the amounts for the husband and wife are different. A lot of families will just obtain the same coverage for each spouse, when the need is often not the same. We strongly recommend working with a financial professional as there are several other factors that could come into play. For example, younger couples with children may want more than 5 years of income replacement because they’ve had less time to grow their other assets. Some folks may sleep better at night with a larger amount.

Term vs. Permanent: What’s the Difference?

Term Life Insurance

Covers you for a set period (10, 20, or 30 years)

Ideal for covering temporary obligations like a mortgage or child-rearing years

Lower monthly cost

Permanent Life Insurance

Covers you for life

Includes a cash value component

Used more often in estate planning or legacy strategies

Higher cost, more complex

What Type of Insurance Should I Get?

For most people in their working years, term coverage offers the most protection for the lowest cost. This is typically what we recommend to families to make sure the amount of coverage is sufficient to cover the need. Over time, most families will continue to accumulate assets, pay down their mortgage, and see the kids grow up and come off the family payroll. This means that the amount of insurance coverage recommended today could be very different 10-15 years from now.

Term policies are a cost-effective way to cover the need while it is there. The annual savings from obtaining a term policy over a permanent policy could also be used to execute other financial strategies that may help in the near and long term.

Another cost saving strategy could be to ladder insurance policies over different periods. In general, the shorter the term period, the lower cost the policy. If the need for insurance is greater for the next 10 years, obtaining a 10-year policy for part of the need and then a 20- or 30-year policy for the remainder could lower the overall cost.

When Should You Review Your Coverage?

It’s smart to review your life insurance every few years or whenever your life changes. Key moments include:

Getting married or divorced

Buying a home

Having or adopting a child

Significant changes to income or debt

Changes to a beneficiary’s needs

These events can shift the amount of coverage you need or how long you need it.

Final Thoughts

Life insurance is not just about numbers—it’s about protecting your family’s future. Whether you need $500,000 or $2 million in coverage depends on your unique circumstances.

Having the wrong amount can leave loved ones exposed. Too little could cause hardship. Too much might waste dollars better used elsewhere.

If you’re unsure how much coverage is right for you, this is a perfect time to consult with a financial advisor who can walk you through the math and build a plan that gives you peace of mind.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

What is the Value of My Pension?

In our latest article, we break down how to calculate the present value of your pension—a powerful way to compare your pension to your other retirement assets and make better long-term decisions.

Whether you’re 5 years from retirement or already collecting, this article will help you see your pension in a new light.

For many Americans approaching retirement, a pension represents one of the most valuable pieces of their financial picture. But while pensions may promise reliable income in the future, they can be hard to evaluate in present terms—especially if you’re trying to compare your pension to a 401(k), IRA, or a lump-sum offer from your employer. That’s where calculating the present value of your pension becomes useful.

In this article, we’ll break down what present value means, how to calculate it, and why it’s essential for retirement planning.

What Is Present Value and Why Does It Matter?

The present value (PV) of your pension tells you how much the future stream of income payments is worth in today’s dollars. It answers this question:

“If I had to replace my pension with a lump sum today, how much money would I need?”

This is especially important when:

You're offered a lump-sum payout option instead of monthly payments

You're comparing your pension to your other investments

You're trying to understand your net worth or financial independence readiness

Step 1: Gather the Details of Your Pension

To begin, you’ll need the following information, which you should be able to request from your employer or pension administrator:

Annual or monthly payment amount

Start date of pension payouts

Expected length of payments (based on life expectancy or plan rules)

Discount rate (assumed rate of return—typically between 4%–6%)

Let’s look at an example:

You’re eligible to receive $30,000 per year

Payments start at age 65

You expect payments to last for 20 years (Age 85 Life Expectancy)

You use a 5% discount rate

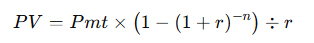

Step 2: Use the Present Value of an Annuity Formula

Most pensions pay a fixed amount each year. This makes them resemble a type of annuity. To calculate the present value of that annuity, use the formula:

Where:

PV = present value

Pmt = annual pension payment

r = discount rate (as a decimal)

n = number of years of payment

In our example:

So the present value of this pension is about $373,866.

Step 3: Adjust for the Time Until Retirement

If you're not retiring immediately, you’ll need to discount the result back to today’s dollars.

Let’s say you're 55 now, and payments begin at 65. That’s a 10-year delay. The formula becomes:

This means the value of your pension—in today’s dollars—is roughly $229,625.

How Should You Choose a Discount Rate?

The discount rate reflects your assumed rate of return if you invested that money yourself. When we create financial plans for individuals, we typically assume a rate of return of 6-7% before retirement and 4% in retirement for investments. Unlike a 401(k) or other investment account where the account owner assumes the investment risk, a pension is more of a “promise to pay” and the investment risk is assumed by the organization paying the benefit. When estimating the present value of a pension, we typically recommend using a more conservative rate of 4-5%. If you believe your rate of return would be higher if you invested the money yourself, that would increase the discount rate used in the calculation above and reduce the estimated present value of your pension.

Other Factors to Consider

Cost of Living Adjustments (COLAs)

If your pension increases each year to keep up with inflation, it’s worth more than a flat pension and requires a different calculation.Joint Life Payouts

If your pension pays for your spouse’s lifetime too, you’ll need to factor in their life expectancy as well.Taxes

Pension payments are typically taxed as ordinary income. This doesn’t change the present value math, but it matters when comparing to Roth accounts or after-tax investments.

When Calculating Present Value Can Help

Here’s when you might want to calculate your pension’s present value:

Deciding between a monthly pension or lump sum

Coordinating pension income with Social Security and investment withdrawals

Evaluating your retirement readiness

Planning how to split retirement assets in a divorce

It gives you a common-dollar framework for comparison—turning an income stream into a lump sum you can benchmark and plan around.

Final Thoughts

Your pension may be one of the most stable sources of income in retirement, but stability doesn’t always equal clarity. By calculating its present value, you equip yourself with a concrete number you can use in your overall retirement strategy. Whether you’re weighing a lump sum, planning for early retirement, or just seeking a clearer financial picture, this number helps turn your pension into a more actionable asset.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Tax-Free Tips and Overtime: What the Big Beautiful Tax Bill Means for Workers

The Big Beautiful Tax Bill introduced two worker-friendly provisions aimed at boosting take-home pay: tax-free tips and tax-free overtime pay.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

The Big Beautiful Tax Bill introduced two worker-friendly provisions aimed at boosting take-home pay: tax-free tips and tax-free overtime pay.

Starting in 2025, many employees in service-based and hourly industries will see a new opportunity to earn more without increasing their federal tax bill. But before you get too excited, there are income phaseouts that limit the benefit for higher earners, and both provisions are temporary—ending in 2028.

Let’s break down how each works, who qualifies, and how you might use this limited-time tax relief to your advantage.

Tax-Free Tips (2025–2028)

Under the new law, cash and electronic tips earned by employees will be excluded from federal income tax starting in 2025. This means waitstaff, bartenders, valets, and other tipped workers can keep more of their tips without paying federal income tax on that income.

Key Details:

Up to $25,000 of qualified tip income is deductible

Applies to all reported tips, including cash, credit card, and digital payment platforms (like Venmo or Square).

Employers are still required to track and report tip income, but it won’t count toward federal taxable wages.

FICA (Social Security and Medicare taxes) still apply to tips unless further guidance says otherwise.

Income Phaseouts for Tax-Free Tips

The benefit is phased out for higher earners. Once your income reaches a certain threshold, the tax-free status begins to shrink—and disappears entirely once fully phased out. The $25,000 deduction amount is reduced by $100 for each $1,000 of modified AGI over $150,000 for single filers and $300,000 for joint filers.

If you’re within the phaseout range, the portion of your tips that are tax-free decreases gradually until it reaches zero.

Tax-Free Overtime Pay (2025–2028)

In a rare move to incentivize additional work hours, the bill also makes overtime pay exempt from federal income tax from 2025 through 2028. This applies to time-and-a-half wages earned beyond 40 hours per week.

Key Details:

Up to $12,500 ($25,000 joint) of qualified overtime compensation is deductible

Applies to hourly workers eligible for overtime under the Fair Labor Standards Act.

Only the premium portion of overtime (typically the 1.5x wage rate) is tax-free. The base rate is still taxable.

Overtime must be properly documented on pay stubs or employer payroll systems.

Income Phaseouts for Tax-Free Overtime

As with tax-free tips, this benefit is designed to help middle-income earners and begins to phase out at higher income levels. The phaseout calculation is the same as the tips deduction, the $12,500 deduction is reduced by $100 for each $1,000 of modified AGI over $150,000 (single) and $300,000 (joint).

If your income falls within the range, only a portion of your overtime premium pay will be excluded from taxes. Above the threshold, none of the overtime qualifies for the exemption.

Could Employers Shift Salaried Workers to Hourly?

One of the more interesting (and perhaps unintended) consequences of the tax-free tips and overtime provisions is that it may incentivize employers to reclassify certain employees from salaried to hourly.

Here’s why:

Only hourly workers are eligible for tax-free overtime under the new law.

Salaried employees—particularly those exempt from overtime rules—don’t benefit at all from this provision.

Employers looking to attract and retain workers in a competitive labor market may consider restructuring compensation models to help employees take advantage of the new tax savings.

For example, a business might:

Reclassify a lower-level manager from salary to hourly, allowing them to earn overtime that’s now tax-free.

Shift part of a base salary into a tip-eligible role (such as hybrid front-of-house service positions) to access the tax-free tip benefit.

Of course, this type of reclassification must be done carefully to remain compliant with wage and hour laws, and may not be appropriate in every industry. But in sectors like hospitality, healthcare, retail, and logistics, this kind of shift could become more common—particularly as employees become more aware of the tax advantages.

Planning Considerations

These two provisions present real planning opportunities for wage earners, especially those working in hospitality, retail, healthcare, and skilled trades.

1. Stack Your Hours Smartly

For hourly workers who are near the phaseout thresholds, it may make sense to shift hours into lower-income years to maximize the benefit.

2. Watch for Unintended Phaseout Triggers

Bonuses, side gigs, or spousal income could push you into the phaseout range and reduce or eliminate your tax-free eligibility. Tax planning with a professional can help you anticipate this.

3. Use the Extra Take-Home Pay Wisely

Since these benefits are temporary (expiring at the end of 2028), consider putting the extra income to work:

Pay down high-interest debt

Build your emergency fund

Contribute more to retirement or a Roth IRA

Save for large purchases without relying on credit

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What are the new tax-free tip and overtime provisions under the Big Beautiful Tax Bill?

Starting in 2025 and lasting through 2028, workers can exclude certain tip income and overtime pay from federal income tax. Up to $25,000 in tips and up to $12,500 ($25,000 for joint filers) in overtime pay may qualify each year, subject to income limits.

Who qualifies for the tax-free tip provision?

Hourly and service-based workers who earn tips—such as restaurant servers, bartenders, or valets—can exclude up to $25,000 of reported tip income from federal income tax. The deduction phases out for single filers with income above $150,000 and joint filers above $300,000.

How does the tax-free overtime pay rule work?

Hourly employees eligible for overtime under the Fair Labor Standards Act can exclude the “premium” portion of overtime pay (the extra half-time pay above their base rate) from federal income tax. The same income phaseouts apply as for tips.

Do workers still pay Social Security and Medicare taxes on tax-free tips and overtime?

Yes. Even though the new law exempts certain tips and overtime from federal income tax, FICA taxes (Social Security and Medicare) still apply unless further IRS guidance states otherwise.

Will salaried employees benefit from the new provisions?

No. Only hourly workers qualify for the tax-free overtime benefit. Some employers may consider reclassifying certain employees as hourly to allow them to take advantage, but any reclassification must comply with labor laws.

How long do the tax-free tip and overtime benefits last?

Both provisions are temporary. They take effect in 2025 and are scheduled to expire at the end of 2028 unless Congress extends them.

What should workers do with the extra take-home pay?

Since the benefits are short-term, consider using the additional after-tax income to pay down high-interest debt, build savings, or contribute to retirement accounts. A financial professional can help you plan the most effective use of the extra cash flow.

Big Beautiful Tax Bill Overhauls Student Loan Repayment Options: End of the SAVE Program

The Big Beautiful Tax Bill has made headlines for reshaping major areas of the tax code but buried within the legislation is a sweeping overhaul of the federal student loan system, which will have long-term implications for both current and future borrowers.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

The Big Beautiful Tax Bill has made headlines for reshaping major areas of the tax code but buried within the legislation is a sweeping overhaul of the federal student loan system, which will have long-term implications for both current and future borrowers.

If you—or your children—have federal student loans or plan to take them out, here’s what you need to know about repayment plans, loan forgiveness, and graduate borrowing limits as we head toward a new era in federal student aid.

Starting in 2026: Only Two Main Repayment Options

One of the biggest shifts takes effect in July 2026, when the federal government will consolidate most repayment options into just two primary plans for new borrowers:

1. Standard Repayment Plan

Fixed monthly payments over 10 years

Similar to current standard plans

Ideal for borrowers with stable income who want to eliminate debt quickly

2. Repayment Assistance Plan (RAP)

Monthly payments based on income and family size

Forgiveness available after 20–30 years, depending on the loan type

Unpaid interest does not capitalize annually, but continues to accrue

While the RAP offers more flexibility, it comes with a longer repayment horizon. This model mirrors existing income-driven plans, but with stricter forgiveness timelines and reduced subsidies over time.

Existing Income-Driven Repayment Plans Will Be Phased Out

The bill also mandates the sunset of current income-driven repayment (IDR) plans such as IBR, PAYE, REPAYE, and even the more recently introduced SAVE plan (discussed later).

Borrowers currently enrolled in these programs will have a transition period until 2028 to switch into the new Repayment Assistance Plan (RAP). After that date:

New enrollment in existing IDR plans will be closed

Borrowers will need to opt into RAP or move into the standard plan

Previously accrued progress toward forgiveness may carry over, depending on guidance from the Department of Education (still pending)

Borrowers currently on track for loan forgiveness in an existing plan should carefully review how the transition may affect their timelines.

Graduate Borrowers Face New Loan Caps

Graduate and professional students—who often rely on federal student loans to cover the full cost of attendance—are facing new borrowing limits:

New Federal Caps for Graduate Borrowers (Effective 2026):

$100,000 lifetime maximum for most graduate and professional programs

Applies across all federal programs, including Graduate PLUS

Borrowers may need to seek private loans or employer aid to cover costs beyond the cap

This is a dramatic departure from current rules, which allow grad students to borrow up to the full cost of attendance—including tuition, housing, and living expenses. Under the new system, graduate students will be expected to budget more conservatively or explore alternative financing.

Changes to the SAVE Program

The Saving on a Valuable Education (SAVE) plan, introduced in 2023 as a more generous income-driven repayment option, is also on the chopping block.

According to the Trump administration, the SAVE plan will:

As of August 1, 2025, interest will begin accruing again for SAVE plan borrowers, even though they may still be in forbearance

The SAVE Program will be eliminated by June 30, 2028, and borrowers will be moved into a new income-driven repayment plan called RAP.

Lose features such as interest subsidies and lowered income thresholds for $0 monthly payments

For many, this means monthly payments could increase significantly once the SAVE subsidies disappear. Borrowers may also need to recalculate their budgets as interest builds up again and full payments resume.

If you're enrolled in SAVE, expect updates from your servicer in late 2025 outlining your transition options.

Forgiveness Becomes Taxable Again After 2025

One of the more overlooked but financially critical changes in the bill relates to taxation of forgiven student loan balances.

Currently, through the end of 2025, student loan forgiveness—whether through IDR, PSLF, or closed school discharge—is not considered taxable income at the federal level. That exclusion is set to expire.

Starting January 1, 2026, any federal student loan balance that is forgiven will be treated as taxable income by the IRS. This change has major implications for borrowers expecting loan forgiveness in the next 5–10 years.

Example: If $100,000 in student loans is forgiven in 2026, the borrower may owe federal taxes on that full amount—potentially triggering a $20,000+ tax bill depending on their bracket.

Borrowers approaching forgiveness in IDR plans may want to accelerate their timelines, if possible, or start preparing for a potential future tax liability.

Final Thoughts

The student loan system has been gradually shifting over the last few years, but the Big Beautiful Tax Bill accelerates those changes in a way that will permanently reshape how future generations borrow and repay federal loans.

Whether you're a current borrower navigating the SAVE sunset, a parent helping a graduate student manage new loan caps, or someone on track for forgiveness after 2025, proactive planning will be essential. Understanding the timing, tax implications, and repayment structures will help you avoid financial surprises in the years ahead.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What major changes does the Big Beautiful Tax Bill make to federal student loans?

Beginning in 2026, the law consolidates most federal student loan repayment options into two main plans—the Standard Repayment Plan and a new Repayment Assistance Plan (RAP). It also caps graduate borrowing at $100,000 and makes forgiven loan balances taxable again starting in 2026.

What are the two new repayment options starting in 2026?

Borrowers can choose between a 10-year Standard Repayment Plan with fixed payments or the new Repayment Assistance Plan (RAP), which bases payments on income and family size. The RAP offers forgiveness after 20–30 years, depending on loan type, but limits interest subsidies compared to current programs.

What happens to existing income-driven repayment (IDR) plans like SAVE, PAYE, or REPAYE?

These programs will be phased out by 2028. Borrowers currently enrolled in them can stay until the transition period ends but will eventually need to move into the new RAP or Standard Plan. Progress toward forgiveness may carry over, though official guidance is still pending.

How does the new law affect graduate and professional borrowers?

Starting in 2026, graduate students will face a $100,000 lifetime borrowing cap across all federal loan programs, including Graduate PLUS. Those who need additional funds may have to rely on private loans, scholarships, or employer tuition assistance.

What happens to the SAVE repayment plan under the new law?

The SAVE plan will begin phasing out in 2025 and be fully eliminated by June 30, 2028. Borrowers will lose features such as interest subsidies and lower payment thresholds. They will be moved automatically into the new RAP once SAVE ends.

Will student loan forgiveness be taxable again?

Yes. Starting January 1, 2026, any federal student loan balance that is forgiven—through income-driven repayment, PSLF, or other discharge programs—will once again be treated as taxable income by the IRS. Borrowers expecting forgiveness soon should prepare for potential tax liability.

How should borrowers prepare for these changes?

Review your repayment plan, understand your eligibility under the new RAP, and talk to a financial or tax advisor about potential tax implications. If you’re approaching forgiveness before 2026, accelerating repayment or adjusting your timeline may reduce future tax exposure.