Planning for Healthcare Costs in Retirement: Why Medicare Isn’t Enough

Healthcare often becomes one of the largest and most underestimated retirement expenses. From Medicare premiums to prescription drugs and long-term care, this article from Greenbush Financial Group explains why healthcare planning is critical—and how to prepare before and after age 65.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

When most people picture retirement, they imagine travel, hobbies, and more free time—not skyrocketing healthcare bills. Yet, one of the biggest financial surprises retirees face is how much they’ll actually spend on medical expenses.

Many retirees dramatically underestimate their healthcare costs in retirement, even though this is the stage of life when most people access the healthcare system the most. While it’s common to pay off your mortgage leading up to retirement, it’s not uncommon for healthcare costs to replace your mortgage payment in retirement.

In this article, we’ll cover:

Why Medicare isn’t free—and what parts you’ll still need to pay for.

What to consider if you retire before age 65 and don’t yet qualify for Medicare.

The difference between Medicare Advantage and Medicare Supplement plans.

How prescription drug costs can take retirees by surprise.

The reality of long-term care expenses and how to plan for them.

Planning for Healthcare Before Age 65

For those who plan to retire before age 65, healthcare planning becomes significantly more complicated—and expensive. Since Medicare doesn’t begin until age 65, retirees need to bridge the coverage gap between when they stop working and when Medicare starts.

If your former employer offers retiree health coverage, that’s a tremendous benefit. However, it’s critical to understand exactly what that coverage includes:

Does it cover just the employee, or both the employee and their spouse?

What portion of the premium does the employer pay, and how much is the retiree responsible for?

What out-of-pocket costs (deductibles, copays, coinsurance) remain?

If you don’t have retiree health coverage, you’ll need to explore other options:

COBRA coverage through your former employer can extend your workplace insurance for up to 18 months, but it’s often very expensive since you’re paying the full premium plus administrative fees.

ACA marketplace plans (available through your state’s health insurance exchange) may be an alternative, but premiums and deductibles can vary widely depending on your age, income, and coverage level.

In many cases, healthcare costs for retirees under 65 can be substantially higher than both Medicare premiums and the coverage they had while working. This makes it especially important to build early healthcare costs into your retirement budget if you plan to leave the workforce before age 65.

Medicare Is Not Free

At age 65, most retirees become eligible for Medicare, which provides a valuable foundation of healthcare coverage. But it’s a common misconception that Medicare is free—it’s not.

Here’s how it breaks down:

Part A (Hospital Insurance): Usually free if you’ve paid into Social Security for at least 10 years.

Part B (Medical Insurance): Covers doctor visits, outpatient care, and other services—but it has a monthly premium based on your income.

Part D (Prescription Drug Coverage): Also carries a monthly premium that varies by plan and income level.

Example:

Let’s say you and your spouse both enroll in Medicare at 65 and each qualify for the base Part B and Part D premiums.

In 2025, the standard Part B premium is approximately $185 per month per person.

A basic Part D plan might average around $36 per month per person.

Together, that’s about $220 per person, or $440 per month for a couple—just for basic Medicare coverage. And this doesn’t include supplemental or out-of-pocket costs for things Medicare doesn’t cover.

NOTE: Some public sector or state plans even provide Medicare Part B premium reimbursement once you reach 65—a feature that can be extremely valuable in retirement.

Medicare Advantage and Medicare Supplement Plans

While Medicare provides essential coverage, it doesn’t cover everything. Most retirees need to choose between two main options to fill in the gaps:

Medicare Advantage (Part C) plans, offered by private insurers, bundle Parts A, B, and often D into one plan. These plans usually have lower premiums but can come with higher out-of-pocket costs and limited provider networks.

Medicare Supplement (Medigap) plans, which work alongside traditional Medicare, help pay for deductibles, copayments, and coinsurance.

It’s important not to simply choose the lowest-cost plan. A retiree’s prescription needs, frequency of care, and preferred doctors should all factor into the decision. Choosing the cheapest plan could lead to much higher out-of-pocket expenses in the long run if the plan doesn’t align with your actual healthcare needs.

Prescription Drug Costs: A Hidden Retirement Expense

Prescription drug coverage is one of the biggest cost surprises for retirees. Even with Medicare Part D, out-of-pocket expenses can add up quickly depending on the medications you need.

Medicare Part D plans categorize drugs into tiers:

Tier 1: Generic drugs (lowest cost)

Tier 2: Preferred brand-name drugs (moderate cost)

Tier 3: Specialty drugs (highest cost, often with no generic alternatives)

If you’re prescribed specialty or non-generic medications, you could spend hundreds—or even thousands—per month despite having coverage.

To help, some states offer programs to reduce these costs. For example, New York’s EPIC program helps qualifying seniors pay for prescription drugs by supplementing their Medicare Part D coverage. It’s worth checking if your state offers a similar benefit.

Planning for Long-Term Care

One of the most misunderstood aspects of Medicare is long-term care coverage—or rather, the lack of it.

Medicare only covers a limited number of days in a skilled nursing facility following a hospital stay. Beyond that, the costs become the retiree’s responsibility. Considering that long-term care can easily exceed $120,000 per year, this can be a major financial burden.

Planning ahead is essential. Options include:

Purchasing a long-term care insurance policy to offset future costs.

Self-insuring, by setting aside savings or investments for potential care needs.

Planning to qualify for Medicaid through strategic trust planning

Whichever route you choose, addressing long-term care early is key to protecting both your assets and your peace of mind.

Final Thoughts

Healthcare is one of the largest—and most underestimated—expenses in retirement. While Medicare provides a foundation, retirees need to plan for premiums, prescription costs, supplemental coverage, and potential long-term care needs.

If you plan to retire before 65, early planning becomes even more critical to bridge the gap until Medicare begins. By taking the time to understand your options and budget accordingly, you can enter retirement with confidence—knowing that your healthcare needs and your financial future are both protected.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQ)

Why isn’t Medicare enough to cover all healthcare costs in retirement?

While Medicare provides a solid foundation of coverage starting at age 65, it doesn’t pay for everything. Retirees are still responsible for premiums, deductibles, copays, prescription drugs, and long-term care—expenses that can add up significantly over time.

What should I do for healthcare coverage if I retire before age 65?

If you retire before Medicare eligibility, you’ll need to bridge the gap with options like COBRA, ACA marketplace plans, or employer-sponsored retiree coverage. These plans can be costly, so it’s important to factor early healthcare premiums and out-of-pocket expenses into your retirement budget.

What are the key differences between Medicare Advantage and Medicare Supplement plans?

Medicare Advantage (Part C) plans combine Parts A, B, and often D, offering convenience but limited provider networks. Medicare Supplement (Medigap) plans work alongside traditional Medicare to reduce out-of-pocket costs. The right choice depends on your budget, health needs, and preferred doctors.

How much should retirees expect to pay for Medicare premiums?

In 2025, the standard Medicare Part B premium is around $185 per month, while a basic Part D plan averages about $36 monthly. For a married couple, that’s roughly $440 per month for both—before adding supplemental coverage or out-of-pocket expenses. These costs should be built into your retirement spending plan.

Why are prescription drugs such a major expense in retirement?

Even with Medicare Part D, out-of-pocket drug costs can vary widely based on your prescriptions. Specialty and brand-name medications often carry high copays. Programs like New York’s EPIC can help eligible seniors manage these costs by supplementing Medicare coverage.

Does Medicare cover long-term care expenses?

Medicare only covers limited skilled nursing care following a hospital stay and does not pay for most long-term care needs. Since extended care can exceed $120,000 per year, retirees should explore options like long-term care insurance, Medicaid planning, or setting aside savings to self-insure.

How can a financial advisor help plan for healthcare costs in retirement?

A financial advisor can estimate future healthcare expenses, evaluate Medicare and supplemental plan options, and build these costs into your retirement income plan. At Greenbush Financial Group, we help retirees design strategies that balance healthcare needs with long-term financial goals.

The HSA 6-Month Rule: What Happens When You Enroll in Medicare at Age 65

If you’re approaching age 65 and contributing to a Health Savings Account (HSA), there’s a little-known Medicare rule that could quietly cost you.

Many people know that Health Savings Accounts (HSAs) offer triple tax benefits: tax-deductible contributions, tax-deferred growth, and tax-free withdrawals for qualified medical expenses. But what’s less commonly understood is the 6-month rule tied to Medicare Part A enrollment—and how it can affect your HSA eligibility.

If you’re turning 65 and planning to sign up for Medicare, this rule could impact when you must stop HSA contributions and potentially trigger a tax penalty if not handled properly.

Let’s walk through what the 6-month rule is, when it applies, and how to avoid costly mistakes.

What Is the HSA 6-Month Rule?

The 6-month rule refers to a Medicare regulation stating that when you apply for Medicare Part A after age 65, your coverage may retroactively begin up to six months prior to your application date—but no earlier than your 65th birthday.

Why does this matter for HSAs?

Because you cannot contribute to an HSA once you are enrolled in any part of Medicare. If your Medicare Part A enrollment is retroactive, and you weren’t aware, you could accidentally contribute to your HSA while you were technically ineligible—and face a tax penalty.

When Does the 6-Month Rule Apply?

This rule only comes into play if:

You are 65 or older, and

You delay enrolling in Medicare Part A, and

You later apply for Medicare Part A (for example, when retiring at 67 or 68)

At that point, the Social Security Administration may retroactively activate your Part A coverage up to 6 months prior to your application date.

Important: If you enroll in Medicare at age 65 or earlier, this rule does not apply. Your Part A coverage starts based on your enrollment date.

Timeline Example

Turns 65: July 2023

Continues working and delays Medicare

Applies for Medicare: October 2025 (at age 67)

Medicare Part A effective date: April 1, 2025

Last eligible month to contribute to an HSA: March 2025

Why You Must Stop HSA Contributions Before Medicare Coverage Starts

HSA rules state that:

You must stop making contributions to your HSA the month before your Medicare coverage begins.

Medicare coverage always begins on the first day of the month—so plan your final HSA contribution accordingly.

If you accidentally contribute while enrolled in Medicare—even retroactively—you may owe a 6% excise tax on those excess contributions.

How to Plan Around the 6-Month Rule

To avoid penalties and protect your tax savings:

1. Stop HSA Contributions at Least 6 Months Before Applying for Medicare

If you plan to delay Medicare past age 65, stop HSA contributions at least 6 months before you submit your Medicare application. This helps avoid retroactive coverage overlapping with HSA eligibility.

2. Calculate and Remove Excess Contributions Promptly

If you do contribute after your Medicare Part A effective date, you must remove the excess to avoid penalties.

How to calculate excess: Total the amount contributed after your Medicare coverage began. This includes both your own and any employer contributions during that ineligible period.

Penalty timeline: You must remove the excess contributions (plus any earnings) by your tax filing deadline—typically April 15 of the following year—to avoid the 6% excise tax.

If you miss that deadline, the 6% penalty applies for each year the excess amount remains in the account.

3. Use a Mid-Year Retirement Strategy

If retiring mid-year, prorate your annual HSA contribution based on the number of months you were eligible. Contributions made after Medicare enrollment—even by your employer—count toward your annual limit and must be removed if you were ineligible.

Final Thought:

The HSA 6-month rule is easy to overlook—but understanding how it works can help you avoid costly mistakes as you transition to Medicare. Whether you’re retiring soon or planning ahead, coordinating your HSA contributions with Medicare enrollment is an essential part of a tax-efficient retirement strategy.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the HSA 6-month rule?

The HSA 6-month rule refers to a Medicare regulation stating that when you apply for Medicare Part A after age 65, your coverage can be retroactive for up to six months—but no earlier than your 65th birthday. Since you cannot contribute to a Health Savings Account (HSA) while enrolled in any part of Medicare, this retroactive coverage can make you ineligible to contribute for that six-month period.

Why does the 6-month rule matter for HSA contributions?

Because Medicare Part A coverage may be applied retroactively, you could unknowingly contribute to your HSA during months when you were technically covered by Medicare. Those contributions would be considered “excess contributions” and subject to a 6% excise tax if not corrected.

When does the 6-month rule apply?

The rule applies only if you delay enrolling in Medicare Part A beyond age 65 and later apply. At that point, the Social Security Administration may backdate your Medicare Part A coverage up to six months. If you enroll at or before age 65, the rule does not apply.

How does retroactive Medicare coverage affect my HSA?

Once your Medicare Part A coverage begins—whether retroactively or not—you lose HSA eligibility from that start date. You must stop making contributions the month before your Medicare coverage begins to avoid excess contributions.

Can you give an example of the 6-month rule?

Yes. Suppose you turn 65 in July 2023 and continue working with an HSA-eligible plan. You apply for Medicare in October 2025 (at age 67). Your Medicare Part A effective date will be April 1, 2025—six months retroactive. Therefore, your last eligible HSA contribution month is March 2025.

When should I stop contributing to my HSA?

You should stop contributing at least six months before applying for Medicare Part A to ensure your contributions don’t overlap with retroactive coverage. This applies to both your own and any employer contributions.

What happens if I accidentally contribute while covered by Medicare?

Any contributions made after your Medicare Part A effective date are considered excess. You must withdraw those excess contributions (plus earnings) by your tax filing deadline—typically April 15 of the following year—to avoid a 6% penalty.

How do I calculate my excess contributions?

Add up all contributions (including employer contributions) made after your Medicare Part A effective date. That total must be withdrawn from your HSA. If not removed by your tax deadline, a 6% penalty applies each year the excess remains.

How should I handle HSA contributions if I retire mid-year?

If you retire partway through the year, prorate your HSA contribution limit based on the number of months you were eligible before Medicare enrollment. Contributions made after that date—even by your employer—count toward your annual limit and may need to be withdrawn.

What’s the best way to avoid penalties from the 6-month rule?

Plan ahead. Stop HSA contributions at least six months before applying for Medicare, coordinate with your HR or benefits department, and track contributions closely to prevent ineligible deposits.

Medicare Supplemental Plans ("Medigap") vs. Medicare Advantage Plans

As you approach age 65, there are a lot of very important decisions that you will have to make regarding your Medicare coverage. Since Medicare Parts A & B by itself have deductibles, coinsurance, and no maximum out of pocket

As you approach age 65, there are a lot of very important decisions that you will have to make regarding your Medicare coverage. Since Medicare Parts A & B by itself have deductibles, coinsurance, and no maximum out of pocket protection for retirees, individuals fill in those cost gaps by enrolling in either a Medicare Supplemental Plan or Medicare Advantage Plan. Most retirees have no idea what the differences are between the two options but I would argue that making the right choice is probably one of the most important decisions that you will make as you plan for retirement.

Making the wrong decision could cost you thousands upon thousands of dollars in unexpected medical and prescription drug costs in the form of:

Inadequate coverage

Paying too much for Medicare insurance that you are not using

Healthcare that is provided outside of the plan’s network of doctors and specialists

Expensive prescription drugs

Insurance claims that are denied by the insurance company

Original Medicare

Before we jump into the differences between the two Medicare insurance options, you first have to understand how Original Medicare operates. “Original Medicare” is a combination of your Medicare Part A & Part B benefits. Medicare is sponsored and administered by the Social Security Administration which means that the government is providing you with your healthcare benefits.

Medicare Part A provides you with your coverage for inpatient services. In other words, health care services that are provided to you when you are admitted to the hospital. If you worked for more than 10 years, there is no monthly premium for Part A but it’s not necessarily “free”. Medicare Part A has both deductibles and coinsurance that retirees are required to pay out of pocket prior to Medicare picking up the tab.

Medicare Part B provides you with your outpatient services. This would be your doctor’s visits, lab work, preventative care, medical equipment, etc. Unlike Medicare Part A, Part B has a monthly premium that individuals pay once they enroll in Medicare. For 2025, most individuals will pay $185.00 per month for their Part B coverage. However, in addition to the monthly premiums, Part B also has deductibles and coinsurance. More specifically, Part B has a 20% coinsurance, meaning anything that is paid by Medicare under Part B, you have to pay 20% of the cost out of pocket, and there are no out of pocket maximums associated with Original Medicare. Your financial exposure is unlimited.

Filling In The Gaps

Since in most cases, Original Medicare is inadequate to cover the total cost of your health care in retirement, individuals will purchase Medicare Insurance to fill in the gaps not covered by Original Medicare. Medicare insurance is provided by private health insurance companies and it comes in two flavors:

Medicare Supplemental Plans (Medigap)

Medicare Advantage Plans (Medicare Part C)

Medicare Supplemental Plans (“Medigap”)

We will start off by looking at Medicare Supplemental Plans, also known as Medigap Plans. If you enroll in a Medicare Supplemental Plan, you are keeping your Medicare Part A & B coverage, and then adding a Medicare Insurance Plan on top of it to fill in the costs not covered by Part A & B. Thus, the name “supplemental” because it’s supplementing your Original Medicare benefits.

There are a variety of Medigap plans that you can choose from and each plan has a corresponding letter such as Plan A, Plan D, Plan G, or Plan N. See the grid below:

When you see a line item in the chart that has “100%”, that means the Medigap plan covers 100% of that particular cost that is not otherwise covered by Original Medicare. For example, on the first line you see 100% across the board, that’s because all of the Medigap plans cover 100% of the Medicare Part A coinsurance and hospital costs. As you would expect, the more each plan covers, the higher the monthly premium for that particular plan.

Medigap Plans Are Standardized

It's very important to understand that Medical Supplemental Plans are “standardized” which means by law each plan is required to covers specific services. The only difference is the cost that each insurance company charges for the monthly premium.

For example, Insurance Company A and Insurance Company B both offer a Medigap Plan N. Regardless of which insurance company you purchased the policy through, they provide the exact same coverage and benefits. However, Insurance Company A might charge a monthly premium of $240 for their Plan N but Insurance Company B only charges a monthly premium of $160. The only difference is the cost that you pay. For this reason, it's prudent to get quotes from all of the insurance companies that offer each type of Medigap plan in your zip code.

Some zip codes have only a handful of insurance providers, while other zip codes could have 15+ providers. Instead of spending hours of time running around to all the different insurance companies getting quotes, it’s usually helpful to work with an Independent Medicare broker to run all of the quotes for you and identify the lowest cost provider in your area. In addition, there is no additional cost to you for using an independent broker.

Freedom of Choice

By enrolling in a Medicare Supplemental Plan, you're allowed to go to any provider that accepts Medicare. You do not have to ask your doctors or specialists if they accept the insurance from the company that is sponsoring your Medigap policy. All you have to ask them is if they accept Medicare. When you access the health care system, the doctor’s office bills Medicare. If Medicare does not cover the total cost of that service, but it’s covered under your Medigap plan, Medicare instructs the insurance company to pay it. The insurance company is not allowed to deny the claim.

This provides individuals with flexibility as to how, when, and where their health care services are provided.

Part D – Prescription Drug Plan

If you enroll in a Medigap plan, you will also need to obtain a Part D Prescription Drug plan which is separate from your Medigap plan. Part D plans are sponsored by private insurance companies and carry an additional monthly premium. Based on the prescription drugs that you are currently taking, you can select the plan that best meets your needs and budget.

Medicare Advantage Plans

Now let's switch gears to Medicare Advantage Plans. I will start off by saying loud and clear:

“Medicare Supplemental Plans and Medicare Advantage Plans are NOT the same.”

All too often, we ask individuals what type of Medicare plan they have, and they reply “a Medigap Plan”, only to find out that they have a Medicare Advantage Plan. The differences are significant, and it's important to understand how those differences will impact your health care options in retirement.

Medicare Advantage Plans REPLACE Your Medicare Coverage

Most people don’t realize that when you enroll in a Medicare Advantage Plan it DOES NOT “supplement” your Medicare Part A & B coverage. It actually REPLACES your Medicare coverage. Once enrolled in a Medicare Advantage Plan you are no longer covered by Medicare.

There are pluses and minuses to Medicare Advantage Plans that we are going to cover in the following sections. Remember, your health care needs and budget are custom to your personal situation. Just because your coworker, friend, neighbor, or family member selected a specific type of Medicare Plan, it does not necessarily mean that it’s the right plan for you.

Lower Monthly Premiums

The primary reason why most individuals select a Medicare Advantage Plan over a Medicare Supplemental Plan is cost. In many cases, the monthly premiums for Advantage Plans are lower than Supplemental Plans.

For example, in 2025, in Albany, New York, a Medicare Supplemental Plan G can cost an individual anywhere between $252 to $655 per month depending on the insurance company that they select. Compared to a Medicare Advantage Plan that can cost $0, $34, all the way up to a few hundred dollars per month.

Time Out!! How Do $0 Premium Plans Work?

When I first started learning about Medicare Advantage Plan, when I found out about the $0 premium plans or plans that only cost $34 per month, my questions was “How does the insurance company make money if I’m not paying them a premium each month?”

Here is the answer. Remember that Medicare Part B monthly premium of $185.00 per month that I mentioned in the “Original Medicare” section? When you enroll in a Medicare Advantage Plan, even though you are technically not covered by Medicare any longer, you still have to pay the $185.00 Part B premium to Medicare. However, instead of Medicare keeping it, they collect it from you and then pass it on to the insurance company that is providing your Medicare Advantage Plan.

But wait…..there’s more. Honestly, I almost fell out of my seat what I discovered this little treat. For each person that enrolls in a Medicare Advantage Plan, the government issues a monthly payment to the insurance company over and above that Medicare Part B premium. These payments to the insurance companies from the U.S government vary by zip code but in our area it’s more than $700 per month per person. So the insurance company receives over $8,400 per year from the U.S. government for each person that they have enrolled in one of their Medicare Advantage Plans.

Plus, Advantage Plans typically have co-pays, deductibles, and coinsurance that they collect from the policyholder throughout the year.

Don’t worry about the insurance company, they are getting paid. For me, it just sounded like one of those too good to be true situations so I had to dig deeper.

Insurance Companies WANT To Sell You An Advantage Plan

Since the insurance companies are receiving all of these payments from the government for these Advantage Plans, they are usually very eager to sell you an Advantage Plan as opposed to a Medicare Supplemental Plan. If you go directly to an insurance company to discuss your options, they may not even present a Medicare Supplemental Plan as an option even though that might be the right plan for you. Also be aware, that not all insurance companies offer Medicare Supplemental Plan which is another reason why they may not present it as an option.

Now I’m not saying Medicare Advantage Plans are bad. Medicare Advantage Plans can often be the right fit for an individual. I’m just saying that it’s up to you and you alone to make sure that you fully understand the difference between the two types of plans because both options may not be presented to you in an unbiased fashion.

HMO & PPO Plans

Most Medicare Advantage Plans are structured as either an HMO or PPO plan. If your employer provided you with health insurance during your working years, you may be familiar with how HMO and PPO plans operate.

With HMO plans, the insurance company has a “network” of doctors, hospitals, and service providers that is usually limited to a geographic area that you are required to receive your health care from. If you go outside of that network, you typically have to pay the full cost of those medical bills. There is an exception in most HMO plans for medical emergencies that occur when you are traveling outside of your geographic region.

PPO plans offer individuals more flexibility because they provide coverage for both “in-network” and “out-of-network” providers. Even though the insurance plan provides you with coverage for out-to-network providers, there is typically a higher cost to the policy owner in the form of higher co-pays or coinsurance for utilizing doctors and hospitals that are outside of the plan’s network. Since PPO plans offer you more flexibility than HMO plans, the monthly premiums for PPO are typically higher.

Non-Standardize Plans

Unlike Medicare Supplemental Plans, Medicare Advantage plans are non-standardized plans. This means that the benefits and costs associated with each type of plan are different from insurance company to insurance company. Insurance companies also typically have multiple Medicare Advantage plans to choose from. Each plan has different monthly premiums, benefit structures, drug coverage, and additional benefits. You really have to do your homework with Medicare Advantage Plans to understand what's covered and what's not.

Medicare Advantage plans include prescription drug coverage

Unlike a Medicare Supplemental Plan which typically requires you to obtain a separate Part D plan to cover your prescription drugs, most Medicare Advantage plans include prescription drug coverage within the plan. However, there are some Medicare Advantage plans that don't have prescription drug coverage. Again, you just have to do your homework and make sure the prescription drugs that you are currently taking are covered by that particular Advantage Plan at a reasonable cost.

Changes To The Network

Since Medicare Advantage Plans incentivize individuals to obtain care from “in-network” service providers, it’s important to know that the doctors, hospitals, and prescription drug coverage can change each year. This is less common with Medigap Plans because the doctor or hospital would have to stop accepting Medicare. The coverage for Medicare plans runs from January 1st – December 31st. The insurance company is required to issue you an “Annual Notice of Change” which summarizes any changes to the plans cost or coverage for the upcoming calendar year.

The insurance company will typically send you these notices prior to September 30th and if you find that your doctors or prescription drugs are no longer covered by the plan or covered at a higher rate, you will have the opportunity to change the type of Advantage Plan that you have during the open enrollment period which lasts from October 15th – December 7th each year.

Thus, Medicare Advantage plans tend to require more ongoing monitoring compared to Medicare Supplemental Plans.

Additional Benefits

Medicare Advantage plans sometimes offer additional benefits that Medicare Supplemental Plans do not, such as reimbursement for gym memberships, vision coverage, and dental coverage. These benefits will vary based on the plan and the insurance company that you select.

Maximum Out of Pocket Limits

As mentioned earlier, one of the largest issues with Original Medicare without Medicare Insurance is there is no maximum out of the pocket limits. If you have a major health event, the cost to you can keep stacking up. Medicare Advantage Plans fix that problem because by law they are required to have maximum out of pocket limits. Once you hit that threshold in a given calendar year, you have no more out of pocket costs. The maximum out of pockets limits vary by provider and by plan but Medicare sets a maximum threshold for these amounts which is $9,350 for in-network services. Notice it only applies to in-network services. If you go outside of the carriers network, there may be no maximum out of pocket protection depending on the plan that you choose.

Most Medigap plans do not have maximum out of the pocket thresholds but given the level of protection that most Medigap plans provide, it’s rare that policy holders have large out of pocket expenses.

New York & Connecticut Residents

When it comes to selecting the right type of Medicare Plan for yourself, residents of New York and Connecticut have an added advantage. For most states, if you choose a Medicare Advantage plan you may not have the option to return to Medicare with a Medigap Plan if your health needs change down the road. Most states allow the insurance companies to conduct medical underwriting if you apply for Medicare Supplemental insurance after the initial enrollment period and they can deny you coverage or charge a ridiculously high premium.

In New York and Connecticut, the insurance laws allow you to change back and forth between Medicare Supplemental Plans and Medicare Advantage Plan as of the first of each calendar year. There are even special programs in New York, that if an individual qualifies for based on income, they are allowed to switch mid-year.

While this is a nice option to have, the ability to switch back and forth between the two types of Medicare plans, also makes Medicare Supplemental Plans more expensive in New York and Connecticut. Individuals in those states can elect the lower cost, lower coverage, Medicare Advantage plans, and if their health needs change they know they can automatically switch back to a Medicare Supplemental Plan that provides them with more comprehensive coverage with a lower overall out of pocket cost.

The Plan That Is Right For You

As you can clearly see there are a lot of variables that come into play when trying to determine whether to select a Medicare Supplemental Plan or Medicare Advantage Plan in retirement; it’s a case by case decision. For clients that live in New York, that are in good health, taking very few prescription drugs, a Medicare Advantage plan maybe the right fit for them. For clients that plan to travel in retirement, have two houses, like the flexibility of seeing any specialist that they want, or clients that are in fair to poor health, a Medicare Supplemental Plan may be a better fit.

Undoubtedly if you live outside of New York or Connecticut the decision is even more difficult knowing that people are living longer, as you age your health care needs become greater, and you may only have one shot at obtaining a Medicare Supplemental Plan

Other Medicare Articles

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Introduction To Medicare

As you approach age 65, there are very important decisions that you will have to make regarding your Medicare coverage. Whether you decide to retire prior to age 65, continue to work past age 65, or have retiree health benefits,

As you approach age 65, there are very important decisions that you will have to make regarding your Medicare coverage. Whether you decide to retire prior to age 65, continue to work past age 65, or have retiree health benefits, you will have to make decisions regarding your Medicare coverage and for many of those decisions you only get one shot at making the right one. The wrong decision can cost you tens of thousands, if not hundreds of thousands of dollars, in retirement via:

Gaps in your coverage leading to unexpected medical bills

Over coverage: Paying too much for insurance that you are not using

Penalties for missing key Medicare enrollment deadlines

The problem is there are a lot of options, deadlines, rules to follow, and with rules there are always exceptions to the rules that you need to be aware of. To make an informed decision you must understand Medicare Part A, Part B, Medicare Supplemental Plans, Medicare Advantage Plans, Part D drug plans, and special exceptions that apply based on the state that you live in.

I urge everyone to read this article whether it’s for you, your parents, grandparents, friends, or other family members. You may be able to help someone that is trying to make these very important healthcare decisions for themselves and it’s very easy to get lost in the Medicare jungle.

Initially my goal was to write a single article to summarize the decisions that retirees face with regard to Medicare. I realized very quickly that the article would end up looking more like a book. So instead I’ve decided to separate the information into series of articles. This first article will provide you with a general overview of Medicare but at the bottom of each article you will find links to other articles that will provide you with more information about Medicare.

With that, let’s go ahead and jump into the first article which will provide you with a broad overview of how Medicare works.

What is Medicare?

Medicare is the government program that provides you with your healthcare benefits after you turn 65. Medicare is run by the Social Security administration, meaning you contact your Social Security office when you have questions or when you apply for benefits.

Original Medicare

While there are a lot of decisions that have to be made about your Medicare benefits, all of the benefits are built on the foundation of Medicare Part A and Medicare Part B. Medicare Part A and Part B together are referred to as “Original Medicare”. You will see the term Original Medicare used a lot when reading about your Medicare options.

Medicare Part A

Medicare Part A covers your inpatient health services such as:

1) Hospitalization

2) Nursing home (Limited)

3) Hospice

4) Home health services (Limited)

As long as you or your spouse worked for at least 10 years, Medicare Part A is provided to you at no cost. During your working years you paid the Medicare tax of 1.45% as part of your payroll taxes. If you or your spouse did not work 10 years or more then you’re still eligible for Medicare Part A but you will have to pay a monthly premium. There are special eligibility rules for individuals that do not meet the 10 year requirement but are either divorced or widowed.

Medicare Part A Is Not Totally “Free”

While there are no monthly premium payments that need to be made for enrolling in Medicare Part A there are deductibles and coinsurance associated with your Part A coverage. While many of us have encountered deductibles, co-pays, and coinsurance through our employer sponsored health insurance plans, I’m going to pause for a moment just to explain three key terms associated with health insurance plans.

Deductible: This is the amount that you have to pay out of pocket before the insurance starts to pay for your healthcare costs. Example, if you have $1,000 deductible, you have to pay $1,000 out-of-pocket before the insurance will start paying anything for the cost of your care.

Co-pays: Co-pays are those small amounts that you have to pay each time a specific service is rendered such as a doctor’s visit or when you pick up a prescription. Example, you may have to pay $25 every time you visit your primary care doctor.

Coinsurance: This is cost sharing between you and the insurance company that’s expressed as either a percentage or a flat dollar amount. Example, if you have a 20% coinsurance for hospital visits, if the hospital bill is $10,000, you pay $2,000 (20%) and the insurance company will pay the remaining $8,000.

Maximum Out Of Pocket: This the maximum dollar amount that you have to pay each year out of pocket before your health care needs are 100% covered by your Medicare or insurance coverage. If your insurance policy has a $5,000 maximum out of pocket, after you have paid $5,000 out of pocket for that calendar year, you will not be expected to pay anything else for the remainder of the year. Monthly premiums and prescription drug costs do not count toward your maximum out of the pocket threshold.

Medicare Part A Has The Following Cost Sharing Structure For 2025

As you will see in the table above, while you don’t have a monthly premium for Medicare Part A, if you are hospitalized at some point during the year, you would have to first pay $1,676 out of pocket before Medicare starts to pay for your health care costs. In addition, there is a flat dollar amount co-insurance, which is in addition to the deductible, and that amount varies depending on when the health services are performed during the calendar year.

Medicare Part B

Medicare Part B covers your outpatient health services. These include:

1) Doctors visits

2) Lab work

3) Preventative care (flu shots)

4) Ambulance rides

5) Home health care

6) Chiropractic care (limited)

7) Medical equipment

Unlike Medicare Part A, Medicare Part B has a monthly premium that you will need to pay once you enroll. The amount of the monthly premium is based on your adjusted gross income (AGI). The higher your income, the higher the monthly premium. Below is the 2019 Part B premium table.

As you will see on the chart, the minimum monthly premium is $185.00 per month which translates to $2,220 per year. The income threshold in this chart will vary each year.

Medicare 2-Year Lookback At Income

Medicare automatically looks at your AGI from two years prior to determine your AGI for purposes of Part B premium. In the first few years of receiving Medicare, this 2-year lookback can create an issue. If you retire in 2025, they are going to look at your 2023 tax return which probably has a full year worth of income because you were still working full time back in 2023. If your AGI was $200,000 in 2023, they would charge you more than twice the minimum premium for your Part B coverage.

I have good news. There is an easy fix to this problem. You are able to appeal your income to the Social Security Administration due to a “life changing event”. You can ask Social Security to use your most recent income and you typically have to provide proof to Social Security that you retired in 2025. They will sometimes request a letter signed by your former employer verifying your retirement date and a copy of your final paycheck. You will need to file Form SSA-44.

The Medicare Part B premiums are automatically deducted from your monthly Social Security or Railroad Retirement Benefit payments. If you are 65 and have not yet turned on Social Security, Medicare will invoice you quarterly for those premium amounts and you can pay by check.

Medicare Part B Deductibles and Coinsurance

In addition to the monthly premiums associated with Part B, as with Part A, there are deductibles and coinsurance associated with Part B coverage. Part B carries:

Annual Deductible: $257

Coinsurance: 20%

Example: In January, your doctor tells you that you need your knee replaced. If the surgery costs $50,000, you would have to pay the first $257 out of pocket, and then you would have to pay an additional $9,948.60 which is 20% of the remaining amount. Not a favorable situation.

But wait, wouldn’t that be covered under Medicare Part A because it happened at a hospital? Not necessarily because “doctor services” performed in a hospital are typically covered under Medicare Part B.

The Largest Issue with Original Medicare is……..

It unfortunately gets worse. If all you have is Original Medicare (Part A & B), there is no Maximum Out of Pocket Limit. Meaning if you get diagnosed with a rare or terminal disease, and your medical bills for the year are $500,000, you may have to pay out of pocket a large portion of that $500,000.

Also, there is no prescription drug coverage under Original Medicare. So you would have the pay the sticker price of all of your prescription drugs out of pocket with no out of pocket limits.

Medicare Part C, Medicare Part D, and Medicare Supplemental Plans

To help individuals over 65 to manage these large costs associated with Original Medicare, there is:

Medicare Part C – Medicare Advantage Plans

Medicare Part D – Standalone Prescription Drug Plans

Medicare Supplemental Plans (“Medigap plans”)

Who Provides What?

Before I get into what each option provides, let’s first identify who provides what:

Medicare Part A: U.S. Government

Medicare Part B: U.S. Government

Medicare Part C – (Medicare Advantage Plan): Private Insurance Company

Medicare Part D – (Prescription Drug Plan): Private Insurance Company

Medicare Supplemental Plan (“Medigap”): Private Insurance Company

The Most Important Decision

Here is where the road splits. To help retirees manage the cost and coverage gaps not covered by Original Medicare, you have two options:

Select a Medicare Advantage Plan

Select a Medicare Supplemental Plan & Medicare Part D Plan

When it comes to your health care decisions in retirement, this is one of the most important decisions that you are going to make. Depending on what state you live in, you may only have one-shot at this decision. It is so vitally important that you fully understand the pros and cons of each option. Unfortunately, as we will detail in other articles, there is big push by the insurance industry to persuade individuals to select the Medicare Advantage option. Both the private insurance company and the insurance agent selling you the policy get paid a lot more when you select a Medicare Advantage Plan instead of a Medicare Supplemental Plan. While this may be the right choice for some individuals, there are significant risks that individuals need to be aware of before selecting a Medicare Advantage Plan.

Medicare Advantage Plans

VERY IMPORTANT: Medicare Advantage Plans and Medicare Supplemental Plans are NOT the same. Medicare Advantage Plans are NOT “Medigap Plans”.

Medicare Advantage Plans do NOT “supplement” your Original Medicare coverage. Medicare Advantage Plans REPLACE your Medicare coverage. If you sign up for a Medicare Advantage Plan, you are no longer covered by Medicare. Medicare has sold you to the private insurance company.

Medicare Advantage Plans are not necessarily an “enhancement” to your Original Medicare Benefit. They are what the insurance industry considers an “actuarial equivalent”. The term actuarial equivalent benefit is just a fancy way of saying that at a minimum it is “worth the same dollar amount”. Medicare Advantage Plans are required to cover the same procedures that are covered under Medicare Part A & B but not necessarily at the same cost. The actuarial equivalent means when they have a large group of individuals, on average, those people are going to receive the same dollar value of benefit as Original Medicare would have provided. In other words, there are going to be clear winners and losers within the Medicare Advantage Plan structure. You are essentially rolling the dice as to what camp you are going to end up in.

If you enroll in a Medicare Advantage Plan, you will no longer have a Medicare card that you show to your doctors. You will receive an insurance card from the private insurance company. If you have a problem with your healthcare coverage, you do not call Medicare. Medicare is no longer involved.

Why Do People Choose Medicare Advantage Plans?

Here are the top reasons why we see people select Medicare Advantage Plan:

Provide Maximum Out Of Pocket protection

Prescription Drug Coverage

Lower Monthly Premium Compared To Medicare Supplemental Plans

Medicare Supplemental Plans (Medigap)

Now let’s switch gears to Medicare Supplemental Plans, also known as “Medigap Plans”. Unlike Medicare Advantage Plan that replace your Medicare Part A & B coverage, with Medicare Supplement Plans you keep your Original Medicare Coverage and these insurance policies fill in the gaps associated with Medicare Part A & B. So it’s truly an enhancement to your Medicare A & B coverage and not just an actuarial equivalent.

There are different levels of benefits within each of the Medigap plans. Each program is identified with a letter that range from A to N. Here is the chart matrix that shows what each of these programs provides.

For example if you go with plan G which is one of the most popular of the Medigap plans going into 2026, most of the costs associated with Original Medicare are covered by your Supplemental Insurance policy. All you pay is the monthly premium, the $257 Part B deductible, and some small co-pays.

Like Medicare advantage plans, Medicare supplemental plans are provided by private insurance companies. However, what’s different is these plans are standardized. “Standardized” means regardless of what insurance company you select, the health insurance benefits associated with those plans are exactly the same. The only difference is the price that you pay for your monthly premium which is why it makes sense to compare the prices of these plans for each insurance company that offers supplemental plans in your zip code.

VERY IMPORTANT: Not all insurance companies offer Medicare Supplemental Plans. Some just offer Medicare Advantage Plans. So if you end up calling an insurance company directly or meeting directly with an insurance company to discuss your Medicare options, those companies may not even present Medicare Supplemental plans as an option even though that might be the best fit for your personal health insurance needs.

However, even if the insurance company offers Medicare Supplemental plans, you still shop that same plan with other insurance companies. They may tell you “yes we have a Medigap Plan G” but their Medigap Plan G monthly premium may be $100 more per month than another insurance company. Remember, Medicare Supplemental plans are standardized meaning Plan G is the same regardless of which insurance company provides you with your coverage.

Part D – Prescription Drug Plans

If you decide to keep your Original Medicare and add a Medicare Supplemental Plan, you will also have to select a Medicare Part D – Prescription Drug plan to cover the cost of your prescriptions. Unlike Medicare Advantage Plan that have drug coverage bundled into their plans, Medicare Supplemental Plans are medical only, so you need a separate drug plans to cover your prescriptions. It can be beneficial to have a standalone drug plans because you are able to select a plan that favors the prescription drugs that you are taking which could lead to lower out of pocket costs throughout the year. Unlike a Medicare Advantage plan where the prescription drug plan is not customized for you because it’s a take it or leave it bundle.

Summary

This article was a 30,000 foot view of Medicare Part A, B, C, D, and Medicare Supplemental Plans. There is a lot more to Medicare such as:

Enrollment deadlines for Medicare

How to enroll with Medicare

Comparison of Medicare Advantage & Medicare Supplemental Plans

Special Exceptions for NY & CT residents

Working past age 65

Coordinating Medicare With Retiree Health Benefits

And so many more considerations that will factor into your Medicare decision as you approach age 65 or leave the workforce after age 65.

VERY IMPORTANT: People have different health needs, budgets, and timelines for retirement. Medicare solutions are not a one size fits all solution. The decisions that your co-worker made, friend made, or family member made, may not be the best solution for you. Plus remember, Medicare is complex, and we have found without help, many people do not understand all of the options. I have met with clients that have told me that “they have a supplemental plan” only to find out that they had a Medicare Advantage plan and didn’t know it because they never knew the difference between the two when the policies were issued to them. It makes working with an independent Medicare insurance agent very important.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Should I Budget For Health Care Costs In Retirement?

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance premiums which can quickly increase the overall cost to $10,000+ per year.

Tough to believe? Allow me to walk you through the numbers for a married couple.

Medicare Part A: $3,352 Per Year

Part A covers inpatient hospital stays, skilled nursing facility stays, some home health visits, and hospice care. While Part A does not have an annual premium, it does have an annual deductible for each spouse. That deductible for 2025 is $1,676 per person.

Medicare Part B: $4,954

Part B covers physician visits, outpatient services, preventive services, and some home health visits. The standard monthly premium is $185 per person but it could be higher depending on your income level in retirement. There is also a deductible of $257 per year for each spouse.

Medicare Part D: $1,080

Part D covers outpatient prescription drugs through private plans that contract with Medicare. Enrollment in Part D is voluntary. The benefit helps pay for enrollees’ drug costs after a deductible is met (where applicable), and offers catastrophic coverage for very high drug costs. Part D coverage is actually provided by private health insurance companies. The premium varies based on your income and the types of prescriptions that you are taking. The national average in 2025 for Part D premiums is $45 per person.

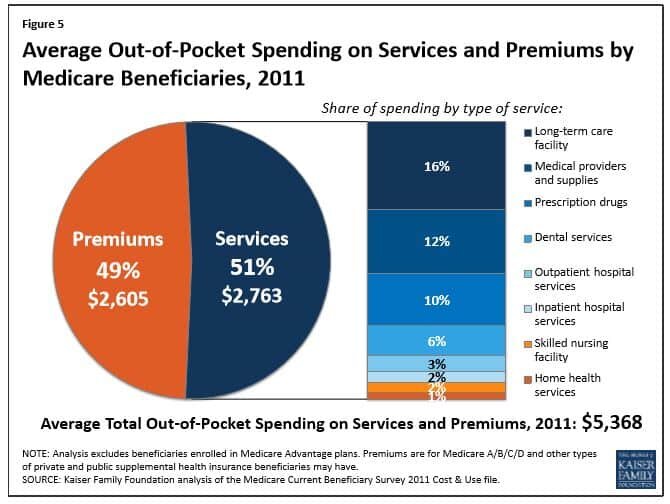

If you total up just these three items, you reach $9,386 in premiums and deductibles for the year. Then you start adding in dental cost, Medigap insurance premiums, co-insurance for Medicare benefits, and it quickly gets a married couple over that $10,000 threshold in health and dental cost each year. Medicare published a report that in 2011, Medicare beneficiaries spent $5,368 out of their own pockets for health care spending, on average. See the table below.

Start Planning Now

Fidelity Investments published a study that found that the average 65 year old will pay $300,000 in out-of-pocket costs for health care during retirement, not including potential long-term-care costs. While that seems like an extreme number, just take the $10,000 that we used above, multiply that by 20 year in retirement, and you get to $200,000 without taking into consideration inflation and other important variable that will add to the overall cost.

Bottom line, you have to make sure you are budgeting for these expenses in retirement. While most individuals focus on paying off the mortgage prior to retirement, very few are aware that the cost of health care in retirement may be equal to or greater than your mortgage payment. When we are create retirement projections for clients we typically included $10,000 to $15,000 in annual expenses to cover health care cost for a married couple and $5,000 – $7,500 for an individual.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Planning for Long Term Care

The number of conversations that we are having with our clients about planning for long term care is increasing exponentially. Whether it’s planning for their parents, planning for themselves, or planning for a relative, our clients are largely initiating these conversations as a result of their own personal experiences.

The number of conversations that we are having with our clients about planning for long term care is increasing exponentially. Whether it’s planning for their parents, planning for themselves, or planning for a relative, our clients are largely initiating these conversations as a result of their own personal experiences.

The baby-boomer generation is the first generation that on a large scale is seeing the ugly aftermath of not having a plan in place to address a long term care event because they are now caring for their aging parents that are in their 80’s and 90’s. Advances in healthcare have allowed us to live longer but the longer we live the more frail we become later in life.

Our clients typically present the following scenario to us: “I have been taking care of my parents for the past three years and we just had to move my dad into the nursing home. What an awful process. How can I make sure that my kids don’t have to go through that same awful experience when I’m my parents age?”

“Planning for long term care is not just about money…….it’s about having a plan”

If there are no plans, your kids or family members are now responsible for trying to figure out “what mom or dad would have wanted”. Now tough decisions need to be made that can poison a relationship between siblings or family members.

Some individuals never create a plan because it involves tough personal decisions. We have to face the reality that at some point in our lives we are going to get older and later in life we may reach a threshold that we may need help from someone else to care for ourselves or our spouse. It’s a tough reality to face but not facing this reality will most likely result in the worst possible outcome if it happens.

Ask yourself this question: “You worked hard all of your life to buy a house, accumulate assets in retirement accounts, etc. If there are assets left over upon your death, would you prefer that those assets go to your kids or to the nursing home?” With some advance planning, you can make sure that your assets are preserved for your heirs.

The most common reason that causes individuals to avoid putting a plan in place is: “I have heard that long term care insurance is too expensive.” I have good news. First, there are other ways to plan for the cost of a long term care event besides using long term care insurance. Second, there are ways to significantly reduce the cost of these policies if designed correctly.

The most common solution is to buy a long term care insurance policy. The way these policies work is if you can no longer perform certain daily functions, the policy pays a set daily benefit. Now a big mistake many people make is when they hear “long term care” they think “nursing home”. In reality, about 80% of long term care is provided right in the home via home health aids and nurses. Most LTC policies cover both types of care. Buying a LTC policy is one of the most effective ways to address this risk but it’s not the only one.

Why does long term care insurance cost more than term life insurance or disability insurance? The answer, most insurance policies insure you against risks that have a low probability of happening but has a high financial impact. Similar to a life insurance policy. There is a very low probability that a 25 year old will die before the age of 60. However, the risk of long term care has a high probability of happening and a high financial impact. According to a study conducted by the U.S Department of Human Health and Services, “more than 70% of Americans over the age of 65 will need long-term care services at some point in their lives”. Meaning, there is a high probability that at some point that insurance policy is going to pay out and the dollars are large. The average daily rate of a nursing home in upstate New York is around $325 per day ($118,625 per year). The cost of home health care ranges greatly but is probably around half that amount.

So what are some of the alternatives besides using long term care insurance? The strategy here is to protect your assets from Medicaid. If you have a long term care event you will be required to spend down all of your assets until you reach the Medicaid asset allowance threshold (approx. $13,000 in assets) before Medicaid will start picking up the tab for your care. Often times we will advise clients to use trusts or gifting strategies to assist them in protecting their assets but this has to be done well in advance of the long term care event. Medicaid has a 5 year look back period which looks at your full 5 year financial history which includes tax returns, bank statements, retirement accounts, etc, to determine if any assets were “given away” within the last 5 years that would need to come back on the table before Medicaid will begin picking up the cost of an individuals long term care costs. A big myth is that Medicare covers the cost of long term care. False, Medicare only covers 100 days following a hospitalization. There are a lot of ins and outs associated with buildings a plan to address the risk of long term care outside of using insurance so it is strongly advised that individuals work with professionals that are well versed in this subject matter when drafting a plan.

An option that is rising in popularity is “semi self-insuring”. Instead of buying a long term care policy that has a $325 per day benefit, an individual can obtain a policy that covers $200 per day. This can dramatically reduce the cost of the LTC policy because it represents less financial risk to the insurance company. You have essentially self insured for a portion of that future risk. The policy will still payout $73,000 per year and the individual will be on the line for $45,625 out of pocket. Versus not having a policy at all and the individual is out of pocket $118,000 in a single year to cover that $325 per day cost.

As you can see there are a number of different options when it come to planning for long term care. It’s about understanding your options and determining which solution is right for your personal financial situation.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.