Types of Retirement Plans

The comparing retirement plans chart gives business owners the ability to compare different types of plans available to their company.

Types of Retirement Plans

The comparing retirement plans chart gives business owners the ability to compare different types of plans available to their company.

Click on the PDF link in the green box below.

Should I Establish an Employer Sponsored Retirement Plan?

Employer sponsored retirement plans are typically the single most valuable tool for business owners when attempting to:

Reduce their current tax liability

Attract and retain employees

Accumulate wealth for retirement

Employer-sponsored retirement plans are typically the single most valuable tool for business owners when attempting to:

Reduce their current tax liability

Attract and retain employees

Accumulate wealth for retirement

But with all of the different types of plans to choose from, which one is the right one for your business? Most business owners are familiar with how 401(k) plans work, but that might not be the right fit given variables such as:

# of Employees

Cash flows of the business

Goals of the business owner

There are four main stream employer-sponsored retirement plans that business owners have to choose from:

SEP IRA

Single(k) Plan

Simple IRA

401(k) Plan

Since there are a lot of differences between these four types of plans, we have included a comparison chart at the conclusion of this newsletter, but we will touch on the highlights of each type of plan.

SEP IRA PLAN

This is the only employer-sponsored retirement plan that can be set up after 12/31 for the previous tax year. So, when you are sitting with your accountant in the spring and they deliver the bad news that you are going to have a big tax liability for the previous tax year, you can establish a SEP IRA up until your tax filing deadline plus extension, fund it, and take a deduction for that year.

However, if the company has employees who meet the plan's eligibility requirement, these plans become very expensive very quickly if the owner(s) want to make contributions to their own accounts. The reason is that these plans are 100% employer-funded, which means there are no employee contributions allowed, and the employer contribution is uniform for all plan participants. For example, if the owner contributes 15% of their income to the SEP IRA, they have to make an employer contribution equal to 15% of compensation for each employee who has met the plan's eligibility requirement. If the 5305-SEP Form, which serves as the plan document, is set up correctly, a company can keep new employees out of the plan for up to 3 years, but often it is either not set up correctly or the employer cannot find the document.

Single(k) Plan or "Solo(k)"

These plans are for owner-only entities. As soon as you have an employee who works more than 1000 hours in a 12-month period, you cannot sponsor a Single(k) plan.

The plans are often the most advantageous for self-employed individuals who have no employees and want to have access to higher pre-tax contribution levels. For all intents and purposes, it is a 401(k) plan, with the same contribution limits, ERISA protected, they allow loans and Roth contributions, etc. However, they can be sponsored at a much lower cost than traditional 401(k) plans because there are no non-owner employees. So there is no year-end testing, it's typically a boilerplate plan document, and the administration costs to establish and maintain these plans are typically under $400 per year compared to traditional 401(k) plans, which may cost $1,500+ per year to administer.

The beauty of these plans is the "employee contribution" of the plan, which gives it an advantage over SEP IRA plans. With SEP IRA plans, you are limited to contributions up to 25% of your income. So if you make $24,000 in self-employment income, you are limited to a $6,000 pre-tax contribution.

With a Single(k) plan, for 2025, I can contribute $23,500 per year (another $7,500 if I'm age 50-59 or 64 or over or $11,250 if I’m age 60-63) up to 100% of my self-employment income and in addition to that amount I can make an employer contribution up to 25% of my income. In the previous example, if you make $24,000 in self-employment income, you would be able to make a salary deferral contribution of $23,500 and an employer contribution of $500, effectively wiping out all of your taxable income for that tax year.

Simple IRA

Simple IRA's are the JV version of 401(k) plans. Smaller companies that have 1 – 50 employees that are looking to start are retirement plan will often times start with implementing a Simple IRA plan and eventually graduate to a 401(k) plan as the company grows. The primary advantage of Simple IRA Plans over 401(k) Plans is the cost. Simple IRA's do not require a TPA firm since they are self-administered by the employer and they do not require annual 5500 filings so the cost to setup and maintain the plan is usually much less than a 401(k) plan.

What causes companies to choose a 401(k) plan over a Simple IRA plan?

Owners want access to higher pre-tax contribution limits

They want to limit to the plan to just full time employees

The company wants flexibility with regard to the employer contribution

The company wants a vesting schedule tied to the employer contributions

The company wants to expand investment menu beyond just a single fund family

401(k) Plans

These are probably the most well-recognized employer-sponsored plans since, at one time or another, each of us has worked for a company that has sponsored this type of plan. So we will not spend a lot of time going over the ins and outs of these types of plan. These plans offer a lot of flexibility with regard to the plan features and the plan design.

We will issue a special note about the 401(k) market. For small business with 1 -50 employees, you have a lot of options regarding which type of plan you should sponsor but it's our personal experience that most investment advisors only have a strong understanding of 401(k) plans so they push 401(k) plans as the answer for everyone because it's what they know and it's what they are comfortable talking about. When establishing a retirement plan for your company, make sure you consult with an advisor who has a working knowledge of all these different types of retirement plans and can clearly articulate the pros and cons of each type of plan. This will assist you in establishing the right type of plan for your company.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Simple IRA vs. 401(k) - Which one is right for your company?

There are a lot of options available to small companies when establishing an employer sponsored retirement plan. For companies that have employees in addition to the owners of the company, the question is do they establish a 401(k) plan or a Simple IRA?The right fit for your company depends on:

There are a lot of options available to small companies when establishing an employer sponsored retirement plan. For companies that have employees in addition to the owners of the company, the question is do they establish a 401(k) plan or a Simple IRA?The right fit for your company depends on:

What are the company's primary goals for establishing the plan?

How much the owner(s) plan to contribute to the plan?

How many employees does the company have?

Do you want to restrict the plan to only full time employees?

The cost of maintaining each plan?

Does the company intend to make an employer contribution to the plan?

Diversity of the investment menu

Below is a chart that contains a quick comparison of some of the main features of each type of plan:

For many small companies it often makes sense to start with a Simple IRA plan and then transition to a 401K plan as the company grows or when the owner intends to start accessing the upper deferral limits offered by the 401(k) plan.

Simple IRA's are relatively easy to setup and the administrative fees to maintain these plans are typically lower in comparison to 401(k) plans. Most Simple IRA providers will only charge $10 - $30 to custody the accounts.

By comparison, 401(k) plans are ERISA covered plans which require a TPA Firm (third party administrator) to maintain the plan documents, conduct year end plan testing, and file the 5500 each year. The TPA fees vary based on the provider and the number of employees eligible to participate in the plan. A ballpark range is $1,500 - $2,500 for companies with under 50 employees.

However, the additional TPA fees associated with establishing a 401(k) plan may be justified if:

The owners intend to max out their employee deferrals

The owners are approaching retirement and need to make big contributions

The company wants to maintain flexibility with the employer contribution

The company would like to make Roth contributions, loans, or rollovers available

WARNING: Most investment providers are "one trick ponies". They will talk about 401(k) plans and not present other options because they either do not have a thorough understand of how Simple IRA plans work or they are only able to offer 401(k) plans. Before establishing a retirement plan it is important to work with a firm that presents both options, helps you to understand the difference between the two types of plans, and assist you in evaluating which plan would best meet your company's goals and objectives.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Comparing Different Types of Employer Sponsored Retirement Plans

Employer sponsored retirement plans are typically the single most valuable tool for business owner when attempting to:

Reduce their current tax liability

Attract and retain employees

Accumulate wealth for retirement

But with all of the different types of plans to choose from which one is the right one for your business? Most business owners are familiar with how 401(k) plans work but that might not be the right fit given variables such as:

Employer sponsored retirement plans are typically the single most valuable tool for business owner when attempting to:

Reduce their current tax liability

Attract and retain employees

Accumulate wealth for retirement

But with all of the different types of plans to choose from which one is the right one for your business? Most business owners are familiar with how 401(k) plans work but that might not be the right fit given variables such as:

# of Employees

Cash flows of the business

Goals of the business owner

There are four main stream employer sponsored retirement plans that business owners have to choose from:

SEP IRA

Single(k) Plan

Simple IRA

401(k) Plan

Since there are a lot of differences between these four types of plans we have included a comparison chart at the conclusion of this newsletter but we will touch on the highlights of each type of plan.

SEP IRA PLAN

This is the only employer sponsored retirement plan that can be setup after 12/31 for the previous tax year. So when you are sitting with your accountant in the spring and they deliver the bad news that you are going to have a big tax liability for the previous tax year, you can establish a SEP IRA up until your tax filing deadline plus extension, fund it, and take a deduction for that year.

However, if the company has employees that meet the plan’s eligibility requirement, these plans become very expensive very quickly if the owner(s) want to make contributions to their own accounts. The reason being, these plans are 100% employer funded which means there are no employee contributions allowed and the employer contribution is uniform for all plan participants. For example, if the owner contributes 15% of their income to the SEP IRA, they have to make an employer contribution equal to 15% of compensation for each employee that has met the plans eligibility requirement. If the 5305-SEP Form, which serves as the plan document, is setup correctly a company can keep new employees out of the plan for up to 3 years but often times it is either not setup correctly or the employer cannot find the document.

Single(k) Plan or “Solo(k)”

These plans are for owner only entities. As soon as you have an employee that works more than 1000 hours in a 12 month period, you cannot sponsor a Single(k) plan.

The plans are often times the most advantageous for self-employed individuals that have no employees and want to have access to higher pre-tax contribution levels. For all intensive purposes it is a 401(k) plan, same contributions limits, ERISA protected, they allow loans and Roth contributions, etc. However, they can be sponsored at a much lower cost than traditional 401(k) plans because there are no non-owner employees. So there is no year-end testing, it’s typically a boiler plate plan document, and the administration costs to establish and maintain these plans are typically under $400 per year compared to traditional 401(k) plans which may cost $1,500+ per year to administer.

The beauty of these plans is the “employee contribution” of the plan which gives it an advantage over SEP IRA plans. With SEP IRA plans you are limited to contributes up to 25% of your income. So if you make $24,000 in self-employment income you are limited to a $6,000 pre-tax contribution.

With a Single(k) plan, for 2016, I can contribute $18,000 per year (another $6,000 if I’m over 50) up to 100% of my self-employment income and in addition to that amount I can make an employer contribution up to 25% of my income. In the previous example, if you make $24,000 in self-employment income, you would be able to make a salary deferral contribution of $18,000 and an employer contribution of $6,000, effectively wiping out all of your taxable income for that tax year.

Simple IRA

Simple IRA’s are the JV version of 401(k) plans. Smaller companies that have 1 – 30 employees that are looking to start a retirement plan will often times start with implementing a Simple IRA plan and eventually graduate to a 401(k) plan as the company grows. The primary advantage of Simple IRA Plans over 401(k) Plans is the cost. Simple IRA’s do not require a TPA firm since they are self-administered by the employer and they do not require annual 5500 filings so the cost to setup and maintain the plan is usually much less than a 401(k) plan.

What causes companies to choose a 401(k) plan over a Simple IRA plan?

Owners want access to higher pre-tax contribution limits

They want to limit to the plan to just full time employees

The company wants flexibility with regard to the employer contribution

The company wants a vesting schedule tied to the employer contributions

The company wants to expand the investment menu beyond just a single fund family

401(k) Plans

These are probably the most well recognized employer sponsored plans since at one time or another each of us has worked for a company that has sponsored this type of plan. So we will not spend a lot of time going over the ins and outs of these types of plan. These plans offer a lot of flexibility with regard to the plan features and the plan design.

We will issue a special note about the 401(k) market. For small business with 1 -50 employees, you have a lot of options regarding which type of plan you should sponsor but it’s our personal experience that most investment advisors only have a strong understanding of 401(k) plans so they push 401(k) plans as the answer for everyone because it’s what they know and it’s what they are comfortable talking about. When establishing a retirement plan for your company, make sure you consult with an advisor that has a working knowledge of all these different types of retirement plans and can clearly articulate the pros and cons of each type of plan. This will assist you in establishing the right type of plan for your company.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Target Date Mutual Funds and Their Role in the 401(k) Space

A target date mutual fund is a fund in the hybrid category that automatically resets the asset mix of stocks, bonds and cash equivalents in its portfolio according to a selected time frame that is appropriate for a particular investor. In simpler terms, an investor can purchase a target date fund based on their anticipated retirement date and the fund will

In recent years, a growing trend in the 401(k) space has been the use of target date mutual funds.

Target Date Mutual Funds

A target date mutual fund is a fund in the hybrid category that automatically resets the asset mix of stocks, bonds and cash equivalents in its portfolio according to a selected time frame that is appropriate for a particular investor. In simpler terms, an investor can purchase a target date fund based on their anticipated retirement date and the fund will automatically become more conservative as the investor approaches retirement.

This is often times a suitable investment for the average investor or participant in a 401(k) plan that would not typically make allocation adjustments on their own. During the financial crisis of 2008 and 2009, many investors approaching retirement were overexposed to the stock market and lost half of their savings with no time to make it back before retirement. This is where the benefit of a well-managed target date fund would have been useful as investors who needed an allocation change as they approached retirement would have got it. Emphasis on the well-managed.

At year end 2013, there was approximately $595.5 billion dollars invested in target date mutual funds, up from approximately $111.9 billion in 2006 based on a study conducted by Morningstar. With so much money being placed in these funds, it is important to know how they work and what to look for when choosing the correct fund for your risk tolerance and time horizon.

As mentioned previously, the allocation of assets within a target date fund will automatically rebalance throughout the life of the investment to focus more on income. With that being said, how does the rebalancing happen and how often does the rebalancing take place? The rebalancing takes place automatically when fund managers of that target date fund determine the allocation in the fund no longer meets its intentions. It is argued that most target date mutual funds do not rebalance nearly enough as some can be as long as 4-5 years.

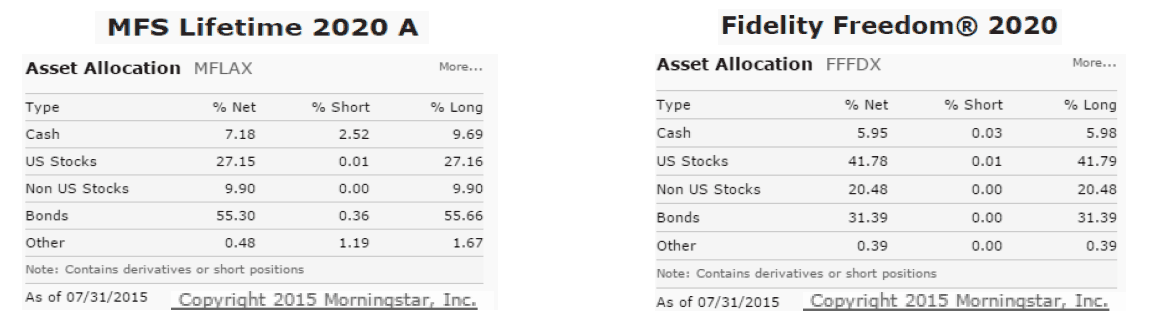

It is important to know that the date of a target date fund is the date the investor plans to retire and is not the date in which the fund is at its most conservative allocation. Fund families operate their target date mutual funds very differently. For example, one fund family may have a 2020 fund that is 30% stocks and 70% bonds compared to another more aggressive fund family that is allocated 60% stocks and 40% bonds in their 2020 target date fund.

There are arguments for both allocations. Since an investor is at their retirement age, they should typically be more conservative. On the other hand, just because the investor hit their retirement age they may not be taking distributions from the account for another 5-10 years, and therefore could possibly achieve more growth.

A target date fund can be a suitable investment option for investors who would like a hands off approach in their 401(k), but participants must be aware that there is still due diligence necessary throughout the life of the investment. Below is a chart showing the results of a study conducted by Morningstar in 2010. It shows the allocation of target date mutual funds for different fund families during the financial crisis of 2008 and 2009. These target date mutual funds were meant for investors retiring in 2010 and therefore should have been allocated in a way that would not over expose them to a significant decline in the market two years from retirement.

As you can see, the equity (stock) allocation varies greatly between fund families and the over exposure led to significant declines in investors accounts. Too many people had their retirement account nearly halved two years from retirement which is devastating for an individuals quality of life.

There are definitely pitfalls to target date mutual funds but they can be appropriate in the right circumstances. It is important that investors are educated on what target date mutual funds are and more importantly what they are not. Here are a few takeaways that may help you determine which, if any, target date fund is appropriate for you.

Determine Your Risk Tolerance First

The first questions an investment advisor will typically have for a client are: “What is your time horizon?” and “What is your risk tolerance?”. Since target date mutual funds allocate assets for a group of investors based on a date in the future, the only piece that is somewhat satisfied is time horizon. Just because a group of investors have the same time horizon does not mean they should be invested the same way. Fund managers cannot allocate funds in a way that satisfies both questions without knowing the risk tolerance for each individual investor. That means, the risk tolerance piece relies on you. Two 45 year old investors may be 20 years from retirement and have completely different portfolio allocations due to their risk tolerance. One may be more aggressive and tolerant of stock market fluctuations while the other may be conservative and less willing to risk their savings. Even though each investor has the same time horizon, the appropriate portfolio for each would vary greatly. It is important to know your risk tolerance and apply that knowledge to the appropriate target date fund.

Research the Different Target Date Fund Options

As shown in the chart on the previous page, the asset allocation for a target date fund for one fund family could be drastically different when compared to the same target date fund for another fund family. This can be confusing for investors which is why it is important to research the fund and the current allocation before investing. The charts below show the asset allocation of two 2020 target date mutual funds from different families.

Both target date mutual funds are the same in terms of retirement date but drastically different in exposure to the stock market. The MFS 2020 fund with approximately 63% allocated to bonds/cash and 37% to stocks is a much more conservative portfolio than the Fidelity 2020, which is approximately 37% bonds/cash and 63% stocks. An investor with 5 years to retirement could have very different objectives with their retirement account and therefore each fund may be appropriate as a 2020 fund. An over exposure to the stock market for someone retiring in 5 years could be devastating as shown in 2008/2009 which is why it is important for each individual to determine their time horizon, risk tolerance, and investment objectives when selecting the correct target date fund for their portfolio.

Difference Between Target Date and Active Management

Although target date mutual funds are often referred to as “set it and forget it”, there are a number of factors that must be taken into consideration. Most target date mutual funds are typically managed exclusively on time horizon. Fund managers traditionally do not make significant allocation adjustments to these types of funds based on changing market conditions which can leave investors exposed to big drops in the stock market as they approach retirement. Investors within 10 years to retirement should work closely with their investment advisor to make sure they have the right mix of stocks and bonds in their portfolio.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.