Selecting The Best Pension Payout Option

When you retire and turn on your pension, you typically have to make a decision as to how you would like to receive your benefits which includes making a decision about the survivor benefits. Do you select….

When you retire and turn on your pension, you typically have to make a decision as to how you would like to receive your benefits which includes making a decision about the survivor benefits. Do you select….

Lump sum

Single Life Benefit

100% Survivor Benefit

50% Survivor Benefit

Survivor Benefit Plus Pop-up Election

The right option varies person by person but some of the primary considerations are:

Marital status

Your age

Your spouse’s age

Income needed in retirement

Retirement assets that you have outside of the pension

Health considerations

Life expectancy

Financial stability of the company sponsoring the plan

Tax Strategy

Risk Tolerance

There are a lot of factors because the decision is not an easy one. In this article, I’m going to walk you through how we evaluate these options for our clients so you can make an educated decision when selecting your pension payout option.

Understanding The Options

To give you a better understanding of the various payout options, I’m going to walk you through how each type of benefit works. Not all pension plans are the same, some plans may only offer some of these options, others after all of these options, and some plans have additional payout options available.

Lump Sum: Some pension plans will give you the option of receiving a lump sum dollar amount instead of receiving monthly payment for the rest of your life. Retirees will typically rollover these lump sum amounts into their IRA’s, which is a non-taxable event, and then take distributions as needed from their IRA.

Single Life Benefit: This is also referred to as the “straight life benefit”. This option usually offers the highest monthly pension payments because there are no survivor benefits attached to it. You receive a monthly payment for the rest of your life but when you pass away, all pension payments stop.

Survivor Benefits: There are usually multiple survivor benefit payout options. They are typically listed as:

100% Survivor Benefit

75% Survivor Benefit

50% Survivor Benefit

25% Survivor Benefit

The percentages represent the amount of the benefit that will continue to your spouse should you pass away first. The higher the survivor benefit, typically the lower your monthly pension payment will be because the pension plans realize they may have to make payments for longer because it’s based on two lives instead of one.

Example: If the Single Life pension payment is $3,000, if instead you elect a 50% survivor benefit, your pension payment may only be $2,800, but if you elect the 100% survivor benefit it may only be $2,700. The monthly pension payments go down as the survivor benefits go up.

Here is an example of the survivor benefit, let’s say you elect the $2,800 pension payment with a 50% survivor benefit. Your pension will pay you $2,800 per month when you retire but if you were to pass away, the pension plan will continue to pay your spouse $1,400 per month (50% of the benefit) for the rest of their life.

Pop-Up Elections: Some pension plans, like the New York State Pension Plan, provide retirees with a “Pop-Up Election”. With the pop-up, if you select a survivor benefit which provides you with a lower monthly pension payment amount but your spouse passes away first, thus eliminating the need for a survivor benefit, your monthly pension payment “pops-up” to the amount that you would have received if you elected the Single Life Benefit.

Example: You are married, getting ready to retire, and you have the following pension payout options:

Single Life: $3,000 per month

50% Survivor Benefit: $2,800 per month

50% Survivor Benefit with Pop-Up: $2,700 per month

If you elect the Single Life option, you would receive $3,000 per month, but when you pass away the pension payments stop.

If you elect the 50% Survivor Benefit, you would receive $2,800 per month, but if you pass away before your spouse, they will continue to receive $1,400 for the rest of their life.

If you elect the 50% Survivor Benefit WITH the Pop-Up, you would receive $2,700 per month, if you were to pass away before your spouse, your spouse would continue to receive $1,350 per month. But if your spouse passes away before you, your pension payment pops-up to the $3,000 Single Life amount for the rest of your life.

Why do people select the pop-up? It’s more related to what happens to the social security benefits when a spouse passes away. If your spouse were to pass away, one of the social security benefits is going to stop, and you receive the higher of the two but some of that lost social security income could be made up by the higher pop-up pension amount.

Marital Status

The easiest variable to address is marital status. If you are not married or there are no domestic partners that depend on your pension payments to meet their expenses, then typically it makes sense to elect either the Lump Sum or Straight Life payment option. Whether or not the lump sum or straight life benefit makes sense will depend on your age, tax strategy, income need, if you want to preserve assets for your children, and other factors.

Income Need

If you are married or have someone that depends on your pension income, by far, the number one factors becomes your income need in retirement when making your pension election. If the primary source of your retirement income is your pension and you were to pass away, your spouse would need to continue to receive all or a portion of those pension payments to meet their expenses, you have to weigh very heavily the survivor benefit options. We have seen people make the mistake of electing the Single Life Option because it was the highest monthly payout and then the spouse with the pension unexpectedly passes away at an earlier age. It’s a devastating financial event for the surviving spouse because the pension payments just stop. If someone were to pass away 5 years after leaving their company, they worked all of those year to receive 5 years worth of pension payments, and then they just stopped.

We usually have to run projections for clients to answer this question, if the spouse with the pension passes away will their surviving spouse need 50%, 75%, or 100% of the pension payments to meet their income needs? In most cases it’s worth accepting a slightly lower monthly pension payment to reduce this survivor risk.

Retirement Assets Outside Of The Pension

If you have substantial retirement savings outside of your pension like 401(k) accounts, investment accounts, 457, IRA’s, 403(b) plans, this may give you more flexibility with your pension options. Having those outside assets almost creates a survivor benefit for your spouse that if the pension payments were to stop or be reduced, there are other retirement assets to draw from to meet their income needs.

Example: You have a retired couple, both have pensions, and they have also accumulated $1M in retirement accounts outside the pension, if one spouse were to pass away, even though the pension payments may stop or be reduced, there may be enough assets to draw from the outside retirement accounts to make up for that lost pension income. This may allow a couple to elect a 50% survivor benefit and receive a higher monthly pension payment compared to electing the 100% survivor benefit with the lower monthly pension payment.

Risk Management

This last example usually leads us into another discussion about long-term risk. Even though you may have the outside assets to accept a higher monthly pension payment with a lower survivor benefit, should you? When we create retirement plans for clients we have to make a lot of assumptions about assumed rates of return, life expectancy, expenses, etc. But what if your investment accounts take a big hit during the next recession or a spouse passes away much sooner than expected, accepting a lower survivor benefit may increase the impact of those risks on your plan. If you and your spouse are both able to elect the 100% survivor benefit on your pensions, you then know, that no matter what happens in the future, that pension income will always be there, so it’s one less variable in your long-term financial plan.

While this could be looked at as a less risky path, there is also the flip side to that. If you lock up the 100% survivor benefit on the pension, that may allow you to take more risk in your outside retirement accounts, because you are not as dependent on those accounts to supplement a survivor benefit depending on which spouse passes away first.

Age

The age of you and your spouse can also be a factor. If the spouse with the pension is quite a bit older than the spouse without pension, it may make sense for normal life expectancy reasons, to elect a larger survivor benefit. Visa versa, if the spouse with then pension is much younger, it may warrant a lower survivor benefit elect. But in the end, it all goes full circle back to the income need if the pension payments were to stop, are there enough other assets to supplement income for the surviving spouse?

Health Considerations / Life Expectancy

When conducting a pension analysis, we will typically use age 90 as a life expectancy for most clients. But there are factors that can alter the use of age 90 such as special health considerations and longevity. If the spouse that has the pension is forced to retire for health reasons, it gives greater weight to electing a pension benefit with a higher survivor benefit. When a client tells us that their father, mother, and grandmother, all lived past age 93, that can impact the pension decision. Since people are living longer, it increases the risk of spending through their traditional retirement savings, whereas the pension payments will be there for as long as they live.

Financial Stability Of The Company / Organization

You are seeing more and more stories about workers that were promised a pension but then their company, union, or not-for-profit goes bankrupt. This is a real risk that should factor into your pension decision. While there are government agencies like the PBGC that are there to help backstop these failed pension plans, there have been so many bankrupt pensions over the past two decades that the PBGC fund itself is at risk of running out of assets. If a retiree is worried about the financial solvency of their employer, it may give greater weight to electing the “Lump Sum Option”, taking your money out of the plan, getting it over to your IRA, and then taking monthly payments from the IRA. Since this is becoming a greater risk to employees, we created a video dedicated to this topic: What Happens To Your Pension If The Company Goes Bankrupt?

Tax Strategy

Tax strategy also comes into play when electing your pension benefit. If we have retirees that have both a pension and retirement accounts outside the pension plan, we have to map out the distribution / tax strategy for the next 10 to 20 years. Depending on who you worked for and what state you live in, the monthly pension payments may be taxed at the federal level, state level, or both. Also, many retirees don’t realize that social security will also be considered taxable income in retirement. Then, if you have pre-tax retirement accounts, at age 72, you have to begin taking Required Minimum Distributions which are taxable.

There are situations where we will have a retiree forego the monthly pension payment from the pension plan and elect the Lump Sum Benefit option, so they can rollover the full balance to an IRA, and then we have more flexibility as to what their taxable income will be each year to execute a long term tax strategy that can save them thousands and thousands of dollars in taxes over their lifetime. We may have them process Roth conversions, or realize long term capital gains at a 0% tax rate, neither of which may be available if the pension income is pushing them up into the higher tax brackets.

There are so many other tax strategies, long term care strategies, and wealth accumulation strategies that come into the mix when deciding whether to take the monthly pension payments or the lump sum payment of your pension benefit.

Pension Option Analysis

These pension decisions are very important because you only get one shot at them. Once the decision is made you are not allowed to go back and change your mind to a different option. We run this pension analysis for clients all of the time, so before you make the decision, feel free to reach out to us and we can help you to determine which pension benefit is the right one for you.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What are the main pension payout options available at retirement?

Most pension plans offer several payout choices, including a lump sum, single life benefit, and various survivor benefit options such as 50%, 75%, or 100% survivor benefits. Some plans also include a pop-up feature, which increases your payment to the single life amount if your spouse passes away first.

How does the lump sum option work?

The lump sum option provides a one-time payout that retirees often roll over into an IRA to avoid immediate taxes. This choice offers more flexibility and control over investments but transfers market and longevity risk to the retiree.

What is the difference between single life and survivor benefit options?

A single life pension pays the highest monthly amount but ends when the retiree dies. A survivor benefit option pays a reduced monthly amount during the retiree’s life, but continues payments—often 50%, 75%, or 100%—to the surviving spouse after death.

What is a pop-up survivor benefit?

A pop-up election reduces your monthly pension slightly compared to a standard survivor benefit but increases (“pops up”) your payment to the full single life amount if your spouse passes away first. This feature can help offset lost Social Security income when one spouse dies.

How does marital status influence your pension decision?

Married retirees or those with financial dependents often need to prioritize survivor benefits to ensure continued income for a spouse. Single retirees, by contrast, may benefit more from the lump sum or single life option since there are no survivor needs to plan for.

How do other retirement assets impact pension elections?

If you have substantial savings in 401(k)s, IRAs, or investment accounts, you may be able to take on more risk with your pension option by selecting a smaller survivor benefit or a lump sum. These outside assets can act as a backup income source for your spouse or emergencies.

What role does health and life expectancy play in choosing a pension option?

Shorter expected life spans or significant health issues may make a lump sum or 100% survivor benefit more appealing.

How does company stability affect pension decisions?

If the employer’s financial health or pension funding is uncertain, a lump sum rollover may provide greater security. While the PBGC insures many pensions, its coverage limits may not fully protect large benefits if a plan fails.

Can taxes influence which pension option you choose?

Yes. Pension income is generally taxable at both federal and state levels. Rolling a lump sum into an IRA provides more control over withdrawals and potential tax strategies, such as Roth conversions or managing tax brackets in retirement.

Buying A Second House In Retirement

More and more retires are making the decision to keep their primary residence in retirement but also own a second residence, whether that be a lake house, ski lodge, or a condo down south. Maintaining two houses in retirement requires a lot of additional planning because you need to be able to answer the following questions:

More and more retirees are making the decision to keep their primary residence in retirement but also own a second residence, whether that be a lake house, ski lodge, or a condo down south. Maintaining two houses in retirement requires a lot of additional planning because you need to be able to answer the following questions:

Do you have enough retirement savings to maintain two houses in retirement?

Should you purchase the house before you officially retire or after?

Are you planning on paying for the house in cash or taking a mortgage?

If you are taking mortgage, where will the down payment come from?

Will you have the option to claim domicile in another state for tax purposes?

Should you setup a trust to own your real estate in retirement?

Adequate Retirement Savings

The most important question is do you have enough retirement income and assets to support the carrying cost of two houses in retirement? This requires you to run detailed retirement projection to determine what your total expense will be in retirement including the expenses associates with the second house, and the spending down of your assets over your life expectancy to make sure you do not run out of money. Here are some of the most common mistakes that we see retirees make:

They underestimated the impact of inflation. The ongoing costs associated with maintaining a house such as property taxes, utilities, association dues, maintenance, homeowners insurance, water bills, etc, tend to go up each year. While it may look like you can afford both houses now, if those expenses go up by 3% per year, will you have enough income and assets to pay those higher cost in the future?

They forget about taxes. If you will have to take larger distributions out of your pre-tax retirement accounts to maintain the second house, those larger distributions could push you into a higher tax bracket, cause your Medicare premiums to increase, lose property tax credits, or change the amount of your social security benefits that are taxable income.

A house is an illiquid asset. When you look at your total net worth, you have to be careful how much of your net worth is tied up in real estate. Remember, you are retired, you are no longer receiving a paycheck, if the economy hits a big recession, and your retirement accounts take a big hit, you may be forced to sell that second house when everyone else is also trying to sell their house. It could put you a in a difficult situation if you do not have adequate retirement assets outside of your real estate holdings.

Should You Purchase A Second House Before You Retire?

Many retirees wrestle with the decision as to whether to purchase their second house before they retire or after they have retired. There are two primary advantages to purchasing the second house prior to retirement:

If you plan on taking a mortgage to buy the second house, it is usually easier to get a mortgage while you are still working. Banks typically care more about your income than they do about your level of assets. We have seen clients retire, have over $2M in retirement assets, and have difficulties getting a mortgage, due to a lack of income.

There can be large expenses associated with acquiring a new piece of real estate. You move into your second house and you learn that it needs new appliances, a new roof, or you have to buy furniture to fill the house. We typically encourage our clients to get these big expenses out of the way before their paychecks stop in case they incur larger expenses than anticipated.

Mortgage or No Mortgage?

The decision of whether or not to take a mortgage on the second house is an important one. Sometimes it makes sense to take a mortgage and sometimes is doesn’t. Many retirees are hesitant to take a mortgage because they realize having a mortgage in retirement means higher annual expenses. While we generally encourage our client to reduce their debt by as much as possible leading up to retirement, there are situations where taking out a mortgage to buy that second house makes sense.

But it’s not for the reason that you may think. It’s not because you may be able to get a mortgage rate of 3% and keep your retirement assets invested with hopes of achieving a return of over 3%. While many retirees are willing to take on that risk, we remind our clients that you will be retired, therefore there is no more money going into your retirement accounts. If you are wrong and the value of your retirement accounts drop, now you have less in assets, no more contributions going in, and you have a new mortgage payment.

In certain situations, it makes sense to take a mortgage for tax purposes. If most of your retirement saving are in pre-tax sources like Traditional IRA’s or 401(k)’s, you withdrawal a large amount from those accounts in a single year to buy your second house, you may avoid having to take a mortgage, but it may also trigger a huge tax bill. For example, if you want to purchase a second house in Florida and the purchase price is $300,000. You take a distribution out of your traditional IRA to purchase the house in full, you will have federal and state income tax on the full $300,000, meaning if you are married filer you may have to withdrawal over $400,000 to get to the $300,000 that you need after tax to purchase the house.

If you are pre-tax heavy, it may be better to take out a mortgage, withdrawal just the down payment out of your IRA or preferably from an after tax source, and then you can make the mortgage payments with monthly withdrawals out of your IRA account. This spreads the tax liability of the house purchase over multiple years potentially keeping you out of those higher tax brackets.

But outside of optimizing a tax strategy, if you have adequate after-tax resources to purchase the second house in full, more times than not, we will encourage retirees to go that route because we are big fans of lowering your fixed expenses by as much as possible in retirement.

Planning For The Down Payment

If we meet with someone who plans to purchase a second house in retirement and we know they are going to have to take a mortgage, we have to start planning for the down payment on that house. Depending on what their retirement picture looks like we may:

Determine what amount of their cash reserves they could safely commit to the down payment

Reduce contributions to retirement accounts to accumulate more cash

If their tax situation allows, take distributions from certain types of accounts prior to retirement

Weigh the pros and cons of using equity in their primary residence for the down payment

If they have permanent life insurance policies, discuss pros and cons of taking a loan against the policy

Becoming A Resident of Another State

If you maintain two separate houses in different states, you may have the opportunity to have your retirement income taxed in the more tax favorable state. This topic could be an article all in itself, but it’s a tax strategy that should not be overlook because it can have a sizable impact on your retirement projections. If your primary residence is in New York, which is a very tax heavy state, and you buy a condo in Florida and you are splitting your time between the two houses in retirement, knowing what it requires to claim domicile in Florida could save you a lot of money in state taxes. To learn more about this I would recommend watching the following two videos that we created specifically on this topic:

Video 1: Will Moving From New York to Florida In Retirement Save You Taxes?

Video 2: How Do I Change My State Residency For Tax Purposes?

Should A Trust Own Your Second House

The final topic that we are going to cover are the pros and cons of a trust owning your house in retirement. For any house that you plan to own during the retirement years, it often makes sense to have the house owned by either a Revocable Trust or Irrevocable Trust. Trust are not just for the ultra wealthy. Trust have practical uses for everyday families just as protecting the house from the spend down process triggered by a long term care event or to avoid the house having to go through probate when you or your spouse pass away. Again, this is a relate topic but one that requires its own video to understand the difference between Revocable Trust and Irrevocable Trusts:

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Can retirees afford to maintain two homes in retirement?

Owning two homes in retirement requires careful planning. Retirees should run detailed projections that include property taxes, insurance, utilities, maintenance, and inflation to ensure their income and assets can cover both homes without depleting savings too quickly.

Is it better to buy a second home before or after retiring?

Buying before retirement often makes financing easier since mortgage approvals are income-based. It also allows retirees to handle large, one-time expenses such as furnishing or repairs while they still have a paycheck.

Should retirees pay cash or take a mortgage for a second home?

If retirees have sufficient after-tax savings, paying cash can reduce fixed expenses in retirement. However, taking a mortgage may make sense for those with most assets in pre-tax accounts (like 401(k)s or IRAs) to spread out tax liability over multiple years instead of taking a large taxable withdrawal all at once.

How should retirees plan for a second-home down payment?

Planning options include using cash reserves, adjusting pre-retirement savings contributions, or tapping equity from the primary home. Retirees should also weigh the tax consequences of withdrawing funds from pre-tax accounts.

Can retirees change their state of residency for tax savings?

Yes. If you split time between homes in different states, you may be able to claim domicile in a state with no income tax, such as Florida. Each state has specific rules about residency, so maintaining documentation—like voter registration and driver’s license—helps prove intent to change domicile.

Should a trust own your second home in retirement?

Using a revocable or irrevocable trust can help avoid probate, protect assets from potential nursing home spend-down, and simplify estate transfers. The right structure depends on your goals—revocable trusts offer flexibility, while irrevocable trusts provide stronger asset protection.

What are the biggest financial risks of owning two homes in retirement?

The main risks include underestimated inflation, loss of liquidity during market downturns, increased annual expenses that outpace retirement income. and unexpected maintenance costs. Retirees should ensure they have sufficient liquid assets and diversified income sources before committing to two properties.

Why Are Long-Term Care Insurance Premiums Skyrocketing?

Many individuals that have long-term care insurance policies are beginning to receive letters in the mail notifying them that that their insurance premiums are going up by 50%, 70%, or more in some cases. This is after many of the same policyholders have experienced similar size premium increases just a few years ago. In this article I’m going to explain……

Many individuals that have long-term care insurance policies are beginning to receive letters in the mail notifying them that that their insurance premiums are going up by 50%, 70%, or more in some cases. This is after many of the same policyholders have experienced similar size premium increases just a few years ago. In this article I’m going to explain:

Why this is happening

Are these premium increases going to continue?

Options for managing the cost of these policies

If you cancel the policy, alternative solutions for managing the financial risk of a LTC event

Premium Increases & Insolvency

Unfortunately, it’s not just the current premium increases that are presenting LTC policyholders with these difficult decisions. Within the letters, some of these insurance carriers are threatening that if they’re not able to raise premiums by 250% within the next 6 years, that the insurance company may not have enough assets to pay the promised benefit. What good is an insurance policy if there’s no insurance company to pay the benefit? I won’t mention any of the insurance companies by name but here is some of the word for word statements in those letters:

“This represents a 69% rate increase in the premiums for your policy.”

“A.M. Best has downgraded its rating of (NAME OF INSURANCE COMPANY) financial strength to C++ in September 2019, indicating A.M. Best’s view that (NAME OF INSURANE COMPANY) has marginal ability to meet its ongoing insurance obligations.”

“Please be aware that as of 06/06/21 over the next 3-6 years we are planning to seek additional rate increases of up to 250% for lifetime benefits”

This creates a very difficult decision for the policyholder to either:

Keep the policy and pay the higher premiums

Cancel the policy

Make adjustments to the current policy to make it more affordable in the short-term

These Policies Are Not Cheap

In most cases, these long-term care insurance premiums were not cheap to begin with. Prior to these premium increases, it was not uncommon for a robust policy in New York to cost between $2,500-$4,000 per year, per person. LTC policies tend to carry a higher cost because they have a higher probability of paying out when compared to other types of insurance policies. For example, with life insurance, they expect you to pay your premiums, you live a long happy life, and the insurance policy never pays out. Compare this to the risk of a long-term event, where in 2021 HealthView Services produced a study that stated:

“An Average healthy 65-year-old couple living to their projected actuarial longevity has a 75% chance that one partner will require a significant level of long term care. There is a 25% probability that both partners will need long-term care” (source: Think Advisor)

Couple that with the fact that long-term care expenses are very high and insurance companies have to charge more in premiums to balance the dollars in versus dollars out.

With these premium increases now in play, some retired couples are faced with a situation where they previously may have been paying $5,000 per year for both policies and they find out their premiums are going up by 70%, increasing that annual cost to $8,500 per year.

Affordability Issue

So what happens when a retired couple, on a fixed amount of income, gets one of these letters, and realizes they can’t afford the premium increase. They essentially have two options:

Cancel the policy

Make amendments to the policy (if the insurance company allows)

Let’s start off by looking at the amendment option. Many insurance companies, in exchange for a lower premium increase, may allow you to reduce the benefits offered by the policy to make it more affordable. You may have options like

Extending the elimination period

Reducing inflation riders

Reducing the daily benefit

Reducing the maximum lifetime benefit

Reducing home care options

These are just some of the adjustments that could be made, but remember, you are taking what you have now, and watering it down to make it more affordable. Caution, at some point you have to ask yourself:

“If I reduce the benefits of this policy, will it provide me enough coverage to meet my financial needs should I have a long-term event?”

If the answer is “No”, then you may have to look more closely at the option of canceling the policy. But what happens if you cancel the policy and you are now exposed to the financial risk of a long-term care event? Answer, you will have to identify another financial strategy to manage that risk. Two of the most common that we have implemented for clients are

Self-insuring

Setting up Medicaid trusts

Self-Insuring Alternative

The way this solution works is you are essentially setting money aside for yourself, acting as your own insurance company, should a long-term care event arise later in life, you will have money set aside to pay those expenses. If you were previously paying an insurance company $4,000 per year for your LTC policy, then cancel the policy, you would set up a separate investment account where you continue to deposit the amount of the premium payments that you were previously making each year so there will be a pool of assets to draw from should a long-term event arise.

But, you have to run projections to determine how much money is estimated to be in those accounts at future ages to make sure it is sufficient to cover enough of those costs that it won’t put you in a tough financial situation later on. There is an upside benefit to this strategy that if you never have a long-term care event, there are assets sitting there that your beneficiaries could inherit. If instead that money was going toward long-term care insurance premiums and there’s not a long-term care event, all that money has essentially been wasted. However, this strategy does take more planning because your self-insurance strategy may be not cover the same dollar for dollar amount that your LTC policy would have covered if a long-term care event arises.

Medicaid trust

Understanding how Medicaid trusts works is a whole article in itself and we have a video dedicated just to this topic. But the general idea behind the strategy is this, if you have a long-term event and you do not have a LTC insurance policy, you essentially have to spend through all of your countable assets to pay for your care. Note, the annual costs of assisted living or a nursing home is often $100,000+ per year. For those that do not have assets, Medicaid will often pay for the cost of assisted-living or nursing home care. By setting up a trust and placing your assets in a trust ahead of time, if those assets are owned by the trust for a specific number of years, if there is a long-term care event, you do not have to spend those assets down, and Medicaid picks up the tab for your care. Like I said, there’s a lot more detail regarding the strategy and if you’d like to know more watch this video:

Medicaid Trust Video: https://www.youtube.com/watch?v=iBVQtrGiUso

Future Premium Increases

You also have to include in your analysis the risk of future premium increases which seem likely. These letters from the insurance companies themselves state that they may have to increase premiums by a lot more just to stay in business. So it’s not just evaluating the current premium increase in these situations but also considering what decisions you could face within the next 5 – 10 years if the premiums double again. This variable can definitely influence the decisions that you are making now.

Why Are These Premium Increases Happening?

This is a 20 year problem in the making. For decades insurance companies have miscalculated how long people were going to live and the rising cost of long-term care. Since they weren’t charging enough at the onset of these policies, they have not collected enough in insurance premiums to cover the insurance claims that are now being filed by policyholders. Thus, the policyholders that currently have policies are now being required to pay more to make up for those underwriting mistakes.

The second issue is that there is less competition in the long term care insurance market. Insurance companies in general do not want to issue policies in a sector of the market where the probability of a payout is high and the dollar amount of the payout is also high; they want to operate in sectors of the market where the probability of a payout is low so they get to just keep your premium payments. Many insurance companies have completely exited the Long Term Care Insurance market. For example, in New York state, there are only two insurance companies remaining that are issuing traditional long-term care policies. Less competition, higher prices.

The third issue is due to the dramatic rise in the annual premium amounts, they have become less affordable for new policyholders. Many retirees can’t afford to pay $4,000+ per year for each spouse’s LTC policy so the issuance of new policies is dropping; that again, saddles the current policy holders with the premium increases.

A Difficult Decision

For all of these reasons, if you are currently a holder of a LTC insurance policy, instead of just blindly paying the higher premiums, it really makes sense to evaluate your options with the anticipation that the premiums may continue to increase in the future. For those that decide to amend their policy to reduce the cost, you really have to evaluate if the policy covers enough going forward to make it worth continuing on with the policy. I strongly recommend seeking professional help with this decision. Professionals in the industry can help you evaluate your options because these decisions can be irreversible and the right solution will vary individual by individual.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Why are long-term care (LTC) insurance premiums increasing so much?

Premiums are rising because insurers underestimated how long people would live, how many would need long-term care, and how expensive care would become. Many carriers didn’t collect enough in premiums to cover claims and are now raising rates to stay solvent. With fewer companies offering LTC coverage today, reduced competition is also driving prices higher.

Will long-term care insurance premiums keep increasing?

Unfortunately, further increases are likely. Some insurance companies have already warned policyholders of potential future hikes of up to 200%–250% over the next several years to remain financially stable. Policyholders should evaluate whether their budget can withstand additional premium increases.

What options do policyholders have when premiums rise?

You generally have three choices:

Keep the policy and pay the higher premium.

Modify the policy to reduce coverage and lower costs (e.g., adjust inflation riders, daily benefits, or elimination periods).

Cancel the policy and explore alternative strategies, such as self-insuring or using Medicaid planning.

What happens if you cancel your long-term care policy?

Canceling the policy means you lose the coverage and must find another way to manage the financial risk of a long-term care event. Common alternatives include self-insuring—setting aside the money you would have paid in premiums—or using Medicaid trust planning to protect assets while qualifying for care assistance later in life.

What does “self-insuring” mean for long-term care?

Self-insuring means saving and investing your own money instead of paying insurance premiums. You create a personal fund to cover potential future care costs. The benefit is that if you never need long-term care, those assets remain available to you or your heirs. However, this strategy requires disciplined saving and careful projections to ensure you have enough set aside.

How does a Medicaid trust help with long-term care planning?

A Medicaid trust allows you to move certain assets out of your name, protecting them from future long-term care spend-down requirements. After a specified look-back period (five years in many states), those trust assets are shielded, and Medicaid can help pay for nursing home or assisted-living expenses.

Are some long-term care insurers at risk of insolvency?

Yes. Some companies have disclosed that without major premium increases, they may not have enough assets to pay future claims. A few have even received credit downgrades from agencies like A.M. Best, signaling weakened financial stability.

What should policyholders do before deciding to cancel or modify their LTC policy?

Work with a financial planner or insurance specialist to evaluate your options carefully. Consider your current health, available assets, other income sources, and long-term care preferences. Once you cancel or reduce coverage, those changes are typically irreversible.

Do You Have To Pay Tax On Your Social Security Benefits?

I have some unfortunate news. If you look at your most recent paycheck, you are going to see a guy by the name of “FICA” subtracting money from your take-home pay. Part of that FICA tax is sent to the Social Security system, which entitles you to receive Social Security payments when you retire. The unfortunate news is that, even though it was a tax that you paid while you were working, when you go to receive your payments from Social Security, most retirees will have to pay some form of Income Tax on it. So, it’s a tax you pay on a tax? Pretty much!

In this article, I will be covering:

· The percent of your Social Security benefit that will be taxable

· The tax rate that you pay on your Social Security benefits

· The Social Security earned income penalty

· State income tax exceptions

· Withholding taxes from your Social Security payments

What percent of your Social Security benefit is taxable?

First, let’s start off with how much of your Social Security will be considered taxable income. It ranges from 0% to 85% of the amount received. Where you fall in that range will depend on the amount of income that you have each year. Here is the table for 2025:

But, here’s the kicker. 50% of your Social Security benefit that you receive counts towards the income numbers that are listed in the table above to arrive at your “combined Income” amount. Here is the formula:

Adjusted Gross Income (AGI) + nontaxable interest + 50% of your SS Benefit = Combined Income

If you are a single tax filer, and you are receiving $30,000 in Social Security benefits, you are already starting at a combined income level of $15,000 before you add in any of your other income from employment, pensions, pre-tax distributions from retirement accounts, investment income, or rental income.

As you will see in the table, if your combined income for a single filer is below $25,000, or a joint filer below $32,000, you will not have to pay any tax on your Social Security benefit. Taxpayers above those thresholds will have to pay some form of tax on their Social Security benefits. But, I have a small amount of good news: no one has to pay tax on 100% of their benefit, because the highest percentage is 85%. Therefore, everyone at a minimum receives 15% of their benefit tax free.

NOTE: The IRS does not index the combined income amounts in the table above for inflation, meaning that even though an individual’s Social Security and wages tends to increase over time, the dollar amounts listed in the table stay the same from year to year. This has caused more and more taxpayers to have to pay tax on a larger portion of their Social Security benefit over time.

Tax Rate on Social Security Benefits

Your Social Security benefits are taxed as ordinary income. There are no special tax rates for Social Security like capital gains rates for investment income. Social Security is taxed at the federal level but may or may not be taxed at the state level. Currently there are 37 states in the U.S. that do not tax Social Security benefits. There are 4 states that tax it at the same level as the federal government and there are 13 states that partially tax the benefit. Here is table:

Withholding Taxes From Your Social Security Benefit

For taxpayers that know that will have to pay tax on their Social Security benefit, it is usually a good idea to have Social Security withholding taxes taken directly from your Social Security payments. Otherwise, you will have to issue checks for estimated tax payments throughout the year which can be a headache. They only provide you with four federal tax withholding options:

7%

0%

12%

22%

These percentages are applied to the full amount of your Social Security benefit, not to just the 50% or 85% that is taxable. Just something to consider when selecting your withholding elections.

To make a withholding election, you have to complete Form W-4V (Voluntary Withholding Request). Once you have completed the form, which only has 7 lines, you can mail it or drop it off at the closest Social Security Administration office.

Social Security Earned Income Penalty

If you elect to turn on your Social Security benefit prior to your Normal Retirement Age (NRA) AND you plan to keep working, you have to be aware of the Social Security earned income penalty. Your Normal Retirement Age is the age that you are entitled to receive your full Social Security benefit, and it’s based on your date of birth.

The earned income penalty ONLY applies to taxpayers that turn on their Social Security prior to their normal retirement age. Once you have reached your normal retirement age, this penalty does not apply.

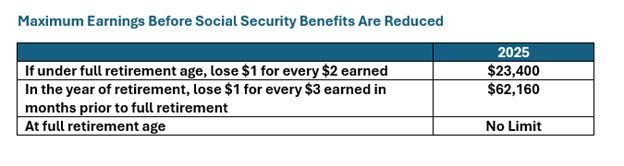

Basically, the IRS limits how much you are allowed to make each year if you elect to turn on your Social Security early. If you earn over those amounts, you may have to pay all or a portion of the Social Security benefit back to the government. Note that for married couples, the earned income numbers below apply to your personal earnings, and do not take into consideration your spouse’s income.

INCOME UNDER $23,400: If you earned income is below $23,400, no penalty, you get to keep your full social security benefit

INCOME OVER $23,400: You lose $1 of your social security benefit for every $2 you earn over the threshold. Example:

You turn on your social security at age 63

Your social security benefit is $20,000 per year

You make $40,000 per year in wages

Since you made $40,000 in wages, you are $16,600 over the $23,400 limit:

$16,600 x 50% ($1 reduction for every $2 earned) = $8,300 penalty.

The following year, your $20,000 Social Security benefit would be reduced by $8,300 for the assessment of the earned income penalty. Ouch!!

As a general rule of thumb, if you plan on working prior to your Social Security normal retirement age, and your wages will be in excess of the $23,400 limit, it usually makes sense to wait to turn on your Social Security benefit until your wages are below the threshold or you reach normal retirement age.

NOTE: You will see in the second row of the table “In the year of retirement”. In the year that you reach your full retirement age for social security the wage threshold is higher and the penalty is lower (a $1 penalty for every $3 over the threshold).

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Retirement Account Withdrawal Strategies

The order in which you take distributions from your retirement accounts absolutely matters in retirement. If you don’t have a formal withdraw strategy it could end up costing you in more ways than one. Click to read more on how this can effect you.

The order in which you take distributions from your retirement accounts absolutely matters in retirement. If you don’t have a formal withdraw strategy it could end up costing you more in taxes long-term, causing you to deplete your retirement assets faster, pay higher Medicare premiums, and reduce the amount of inheritance that your heirs would have received. Retirees will frequently have some combination of the following income and assets in retirement:

· Pretax 401(k) and IRA’s

· Roth IRA IRA’s

· After tax brokerage accounts

· Social Security

· Pensions

· Annuities

As Certified Financial Planner’s®, we look at an individual’s income needs, long-term goals, and map out the optimal withdraw strategy. In this article, I will be sharing with you some of the considerations that we use with our clients when determining the optimal withdrawal strategy.

Layer One : Pension Income

When you develop a withdrawal strategy for your retirement assets it’s similar to building a house. You have to start with a foundation which is taxable income that you expect to receive before you begin taking withdrawals from your retirement accounts. For retirees that have pensions, this is the first layer. Income from pensions are typically taxable income at the federal level but may or may not be taxable at the state level depending on which state you live in and who the sponsor of the pension plan is. While pensions are great, retirees that have pension income have to be very careful about how they make withdrawals from their retirement accounts because any withdraws from pre-tax accounts will stack up on top of their pension income making those withdrawal potentially subject to higher tax rates or cause you to lose tax deductions and credits that were previously received.

Layer Two: Social Security

Social Security income is also something that has to be factored into the mix. Most retirees will have to pay federal income tax on a large portion of their Social Security benefit. When we are counseling clients on their Social Security filing strategy, one of the largest influencers in that decision is what type of retirement accounts that have and how much is in each account. Delaying Social Security each year, increases the amount that an individual receives in the range of 6% to 8% per year forever. As financial planners, we view this as a “guaranteed rate of return” which is tough to replicate in other asset classes. Not turning your Social Security benefit prior to your normal retirement age can:

· Increase 50% spousal benefit

· Increase the survivor benefit

· Increase the value of SS cost of living adjustments

· Reduce the amount required to be withdrawn for other sources

For purposes of this article, we will just look at Social Security as another layer of income but know that depending on your financial situation your Social Security filing strategy does factor into your asset withdrawal strategy.

Roth Accounts: Last To Touch

In most situations, Roth assets are typically the last asset that you touch in retirement. Since Roth assets accumulate and are withdrawn tax free, they are by far the most valuable vehicle to accumulate wealth long-term. The longer they accumulate, the more valuable they are.

The other wonderful feature about Roth IRAs is that there is no required minimum distributions (RMD’s) at age 72. Meaning the government does not force you to take distributions once you have reached a certain age so you can continue to accumulate wealth within that asset class.

Roth’s are also one of the most valuable assets to pass onto beneficiaries because they can continue to accumulate tax free and are withdrawn tax free. For spousal beneficiaries, they can roll over the balance into their own Roth IRA and continue to accumulate wealth tax free. For non-spouse beneficiaries, under the new 10 year rule, they can continue to accumulate wealth for a period of up to 10 years after inheriting the Roth before they are required to distribute the full balance but they don’t pay tax on any of it.

Financial Nerd Note: While Roth are great accumulation vehicles, it’s impossible to protect them from a long term care event spend down situation. They cannot be transferred into a Medicaid trust and they are subject to full spend down for purposes of qualifying for Medicaid in New York since there is no RMD requirements. It’s just a risk that I want you to be aware of.

Pre-tax Assets

Pre-taxed retirement assets often include:

· Traditional & Rollover IRAs

· 401k / 403b / 457 plans

· Deferred compensation plans

· Qualified Annuities

When you withdraw money from these pre-tax sources you have to pay federal income tax on the amount withdrawn but you may also have to pay state income tax as well. If you live in a state that has state income tax, it’s very important to understand the taxation rules for retirement accounts within your state.

For example, New York has a unique rule that each person over the age of 59½ is allowed to withdraw $20,000 from a pre-tax retirement account without having to pay state income tax. Any amounts withdrawn over that threshold in a given tax year are subject to state income tax.

Pretax retirement accounts are usually subject to something called a required minimum distribution (RMD). The IRS requires you to start taking small distributions out of your pre-tax retirement accounts at 72. Without proper guidance, retirees often make the mistake of withdrawing from their after tax assets first, and then waiting until they are required to take the RMD’s from their pre-tax retirement accounts at age 72 and beyond. But this creates a problem for many retirees because it causes:

· The distribution to be subject to higher tax rates

· Loss of tax deductions and credits

· Increase the tax ability of Social Security Increase Medicare premiums Loss of certain property tax credits for

seniors

· Other adverse consequences……

Instead as planners, we proactively plan ahead and ask questions like:

“instead of waiting until age 72 and taking larger RMD’s from the pre-tax account, does it make sense to start making annual distribution from the pre-tax retirement accounts leading up to age 72, thus spreading those distribution in lower amounts, across more tax year resulting in:

· Lower tax liability

· Lower Medicare premiums

· Maintaining tax deductions and credits

· The assets last longer due to a lower aggregate tax liability

· More inheritance for their family members

Since everyone’s tax situation and retirement income situation is different, we have to work closely with their tax professional to determine what the right amount is to withdraw out of the pre-tax retirement accounts each year to optimize their net worth long-term.

After Tax Accounts

After tax assets can include:

· Savings accounts

· Brokerage accounts

· Non-qualified annuities

· Life Insurance with cash value

Just because I’m listing them as “after tax assets” does not mean the whole account value is free and clear of taxes. What I’m referring to is the accounts listed above typically have some “cost basis” meaning a portion of the account it what was originally contributed to the account and can be withdrawal tax fee. The appreciation within the account would be taxes at either ordinary income or capital gains rates depending on the type of the account and how long the assets have been held in the account.

Having after tax assets often provides retirees with a tax advantage because they may be able to “choose their tax rate” when they retire. Meaning they can choose to withdrawal “X” amount from an after tax source and pay little know taxes and show very little taxable income in any given year which opens the door for more long term advanced tax planning.

Withdrawal Strategies

Now that have covered all of the different types of retirement assets and how they are taxed, let move into some of the common withdrawal strategies that we use with our clients:

Retirees With All Three: Pre-tax, Roth, and After-tax Assets

When retirees have all three types of retirement account sources, the strategy usually involves leaving the Roth assets for last, and then meeting with their accountant to determine the amount that should be withdrawn out of their pre-tax and after tax accounts year to minimize the amount of aggregate taxes that they pay long term.

Example: Jim and Carol are both age 67 and just retired and they financial picture consists of the following:

Joint brokerage account: $200,000

401(k)’s: $500,000

Roth IRA‘s: $50,000

Combined Social Security: $40,000

Annual Expenses $100,000

Residents of New York State

An optimal withdrawal strategy may include the following:

Assuming we recommend that they turn on Social Security at their normal retirement age, it will provide them with $40,000 pre-tax Income, 85% of their Social Security benefit will be taxed at the federal level but there will be no state tax deal, resulting in an estimated $35,000 after tax.

That means we need an additional $65,000 after-tax per year from another source to meet their $100,000 per year in expenses. Instead of taking all the money from their joint brokerage account, we could have them rollover their 401(k) balances into Traditional IRAs and then take $20,000 distributions each from their accounts which they not have to pay state income tax on because it’s below the $20K threshold. That would result in another $40,000 in pre-tax income, translating to $35,000 after-tax.

The final $30,000 that is needed to meet their annual expenses would most likely come from their after tax brokerage account unless their accountant advises differently.

This strategy accomplishes a number of goals:

1) We are withdrawing pre-tax retirement assets in smaller increments and taking advantage of the New York

State tax free portion every year. This should result in lower total taxes paid over their lifetime as opposed to waiting until RMD’s start at age 72 and then being required to take larger distributions which could push them over the $20,000 annual limit making them subject in your state tax income tax and higher federal tax rates.

2) We are preserving the after-tax brokerage account for a longer period of time as opposed to using it all to supplement their expenses which would only last for about two years and then they would be forced to take all of their distributions from their pre-tax retirement account making them subject to a higher tax liability

3) For the Roth accounts, we are law allowing them to continue to accumulate as much as possible resulting in more tax free dollars to be withdrawn in the future, or if they pass onto their children, they are inheriting a larger assets that can be withdrawn tax free.

All Pre-Tax Retirement Savings

It’s not uncommon for retirees to have 100% of their retirement savings all within a pre-tax sources like 401(k)s, 403(b)s, traditional IRA‘s, and other types of pre-tax retirement account. This makes the withdrawal strategy slightly more tricky because if there are any big one-time expenses that are incurred during retirement, it forces the retiree to take a large withdrawal from a pre-tax source which also increases the tax liability associate the distribution.

A common situation that we often have to maneuver around is retirees that have plans to purchase a second house in retirement but in order to do that they need to have the cash to come up with a down payment. If they don’t have any after-tax retirement savings, those amounts will most likely have to come from a pre-tax account. Withdrawing $60,000 or more for a down payment can lead to a higher tax liability, higher Medicare premiums the following year, and make a larger portion of your Social Security taxable. For clients in the situation, we often have to plan a few year ahead, and will begin taking pre-text Distributions over multiple tax years leading up to the purchase of the retirement house in an effort to spread the tax liability over multiple years and avoiding the adverse tax and financial consequences of taking one large distribution.

Since many retirees are afraid of taking on debt in retirement, we often get the question in these second house situations is “Should I just take a big distribution from my retirement, pay for the house in full, and not have a mortgage?” If all of the retirement assets are tied up in pre-tax sources, it typically makes the most sense to take a mortgage which allows you to then take smaller distributions from your IRA accounts over multiple tax years to make the mortgage payments compared to taking an enormous tax hit by withdrawing $200,000+ out of a pre-tax return account in a single year.

Pensions With No Need For Retirement Accounts

For retirees that have pensions, it’s not uncommon for their pension and Social Security to provide enough income to meet all of their expenses. But these individual may also have pre-tax retirement accounts and the question becomes “what do we do with them if we don’t need them, and we expect the kids to inherit them?”

This situation often involves a Roth conversion strategy where each year we convert money from the pre-tax IRA’s over to Roth IRA’s. This allows those retirement accounts to accumulate tax free and ultimately withdrawn tax free by the beneficiaries. Versus if they continue to accumulate in pre-tax retirement accounts, the beneficiaries will have to distribute those accounts within 10 years and pay tax on the full balance.

Also when those retirees turn age 72 they have to start taking required minimum distributions which they don’t necessarily need. Since they are receiving pension and Social Security income, those distributions from the retirement accounts could be subject to higher tax rates. By proactively moving assets from a pre-tax source to a Roth source we are essentially reducing the amount of retirement assets that will be subject to RMD’s at age 72 because Roth assets are not subject to RMD‘s.

Using this Roth conversion strategy, it’s also not uncommon for us to have these retirees delay their Social Security. Since Social Security is taxable at the federal level, if we delay Social Security, it gives us more room to process larger Roth conversions because it free up those lower tax brackets. At the same time, it also allows Social Security to accumulate at a guaranteed rate of 6% - 8%.

Nerd Note: When you process these Roth conversions, make sure you’re taking into account the tax liability that’s being generated. You have to have a way to pay the taxes on the amounts converted because the money goes directly from your traditional IRA to your Roth IRA. Retirees that implement this strategy typically have large cash holdings, after tax retirement holdings, or we convert some of the money, and take pre-tax IRA distribution to cover the taxes.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

When To Enroll In Medicare

Medicare has important deadlines that you need to be aware of during your initial enrollment period. Missing those deadlines could mean gaps in coverage, penalties, and limited options when it comes to selecting a Medicare

Medicare has important deadlines that you need to be aware of during your initial enrollment period. Missing those deadlines could mean gaps in coverage, penalties, and limited options when it comes to selecting a Medicare Supplemental Plan.

Many people are aware of the age 65 start date for Medicare, however, it’s not uncommon for individuals to work past age 65 and have health insurance coverage through their employer or through their spouse’s employer. For many of these individuals working past age 65, they are often surprised to find out that even though they are still covered by an employer sponsored health plan, depending on the size of the employer, and the insurance carrier, they may still be required to enroll in Medicare at age 65.

In this article we will cover:

Enrollment deadlines for Medicare

When to start the enrollment process

Effective dates of coverage

Special rules for individuals working past age 65

Medicare vs. employer health coverage

Initial Enrollment Period

For many individuals, when they turn age 65, they are required to enroll in Medicare Part A and Part B which becomes their primary health insurance provider. The Medicare initial enrollment period lasts for seven months. This period begins 3 months prior to the month of your 65th birthday and ends 3 months after that month.

Example: If you turn age 65 on June 10th, your initial enrollment period begins on March 1 and ends on September 30.

Retired and Collecting Social Security

If you are retired and you are already receiving Social Security benefits prior to your 65th birthday, no action is needed to enroll in Medicare Part A & B. Your Medicare card should arrive in the mail one or two months prior to your 65th birthday.

However, even though you are automatically enrolled in Medicare Part A and Part B, if you are not covered by a retiree health plan through your former employer, you should begin the process of enrolling in either a Medicare Supplemental Plan or Medicare Advantage Plan at least two months prior to your 65th birthday. Medicare Part A and Part B by itself, does not cover all of your health costs which is why most retirees obtain a Supplemental Plan. If you wait until your 65th birthday, the effective date of that Supplemental coverage may not begin until the following month which creates a gap in coverage.

As soon as you receive your Medicare card, you can enroll in a Medicare Supplemental Plan or Medicare Advantage Plan to ensure that both your Medicare coverage and Supplemental Coverage will begin as soon as your employer health coverage ends.

Retired But Not Collecting Social Security Yet

If you are retired, about to turn age 65, but you have not turned on your Social Security benefits yet, action is required. Medicare is not going to proactively notify you that you need to enroll in Medicare Part A & B. The responsibility of enrolling at the right time within your initial enrollment period falls 100% on you.

Three months prior to your 65th birthday you can either enroll in Medicare online or schedule an appointment to enroll in Medicare at your local Social Security office.

Note: If you plan to enroll in Medicare via an in-person meeting at the Social Security office, it is strongly recommended that you call your local Social Security office two months prior to the beginning of your initial enrollment period because they may require you to make an appointment.

If you decide to enroll online, it’s a fairly easy process, and it should only take you 10 to 15 minutes. Here is the link to enroll online: https://www.ssa.gov/benefits/medicare/

If you are simultaneously applying for Medicare and Social Security to begin at age 65, there is a separate link where you can enroll in both online: https://www.ssa.gov/retire

Working Past Age 65

If you or your spouse plan to work past age 65 and will be covered by an employer sponsored health plan, you may or may not need to enroll in Medicare at age 65. Unfortunately, many people assume that because they are covered by a company health plan, they don’t have to do anything with Medicare until they officially retire. That assumption can lead to problems for many people when they go to enroll in Medicare after age 65.

The following factors need to be taken into consideration if you have employer sponsored health coverage past age 65:

How many employees work for the company

The insurance company providing the health benefit

Does the plan qualify as “credible coverage” in the eyes of Medicare

The terms of your company’s plan

At Age 64: TAKE ACTION

I’m going to review each of the variables listed above but before I do, I want to make a blanket recommendation. If you plan to work past age 65 and will be covered by your employer’s health insurance plan, right after your 64th birthday, go talk to the person at your company that handles the health insurance benefit and ask them how the company’s health plan coordinates with Medicare. Do not wait until a week before you turn 65 to ask questions. If you or your spouse are required to enroll in Medicare, the process takes time.

19 or Fewer Employees

Medicare has a general rule of thumb that if a company has 19 or fewer employees, at age 65, employees have to enroll in Medicare Part A and B. Medicare becomes your primary insurance coverage and the employer’s health plan becomes your secondary insurance coverage. Your open enrollment period is the same as if you were turning age 65 with no employer health coverage.

20 or More Employees

If your company has 20 or more employees and the health insurance plan is considered “credible coverage” in the eyes on Medicare, there may be no action needed at age 65. As mentioned above, you should go to your human resource representative at your company, after your 64th birthday, to verify that the health plan that they have is considered “credible coverage” for Medicare. If it is, then there is no need to sign up for Medicare at age 65, your employer health coverage will continue to serve as your primary coverage until you retire.

However, if your company’s health plan does not qualify as “creditable coverage” then you will have to enroll in Medicare Part A & B at age 65 to avoid having to pay a penalty and avoid gaps in coverage once you officially retire.

Action: 90 Days Before You Retire

If you work past age 65 and have credible employer health coverage, 90 days before you plan to retire, you will need to take action regarding your Medicare benefits. This will ensure that your Medicare Part A & B coverage as well as your Medicare Supplemental coverage will begin immediately after your employer health insurance coverage ends.

When you retire after age 65, Medicare provides you with a “Special Enrollment Period”. You have 8 months to enroll in Medicare Part A & B without a late penalty:

63 Day Enrollment Window: Medicare Supplemental, Advantage, & Part D Plans

Even though the Special Enrollment Period lasts for 8 months, you only have 63 days after your employer coverage ends to enroll in a Medicare Supplemental, Medicare Advantage Plan (Part C), or a Medicare Part D Prescription Drug Plan. But remember, you are not eligible to enroll in those plans until after you have already enrolled in Medicare Part A & B which is why you need to start the process 90 days in advance of your actual retirement date to make sure you meet the deadlines.

COBRA Coverage Does Not Count

Some individuals voluntarily elect COBRA coverage after they retire to extend the employer based health coverage. But be aware, COBRA coverage does not count as credible insurance coverage in the eyes of Medicare regardless of the plan that you are covered by. If you do not enroll in Medicare within the eight months after leaving employment, you may face gaps in coverage and permanent Medicare penalties once your COBRA coverage ends.

Spousal Coverage After Age 65

You have to be very careful if you plan to be covered by your spouse’s employer sponsored health insurance past age 65. Some plans with 20 or more employees will serve as primary insurance provider for the employee but not their spouse. In these plans, the non-working spouse is required to enroll in Medicare at age 65.

We have even seen plans where the health insurance for the non-working spouse ends on the first day of the calendar year that they are scheduled to turn age 65. This creates a whole other issue because there is a gap in coverage between January 1st and when the non-working spouse turns age 65. Again, as soon as you or your spouse turn age 64, you should start asking questions about your health coverage.

The Insurance Company Matters

There are a few insurance companies that voluntarily deviate from the 19 or less employees rule listed above. These insurance companies serve as the primary insurance coverage for employee that work past age 65 regardless of the size of the company. Medicare does not fight it because the government is more than happy to allow an insurance company to foot the bill for your health coverage. In these cases, even if your company employs less than 20 employees, you do not have to take any action with regard to Medicare at age 65.

You Cannot Enroll Online

If you work past age 65 and have employer based health coverage, you do not have the option to enroll in Medicare online. You have to prove to Medicare that you have maintained credible health insurance coverage through your employer since age 65, otherwise you face penalties and potential gaps in coverage. You will need to make an appointment at your local Social Security office to enroll. Your employer or the health insurance company will provide you with a letter which serves as your proof of insurance coverage.

Enrolling in Medicare Supplemental or Medicare Advantage Plans

Once enrolled in Medicare Part A and part B, individuals that do not have retiree health benefits, will enroll in either a Medicare Advantage Plan or Medicare Supplemental Plan. You have to be enrolled in Medicare Part A & B, before you can enroll in a Supplemental or Advantage Plan.

It’s extremely important to understand the differences between a Medicare Supplemental Plan and Medicare Advantage Plan which is why we dedicated an entire article to this topic:

Article: Medicare Supplemental Plan vs. Medicare Advantage Plan

Retiree Health Benefits Through Your Former Employer

For employees that have retiree health coverage, you still need to enroll in Medicare Part A & B which serves as the primary insurance coverage and the retiree health coverage serves as your secondary insurance coverage.

Some larger employers even give employees access to multiple retiree health plans. You have to do your homework because some of those plans are structured as Supplemental Plans while others are structured as Advantage Plans.

Medicare vs Employer Health Coverage

Once you turn age 65, if you plan to continue to work, and have access to an employer based health plan, you still need to evaluate your options. A lot of companies have high deductible plans where the employee is required to pay a lot of money out of pocket before the insurance coverage begins. In general, Medicare Part A & B, paired with a Supplemental Plan, can offer very comprehensive coverage at a reasonable cost to individuals 65 and old. You have to compare how much you are paying in your employer health plan and the benefits, versus if you decided to voluntarily enroll in Medicare and obtain a Supplemental policy.

The results vary on a case by case basis and each person’s health needs are different but it’s worth running a comparison. In some cases, it can save both the employer and the employee money while providing the employee with a higher level of health insurance coverage.

Contact Us For Help

If you have any questions about anything Medicare related, please feel free to contact us at 518-477-6686. We are independent Medicare brokers and we can make the Medicare enrollment process easy, help you select the right Medicare Supplemental or Advantage Plan, and provide you with ongoing support with your Medicare benefits in retirement.

Other Medicare Articles

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Do Social Security Survivor Benefits Work?

Social Security payments can sometimes be a significant portion of a couple’s retirement income. If your spouse passes away unexpectedly, it can have a dramatic impact on your financial wellbeing in retirement. This is especially

Social Security payments can sometimes be a significant portion of a couple’s retirement income. If your spouse passes away unexpectedly, it can have a dramatic impact on your financial well-being in retirement. This is especially true if there was a big income difference between you and your spouse. In this article, we will review:

Who is eligible to receive the Social Security Survivor's Benefit

How the benefit is calculated

Electing to take the benefit early vs. delaying the benefit

Filing strategies that allow the surviving spouse to receive more from Social Security

Social Security Earned Income Penalty

Social Security filing strategies that married couples should consider preserving the Survivor Benefit

Divorce: 2 Ex-spouses & 1 Current Spouse: All receiving the same Survivor Benefit

How Much Social Security Does A Surviving Spouse Receive?

When your spouse passes away, as the surviving spouse, you are entitled to receive the higher of the two benefits. You do not continue to collect both benefits simultaneously.

Example: Jim is age 80 and he is collecting a Social Security benefit of $2,500 per month. His wife Sarah is 79 and is collecting $2,000 per month for her Social Security benefit.