IRA RMD Start Date Changed From Age 70 ½ to Age 72 Starting In 2020

The SECURE Act was passed into law on December 19, 2019 and with it came some big changes to the required minimum distribution (“RMD”) requirements from IRA’s and retirement plans. Prior to December 31, 2019, individuals

The SECURE Act was passed into law on December 19, 2019 and with it came some big changes to the required minimum distribution (“RMD”) requirements from IRA’s and retirement plans. Prior to December 31, 2019, individuals were required to begin taking mandatory distributions from their IRA’s, 401(k), 403(b), and other pre-tax retirement accounts starting in the year that they turned age 70 ½. The SECURE Act delayed the start date of the RMD’s to age 72. But like most new laws, it’s not just a simple and straightforward change. In this article we will review:

Old Rules vs New Rules surrounding RMD’s

New rules surrounding Qualified Charitable Distributions from IRA’s

Who is still subject to the 70 ½ RMD requirement?

The April 1st delay rule

Required Minimum Distributions

A quick background on required minimum distributions, also referred to as RMD’s. Prior to the SECURE Act, when you turned age 70 ½ the IRS required you to take small distributions from your pre-tax IRA’s and retirement accounts each year. For individuals that did not need the money, they did not have a choice. They were forced to withdraw the money out of their retirement accounts and pay tax on the distributions. Under the current life expectancy tables, in the year that you turned age 70 ½ you were required to take a distribution equaling 3.6% of the account balance as of the previous year end.

With the passing of the SECURE Act, the start age from these RMD’s is now delayed until the calendar year that an individual turns age 72.

OLD RULE: Age 70 ½ RMD Begin Date

NEW RULE: Age 72 RMD Begin Date

Still Subject To The Old 70 ½ Rule

If you turned age 70 ½ prior to December 31, 2019, you will still be required to take RMD’s from your retirement accounts under the old 70 ½ RMD rule. You are not able to delay the RMD’s until age 72.

Example: Sarah was born May 15, 1949. She turned 70 on May 15, 2019 making her age 70 ½ on November 15, 2019. Even though she technically could have delayed her first RMD to April 1, 2020, she will not be able to avoid taking the RMD’s for 2019 and 2020 even though she will be under that age of 72 during those tax years.

Here is a quick date of birth reference to determine if you will be subject to the old 70 ½ start date or the new age 72 start date:

Date of Birth Prior to July 1, 1949: Subject to Age 70 ½ start date for RMD

Date of Birth On or After July 1, 1949: Subject to Age 72 start date for RMD

April 1 Exception Retained

OLD RULE: In the the year that an individual turned age 70 ½, they had the option to delay their first RMD until April 1st of the following year. This is a tax strategy that individuals engaged in to push that additional taxable income associated with the RMD into the next tax year. However, in year 2, the individual was then required to take two RMD’s in that calendar year: One prior to April 1st for the previous tax year and the second prior to December 31st for the current tax year.

NEW RULE: Unchanged. The April 1st exception for the first RMD year was retained by the SECURE Act as well as the requirement that if the RMD was voluntarily delayed until the following year that two RMD’s would need be taken in the second year.

Qualified Charitable Distributions (QCD)

OLD RULES: Individuals that had reached the RMD age of 70 ½ had the option to distribute all or a portion of their RMD directly to a charitable organization to avoid having to pay tax on the distribution. This option was reserved only for individuals that had reached age 70 ½. In conjunction with tax reform that took place a few years ago, this has become a very popular option for individuals that make charitable contributions because most individual taxpayers are no longer able to deduct their charitable contributions under the new tax laws.

NEW RULES: With the delay of the RMD start date to age 72, do individuals now have to wait until age 72 to be eligible to make qualified charitable distributions? The answer is thankfully no. Even though the RMD start date is delayed until age 72, individuals will still be able to make tax free charitable distributions from their IRA’s in the calendar year that they turn age 70 ½. The limit on QCDs is still $100,000 for each calendar year.

NOTE: If you plan to process a qualified charitable distributions from your IRA after age 70 ½, you have to be well aware of the procedures for completing those special distributions otherwise it could cause those distributions to be taxable to the owner of the IRA. See the article below for more on this topic:

ANOTHER NEW RULE: There is a second new rule associated with the SECURE Act that will impact this Qualified Charitable Distribution strategy. Under the old tax law, individuals were unable to contribute to Traditional IRA’s past the age of 70 ½. The SECURE Act eliminated that rule so individuals that have earned income past age 70 ½ will be eligible to make contributions to Traditional IRAs and take a tax deduction for those contributions.

As an anti-abuse provision, any contributions made to a Traditional IRA past the age of 70 ½ will, in aggregate, dollar for dollar, reduce the amount of your qualified charitable distribution that is tax free.

Example: A 75 year old retiree was working part-time making $20,000 per year for the past 3 years. To reduce her tax bill, she contributed $7,000 per year to a traditional IRA which is allowed under the new tax laws. This year she is required to take a $30,000 required minimum distribution (RMD) from her retirement accounts and she wants to direct that all to charity to avoid having to pay tax on the $30,000. Because she contributed $21,000 to a traditional IRA past the age of 70 ½, $21,000 of the qualified charitable distribution would be taxable income to her, while the remaining $9,000 would be a tax free distribution to the charity.

$30,000 QCD – $21,000 IRA Contribution After Age 70 ½ = $9,000 tax free QCD

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Introduction To Medicare

As you approach age 65, there are very important decisions that you will have to make regarding your Medicare coverage. Whether you decide to retire prior to age 65, continue to work past age 65, or have retiree health benefits,

As you approach age 65, there are very important decisions that you will have to make regarding your Medicare coverage. Whether you decide to retire prior to age 65, continue to work past age 65, or have retiree health benefits, you will have to make decisions regarding your Medicare coverage and for many of those decisions you only get one shot at making the right one. The wrong decision can cost you tens of thousands, if not hundreds of thousands of dollars, in retirement via:

Gaps in your coverage leading to unexpected medical bills

Over coverage: Paying too much for insurance that you are not using

Penalties for missing key Medicare enrollment deadlines

The problem is there are a lot of options, deadlines, rules to follow, and with rules there are always exceptions to the rules that you need to be aware of. To make an informed decision you must understand Medicare Part A, Part B, Medicare Supplemental Plans, Medicare Advantage Plans, Part D drug plans, and special exceptions that apply based on the state that you live in.

I urge everyone to read this article whether it’s for you, your parents, grandparents, friends, or other family members. You may be able to help someone that is trying to make these very important healthcare decisions for themselves and it’s very easy to get lost in the Medicare jungle.

Initially my goal was to write a single article to summarize the decisions that retirees face with regard to Medicare. I realized very quickly that the article would end up looking more like a book. So instead I’ve decided to separate the information into series of articles. This first article will provide you with a general overview of Medicare but at the bottom of each article you will find links to other articles that will provide you with more information about Medicare.

With that, let’s go ahead and jump into the first article which will provide you with a broad overview of how Medicare works.

What is Medicare?

Medicare is the government program that provides you with your healthcare benefits after you turn 65. Medicare is run by the Social Security administration, meaning you contact your Social Security office when you have questions or when you apply for benefits.

Original Medicare

While there are a lot of decisions that have to be made about your Medicare benefits, all of the benefits are built on the foundation of Medicare Part A and Medicare Part B. Medicare Part A and Part B together are referred to as “Original Medicare”. You will see the term Original Medicare used a lot when reading about your Medicare options.

Medicare Part A

Medicare Part A covers your inpatient health services such as:

1) Hospitalization

2) Nursing home (Limited)

3) Hospice

4) Home health services (Limited)

As long as you or your spouse worked for at least 10 years, Medicare Part A is provided to you at no cost. During your working years you paid the Medicare tax of 1.45% as part of your payroll taxes. If you or your spouse did not work 10 years or more then you’re still eligible for Medicare Part A but you will have to pay a monthly premium. There are special eligibility rules for individuals that do not meet the 10 year requirement but are either divorced or widowed.

Medicare Part A Is Not Totally “Free”

While there are no monthly premium payments that need to be made for enrolling in Medicare Part A there are deductibles and coinsurance associated with your Part A coverage. While many of us have encountered deductibles, co-pays, and coinsurance through our employer sponsored health insurance plans, I’m going to pause for a moment just to explain three key terms associated with health insurance plans.

Deductible: This is the amount that you have to pay out of pocket before the insurance starts to pay for your healthcare costs. Example, if you have $1,000 deductible, you have to pay $1,000 out-of-pocket before the insurance will start paying anything for the cost of your care.

Co-pays: Co-pays are those small amounts that you have to pay each time a specific service is rendered such as a doctor’s visit or when you pick up a prescription. Example, you may have to pay $25 every time you visit your primary care doctor.

Coinsurance: This is cost sharing between you and the insurance company that’s expressed as either a percentage or a flat dollar amount. Example, if you have a 20% coinsurance for hospital visits, if the hospital bill is $10,000, you pay $2,000 (20%) and the insurance company will pay the remaining $8,000.

Maximum Out Of Pocket: This the maximum dollar amount that you have to pay each year out of pocket before your health care needs are 100% covered by your Medicare or insurance coverage. If your insurance policy has a $5,000 maximum out of pocket, after you have paid $5,000 out of pocket for that calendar year, you will not be expected to pay anything else for the remainder of the year. Monthly premiums and prescription drug costs do not count toward your maximum out of the pocket threshold.

Medicare Part A Has The Following Cost Sharing Structure For 2025

As you will see in the table above, while you don’t have a monthly premium for Medicare Part A, if you are hospitalized at some point during the year, you would have to first pay $1,676 out of pocket before Medicare starts to pay for your health care costs. In addition, there is a flat dollar amount co-insurance, which is in addition to the deductible, and that amount varies depending on when the health services are performed during the calendar year.

Medicare Part B

Medicare Part B covers your outpatient health services. These include:

1) Doctors visits

2) Lab work

3) Preventative care (flu shots)

4) Ambulance rides

5) Home health care

6) Chiropractic care (limited)

7) Medical equipment

Unlike Medicare Part A, Medicare Part B has a monthly premium that you will need to pay once you enroll. The amount of the monthly premium is based on your adjusted gross income (AGI). The higher your income, the higher the monthly premium. Below is the 2019 Part B premium table.

As you will see on the chart, the minimum monthly premium is $185.00 per month which translates to $2,220 per year. The income threshold in this chart will vary each year.

Medicare 2-Year Lookback At Income

Medicare automatically looks at your AGI from two years prior to determine your AGI for purposes of Part B premium. In the first few years of receiving Medicare, this 2-year lookback can create an issue. If you retire in 2025, they are going to look at your 2023 tax return which probably has a full year worth of income because you were still working full time back in 2023. If your AGI was $200,000 in 2023, they would charge you more than twice the minimum premium for your Part B coverage.

I have good news. There is an easy fix to this problem. You are able to appeal your income to the Social Security Administration due to a “life changing event”. You can ask Social Security to use your most recent income and you typically have to provide proof to Social Security that you retired in 2025. They will sometimes request a letter signed by your former employer verifying your retirement date and a copy of your final paycheck. You will need to file Form SSA-44.

The Medicare Part B premiums are automatically deducted from your monthly Social Security or Railroad Retirement Benefit payments. If you are 65 and have not yet turned on Social Security, Medicare will invoice you quarterly for those premium amounts and you can pay by check.

Medicare Part B Deductibles and Coinsurance

In addition to the monthly premiums associated with Part B, as with Part A, there are deductibles and coinsurance associated with Part B coverage. Part B carries:

Annual Deductible: $257

Coinsurance: 20%

Example: In January, your doctor tells you that you need your knee replaced. If the surgery costs $50,000, you would have to pay the first $257 out of pocket, and then you would have to pay an additional $9,948.60 which is 20% of the remaining amount. Not a favorable situation.

But wait, wouldn’t that be covered under Medicare Part A because it happened at a hospital? Not necessarily because “doctor services” performed in a hospital are typically covered under Medicare Part B.

The Largest Issue with Original Medicare is……..

It unfortunately gets worse. If all you have is Original Medicare (Part A & B), there is no Maximum Out of Pocket Limit. Meaning if you get diagnosed with a rare or terminal disease, and your medical bills for the year are $500,000, you may have to pay out of pocket a large portion of that $500,000.

Also, there is no prescription drug coverage under Original Medicare. So you would have the pay the sticker price of all of your prescription drugs out of pocket with no out of pocket limits.

Medicare Part C, Medicare Part D, and Medicare Supplemental Plans

To help individuals over 65 to manage these large costs associated with Original Medicare, there is:

Medicare Part C – Medicare Advantage Plans

Medicare Part D – Standalone Prescription Drug Plans

Medicare Supplemental Plans (“Medigap plans”)

Who Provides What?

Before I get into what each option provides, let’s first identify who provides what:

Medicare Part A: U.S. Government

Medicare Part B: U.S. Government

Medicare Part C – (Medicare Advantage Plan): Private Insurance Company

Medicare Part D – (Prescription Drug Plan): Private Insurance Company

Medicare Supplemental Plan (“Medigap”): Private Insurance Company

The Most Important Decision

Here is where the road splits. To help retirees manage the cost and coverage gaps not covered by Original Medicare, you have two options:

Select a Medicare Advantage Plan

Select a Medicare Supplemental Plan & Medicare Part D Plan

When it comes to your health care decisions in retirement, this is one of the most important decisions that you are going to make. Depending on what state you live in, you may only have one-shot at this decision. It is so vitally important that you fully understand the pros and cons of each option. Unfortunately, as we will detail in other articles, there is big push by the insurance industry to persuade individuals to select the Medicare Advantage option. Both the private insurance company and the insurance agent selling you the policy get paid a lot more when you select a Medicare Advantage Plan instead of a Medicare Supplemental Plan. While this may be the right choice for some individuals, there are significant risks that individuals need to be aware of before selecting a Medicare Advantage Plan.

Medicare Advantage Plans

VERY IMPORTANT: Medicare Advantage Plans and Medicare Supplemental Plans are NOT the same. Medicare Advantage Plans are NOT “Medigap Plans”.

Medicare Advantage Plans do NOT “supplement” your Original Medicare coverage. Medicare Advantage Plans REPLACE your Medicare coverage. If you sign up for a Medicare Advantage Plan, you are no longer covered by Medicare. Medicare has sold you to the private insurance company.

Medicare Advantage Plans are not necessarily an “enhancement” to your Original Medicare Benefit. They are what the insurance industry considers an “actuarial equivalent”. The term actuarial equivalent benefit is just a fancy way of saying that at a minimum it is “worth the same dollar amount”. Medicare Advantage Plans are required to cover the same procedures that are covered under Medicare Part A & B but not necessarily at the same cost. The actuarial equivalent means when they have a large group of individuals, on average, those people are going to receive the same dollar value of benefit as Original Medicare would have provided. In other words, there are going to be clear winners and losers within the Medicare Advantage Plan structure. You are essentially rolling the dice as to what camp you are going to end up in.

If you enroll in a Medicare Advantage Plan, you will no longer have a Medicare card that you show to your doctors. You will receive an insurance card from the private insurance company. If you have a problem with your healthcare coverage, you do not call Medicare. Medicare is no longer involved.

Why Do People Choose Medicare Advantage Plans?

Here are the top reasons why we see people select Medicare Advantage Plan:

Provide Maximum Out Of Pocket protection

Prescription Drug Coverage

Lower Monthly Premium Compared To Medicare Supplemental Plans

Medicare Supplemental Plans (Medigap)

Now let’s switch gears to Medicare Supplemental Plans, also known as “Medigap Plans”. Unlike Medicare Advantage Plan that replace your Medicare Part A & B coverage, with Medicare Supplement Plans you keep your Original Medicare Coverage and these insurance policies fill in the gaps associated with Medicare Part A & B. So it’s truly an enhancement to your Medicare A & B coverage and not just an actuarial equivalent.

There are different levels of benefits within each of the Medigap plans. Each program is identified with a letter that range from A to N. Here is the chart matrix that shows what each of these programs provides.

For example if you go with plan G which is one of the most popular of the Medigap plans going into 2026, most of the costs associated with Original Medicare are covered by your Supplemental Insurance policy. All you pay is the monthly premium, the $257 Part B deductible, and some small co-pays.

Like Medicare advantage plans, Medicare supplemental plans are provided by private insurance companies. However, what’s different is these plans are standardized. “Standardized” means regardless of what insurance company you select, the health insurance benefits associated with those plans are exactly the same. The only difference is the price that you pay for your monthly premium which is why it makes sense to compare the prices of these plans for each insurance company that offers supplemental plans in your zip code.

VERY IMPORTANT: Not all insurance companies offer Medicare Supplemental Plans. Some just offer Medicare Advantage Plans. So if you end up calling an insurance company directly or meeting directly with an insurance company to discuss your Medicare options, those companies may not even present Medicare Supplemental plans as an option even though that might be the best fit for your personal health insurance needs.

However, even if the insurance company offers Medicare Supplemental plans, you still shop that same plan with other insurance companies. They may tell you “yes we have a Medigap Plan G” but their Medigap Plan G monthly premium may be $100 more per month than another insurance company. Remember, Medicare Supplemental plans are standardized meaning Plan G is the same regardless of which insurance company provides you with your coverage.

Part D – Prescription Drug Plans

If you decide to keep your Original Medicare and add a Medicare Supplemental Plan, you will also have to select a Medicare Part D – Prescription Drug plan to cover the cost of your prescriptions. Unlike Medicare Advantage Plan that have drug coverage bundled into their plans, Medicare Supplemental Plans are medical only, so you need a separate drug plans to cover your prescriptions. It can be beneficial to have a standalone drug plans because you are able to select a plan that favors the prescription drugs that you are taking which could lead to lower out of pocket costs throughout the year. Unlike a Medicare Advantage plan where the prescription drug plan is not customized for you because it’s a take it or leave it bundle.

Summary

This article was a 30,000 foot view of Medicare Part A, B, C, D, and Medicare Supplemental Plans. There is a lot more to Medicare such as:

Enrollment deadlines for Medicare

How to enroll with Medicare

Comparison of Medicare Advantage & Medicare Supplemental Plans

Special Exceptions for NY & CT residents

Working past age 65

Coordinating Medicare With Retiree Health Benefits

And so many more considerations that will factor into your Medicare decision as you approach age 65 or leave the workforce after age 65.

VERY IMPORTANT: People have different health needs, budgets, and timelines for retirement. Medicare solutions are not a one size fits all solution. The decisions that your co-worker made, friend made, or family member made, may not be the best solution for you. Plus remember, Medicare is complex, and we have found without help, many people do not understand all of the options. I have met with clients that have told me that “they have a supplemental plan” only to find out that they had a Medicare Advantage plan and didn’t know it because they never knew the difference between the two when the policies were issued to them. It makes working with an independent Medicare insurance agent very important.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Potential Consequences of Taking IRA Distributions to Pay Off Debt

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents

Taking IRA Distributions to Pay Off Debt: The Tax Consequences

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents opportunities to use retirement savings to pay off debt; but before doing so, it is important to consider the possible consequences.

Clients often come to us saying they have some amount left on a mortgage and they would feel great if they could just pay it off. Lower monthly bills and less debt when living on a fixed income is certainly good, both from a financial and psychological point of view, but taking large distributions from retirement accounts just to pay off debt may lead to tax consequences that can make you worse off financially.

Below are three items I typically consider before making a recommendation for clients. Every retiree is different so consulting with a professional such as a financial planner or accountant is recommended if you’d like further guidance.

Impact on State Income and Property Taxes

Depending on what state you are in, withdrawals from IRA’s could be taxed very differently. It is important to know how they are taxed in your state before making any big decision like this. For example, New York State allows for tax free withdrawals of IRA accounts up to a maximum of $20,000 per recipient receiving the funds. Once the $20,000 limit is met in a certain year, any distribution you take above that will be taxed.

If someone normally pulls $15,000 a year from a retirement account to meet expenses and then wanted to pull another $50,000 to pay off a mortgage, they have created $45,000 of additional taxable income to New York State. This is typically not a good thing, especially if in the future you never have to pull more than $20,000 in a year, as you would have never paid New York State taxes on the distributions.

Note: Another item to consider regarding states is the impact on property taxes. For example, New York State offers an “Enhanced STAR” credit if you are over the age of 65, but it is dependent on income. Here is an article that discusses this in more detail STAR Property Tax Credit: Make Sure You Know The New Income Limits.

What Tax Bracket Are You in at the Federal Level?

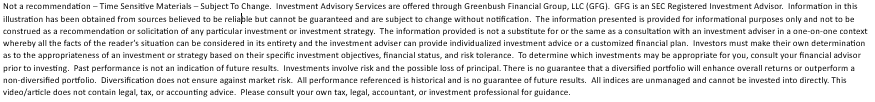

Federal income taxes are determined using a “Progressive Tax” calculation. For example, if you are filing single, the first $11,925 of taxable income you have is taxed at a lower rate than any income you earn above that. Below are charts of the 2025 tax tables so you can review the different tax rates at certain income levels for single and married filing joint ( ). ( Source: Nerd Wallet ).

There isn’t much of a difference between the first two brackets of 10% and 12%, but the next jump is to 22%. This means that, if you are filing single, you are paying the government 10% more on any additional taxable income from $48,476 – $103,350. Below is a basic example of how taking a large distribution from the IRA could impact your federal tax liability.

How Will it Impact the Amount of Social Security You Pay Tax on?

This is usually the most complicated to calculate. Here is a link to the 2024 instructions and worksheets for calculating how much of your Social Security benefit will be taxed ( IRS Publication 915 ). Basically, by showing more income, you may have to pay tax on more of your Social Security benefit. Below is a chart put together with information from the IRS to show how much of your benefit may be taxed.

To calculate “Combined Income”, you take your Adjusted Gross Income + Nontaxable Interest + Half of your Social Security benefit. For the purpose of this discussion, remember that any amount you withdraw from your IRA is counted in your Combined Income and therefore could make more of your social security benefit subject to tax.

Peace of mind is key and usually having less bills or debt can provide that, but it is important to look at the cost you are paying for it. There are times that this strategy could make sense, but if you have questions about a personal situation please consult with a professional to put together the correct strategy.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

How To Change Your Residency To Another State For Tax Purposes

If you live in an unfriendly tax state such as New York or California, it’s not uncommon for your retirement plans to include a move to a more tax friendly state once your working years are over. Many southern states offer nicer weather, no income taxes, and lower property taxes. According to data from the US Census Bureau, more residents

If you live in an unfriendly tax state such as New York or California, it’s not uncommon for your retirement plans to include a move to a more tax friendly state once your working years are over. Many southern states offer nicer weather, no income taxes, and lower property taxes. According to data from the US Census Bureau, more residents left New York than any other state in the U.S. Between July 2017 and July 2018, New York lost 180,360 residents and gained only 131,726, resulting in a net loss of 48,560 residents. With 10,000 Baby Boomers turning 65 per day over the next few years, those numbers are expected to escalate as retirees continue to leave the state.

When we meet with clients to build their retirement projections, the one thing anchoring many people to their current state despite higher taxes is family. It’s not uncommon for retirees to have children and grandchildren living close by so they greatly favor the “snow bird” routine. They will often downsize their primary residence in New York and then purchase a condo or small house down in Florida so they can head south when the snow starts to fly.

The inevitable question that comes up during those meetings is “Since I have a house in Florida, how do I become a resident of Florida so I can pay less in taxes?” It’s not as easy as most people think. There are very strict rules that define where your state of domicile is for tax purposes. It’s not uncommon for states to initiate tax audit of residents that leave their state to claim domicile in another state and they split time travelling back and forth between the two states. Be aware, the state on the losing end of that equation will often do whatever it can to recoup that lost tax revenue. It’s one of those guilty until proven innocent type scenarios so taxpayers fleeing to more tax favorable states need to be well aware of the rules.

Residency vs Domicile

First, you have to understand the difference between “residency” and “domicile”. It may sound weird but you can actually be considered a “resident” of more than one state in a single tax year without an actual move taking place but for tax purposes each person only has one state of “domicile”.

Domicile is the most important. Think of domicile as your roots. If you owned 50 houses all around the world, for tax purposes, you have to identify via facts and circumstances which house is your home base. Domicile is important because regardless of where you work or earn income around the world, your state of domicile always has the right to tax all of your income regardless of where it was earned.

While each state recognizes that a taxpayer only has one state of domicile, each state has its own definition of who they considered to be a “resident” for tax purposes. If you are considered a resident of a particular state then that state has the right to tax you on any income that was earned in that state. But they are not allowed to tax income earned or received outside of their state like your state of domicile does.

States Set Their Own Residency Rules

To make the process even more fun, each state has their own criteria that defines who they considered to be a resident of their state. For example, in New York and New Jersey, they consider someone to be a resident if they maintain a home in that state for all or most of the year, and they spend at least half the year within the state (184 days). Other states use a 200 day threshold. If you happen to meet the residency requirement of more than one state in a single year, then two different states could consider you a resident and you would have to file a tax return for each state.

Domicile Is The Most Important

Your state of domicile impacts more that just your taxes. Your state of domicile dictates your asset protection rules, family law, estate laws, property tax breaks, etc. From an income tax standpoint, it’s the most powerful classification because they have right to tax your income no matter where it was earned. For example, your domicile state is New York but you worked for a multinational company and you spent a few months working in Ireland, a few months in New Jersey, and most of the year renting a house and working in Florida. You also have a rental property in Virginia and are co-owners of a business based out of Texas. Even though you did not spend a single day physically in New York during the year, they still have the right to tax all of your income that you earned throughout the year.

What Prevents Double Taxation?

So what prevents double taxation where they tax you in the state where the money is earned and then tax you again in your state of domicile? Fortunately, most states provide you with a credit for taxes paid to other states. For example, if my state of domicile is Colorado which has a 4% state income tax and I earned some wages in New York which has a 7% state income tax rate, when I file my state tax return in Colorado, I will not own any additional state taxes on those wages because Colorado provides me with a credit for the 7% tax that I already paid to New York.

It only hurts when you go the other way. Your state of domicile is New York and you earned wage in Colorado during the year. New York will credit you with the 4% in state tax that you paid to Colorado but you will still owe another 3% to New York State since they have the right to tax all of your income as your state of domicile.

Count The Number Of Days

Most people think that if they own two houses, one in New York and one in Florida, as long as they keep a log showing that they lived in Florida for more than half the year that they are free to claim Florida, the more tax favorable state, as their state of domicile. I have some bad news. It’s not that easy. The key in all of this is to take enough steps to prove that your new house is your home base. While the number of days that you spend living in the new house is a key factor, by itself, it’s usually not enough to win an audit.

That notebook or excel spreadsheet that you used to keep a paper trail of the number of days that you spent at each location, while it may be helpful, the state conducting the audit may just use the extra paper in your notebook to provide you with the long list of information that they are going to need to construct their own timeline. I’m not exaggerating when I say that they will request your credit card statement to see when and where you were spending money, freeway charges, cell phone records with GPS time and date stamps, dentist appointments, and other items that give them a clear picture of where you spent most of your time throughout the year. If you supposedly live in Florida but your dentist, doctors, country club, and newspaper subscriptions are all in New York, it’s going to be very difficult to win that audit. Remember the number of days that you spend in the state is just one factor.

Proving Your State of Domicile

There are a number of action items that you should take if it’s your intent to travel back and forth between two states during the year, and it’s your intent to claim domicile in the more favorable tax state. Here is the list of the action items that you should consider to prove domicile in your state of choice:

Register to vote and physically vote in that state

Register your car and/or boat

Establish gym memberships

Newspapers and magazine subscriptions

Update your estate document to comply with the domicile state laws

Use local doctors and dentists

File your taxes as a resident

Have mail forwarded from your “old house” to your “new house”

Part-time employment in that state

Join country clubs, social clubs, etc.

Host family gatherings in your state of domicile

Change your car insurance

Attend a house of worship in that state

Where your pets are located

Dog Saves Owner $400,000 In Taxes

Probably the most famous court case in this area of the law was the Petition of Gregory Blatt. New York was challenging Mr Blatt’s change of domicile from New York to Texas. While he had taken numerous steps to prove domicile in Texas at the end of the day it was his dog that saved him. The State of New York Division of Tax Appeals in February 2017 ruled that “his change in domicile to Dallas was complete once his dog was moved there”. Mans best friends saved him more than $400,000 in income tax that New York was after him for.

Audit Risk

When we discuss this topic people frequently ask “what are my chances of getting audited?” While some audits are completely random, from the conversations that we have had with accountants in this subject area, it would seem that the more you make, the higher the chances are of getting audited if you change your state of domicile. I guess that makes sense. If your Mr Blatt and you are paying New York State $100,000 per year in income taxes, they are probably going to miss that money when you leave enough to press you on the issue. But if all you have is a NYS pension, social security, and a few small distributions from an IRA, you might have been paying little to no income tax to New York State as it is, so the state has very little to gain by auditing you.

But one of the biggest “no no’s” is changing your state of domicile on January 1st. Yes, it makes your taxes easier because you file your taxes in your old state of domicile for last year and then you get to start fresh with your new state of domicile in the current year without having to file two state tax returns in a single year. However, it’s a beaming red audit flag. Who actually moves on New Year’s Eve? Not many people, so don’t celebrate your move by inviting a state tax audit from your old state of domicile

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Advanced Tax Strategies For Inherited IRA's

Inherited IRA’s can be tricky. There are a lot of rules surrounding;

Establishment and required minimum distribution (“RMD”) deadlines

Options available to spouse and non-spouse beneficiaries

Strategies for deferring required minimum distributions

Special 60 day rollover rules for inherited IRA’s

Inherited IRA’s can be tricky. There are a lot of rules surrounding;

Establishment and required minimum distribution (“RMD”) deadlines

Options available to spouse and non-spouse beneficiaries

Strategies for deferring required minimum distributions

Special 60 day rollover rules for inherited IRA’s

Establishment Deadline

If the decedent passed away prior to December 31, 2019, as a non-spouse beneficiary you have until December 31st of the year following the decedent’s death to establish an inherited IRA, rollover the balance into that IRA, and begin taking RMD’s based your life expectancy. If you miss that deadline, you are locked into distribution the full balance with a 10 year period.

If the decedent passed away January 1, 2020 or later, with limited exceptions, the inherited IRA rollover option with the stretch option is no longer available to non-spouse beneficiaries.

RMD Deadline - Decedent Passed Away Prior to 12/31/19

If you successfully establish an inherited IRA by the December 31st deadline, if you are non-spouse beneficiary, you will be required to start taking a “required minimum distribution” based on your own life expectancy in the calendar year following the decedent’s date of death.

Here is the most common RMD mistake that is made. The beneficiary forgets to take an RMD from the IRA in the year that the decedent passes away. If someone passes away toward the beginning of the year, there is a high likelihood that they did not take the RMD out of their IRA for that year. They are required to do so and the RMD amount is based on what the decedent was required to take for that calendar year, not based on the life expectancy of the beneficiary. A lot of investment providers miss this and a lot of beneficiaries don’t know to ask this question. The penalty? A lovely 50% excise tax by the IRS on the amount that should have been taken.

Distribution Options Available To A Spouse

If you are the spouse of the decedent you have three distribution options available to you:

Take a cash distribution

Rollover the balance to your own IRA

Rollover the balance to an Inherited IRA

Cash distributions are treated the same whether you are a spouse or non-spouse beneficiary. You incur income tax on the amounts distributed but you do not incur the 10% early withdrawal penalty regardless of age because it’s considered a “death distribution”. For example, if the beneficiary is 50, normally if distributions are taken from a retirement account, they get hit with a 10% early withdrawal penalty for not being over the age of 59½. For death distributions to beneficiaries, that 10% penalty is waived.

#1 Mistake Made By Spouse Beneficiaries

This exemption of the 10% early withdrawal penalty leads me to the number one mistake that we see spouses make when choosing from the three distribution options listed above. The spouse has a distribution option that is not available to non-spouse beneficiaries which is the ability to rollover the balance to their own IRA. While this is typically viewed as the easiest option, in many cases, it is not the most ideal option. If the spouse is under 59½, they rollover the balance to their own IRA, if for whatever reason they need to access the funds in that IRA, they will get hit with income taxes AND the 10% early withdrawal penalty because it’s now considered an “early distribution” from their own IRA.

Myth: Spouse Beneficiaries Have To Take RMD’s From Inherited IRA’s

Most spouse beneficiaries make the mistake of thinking that by rolling over the balance to their own IRA instead of an Inherited IRA they can avoid the annual RMD requirement. However, unlike non-spouse beneficiaries which are required to take taxable distributions each year, if you are the spouse of the decedent you do not have to take RMD’s from the inherited IRA unless your spouse would have been age 70 ½ if they were still alive. Wait…..what?

Let me explain. Let’s say there is a husband age 50 and a wife age 45. The husband passes away and the wife is the sole beneficiary of his retirement accounts. If the wife rolls over the balance to an Inherited IRA, she will avoid taxes and penalties on the distribution, and she will not be required to take RMD’s from the inherited IRA for 20 years, which is the year that their deceased spouse would have turned age 70 ½. This gives the wife access to the IRA if needed prior to age 59 ½ without incurring the 10% penalty.

Wait, It Gets Better......

But wait, since the wife was 5 years young than the husband, wouldn’t she have to start taking RMD’s 5 years sooner than if she just rolled over the balance to her own IRA? If she keeps the balance in the Inherited IRA the answer is “Yes” but here is an IRA secret. At any time, a spouse beneficiary is allowed to rollover the balance in their inherited IRA to their own IRA. So in the example above, the wife in year 19 could rollover the balance in the inherited IRA to her own IRA and avoid having to take RMD’s until she reaches age 70½. The best of both worlds.

Spouse Beneficiary Over Age 59½

If the spouse beneficiary is over the age of 59½ or you know with 100% certainty that the spouse will not need to access the IRA assets prior to age 59 ½ then you can simplify this process and just have them rollover the balance to their own IRA. The 10% early withdrawal penalty will never be an issue.

Non-Spouse Beneficiary Options

As mentioned above, the distribution options available to non-spouse beneficiaries were greatly limited after the passing of the SECURE ACT by Congress on December 19, 2019. For most individuals that inherit retirement accounts after December 31, 2019, they will now be subject to the new "10 Year Rule" which requires non-spouse beneficiary to completely deplete the retirement account 10 years following the year of the decedents death.

For more on the this change and the options available to Non-Spouse beneficiaries in years 2020 and beyond, please read the article below:

60 Day Rollover Mistake

There is a 60 day rollover rule that allows the owner of an IRA to take a distribution from an IRA and if the money is deposited back into the IRA within 60 days, it’s like the distribution never happened. Each taxpayer is allowed one 60 day rollover in a 12 month period. Think of it as a 60 day interest free loan to yourself.

Inherited IRA’s are not eligible for 60 day rollovers. If money is distributed from the Inherited IRA, the rollover back into the IRA will be disallowed, and the individual will have to pay taxes on the amount distributed.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

What Happens To My Pension If The Company Goes Bankrupt?

Given the downward spiral that GE has been in over the past year, we have received the same question over and over again from a number of GE employees and retirees: “If GE goes bankrupt, what happens to my pension?” While it's anyone’s guess what the future holds for GE, this is an important question that any employee with a pension should

Over the past few years, we have seen a number of companies go bankrupt that sponsored pension plans for their employees which causes the employees to ask “If my company goes bankrupt, what happens to my pension?” While some employees are aware of the PBGC (Pension Benefit Guarantee Corporation), which is an organization that exists to step in and provide pension benefits to employees if the employer becomes insolvent, very few are aware that the PBGC itself may face insolvency within the next ten years. So, if the company can’t make the pension payments and the PBGC is out of money, are employees left out in the cold?

Pension shortfall

When a company sponsors a pension plan, they are supposed to make contributions to the plan each year to properly fund the plan to meet the future pension payments that are due to the employees. However, if the company is unable to make those contributions or the underlying investments that the pension plan is invested in underperform, it can lead to shortfalls in the funding.

We have seen instances where a company files for bankruptcy and the total dollar amount owed to the pension plan is larger than the total assets of the company. When this happens, the bankruptcy courts may allow the company to terminate the plan and the PBGC is then forced to step in and continue the pension payments to the employees. While this seems like a great system since up until now that system has worked as an effective safety net for these failed pension plans, the PBGC in its most recent annual report is waiving a red flag that it faces insolvency if Congress does not make changes to the laws that govern the premium payments to the PBGC.

What is the PBGC?

The PBGC is a federal agency that was established in 1974 to protect the pension benefits of employees in the private sector should their employer become insolvent. The PBGC does not cover state or government-sponsored pension plans. The number of employees who were plan participants in an insolvent pension plan that now receive their pension payments from the PBGC is daunting. According to the 2017 PBGC annual report, the PBGC “currently provides pension payments to 840,000 participants in 4,845 failed single-employer plans and an additional 63,000 participants across 72 multi-employer plans.”

Wait until you hear the dollar amounts associated with those numbers. The PBGC paid out $5.7 Billion dollars in pension payments to the 840,000 participants in the single-employer plans and $141 Million to the 63,000 participants in the multi-employer plans in 2017.

Where Does The PBGC Get The Money To Pay Benefits?

So where does the PBGC get all of the money needed to make billions of dollars in pension payments to these plan participants? You might have guessed “the taxpayers” but for once that’s incorrect. The PBGC’s operations are financed by premiums payments made by companies in the private sector that sponsor pension plans. The PBGC receive no taxpayer dollars. The corporations that sponsor these pension plans pay premiums to the PBGC each year and the premium amounts are set by Congress.

Single-Employer vs Multi-Employer Plans

The PBGC runs two separate insurance programs: “Single-Employer Program” and “Multi-Employer Program”. It’s important to understand the difference between the two. While both programs are designed to protect the pension benefits of the employees, they differ greatly in the level of benefits guaranteed. The assets of the two programs are also kept separate. If one programs starts to fail, the PBGC is not allowed to shift assets over from the other program to save it.

The single-employer program protects plans that are sponsored by single employers. The PBGC steps in when the employer goes bankrupt or can no longer afford to sponsor the plan. The Single-Employer Program is the larger of the two programs. About 75% of the annual pension payments from the PBGC come from this program. Some examples of single-employer companies that the PBGC has had to step into to make pension payments are United Airlines, Lehman Brothers, and Circuit City.

The Multi-Employer program covers pension plans created and funded through collective bargaining agreements between groups of employers, usually in related industries, and a union. These pension plans are most commonly found in construction, transportation, retail food, manufacturing, and services industries. When a plan runs out of money, the PBGC does not step in and takeover the plan like it does for single-employer plans. Instead, it provides “financial assistance” and the guaranteed amounts of that financial assistants are much lower than the guaranteed amounts offered under the single-employer program. For example, in 2017, the PBGC began providing financial assistance to the United Furniture Workers Pension Fund A (UFW Plan), which covers 10,000 participants.

Maximum Guaranteed Amounts

The million dollar question. What is the maximum monthly pension amount that the PBGC will guarantee if the company or organization goes bankrupt? There are maximum dollar amounts for both the single-employer and multi-employer program. The maximum amounts are indexed for inflation each year and are listed on the PBGC website. To illustrate the dramatic difference between the guarantees associated with the pension pensions in a single-employer plan versus a multi-employer plan; here is an example from the PBGC website based on the 2018 rates.

“PBGC’s guarantee for a 65-year-old in a failed single-employer plan can be up to $89,181 annually, while a participant with 30 years of service in a failed multi-employer plan caps out at $12,870 per year. The multi-employer program guarantee for a participant with only 10 years of service caps out at $4,290 per year.”

It’s a dramatic difference.

For the single-employer program the PBGC provides participants with a nice straight forward benefits table based on your age. Below is a sample of the 2025 chart. However, the full chart with all ages can be found on the PBGC website.

Unfortunately, the lower guaranteed amounts for the multi-employer plans are not provided by the PBGC in a nice easy to read table. Instead they provide participant with a formula that is a headache for even a financial planner to sort through. Here is a link to the formula for 2018 on the PBGC website.

PBGC Facing Insolvency In 2025

If the organization guaranteeing your pension plan runs out of money, how much is that guarantee really worth? Not much. If you read the a previous year’s annual report issued by the PBGC (which was painful), at least 20 times throughout the report you will read the phase:

“The Multi-employer Program faces very serious challenges and is likely to run out of money by the end of fiscal year 2025.”

They have placed a 50% probability that the multi-employer program runs out of money by 2025 and a 99% probability that it runs out of money by 2036. Not good. However, as of September of 2024, the Multi-Employer program reported a net positive position, of $2.1 billion.

There is also good news for the Single-Employer Program. As of 2025, even though the Single-Employer Program ran a cumulative deficit in the billions of dollars in previous years, the program now has a net surplus of $54.1 billion.

Difficult Decision For Employees

While participants in Single-Employer plans may be breathing a little easier after reading this article, if the next recession results in a number of large companies defaulting on their pension obligations, the financial health of the PBGC could change quickly without help from Congress. Employees are faced with a one-time difficult decision when they retire. Option one, take the pension payments and hope that the company and PBGC are still around long enough to honor the pension payments. Or option two, elect the lump sum, and rollover then present value of your pension benefit to your IRA while the company still has the money. The right answer will vary on a case by case basis but the projected insolvency of the PBGC’s Multi-employer Program makes that decision even more difficult for employees.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should I Rollover My Pension To An IRA?

Whether you are about to retire or if you were just notified that your company is terminating their pension plan, making the right decision with regard to your pension plan payout is extremely important. It's important to get this decision right because you only get one shot at it. There are a lot of variables that factor into choosing the right option.

Whether you are about to retire or if you were just notified that your company is terminating their pension plan, making the right decision with regard to your pension plan payout is extremely important. It's important to get this decision right because you only get one shot at it. There are a lot of variables that factor into choosing the right option. While selecting the monthly payment option may be the right choice for your fellow co-worker, it could be the wrong choice for you. Here is a quick list of the items that you should consider before making the decision.

Financial health of the plan sponsor

Your age

Your health

Flexibility

Monthly benefit vs lump sum amount

Inflation

Your overall retirement picture

Financial Health Of The Plan Sponsor

The plan sponsor is the company, organization, union, municipality, state agency, or government entity that is in charge of the pension plan. The financial health of the plan sponsor should weigh heavily on your decision in many cases. After all what good is a monthly pension payment if five years from now the company or entity that sponsors the plan goes bankrupt?

Pension Benefit Guarantee Corporation

But wait……..isn’t there some type of organization that guarantees the pension payments? The answer, there may or may not be. The Pension Benefit Guarantee Corporation (PBGC) is an organization that was established to protect your pension benefit. But PBGC protection only applies if your company participates in the PBGC. Not all pension plans have this protection.

Large companies will typically have PBGC protection. The pension plan is required to pay premiums to the PBGC each year. Those premiums are used to subsidize the cost of bankrupt pension plans if the PBGC has to step in to pay benefits. But it’s very important to understand that even through a pension plan may have PBGC protection that does not mean that 100% of the employee’s pension benefits are protected if the company goes bankrupt.

There is a dollar limited placed on the monthly pension benefit that the PBGC will pay if it has to step in. It’s a sliding scale based on your age and the type of pension benefit that you elected. If your pension payment is greater that the cap, the excess amount is not insured. Here is the PBGC 2021 Maximum Monthly Guarantee Table:

Another important note, if you have not reached age 65, your full pension benefit may not be insured even if it is less than the cap listed in the table.

Again, not all pension plans are afforded this protection by the PBGC. Pension plans offered by states and local government agencies typically do not have PBGC protection.

If you are worried about the financial health of the plan sponsor, that scenario may favor electing the lump sum payment option and then rolling over the funds into your rollover IRA. Once the money is in your IRA, the plan sponsor insolvency risk is eliminated.

Your Age

Your age definitely factors into the decision. If you have 10+ years to retirement and your company decides to terminate their pension plan, it may make sense to rollover your balance in the pension plan into an IRA or your current employer’s 401(k) plan. Primarily because you have the benefit of time on your side and you have full control over the asset allocation of the account.

Pension plans typically maintain a conservative to moderate growth investment object. You will rarely ever find a pension plan that has 80%+ in equity exposure. Why? It’s a pooled account for all of the employees of all ages. Since the assets are required to meet current pension payments, pension plans cannot be subject to high levels of volatility.

If your personal balance in the pension plan is moved into our own IRA, you have the option of selecting an investment objective that matches your personal time horizon to retirement. If you have a long time horizon to retirement, it allows you the freedom to be more aggressive with the investment allocation of the account.

If you are within 5 years to retirement, it does not necessarily mean that selecting the monthly pension payment is the right choice but the decision is less cut and dry. You really have to compare the monthly pension payment versus the return that you would have to achieve in your IRA to replicate that income stream in retirement.

Your Health

Your health is a big factor as well. If you are in poor health, it may favor electing the lump sum option and rolling over the balance into an IRA. Whatever amount is left in your IRA account will be distributed to your beneficiaries. With a straight life pension option, the benefit just stops when you pass away. However, if you are worried about your spouse's spending habits and your spouse is either in good health or is much younger than you, you may want to consider the pension option with a 100% survivor benefit.

Flexibility

While some retirees like the security of a monthly pension payment that will not change for the rest of their life, other retirees prefer to have more flexibility. If you rollover you balance to an IRA, you can decide how much you want to take or not take out of the account in a given year.

Some retirees prefer to spend more in their early years in retirement because that is when their health is the best. Walking around Europe when you are 65 is usually not the same experience as walking around Europe when you are 80. If you want to take $10,000 out of your IRA to take that big trip to Europe or to spend a few months in Florida, it provides you with the flexibility to do so. By making sure that you have sufficient funds in your savings at the time of retirement can help to make things like this possible.

Working Because I Want To

The other category of retirees that tend to favor the IRA rollover option is the "I'm working because I want to" category. It has becoming more common for individuals to retire from their primary career and want to still work doing something else for two or three days a week just to keep their mind fresh. If the income from your part-time employment and your social security are enough to meet your expenses, having a fixed pension payment may just create more taxable income for you when you don't necessarily need it. Rolling over your pension plan to an IRA allows you to defer the receipt of that income until at least age 70½. That is the age that distributions are required from IRA accounts.

Monthly Pension vs Lump Sum

It’s important to determine the rate of return that you would need to achieve in your IRA account to replicate the pension benefit based on your life expectancy. With the monthly pension payment option, you do not have to worry about market fluctuations because the onus is on the plan sponsor to produce the returns necessary to make the pension payments. With the IRA, you or your investment advisor are responsible for producing the investment return in the account.

Example 1: You are 65 and you have the option of either taking a monthly pension payment of $3,000 per month or taking a lump sum in the amount of $500,000. If your life expectancy is age 85, what is the rate of return that you would need to achieve in your IRA to replicate the pension payment?

The answer: 4%

If your IRA account performs better than 4% per year, you are ahead of the game. If your IRA produces a return below 4%, you run the risk of running out of money prior to reaching age 85.

Part of this analysis is to determining whether or not the rate of return threshold is a reasonable rate of return to replicate. If the required rate of return calculation results in a return of 6% or higher, outside of any special circumstances, you may be inclined to select the pension payments and put the responsibility of producing that 6% rate of return each year on the plan sponsor.

Low Interest Rate Environment

A low interest rate environment tends to favor the lump sum option because it lowers the “discount rate” that actuaries can use when they are running the present value calculation. Wait……what?

The actuaries are the mathletes that produce the numbers that you see on your pension statement. They have to determine how much they would have to hand you today in a lump sum payment to equal the amount that you would have received if you elected the monthly pension option.

This is called a “present value” calculation. This amount is not the exact amount that you would have received if you elected the monthly pension payments because they get to assume that they money in the pension plan will earn interest over your life expectancy. For example, if the pension plan is supposed to pay you $10,000 per year for the next 30 years, that would equal $300,000 paid out over that 30 year period. But the present value may only be $140,000 because they get to assume that you will earn interest off of that money over the next 30 years for the amount that is not distributed until a later date.

In lower interest rate environments, the actuaries have to use a lower assume rate of return or a lower “discount rate”. Since they have to assume that you will make less interest on the money in your IRA, they have to provide you with a larger lump sum payment to replicate the monthly pension payments over your life expectancy.

Inflation

Inflation can be one of the largest enemies to a monthly pension payment. Inflation, in its simplest form is “the price of everything that you buy today goes up in price over time”. It’s why your grandparents have told you that they remember when a gallon of milk cost a nickel. If you are 65 today and your lock into receiving $2,000 per month for the rest of your life, inflation will erode the spending power of that $2,000 over time.

Historically, inflation increases by about 3% per year. As an example, if your monthly car payment is $400 today, the payment for that same exact car 20 years from now will be $722 per month. Now use this multiplier against everything that you buy each month and it begins to add up quickly.

If you have the money in an IRA, higher inflation typically leads to higher interest rate, which can lead to higher interest rates on bonds. Again, having control over the investment allocation of your IRA account may help you to mitigate the negative impact of inflation compared to a fixed pension payment.

A special note, some pension plans have a cost of living adjustment (“COLA”) built into the pension payment. Having this feature available in your pension plan will help to manage the inflation risk associated with selecting the monthly pension payment option. The plan basically has an inflation measuring stick built into your pension payment. If inflation increases, the plan is allowed to increase the amount of your monthly pension payment to help protect the benefit.

Your Overall Financial Picture

While I have highlighted a number of key variables that you will need to consider before selecting the payout option for your pension benefit, at the end of the day, you have to determine how each option factors into your own personal financial situation. It’s usually wise to run financial projections that identify both the opportunities and risks associated with each payment option.

Don’t be afraid to seek professional help with this decision. They will help you consider what you might need to pay for in the future. Are you going to need money spare for holidays, transportation, even funeral costs should be considered. Where people get into trouble is when they guess or they choose an option based on what most of their co-workers selected. Remember, those co-workers are not going to be there to help you financially if you make the wrong decision.

As an investment advisor, I will also say this, if you meet with a financial planner or investment advisor to assist you with this decision, make sure they are providing you with a non-bias analysis of your options. Depending on how they are compensation, they may have a vested interest in getting you to rollover you pension benefit to an IRA. Even though electing the lump sum payment and rolling the balance over to an IRA may very well be the right decision, they should walk you through a thorough analysis of the month pension payments versus the lump sum rollover option to assist you with your decision.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Should I Budget For Health Care Costs In Retirement?

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance premiums which can quickly increase the overall cost to $10,000+ per year.

Tough to believe? Allow me to walk you through the numbers for a married couple.

Medicare Part A: $3,352 Per Year

Part A covers inpatient hospital stays, skilled nursing facility stays, some home health visits, and hospice care. While Part A does not have an annual premium, it does have an annual deductible for each spouse. That deductible for 2025 is $1,676 per person.

Medicare Part B: $4,954

Part B covers physician visits, outpatient services, preventive services, and some home health visits. The standard monthly premium is $185 per person but it could be higher depending on your income level in retirement. There is also a deductible of $257 per year for each spouse.

Medicare Part D: $1,080

Part D covers outpatient prescription drugs through private plans that contract with Medicare. Enrollment in Part D is voluntary. The benefit helps pay for enrollees’ drug costs after a deductible is met (where applicable), and offers catastrophic coverage for very high drug costs. Part D coverage is actually provided by private health insurance companies. The premium varies based on your income and the types of prescriptions that you are taking. The national average in 2025 for Part D premiums is $45 per person.

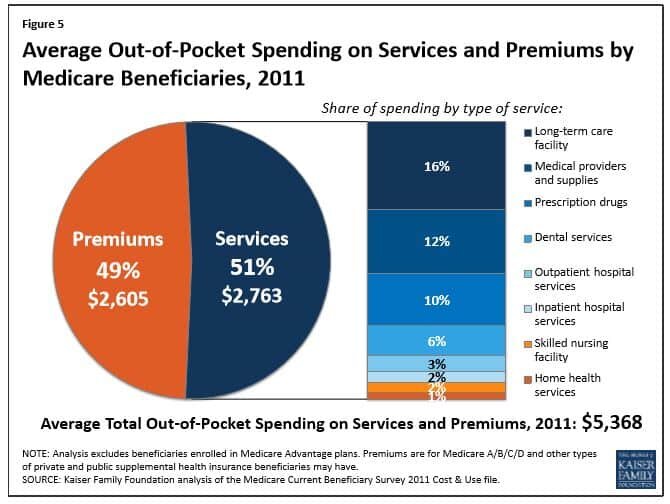

If you total up just these three items, you reach $9,386 in premiums and deductibles for the year. Then you start adding in dental cost, Medigap insurance premiums, co-insurance for Medicare benefits, and it quickly gets a married couple over that $10,000 threshold in health and dental cost each year. Medicare published a report that in 2011, Medicare beneficiaries spent $5,368 out of their own pockets for health care spending, on average. See the table below.

Start Planning Now

Fidelity Investments published a study that found that the average 65 year old will pay $300,000 in out-of-pocket costs for health care during retirement, not including potential long-term-care costs. While that seems like an extreme number, just take the $10,000 that we used above, multiply that by 20 year in retirement, and you get to $200,000 without taking into consideration inflation and other important variable that will add to the overall cost.

Bottom line, you have to make sure you are budgeting for these expenses in retirement. While most individuals focus on paying off the mortgage prior to retirement, very few are aware that the cost of health care in retirement may be equal to or greater than your mortgage payment. When we are create retirement projections for clients we typically included $10,000 to $15,000 in annual expenses to cover health care cost for a married couple and $5,000 – $7,500 for an individual.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.