Potential Consequences of Taking IRA Distributions to Pay Off Debt

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents

Taking IRA Distributions to Pay Off Debt: The Tax Consequences

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents opportunities to use retirement savings to pay off debt; but before doing so, it is important to consider the possible consequences.

Clients often come to us saying they have some amount left on a mortgage and they would feel great if they could just pay it off. Lower monthly bills and less debt when living on a fixed income is certainly good, both from a financial and psychological point of view, but taking large distributions from retirement accounts just to pay off debt may lead to tax consequences that can make you worse off financially.

Below are three items I typically consider before making a recommendation for clients. Every retiree is different so consulting with a professional such as a financial planner or accountant is recommended if you’d like further guidance.

Impact on State Income and Property Taxes

Depending on what state you are in, withdrawals from IRA’s could be taxed very differently. It is important to know how they are taxed in your state before making any big decision like this. For example, New York State allows for tax free withdrawals of IRA accounts up to a maximum of $20,000 per recipient receiving the funds. Once the $20,000 limit is met in a certain year, any distribution you take above that will be taxed.

If someone normally pulls $15,000 a year from a retirement account to meet expenses and then wanted to pull another $50,000 to pay off a mortgage, they have created $45,000 of additional taxable income to New York State. This is typically not a good thing, especially if in the future you never have to pull more than $20,000 in a year, as you would have never paid New York State taxes on the distributions.

Note: Another item to consider regarding states is the impact on property taxes. For example, New York State offers an “Enhanced STAR” credit if you are over the age of 65, but it is dependent on income. Here is an article that discusses this in more detail STAR Property Tax Credit: Make Sure You Know The New Income Limits.

What Tax Bracket Are You in at the Federal Level?

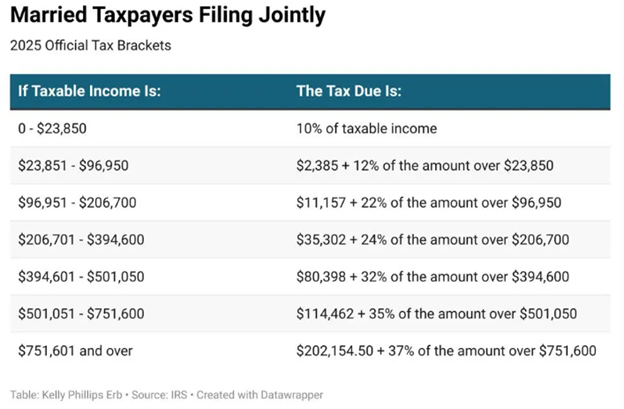

Federal income taxes are determined using a “Progressive Tax” calculation. For example, if you are filing single, the first $11,925 of taxable income you have is taxed at a lower rate than any income you earn above that. Below are charts of the 2025 tax tables so you can review the different tax rates at certain income levels for single and married filing joint ( ). ( Source: Nerd Wallet ).

There isn’t much of a difference between the first two brackets of 10% and 12%, but the next jump is to 22%. This means that, if you are filing single, you are paying the government 10% more on any additional taxable income from $48,476 – $103,350. Below is a basic example of how taking a large distribution from the IRA could impact your federal tax liability.

How Will it Impact the Amount of Social Security You Pay Tax on?

This is usually the most complicated to calculate. Here is a link to the 2024 instructions and worksheets for calculating how much of your Social Security benefit will be taxed ( IRS Publication 915 ). Basically, by showing more income, you may have to pay tax on more of your Social Security benefit. Below is a chart put together with information from the IRS to show how much of your benefit may be taxed.

To calculate “Combined Income”, you take your Adjusted Gross Income + Nontaxable Interest + Half of your Social Security benefit. For the purpose of this discussion, remember that any amount you withdraw from your IRA is counted in your Combined Income and therefore could make more of your social security benefit subject to tax.

Peace of mind is key and usually having less bills or debt can provide that, but it is important to look at the cost you are paying for it. There are times that this strategy could make sense, but if you have questions about a personal situation please consult with a professional to put together the correct strategy.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Do I Have To Pay Tax On A House That I Inherited?

The tax rules are different depending on the type of assets that you inherit. If you inherit a house, you may or may not have a tax liability when you go to sell it. This will largely depend on whose name was on the deed when the house was passed to you. There are also special exceptions that come into play if the house is owned by a trust, or if it was gifted

Do I Have To Pay Tax On A House That I Inherited?

The tax rules are different depending on the type of assets that you inherit. If you inherit a house, you may or may not have a tax liability when you go to sell it. This will largely depend on whose name was on the deed when the house was passed to you. There are also special exceptions that come into play if the house is owned by a trust, or if it was gifted with the kids prior to their parents passing away. On the bright side, with some advanced planning, heirs can often times avoid having to pay tax on real estate assets when they pass to them as an inheritance.

Step-up In Basis

Many assets that are included in the decedent’s estate receive what’s called a step-up in basis. As with any asset that is not held in a retirement account, you must be able to identify the “cost basis”, or in other words, what you originally paid for it. Then when you eventually sell that asset, you don’t pay tax on the cost basis, but you pay tax on the gain.

Example: You buy a rental property for $200,000 and 10 years later you sell that rental property for $300,000. When you sell it, $200,000 is returned to you tax free and you pay long-term capital gains tax on the $100,000 gain.

Inheritance Example: Now let’s look at how the step-up works. Your parents bought their house 30 years ago for $100,000 and the house is now worth $300,000. When your parents pass away and you inherit the house, the house receives a step-up in basis to the fair market value of the house as of the date of death. This means that when you inherit the house, your cost basis will be $300,000 and not the $100,000 that they paid for it. Therefore, if you sell the house the next day for $300,000, you receive that money 100% tax-free due to the step-up in basis.

Appreciation After Date of Death

Let’s build on the example above. There are additional tax considerations if you inherit a house and continue to hold it as an investment and then sell it at a later date. While you receive the step-up in basis as of the date of death, the appreciation that occurs on that asset between the date of death and when you sell it is going to be taxable to you.

Example: Your parents passed away June 2019 and at that time their house is worth $300,000. The house receives the step-up in basis to $300,000. However, lets say this time you rent the house or don’t sell it until September 2020. When you sell the house in September 2020 for $350,000, you will receive the $300,000 tax-free due to the step-up in basis, but you’ll have to pay capital gains tax on the $50,000 gain that occurred between date of death and when you sold house.

Caution: Gifting The House To The Kids

In an effort to protect the house from the risk of a long-term event, sometimes individuals will gift their house to their kids while they are still alive. Some see this as a way to remove themselves from the ownership of their house to start the five-year Medicaid look back period, however, there is a tax disaster waiting for you with the strategy.

When you gift an asset to someone, they inherit your cost basis in that asset, so when you pass away, that asset does not receive a step-up in basis because you don’t own it and it’s not part of your estate.

Example: Your parents change the deed on the house to you and your siblings while they’re still alive to protect assets from a possible nursing home event. They bought the house 30 years ago for $100,000, and when they pass away it’s worth $300,000. Since they gifted the assets to the kids while they were still alive, the house does not receive a step-up in basis when they pass away, and the cost basis on the house when the kids sell it is $100,000; in other words, the kids will have to pay tax on the $200,000 gain in the property. Based on the long-term capital gains rates and possible state income tax, when the children sell the house, they may have a tax bill of $44,000 or more which could have been completely avoided with better advanced planning.

How To Avoid Paying Capital Gains Tax On Inherited Property

There are ways to both protect the house from a long-term event and still receive the step-up in basis when the current owners pass away. This process involves setting up an irrevocable trust to own the house which then protects the house from a long-term event as long as it’s held in the trust for at least five years.

Now, we do have to get technical for a second. When an asset is owned by an irrevocable trust, it is technically removed from your estate. Most assets that are not included in your estate when you pass do not receive a step-up in basis; however, if the estate attorney that drafts the trust document puts the correct language within the trust, it allows you to protect the assets from a long-term event and receive a step-up in basis when the owners of the house pass away.

For this reason, it’s very important to work with an attorney that is experienced in handling trusts and estates, not a generalist. It only takes a few missing sentences from that document that can make the difference between getting that asset tax free or having a huge tax bill when you go to sell the house.

Establishing this trust can sometimes cost between $3,000 and $6,000. But by paying this amount upfront and doing the advance planning, you could save your heirs 10 times that amount by avoiding a big tax bill when they inherit the house.

Making The House Your Primary

In the case that the house is gifted to the children prior to the parents passing away and the house is not awarded the step-up in basis, there is an advance tax planning strategy if the conditions are right to avoid the big tax bill. If one of the children would be interested in making their parent’s house their primary residence for two years, then they are then eligible for either the $250,000 or $500,000 capital gains exclusion.

According to current tax law, if the house you live in has been your primary residence for two of the previous five years, when you go to sell the house you are allowed to exclude $250,000 worth of gain for single filers and $500,000 worth of gain for married filing joint. This advanced tax strategy is more easily executed when there is a single heir and can get a little more complex when there are multiple heirs.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How To Use Your Retirement Accounts To Start A Business

One of the most challenging aspects of starting a new business is finding the capital that is needed to support your expenses as you begin to build up a revenue stream since it’s not always easy to ask friends and family for money to invest in a startup business. Luckily, for new entrepreneurs, there are some little-known ways on how you can use

One of the most challenging aspects of starting a new business is finding the capital that is needed to support your expenses as you begin to build up a revenue stream since it’s not always easy to ask friends and family for money to invest in a startup business. Luckily, for new entrepreneurs, there are some little-known ways on how you can use retirement accounts as a funding source for your new business. However, before you cash out your 401(k) account to start a business, you have to fully understand the pros and cons of each option.

ROBS Plans

ROBS stands for “Rollover for Business Startups”. ROBS is a special program that allows you to use the balance in your 401(k) or IRA account to fund your new business while avoiding having to pay taxes and the 10% early withdrawal penalty for business owners under age 59.5. Unlike a 401(k) loan that has limits, loan payments, and interest, ROBS plans allow you to use your full retirement account balance without having to enter into a repayment plan.

Why do business owners use ROBS plans?

The benefits are fairly obvious. First off, by using your own retirement assets to fund your new business, you don’t have to ask friends and family for money. Secondly, if you were to embark on the traditional lending route from a bank for your start-up, most would require you to pledge personal assets, such as your house, as collateral for the loan. Doing this puts an added pressure on the new entrepreneur because if the business fails you not only lose the business, but potentially your house as well. By using the ROBS plan, you are only risking your own assets, you have quick and easy access to those funds, and if the business fails, worst case scenario, you just have to work longer than you expected.

Is this too good to be true?

When I explain this funding strategy to new business owners, the question I usually get is, “Why haven’t I heard of these plans before?”, and here are a few reasons why. To begin, you are using retirement plan dollars and accessing the tax benefits, and in doing so there are a lot of complex rules surrounding these types of plans. It’s not uncommon for accountants, third-party administrators, and financial advisors to not know what a ROBS plan is, let alone understand the compliance rules surrounding these plans; thus, it’s rarely presented as a viable option. Over the course of this article we will cover the pros and cons of this funding mechanism.

How do ROBS plans work?

The concept is fairly simple, your retirement account essentially buys shares of stock in your new business which provides the business with the cash needed to grow. You do not have to be a publicly traded company for your retirement account to buy shares, however, you are required to establish your new company as a C-Corp in order for this plan to work.

This process entails incorporating your new business, as well as establishing a new 401(k) plan within that business, that contains the special ROBS features. Then, you can transfer assets from your various retirement accounts into the new 401(k) plan allowing the 401(k) plan to then buy shares in your new company. While this sounds easy, I cannot stress enough that you must work with a firm that fully understands these types of plans and the funding strategy. These plans are perfectly legal, but there are a lot of rules to follow. Since this funding strategy allows you to access retirement account dollars without having to pay tax to the IRS, the IRS will sometimes audit these plans hoping that you did not fully understand or comply with the rules surrounding the establishment and operations of these ROBS plans.

The steps to set up a ROBS plan

Here are the steps for setting up the plan:

1) Establish your new business as a C-Corp.

2) Establish a new 401(k) plan for your new business

3) Process direct rollovers from your 401(k) accounts and IRA accounts into your new 401(k) plan

4) Use the balance in your 401(k) account to purchase shares of the corporation

5) Now you have cash in your business checking account to pay expenses

You must be a C-Corp

The only type of corporate structure that works for a ROBS plan is a C-Corp because only a C-Corp can sell shares of the business to a retirement account legally. That means that LLCs, sole proprietorships, partnerships or even S-Corps will not work for this funding option.

Establishing the new 401(k) plan

ROBS plans have all the same features and benefits of a traditional 401(k) plan, profit-sharing plan, or defined benefit plan, except they also have special features that allow the plan to invest plan assets in the privately held C-Corp.

You need to work with a firm that knows these plans well because not all custodians will allow you to hold shares of a privately held corporation in a qualified retirement account. For many investment firms and custodians, this is considered either a “private placement” or an “alternative investment”. There is typically a special approval process that you must go through with the custodian before they allow your 401(k) account to purchase the shares of stock in your new company. Be ready, there are a lot of mainstream 401(k) providers that will not only not know what a ROBS plan is, but they often times limit the plan investment options to mutual funds; to avoid this, make sure you are aligning yourself with the right provider.

Transferring funds from your retirement accounts to your new 401(k) plan

Your new investment provider should assist you with coordinating the rollovers into your 401(k) account to avoid paying taxes and penalties. Also, if you have 401(K) Roth or after-tax money in your retirement accounts, special preparations need to be made prior to the rollover occurring for those sources.

Purchasing stock in the business

It’s not as easy as simply transferring money into the business checking account since you have to go through the process of issuing shares to the 401(k) account. In most cases, the percentage of ownership attributed to the 401(k) plan is based upon your total funding picture to start up the company. If your retirement accounts are the sole resource to fund the business, then technically your 401(k) plan owns 100% of the company. It’s not uncommon for new business owners to use multiple funding sources including personal savings, funding from friends and family, or a home-equity loan. In these instances, a ROBS plan is still allowed but the plan will own less than 100% of the business.

I don’t want to get too deep in the weeds with this point, but it’s usually advisable not to issue 100% of the shares of the business to your 401(k) plan. This could limit your ability to raise additional capital down the road because you don’t have any additional shares to issue to new investors or to share equity with a new partner.

Using the capital to grow your business

Once the share purchase is complete, the cash will be transferred from your retirement account into the business checking account allowing use those funds to start growing the business.

There is a very important rule when it comes to what you can use these funds for within the new business. First and foremost, you cannot use these funds to pay yourself compensation as the business owner. This is probably the biggest ‘no-no’ associated with these types of plans. The IRS does not want you circumnavigating income taxes and penalties just to pay yourself under a ROBS plan. In order to pay yourself as the business owner, you have to be able to generate revenue from the business. The assets from the stock purchase can be used to pay all of your expenses but before you’re able to take any money out of the business to pay yourself compensation you have to be showing revenue.

Once new business owners hear this, it’s often disheartening. It’s great that they have access to capital to build their business, but how do they pay their bills while they’re building up the revenue stream? Luckily, I have good news on this front. We have additional strategies that we can implement using your retirement accounts outside of the ROBS plan that will allow you to pay yourself compensation as the owner and it can work out better tax wise than paying yourself as a W2 income through the C-corp.

Requirements for ROBS plans

There are a few requirements you have to meet for this funding strategy to work.

1) The funds have to be held in a pre-tax retirement account. This means that money in Roth IRA’s and Roth 401(k)’s are not eligible for this funding strategy.

2) You typically need at least $50,000 in your new 401(k) account for the ROBS plan to make sense since there are special costs associated with establishing and maintaining a ROBS 401(k) plan. If your balance is less than $50,000, the cost to establish and maintain the plan begins to outweigh the benefit of executing this funding strategy.

3) If you’re rolling over a 401(k) plan to fund your ROBS 401(k) plan, it cannot be from a current employer. In other words, if you are still working for a company and you’re running this new business on the side, you are not able to rollover your 401(k) balance into your newly established 401(k) plan and implement this ROBS strategy. The 401(k) account must be coming from a former employer that you no longer work for.

4) You have to be an active employee in the business

There are special IRS rules that define if an employee is actively or materially participating in a business. Since ROBS plans do not work for passive business owners, it is difficult to use these plans for real estate investments unless you can prove that you are an active employee of that real estate corporation. If your new business is your only employer, you work over 1000 hours per year, and it’s your primary source of revenue, then you should not have a problem qualifying as an active employee. If you have multiple businesses however, you really need to consult your accountant and ROBS provider to make sure you satisfy the IRS definition of materially participating.

A ROBS plan can be used for more than just start-ups

While we have talked a lot about using ROBS plans to start up a business, they can also be used for other purposes. These plans can be a funding source to:

1) Buy an existing business

2) Recapitalize a business

3) Build a franchise

These plans can offer fast access to large amounts of capital without having to go through the traditional lending channels.

Cost of setting up and maintaining a ROBS plan

It typically costs $4,000 – $5,000 to set up a ROBS plan and you cannot use the balance in your retirement account to pay this fee. It must be paid with outside funds.

As for ongoing fees, you will have the regular administrative, recordkeeping, and investment advisory fees associated with sponsoring a 401(k) plan which vary from provider to provider. You may also have additional fees charged each year by the custodian for holding the privately held C-Corp shares in your retirement account. Make sure you clearly understand what the custodian will require from you each year to value those shares. If you wind up with a custodian that requires audited financial statements, this could easily run you an additional $8,000+ per year to obtain those audited financial statements from an accounting firm. If you are sponsoring one of these plans, you probably want to try to avoid this large additional cost.

Complications if you have employees

For start-up companies or established companies that have employees that would otherwise be eligible for the 401(k) plan, there are special issues that need to be addressed. The rules within the 401(k) world state that all investment options available within the plan must be made available to all eligible employees. That means if the business owner is able to purchase shares of the company within the retirement plan, the other eligible employees must also be given the same investment opportunity. You can see immediately where this would pose a challenge to the ROBS plan if you have eligible employees.

However, investment options can be changed which is why ROBS plans are the most common in start-ups where there are no employees yet, allowing the 401(k) plan to setup the only eligible plan participant, the business owner, allowing them to buy shares of the company. Once the share purchases are complete, the business owner can then remove those shares as an investment option in the plan going forward.

The Cons of a ROBS plan

Up until now we have presented the advantages of the ROBS plan but there are some disadvantages.

1) The first one is pretty obvious. You are risking your retirement account dollars in a start-up business. If the business fails, not only will you be looking for a new job, but you’ve depleted your retirement assets.

2) You are required to sponsor a C-Corp which may not be the most advantageous corporate structure.

3) You are required to sponsor a 401(k) plan. When running a start-up business, it’s sometimes more advantageous to sponsor a Simple IRA or SEP IRA which requires less cost and time to maintain, but you don’t have that option using this funding strategy.

4) The business owners can’t pay themselves compensation from the stock purchase

5) The cost to setup and maintain the plan. Paying $5,000 just to establish the plan isn’t exactly cheap. Plus, you’re looking at $2,000+ in annual maintenance costs for the plan. Other options like taking a home-equity loan or establishing a Solo 401(K) plan and taking a $50,000 401(k) loan from the plan may be the better funding option.

6) Audit risk. While it’s not the case that all these plans are audited, they do present an audit opportunity for the IRS given the compliance rules surrounding the operation of these plans. However, this risk can be managed with knowledgeable providers.

7) Asset sale of the business becomes complex. If 10 years from now you sell your company, there are two ways to sell it. An asset sale or a stock sale. While a stock sale jives very easily with this ROBS funding strategy, an asset sale becomes more complex.

Summary

Finding the capital to start up a business is never easy. Each funding option comes with its own set of pros and cons. The ROBS plan is just another option for consideration. While I have greatly simplified how these plans work and how they operate, if you are strongly considering using this plan as a funding vehicle for your new business, please reach out to us so we can have an open discussion about what you are trying to accomplish, and how the ROBS plan stacks up against other funding options that you may have available.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Top 4 Things That You Need To Know About The Trade War With China

The trade negotiations between the U.S. and China have been the center of the stock market’s attention for the past 6 months. One day it seems like they are close to a deal and then the next day both countries are launching new tariffs against each other. While many investors in the U.S. understand the trade wars from the vantage point of the United

The trade negotiations between the U.S. and China have been the center of the stock market’s attention for the past 6 months. One day it seems like they are close to a deal and then the next day both countries are launching new tariffs against each other. While many investors in the U.S. understand the trade wars from the vantage point of the United States, very few people understand China’s side of the equation. The more we learn about China’s motivation and viewpoint, the more we realize that this could be a very long, ugly, and drawn out battle. The main risk is if this battle is not resolved soon it could lead to a recession in the U.S. sooner than expected.

1: China Is Tired Of Being On The Losing End Of Trade Deals

When you look back through history, going as far back as the mid 1800’s, China has been on the losing end of many of it’s trade deals. To summarize that history, when you are a very poor country, and your economy is based primarily on exporting goods to other countries, those countries that are buying your goods have a lot of power over you. If you don’t agree to their terms, they stop buying from you, and your economy collapses. China’s history is filled with trade deals where terms were dictated to them so they feel like they have been taken advantage of.

Now that China has the fastest growing middle class in the world, they are less reliant on trade to fuel their economy. Also, the size of China’s economy is growing extremely fast. The size of a country’s economy is measured by their GDP (Gross Domestic Product). A country’s annual GDP is the dollar value of all the goods and services that are produced in that country in a single year. It’s fascinating to see how quickly China has grown over the past 20 years compared to the U.S.

The numbers speak for themselves. In 2000, the size of China’s economy was only 9% of the U.S. economy. In only a 17-year period, China’s economy is now 67% the size of the U.S. economy and based on current GDP data from both countries, they are still growing at a pace that is about three times faster than the U.S. economy.

China seems to be making a statement to the world in these negotiations that terms will no longer be dictated to them. China now has the economic firepower to negotiate terms as an equal which could drag out the trade negotiations longer than investors expect.

2: Tariff Impact On China vs U.S.

In May, the U.S. raised the tariffs on select goods imported from China from 10% to 25%. China then retaliated by raising their tariffs on US imports from 10% to 25%. We have heard in the news that these tariffs hurt China more than they hurt the U.S. In the short term this would seem to be true. The U.S. imports about $500 Billion in goods from China compared to the $100 Billion in goods that China imports from the U.S.

But the next question is, “if it hurts China more, does it hurt them a lot or a little from the standpoint of their overall economy?” The answer; not as much as you would think. The chart below shows China’s total exports as a percentage of their GDP.

Back in 2007, exports contributed to over 35% of China’s total GDP. As of 2018, exports represent less than 20% of China’s annual GDP. Of their total exports about 18% go to the U.S. So if you do the math, exports to the U.S. equal about 3.6% of China’s total annual GDP. Personally, I was surprised how low that number was. Based on what we have been hearing about the negotiations and how the U.S. is in such a strong position to negotiate, I would have expected the export number to be much larger, but it’s less than 4% of their total GDP. This again may lead investors to conclude that the volatility we are seeing in the markets surrounding the trade negotiations may be an unwelcomed guest that is here to stay for longer than expected.

3: The Impact of Tariffs On The US Economy

While the U.S. is using tariffs as a negotiating tool, it may be the U.S. consumer that ends up paying the price. That washing machine that was $500 in April may end up costing $625 in June. Companies that are importing goods from China and selling them to the U.S. consumer will have to decide whether to absorb the cost of the tariffs which would decrease their net profits or pass those costs onto the consumer in the form of higher prices.

The other problem that you can see in this example is tariffs are inflationary. Meaning they push prices higher. The Fed announced at their last meeting that they were content with keeping interest rates where they are for the remainder of 2019 given the slowing economic growth rate and tame inflation. But if tariffs spark inflation, they may have to reverse course and raise rates unexpectedly to keep the inflation rate under control which would be bad news for the stock market.

4: Global uncertainty

Companies typically do not invest or make plans for growth if the global economy is filled with uncertainty, they pause and wait for the smoke to clear. The longer the trade uncertainty between the U.S. and China persists, the more downward pressure there will be on global economic growth around the world.

Summary

It’s unclear how this situation between the U.S. and China will play out and how long it will be before there is a resolution. In times of uncertainty, investors need to be very aware of how these trends could potentially impact their investment portfolio and it may be the appropriate time to begin building some defensive positions if you have not done so already.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Emergency Fund Should You Have And How To Get There

If you watched the nightly news during the latest government shutdown you would have seen stories about how people struggle when they aren’t getting a paycheck. Most Americans are not immune to having a set back at a job and it is a scary feeling to not know when the next paycheck will come. The emergency fund is what will help you bridge the

How Much Emergency Fund Should You Have And How To Get There

If you watched the nightly news during the latest government shutdown you would have seen stories about how people struggle when they aren’t getting a paycheck. Most Americans are not immune to having a set back at a job and it is a scary feeling to not know when the next paycheck will come. The emergency fund is what will help you bridge the gap in these hard times. This article should help determine how much emergency fund you should have and strategies on how you can get there.

We make a point of this in every financial plan we put together because of its importance. A lot of people will say their job is secure so they don’t need to worry about having an emergency fund. This may be true, nevertheless the emergency fund is not only for the most extreme circumstances but any unexpected expense. Anyone can have an unforeseen cost of $1,000 to $5,000 and most people would have to pay for this expense on a credit card that will accrue interest and take time to payoff.

Another common thought is, “I have disability insurance, so I don’t need an emergency fund”. Most disability insurance will not start until a 90-day elimination period has been met. This means you will be out of a check for that period but still have all the expenses you normally would.

Current Savings In The United States

“Smartasset” came out with a study in November 2018 that stated; of those Americans with savings accounts, the average savings account balance was $33,766.49. This seems like an amount that would be enough for most people to have in a “rainy day fund”. But that is the average. Super Savers with very large balances will skew this calculation so we use the median which more accurately reflects the state of most Americans. The median balance is only approximately $5,200 per “Smartasset”.

With a median balance of only $5,200, it doesn’t take much misfortune for that to be spent down to $0. At $5,200, it is safe to assume that most Americans are living paycheck to paycheck.

If your income only meets your normal expenses, you need to ask yourself the question “where am I coming up with the money for an unexpected cost?”. For a lot of people, it is a credit card, another type of loan, or dipping into their retirement assets. By taking care of the immediate need, you shift the burden to another part of your financial wellbeing.

Emergency Fund Calculator

There is no exact dollar amount but a consensus in the planning industry is between 4-6 months of living expenses. This is usually enough to cover expenses while you are searching for the next paycheck or to have other assistance kick in.

It is important for everyone to put together a budget. How do you know what 4-6 months of living expenses is if you don’t know what you spend? Putting together a budget takes time but you need to know where your money is going in order to make the adjustments necessary to save. If you are in a position that you don’t see your savings account increasing, or at least remaining the same, you are likely just meeting expenses with your current income.

Resource: EXPENSE PLANNER to help you focus on your spending.

I Know My Number, How Do I get There?

Determining the amount is the easy part, now it is getting there. The less likely option would be going to your boss asking, “I need to replenish my emergency fund, can you increase my pay?”. Winning the lottery would also be nice but not something you can count on.Changing spending habits is an extremely difficult thing to do. Especially if you don’t know what you’re spending money on. Once you have an accurate budget, you should take a hard look at it and make cuts to some of the discretionary items on the list. It will likely take a combination of savings strategies that will get you to an appropriate emergency fund level. Below is a list of some ideas;

Skip a vacation one year

Put any potential tax refund in savings

Put a bonus check into savings

Increase the amount of your paycheck that goes to savings when you get a raise

Side work

Don’t upgrade a phone every time your due

Downgrade a vehicle or use the vehicle longer once paid off

Reward Yourself

There is no doubt some pain will be felt if you are trying to save more and it also takes time. Set a goal and stick to it but work in some rewards to yourself. If you are making good progress after say 3 months, splurge on something to keep your sanity but won’t impact the main objective.

Where To Keep Your Emergency Fund?

This account is meant to be liquid and accessible. So locking it up in some sort of long term investment that may have penalties for early withdrawal would not be ideal. We typically suggest using an institution you are familiar with and putting it in a savings account that can earn some interest.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

STAR Property Tax Credit: Make Sure You Know The New Income Limits

The STAR Credit is a great way to reduce your property taxes in New York. If you are over the age of 65, it gets even better with the Enhanced STAR Credit. But you have to know the income limits associated with the credit otherwise you could unexpectedly lose the credit which could cost you thousands of dollars in additional property taxes. They

The STAR Credit is a great way to reduce your property taxes in New York. If you are over the age of 65, it gets even better with the Enhanced STAR Credit. But you have to know the income limits associated with the credit otherwise you could unexpectedly lose the credit which could cost you thousands of dollars in additional property taxes. They made some big changes to the credit that a lot of homeowners are not aware of. In this article we will review:

The income limits for the STAR Credit

Eligibility requirements for the Enhanced STAR Credit

How much money the STAR credit saves you

The most common mistakes that people make that disqualify them from the credit

The changes that were made to the property tax credit

STAR Property Tax Exemption

Let’s start with the basics. STAR stands for School Tax Relief. It’s a partial exemption from school taxes for your primary residence. There are two different STAR programs:

Basic STAR

Enhanced STAR

You Have To Apply For The Credit

You have to apply for the credit to receive it. It’s not automatic. Also, if you turn 65 this year and you want to further reduce your property taxes, there is a special application process for the Enhanced STAR Credit which requires you to enroll in the annual Income Verification Program (IVP). We will cover this in more detail later on in the article.

How Does The STAR Credit Work

The STAR credit exempts a specified dollar amount from the assessed value of your house prior to the calculation of your school tax bill. Here are the current exemption amounts:

Basic STAR: $30,000

Enhanced STAR: $65,000

The actual dollar amount that you save in school taxes will vary based on where you live in New York State. But if you live in a $300,000 house, you qualify for Basic STAR, and your school taxes before the STAR’s credit are $7,000. It could save you around $700 per year in school taxes. If you qualify for the enhanced STAR, you can more than double that savings number. In a high property tax state like New York, every little bit helps.

Income Limits For The STAR Credit

Here is a table from NYS Department of Taxation and Finance that summarizes the eligibility requirements for the Basic STAR and Enhanced STAR credit:

Requirement #1: It must be your primary residence. The credit does not apply for rental properties or second homes.

Requirement #2: To qualify for the Enhanced STAR, one of the homeowners must be age 65

Requirement #3: The income limitations. We see fewer issues with the Basic STAR since the income limit is $500,000. We see a lot more issues with the Enhanced STAR credit with the income limit at $86,300. Mainly because when you add up social security, pension payments, and required minimum distributions from IRA’s, you have homeowners that flirt with that income limit on a year by year basis. Crossing the income line would drop you back into the Basic STAR program which will most likely result in an unfriendly property tax surprise.

Income Calculation

The eligibility for the 2019 STAR credit is actually based on your income from 2017. You can reference your 2017 federal and state tax returns against the table listed below:

Enhanced STAR Credit

Once you or your spouse turn age 65, you are then eligible to apply for the Enhanced STAR program.

Unlike the basic STAR program, the Enhanced STAR program required homeowners to file renewal applications with their local assessor each year to remain in the program. Under the new rules, new applicants are required to enroll in the Enhanced STAR Income Verification Process.

The application deadline is typically March 1st if you are filing at the county level but it can vary from county to county. You should contact your assessor to verify the application deadline in your area. The good news about enrolling in the Enhance STAR Income Verification Program is you only have to do it once. Once enrolled you will receive the Enhanced STAR credit each year as long as your income is below the required threshold.

Common Mistakes With The Enhanced STAR Credit

Since the income threshold for the Enhanced STAR program is much lower than the Basic STAR program this is where we see homeowners get into trouble. For most retirees, their income is relatively the same from year to year. However, there are frequently one-time events that occur that can push a retiree’s income higher for a given year. Not only do they end up with a large tax bill when they file their taxes but they also find out that they lost the Enhanced STAR Credit for that year. Double ouch!!

Here are the most common income events that retirees have to watch out for:

Capital gains and dividends from taxable investment accounts

Taking larger distributions from IRA’s or pre-tax retirement plans

Age 70 ½ - Required minimum distributions start from IRA’s

Receive an inheritance (some sources can be taxable)

Sell real estate or land other than the primary residence

Surrendering a life insurance policy

Part-time income

The year you turn on social security benefits

If you experience financial events that are expected to increase your taxable income for a given year, you should work closely with you financial advisor or accountant during those years because there may be ways to reduce your income to maintain the Enhanced STAR credit with some advanced planning.

Changes To The STAR Credit

New York made some significant changes to both the Basic STAR and the Enhanced STAR credit that not many homeowners are aware of. The amount of the credit did not change but the methods for applying for and receiving the credit did change.

If you were receiving the Basic STAR credit before and you have not moved since 2016, there is nothing that you have to do. Everything will continue to operate the same. However, if you move or if you are new homeowner, the STAR process will be different. Under the old method, you would simply see a deduction for your STAR credit on your school tax bill. Going forward, when you buy a new house, you will have to pay your full school tax bill, and then New York will mail you a physical check for your STAR credit. In order to receive your check in September, you must register for the Basic STAR program through the state Department of Taxation and Finance by July 1st.

After July 1st, you can still apply for the STAR credit, and the state will provide you with a check, but you may receive the check after September. The same manual check process is applicable with the Enhanced STAR program as well.

If you were receiving the Enhanced STAR and you have not moved, New York is allowing those homeowners to continue to file their renewal applications with their local assessor each year without having to enroll in the new Enhanced STAR Income Verification Program. However, if you move, you will have to enroll in the Income Verification Program in order to remain in the Enhanced STAR Program.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Why Do You Owe More In Taxes This Year?

“I thought there was a tax break. Last year I got a refund. This year, I owe money to the IRS. How did this happen and what do I need to change to fix this?.” As more and more people file their taxes for 2018, the situation described above seems to be the norm instead of the exception to the rule. Taxpayers are realizing that either their tax refund is lower, they owe money for the first time, o

“I thought there was a tax break. Last year I got a refund. This year, I owe money to the IRS. How did this happen and what do I need to change to fix this?”

As more and more people file their taxes for 2018, the situation described above seems to be the norm instead of the exception to the rule. Taxpayers are realizing that either their tax refund is lower, they owe money for the first time, or their tax bill is larger than it normally is. While this is a shock to many families and individuals, we saw this issue coming in February of 2018. We even wrote an article at that time titled “Warning To All Employees: Review The Tax Withholding In Your Paycheck Otherwise A Big Tax Bill May Be Waiting For You”.

Below we will highlight some of the catalysts of this issue and provide you with some strategies on how to better prepare for the coming tax year.

New Tax Withholding Tables

When tax reform was passed, the government issued new federal income tax withholding tables to your employer in February which provides them with the amount that they should withhold from your paycheck for tax purposes. Since the federal tax brackets dropped, so did the withholding tables. In February 2018, this seemed like a great thing because most taxpayers saw an increase in their take home pay. However, it simultaneously created a big tax problem for a lot of employees.

Gross Income vs. Taxable Income

There is a difference between your “gross income” and your “taxable income”. If your salary is $80,000 per year, that is your gross income. At tax time, you get to take deductions against your gross income, to reach your total “taxable income” which is a lower amount. Your taxable income is the amount that you actually have to pay taxes on.

For example, you have a married couple, husband has a W2 for $60,000 and his wife has a W2 for $70,000. Their combined gross income is $130,000. Let’s assume they take the standard deduction in 2018 which is a $24,000 deduction. Their total taxable income for 2018 is $106,000.

Impact of Tax Reform

While tax forms did bring lower federal income tax brackets, it also made a lot of changes to the deduction side of the equation. For those of us living in New York, California, and other high tax states, the biggest change was probably the $10,000 cap that they placed on property taxes and state income taxes. The other big change for taxpayers with children was the elimination of the personal exemption deduction which was replaced with a credit. The personal exemption change works for some taxpayers and against others. For more on this topic reference: More Taxpayers Will Qualify For The Child Tax Credit In 2018

For that married couple above that made $130,000 in 2018, under the new tax rules their total taxable income may be $106,000 but if they applied the old tax rules it may have only been $95,000. People are finding out that while the federal tax rates dropped, their total taxable income for the year increased because the higher standard deduction did not make up for all of the itemized deductions that were lost under the new tax rules.

To further aggravate that wound, at the beginning of 2018, the federal government instructed your employer to withhold less federal income tax from your paycheck which put some taxpayers further behind on their withholdings. If you were used to getting a refund when you filed your taxes, technically you may have already received it throughout the year in your paycheck but you just didn’t know it. There are of course taxpayers in the even more difficult camp that were banking on getting a refund only to find out that they actually owe money to the IRS.

How Do You Fix This?

If you unexpectedly owed money to the IRS this year or if you want to restore that refund that you typically receive when you file your taxes, you are going to have to change your tax withholding amount with your employer. You have to request a Form W-4 from your employer. I looks like this……

You can reduce the number of allowances that you are claiming on line 5 or you can instruct your employer to withhold an additional flat dollar amount each pay period on line 6.

There are also other options beside increasing your tax withholdings like increasing your contributions to your 401(k) account or contributing money to a Health Savings Account for your health expenses. These moves may assist you in reducing your taxable income which could lead to a lower tax liability.

Consult With Your Accountant

While I have highlighted the more common catalysts leading to this under withholding issue, there were a lot of changes made to the tax rules so there could have been other factors that led to your higher tax liability this year. Your gross income could have been higher, maybe you took a distribution from an IRA account, or you have realized gains from an investment that you sold during the year. You really have to work with your tax professional to identify what triggered the additional tax liability and determine what action should be taken to reduce your tax liability going forward.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future

How To Change Your Residency To Another State For Tax Purposes

If you live in an unfriendly tax state such as New York or California, it’s not uncommon for your retirement plans to include a move to a more tax friendly state once your working years are over. Many southern states offer nicer weather, no income taxes, and lower property taxes. According to data from the US Census Bureau, more residents

If you live in an unfriendly tax state such as New York or California, it’s not uncommon for your retirement plans to include a move to a more tax friendly state once your working years are over. Many southern states offer nicer weather, no income taxes, and lower property taxes. According to data from the US Census Bureau, more residents left New York than any other state in the U.S. Between July 2017 and July 2018, New York lost 180,360 residents and gained only 131,726, resulting in a net loss of 48,560 residents. With 10,000 Baby Boomers turning 65 per day over the next few years, those numbers are expected to escalate as retirees continue to leave the state.

When we meet with clients to build their retirement projections, the one thing anchoring many people to their current state despite higher taxes is family. It’s not uncommon for retirees to have children and grandchildren living close by so they greatly favor the “snow bird” routine. They will often downsize their primary residence in New York and then purchase a condo or small house down in Florida so they can head south when the snow starts to fly.

The inevitable question that comes up during those meetings is “Since I have a house in Florida, how do I become a resident of Florida so I can pay less in taxes?” It’s not as easy as most people think. There are very strict rules that define where your state of domicile is for tax purposes. It’s not uncommon for states to initiate tax audit of residents that leave their state to claim domicile in another state and they split time travelling back and forth between the two states. Be aware, the state on the losing end of that equation will often do whatever it can to recoup that lost tax revenue. It’s one of those guilty until proven innocent type scenarios so taxpayers fleeing to more tax favorable states need to be well aware of the rules.

Residency vs Domicile

First, you have to understand the difference between “residency” and “domicile”. It may sound weird but you can actually be considered a “resident” of more than one state in a single tax year without an actual move taking place but for tax purposes each person only has one state of “domicile”.

Domicile is the most important. Think of domicile as your roots. If you owned 50 houses all around the world, for tax purposes, you have to identify via facts and circumstances which house is your home base. Domicile is important because regardless of where you work or earn income around the world, your state of domicile always has the right to tax all of your income regardless of where it was earned.

While each state recognizes that a taxpayer only has one state of domicile, each state has its own definition of who they considered to be a “resident” for tax purposes. If you are considered a resident of a particular state then that state has the right to tax you on any income that was earned in that state. But they are not allowed to tax income earned or received outside of their state like your state of domicile does.

States Set Their Own Residency Rules

To make the process even more fun, each state has their own criteria that defines who they considered to be a resident of their state. For example, in New York and New Jersey, they consider someone to be a resident if they maintain a home in that state for all or most of the year, and they spend at least half the year within the state (184 days). Other states use a 200 day threshold. If you happen to meet the residency requirement of more than one state in a single year, then two different states could consider you a resident and you would have to file a tax return for each state.

Domicile Is The Most Important

Your state of domicile impacts more that just your taxes. Your state of domicile dictates your asset protection rules, family law, estate laws, property tax breaks, etc. From an income tax standpoint, it’s the most powerful classification because they have right to tax your income no matter where it was earned. For example, your domicile state is New York but you worked for a multinational company and you spent a few months working in Ireland, a few months in New Jersey, and most of the year renting a house and working in Florida. You also have a rental property in Virginia and are co-owners of a business based out of Texas. Even though you did not spend a single day physically in New York during the year, they still have the right to tax all of your income that you earned throughout the year.

What Prevents Double Taxation?

So what prevents double taxation where they tax you in the state where the money is earned and then tax you again in your state of domicile? Fortunately, most states provide you with a credit for taxes paid to other states. For example, if my state of domicile is Colorado which has a 4% state income tax and I earned some wages in New York which has a 7% state income tax rate, when I file my state tax return in Colorado, I will not own any additional state taxes on those wages because Colorado provides me with a credit for the 7% tax that I already paid to New York.

It only hurts when you go the other way. Your state of domicile is New York and you earned wage in Colorado during the year. New York will credit you with the 4% in state tax that you paid to Colorado but you will still owe another 3% to New York State since they have the right to tax all of your income as your state of domicile.

Count The Number Of Days

Most people think that if they own two houses, one in New York and one in Florida, as long as they keep a log showing that they lived in Florida for more than half the year that they are free to claim Florida, the more tax favorable state, as their state of domicile. I have some bad news. It’s not that easy. The key in all of this is to take enough steps to prove that your new house is your home base. While the number of days that you spend living in the new house is a key factor, by itself, it’s usually not enough to win an audit.

That notebook or excel spreadsheet that you used to keep a paper trail of the number of days that you spent at each location, while it may be helpful, the state conducting the audit may just use the extra paper in your notebook to provide you with the long list of information that they are going to need to construct their own timeline. I’m not exaggerating when I say that they will request your credit card statement to see when and where you were spending money, freeway charges, cell phone records with GPS time and date stamps, dentist appointments, and other items that give them a clear picture of where you spent most of your time throughout the year. If you supposedly live in Florida but your dentist, doctors, country club, and newspaper subscriptions are all in New York, it’s going to be very difficult to win that audit. Remember the number of days that you spend in the state is just one factor.

Proving Your State of Domicile

There are a number of action items that you should take if it’s your intent to travel back and forth between two states during the year, and it’s your intent to claim domicile in the more favorable tax state. Here is the list of the action items that you should consider to prove domicile in your state of choice:

Register to vote and physically vote in that state

Register your car and/or boat

Establish gym memberships

Newspapers and magazine subscriptions

Update your estate document to comply with the domicile state laws

Use local doctors and dentists

File your taxes as a resident

Have mail forwarded from your “old house” to your “new house”

Part-time employment in that state

Join country clubs, social clubs, etc.

Host family gatherings in your state of domicile

Change your car insurance

Attend a house of worship in that state

Where your pets are located

Dog Saves Owner $400,000 In Taxes

Probably the most famous court case in this area of the law was the Petition of Gregory Blatt. New York was challenging Mr Blatt’s change of domicile from New York to Texas. While he had taken numerous steps to prove domicile in Texas at the end of the day it was his dog that saved him. The State of New York Division of Tax Appeals in February 2017 ruled that “his change in domicile to Dallas was complete once his dog was moved there”. Mans best friends saved him more than $400,000 in income tax that New York was after him for.

Audit Risk

When we discuss this topic people frequently ask “what are my chances of getting audited?” While some audits are completely random, from the conversations that we have had with accountants in this subject area, it would seem that the more you make, the higher the chances are of getting audited if you change your state of domicile. I guess that makes sense. If your Mr Blatt and you are paying New York State $100,000 per year in income taxes, they are probably going to miss that money when you leave enough to press you on the issue. But if all you have is a NYS pension, social security, and a few small distributions from an IRA, you might have been paying little to no income tax to New York State as it is, so the state has very little to gain by auditing you.

But one of the biggest “no no’s” is changing your state of domicile on January 1st. Yes, it makes your taxes easier because you file your taxes in your old state of domicile for last year and then you get to start fresh with your new state of domicile in the current year without having to file two state tax returns in a single year. However, it’s a beaming red audit flag. Who actually moves on New Year’s Eve? Not many people, so don’t celebrate your move by inviting a state tax audit from your old state of domicile

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.